eCommerce: Fashion Market

Zara: Global Online Sales, Stores Are Changing & Fashion Trends

Zara is the flagship brand of fashion conglomerate Inditex. Its online strategy helps Zara thrive in the global fashion market, but new entrants are changing the game. Here is how Zara operates amidst growing competition and market dynamics.

February 22, 2024

Zara Online Strategy: Key Insights

Pandemic Impact: Zara's online net sales grew during the pandemic, which helped balance out some of the losses by its parent company, Inditex.

High Market Concentration: Zara.com's target markets are quite diverse. Its top 10 countries account for 71.5% of online revenues, and many smaller markets round out the rest.

Surviving in the Online Fashion Market: Competition from new entrants like Shein is putting pressure on established retailers Zara and H&M. Zara is cutting back while modernizing its existing stores, and offering a hybrid experience.

Strolling through the center of your hometown, you may notice familiar storefronts giving way to new businesses or disappearing altogether. The pandemic has left a lasting mark on the way retailers interact with their customers: The benefits of an online strategy or hybrid model are becoming apparent, and this applies to the fashion industry as well.

Many fashion retailers are cutting back on physical retail space to make way for thorough online integration, which is following the success of online-only rivals such as Shein and Asos. Ultimately, this means that stores are pursuing an online strategy at the expense of offline stores.

While Zara has joined the trend of reducing physical retail space, the story is not as clear-cut as it seems. Check out Zara's strategy for surviving in the competitive fashion market, both by responding to changing consumer needs and rising costs.

But first, a look at Zara's online sales performance over the past few years.

Pandemic Spurred Zara's Online Growth

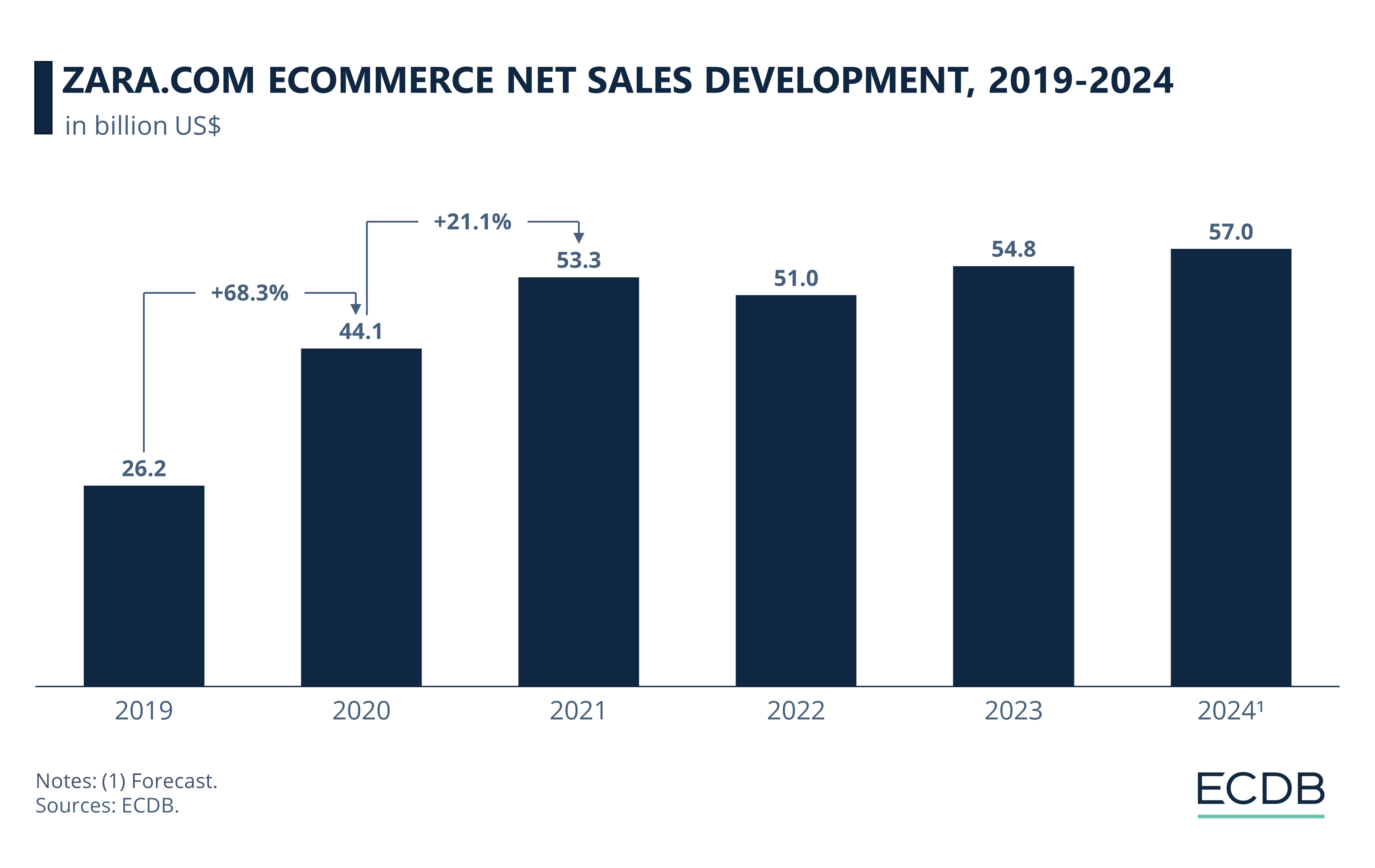

Zara's shift to online has been accelerated by the pandemic, with a 68.3% growth from 2019 to 2020. While in 2019, global online sales were at US$26.2 billion, this figure increased to US$44.1 billion within just one year. The following year of the pandemic still saw positive growth at 21.1%, reaching online revenues of US$53.4 billion in 2021.

After the pandemic, global online revenues grew more slowly in 2022, but are expected to accelerate again in 2023 and 2024, reaching revenues of US$57.5 billion and US$60.3 billion, respectively.

Since Zara operates mainly on its zara.com domain, ECDB provides data on its key markets.

How Much Do Zara.com's Top Markets Contribute to Online Revenues?

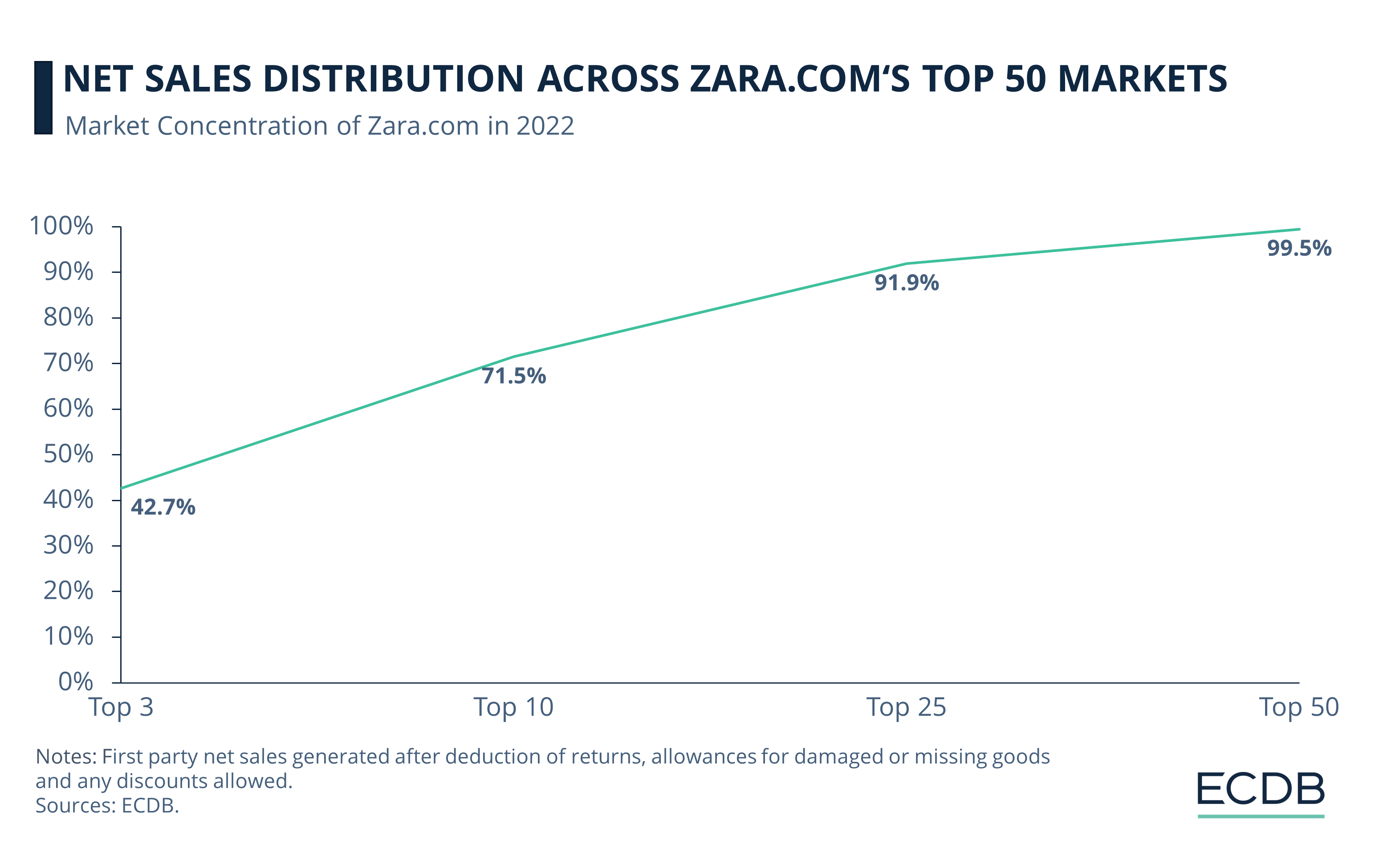

Based on the top markets in which Zara operates with its .com domain, the following histogram visualizes net sales distribution:

Of all the countries in which zara.com operated in 2022, the United States emerges as the number one market, accounting for 23% of Zara’s total online revenues. Including the United Kingdom (11.1%) and Spain (8.6%), these top 3 markets represent a total revenue share of 42.7%.

Zara.com's top 10 markets comprise Canada (5.9%), France (5.1%), Germany (4.5%), Poland (4%), Italy (3.9%), Portugal (2.8%) and the Netherlands (2.6%). Taken together, the top 10 contribute 71.5% of the domain's total revenues.

But there are many other markets with marginal percentages that collectively round out zara.com's total net sales. More precisely, the top 25 markets of the domain account for 91.9% of revenues, while the top 50 reach 99.5%. We can see that this includes 25 markets that together generate 7.6% of zara.com's net sales.

Learn About ECDB Store Profiles

Diverse Market Portfolio: Pros and Cons

The diverse market landscape in which Zara operates is a double-edged sword. On the one hand, a geographically diverse customer base can provide a safety net against economic downturns in certain regions, while also offering a range of opportunities for growth and expansion. On the other hand, this diversity presents logistical and operational challenges, such as matching consumer preferences and complying with different regulatory environments.

These aspects become even more important when keeping in mind how competitive the online fashion sector is. Nowadays, consumers can choose from a wide variety of online shops to buy their clothing from.

Zara's Online Net Sales Lag Behind Its Competitors

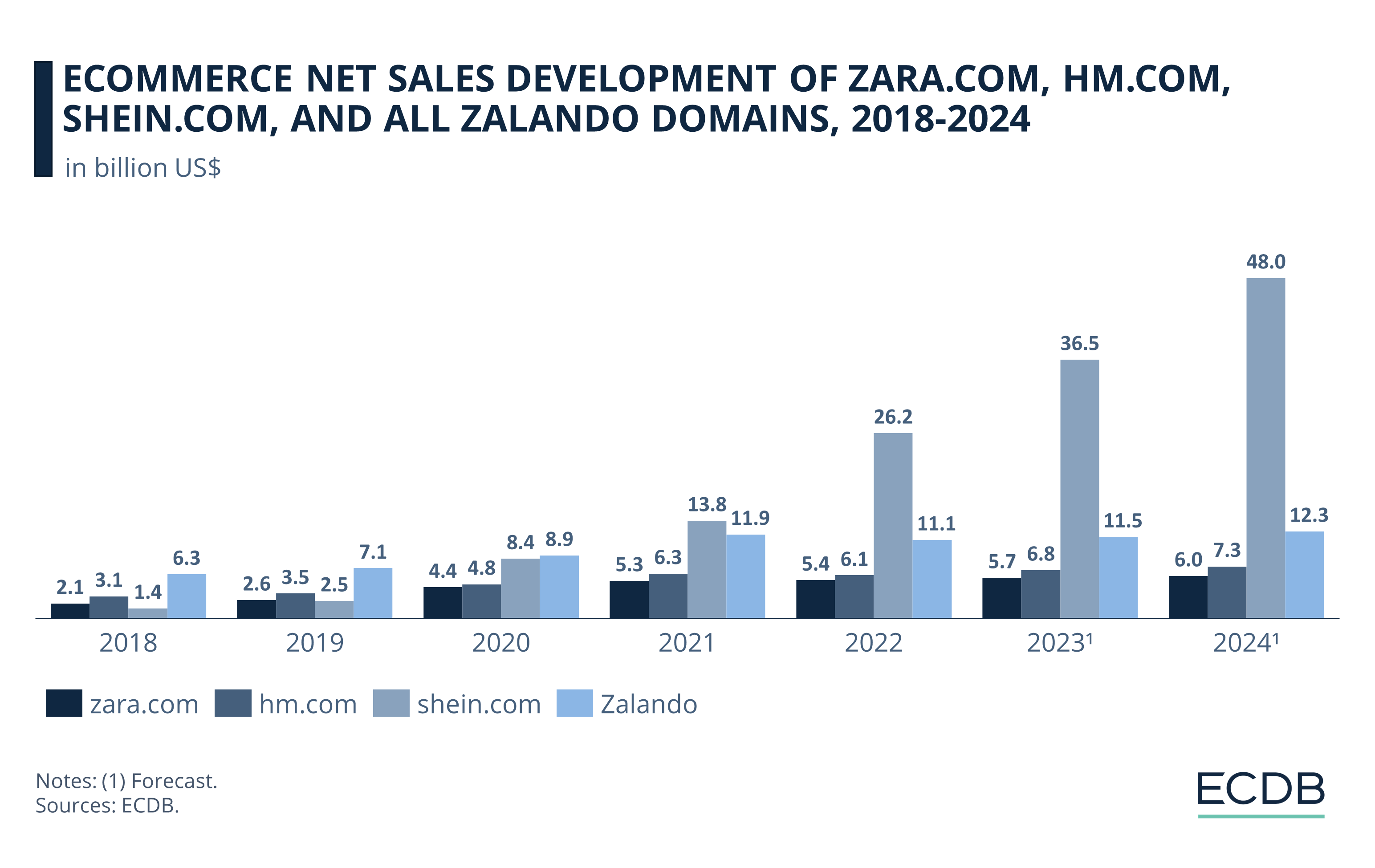

Comparing the respective eCommerce net sales of key players in the global online fashion market, we see that Zalando and Shein are increasingly outpacing H&M and Zara.

While Zara and H&M generated online net sales of around US$2.3 billion and US$3.3 billion in 2018 and 2019, respectively, Zalando outshone both of them with online net sales of around US$6.7 billion. Of course, Zara and H&M generated additional offline sales that are not included in the eCommerce net sales development shown in this chart.

The most notable development, however, is the meteoric rise of Shein in the online fashion market. By 2020, the Chinese online player had already drawn level with Zalando at online net sales of US$8.4 billion. According to projections, there is no sign of Shein's growth slowing: From online net sales of US$26.2 billion in 2022, shein.com is expected to reach online revenues of US$48 billion by 2024.

The other brands are well behind Shein's growth over this period. Zalando still stands out with the second-highest net sales, which are projected to stabilize at around US$11 billion to US$12 billion by 2024. But Zara and H&M lag behind, with Zara consistently generating lower online net sales than the others, ranging from US$5.3 billion in 2021 to US$6 billion in 2024. It seems that Zara is right to adapt its business model to a changing market.

Zara: Innovations to Its Business Model

The previous sections already alluded to how the pandemic reshaped the fashion industry, also affecting Inditex, Zara's parent company. Inditex reported overall revenue losses during the pandemic, which were mitigated by online channels. However, Inditex's financial report for June 2023 shows a rebound in both online and in-store sales.

As Inditex’s flagship, Zara is leading the operational changes envisioned by its parent company. This occurs against a backdrop of heightened online competition, evolving consumer tastes and rising business costs due to inflation and high energy prices.

Downsizing Physical Outlets by 19.3% Since 2020

The most notable shift is the global reduction of physical stores. Here are the specifics:

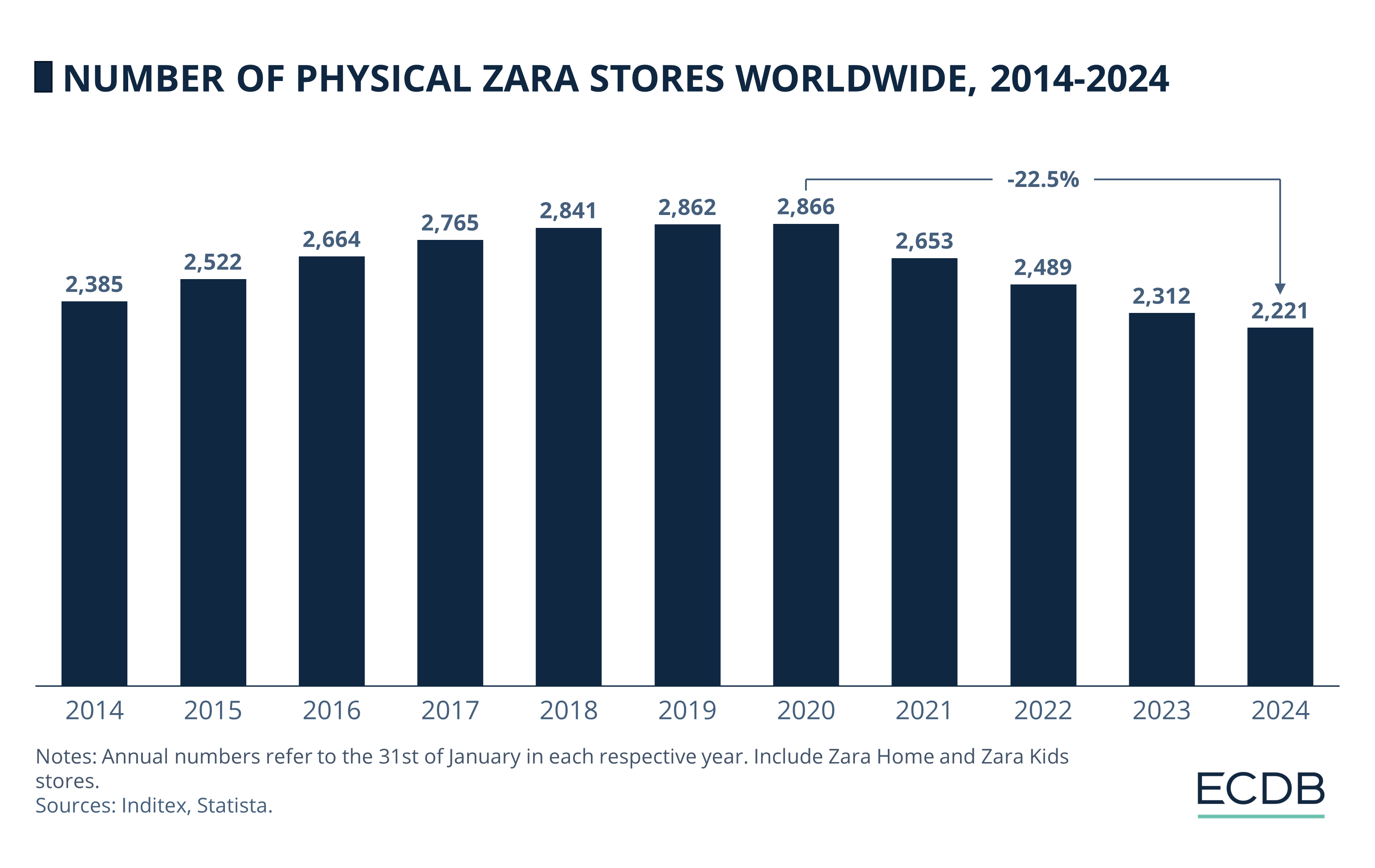

Up until 2020, Zara's store count had been on an upward trajectory, peaking at 2,866 stores that year. Then, the pandemic led to a significant decline in numbers. Over the course of three years, the total physical store count, including Zara Home and Zara Kids, fell 19.3% to 2,312 stores as of early 2023.

This move is in line with broader industry trends, exemplified by competitors like H&M. Inditex's strategy involves closing underperforming stores to strengthen its digital and hybrid offerings, while enlarging remaining outlets.

Enhancing Online and In-Store Synergy

The function of the remaining stores is also being transformed: In line with recent innovations, the store experience is being redefined to include advanced digital capabilities, such as real-time fitting room bookings, 2-hour click & collect services, online inventory checks, self-checkout and automated online returns.

As a result, these enhanced stores will serve as both warehouses and distribution hubs, enabling a more efficient hybrid retail model. Additionally, Zara has expanded its product lines, which includes new cosmetics, shoes, and athletic wear.

But these changes do not mean that Zara is not growing its global presence. Quite the contrary, the fashion retailer has opened its first physical store in Cambodia, where the brand is also building an online presence.

These moves do not suggest that Zara is retreating, but rather that the brand is recalibrating its business approach to combine digital capabilities with physical retail integration.

Zara's Global Strategy: Closing Remarks

Zara's store closures reflect shifting market dynamics in the fashion industry, driven by newly emerging online players that are undercutting established retailers on turnaround time and price. With a strategy that prioritizes quality over quantity, Inditex's moves can help Zara gain new recognition as a brand beyond the fast-fashion label. For the low-income customer, Inditex is in any case marching out new store concepts, as seen with the rise of the economical fashion brand "lefties", which is designed to take on the price battle with low-cost competition from China.

Sources: Financial Times - Guardian - Inditex - Reuters

Related insights

Article

Top Online Stores in Europe 2023 By Net Sales & Market Share

Top Online Stores in Europe 2023 By Net Sales & Market Share

Article

Online Food Delivery: Market Development, Top Online Stores & Revenue

Online Food Delivery: Market Development, Top Online Stores & Revenue

Article

U.S. Luxury Goods Market: Top Brands & Companies, Online Sales, Growth

U.S. Luxury Goods Market: Top Brands & Companies, Online Sales, Growth

Article

Video Games Market Development 2024: Revenue Worldwide & Growth Rate

Video Games Market Development 2024: Revenue Worldwide & Growth Rate

Article

Most Valuable eCommerce Companies Worldwide 2024

Most Valuable eCommerce Companies Worldwide 2024

Back to main topics