eCommerce: Logistics

Global eCommerce Logistics: Market Size, Regional Trends, Growth Factors

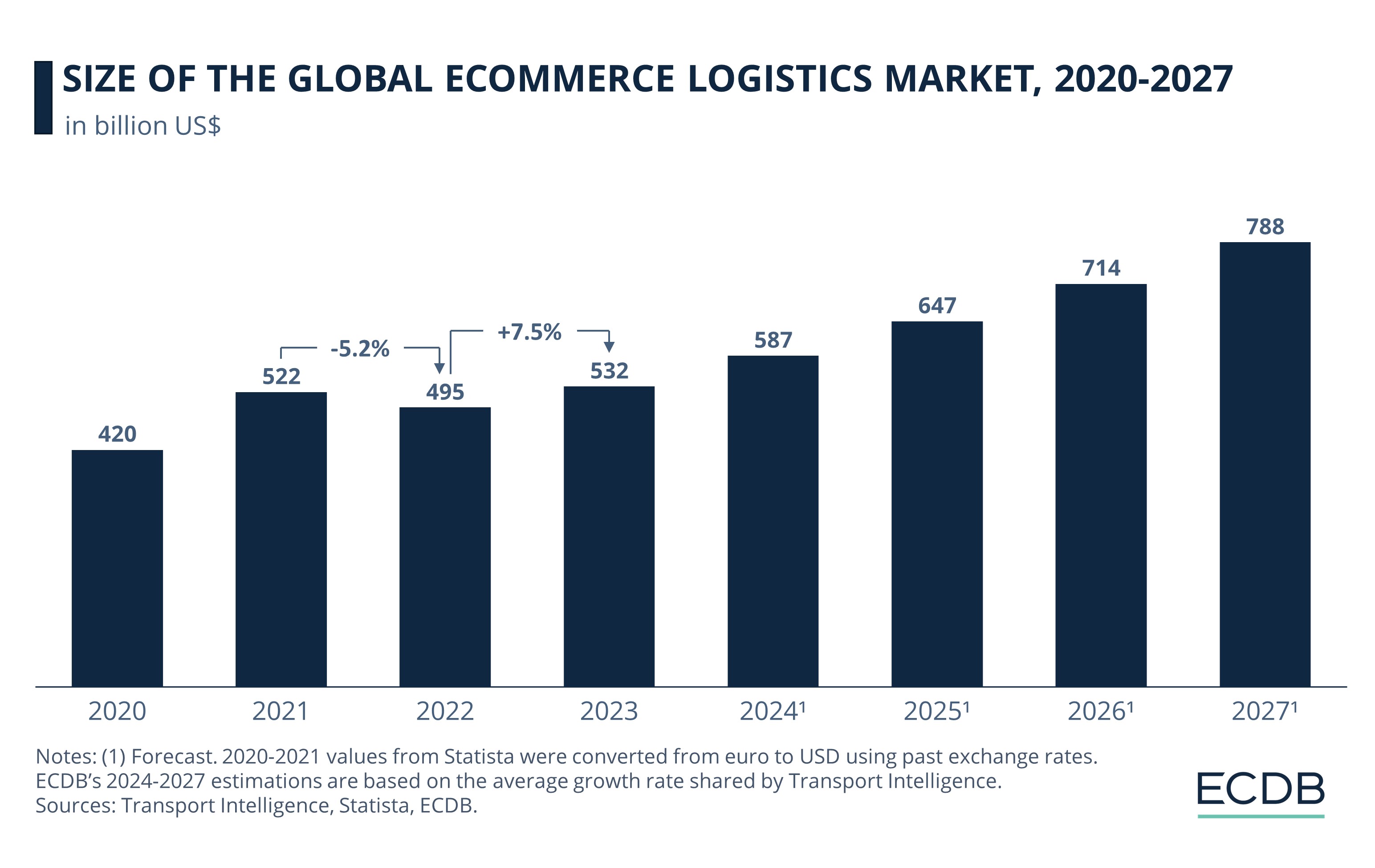

In 2023, global eCommerce logistics grew by 7.5% year-over-year and is valued at US$532 billion. Discover ECDB’s data-driven projections for the eCommerce logistics market.

March 19, 2024

Global eCommerce Logistics: Key Insights

Recovery in 2023: The global eCommerce logistics market rebounded from a decline of over 5% in 2022 and reached a value of US$532 billion in 2023.

Growth projection: From 2022-2027, the market is expected to grow at an average yearly growth rate of over 10%. It is estimated to be worth approximately US$788 billion by 2027.

Regional trends: In 2023, North America replaced APAC as the strongest region for eCommerce logistics revenues. As of now, APAC stands second and Europe is third.

In recent years, a surge in online retail has spurred the demand for efficient delivery. In turn, this accelerated growth of global eCommerce logistics revenues. However, the growth trajectory is not linear, with a decline registered in the past year.

Is the global eCommerce logistics market on the road to recovery? How has it performed in leading eCommerce regions?

Global eCommerce Logistics: Revenues Expected to Grow to US$788 Billion by 2027

In 2023, the global eCommerce logistics market grew by 7.5% since 2022, increasing revenues to US$532 billion.

This positive development comes one year after a slump: in 2022, a negative year-on-year growth of 5.2% had shrunk the market to US$495 billion. High inflation and the cost-of-living crisis likely contributed to this decline.

In 2021, revenues amounted to US$522 billion. This increase of over 20% from 2020 occurred despite persisting lockdowns and global supply chain issues.

In 2023, the global eCommerce logistics market reclaimed lost ground and surpassed the 2021 level. It is also forecast to grow.

Transport Intelligence anticipates that the global eCommerce logistics market will expand at an average yearly growth rate of over 10% between 2022 and 2027. At this rate, the market will be worth US$788 billion by 2027.

Global eCommerce Logistics: Regional Outlook and Factors Driving Growth

The global eCommerce market is mainly driven by industrialized world regions: Asia-Pacific (APAC), North America, and Europe.

According to Transport Intelligence, in 2023, North America emerged as the strongest region for eCommerce logistics revenues, displacing APAC from the top spot. APAC is now a close second, followed by Europe. Logistics for eCommerce in North America grew at an annual rate of 7.6% and is now worth US$174.8 billion.

Notably, the North American eCommerce logistics market had also increased by 8.5% in 2022 despite the overall trend of decline. This positive trajectory enabled it to overtake APAC and become the region generating the highest revenues from eCommerce logistics globally in 2023.

While APAC’s growth is also strong, the European eCommerce logistics market is growing at a much slower pace (at 4.5% annually, and worth US$85.26 billion in 2023) than the other regions.

eCommerce logistics is an evolving industry. Some factors that are expected to continue furthering its expansion include:

The growth of eCommerce: The acceleration in eCommerce activity around the world is driving the growth of the global logistics industry. According to ECDB estimates, the worldwide eCommerce market is expected to grow at a CAGR (2024-2028) of 8.5%.

Rise in cross-border eCommerce: Online shoppers are not just shopping domestically, but they are also engaging in cross-border eCommerce. As consumer demand for cross-border products grows, the resulting changes in eCommerce activity are also anticipated to drive growth of global eCommerce logistics.

Innovation in digital technology: Real-time tracking, drone delivery, automated warehousing, blockchain for supply chains, and the integration of AI are some technological advancements that have introduced a paradigm shift in the traditional logistics industry. As more logistics companies invest in technology and scale up, the results will also contribute to the expansion and efficiency of the global eCommerce logistics market.

eCommerce Logistics: Closing Remarks

Data underlines the preference for ultra-modern delivery among younger generations of online shoppers. Autonomous delivery options, such as drones and self-driving cars, are already impacting logistics in terms of delivery capacity, times, and accuracy.

However, for the global eCommerce logistics market to optimize its operations and fully capitalize on this new technology, it must also address existing challenges, some of which include security risks, costs, consumer perception and trust, as well as regulatory frameworks in different world regions.

Sources: Transport Intelligence, Trans.iNFO

Related insights

Article

Shein and Temu Products Clog Air Transports

Shein and Temu Products Clog Air Transports

Article

Cart Abandonment Rate in Europe: Country Statistics, Shipping & Consumer Behavior

Cart Abandonment Rate in Europe: Country Statistics, Shipping & Consumer Behavior

Article

Innovative Delivery Options in Germany in 2023: Consumer Behavior by Generation and Gender

Innovative Delivery Options in Germany in 2023: Consumer Behavior by Generation and Gender

Article

eCommerce Logistics: What Is It & How Does It Work

eCommerce Logistics: What Is It & How Does It Work

Article

eCommerce Logistics 2023: Market Size, Analysis & Consumer Preferences

eCommerce Logistics 2023: Market Size, Analysis & Consumer Preferences

Back to main topics