eCommerce: China's Dominance

Top 5 Online Marketplaces in Asia: Analysis & Predictions

Asian online marketplaces are dominated by Chinese players with eCommerce giants such as Taobao, Tmall, JD.com, Pinduoduo, and Kwai Shop. Learn about performance figures such as 2022 GMV, market forecasts and non-Chinese competitiors.

January 17, 2024

Top Asian Marketplaces: Key Insights

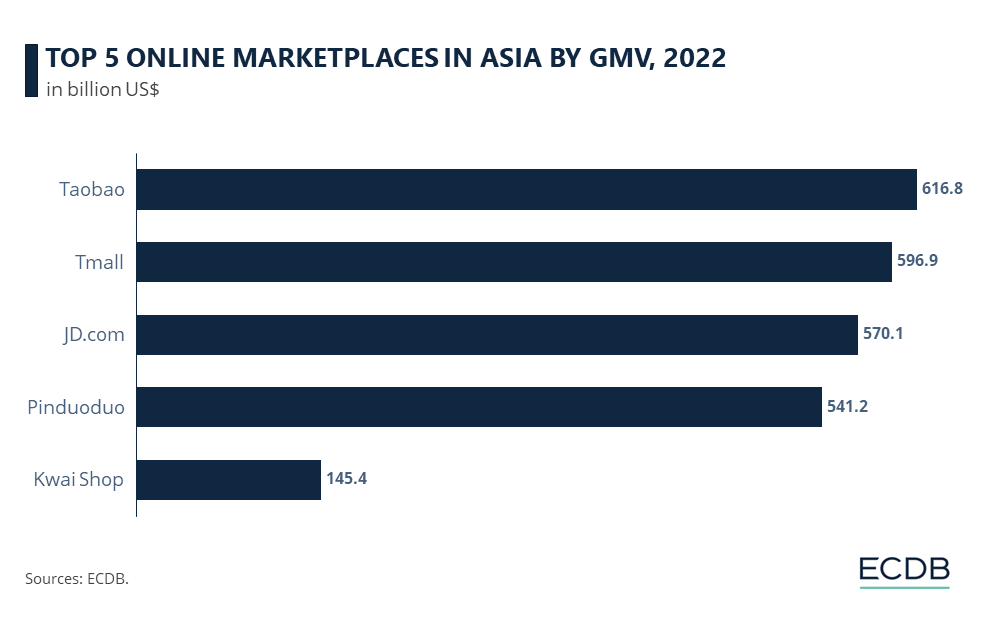

Chinese Dominance: China solidifies its dominance among Asian online marketplaces with five major platforms, led by Taobao. Taobao performed best in 2022 with a GMV of US$616.8 billion, closely followed by Alibaba's Tmall and JD.com, intensifying the competition among these eCommerce giants.

Pinduoduo's Ascendance: A rising star in the Asian market, Pinduoduo, is showing remarkable growth, with a 43% increase in GMV from US$378.5 billion in 2021 to US$541.2 billion in 2022.

Rise of Non-Chinese Players: Shopee emerges as the largest Asian marketplace outside of China, with a projected GMV of US$73.5 billion in 2022 and expected growth to US$84 billion by 2024. South Korea's Coupang and Japan's Rakuten are also making significant progress.

Today's Asian online marketplaces are dominated by China, one of the largest and most populous countries in the world. With its many online marketplaces, it is no surprise that China-based marketplaces top the list with five online marketplaces in Asia, led by the currently largest Asian online marketplace in Taobao.

This insight examines the GMV (Gross Merchandise Volume) generated by the top 5 Asian online marketplaces in 2022, followed by ECDB forecasts and Asian competitors outside of China. Without further ado, which are the five leading online marketplaces on the Asian continent?

Alibaba’s Taobao and Tmall Outpace Competitors

Number one Taobao secured the top spot in the ranking by increasing its GMV to US$616.8 billion, a growth of 0.3% compared to the previous year. The marketplace, owned by eCommerce giant Alibaba, faces stiff competition from another Alibaba-owned company, Tmall. With a GMV of US$596.9 billion, Tmall, like Taobao, was able to slightly increase its GMV by 0.3%.

The first non-Alibaba-owned marketplace is JD.com, which ranks third. With a GMV of US$570.1 billion in 2022, JD.com was able to generate 11.5% more sales on its platform than in 2021, bringing it closer to Alibaba's competitors.

Not far behind is the rising star not only in the Asian market, Pinduoduo, with a GMV of US$541.2 billion in 2022. It closed the previous year with a GMV of US$378.5 billion, representing a 43% improvement in GMV in one year. The fifth largest online marketplace in Asia was Kwai Shop with a significantly lower GMV of US$145.4 billion. The Beijing-based third-party marketplace had a GMV of US$104.2 billion in 2021, an increase of 39.5% year-over-year.

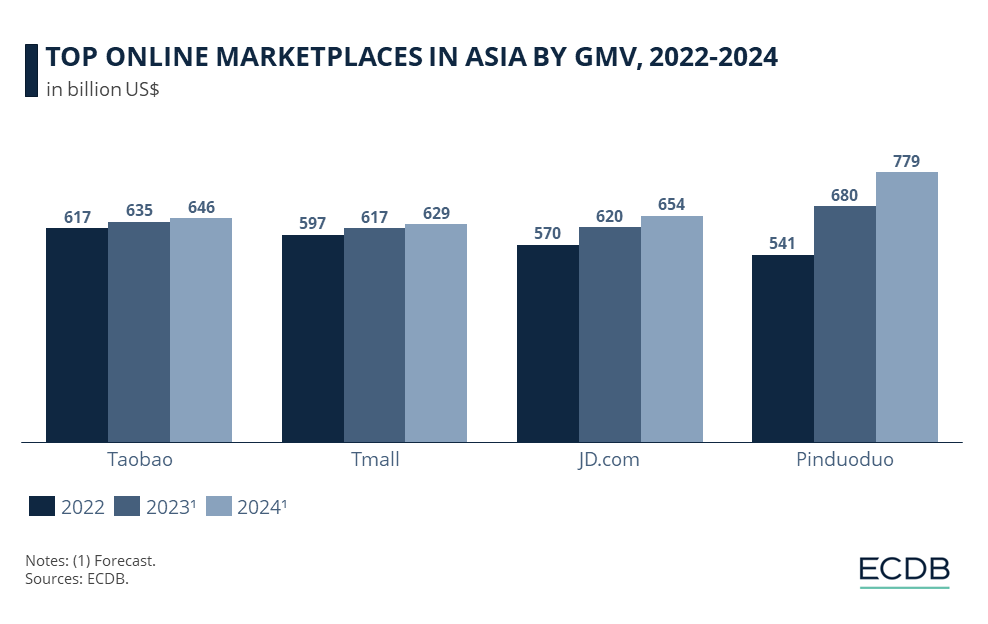

ECDB Forecasts: Pinduoduo on the Rise

Looking ahead, the top Asian online marketplaces in 2024 will look a little different. According to ECDB forecasts, Pinduoduo is likely to lead the Asian marketplaces in 2024. With a projected GMV of US$779 billion, Pinduoduo may leave its nearest competitors Alibaba and JD.com far behind. The Shanghai-based eCommerce giant will grow at a CAGR (2022-2024) of 20%.

In second place is likely to be JD.com, which is set to surpass Alibaba's marketplaces with a projected GMV of US$653.7 billion, a potential increase of US$83 billion from 2022. This is followed by Taobao with a projected GMV of US$645.8 billion and Tmall with US$628.9 billion.

Non-Chinese Players Enter the Stage

As China dominates the Asian market, let's take a look at the top online marketplaces outside of China. Shopee is not only the 6th largest online marketplace, but also the largest marketplace outside of China and the largest online marketplace in Indonesia with a GMV of US$73.5 billion, projected to reach US$84 billion by 2024.

South Korea-based Coupang ranks second on this list with a GMV of US$40 billion in 2022. With a CAGR of 22.8% from 2022 to 2024, Coupang is expected to reach US$60.3 by 2024. The third largest non-Chinese online marketplace in Asia is Rakuten. The Japanese player reached a GMV of US$35.6 billion in 2022 and is expected to increase its generated value at a CAGR of 26.1% to 2024 compared to 2022.

Learn More About Our Marketplace Rankings

Top 5 Online Marketplaces in Asia: Closing Remarks

Asian online marketplaces are currently dominated by China, demonstrating the country's prominence with five top-ranked platforms, notably led by the giant Taobao. Taobao secured its position at the top, closely followed by Tmall and JD.com, with a remarkable 11.5% growth in 2022. A standout performer is Pinduoduo, which the ECDB predicts will lead Asian marketplaces in 2024. Pinduoduo's projected growth, with an expected GMV of US$779 billion, highlights the rapid evolution and potential shifts within Asian eCommerce.

Related insights

Article

Kaufland Increases Fees for Marketplaces and Opens New Domains

Kaufland Increases Fees for Marketplaces and Opens New Domains

Article

Online Marketplace VIP.com: GMV Development, YoY Growth Rate & Chinese eCommerce Market

Online Marketplace VIP.com: GMV Development, YoY Growth Rate & Chinese eCommerce Market

Article

Amazon Business Segments: Top Domains, Prime & Seller Statistics

Amazon Business Segments: Top Domains, Prime & Seller Statistics

Article

Most Profitable Amazon Categories 2024: Trends, Shares & Growth

Most Profitable Amazon Categories 2024: Trends, Shares & Growth

Article

Top Online Marketplaces in the World: GMV, Top Markets & Product Categories

Top Online Marketplaces in the World: GMV, Top Markets & Product Categories

Back to main topics