eCommerce: Payment Providers

Top Payment Providers: Visa and Mastercard Lead in the United States and Europe

Visa and Mastercard emerge as the top payment providers offered by online shops in the U.S., UK, France, and Italy, while PayPal dominates in Germany. ECDB data highlights the market penetration of payment providers by country.

March 12, 2024

Top Payment Providers: Key Insights

Visa and Mastercard: In the U.S. and European eCommerce markets, including the UK, France, and Italy, Visa and Mastercard are the top payment providers.

PayPal: In Germany, PayPal is the top payment provider. It is also popular in the other European markets under review, where it ranks third overall. PayPal’s coverage is relatively smaller in the U.S., where it stands as the fifth most offered payment provider.

Other payment providers: In the U.S., American Express and Discover rank as the third and fourth most preferred payment providers, respectively. In Europe, bank transfer and Apple Pay are also popular, but behind other cards and PayPal.

Credit and debit cards are still amongst the most used payment methods in major eCommerce markets, including the United States and Europe, where providers like Visa and Mastercard prevail. However, eWallet payment services like PayPal are also gaining ground steadily.

Which payment providers are most preferred in eCommerce markets in the U.S., UK, Germany, France, and Italy? What does the payment provider penetration across regions indicate about preferences for different payment methods? ECDB data offers insights into the subject.

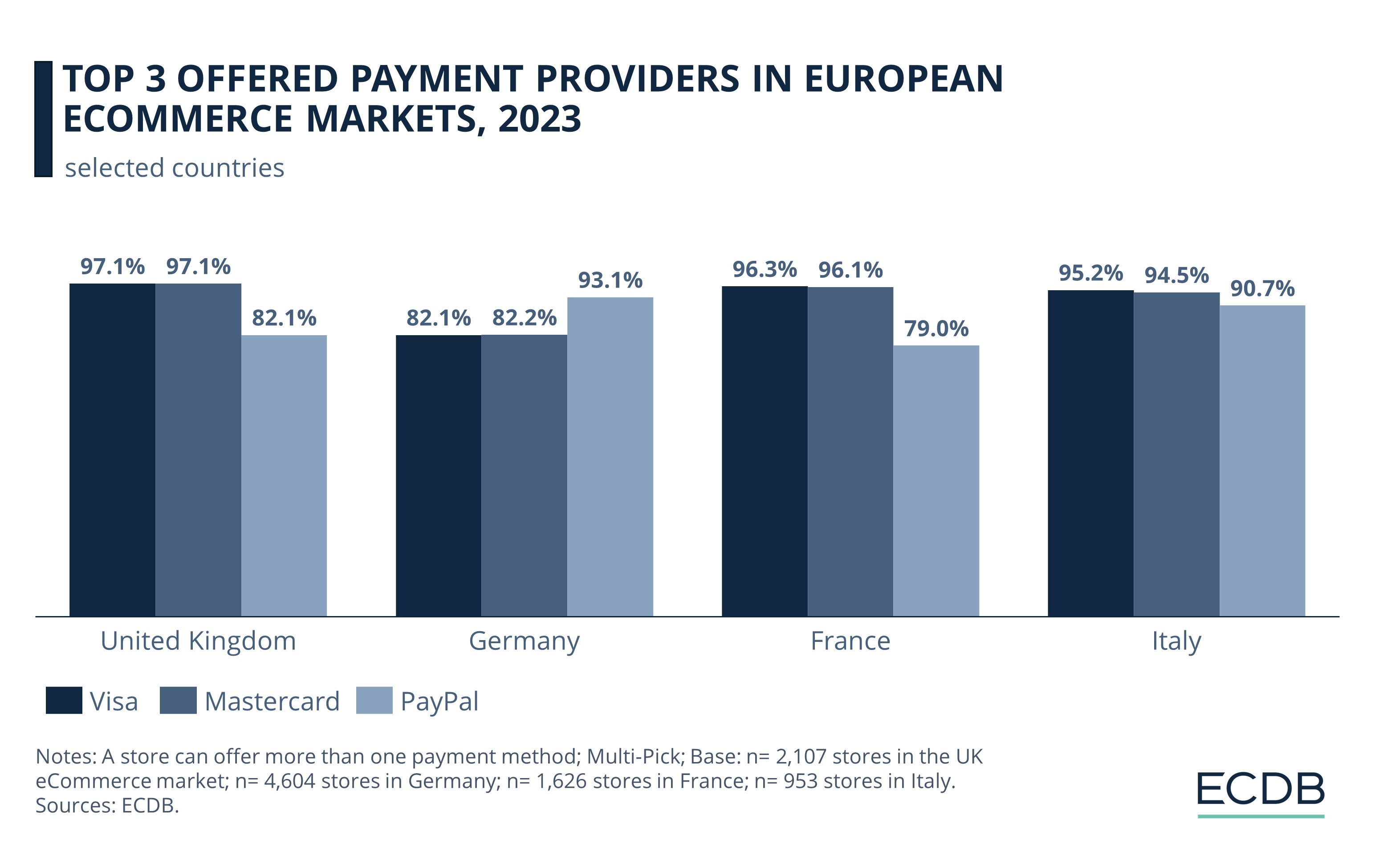

Top Payment Providers in Europe: Visa, Mastercard, and PayPal Have High Market Penetration

According to ECDB data, different European countries vary in their preferences for eCommerce payment options.

In 2023, the European markets under review all feature Visa and Mastercard as the top providers, except for one country: Germany.

In the UK, Visa and Mastercard are in a tie, with each offered by 97.1% of eCommerce shops. France and Italy also show head-to-head competition between Visa and Mastercard, with both being offered by 94% to 96% of online shops.

In all these countries, PayPal is the third most offered payment provider. Its market penetration is higher in Italy (91%) than in the UK (82%) and France (79%). American Express, Apple Pay, and bank transfer are among other preferred payment providers offered by online stores in these markets.

Thus, in these three European markets, the popularity of card providers indicates the enduring retailer and consumer confidence in the card-based payment method, more so than newer methods like eWallets.

Within Europe, Germany is an outlier. Here, PayPal emerges as the most used payment provider, at 93.1%.

In fact, Germany is the country with the highest adoption rate of PayPal worldwide, hinting at a transformative shift in the country’s consumer behavior. Instead of debit or credit cards, tech-savvy German online shoppers today prefer the contactless, secure, and fast payment process that PayPal – an eWallet service – offers.

In the German eCommerce market, card providers like Visa (82.1%) and Mastercard (82.2%) have the lowest penetration compared to all other countries under analysis, where they have coverage of 95% and above.

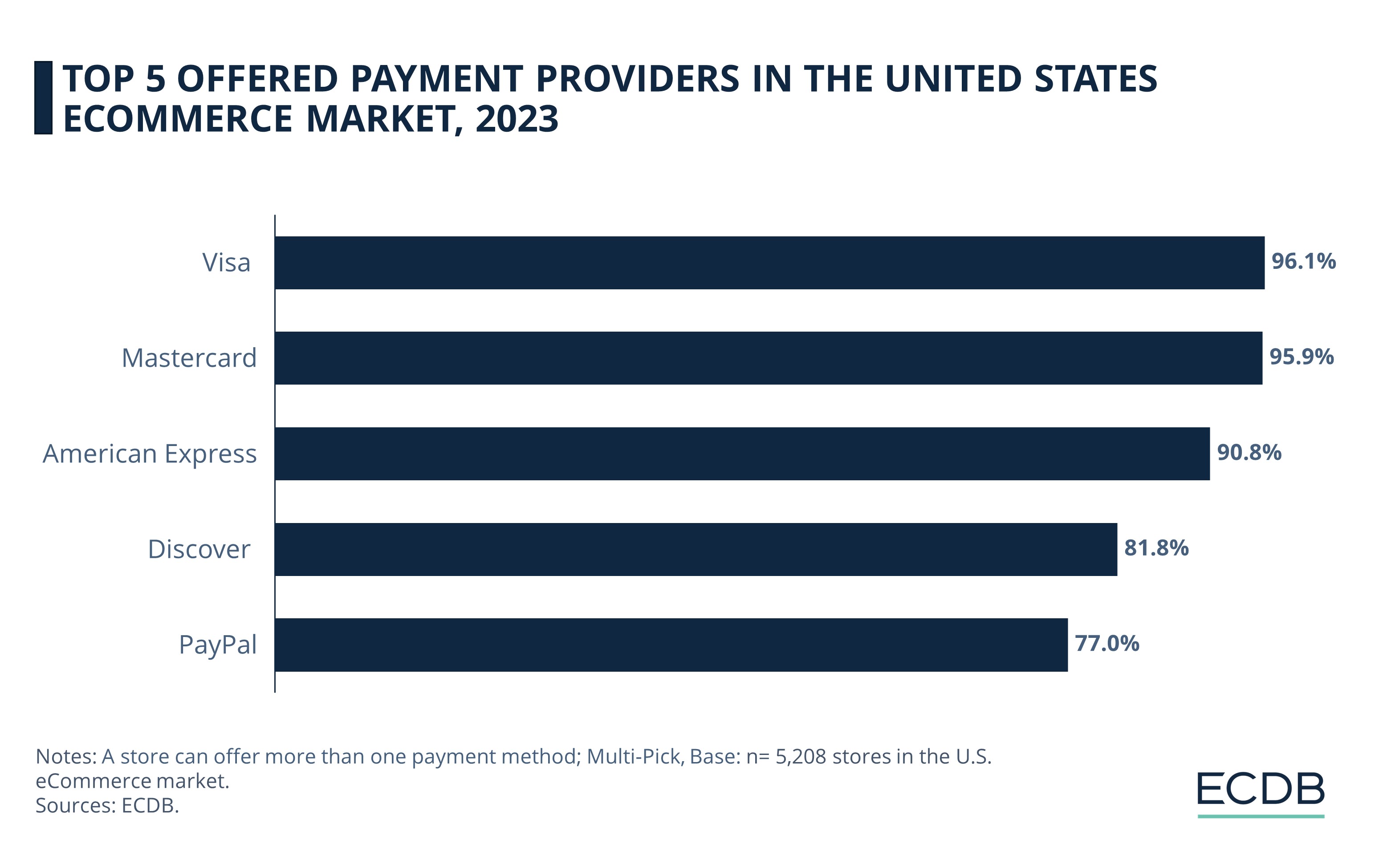

Top Payment Providers in the U.S.: Visa and Mastercard Dominate, PayPal Less Popular

As the United States often leads the way when it comes to advancements in eCommerce, it becomes important to assess which online payment providers are at the forefront in the U.S. eCommerce market today.

A look at the payment landscape in the U.S. reveals that card providers – Visa and Mastercard, specifically – are most commonly used in the country. On the other hand, providers such as PayPal are less preferred.

Visa and Mastercard have very high – as well as similar – coverage levels in the U.S., at around 96% each.

After Visa and Mastercard, the next most preferred payment providers in the U.S. are American Express (90.8%) and Discover (81.8%). These two are also traditional cards.

PayPal, which is an eWallet payment service, lags: it is only the fifth most used payment provider, at 77%.

While eWallets may trail behind traditional card-based methods as of now, data also shows that PayPal has a higher popularity amongst online shoppers in the U.S. and Europe than other eWallet services, such as Apple Pay and Google Pay. PayPal’s popularity is paving the way for a greater turn towards eWallets as the payment method of choice.

Payment Providers: Closing Remarks

Even as newer payment methods such as eWallets gain in popularity, an analysis of the current top payment providers confirms that card-based payment methods are still more preferred in both Europe and the U.S.

The global reach and acceptance of cards such as Visa and Mastercard, customers’ ability to build credit and use it for purchases, gain reward points, and the flexibility to conduct higher value transactions are some reasons that contribute to cards’ enduring relevance in online retail.

Considering the findings, online vendors and stores across the world are well-advised to offer a broad range of payment providers, as many consumers put immense value on payment options that meet their expectations.

Related insights

Article

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Article

Global PayPal Usage: Germany Leads in Online Store Acceptance

Global PayPal Usage: Germany Leads in Online Store Acceptance

Article

Tencent Holdings: Business Model, Strategy & Revenue Development

Tencent Holdings: Business Model, Strategy & Revenue Development

Article

Online Payment Methods in the U.S. in 2023: Challenges, Market Development & Trends

Online Payment Methods in the U.S. in 2023: Challenges, Market Development & Trends

Article

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Back to main topics