eCommerce: Shopping Days

U.S. Cyber Week & Holiday Season Recap: Online Shopping Trends

U.S. consumers set new spending records during Cyber Week and the 2023 holiday season. Adobe data reveals online shopping trends such as mobile shopping, “Buy Now, Pay Later”, AI, and social media. See also which product categories were discounted the most and which marketing channels drove sales.

Article by Nadine Koutsou-Wehling | January 12, 2024

Cyber Week & Holiday Season: Key Insights

New Spending Record: U.S. online shoppers spent US$222.1 billion online from November 1 to December 31, a 4.9% increase over 2022. Cyber Week alone accounted for US$38 billion in online spending, representing a 7.8% increase.

Growing Mobile Usage: Mobile shopping accounted for 51.1% of online sales, peaking on Christmas Day (December 25) when 63% of online sales were made from smartphones. In total, Adobe estimates that US$113 billion was spent through mobile devices during the 2023 holiday season.

Holiday Shopping Trends: BNPL usage increased in 2023. Finding gift inspiration on social media is common, while finding gifts with the help of AI is infrequent. Electronics, toys, and computers saw the highest discounts this season, and most consumers found their products through paid search ads and direct visits to retailers' websites.

As the new year begins following the holiday season, Adobe has released comprehensive findings of U.S. online spending from November 1 through December 31. This period is rife with shopping events, all of which offer discounts to consumers in search of holiday gifts for friends and family.

Of these, Cyber Week is arguably the most renowned shopping event in the West. Originally, the unofficial Black Friday holiday commemorated a stock market crash in the mid-1800s caused by gold price manipulation that was exposed on that day. Today, Black Friday and Cyber Monday have evolved into Cyber Week, a shopping time designed to benefit both retailers and shoppers with increased engagement through price discounts at the start of the holiday season.

This article focuses on consumer spending figures for the 2023 holiday season, including shopping trends such as mobile spending, "Buy Now, Pay Later" (BNPL), AI, and social media. You'll also learn which product categories saw the highest discounts, and which marketing channels accounted for how many online sales.

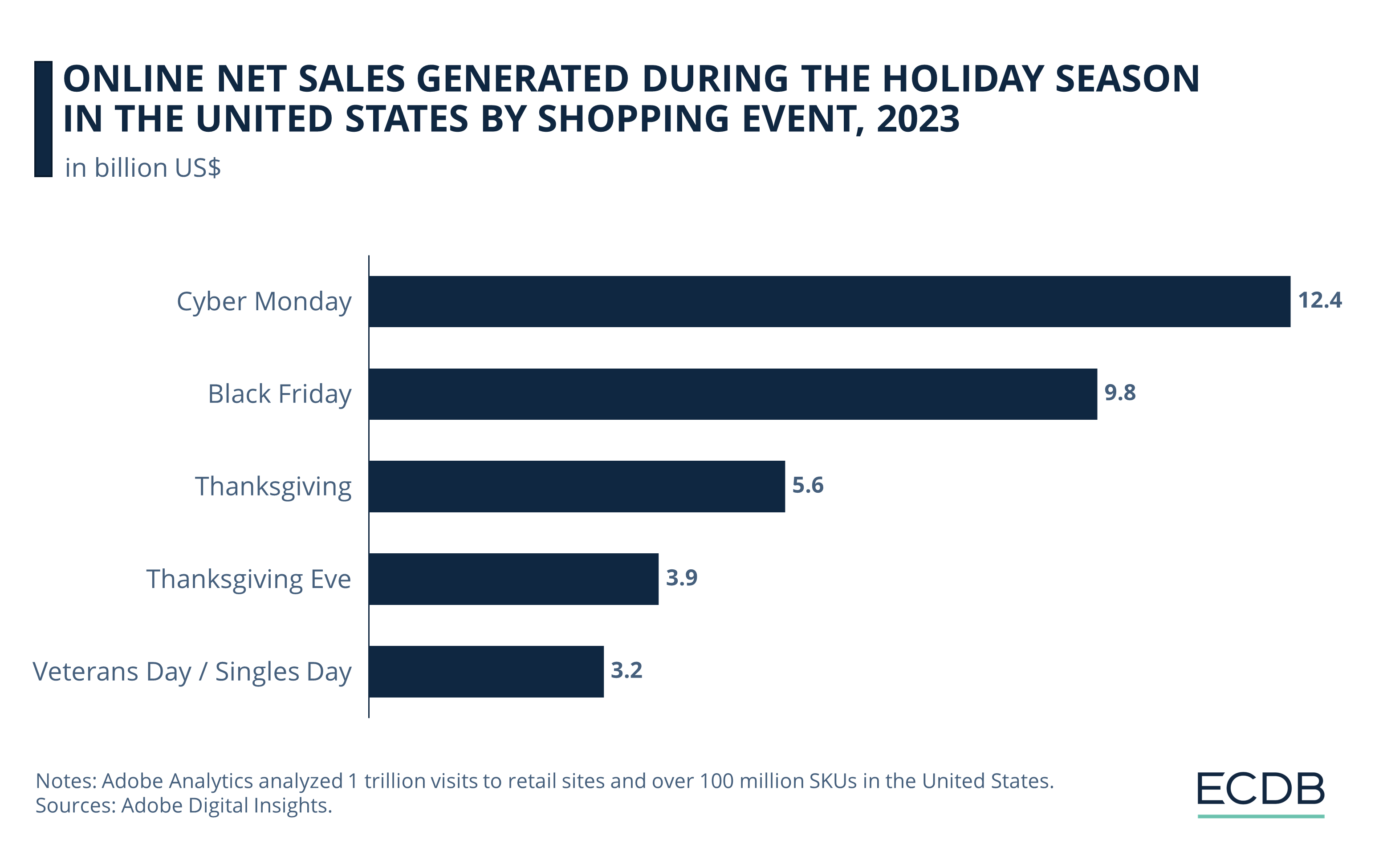

Cyber Monday 2023 Generated Highest Online Spend

U.S. consumers spent US$222.1 billion online between November 1 and December 31, according to Adobe Digital Insights. Of all shopping days during this period, Cyber Monday 2023 generated the highest net online sales.

In the U.S. alone, US$12.4 billion was generated on Cyber Monday, with an additional US$9.8 billion generated on Black Friday a few days prior. In total, Adobe calculated US$38 billion in online spending for Cyber Week, the five-day period from Thanksgiving through Cyber Monday. Compared to 2022, online Cyber Week sales grew by 7.8% in 2023.

While Adobe measured a total of US$9.5 billion in online net sales on both Thanksgiving and Thanksgiving Eve, Singles’ Day, which coincides with Veterans’ Day, fell short at US$3.9 billion.

Overall, online spending was higher in November at US$123.5 billion (a 6% increase from 2022) than in December, when US$98.6 billion was spent online (a 3.7% increase from 2022).

According to Adobe's Digital Price Index, eCommerce prices in December 2023 were 5.3% lower than in December 2022. While the above figures are not adjusted for inflation, this means that consumer demand has increased even more when adjusted. As prices have fallen while net online sales have risen, it is net consumer demand that has driven this record-breaking growth.

In addition to an increase in eCommerce net sales during the 2023 holiday season, another notable trend is coming to the fore: A growing preference for mobile shopping. Adobe data provides more details.

U.S. Consumers Shopping From Mobile Devices

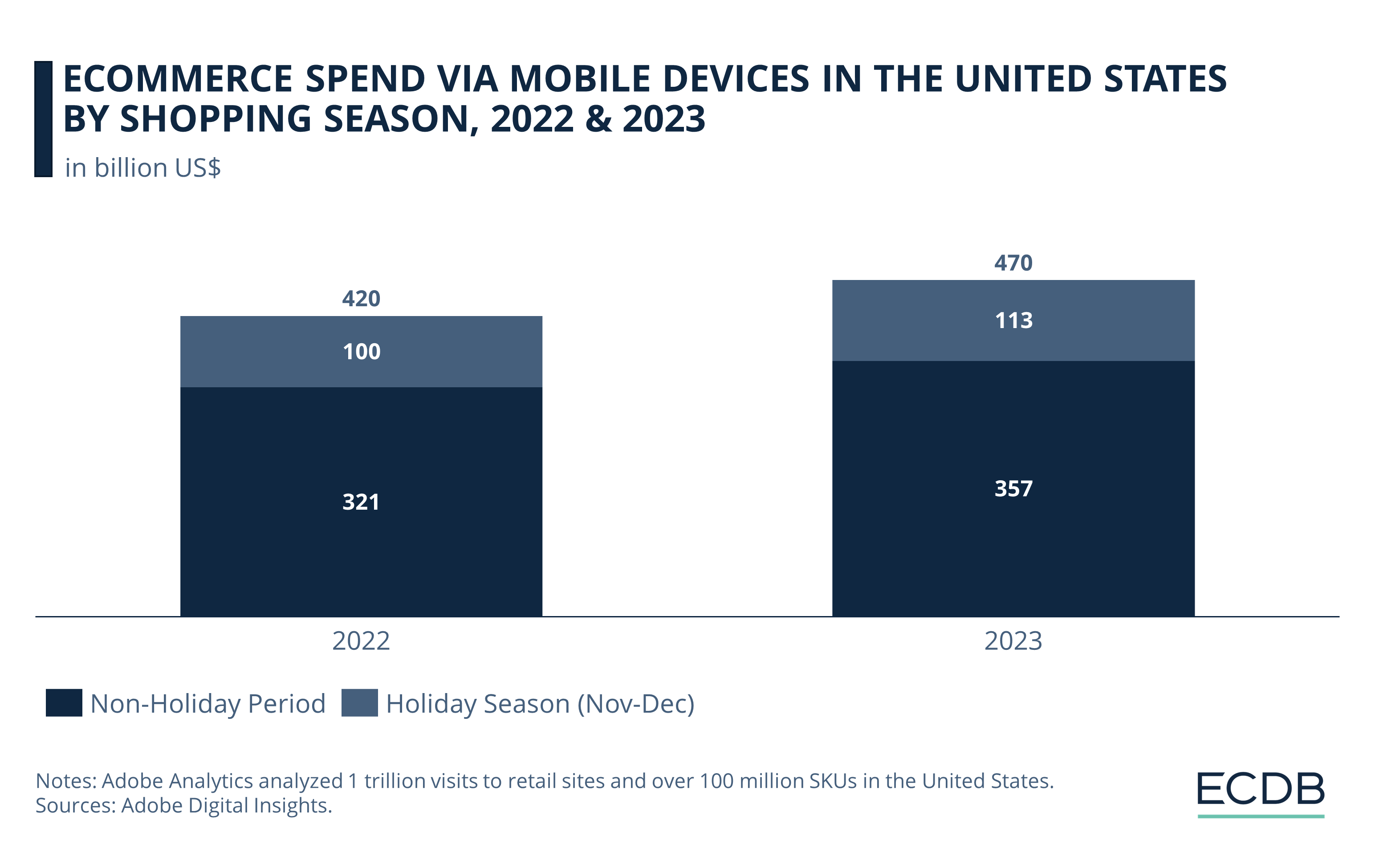

In 2023, U.S. consumers spent a total of US$470 billion on online purchases from mobile devices, as per Adobe. This represents an increase of US$50 billion, or nearly 12% from 2022.

Specifically, Adobe projected that US$113 billion was spent online from mobile devices this holiday season in the U.S. alone. This represents nearly a quarter (24%) of full-year online sales generated from mobile devices. Of all online sales during this period, smartphones accounted for a share of 51.1%. This percentage peaked on Christmas Day (December 25), when 63% of online sales came through mobile devices.

In addition to highlighting the importance of the holiday season to online retail sales, the data indicates that consumers are increasingly shopping on their mobile devices. With this comes a growing emphasis on convenience when shopping online. It also shows that confidence in mobile shopping is rising, as fewer consumers are hesitant to spend money online using their smartphones or tablets.

But mobile spending is not the only variable that has increased this year. Consumers are also taking advantage of installment payments, otherwise known as buy now, pay later or BNPL. The following subsection explores this in more detail.

BNPL: A Trend Among Younger Shoppers

The holiday season can be financially burdensome. As it has become commonplace to shower friends and family with lavish gifts at the end of the year, a season once intended to be a time of contemplation and closeness turns into a time of questioning how to manage the more material forms of affection.

A trend in recent years promises relief: BNPL. By spreading payments into smaller installments over a longer period of time, consumers feel more confident about making larger purchases they might not have otherwise considered. The 2023 holiday season confirms this assumption: BNPL payments set new records during this period, with US$16.6 billion having been spent online with this payment method. This denotes a 14% year-over-year growth compared to 2022, or an increase of US$2.1 billion in absolute figures.

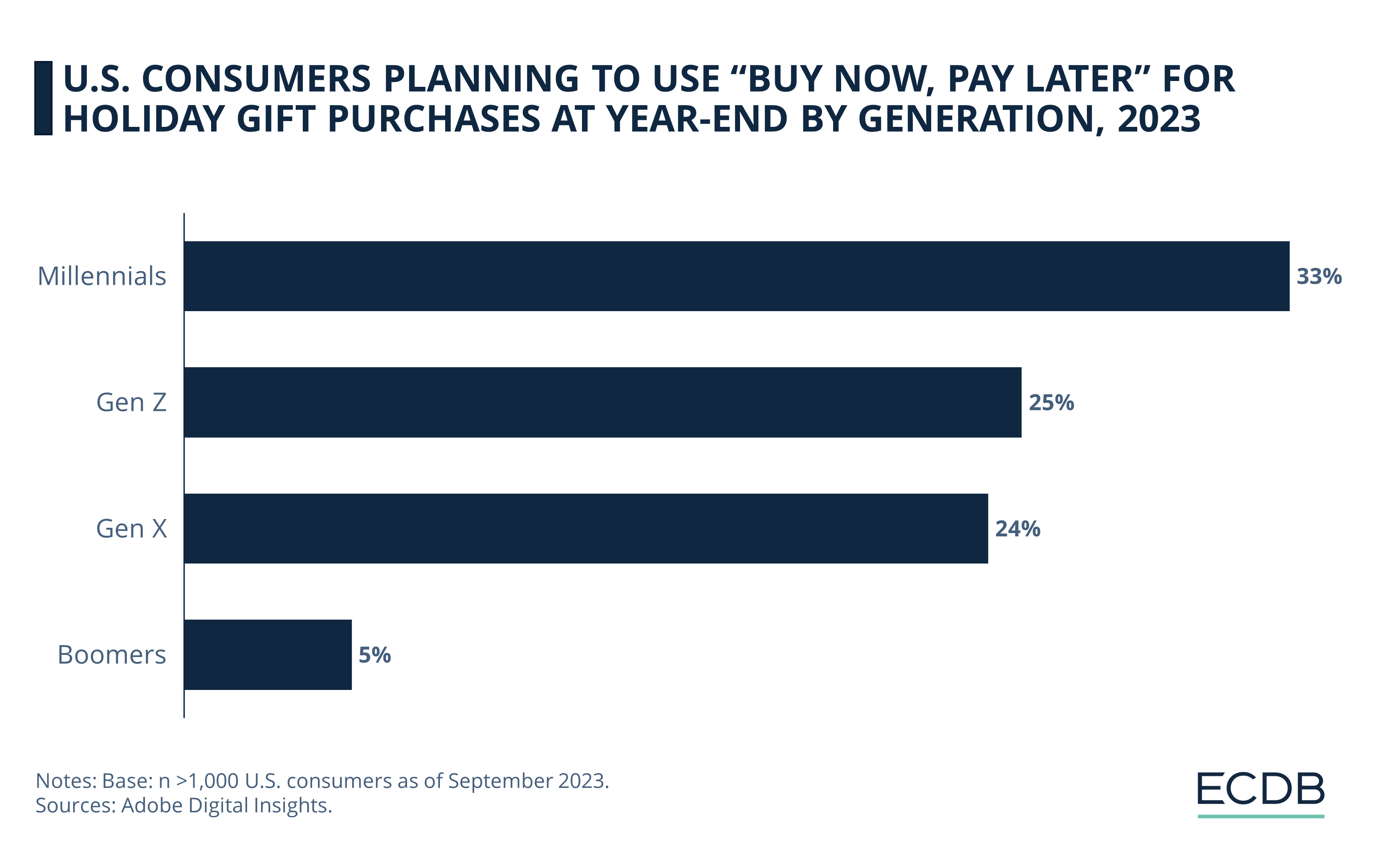

When looking at which age cohorts tend to prefer installment payments for holiday gift purchases, it is younger shoppers who are driving this trend. This is especially true for millennials, who lead among all U.S. generations in expressing a preference for BNPL use. See the Adobe survey results in the chart below.

One third of millennials said they plan to use BNPL offers for their 2023 holiday gift purchases. This is followed by a quarter of Gen Z, and just behind that, 24% of Gen X.

Very unlikely to pay in installments is the oldest cohort, baby boomers, only 5% of whom expressed interest in BNPL offers.

The trend toward younger consumers using BNPL services is consistent with previous research. This pattern therefore extends beyond the holiday season and can be applied more broadly.

Similarly, younger shoppers are driving the movement toward social media shopping, or social commerce. Social media already plays a huge role in product discovery, as the next section shows.

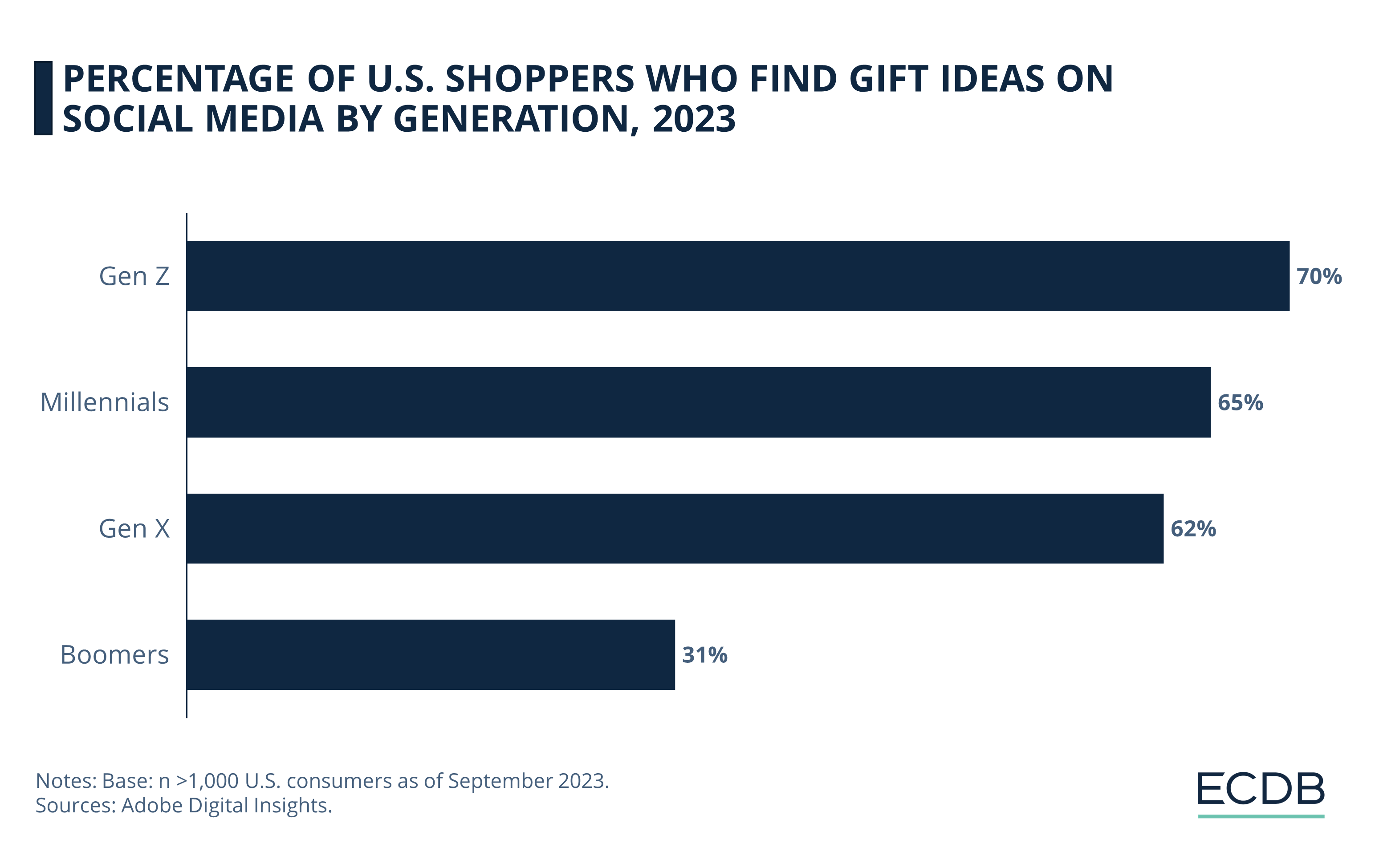

Most Shoppers Find Inspiration for Holiday Gifts on Social Media

This time around, Gen Z is the most likely to turn to social media for inspiration when it comes to finding holiday gifts. 70% of Gen Z respondents to the Adobe Consumer Survey agreed that social media plays a leading role in gift discovery.

Millennial consumers follow at 65% and Gen X respondents are not far behind at 62%. Again, baby boomer shoppers lag behind the other age groups, with 31% saying they find gift ideas on social media.

Aside from the oldest age group, the survey reveals a surprisingly high rate of consumers using social media to find gift ideas for the holiday season. These findings point to the growing importance of social platforms for online shopping, whether it is to find trendy products or discover new brands.

But there's another emerging online phenomenon that consumers are using to help them with their holiday shopping: Generative AI. Learn more about it here.

Generative AI Used in Part to Find the Best Deals and Specific Items

Generative AI describes large language models that are trained on expansive datasets to interact with users and provide solutions to queries posed to them. Popular examples of generative AI based on text input and output include ChatGPT and Google Bard.

Since their introduction to the public, companies have been experimenting with integrating these “chatbots”, as they are also called, into the retail experience to help customers find the right products and browse assortments more effectively.

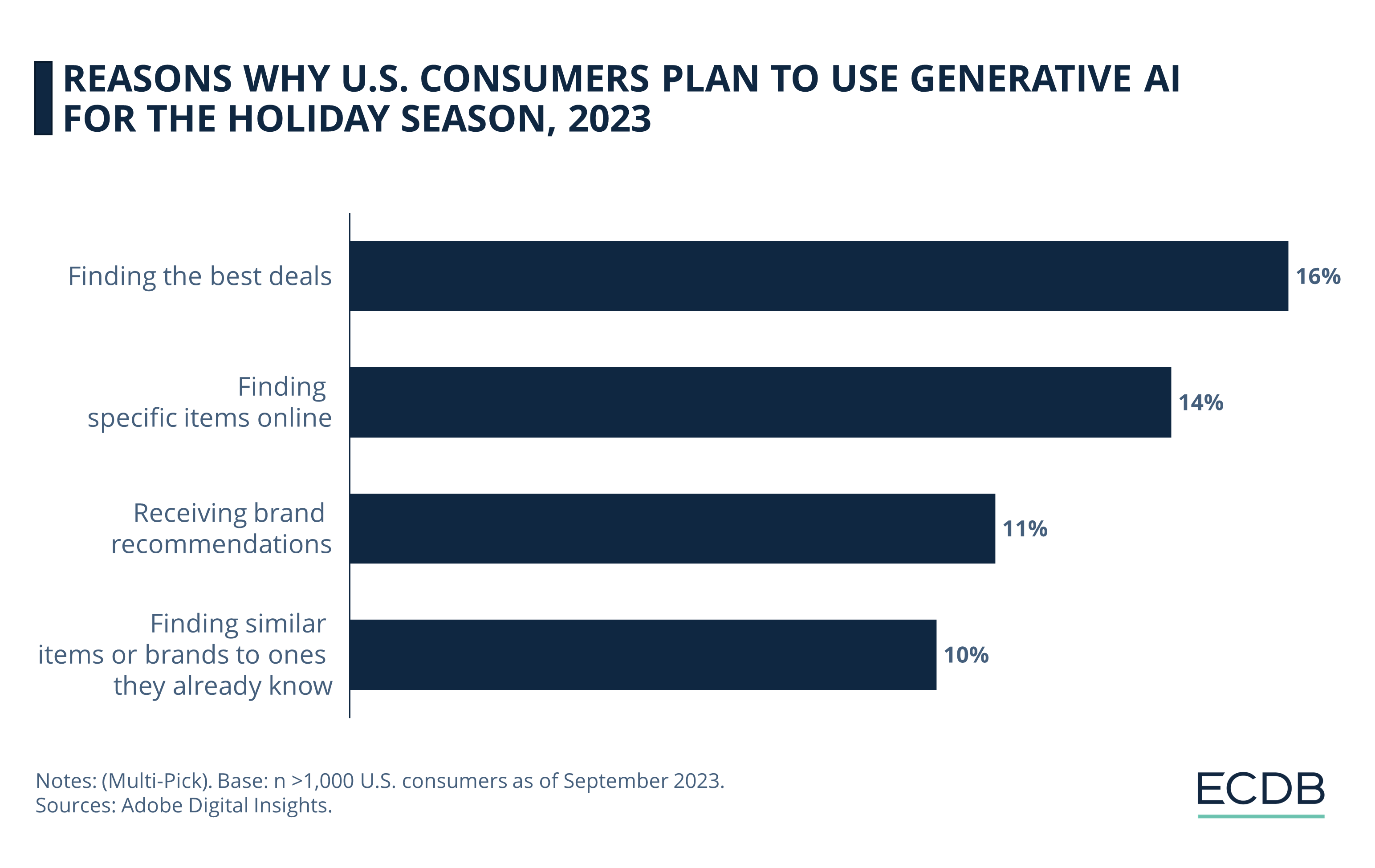

It is no surprise, then, that generative AI is also being used to assist shoppers during the holiday season. Check out the chart below to see the most common reasons consumers say they plan to use chatbots to shop for gifts.

While the overall percentage of consumers who say they plan to use generative AI for holiday shopping is not yet overwhelmingly high, some preferences are emerging.

Product discovery plays a primary role in the use of chatbots, with 16% of survey respondents saying they plan to use generative AI to find the best deals and 14% to find specific items.

By prompting the chatbot with product preferences or specific features, 11% of consumers hope to receive useful brand recommendations. Similarly, 10% of users expect to find items or brands similar to those they are already familiar with by letting AI do most of the research.

Since generative AI is still a relatively new phenomenon, this may explain the low percentage of users who plan to find holiday gifts with the help of chatbots. However, as it becomes more integrated into websites and consumer experiences, this trend may become more prevalent in the near future.

Introducing ECDB

In addition to innovative product discovery technologies, discounts are driving sales during this season of shopping events. But which product categories stood out as having the highest price reductions?

Electronics, Toys, and Computers Most Discounted

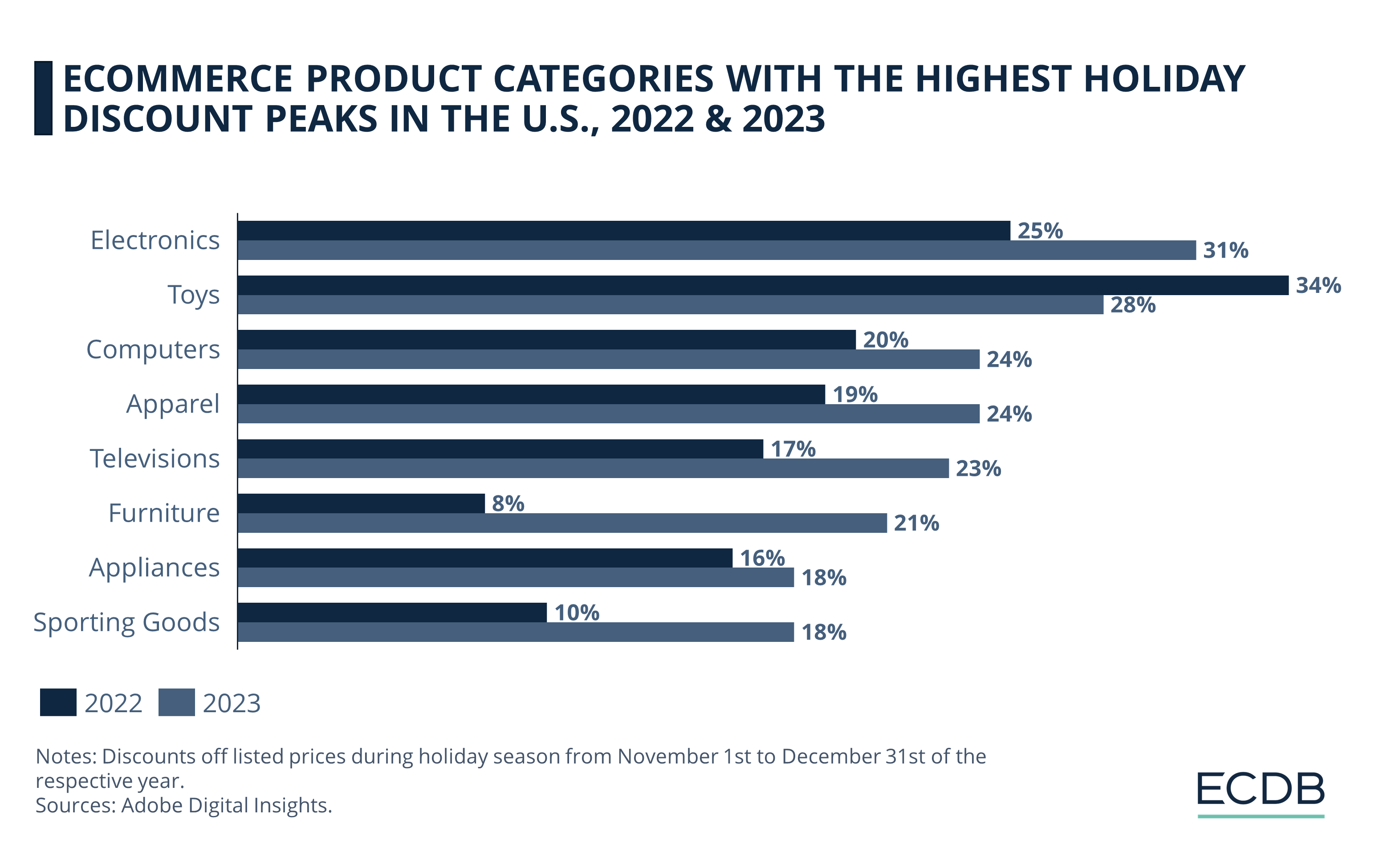

Adobe’s analysis of the product categories which were most discounted during the 2023 holiday season and the respective shopping days yields the following results:

Except for toys, all product categories saw higher discounts in 2023 than in 2022. Of those, electronics peaked at discounts of 31% (compared to 25% in 2022), followed by toys at 28% (down from 34% in 2022), computers and apparel at 24% (up from 20% and 19% respectively), and TVs at 23% (17% in 2022).

Furniture saw the highest increase year-over-year, peaking at 21% (up from 8% in 2022). Appliances and sporting goods were at an equal level, peaking at discounts of 18% (up from 16% and 10% respectively).

Most Favored Products During Holiday Season

Regarding the products that were most favored during the 2023 holiday season, Adobe identified further trends: Products that sold best within the electronics category are TVs, smart speakers, tablets, Bluetooth headphones and smart watches. For toys, this season saw high online sales of Barbie products, Disney Little People, Uno Show No Mercy, KidKraft Playsets and Squishmallows. Other top sellers that do not fit into any of the aforementioned categories are skin care serums and moisturizers.

That price reductions are a primary motivator for consumers to buy products is obvious, but what about the channels through which U.S. users find these offers? The following section examines this question in more detail.

Paid Search Ads Contributed to Most Online Sales

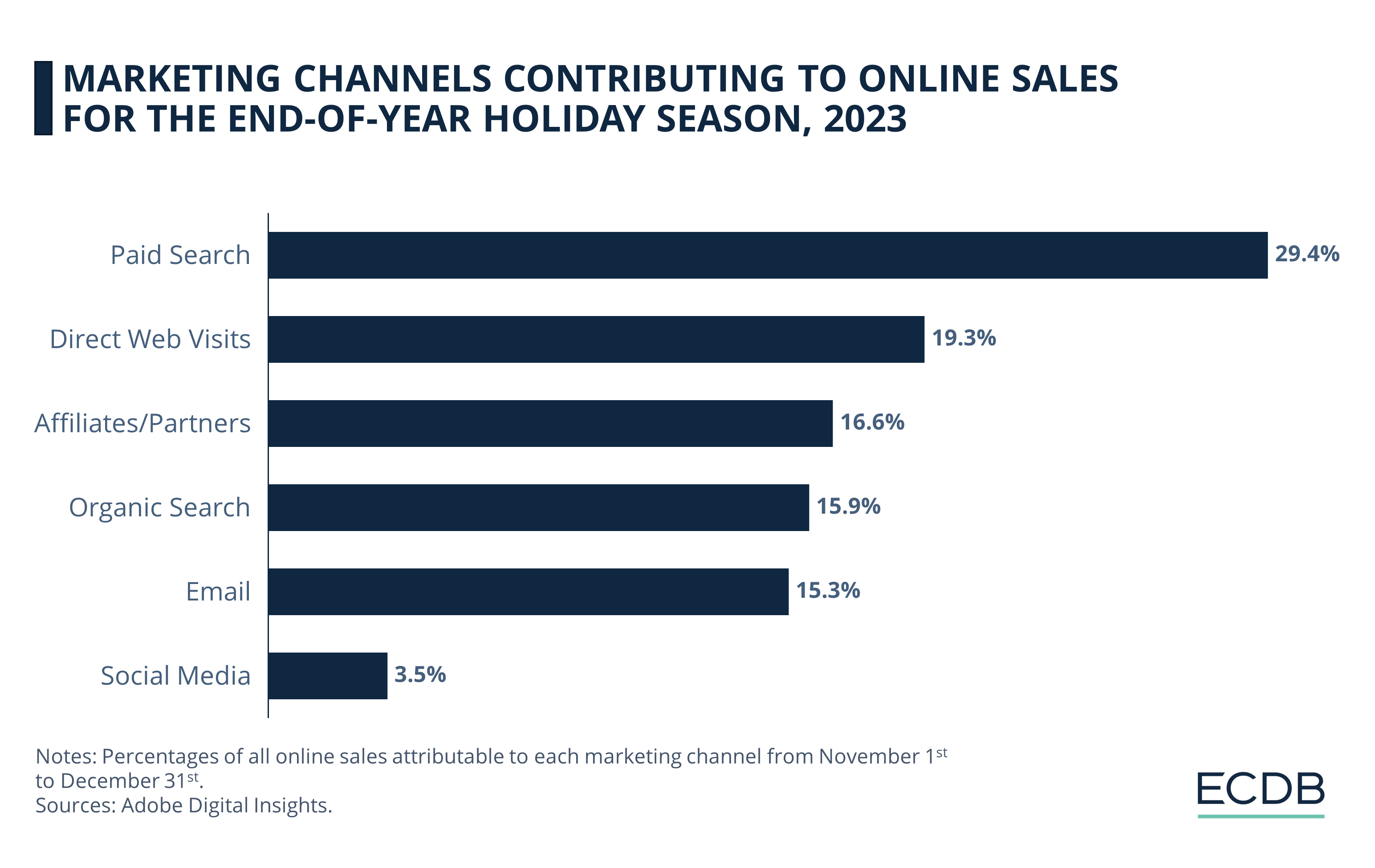

Among the primary marketing channels through which consumers found their products this season, paid search ads that are displayed as search engine results accounted for the highest share of sales at 29.4%.

The following marketing channels were all clearly below this rate, including the second most lucrative channel, direct web visits, at 19.3%. Affiliations and partnerships with other retailers accounted for 16.6% of online sales, followed by organic search (i.e., non-paid advertising) at 15.9%, and email marketing campaigns a close second at 15.3%.

Interestingly, social media had the lowest share of all the marketing channels listed, contributing only 3.5% of online sales. This is consistent with previous reports of a lower propensity for U.S. consumers to engage in social commerce. Adobe’s findings support the notion that social media is more of a product discovery tool than a sales channel in the U.S.

Online Shopping During the Holiday Season: Concluding Remarks

Adobe data on holiday spending 2023 in the U.S. shows that consumer demand has increased as total spend rose, while inflation fell and the average prices with it. While lower prices have certainly contributed to greater consumer willingness to spend during this season, the overall economic recovery following a three-year pandemic period is also expected to have had an impact.

These findings underline the continued importance shopping days have on consumer spending during the holiday season. With expansive discounts and product discovery tools, both retailers and consumers benefit from increased purchasing power and greater affordability.

Sources: Adobe Digital Insights: 1 2 – History.com

Related insights

Article

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Article

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Article

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

Back to main topics