eCommerce: Omnichannel

H&M: Expanding Global Online Stores

H&M's global online store presence is getting bigger and and the hybrid experience better! Learn what else the company has planned to compete in the global fashion market.

April 09, 2024

H&M Online Presence: Key Insights

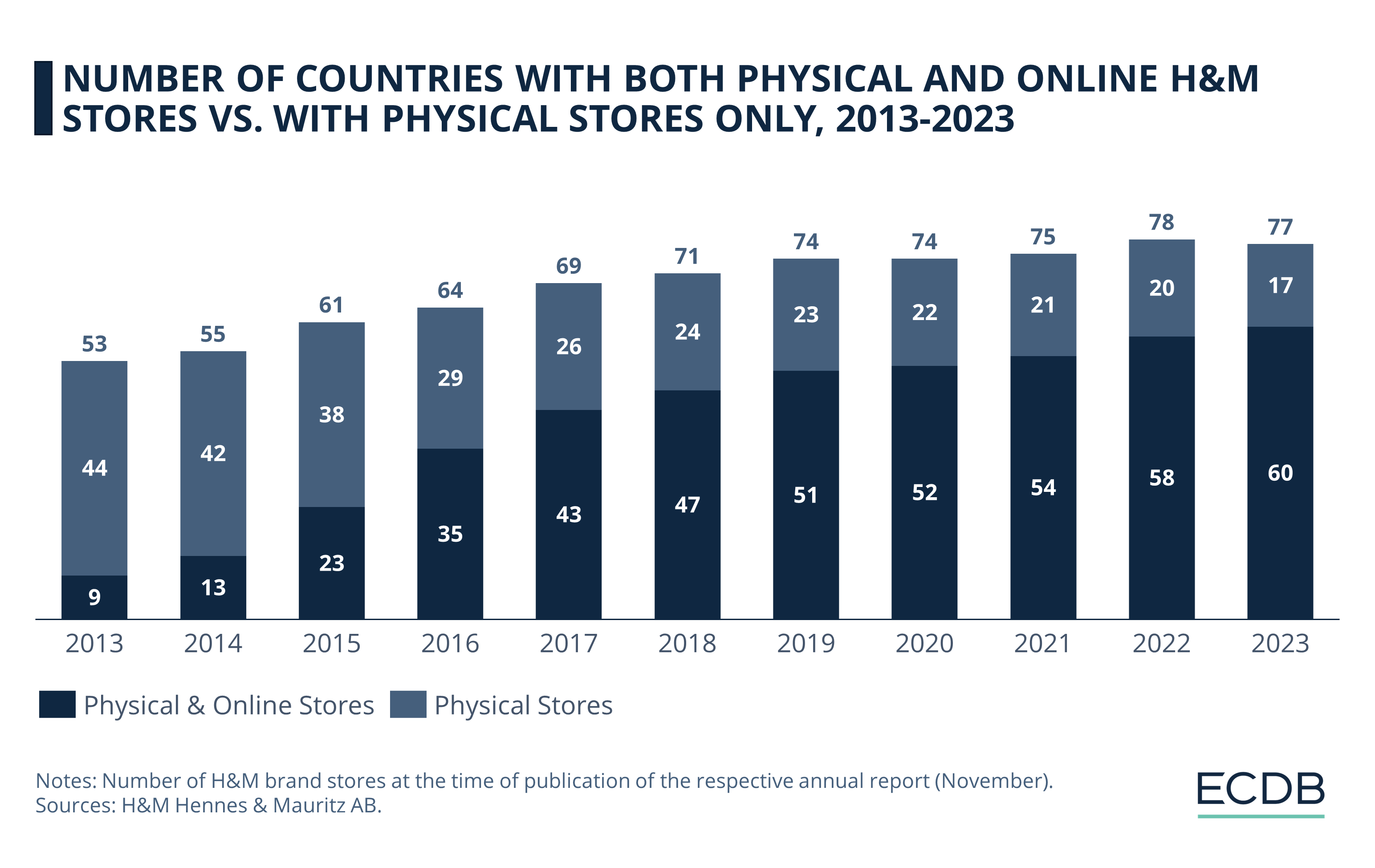

Refining the Hybrid Approach: The share of countries where H&M operates both online and with physical stores has grown steadily since 2013. In 2023, 78% of H&M's markets have both online and offline access to H&M.

H&M Under Pressure to Act: Rising costs and a shift to online are driving the development of widespread store closures in the fashion industry. A change in which H&M is an active part.

Growth in Emerging Markets: Despite closures in established markets, H&M continues to enter new markets and expand its store presence in emerging ones. One major region of development for the company is Latin America.

Over the past decade, the availability of H&M online stores alongside physical ones in various countries has grown notably. This development is supported by an increase in H&M's hybrid network, an expansion into emerging markets and third-party online marketplaces.

Check out what the latest announcement means for the conglomerate's portfolio.

H&M: Offline and Online Sales in 60 Markets

According to the latest data published by the company, the trend towards a growing online and physical store presence continues, with 78% of countries having both physical and online H&M stores in 2023.

This means that more than three quarters of customers now have access to a local H&M online store, whereas in 2013 this was the case only for a sixth of customers. The trend reflects the importance the company places on eCommerce. After all, according to H&M, around 30% of sales now come from eCommerce.

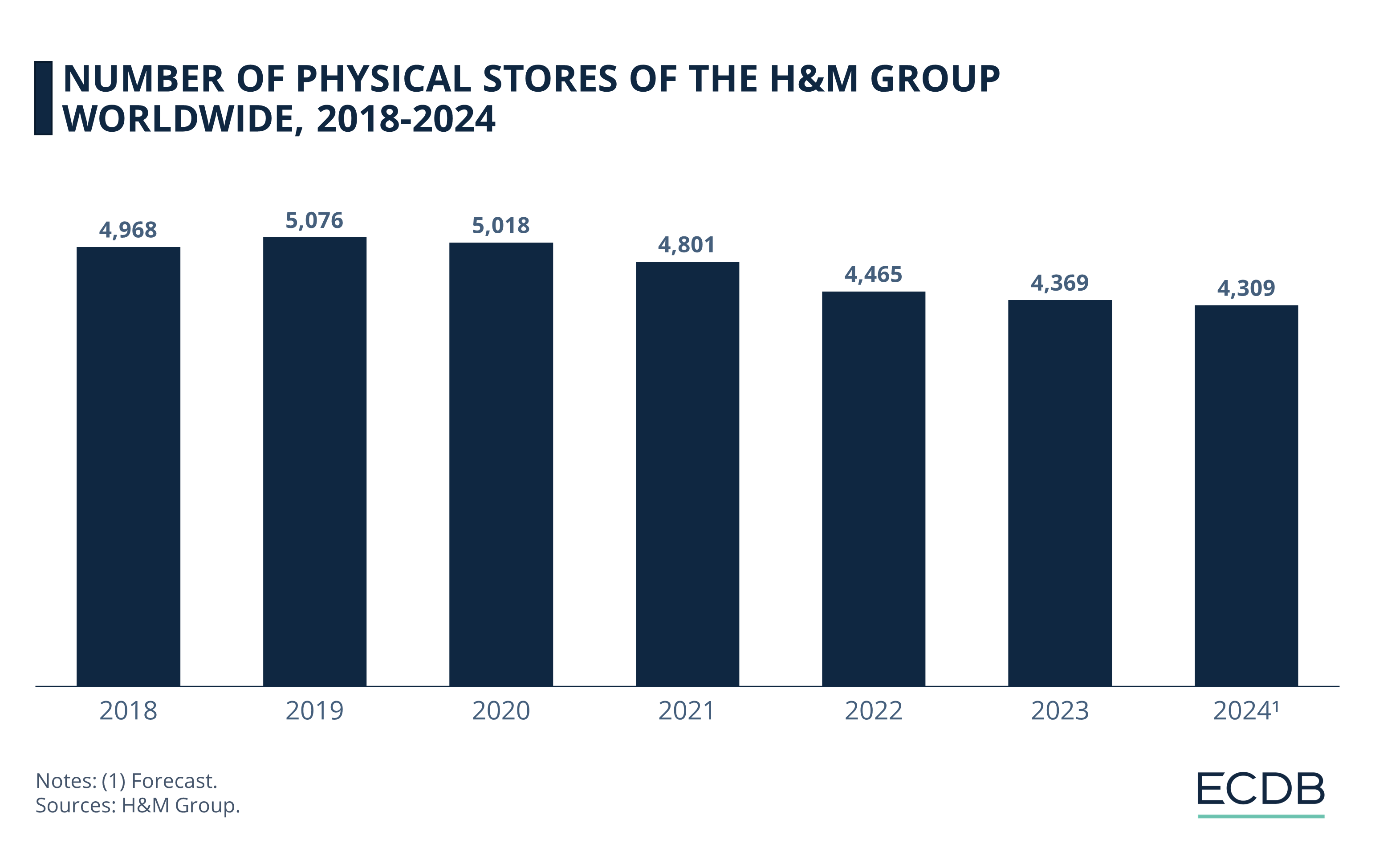

The move comes at a time when fashion retailers are closing physical stores across markets. Increased costs due to inflation and a growing emphasis on online retail are driving an industry-wide shift to a hybrid experience that aims to offer more flexibility to consumers while streamlining internal processes.

After ceasing operations in Russia due to the war in Ukraine, which accounts for the loss of one market depicted in 2023, H&M is otherwise expanding its presence around the world. In 2023, the Swedish fashion retailer entered two new online markets (Ecuador and Vietnam). The conglomerate also increases its presence on third-party online marketplaces in China (JD.com), the UAE (namshi.com) and South Africa (superbalist.com).

In its 2023 annual report, H&M Group disclosed its intent to trim the number of physical stores in emerging markets, and becoming more present physically in emerging ones. The stated goal for 2024 is an opening of 100 new stores, while closing 160 stores, resulting in a net loss of 60 over the course of the year.

The strategy for the remaining brands in the conglomerate's portfolio looks a little different.

H&M Group: Other Brands Grow

Across its subsidiary brands, H&M Group is continuing its path towards expansion: The high-quality brand Arket entered the markets in Estonia, Switzerland, and Latvia in 2023. COS opened its first store in Mexico, as did & Other Stories in Switzerland. All of these brands are known for offering products at higher prices than what consumers are typically used to from H&M.

For 2024, Arket is planned to expand its store presence into Spain, Italy, and Poland. At the same time, H&M's subsidiaries are also joining third-party online marketplaces. More precisely, & Other Stories and COS joined iconic.com in Australia and New Zealand. Monki, the other low-cost brand of the conglomerate, added Hong Kong as an additional market, with its introduction on zalora.com.

H&M's Store Presence: Closing Thoughts

Recent criticism of the fashion industry has prompted H&M to react, and building on a multichannel concept to improve efficiency is one way to improve the conglomerate's reputation. While in 2013, countries with a pure physical store presence were the norm, the trend has changed significantly over the years.

Rising competition from ultra-fast fashion platforms like Shein further put H&M under immense pressure, since its costs and turnaround time are reduced. H&M's move to streamline operations on the one hand, while expanding higher quality offerings on the other, corresponds to broader industry developments.

Related insights

Article

Most Valuable Global eCommerce Companies 2024

Most Valuable Global eCommerce Companies 2024

Article

Adidas: Stagnant Online Sales Development

Adidas: Stagnant Online Sales Development

Article

TikTok Ban in the United States: How Will This Impact Social Commerce?

TikTok Ban in the United States: How Will This Impact Social Commerce?

Article

Online Consumer Electronics Market in the United States: Top Players & Market Development

Online Consumer Electronics Market in the United States: Top Players & Market Development

Article

Cross-Border eCommerce in China: GMV Growth, Leading Markets, Top Companies

Cross-Border eCommerce in China: GMV Growth, Leading Markets, Top Companies

Back to main topics