eCommerce: Payment Methods in the UK

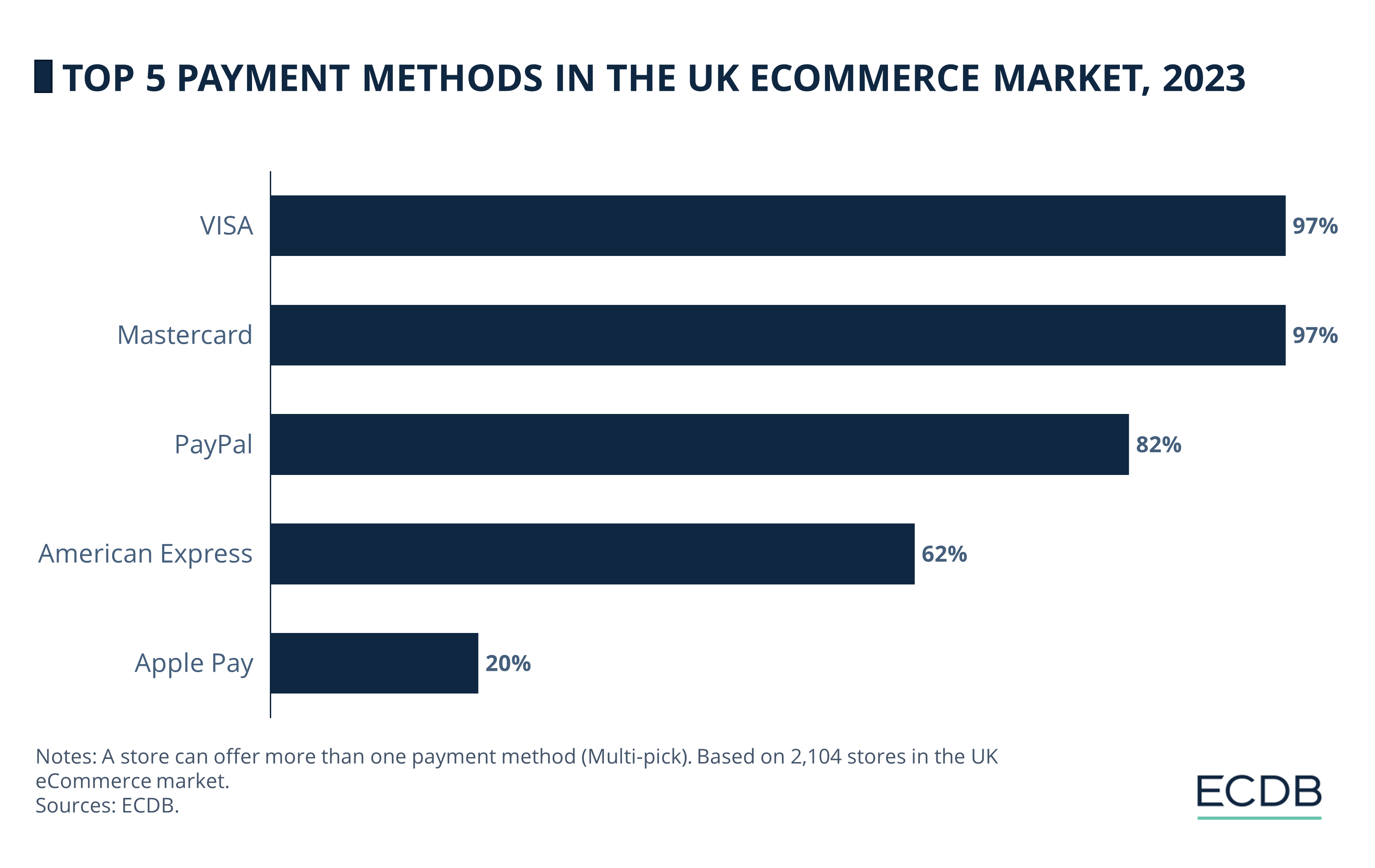

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Discover the top 5 online payment methods in the UK. From cards to digital wallets, find out which online payment options are leading the way in 2024.

Article by Antonia Tönnies | May 15, 2024

Top Online Payment Methods in the UK: Key Insights

Fee Caps on Cards:

Despite VISA and Mastercard's 97% usage rate among UK online retailers, proposed fee caps due to increased post-Brexit costs are raising concerns about their impact on businesses and consumers.

PayPal's Complete Payments:

PayPal, with an 82% usage rate, enhances its appeal to small businesses through its new "Complete Payments" solution, which allows acceptance of various payment methods and offers advanced features for secure transactions and package tracking.

American Express Adaptation:

American Express, holding a 62% usage rate, demonstrated resilience by adapting to pandemic challenges with non-travel benefits and the "shop small" campaign, leading to a significant rebound in consumer spending by 2023.

Apple Pay Integration:

At a 20% usage rate, Apple Pay's new feature from November 2023 further integrates it into the UK market, enhancing user control over finances and strengthening relationships with banks through the Open Banking initiative.

Particularly in the last 20 years, digital payment methods have rapidly expanded. eWallets, digital wallets, and mobile wallets like PayPal, Amazon Pay, Apple Pay, and Google Pay, are among the fastest-growing transaction methods of the current decade.

Payment preferences thereby vary depending on the country, with PayPal being one of the most common methods as the oldest and most established digital payment platform. Even back in 2003, private customers in the UK were able to use this payment method.

A lot has happened since then and the payment system has spread rapidly. But is PayPal actually the most popular payment option offered in the UK?

1. VISA

As per our 2023 data, cards are the most commonly used payment type by online retailers in the UK. Among the most offered payment methods is VISA with a 97% usage rate. Despite VISA's widespread acceptance, recent regulatory scrutiny has raised concerns.

Late last year, the Payment Systems Regulator (PSR) in the UK proposed capping fees that VISA charges retailers for transactions between the EU and the UK. These fees, which spiked after Brexit, cost UK firms an extra £150 to £200 million (US$190 to US$250 million with the current exchange rate) in 2022. VISA disputes the need for a cap, arguing that the fees support reliable and secure digital payments.

While large companies might absorb these extra costs, smaller ones could pass them onto consumers. It's also worth noting that these developments caused calls for a UK-developed alternative to U.S. payment giants.

2. Mastercard

Mastercard shares the first spot with VISA, also with a 97% rate. Like VISA, Mastercard faces proposed fee caps from the PSR due to increased costs for cross-border transactions since Brexit.

These fees, which were previously regulated by the European Union, have significantly risen, impacting UK businesses. Mastercard contends that these fees offer value in a competitive market and are crucial for maintaining the security and efficiency of digital payments.

3. PayPal

Not far behind the cards is the well-known digital payment platform PayPal, with 82% usage rate in the UK.

In March this year, PayPal launched "Complete Payments" for online small businesses in the UK, Canada, and over 20 European markets. This new solution allows businesses to accept various payment methods, including buy now pay later options, Apple Pay, Google Pay, and credit and debit cards.

With integrations in major eCommerce platforms and advanced features like secure payment storage and package tracking, PayPal aims to boost checkout conversions and provide robust fraud protection, making it a favorite among UK consumers.

4. American Express

American Express follows the top 3 with 62%. Despite the challenges brought on by the pandemic, American Express adapted in the UK by investing in non-travel benefits like online workshops and the “shop small” campaign.

This shift helped counter the decline in travel-related perks and proved that Amex could still thrive even with reduced travel. By 2023, American Express saw a significant rebound in consumer spending in the UK, demonstrating resilience and adaptability in a changing market.

5. Apple Pay

Significantly further down the list is the payment method of the tech giant, Apple Pay, with 20%. Apple Pay launched in the UK in 2015, providing a secure and easy way to pay using popular credit and debit cards.

In November 2023, Apple Pay introduced a new feature allowing users to view their debit card balance, transaction history, and account details directly in their Wallet.

This move, part of the Open Banking initiative, further integrates Apple Pay into the UK market, enhancing user control over their finances and fostering deeper relationships between banks and their customers.

Top Online Payment Methods in the UK: Closing Thoughts

In 2021, cash in advance held the fifth position with 12%, but by 2023, Apple Pay had taken over this spot, surpassing the former. This makes Apple not only a growing competitor for individual payment companies, but also, together with PayPal, mobile wallets that could potentially surpass card payments. While PayPal has seen an almost 4% increase compared to 2021, the values of VISA, Mastercard, and American Express, albeit only minimally, have decreased.

Claiming that cards are being replaced by eWallets and digital wallets might be an overstatement, but the change is clearly there. The future will reveal which payment method remains the most popular in the UK.

Sources: BBC, PayPal, The Guardian, Apple, Statista, ECDB

Related insights

Article

In-Game Purchases Analysis: Walmart Dives Into Roblox

In-Game Purchases Analysis: Walmart Dives Into Roblox

Article

Global PayPal Usage: Germany Leads in Online Store Acceptance

Global PayPal Usage: Germany Leads in Online Store Acceptance

Article

Online Payment Methods in the U.S. in 2023: Challenges, Market Development & Trends

Online Payment Methods in the U.S. in 2023: Challenges, Market Development & Trends

Article

Top Payment Providers: Visa and Mastercard Lead in the United States and Europe

Top Payment Providers: Visa and Mastercard Lead in the United States and Europe

Article

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Back to main topics