eCommerce: Fast Fashion

Shein and Temu Products Clog Air Transports

108 Boeing 777s: That's the number of planes that need to take off every day to keep up with the fast fashion exports of China's eCommerce giants like Shein, Temu and Alibaba. This does affect air traffic – in a bad way.

Article by Lukas Görlitz | April 09, 2024

Shein and Temu Products Clog Air Transports: Key Insights

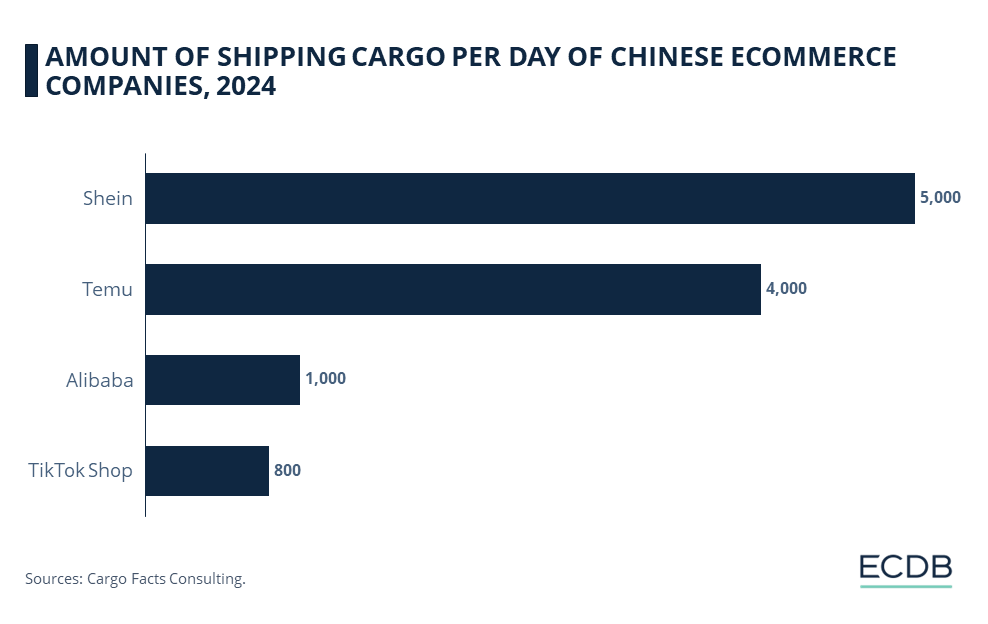

Air Freight Problems: Shein and Temu together account for over 9,000 tons of cargo per day. This leads to air traffic bottlenecks and high freight costs.

Custom Restrictions Produce More Cargo: Products are sent in many packages or shipped to nearby countries to avoid export custom restrictions.

Sustainability Questions: The high air pollution from flights and sustainability critics from fast fashion can become a problem for logistic companies.

Chinese eCommerce players like Shein and Temu are not only taking the Western market by storm – air freight is also at a record high due to their order packages. Offering low-cost fast fashion and cheap everyday essentials, Shein and Temu have become very popular in the Western market since their launch. According to Coresight Research, Shein already owns 20% of the fast fashion market value which had a total value of US$60.5 billion in 2022.

A report U.S. Congressional report from June 2023 states that 600,000 packages from Shein and Temu arrive in America every day. Since deliveries must arrive a few days after the purchase, this has significant implications for air freight.

Over 10,000 tons freight per day from China

Both Chinese eCommerce players do not rely on logistics centers, warehouses or distributors, which means that packages must be delivered immediately after the plane lands. Shein and Temu are responsible for 5,000 tons and 4,000 tons of freight respectively every day.

In combination, Alibaba and TikTok Shop add another 1,000 and 800 tons of freight per day, respectively. In other words: It would take 108 Boeing 777s flying from China to the rest of the world every day to deliver all those packages.

In comparison, Apple produces 1000 tons of freight per day. According to industry sources, Apple really must fight for fright space on planes because there is too little space since Shein and Temu emerged as global players, Handelsblatt said.

Custom Restrictions Produce More Cargo

One reason for low prices and high freight rates is to avoid customs restrictions. One expert explained that a pen, for example, might be packaged in four pieces to avoid China's strict export restrictions. Another method used by Chinese eCommerce players is to truck products to Vietnam or Thailand and fly them from there.

Currently, Temu is looking for its own aircraft to lease to ship even more cargo. In addition, the company is also looking for suppliers in Europe and the U.S. to minimize transportation times. Even with these actions, experts do not expect any significant changes in air freight soon. There is also sceptics if the logistics companies’ retailers will continue to deliver Chinese products because of the environmental sustainability aspects.

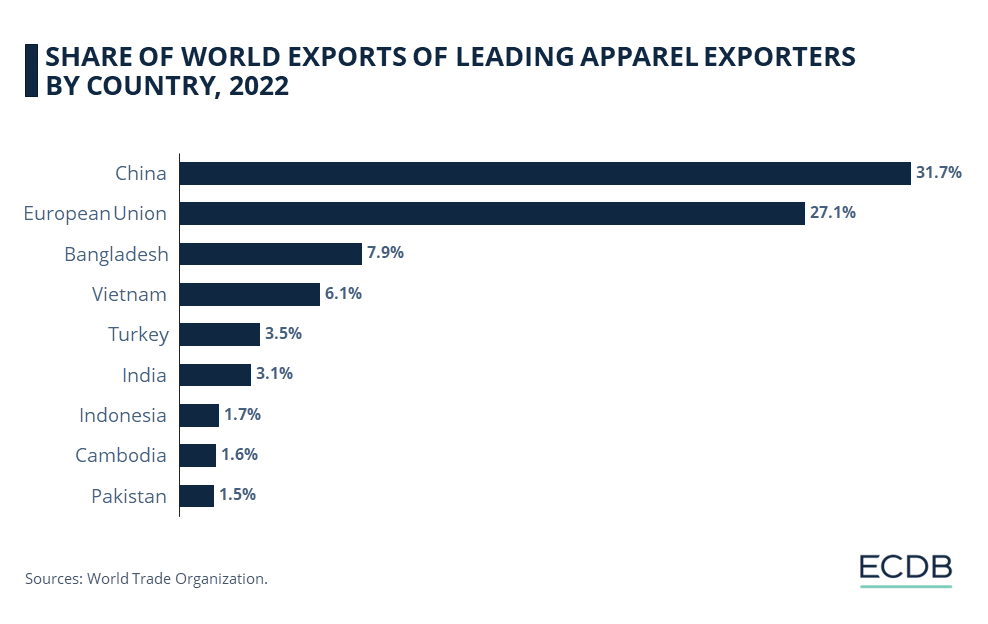

So far, fast fashion from Shein and Temu help China to remain their top spot as the top fast fashion export nation. With exports of US$182 billion in 2022 they took the biggest share of the cake with 31.7%. In Second place is the European Union with a share of 27.1%. Behind comes a huge gap to the 3rd place Bangladesh with 7.9%.

Shein and Temu Products Clog Air Transports: Closing Remarks

The dominance of Shein and Temu in the fast fashion market has led to high levels of air freight, creating logistical bottlenecks and environmental concerns. It is likely that Chinese eCommerce players will buy warehouses and logistics centers in Europe and America to improve delivery times. This could ease the air freight situation by reducing the number of packages delivered directly to customers. With a growing eCommerce market, including fast fashion, the problems of cargo space and high freight will continue.

Sources: Handelsblatt, Reuters.

Related insights

Article

Most Valuable Global eCommerce Companies 2024

Most Valuable Global eCommerce Companies 2024

Article

Adidas: Stagnant Online Sales Development

Adidas: Stagnant Online Sales Development

Article

TikTok Ban in the United States: How Will This Impact Social Commerce?

TikTok Ban in the United States: How Will This Impact Social Commerce?

Article

Online Consumer Electronics Market in the United States: Top Players & Market Development

Online Consumer Electronics Market in the United States: Top Players & Market Development

Article

Cross-Border eCommerce in China: GMV Growth, Leading Markets, Top Companies

Cross-Border eCommerce in China: GMV Growth, Leading Markets, Top Companies

Back to main topics