eCommerce: Consumer Insights

Shipping Preferences of U.S. Online Shoppers 2023: Gender, Age, Income & City Size

A recent Top Shop survey by Statista asked U.S. consumers about their shipping preferences for online orders. ECDB discusses the findings, including demographic analyses of gender, age, household income and city size.

Article by Nadine Koutsou-Wehling | January 09, 2024Download

Coming soon

Share

U.S. Consumer Shipping Preferences: Key Insights

Free Delivery Is Most Important: U.S. consumers value free shipping the most when ordering (non-food) products online, followed by easy return shipping, next-day delivery and same-day delivery.

Demographics Matter: Gender and age differences are seen in a higher preference for low cost among female shoppers and older respondents, while male users and younger respondents are more likely to prefer next-day or same-day delivery.

Household Demographic Vary: Household income has little impact on shipping preferences. However, city size shows a negative correlation with free delivery and easy returns.

Shipping is a fundamental aspect of eCommerce and has a decisive impact on consumer purchasing behavior. In addition, shopper demographics play a role in what consumers value most when receiving their online orders.

It is therefore vital to ask about consumer shipping preferences. Is it more important to keep prices low with free delivery or to receive the shipment quickly? Are online shoppers more interested in the selection of a delivery window or the sustainability of shipments?

Statista’s 2023 Top Shop survey asked U.S. consumers about their eCommerce shipping preferences. See how the most commonly given responses relate to shopper demographics like gender, age and income below. Additionally, the analysis extends to the city size of respondents’ residence.

Free Delivery Is Most Important to U.S. Users

When asked what shipping features of online (non-food) orders are most important to consumers, free delivery was by far the most frequently cited response. A clear majority of 89% of U.S. consumers selected free delivery as a valued aspect of online shopping.

The second most frequently cited feature by U.S. consumers is the ease of returning items, with 65% in favor. Sending reusable packaging with a return label included can go a long way in terms of convenience for consumers, and this service appears to be highly valued.

The third and fourth most popular responses received less agreement, but are similar in nature and share: 36% of consumers said they value next-day delivery, while 30% selected same-day delivery. The overall higher ranking of free delivery shows that U.S. consumers tend to prefer low cost over immediacy, but together with convenience, these three shipping preferences are still the most valued.

Next in importance is choosing a specific shipping provider (20%) or delivery window (19%), while green or sustainable shipping is less important, at 18%. Only 1% of U.S. respondents said that none of the above was important to them.

Learn More About the ECDB Company Rankings

Free delivery, easy returns, and fast shipping are important in online shopping, but they're not everything. Companies need to consider how a shopper's gender and age influence their choices.

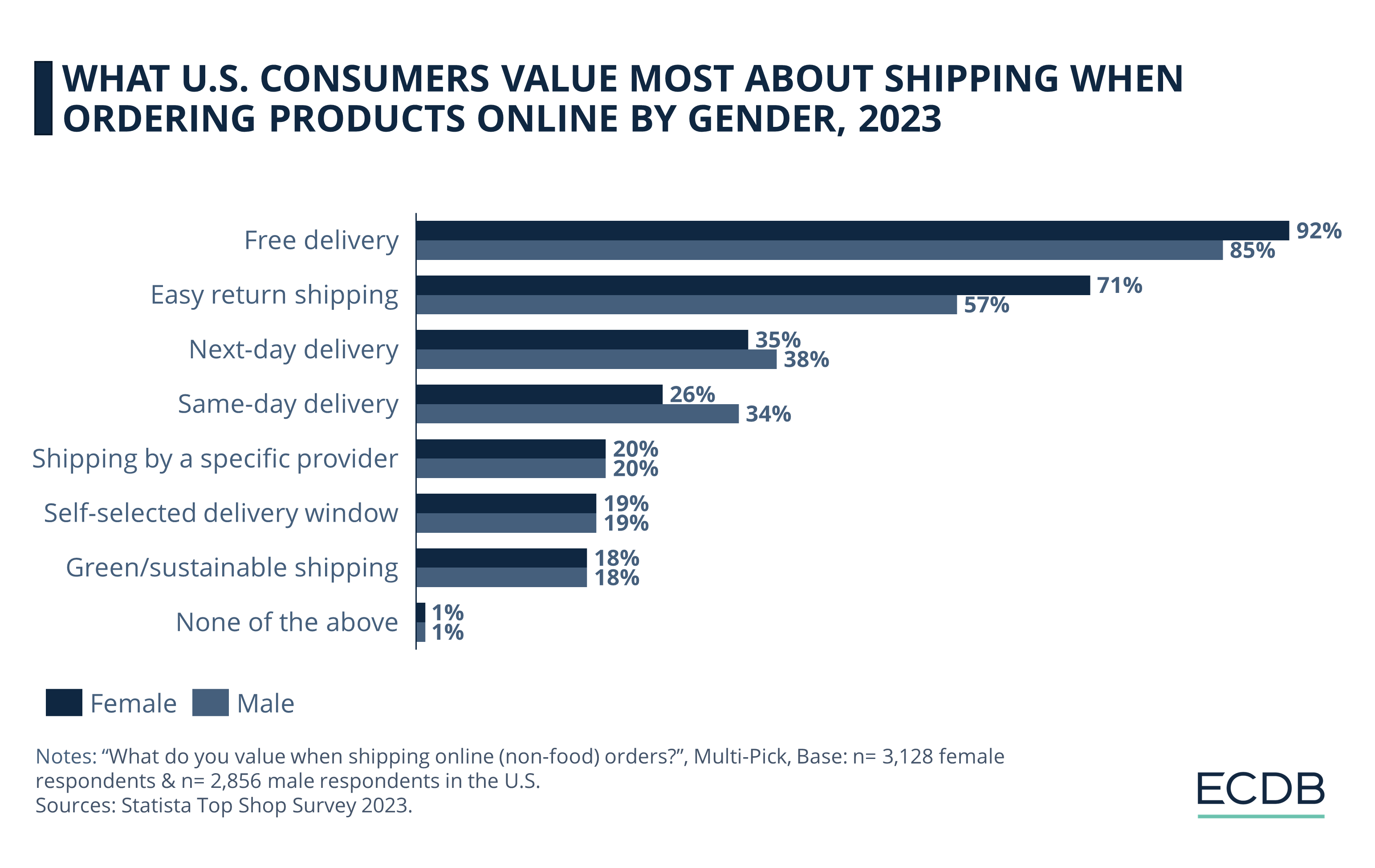

Shipping 2023: Gender Differences Found

An examination of shipping preferences by gender shows that the frequency of respondents agreeing with the statements differs in the higher rankings, but the order of preference remains the same.

At the lower rankings, however, the differences in preference between male and female consumers disappear.

Specifically, female respondents are more likely to say they value free shipping (92%) than male respondents (85%), and the same is true for the second aspect, easy return shipping, where 71% of female users and only 57% of male users say they prefer it.

This discrepancy between male and female shoppers' preference for easy returns may be due to a higher proportion of female fashion online purchases, which require convenient returns processes in case items do not fit or are otherwise unsatisfactory. Of course, other factors may account for this difference, such as varying product research behaviors or willingness to return items in the first place.

When it comes to next-day and same-day delivery, male respondents were more likely to express a preference. 38% of male users said they value next-day delivery when ordering products online, while 35% of female consumers agreed.

That immediacy tends to be more appreciated by male consumers is further reinforced by the fact that the gender gap in preference widens when it comes to same-day delivery. Specifically, 34% of male users expressed a preference for same-day delivery, with only 26% of female shoppers agreeing.

There are no gender differences in preference for the following shipping features. Therefore, the percentages remain the same as in the previous section: 20% for selecting a specific shipping provider, 19% for self-selected delivery window, and 18% for green/sustainable shipping.

How does age influence the results? Let's find out.

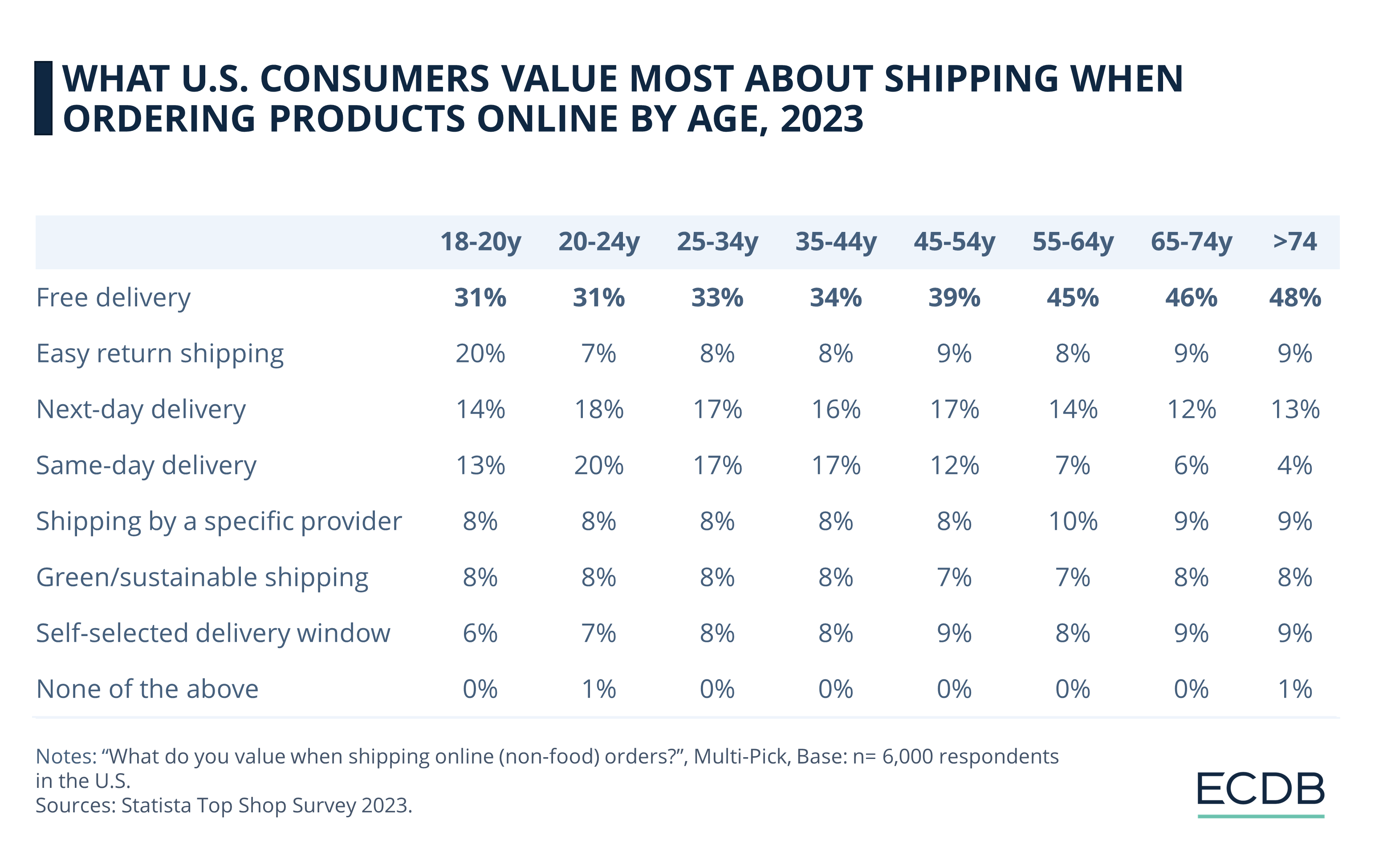

Younger U.S. Consumers Value Immediacy

Age is another factor that influences not only how consumers shop online, but also how they prefer to receive their packages. Although free shipping remains the most valued aspect of shipping across all age groups, this preference increases with age, meaning it is positively correlated.

While 31% of U.S. respondents between the ages of 18 and 24 say they value free shipping, 39% of 45-54 year olds say it is important to them, and 46% of consumers between the ages of 65 and 74. Older consumers are even more likely to agree, at 48%.

On the other hand, easy return shipping is most highly valued by the youngest age group, respondents aged 18 to 20. Older age groups cite easy return shipping at rates between 7% and 9%. One reason for this anomaly may be that very young users tend to order more products than they intend to keep, which may explain the need for easy returns.

Next-day delivery and same-day delivery are not as evenly distributed. For both, the 20-24 age group has the highest preference, at 18% and 20% respectively. There appears to be an overall higher preference for next-day delivery across all age groups, while same-day delivery is most valued by U.S. consumers between the ages of 20 and 44.

The remaining categories show little variation across age groups. When it comes to shipping from a specific carrier, 55-64 year olds stand out with a 10% agreement rate, as opposed to 8%-9% for other age groups. Green/sustainable shipping remains at a consistently low share of 8% across most age groups, with the exception of 45-64 year olds, who agreed at 7%. Finally, the self-selected delivery window ranges from 6% for respondents aged 18-20, to 9% for those aged 45-54 and over 64.

A last examination of income groups rounds out the analysis.

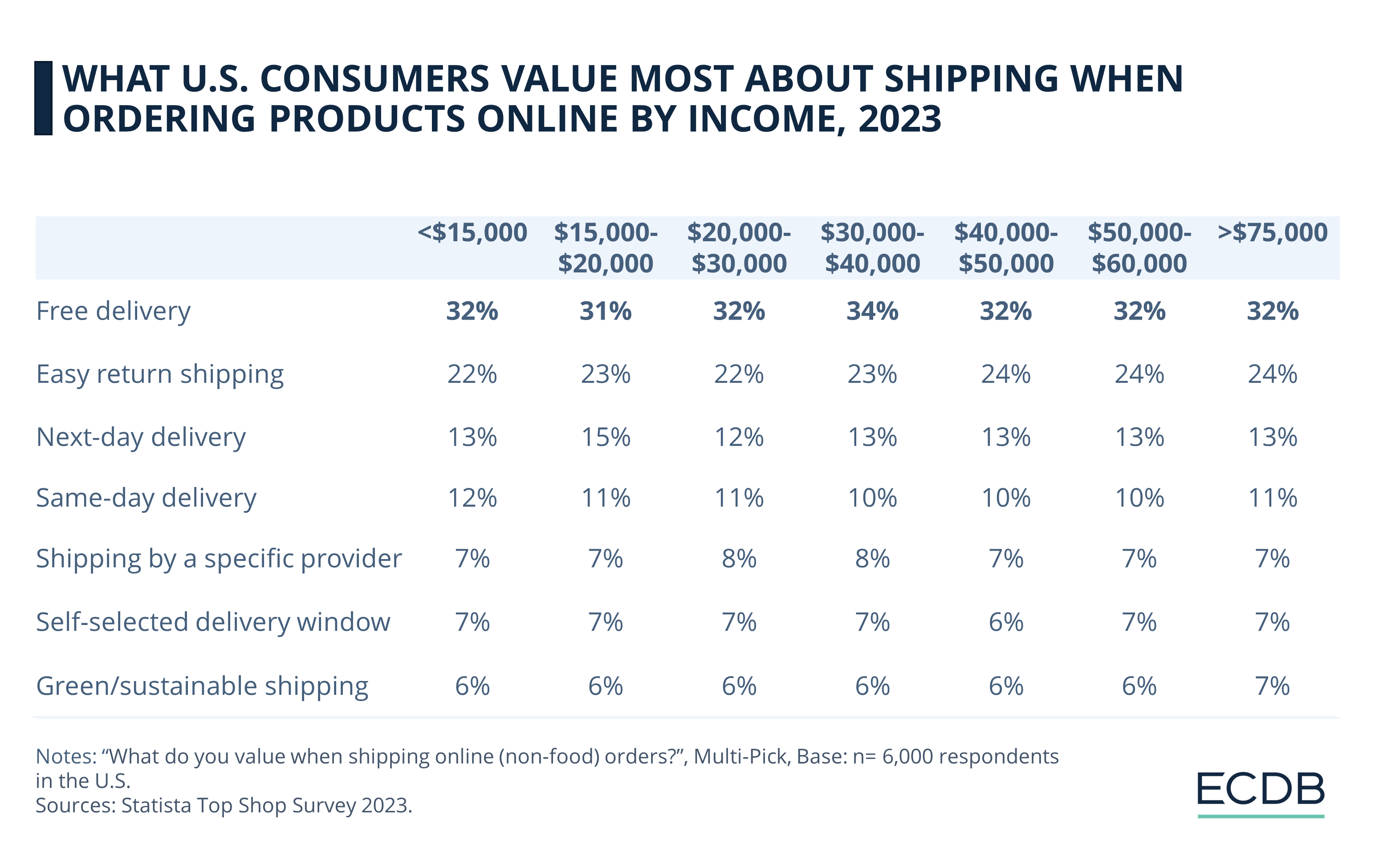

Income Has Little Impact on Shipping Preferences

Again, free delivery remains the most important aspect across income groups, but this time the distribution is more even than for age. There is a notably less variation between income groups, starting at 31% for a household income of US$15,000-US$20,000 and reaching up to 34% for the US$30,000-US$40,000 group.

This may be counterintuitive, as the highest income households are just as likely to value free shipping as the lowest income group under US$15,000 at 32%.

Easy return shipping is also equally consistent across income groups, with lower income households only slightly less likely to value easy return shipping at 22%, compared to higher income groups at 24%.

The other categories show an even distribution across household income as well. This is the case for next-day delivery, which is most preferred by the US$15,000-US$20,000 group at 15%, and more preferred overall than same-day delivery. Only households with an annual disposable income of less than US$15,000 show a small difference in preference between the two delivery types, at just one percentage point.

Overall, demographics suggest that gender and age shape shipping preferences, while preferences remain consistent across household income levels. But is there a difference in preferences between rural and urban consumers? Let’s take a look.

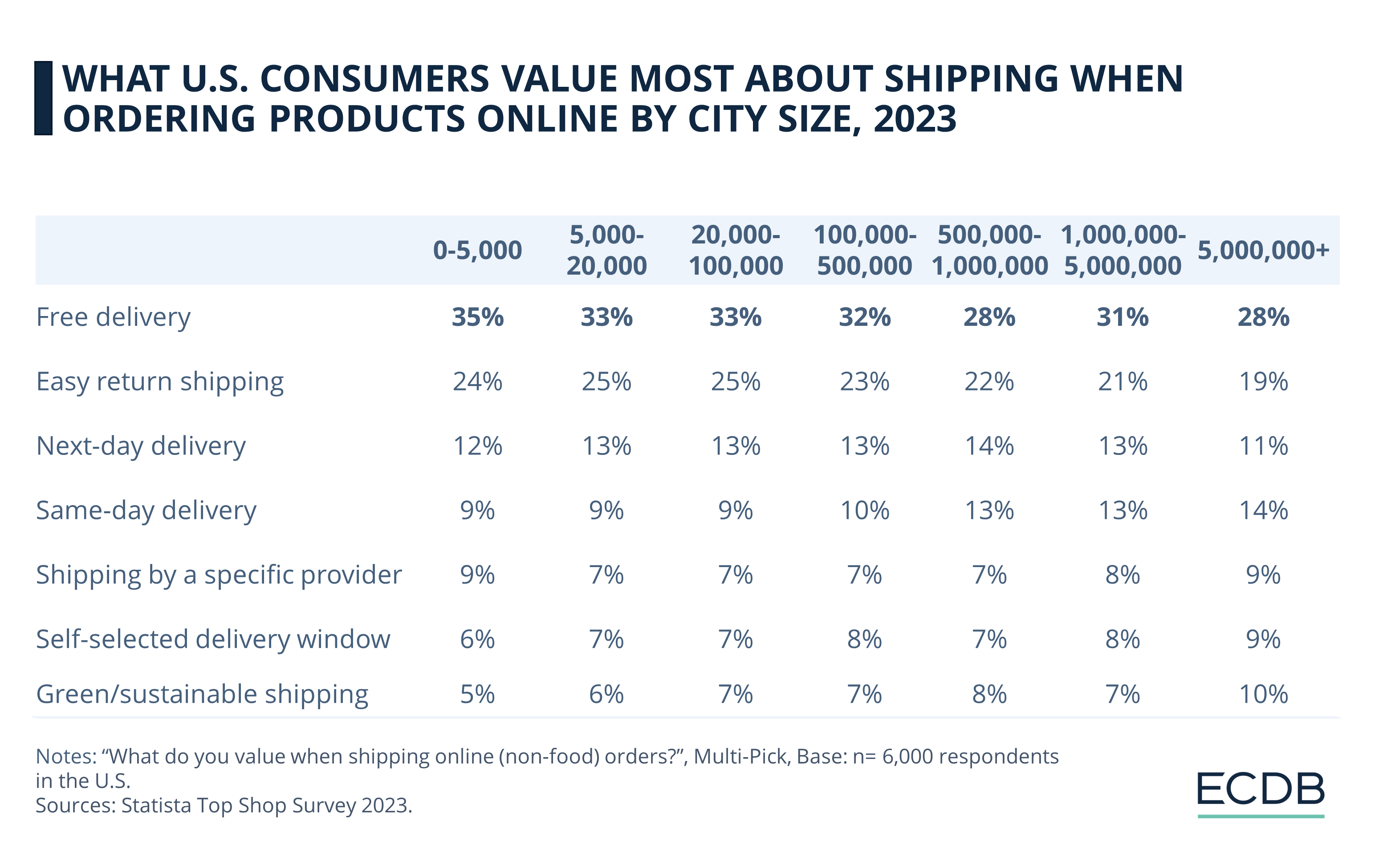

Residents of Larger Cities More Likely to Value Fast Delivery

When analyzing shipping preferences across a spectrum of city sizes, some general patterns emerge, albeit with small variations.

In particular, we see that free delivery and easy returns are more preferred by residents of smaller cities, while residents of larger cities are more likely to prefer same-day delivery. Shipping flexibility and sustainability are less preferred overall, but residents of larger cities are more likely to value these two aspects.

Although the relationship between city size and free delivery is not entirely linear, it is clear that rural areas with a population of up to 5,000 have the highest preference for free delivery at 35%. These percentages decrease progressively with the size of the city: 33% for cities between 5,000 and 100,000 inhabitants, 32% for cities between 100,000 and 500,000 inhabitants. While cities with more than 1 million inhabitants prefer free delivery (31%), the third and largest categories both have the same share (28%).

The same pattern emerges for easy return shipping: The largest category, cities with more than 5 million people, prefers easy returns at 19%, while the highest preference is found in cities with populations between 5,000 and 100,000, at 25%. The smallest city size category is slightly lower at 24%. This could be due to fewer omnichannel options in rural areas, while residents of larger cities have more opportunities for returning orders to a nearby store.

Interestingly, while next-day delivery shows no clear pattern, same-day delivery is positively correlated with city size. This means that inhabitants of larger cities tend to show a higher preference for receiving shipments on the same day. Since metropolitan areas are typically more fast-paced than smaller communities, the tendency to prefer conveniences like same-day delivery should not come as too much of a surprise.

Flexibility and Sustainability More Valued in Urban Areas

While a specific provider does not vary significantly across city size classes, a self-selected delivery window seems to play a larger role in bigger cities. Again, however, the variation is very small and the distribution is not entirely linear.

Finally, green and sustainable shipping options resonate more strongly in areas with larger populations, although the relationship is not linear. Nevertheless, the difference between rural and urban areas is noteworthy: While only 5% of residents in villages of up to 5,000 people say they value sustainable shipping, 10% of citizens in the largest category of cities with more than 5 million people prefer green shipping options.

U.S. Shipping Preferences: Final Remarks

Statista’s 2023 Top Shop survey shows that U.S. online shoppers tend to prioritize free shipping and convenient returns over immediacy, while choice of provider or timeframe and sustainability lag behind.

Gender analysis shows that female consumers are more price-sensitive and prefer easy returns, while male users express a higher preference for immediacy. Younger consumers are also more inclined toward fast delivery, while older age groups are more price-conscious. Residents of larger cities tend to value same-day delivery, a self-selected delivery window, and green shipping options. Those in rural areas are more likely to emphasize free delivery and easy returns. Surprisingly, income does not have a significant impact on shipping preferences.

Related insights

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Article

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

Article

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Article

eCommerce in India: How Young Consumers Like to Shop and Engage Online

eCommerce in India: How Young Consumers Like to Shop and Engage Online

Back to main topics