The De Minimis Rule & eCommerce: U.S. Considers Ending Tariff Exemptions For China

Article by Patrick Nowak | August 24, 2023

Inflation is on the rise, and tariffs on goods imported from China are still in effect. So how is it that you can still find cheap clothes and electronics on the Amazon market of the U.S.? It's all thanks to a trade loophole called "de minimis".

The U.S. is mulling over ending tariff exemptions for packages valued under US$800 for certain countries. This idea, largely seen as an attempt to curb the influx of duty-free goods from China, has prompted Chinese eCommerce exporters to ready themselves for the potential challenges ahead.

De Minimis: Small Stuff, Big Problems?

In 2016, the de minimis threshold was raised to US$800 from US$200. A happy day for fast fashion lovers and the U.S. Customs Department, but a sad day for domestic brands. They cannot compete with Chinese prices, especially since the pandemic hit and online shopping boomed.

But how did the de minimis loophole actually benefit Chinese marketplaces? The de minimis loophole has been a boon for Chinese marketplaces, which have been able to ship small batches of goods directly to American consumers without paying import duties.

This has allowed them to offer lower prices than traditional retailers, which typically have to import large batches of goods and pay higher duties.

If you're thinking about getting a cheap drone to spy on your neighbors' grill parties or grabbing a bunch of fancy shirts from AliExpress, this might be your last chance to do it.

De Minimis Threshold Stands, But Not For Everyone

In July 2023 U.S. Senators Bill Cassidy and Tammy Baldwin introduced the De Minimis Reciprocity Act of 2023 to "stop Communist China and other countries from abusing U.S. trade laws that allow small dollar imports into the U.S. duty free".

Another bill, introduced by Senators Marco Rubio, a Republican from Florida, and Sherrod Brown, an Ohio Democrat, and Representatives Earl Blumenauer, Democrat from Oregon, and Neal Dunn, a Florida Republican, would restrict the eligibility for duty-free treatment for goods imported from China and other "nonmarket economy" nations like Russia, Belarus or Vietnam.

So, there are two bills that, if implemented, will bring about significant changes to eCommerce between China and the U.S.:

Exclude untrustworthy countries from using the "trusted" de minimis channel

Only allow express carriers to facilitate de minimis imports into the U.S.

Require more information on every package entering the U.S.

Use the revenue proceeds to establish a fund for reshoring industry from China

Those bills are still in the early stages, but their consequences could be dramatic for Chinese eCommerce. In particular, the sections electronic goods and fast fashion.

De Minimis Value: A Look At The Numbers

The Global Times reported, that "so far in 2023, the US imported 395 million packages that benefited from the de minimis rule, accounting for 76.54 percent of total package imports, according to statistics released by the US Customs and Border Protection (CBP) on May 12".

According to another CBP report, packages from China accounted for about 60% of its imported de minimis shipment in 2021.

Managing every single package is nearly impossible given the sheer magnitude of these numbers, which is why the threshold was initially raised. However, this decision has proven to be counterproductive, as per the accounts of numerous U.S. politicians.

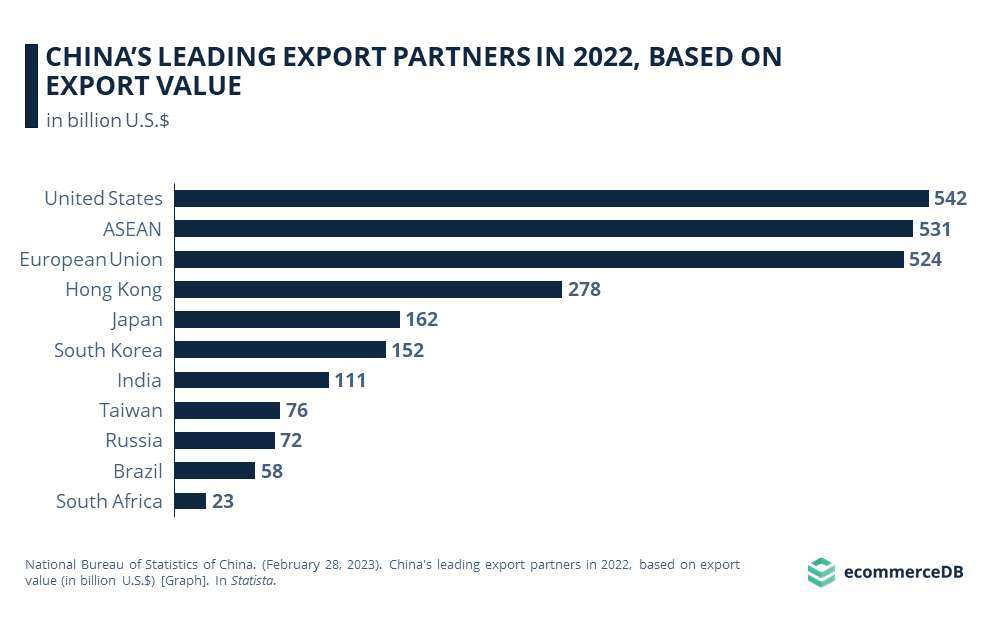

In 2022, the U.S. market was the biggest partner for exports of Chinese goods, with a value of US$542 billion.

As seen on the chart, the ASEAN and European markets are not far behind, with values of US$531 billion and US$524 billion, respectively.

Numerous Chinese foreign trade enterprises have begun to venture into untapped markets in Latin America, and Africa, all the while sustaining their presence in the European and Asian markets.

De Minimis and Fashion

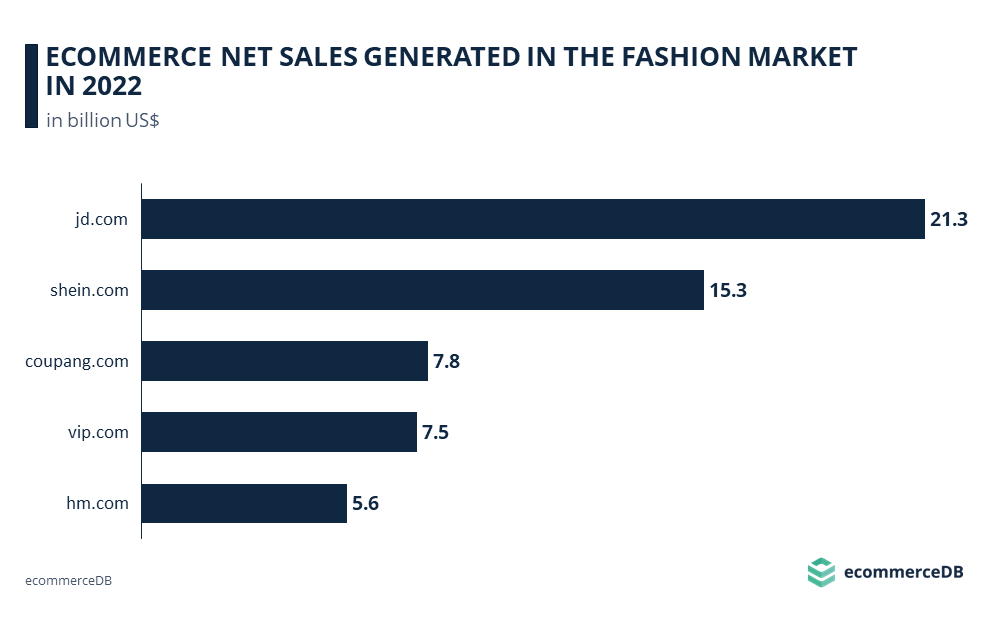

Still, the U.S. market is really important for stores like shein.com, which generated US$7.7 billion last year in the United States.

Which is almost 40% of their global revenue in the Fashion category. The global leader, JD.com, won't be hurt as badly because it focuses on domestic markets, but losing the U.S. market would severely trip up Shein and others.

On a global scale, we can see how strong Chinese companies are in the fashion category. Three of the top five online stores by net sales in 2022 are from China. JD.com leads with a respectable growth rate of 11.2%, followed by shein.com, which made an immense leap forward with 53.2%, challenging its competitor vip.com, which secured 4th place in 2022. Coupang.com from South Korea grew by 11% and surpassed vip.com. Yet, this wild growth might just hit its expiration date soon!

Problematic: Diverse Perspectives on De Minimis Legislation

According to Zhu Qiucheng, CEO of Ningbo New Oriental Electric Industrial Development, such a move would reflect U.S. trade protectionism and run counter to the global trend of advocating cooperation and openness.

This opinion is backed by numerous eCommerce entrepreneurs from China, including major marketplaces like Pinduoduo. Pinuoduo, the owner of Temu, experienced a remarkable 43% growth by GMV in 2022, solidifying its position as one of Amazon's strongest competitors.

The GMV of Chinese companies selling their goods on Amazon is growing, but the de minimis rule could put an end to this, which is not what eCommerce specialists from China want.

But it strongly contrasts with the stance of U.S. officials who assert that China is leveraging the de minimis rule for illicit activities such as forced labor, money laundering, smuggling, and drug imports.

This argument may hold some truth, but there are other significant issues.

Cassidy, one of the creators of the new bill, expressed: "Our customs laws are outdated. China is taking advantage of that by importing billions of dollars of cheap goods into the U.S. with no oversight".

This perspective is reinforced by fellow members within the Republican party.

“Temu and Shein are building empires around the de minimis loophole in our import rules — dodging import taxes and evading scrutiny on the millions of goods they sell to Americans,” Rep. Mike Gallagher said in a statement for the New York Times.

Lawmakers argue that the current de minimis provision allows for the import of cheap goods from China that are made with forced labor, which is a violation of human rights.

In short: Zhu Qiucheng and several Chinese e-commerce entrepreneurs believe that certain U.S. trade moves are protectionist and against global cooperation trends, with Pinduoduo showcasing significant growth in 2022. However, U.S. officials argue that China exploits the de minimis rule for illegal activities.

Both sides present arguments that are difficult to dispute. There is one point that is indisputable though.

The United States Is Growing Increasingly Wary of Chinese Companies

To improve transparency on affordable merchandise, it's crucial for products from China to provide more detailed information. Senator Cassidy's bill aims to do just that.

The New York Times reported, that in March, U.S. lawmakers questioned TikTok’s chief executive for five hours about the platform’s ties to China. "Even eCommerce giants like Temu aren't immune to scrutiny for their ties to the country."

In 2016, when the rule was last adjusted, “people were less concerned about China than they are now,” said William Reinsch, senior adviser at Kelley, Drye & Warren and former president of the National Foreign Trade Council.

The German journalist, Sascha Pallenberg, noted on LinkedIn that cheap platforms like Shein and Aliexpress, both from China, have "mastered" distribution via TikTok in a disturbing manner, often using video production farms that employ forced labor. He mentions that the Chinese TikTok version, Douyin, penalizes streamers from poorer areas when promoting products. As a result, many Chinese streamers broadcast from affluent areas, even under bridges, to benefit their sales shows. That is only one of the aspects that require actions from U.S. lawmakers.

The Death of Fast Fashion: Possible Consequences in the United States

So there is no doubt about it: The recommended alterations to the de minimis rule have far-reaching implications for China's cross-border eCommerce industry. But this goes both ways. As many U.S. retailers depend on imports from China, they will be faced with difficult decisions as to how to adjust their business models in order to accommodate U.S. customs regulations.

This would likely lead to increased prices in the fashion industry, which consumers would have to bear.

On the contrary, banning Chinese fast fashion could be an opportunity to "make fashion great again" and prompt a reevaluation of its practices.

For local businesses, it presents a significant chance to increase their market share, provided they can maintain competitiveness by minimizing costs and promoting sustainability in production.

De Minimis In The U.S.: Key Takaways and Cheat Sheet

This topic is a bit challenging, but here are the key points in a fast format.

De Minimis Rule and Its Impact: The "de minimis" loophole allows packages valued under US$800 to be imported into the U.S. without paying import duties. This has enabled Chinese marketplaces to ship small batches of goods directly to American consumers at lower prices than traditional retailers.

Potential Changes to U.S. Trade Laws: U.S. Senators have introduced bills in 2023 aiming to:

1. Exclude certain countries, including China, from the de minimis exemption.

2. Restrict the eligibility for duty-free treatment for goods from "nonmarket economy" nations.

3. Require more detailed information on every package entering the U.S.

4. Use the revenue from duties to establish a fund for reshoring industry from China.

Significance of De Minimis Imports: In 2023, 76.54% of total package imports into the U.S. benefited from the de minimis rule. Packages from China accounted for about 60% of the U.S.'s imported de minimis shipments in 2021.

Differing Opinions on the De Minimis Legislation: Chinese eCommerce entrepreneurs, like Zhu Qiucheng and companies like Pinduoduo, view potential changes as protectionist and against global cooperation trends. U.S. officials argue that China exploits the de minimis rule for illicit activities, including money laundering, smuggling, and drug imports. They also raise concerns about the importation of goods made with forced labor.

Potential Consequences for U.S. Retail and Consumers: Alterations to the de minimis rule could impact the U.S. fashion industry, leading to increased prices for consumers. However, it might also provide an opportunity for local businesses to increase their market share and promote sustainable production practices.

Related insights

Article

Walmart, Amazon & Shein: Which Store Ranks First in U.S. Online Fashion?

Walmart, Amazon & Shein: Which Store Ranks First in U.S. Online Fashion?

Article

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Article

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Back to main topics