eCommerce: Top Stores in the U.S.

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

The U.S. eCommerce sector is one of the largest in the world and is expected to break the trillion mark this year. Learn more about the latest developments in this field.

May 16, 2024

Top 10 Online Stores in the United States: Key Insights

Major Players:

The U.S. eCommerce market is dominated by Amazon, Walmart, and Apple, which together generate over US$225 billion in net sales, highlighting the significant influence of a few major players in shaping the industry.

Diverse Focuses:

Homedepot.com, Target.com, Shein.com, BestBuy.com, Chewy.com, Costco.com, and Samsclub.com hold significant positions in the U.S. eCommerce market, with diverse focuses ranging from home improvement to fashion and pet supplies.

Rising Penetration:

The U.S. eCommerce penetration rate has steadily increased from 55% in 2017 to 81% last year. Forecasts suggest it will reach 84.5% this year and 97% by 2029, indicating that nearly all U.S. consumers will shop online.

Continued Growth:

The U.S. eCommerce market is set to surpass US$1 trillion by 2024, reflecting its crucial and expanding role in the economy, with continued growth projected to reach US$1.4 trillion by 2028.

The global eCommerce landscape is significantly influenced by the United States, holding the position of the world's second-largest market with an anticipated total revenue of over US$1 trillion by the end of this year. But to fully comprehend the mechanics of this booming sector, we need a closer examination of the top online stores.

Based on our data, the American online retail sphere is essentially a story of giants and their followers. The top three online stores — Amazon.com, Walmart.com, and Apple.com — distinctly dominate the field, collectively amassing over US$225 billion in net sales.

1. Amazon.com

Amazon.com is the undisputed leader in the U.S. online retail sector, boasting impressive sales of US$135.2 billion in 2023, far surpassing its competitors. Dominating the market for years, Amazon's influence in American eCommerce remains unchallenged. Notably, 97.3% of Amazon's global revenue comes from its U.S. operations, highlighting its strong domestic focus.

Despite its leading position, Jeff Bezos has expressed concerns about Amazon falling behind in the AI race. To stay competitive, Amazon is heavily investing in AI tools and startups, including a US$4 billion investment in Anthropic. The company is also developing its own AI solutions, such as the Amazon Bedrock platform for businesses and the recently launched AI assistant Q. Bezos is actively involved in these efforts, aiming to keep pace with industry giants like OpenAI, Microsoft, and Google.

2. Walmart.com

Walmart.com is next, but at a substantial distance, reporting US$64.9 billion in sales. The online store rose from third to second place in 2019 and has successfully maintained this rank through 2023. This ascendancy, although noteworthy, hasn't been enough to topple Amazon.com from the top spot.

Recently, Walmart has expanded its drone delivery service to more customers. This service, powered by Wing and Zipline, offers super fast delivery of essentials, with over 20,000 orders already completed. Walmart aims to build on this momentum, providing convenient drone deliveries to more communities and solidifying its position in the competitive eCommerce sector.

3. Apple.com

Apple.com rounds out the top three with US$25.9 billion in eCommerce net sales. The online store has had a turbulent ride, holding second place in 2018 but dropping to sixth in 2020. It regained its footing by climbing back to third place in 2021 and maintained it until last year. The U.S. is the dominant contributor to Apple.com’s global revenue, accounting for 54.8%.

Last year, Apple updated its online store with a feature called “Shop with a Specialist over Video.” This allows U.S. customers to connect with an Apple Specialist via one-way video when purchasing products like the iPhone. Recently, this feature was added to the Apple Store app on iOS. Customers can now get live support during their purchase process, making shopping more interactive and convenient.

4. Homedepot.com

Homedepot.com closely follows Target.com with US$19.38 billion in sales. In the first quarter of this year, Home Depot experienced a 2.3% decline in overall sales, down to US$36.4 billion, and a 2.8% drop in comparable sales.

Despite these challenges, online sales grew by 3.3%. The company emphasized improving the online shopping experience, enhancing search functionality, and simplifying returns. Home Depot’s investment in digital infrastructure has been crucial as the company navigates economic challenges and shifts in consumer behavior.

5. Target.com

Target.com sits in fifth place, pulling in US$19.36 billion. Recently, Target announced changes to its Pride Month merchandise strategy, limiting availability to online and select stores after backlash over last year's designs. The collection, which includes adult apparel, home products, and food and beverages, is curated based on consumer research and historical sales.

This development, although having minimal direct impact, might draw more customers to shop online, where they can easily access the full range of Pride products without confronting in-store controversies.

Top Online Stores in the U.S: Lower Ranks

Further down the list are Shein.com, BestBuy.com, Chewy.com, Costco.com, and Samsclub.com. These stores report eCommerce net sales figures ranging from US$10 billion to US$18 billion for 2023. Although they operate at a significant level, their scale pales in comparison to the leading trio.

Shein.com has seen a remarkable rise, moving from the 51st position in 2018 to break into the top 10 by 2022. The Chinese-Singaporean company's main online store climbed to sixth position in 2023. This rapid ascent highlights its growing influence in the U.S. market, particularly in the Fashion sector.

BestBuy.com, known for its strong presence in the Electronics category, grabbed attention by capturing the third spot in 2020. However, it slipped back to sixth place in subsequent years and eventually dropped to seventh place last year. Despite this, it remains a key player in the electronics retail space.

Chewy.com specializes in pet products and has carved out a significant niche in the online retail market. Its focus on pet supplies and excellent customer service has helped it secure a spot among the top online stores in the U.S.

Costco.com, another major player, continues to perform strongly, leveraging its well-known warehouse club model to attract online shoppers. It consistently ranks in the top 10, driven by its diverse product range and competitive pricing.

Finally, Samsclub.com, another warehouse club giant, rounds out the top 10. Like Costco, it benefits from its membership model and bulk purchasing options, which appeal to a broad customer base looking for value and convenience.

A look at the main product categories of these top 10 online stores reveals that Electronics is the dominant retail sector, represented by four stores. Hobby & Leisure and Fashion follow with three and two stores respectively, while only one top 10 shop has DIY as its main category.

U.S. eCommerce Penetration Rate Might Reach 87% By 2029

The eCommerce penetration rate in the U.S. has been on a steady incline, a trend clearly visible when examining key years. In 2017, the rate stood at a then-modest 54.9%. By 2023, this figure had risen significantly to 81.3%.

Looking ahead to the near future, the forecast for 2024 suggests this upward momentum will persist, albeit at a slightly moderated pace. The rate is expected to hit 84.5%, marking a modest yet positive increase from the 2023 level. Peering even further into the horizon, the projected penetration rate for 2029 is 97.1%, at which point, virtually almost all U.S. consumers will be shopping online.

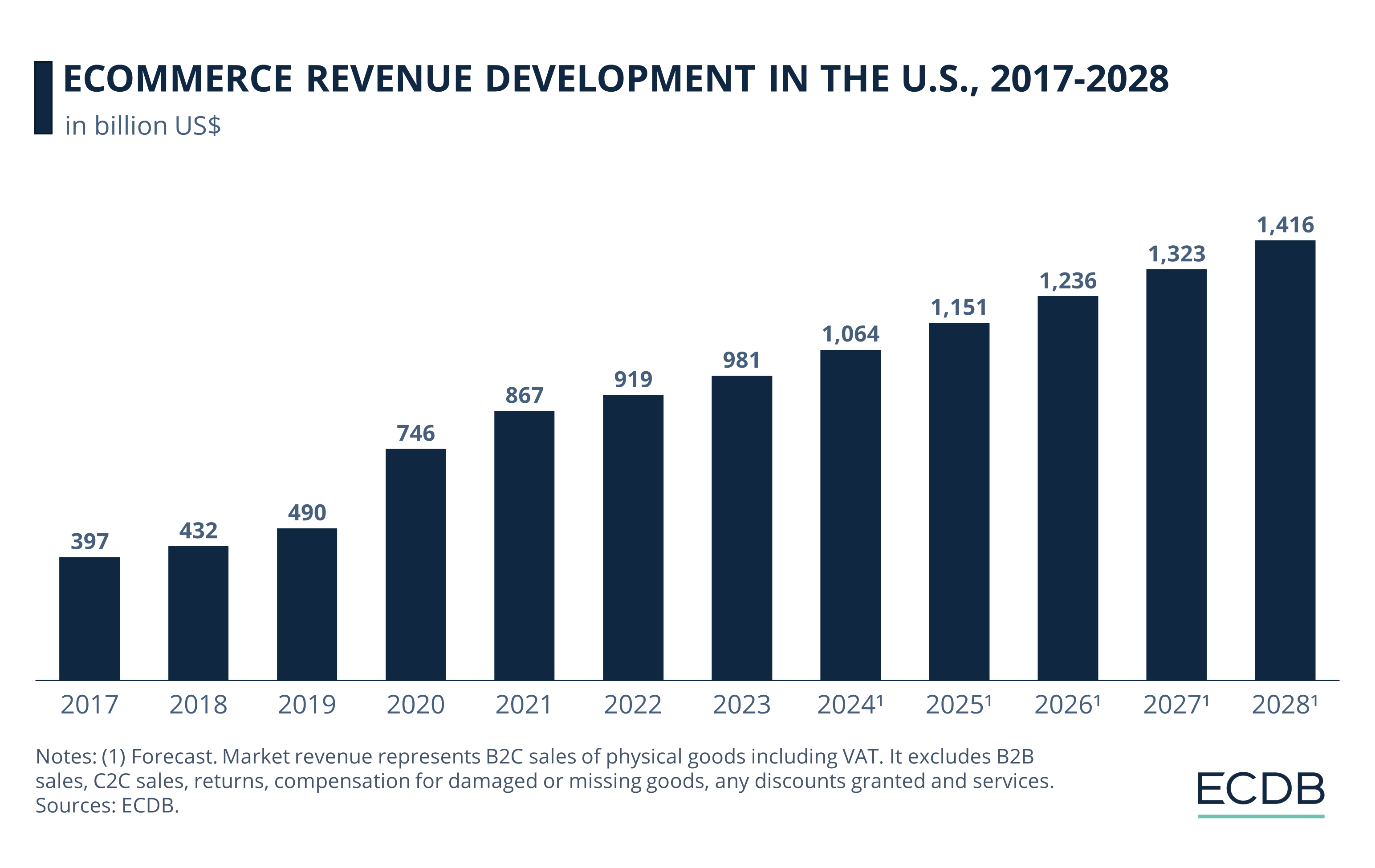

Market Growth in the U.S.: Revenue Hits US$1 Trillion This Year

The U.S. eCommerce market has been on a steady climb, growing from US$397 billion in 2017 to a projected US$1.06 trillion by 2024. Notably, the sector experienced a significant jump in 2020, fueled by the pandemic, reaching US$746 billion.

It's important to underline that by 2024, the market is expected to hit the US$1 trillion mark, confirming eCommerce's growing role in the U.S. economy. Beyond 2024, the market is projected to sustain its growth, reaching US$1.41 trillion by 2028.

Sources: Business Insider, Daily Mail, 9to5Mac, Digital Commerce 360, The Hill, Statista, ECDB

Related insights

Article

eCommerce Market in Europe 2024: Worth 1 Trillion Dollars Soon

eCommerce Market in Europe 2024: Worth 1 Trillion Dollars Soon

Article

Walmart, Amazon & Shein: Which Store Ranks First in U.S. Online Fashion?

Walmart, Amazon & Shein: Which Store Ranks First in U.S. Online Fashion?

Article

Video Games Market in 2024: Market Revenues, Segments, Regions & Top Companies

Video Games Market in 2024: Market Revenues, Segments, Regions & Top Companies

Article

Top Amazon Rivals: The Tech Giant’s Biggest Competition

Top Amazon Rivals: The Tech Giant’s Biggest Competition

Article

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Back to main topics