ECOMMERCE: CROSS-BORDER

Cross-Border eCommerce in China: GMV Growth, Leading Markets, Top Companies

China is the most popular market to buy online cross-border. In this article, we explore the GMV development, the top target countries, and the most valuable eCommerce companies for China’s cross-border eCommerce.

Article by Nashra Fatima | April 29, 2024

Cross-Border eCommerce in China: Key Insights

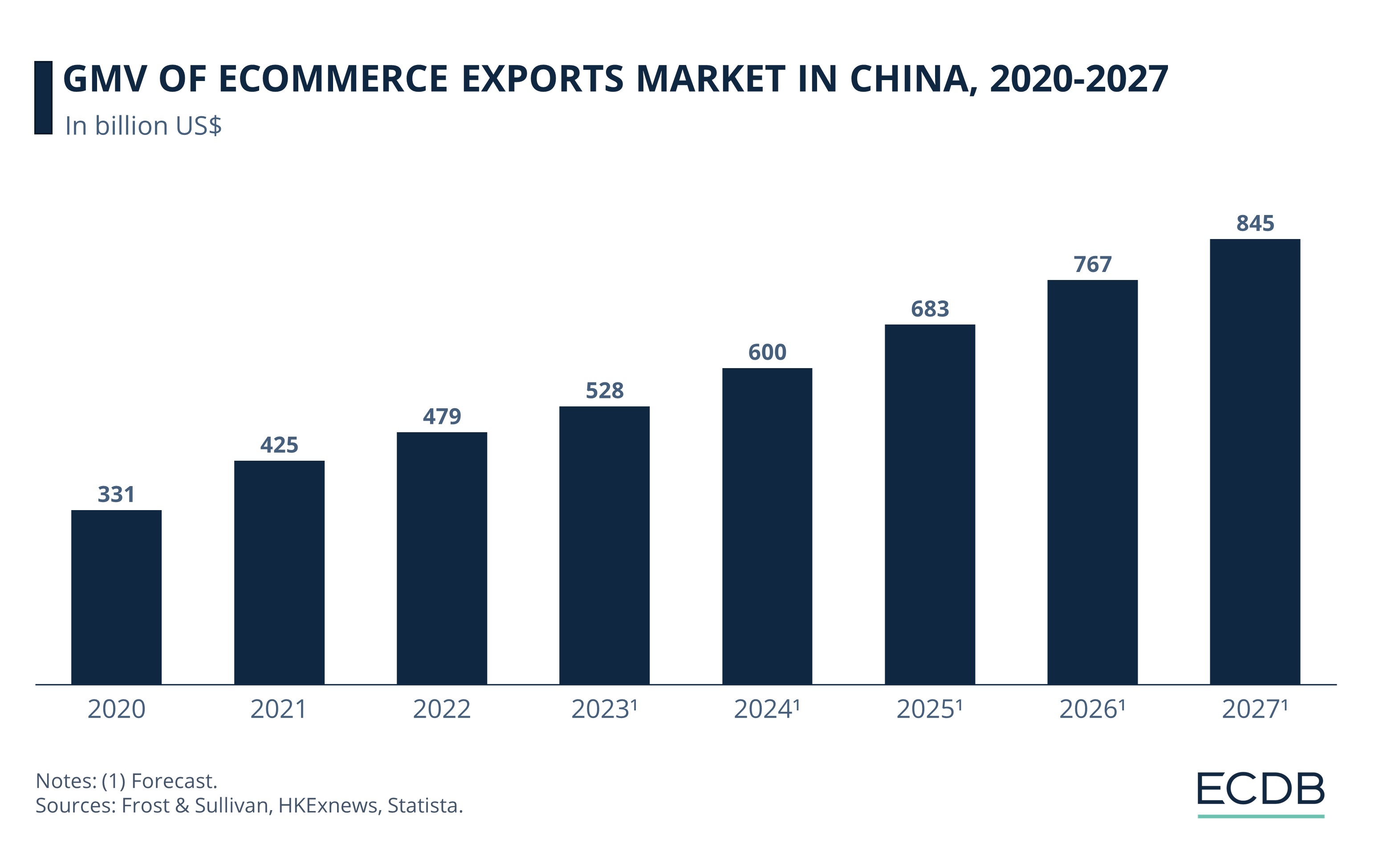

GMV of Cross-Border Exports: In 2023, the gross merchandise value (GMV) of China’s cross-border exports is valued at US$528 billion. It is projected to reach US$845 billion by 2027.

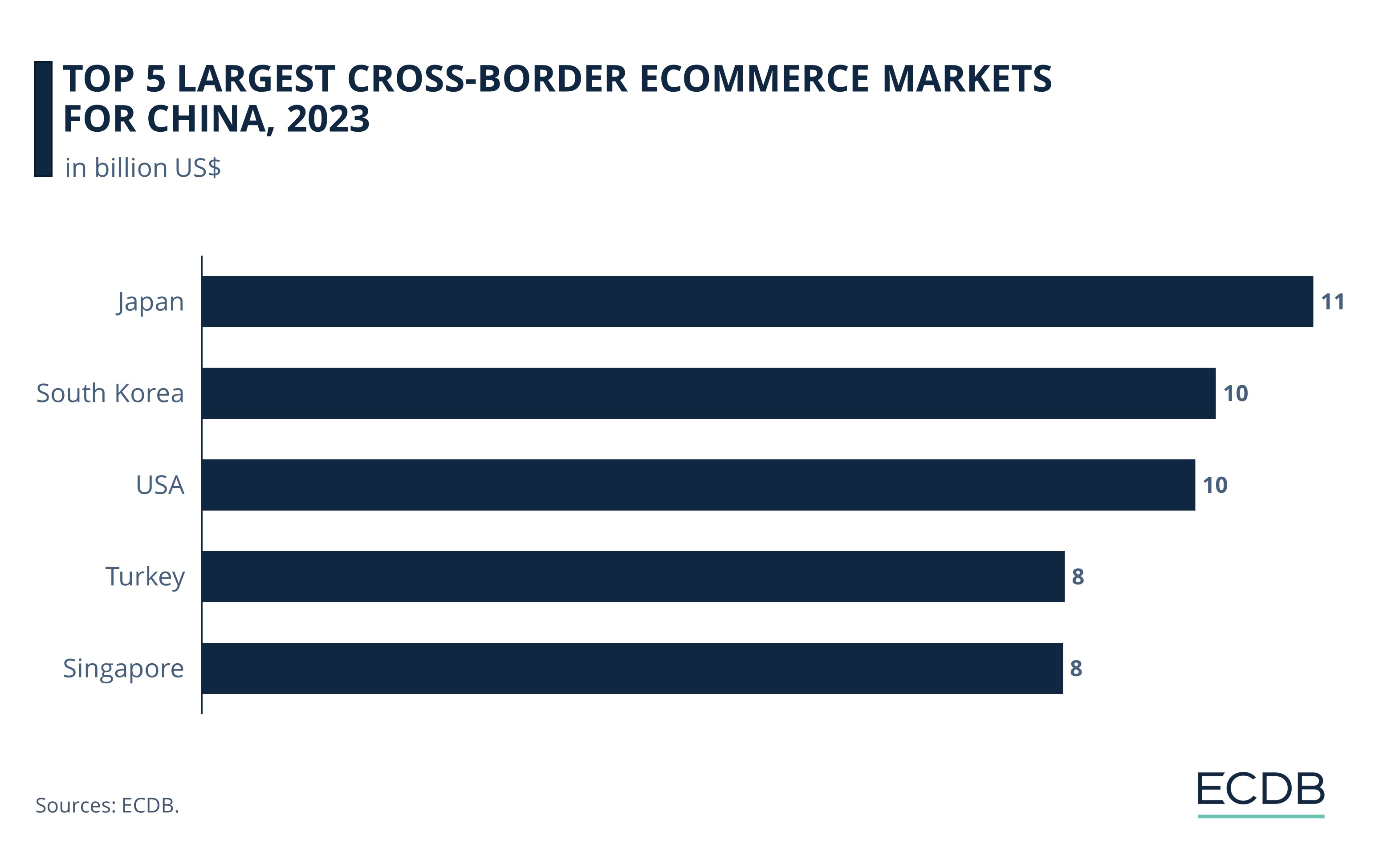

Leading Cross-Border Markets for China: Japan is the leading market for China’s cross-border eCommerce activity, accounting for 10.4% of all cross-border revenues – or US$11 billion. It is followed by South Korea and the U.S.

Top Cross-Border eCommerce Companies in China: In terms of market value, Shein is China’s most valuable cross-border eCommerce player, at US$66 billion. It is followed by Airwallex, valued at US$6 billion.

Products from beyond the border have become readily accessible to consumers worldwide. Many now shop regularly in various countries – but online, from the comfort of their screens.

China, the largest eCommerce market, is also formidable in global cross-border eCommerce. Its popularity is undeniable: 37% of respondents in 2023 said that they made their last cross-border online purchase in China – far ahead of second-ranked Germany (13%) and third-ranked United States (10%).

Find out the GMV growth of China’s cross-border exports, alongside the leading destination countries and the most valuable companies in Chinese cross-border eCommerce.

GMV Growth of China’s Cross-Border eCommerce Exports, 2020-2027

Cross-border export GMV refers to the total value of merchandise sold by retailers and marketplaces outside the country of origin.

A look at the data shows that Chinese cross-border eCommerce exports have grown consistently in value since 2017.

Projections put the GMV of eCommerce exports in China at US$528 billion in 2023. This is an increase of 10% from the past year, when GMV stood at US$479 billion.

The largest growth jump in GMV occurred in 2020. Aided by the turn towards online shopping during the pandemic, the value of Chinese eCommerce exports climbed by 43% in this year, crossing the US$300 billion mark.

Following the peak pandemic period, despite global economic headwinds and slowdown in eCommerce activity, cross-border eCommerce exports in China continued to increase in value.

In terms of market size as well, Chinese cross-border eCommerce has expanded, with no decline recorded in the past several years. Per Statista, the market size for China’s export cross-border eCommerce grew from US$1.8 trillion in 2020 to an estimated US$2.3 trillion in 2023.

The developments indicate the resilience of Chinese eCommerce market, which is able to withstand disturbances in global trade. By 2027, the cross-border eCommerce export GMV is projected to reach US$845 billion.

Japan and South Korea are China’s Top Cross-Border eCommerce Markets in 2023

China’s online retail market has found consumers in several parts of the world. But from a regional perspective, East Asia is the biggest market for Chinese eCommerce.

ECDB data shows that in 2023, the top destination for China’s cross-border eCommerce activity was Japan. It accounted for 10.4% of all eCommerce revenue generated outside of China, amounting to US$11 billion.

South Korea is the second largest market, making up 9.5% of all the revenue – or US$10 billion.

Under threat of losing tariff exemption, China’s cross-border activity remained robust in the United States in 2023. Here, China generated 9.3% of all its cross-border eCommerce revenues, worth US$9.8 billion. Next, Turkey and Singapore contributed US$8.5 billion each to the total cross-border exports for China.

In comparison, European countries like France, Germany, and the UK are not the biggest markets for Chinese eCommerce – although China is the leading market for cross-border online shopping for consumers in these countries. Their share in China’s cross-border revenue stands between 2%-2.75%.

Top Chinese Cross-Border Companies by Market Value: Shein Leads with US$66 Billion

Market value refers to the worth of a company on the financial market. It indicates investor confidence in a company, as well as the strength of its brand name and access to capital.

In China, the top cross-border eCommerce company by market value is Shein. In 2023, its market cap was a sizeable US$66 billion.

Other players on the list have a comparatively modest market valuation. At second place is Airwallex, a global eCommerce payment service. Its market value was US$6 billion.

The third to fifth ranked eCommerce companies on the list are Xingyun Group, KK Group, and Patpat.com – each with a market value between US$3 to 4 billion.

Notably, the top valued Chinese cross-border company Shein has made ripples globally. It is one of only 1,200 “unicorn” companies in the venture market – those with market cap of over US$1 billion. Shein ranks fourth on the list, just behind OpenAI, hinting at strong investor confidence.

There is a good reason for it: Shein has recorded staggering growth in the past years and is slated to maintain its growth momentum. Its revenues are predicted to hit US$44 billion by 2024.

China's Cross-Border eCommerce: Closing Remarks

Cross-border eCommerce activity has surged in China in recent years. The GMV of cross-border exports has increased at a consistent pace, and its market size has also expanded.

Several reasons fortify China’s cross-border eCommerce – including strong production values, price competitive goods, and supportive government policies for eCommerce exports. New marketplaces like Temu have garnered enormous success upon entering the international market, underlining the dominance of Chinese players in global eCommerce.

Cross-border eCommerce comes with many challenges. Factors like supply chain and delivery costs, customs regulations, as well as tax and tariffs thwart many companies’ ambitions of international expansion. But Chinese companies are investing heavily in key areas like global warehousing and logistics infrastructure. Such steps are likely to bolster China’s cross-border eCommerce market going forward.

Sources: Statista: 1, 2, Reuters, CB Insights, China Daily: 1, 2, CSA

Related insights

Article

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

Article

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Article

UK Fashion Market: Brands ASOS and Boohoo Under Scrutiny For Greenwashing

UK Fashion Market: Brands ASOS and Boohoo Under Scrutiny For Greenwashing

Article

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Article

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Back to main topics