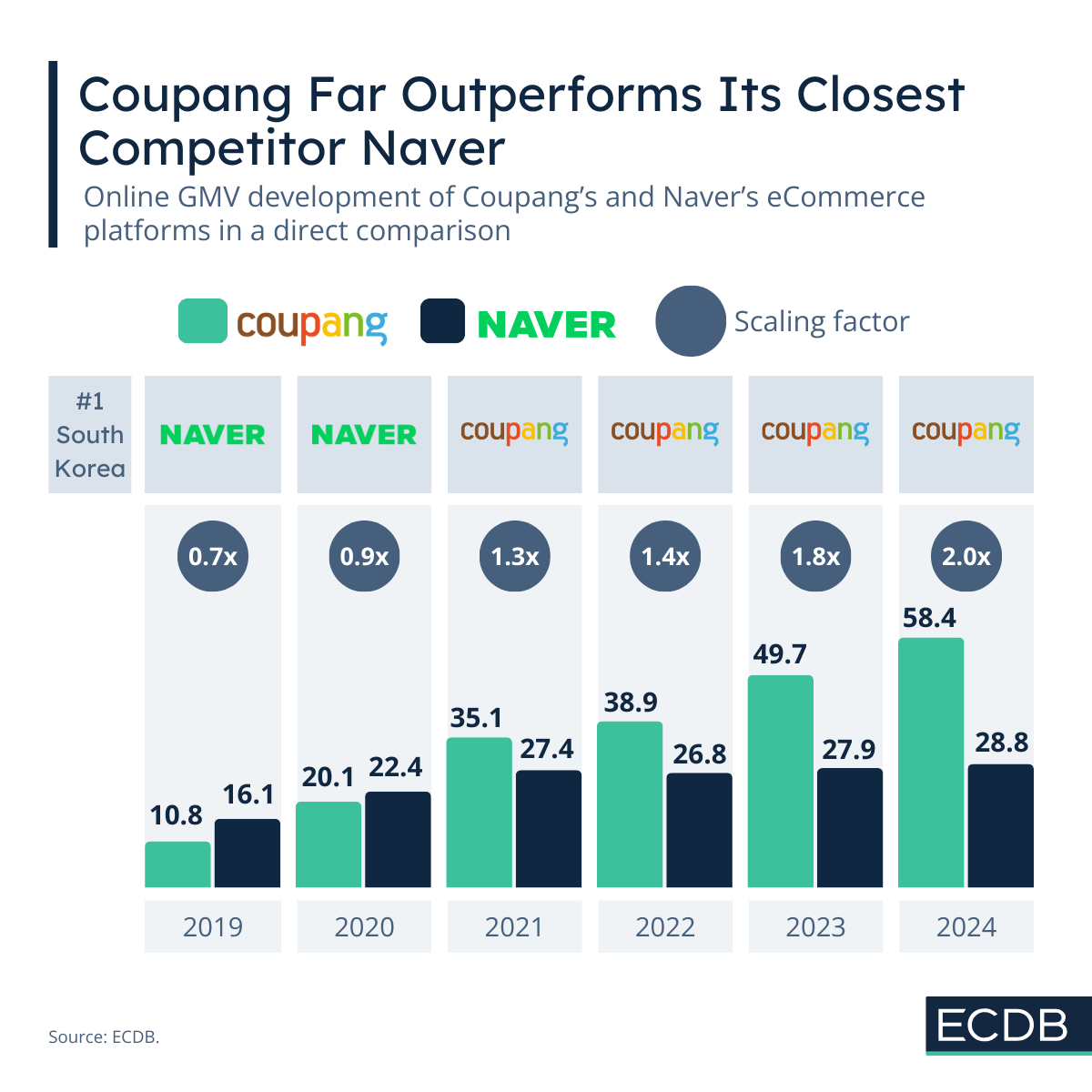

Coupang is widely referred to as the Amazon of South Korea, a name that increasingly befits its status as the number one eCommerce platform in the country. Unlike Amazon, however, Coupang’s eCommerce rise is still in full swing. Just a few years ago, in 2021 to be exact, Coupang surpassed its closest competitor, Naver, in terms of GMV. Both Coupang and Naver generate most of their GMV in South Korea, Coupang with 99.5%, Naver with 98.6%.

Among South Korean platforms, Coupang has clear benefits that make it the number one player among the others. But there are other platforms from abroad that are looking to overhaul the South Korean eCommerce ranking.

Coupang’s Offering Is Customer-Centric and Asset-Heavy

Coupang and Naver are the two companies that are usually mentioned in the same breath when talking about South Korean eCommerce. Coupang’s online GMV has surged over recent years. It jumped from US$10.8 billion in 2019 to US$35.1 billion in 2021 and is currently at US$62.4 billion. Naver’s development is flatter, almost at half the value in 2024. Why does Coupang stand out over its domestic rival?

Quite simply, Coupang has invested heavily in building its own logistics infrastructure to ensure seamless and fast delivery. It owns every part of the delivery chain and can therefore exert more control over the logistics process than its direct competitors, including Naver. Case in point: Coupang returns, which are easily manageable by application and require customers to simply leave their returns at their doorstep for pickup.

Coupang’s offering includes dawn delivery (delivered before 7 a.m. when ordered before midnight), same-day delivery and next-day delivery. Catch the Amazon drift? But it goes on. Coupang’s faster delivery options are included in the Wow Membership, for which customers pay an additional monthly fee.

Among other similarities to Amazon that include a streaming subscription, digital payment and grocery service, Coupang stands out for its discounts and competitive prices. As the company grows in scale, its capacity to decrease prices at a profit increases, naturally, which can contribute to Coupang's continued growth.

A watershed moment was Coupang’s IPO in 2021.

Coupang’s Financials Are Good at the Moment, but…

Coupang’s investments paid off when it entered the New York Stock Exchange (NYSE) in 2021, where its shares rose by 41% and the company reached a valuation of US$85 billion. Coupang’s IPO was the second most successful of an Asian company, after the Alibaba Group. It reflected investors’ confidence in the business model and in turn pushed Coupang above its former level, from which it has outpaced Naver to this day.

Coupang’s customer-centric approach is stealing users away from other comparable platforms. But the same thing could happen to Coupang itself, according to fringe opinions. What are these concerns about?

…It May Stumble as International Competitors Grow

Some voices are concerned about the viability of Coupang's approach, both in terms of its profitability and the impact of international competitors that operate on a lower-price model.

Most clearly, AliExpress and Temu are a growing concern, according to people familiar with the matter. The two platforms not only undercut Coupang on price, but also offer the same to very similar products at a comparable range. For consumers, it is the discovery-based nature of platforms like AliExpress and Temu that they are willing to wait a few days for.

Investor confidence is a good measure of a company's potential for success. But it could just as easily be that a future development in which Coupang stumbles due to external influences will reverse the gains it has made in the past few years.