Blog

The ECDB Blog turns data from the Tool into eCommerce insights that illustrate which use you can make of our comprehensive data. It elaborates on relevant eCommerce news to help your brand gain a broader perspective on current retail trends and their effects. Our articles are carefully crafted to present to you the latest market trends, including retail, payment, shipping, transactions, cross-border and more.

Item 1 of 5

All Articles

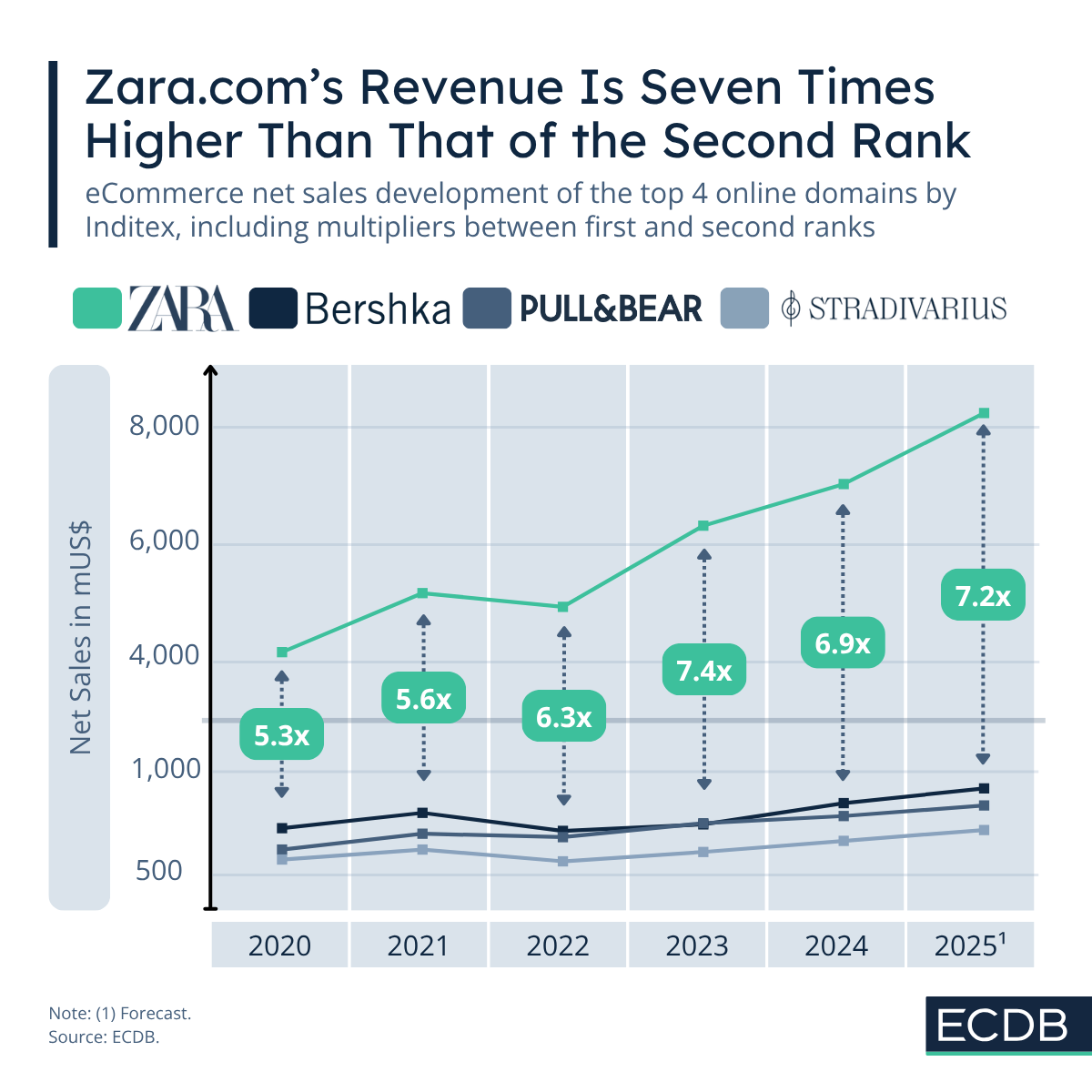

Three Inditex Domains Are Over US$1Bn Online Net Sales in 2025

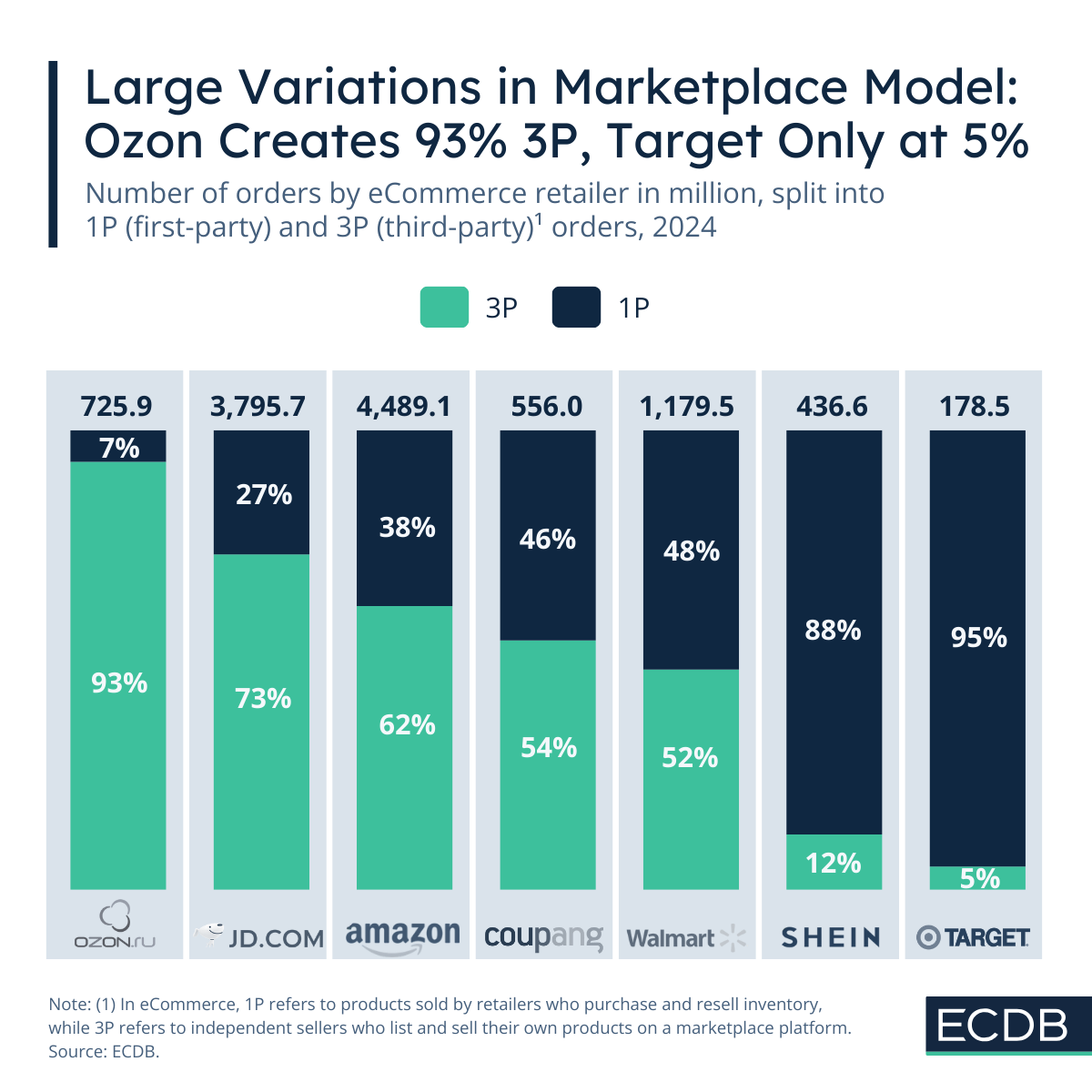

1P and 3P Orders in World eCommerce: Here Is How Top Retailers Operate

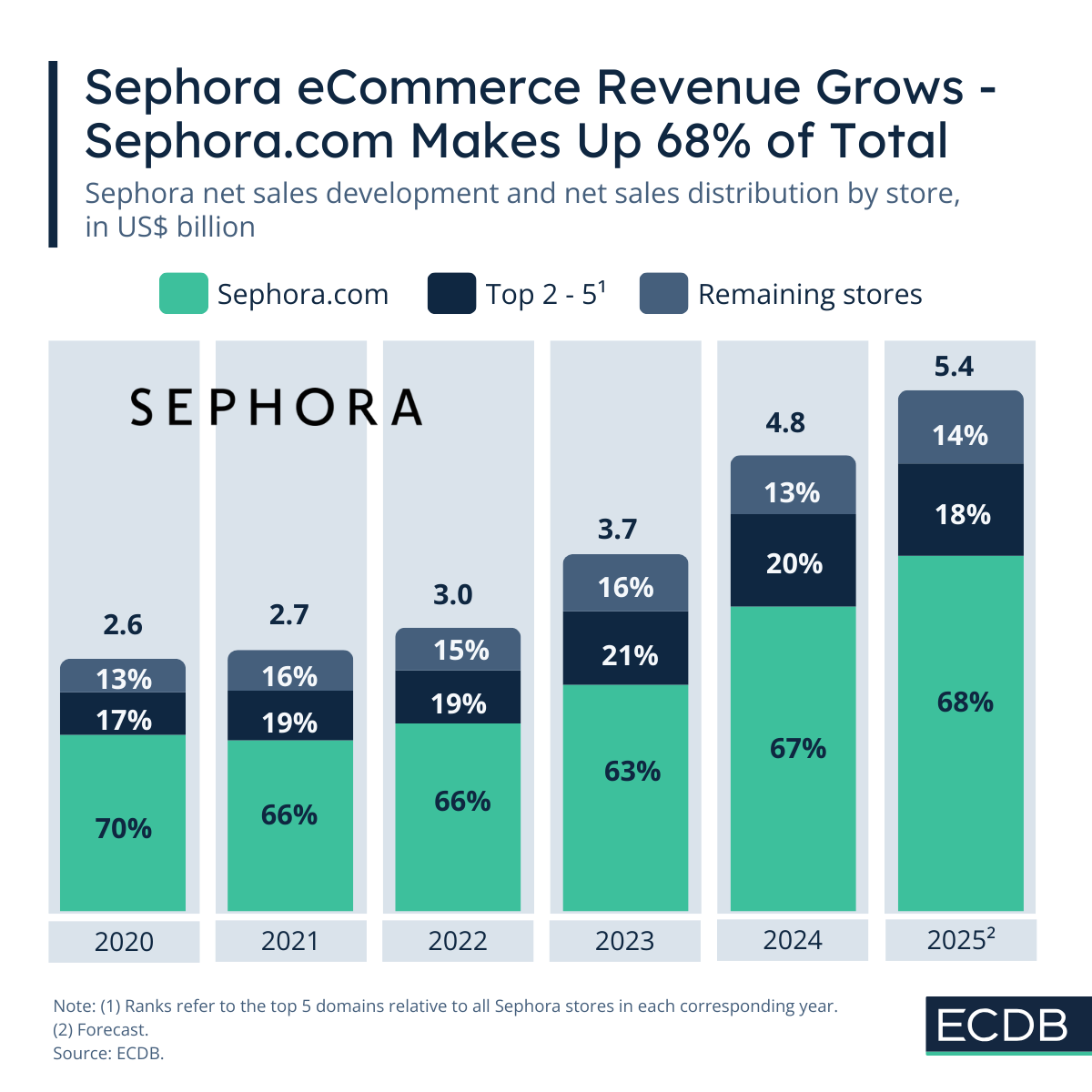

Sephora eCommerce Revenues Are Surging — Which Domains Take the Lead

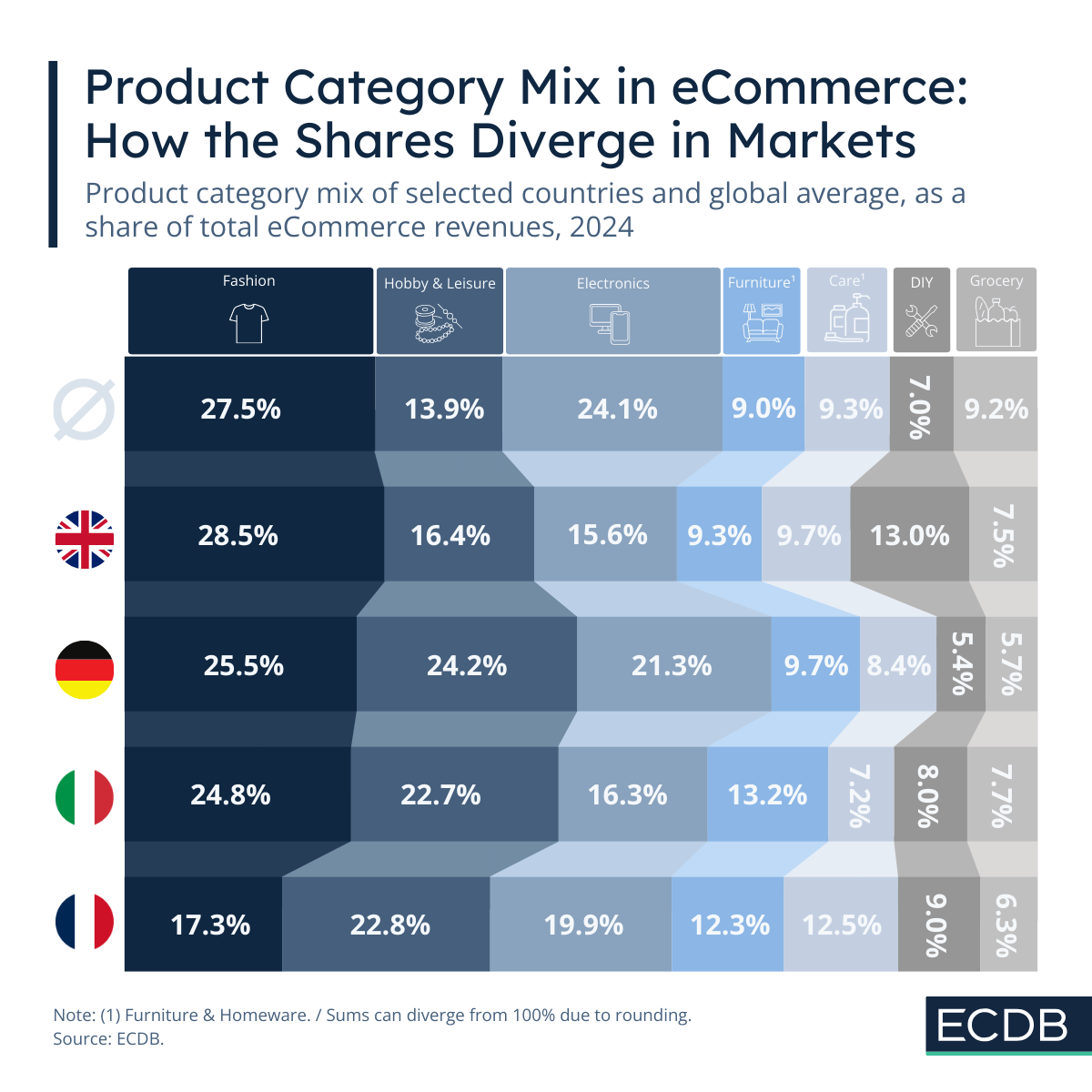

Product Category Mix in eCommerce: Where Which Category Performs Best

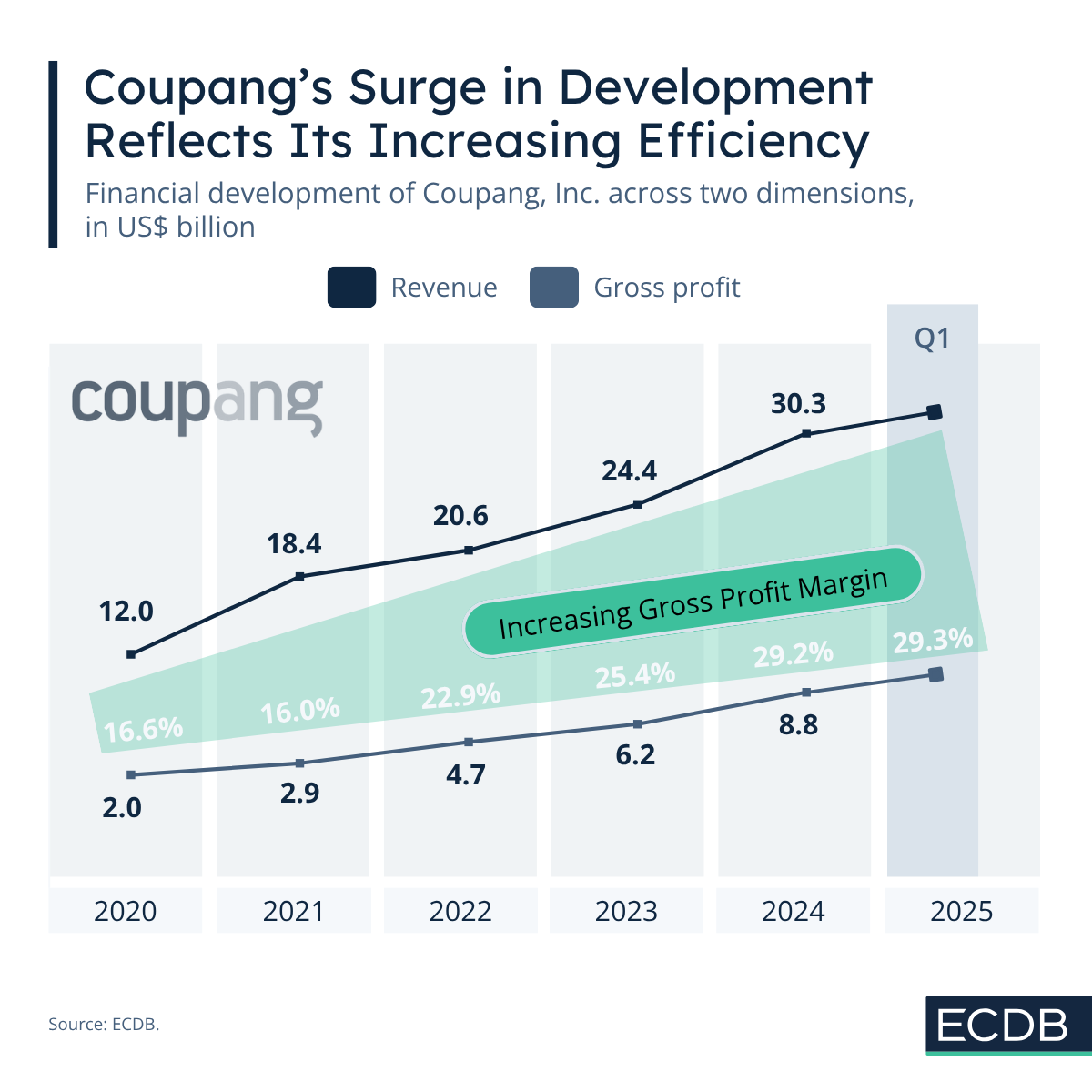

Coupang’s Investments Pay Off: Its Q1 2025 Company Results Indicate Growing Efficiency

Ready To Get Started?

Find your perfect solution and let ECDB empower your eCommerce success.