With online shopping becoming increasingly convenient and integrated into busy lifestyles, delivery expectations are evolving in line with consumer preferences. Online shoppers expect the eCommerce industry to improve constantly, particularly when it comes to delivery. New features that enhance consumer convenience are happily accepted and quickly taken for granted by many.

Consumer Expectations: Faster Delivery Matters More than Price

The arrival of qCommerce has significantly shaped consumer expectations regarding the speed of online order deliveries – this is what Wunderman Thompson’s The Future Shopper Report 2023 suggests. According to the research, if they could change one thing about their general delivery experience in online shopping, almost half of the consumers worldwide (48%) would want faster delivery.

This makes speed even more important than price: compared to the numbers for faster delivery, only 43% would choose cheaper delivery. The influence that qCommerce has had on consumers’ delivery speed expectations becomes obvious upon taking a closer look at the data.

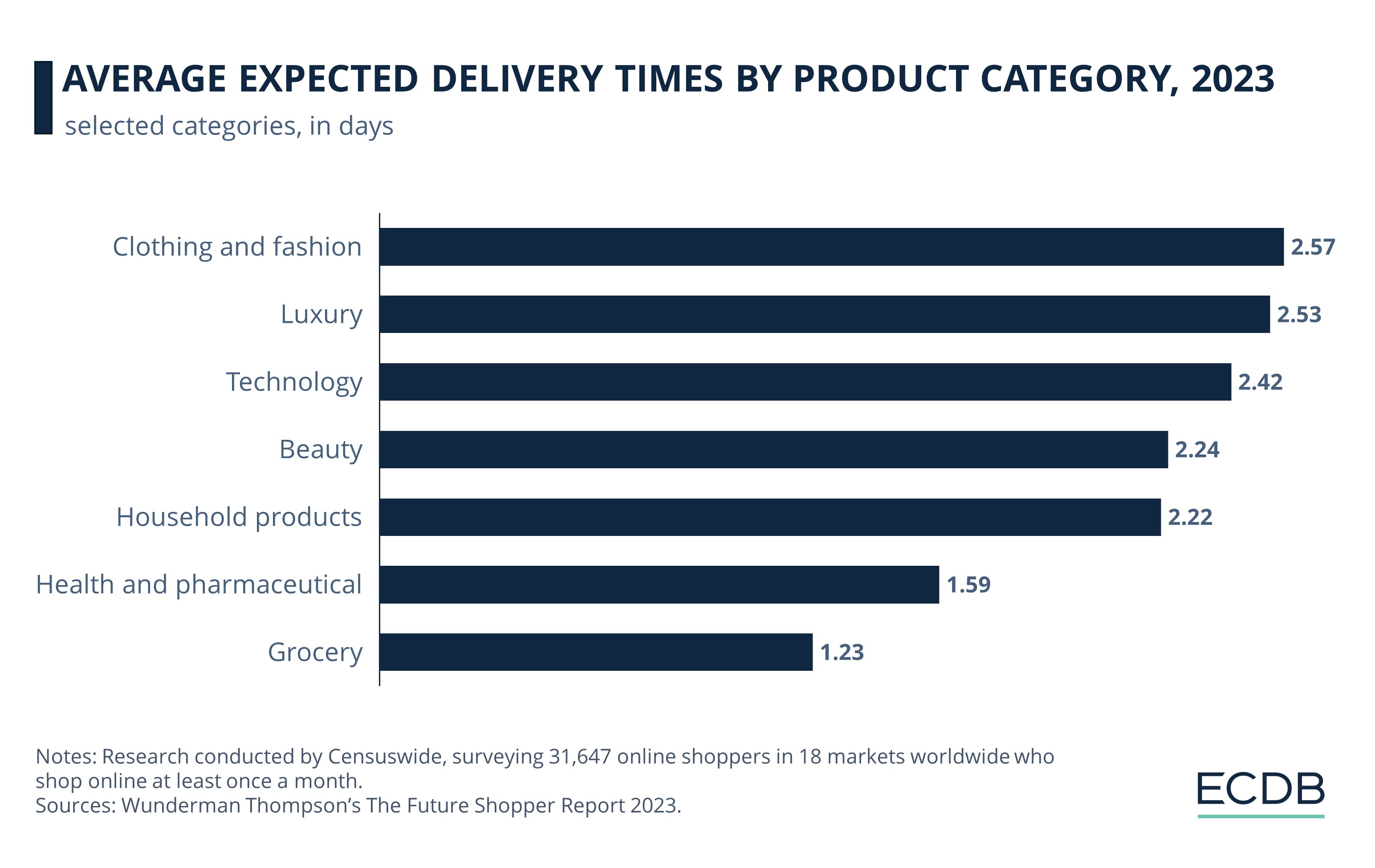

Expected Delivery Times in Days by Product Category in 2023

In 2023, people’s delivery expectations have changed, with a large section wanting their deliveries to arrive faster as compared to 2022.

From a global perspective, the average number of days that consumers are prepared to wait for their orders across all product categories fell from 2.36 days in 2022 to 2.15 days in 2023.

However, expectations deviate from the average depending on the product category.

Thanks to qCommerce players like Uber Eats, Gorillas, and Flink, consumers know that groceries can be delivered very fast. The average global consumer in 2023 is prepared to wait a mere 1.23 days for their grocery delivery.

Health and pharmaceutical products, as well as alcohol and financial products, are also expected to be delivered faster than the average, with expected delivery times ranging from 1.59 to 1.73 days.

At the other end of the spectrum are categories such as automotive and clothing and fashion. Consumers are more patient when it comes to delivery times for products in these categories, demonstrating a willingness to wait for about 2.5 days for their orders.

The average global consumer's willingness to wait for orders decreased from 2.36 days in 2022 to 2.15 days in 2023, varying by product category.

For groceries, consumers expect delivery in just 1.23 days in 2023, influenced by qCommerce services like Uber Eats, Gorillas, and Flink.

Health, pharmaceutical, alcohol, and financial products have shorter expected delivery times (1.59 to 1.73 days), whereas consumers are more patient with automotive and fashion products, waiting up to 2.5 days.

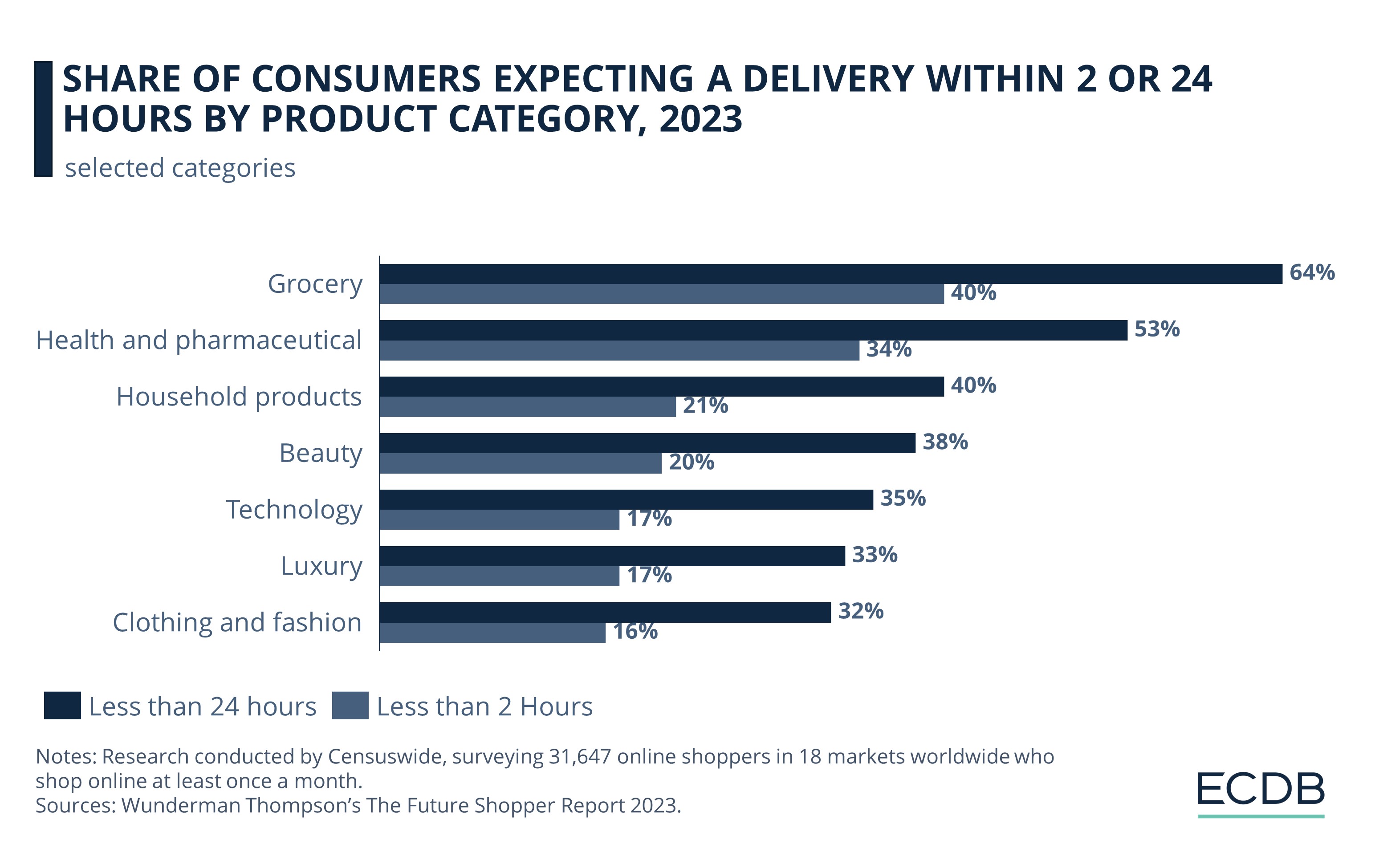

Share of Consumers Expecting Quick Delivery by Product Category, 2022-2023

For many consumers, qCommerce has remarkably altered their expectations when it comes to delivery across different product categories. But what stands out is the share of consumers who expect grocery delivery within just a few hours.

Although the average consumer is prepared to wait under 24 hours until they receive their online grocery order, a surprising percentage of consumers is much more impatient: 40% of respondents in the Wunderman Thompson survey stated that they expect grocery delivery within two hours.

Other FMCG (fast moving consumer goods) like health and pharmaceutical products or alcohol are again among the top categories for which consumers expect fast delivery. Around one third of consumers want health products and alcohol to arrive within two hours of ordering. In the top three categories, between half and two thirds of consumers expect delivery within 24 hours.

On the other hand, a larger share of consumers is willing to wait longer for product categories such as beauty, technology, and clothing and fashion. For instance, only 20% of consumers want their beauty products delivered in less than 2 hours, while 38% expect it in less than 24 hours. A similar pattern is seen for technology, with the willingness to wait less than 24 hours (35%) more than double that of waiting less than 2 hours (17%).

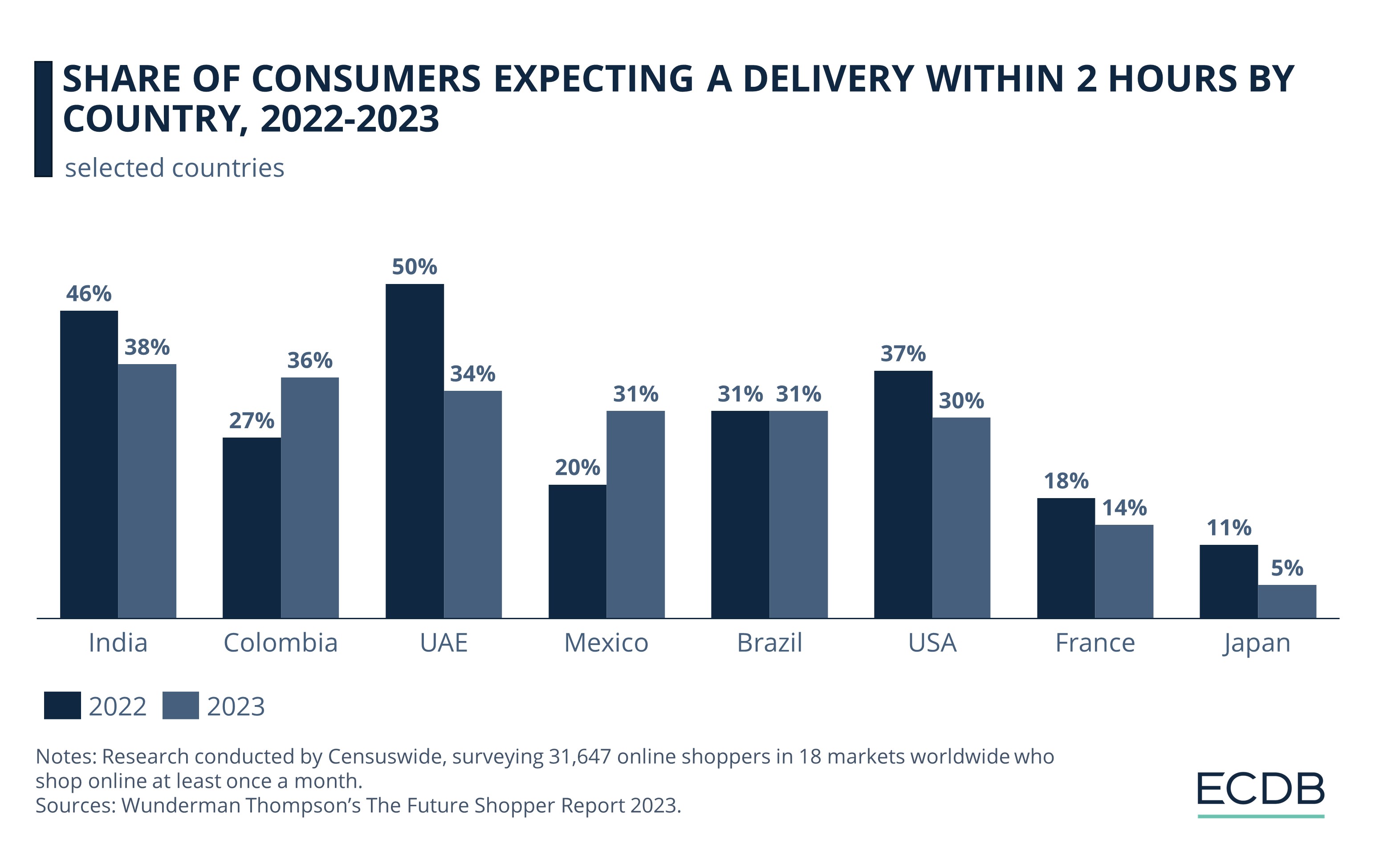

Regional Variations: Indian Consumers Most Impatient about Delivery

In addition to variation by product categories, Wunderman Thompson has also examined regional differences in delivery time expectations. The results show noticeable differentiation not only among countries but within countries between the years 2022 and 2023.

In this one year, while consumers from some countries acquired patience when it comes to delivery times, others began to demand even faster deliveries.

According to the study, in 2023, consumers from India were the most impatient, with 38% expecting delivery within 2 hours. This is 15 percentage points above the global average of 23%.

Although the share for India is higher than consumers from countries like Colombia (36%) and UAE (34%), a comparative look confirms that in fact, Indian consumers have significantly lowered their delivery time expectations from where they stood in 2022, when a remarkable 46% anticipated delivery within 2 hours.

At 36% in 2023, consumers from Colombia rank second when it comes to the share of consumers expecting delivery in 2 hours. The share has risen noticeably from 2022, when a smaller 27% expressed a desire for delivery within 2 hours.

Mexico follows suit, registering the highest increase out of all countries under study: the share of Mexican consumers expecting delivery in 2 hours reached 31% in 2023 from just 20% in 2022.

On the other hand, UAE has registered the sharpest decline in consumer expectations around ultra-fast delivery in 2023. Where in 2022, half the consumers surveyed wanted delivery within 2 hours, the share of consumers who hoped for the same in 2023 stood at 34%, thus showing a decrease of 16 percentage points.

While consumers in Brazil have maintained the same level of expectations around delivery time of 2 hours (31% in both 2022 and 2023), online shoppers in the USA, France, and especially Japan have become more patient. Where 11% of Japanese consumers wanted delivery within 2 hours, the share dropped to just 5% in 2022.

The numbers underline stark variations in consumer preferences around eCommerce delivery across different world markets – an aspect that online businesses must consider for devising more customer-centric strategies.

Delivery Expectations: Closing Remarks

The rise of qCommerce and an increasingly fast-paced economy are leading consumers to demand less and less time for delivery of their online orders.

While consumers expect ultra-fast delivery for product categories like grocery, overall, the expectations of two-hour delivery are still in the minority. For most categories surveyed, consumers are more likely to expect 24-hour delivery.