Product Category Mix in eCommerce: Where Which Category Performs Best

Product categories don't have the same signfiicance in each eCommerce country – some markets diverge notably from global averages.

Luxury eCommerce

The revenue from luxury eCommerce in a country isn't directly tied to the number of luxury brands it hosts. Data reveals that countries with many luxury companies don't always lead in online sales.

Nashra Fatima

Data Journalist

June 21, 2024

Market Trends

Brand origin is a cornerstone in the luxury business, with companies using it to craft narratives of heritage, quality, and prestige. European countries like Italy and France have been important pillars of global luxury historically; many brands originating in the region have achieved legendary status.

Meanwhile, relatively newer markets like the U.S. and China have also produced companies that have since become trendsetters in the luxury industry. Modernity and creativity are also central to their identity, which they use to inspire connections with fresh waves of affluent buyers.

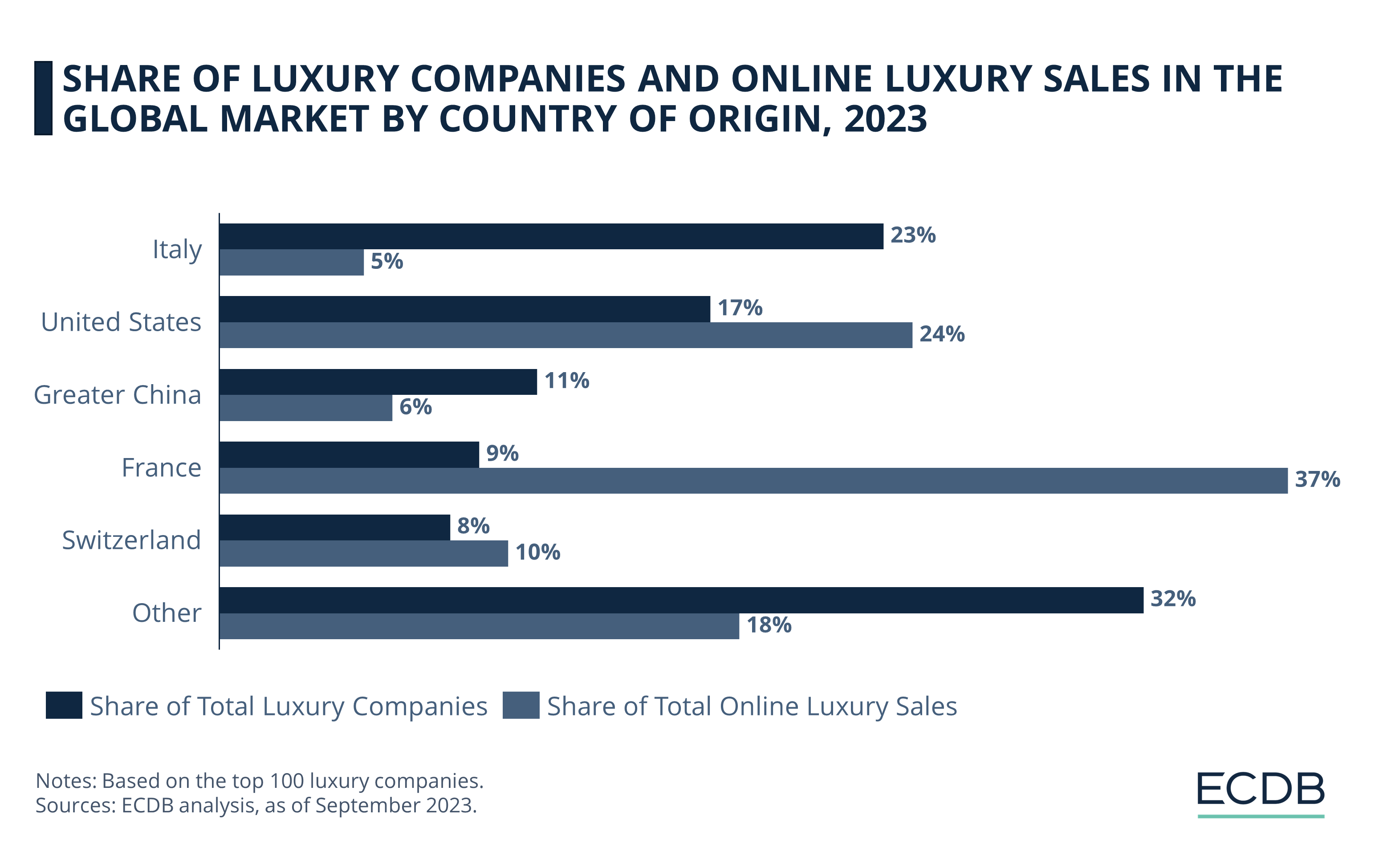

Which country is home to the largest share of luxury companies, and which country stands top in terms of eCommerce sales? Our data confirms: the answer to the two questions is not the same.

The global market for personal luxury goods includes high-end fashion, accessories, jewelry, watches, cosmetics, and fragrances. These items are characterized by exceptional quality, craftsmanship, and exclusivity.

The market is driven by renowned brands that epitomize luxury, such as Louis Vuitton, Gucci, and Chanel. It caters to affluent consumers seeking prestige and superior products, with sales occurring through both traditional brick-and-mortar stores and increasingly through online channels.

The market is also influenced by cultural heritage, innovation, and brand positioning, making it a dynamic and multifaceted sector in the global economy.

Sales data by country suggests leading companies in luxury are strategizing to accelerate eCommerce sales.

Although France is not home to the highest number of luxury companies – it only ranks fourth on the list – it claims the largest share of total online sales in luxury. Its performance surpasses countries on the second and third position, namely the U.S. and Switzerland, by a mile.

At 37%, France claims the biggest portion of total luxury eCommerce sales, even though only 9% of luxury companies are based there. The country's sales performance is strong as it is home to the top luxury conglomerates, including LVMH and Kering. Fiercely competitive, these companies have built impressive portfolios of some of the most recognizable brands with a global footprint in luxury. LVMH, for example, owns Louis Vuitton, Dior, and Givenchy.

At 24%, the United States is the second largest country for luxury eCommerce sales. Although 17% of luxury companies are U.S.-based, their offerings tend to be at the more accessible end of the luxury spectrum to attract aspirational luxury buyers.

Switzerland is the third most represented country with 10% online sales share. In terms of company numbers, 8% of luxury giants are Swiss origin. This includes Richemont, with its many subsidiary luxury brands, and the Swatch Group, which leads the world-renowned Swiss watch industry.

Several Swiss-based brands have above-average levels of exclusivity and pricing, which may contribute to their high sales volumes. However, since Watches as a category is still predominantly sold through offline retail networks, the reported online sales remains smaller.

On the other hand, Italy generates 5% of the total online sales despite being country of origin for the highest number of luxury companies (23%). However, many of these luxury houses are comparatively small and independently owned.

The same trend can be seen in other countries such as Germany and India.

Of the luxury companies included in our report, more than half are based in Italy, the U.S., or Greater China. This includes some of the top luxury companies that have strengthened their positions across multiple markets over time.

23% of luxury companies in the top 100 are based in Italy, cementing the country's position as the epicenter of luxury. Several original labels, including iconic brands like Gucci and Versace, trace their roots to Italy. With centuries of cultural history and skills passed down through generations, Italy remains a hotbed of innovation in the luxury market.

At 17%, the United States is home to the second-largest share of luxury companies. A large base of affluent consumers willing to spend on luxury products and an established network of stores makes the U.S. a key region in the luxury landscape, with the country often prompting comparisons to Europe.

11% of luxury companies are based in China. A large population of high-income Chinese consumers make it a rising center for luxury activity in the APAC region. For many of those luxury consumers, country associations with long-standing names may not be the most vital factor shaping their purchase intention. Importantly

, China offers lower production costs and access to a large labor market, both of which support luxury manufacturing.

From a regional perspective, Europe retains its place as the capital of global luxury. It boasts good manufacturing capabilities and the availability of skilled artisans that appeal to luxury companies worldwide. Heritage stories that speak of prestige and timelessness also lend credibility to luxury houses that originate in Europe.

Related Articles

Product categories don't have the same signfiicance in each eCommerce country – some markets diverge notably from global averages.

The German online baby market is highly competitive, not least due to the dominance of low-cost generalist retailers. Here is how the proposed acquisition is expected to turn out for Babymarkt and Baby Walz.

eCommerce is a globally important part of economic systems, but where is its significance highest? The top 10 list based on ECDB calculations provides a clear answer.

Click here for

more relevant insights from

our partner Mastercard.

Our Tool

We’re not just another blog—we’re an advanced eCommerce data analytics tool. The insights you find here are powered by real data from our platform, providing you with a fact-based perspective on market trends, store performance, industry developments, and more.

Analyze retailers in depth with our extensive Retailer dashboards and compare up to four retailers of your choice.

Learn More

Combine countries and categories of your choice and analyze markets in depth with our advanced market dashboards.

Learn More

Compile detailed rankings by category and country and fine-tune them with our advanced filter options.

Learn More

Discover relevant leads and contacts in your chosen markets, build lists, and download them effortlessly with a single click.

Learn More

Benchmark transactional and conversion funnel KPIs against market standards and gain insight into the key metrics of your relevant market.

Learn More

Our reports provide pre-analysed data and highlight key insights to help you quickly identify key trends.

Learn More

Find your perfect solution and let ECDB empower your eCommerce success.