Blog

The ECDB Blog turns data from the Tool into eCommerce insights that illustrate which use you can make of our comprehensive data. It elaborates on relevant eCommerce news to help your brand gain a broader perspective on current retail trends and their effects. Our articles are carefully crafted to present to you the latest market trends, including retail, payment, shipping, transactions, cross-border and more.

All Articles

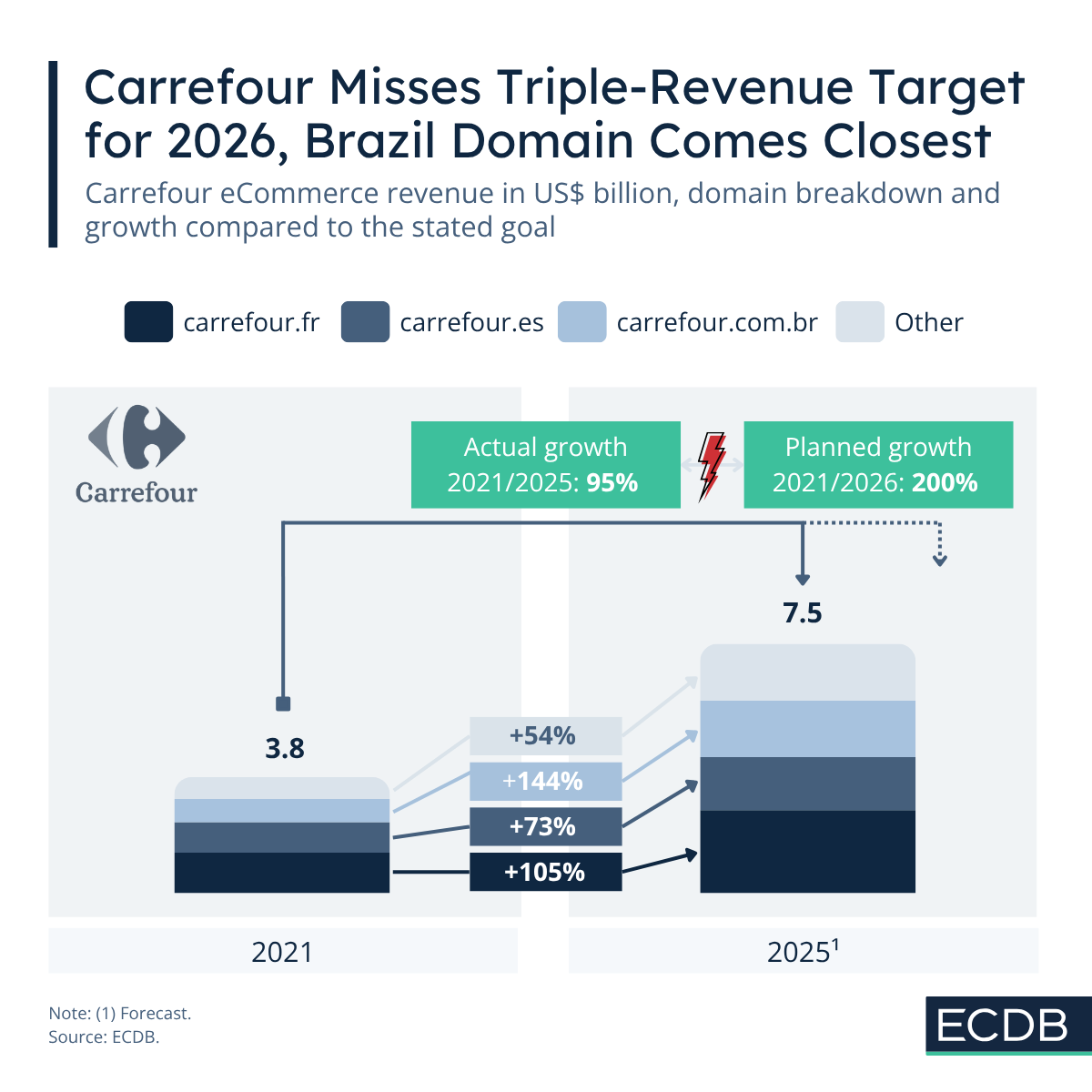

Carrefour Is Going to Miss Its Triple-Revenue eCommerce Target by 2026

Shop-Apotheke Beats DocMorris in Terms of Net Sales. How Is It Going to End?

PDD Holdings Could Soon Replace Amazon as the Number One Marketplace Provider in the World

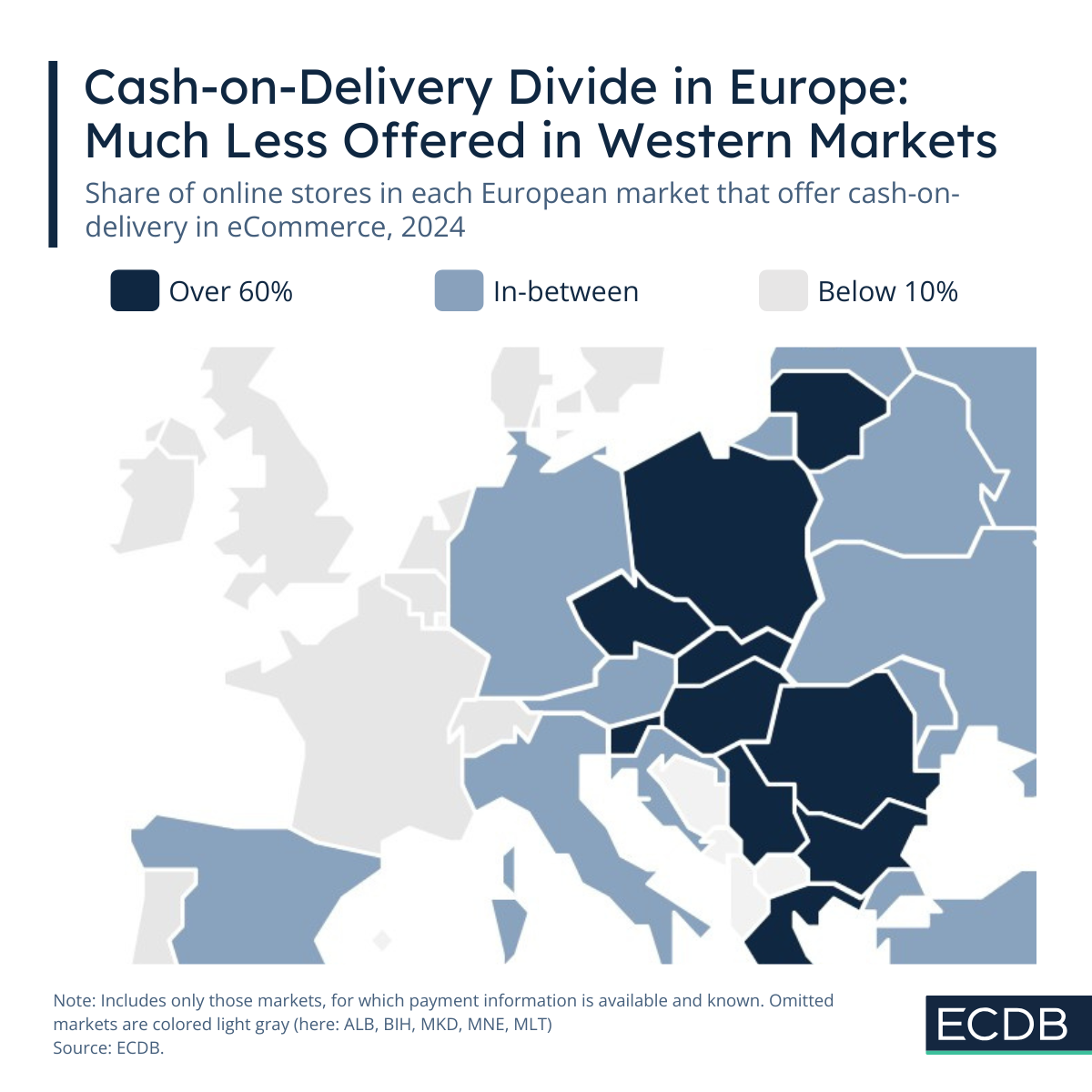

Cash on Delivery Is Most Used in Middle and Central Europe

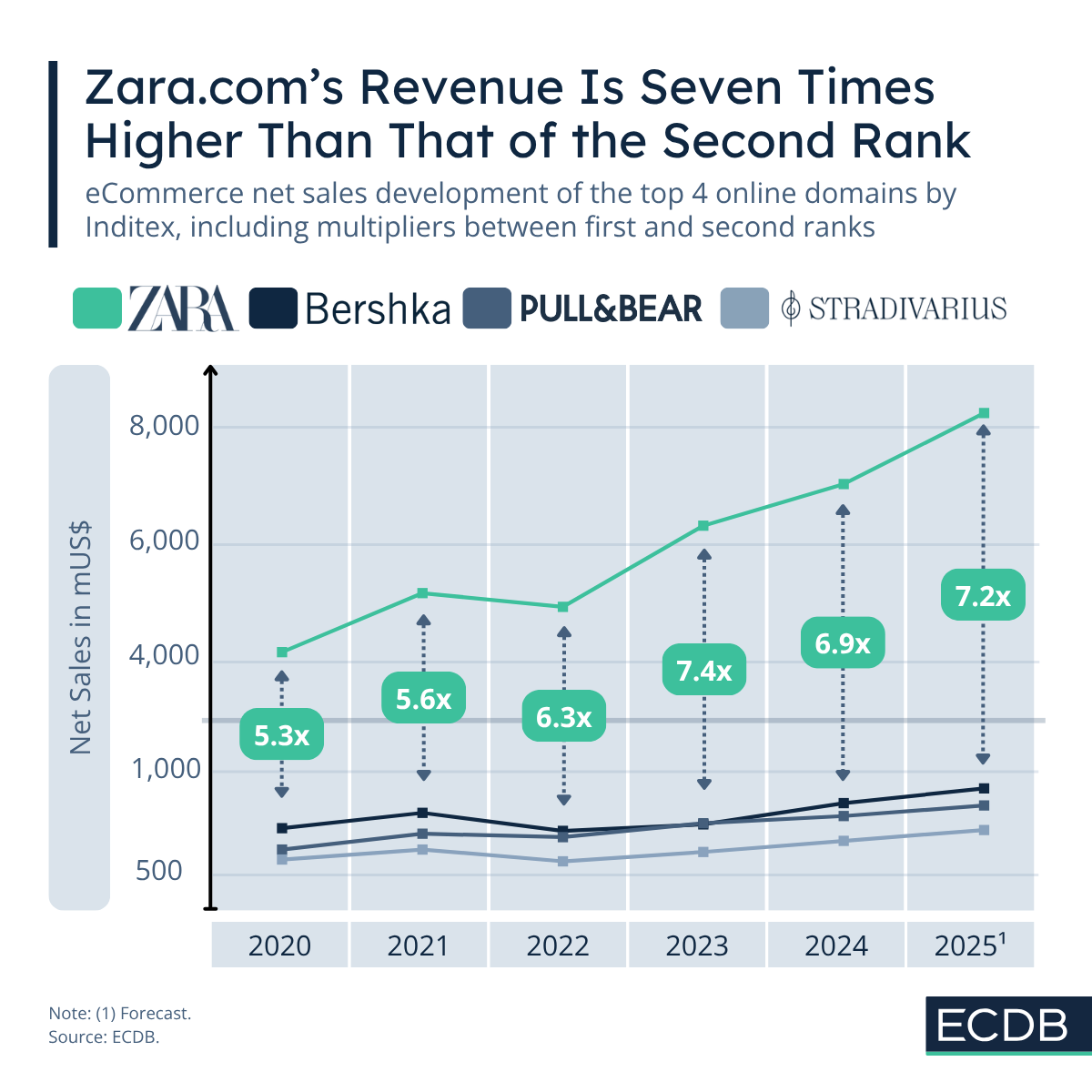

Three Inditex Domains Are Over US$1Bn Online Net Sales in 2025

Ready To Get Started?

Find your perfect solution and let ECDB empower your eCommerce success.