Most Online Stores in Germany Offer PayPal as Payment Option

PayPal is most offered by online stores in Germany, in the U.S. not so much. The e-wallet performs best in Europe, overall.

eCommerce: UK Payments

UK online payment methods show that VISA and Mastercard dominate. While PayPal enhances tools, Apple Pay integrates more deeply, and eWallets slowly gain ground.

Antonia Tönnies

Working Student

October 17, 2024

Payment

The rise of online payment methods has closely paralleled the growth of eCommerce. Among the fastest-growing options today are eWallets like PayPal, Amazon Pay, Apple Pay, and Google Pay.

Payment preferences vary by country, and in the UK, PayPal - of the earliest digital payment platforms, active since 2003 - still isn’t among the most popular. Instead, cards continue to dominate the payment space.

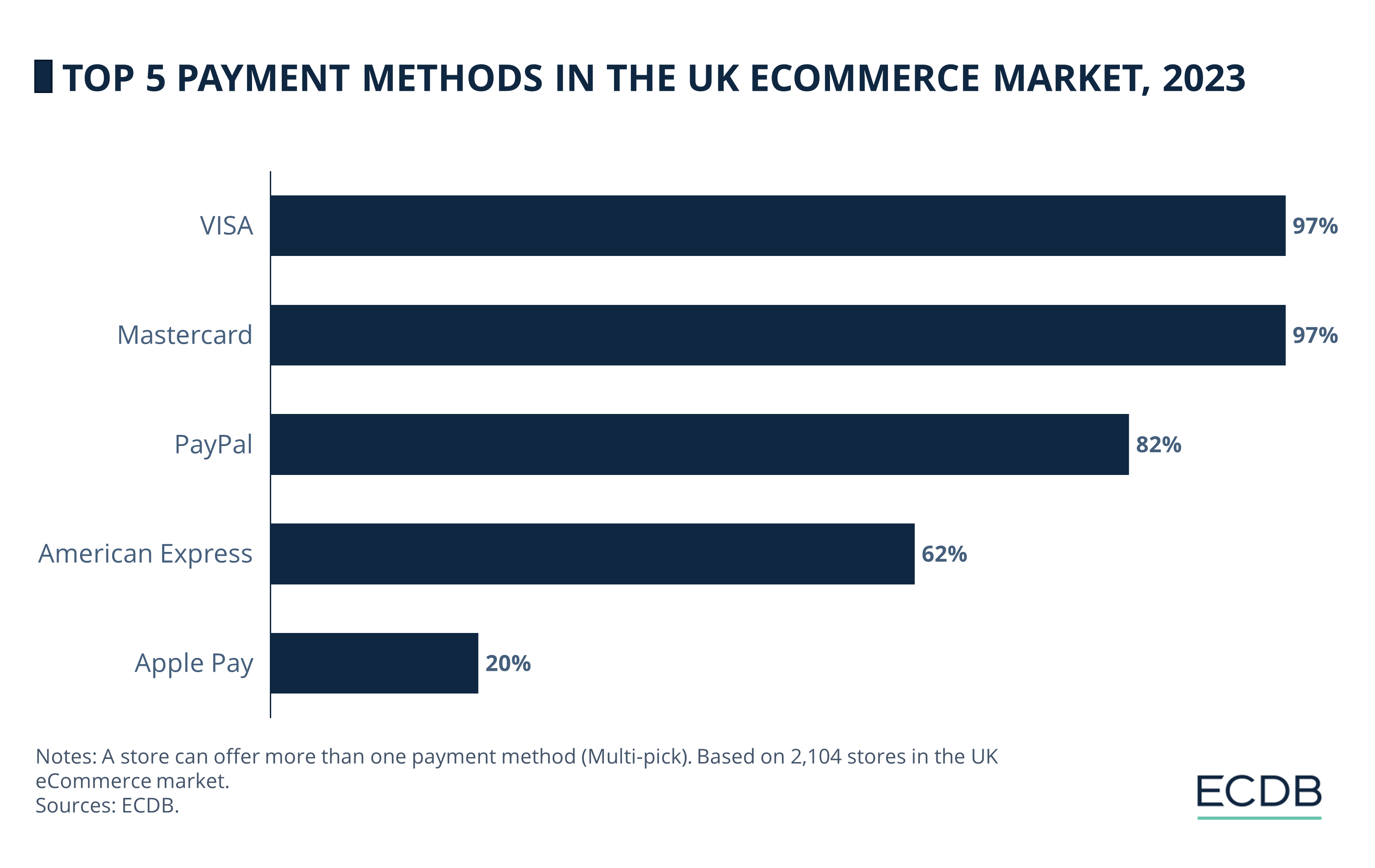

Based on the online stores on our database, we provide a detailed map of the eCommerce payment landscape in the UK:

VISA and Mastercard share the top spot at 97% penetration each.

The popular eWallet option PayPal is at number 2, with 82% of online stores in the UK offering it.

While American Express is at number 3 with 62%, Apple Pay rounds out the top 5 with 20% penetration.

As per our 2023 data, cards are the most commonly used payment type by online retailers in the UK. Among the most offered payment methods is VISA with a 97% usage rate. Despite VISA's widespread acceptance, recent regulatory scrutiny has raised concerns.

Late last year, the Payment Systems Regulator (PSR) in the UK proposed capping fees that VISA charges retailers for transactions between the EU and the UK. These fees, which spiked after Brexit, cost UK firms an extra £150 to £200 million (US$195 to US$260 million with the current exchange rate) in 2022. VISA disputes the need for a cap, arguing that the fees support reliable and secure digital payments.

While large companies might absorb these extra costs, smaller ones could pass them onto consumers. It's also worth noting that these developments caused calls for a UK-developed alternative to U.S. payment giants.

Mastercard shares the first spot with VISA, also with a 97% rate. Like VISA, Mastercard faces proposed fee caps from the PSR due to increased costs for cross-border transactions since Brexit.

These fees, which were previously regulated by the European Union, have significantly risen, impacting UK businesses. Mastercard contends that these fees offer value in a competitive market and are crucial for maintaining the security and efficiency of digital payments.

Not far behind the cards is the well-known digital payment platform PayPal, with 82% usage rate in the UK.

In March this year, PayPal launched "Complete Payments" for online small businesses in the UK, Canada, and over 20 European markets. This new solution allows businesses to accept various payment methods, including buy now pay later options, Apple Pay, Google Pay, and credit and debit cards.

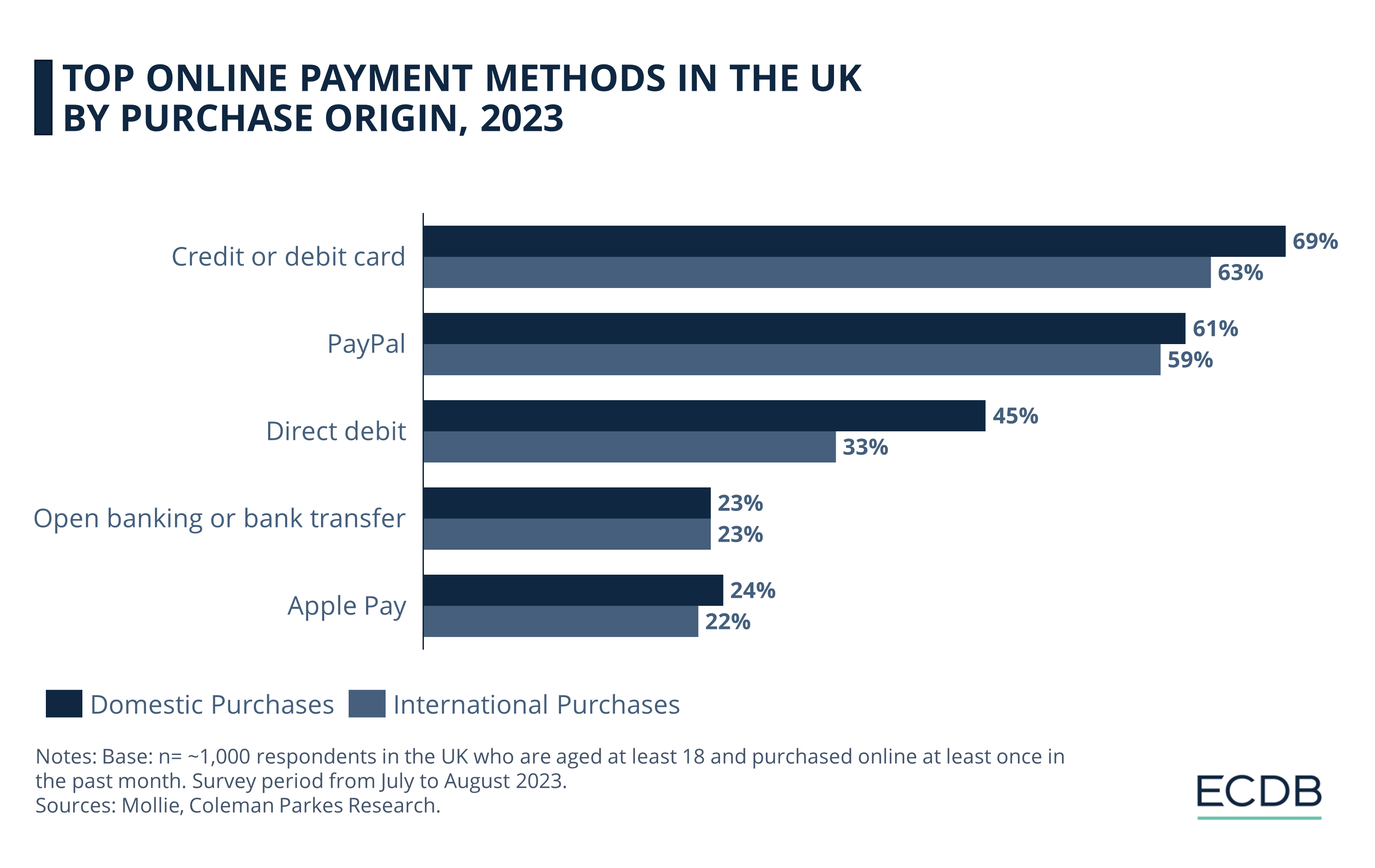

Looking at the top online payment methods in the UK, we see that credit/debit cards are the top payment method for both domestic and international purchases. While the shares between domestic and international purchases are minimal (2-7%) for each payment method, the gap is rather large (12%) for direct debit.

With integrations in major eCommerce platforms and advanced features like secure payment storage and package tracking, PayPal aims to boost checkout conversions and provide robust fraud protection, making it a favorite among UK consumers.

American Express follows the top 3 with 62%. Despite the challenges brought on by the pandemic, American Express adapted in the UK by investing in non-travel benefits like online workshops and the “shop small” campaign.

This shift helped counter the decline in travel-related perks and proved that Amex could still thrive even with reduced travel. By 2023, American Express saw a significant rebound in consumer spending in the UK, demonstrating resilience and adaptability in a changing market.

Significantly further down the list is the payment method of the tech giant, Apple Pay, with 20%. Apple Pay launched in the UK in 2015, providing a secure and easy way to pay using popular credit and debit cards.

In November 2023, Apple Pay introduced a new feature allowing users to view their debit card balance, transaction history, and account details directly in their Wallet.

This move, part of the Open Banking initiative, further integrates Apple Pay into the UK market, enhancing user control over their finances and fostering deeper relationships between banks and their customers.

In 2021, cash in advance held the fifth position with 12%, but by 2023, Apple Pay had taken over this spot, surpassing the former. This makes Apple not only a growing competitor for individual payment companies, but also, together with PayPal, mobile wallets that could potentially surpass card payments. While PayPal has seen an almost 4% increase compared to 2021, the values of VISA, Mastercard, and American Express, albeit only minimally, have decreased.

Claiming that cards are being replaced by eWallets and digital wallets might be an overstatement, but the change is clearly there. The future will reveal which payment method remains the most popular in the UK.

Related Articles

PayPal is most offered by online stores in Germany, in the U.S. not so much. The e-wallet performs best in Europe, overall.

While the number of payment options offered varies from country to country, so too does the diversity of payment methods. In the field of payments, two methods can be found again and again: Mastercard & VISA.

What used to be done with credit cards can now be done by most online installments - but which provider to choose? In eCommerce, one installment option is always a safe bet, regardless of the product category: Klarna.

Click here for

more relevant insights from

our partner Mastercard.

Our Tool

We’re not just another blog—we’re an advanced eCommerce data analytics tool. The insights you find here are powered by real data from our platform, providing you with a fact-based perspective on market trends, store performance, industry developments, and more.

Analyze retailers in depth with our extensive Retailer dashboards and compare up to four retailers of your choice.

Learn More

Combine countries and categories of your choice and analyze markets in depth with our advanced market dashboards.

Learn More

Compile detailed rankings by category and country and fine-tune them with our advanced filter options.

Learn More

Discover relevant leads and contacts in your chosen markets, build lists, and download them effortlessly with a single click.

Learn More

Benchmark transactional and conversion funnel KPIs against market standards and gain insight into the key metrics of your relevant market.

Learn More

Our reports provide pre-analysed data and highlight key insights to help you quickly identify key trends.

Learn More

Find your perfect solution and let ECDB empower your eCommerce success.