Blog

The ECDB Blog turns data from the Tool into eCommerce insights that illustrate which use you can make of our comprehensive data. It elaborates on relevant eCommerce news to help your brand gain a broader perspective on current retail trends and their effects. Our articles are carefully crafted to present to you the latest market trends, including retail, payment, shipping, transactions, cross-border and more.

Item 1 of 5

All Articles

PDD Holdings Could Soon Replace Amazon as the Number One Marketplace Provider in the World

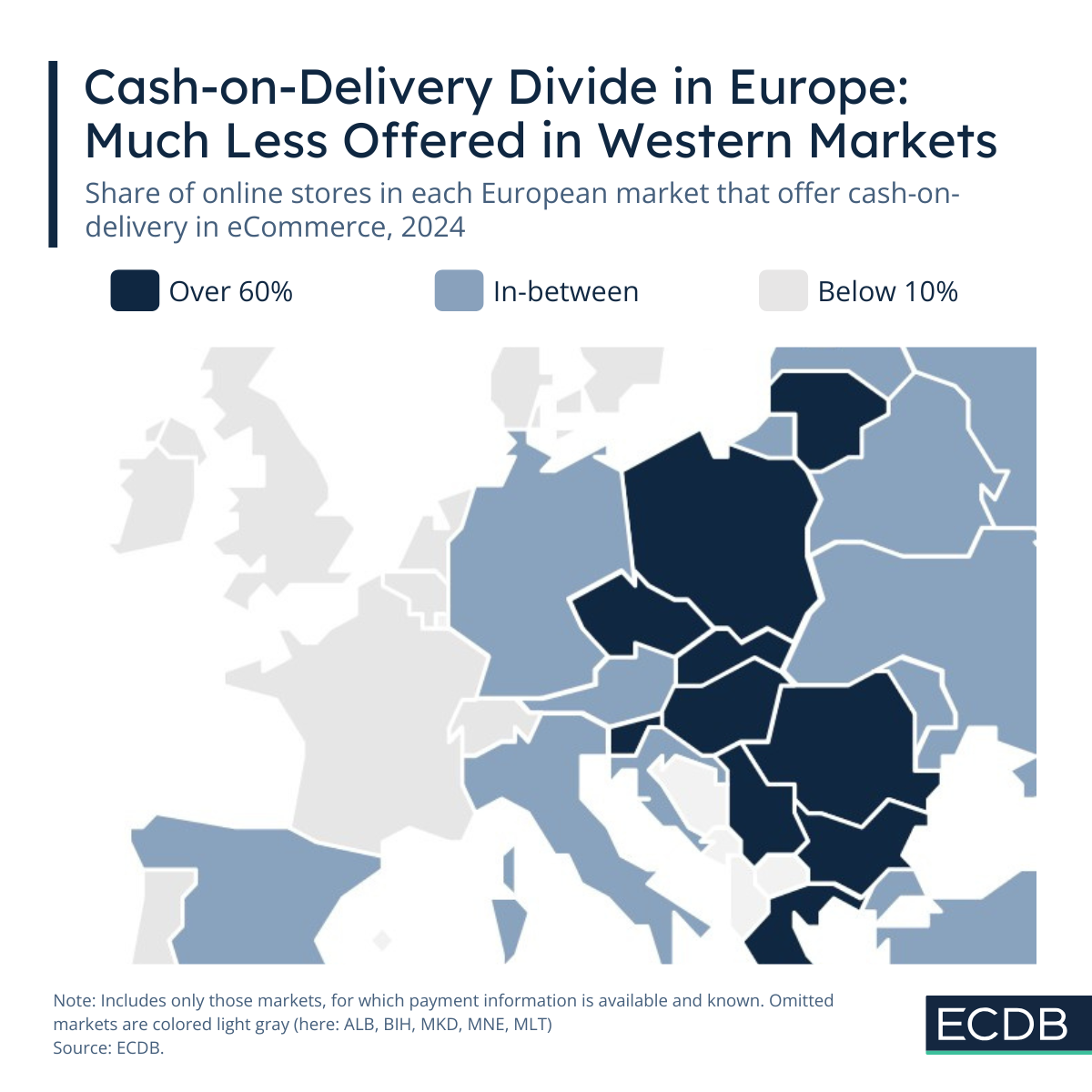

Cash on Delivery Is Most Used in Middle and Central Europe

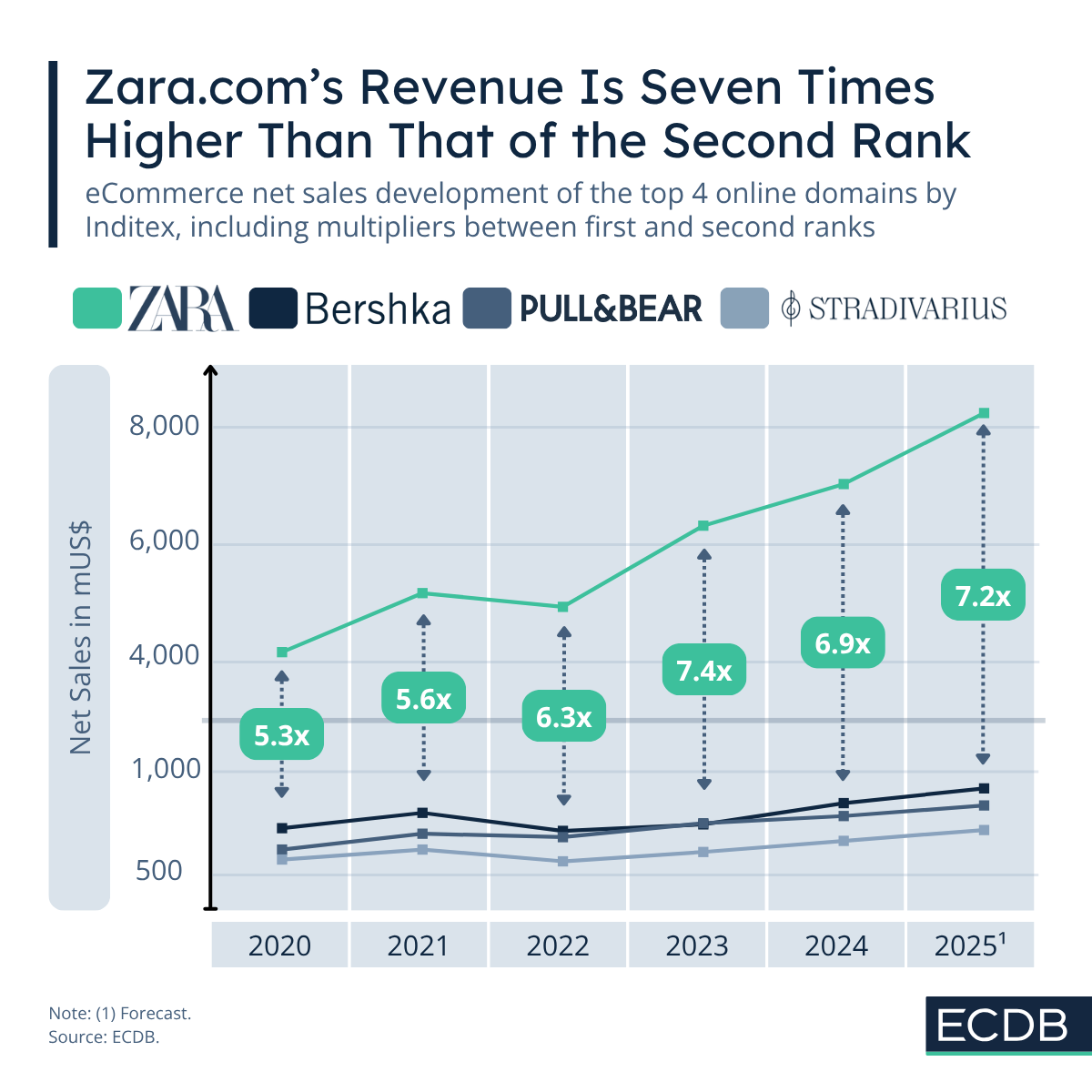

Three Inditex Domains Are Over US$1Bn Online Net Sales in 2025

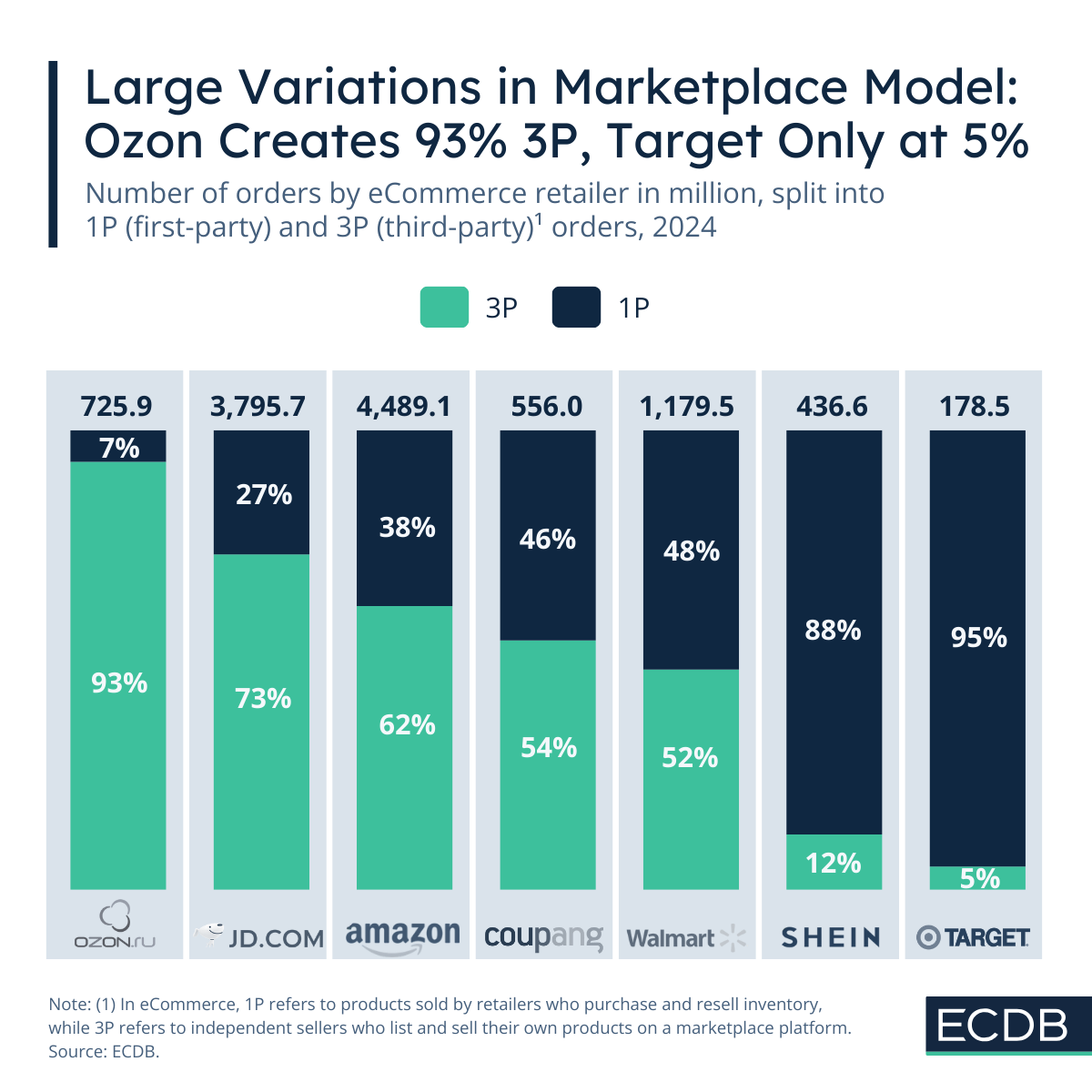

1P and 3P Orders in World eCommerce: Here Is How Top Retailers Operate

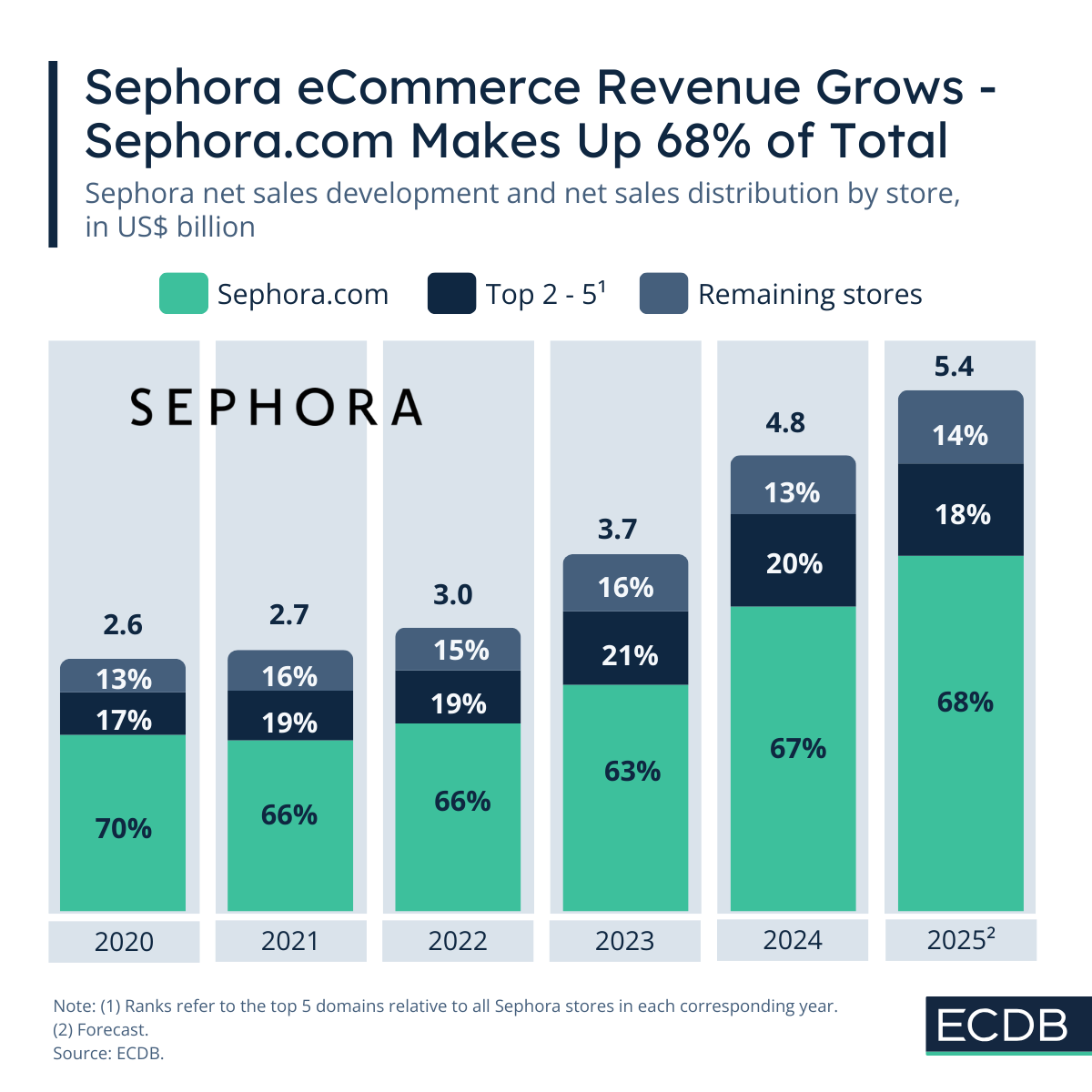

Sephora eCommerce Revenues Are Surging — Which Domains Take the Lead

Ready To Get Started?

Find your perfect solution and let ECDB empower your eCommerce success.