Europe may not be that big geographically, but it's a region with a lot of potential. To capitalize on this potential, many big names in the retail industry have focused a significant (if not the largest) part of their business strategies on the continent.

Although many are competing to take over the market, which online marketplaces actually dominate Europe? Using our data, we take a look at the names at the top and zoom in on the top 5.

“The Everything Store” Leaves All Marketplaces in the Dust

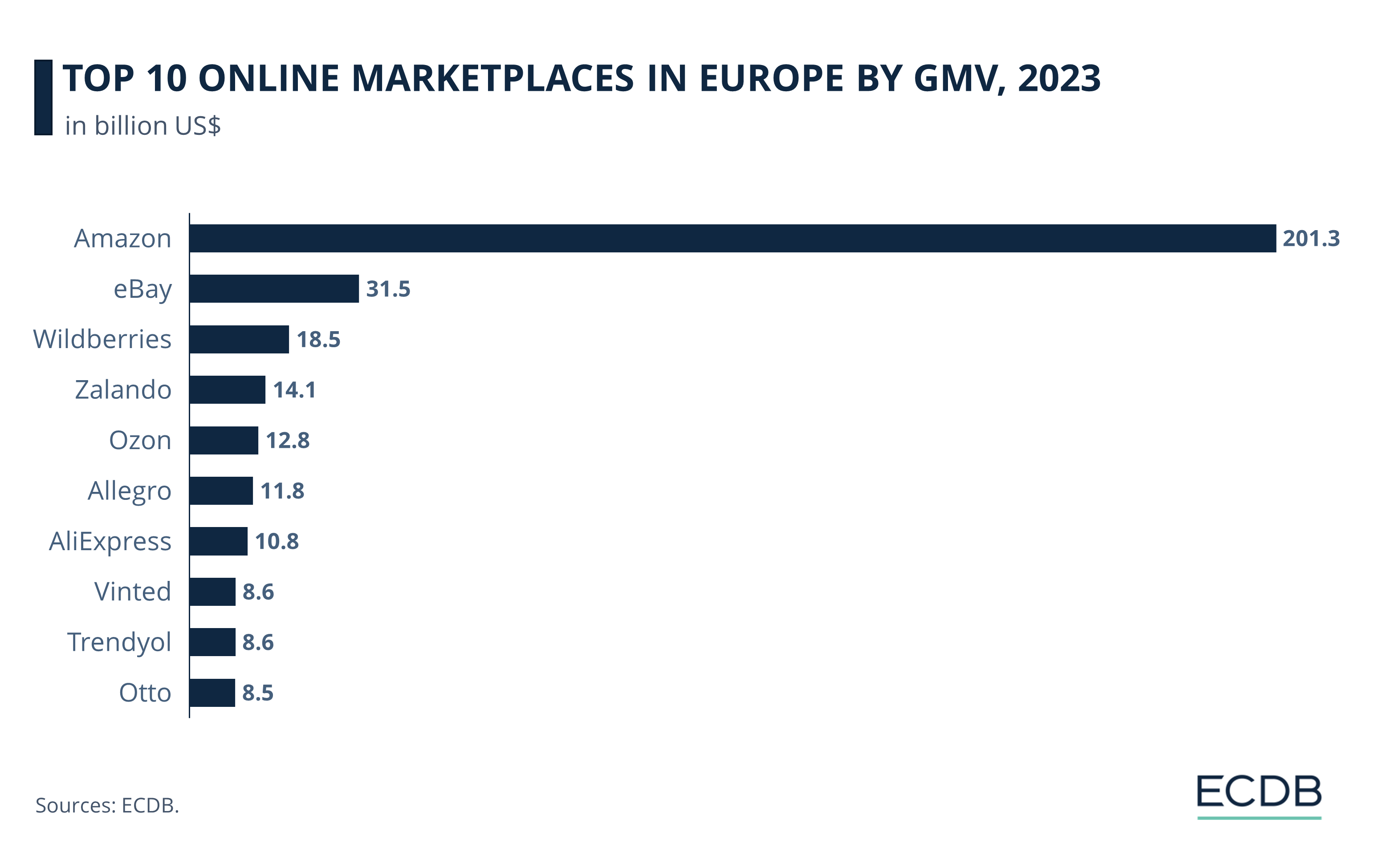

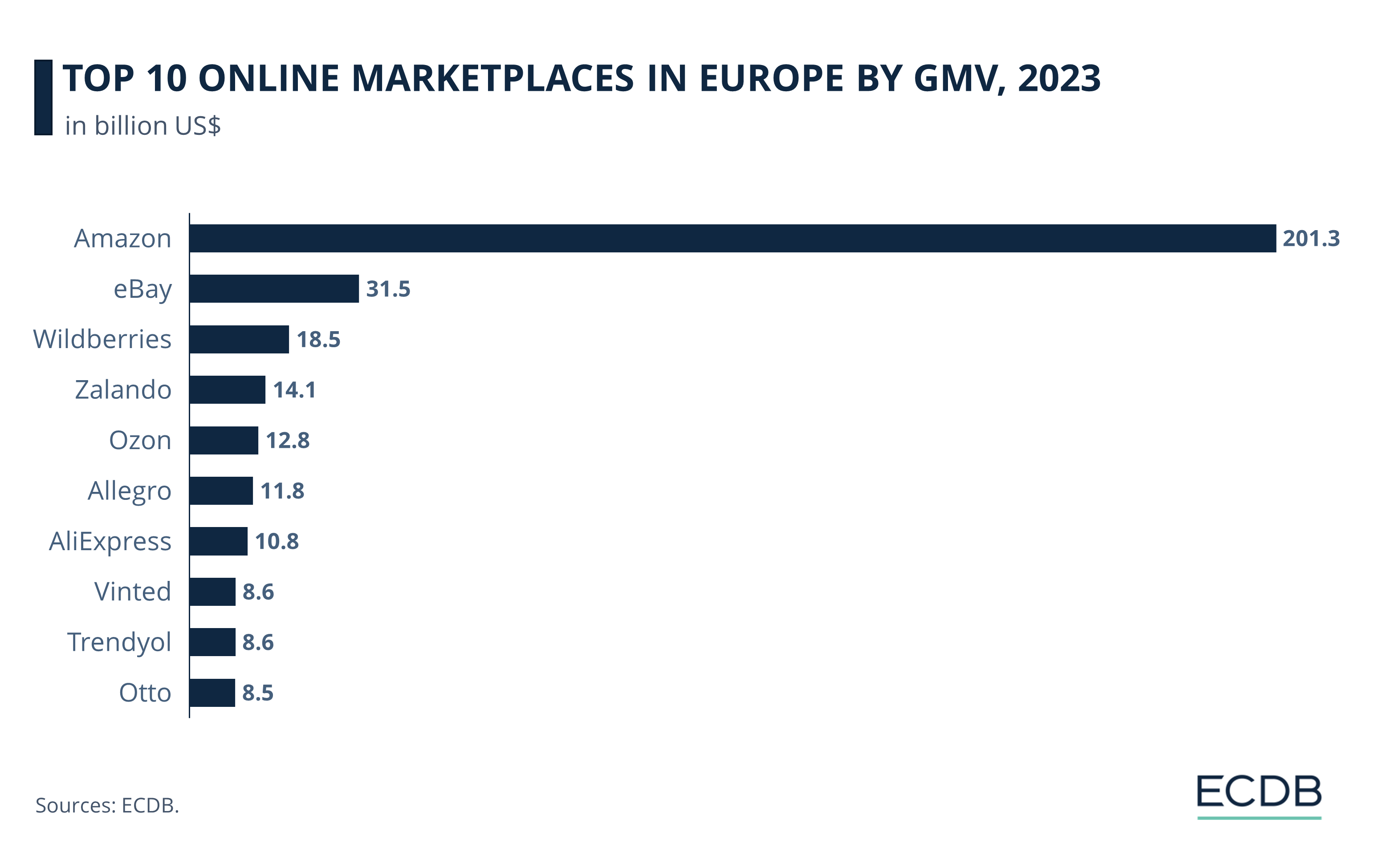

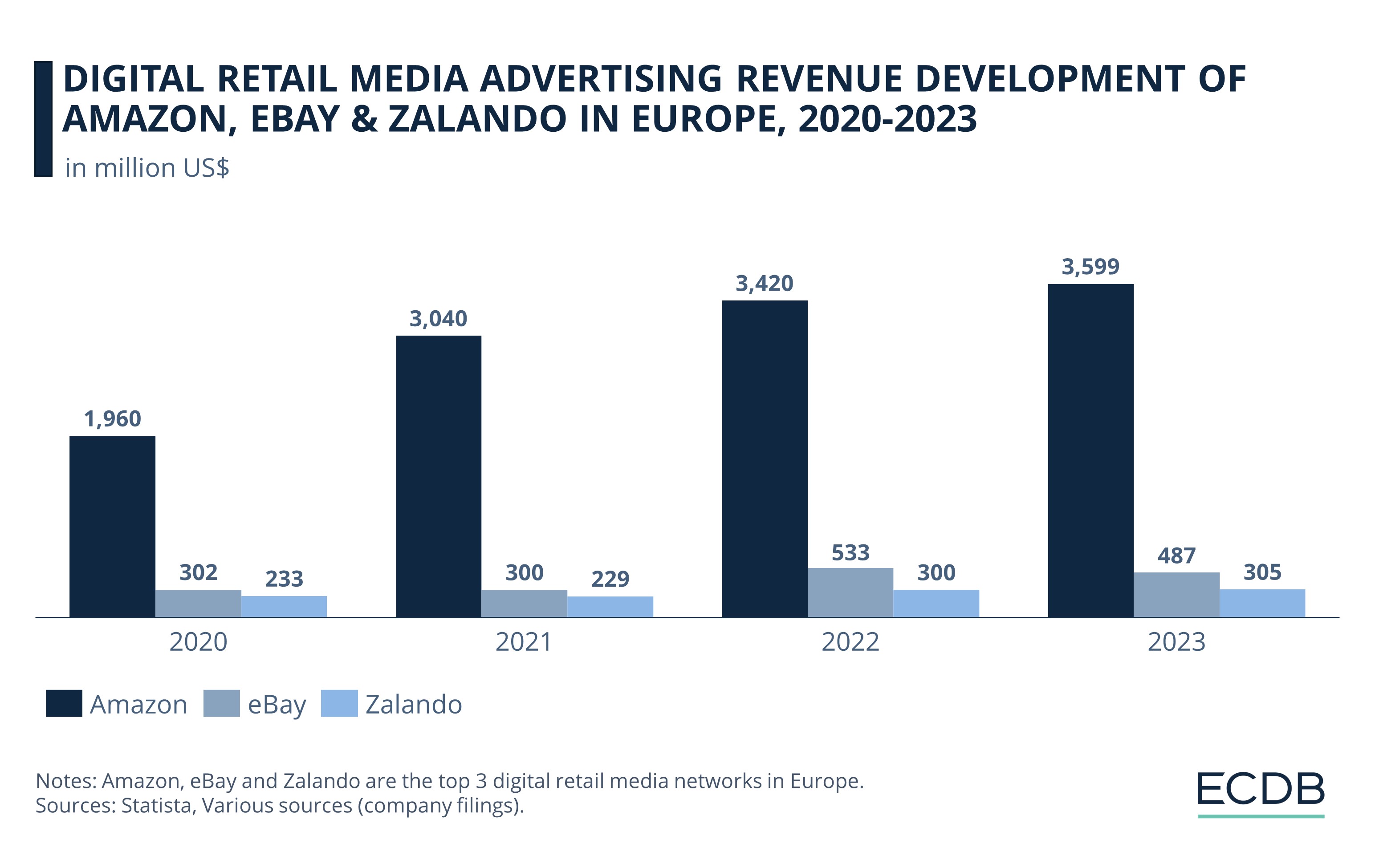

Sorted by GMV (Gross Merchandise Volume), Amazon is the top online marketplace in Europe with US$201 billion last year. Although eBay is in second place with a GMV of US$31 billion last year, it doesn't even come close to Amazon's numbers.

What we can see as a middle tier in this top 10 consists of online marketplaces from third to seventh place. These are Wildberries, Zalando, Ozon, Allegro and AliExpress, with 2023 GMVs ranging from US$18.5 billion to US$10.8 billion.

The last three online marketplaces on our list - Vinted, Trendyol and Otto - make up the bottom tier. These players had a GMV of about US$8.5 billion last year.

Considering GMV, Amazon's 2023 sales in Europe were 60% higher than the combined sales of all other online marketplaces in the top 10.

Although the top two spots have been held by their current holders for the past 5 years, the rest of the rankings have seen quite a bit of change over time.

Market Development: A Lot Has Changed, But Not Amazon and eBay’s Lead

Since 2019, Amazon and eBay have consistently been the no. 1 and no. 2 online marketplaces in Europe.

Wildberries in third place, however, hasn't always been there. The Russian online marketplace improved its ranking from #10 to #3, jumping up at least two places each year until 2022 and remaining in third sport last year. Zalando, in fourth place, has mostly stayed in the same position for the past five years, except for a one-rank jump in 2021.

Ozon's rise to fifth place is similar to that of Wildberries. In addition to its impressive rise in the previous years, 2022 was a turning point for the Russian online marketplace, as it rose from the 11th spot to the 5th and has remained there since.

While Allegro hasn't changed much over the past five years, landing in 6th place last year, AliExpress - #3 in 2019 and 2020 - has lost ground in Europe, falling to 7th place in 2023.

Although 7 out of 10 online marketplaces in the top 10 are local players, foreign players make up most of the market share, largely thanks to Amazon at #1.

In terms of the number of positions, Vinted's rise is the most remarkable in our top 10. The Lithuanian online marketplace for used items has significantly improved its ranking, from #23 in 2019 to #8 last year, benefiting greatly from the pandemic's boost.

Rounding out the top 10, we see Trendyol at #9, which has improved its ranking since 2019. However, German retailer Otto at no. 10 is below its pre-pandemic ranking after ups and downs over the past few years.

Top Online Marketplaces in Europe:

A Closer Look

Now that we have a general overview of the top online marketplaces in Europe, let's zoom in on the top 5 and see their impact on the European market and recent developments around these companies.

1. Amazon

The world leading online marketplace Amazon, will launch Amazon.ie in 2025, a new store tailored for Ireland. The online store will feature products from over 1,000 local SMEs and emphasizing fast, local service. This move follows the opening of Amazon's Dublin fulfillment center, which has already enhanced logistics across Ireland.

Amazon is simultaneously involved in European digital policy, advocating for a strong Single Market – a European Union initiative that allows free movement of goods, services, money, and people across member states to enhance competitiveness – and support SMEs across the EU. This advocacy complements their investment in European SMEs, which generated over €9.8 billion in intra-EU sales in 2022.

Additionally, Amazon supports sustainable initiatives, as seen in its collaboration with Ecotrans to achieve record-breaking mileage for electric trucks in Europe, emphasizing their commitment to environmental and business growth across the continent.

2. eBay

eBay is championing sustainability and local commerce across Europe. In the UK, it has eliminated fees for selling second-hand clothes, except for high-value items like sneakers and jewelry, to promote a circular economy and encourage the sale of unworn garments valued at billions.

At the same time, eBay Germany has launched eBay Lokal to enhance local commerce by increasing visibility for local sellers and simplifying community-based trading. Additionally, eBay is introducing innovative features like AI-generated descriptions and livestream shopping events to improve the selling and buying process, aiming to boost user engagement and support the growing trend of neighborhood trading.

3. Wildberries

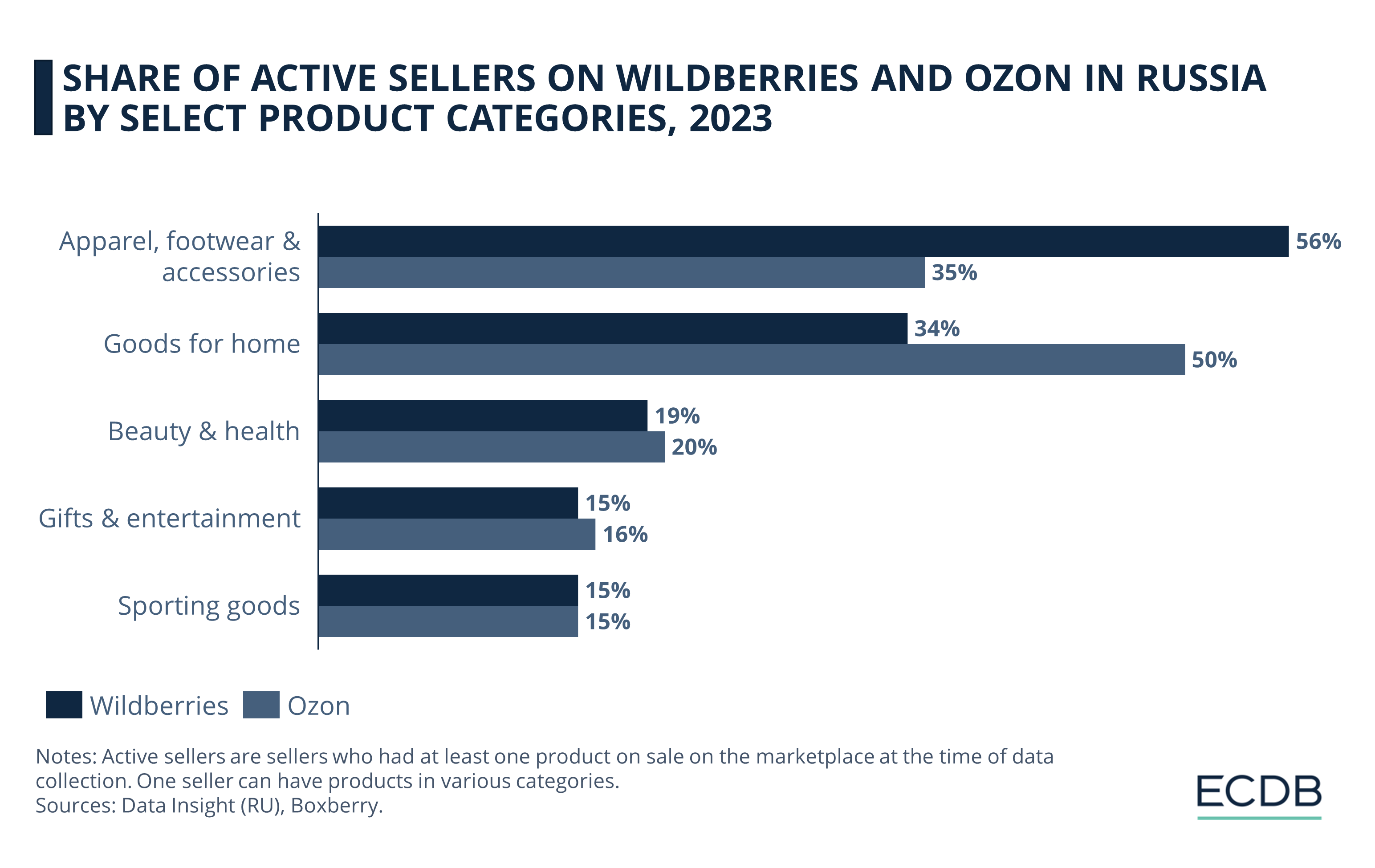

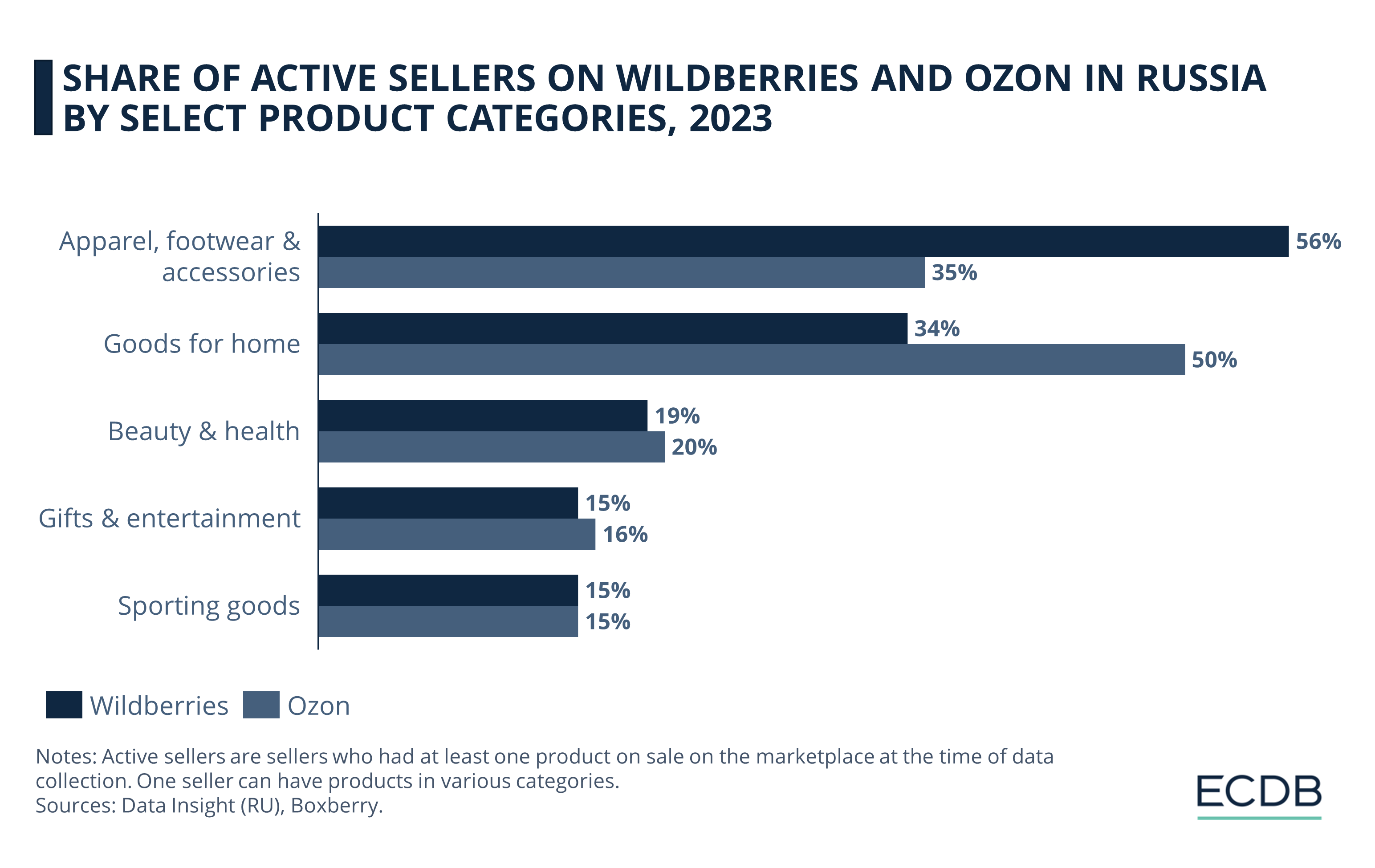

Wildberries, Russia's leading online marketplace, is expanding its reach by entering the Chinese market, aiming to integrate local manufacturers directly into its global platform. This move is part of an ambitious strategy to increase its international activities, which currently make up about 10% of its total turnover.

Additionally, Wildberries has recently started operations in Armenia and is exploring market opportunities in Turkmenistan and Uzbekistan. In Uzbekistan, it plans to extend into financial services by establishing a bank.

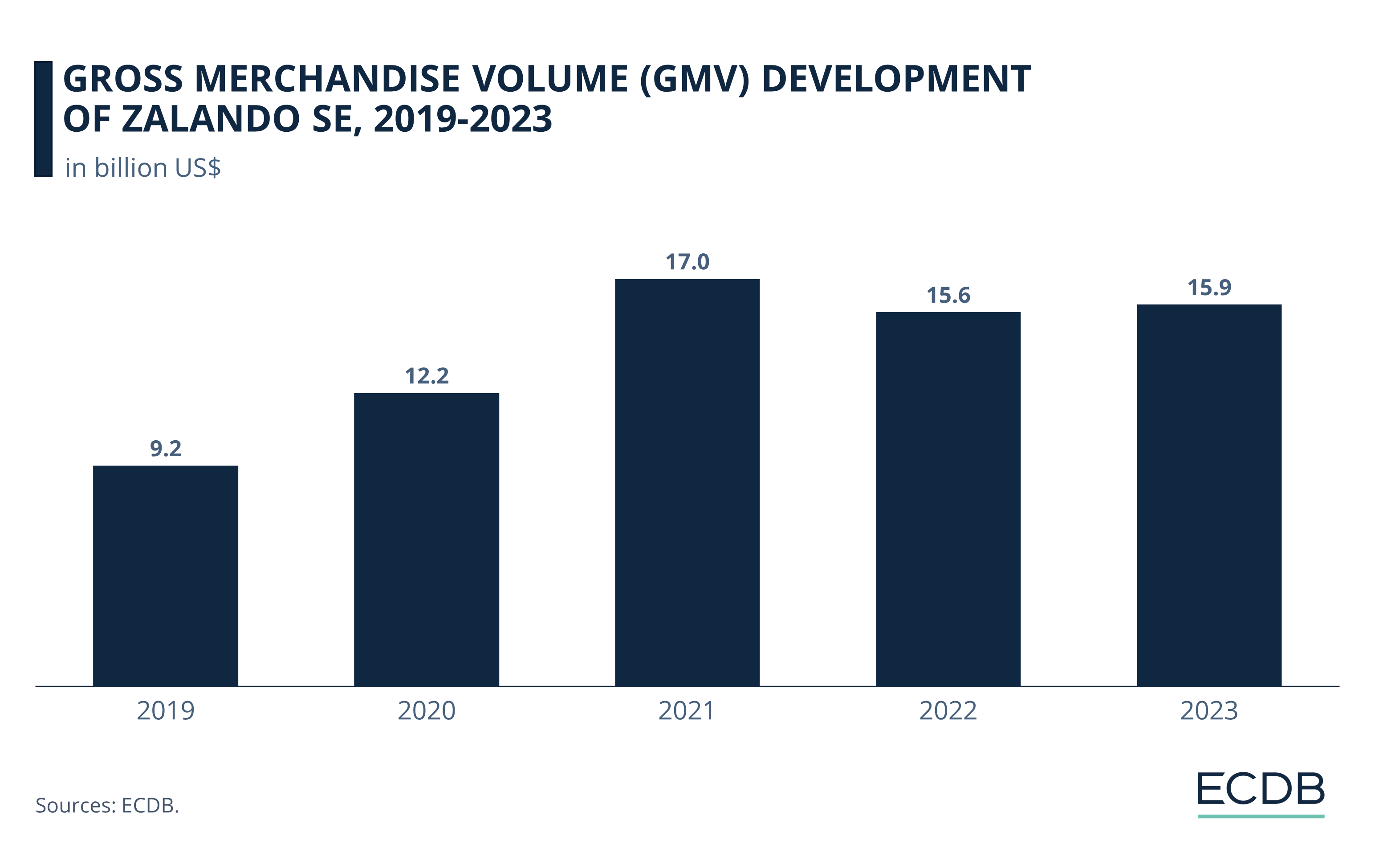

4. Zalando

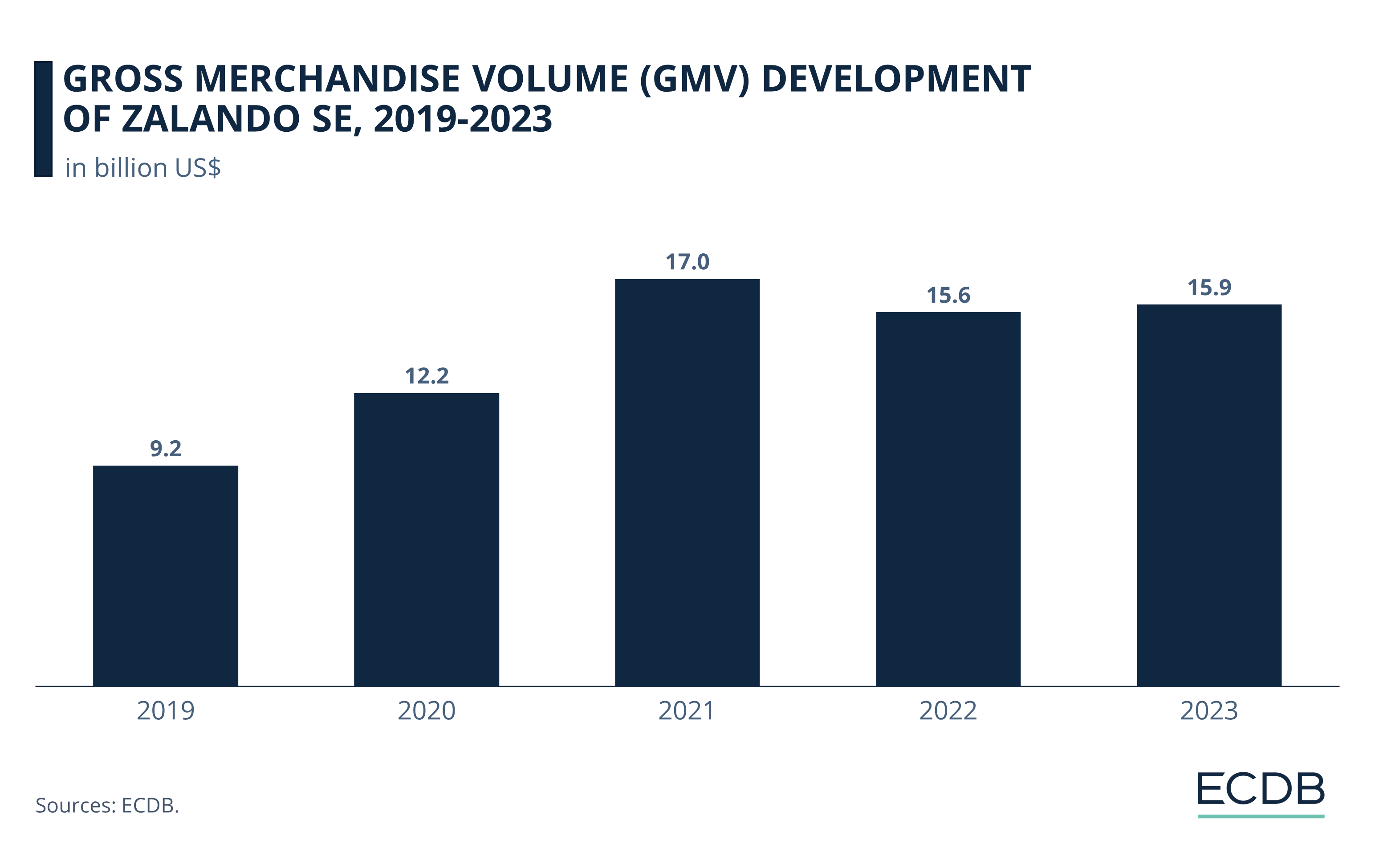

The Berlin-native Zalando is transforming into a comprehensive ecosystem for fashion and lifestyle eCommerce across Europe with its new B2B brand, ZEOS. This strategy aims to streamline complex cross-border operations by providing a unified operating system that integrates logistics, software, and services.

Meanwhile, Zalando has initiated legal action against the European Commission, contesting its classification as a "Very Large Online Platform" under the Digital Services Act. Zalando argues this label overlooks the retail-centric nature of its business and asserts it maintains a safe online shopping environment, challenging the criteria used for such designations.

5. Ozon

With its recent efforts, Ozon has been enhancing its eCommerce platform by introducing specialized stores, including a new section for athletes with brands like Adidas and Nike, reflecting a surge in health and fitness interest.

In collaboration with Russian Post, Ozon now facilitates order pickups at over 600 locations nationwide, broadening access to its services. Additionally, through a strategic partnership with LitRes, Ozon integrates a vast digital book catalog, aiming to significantly boost LitRes' revenues.

The Russian online marketplace has seen an 88% GMV increase in Q1 2024, though EBITDA (earnings before interest, taxes, depreciation, and amortization) dipped due to the rising costs of logistics and infrastructure expansions.

Top Online Marketplaces in Europe:

Closing Thoughts

As the cultural and economic mosaic that it is, Europe has been and will continue to be a place of innovation and change. Due to its dynamic nature and connection to technology, eCommerce is one of the sectors that benefits greatly from such regions.

While international retail giants dominate the continent currently, this is not to say that local companies will not eventually take over as Europe's eCommerce leaders. Time will tell if this is the case, and we look forward to following this race closely.