Blog

The ECDB Blog turns data from the Tool into eCommerce insights that illustrate which use you can make of our comprehensive data. It elaborates on relevant eCommerce news to help your brand gain a broader perspective on current retail trends and their effects. Our articles are carefully crafted to present to you the latest market trends, including retail, payment, shipping, transactions, cross-border and more.

Item 1 of 5

All Articles

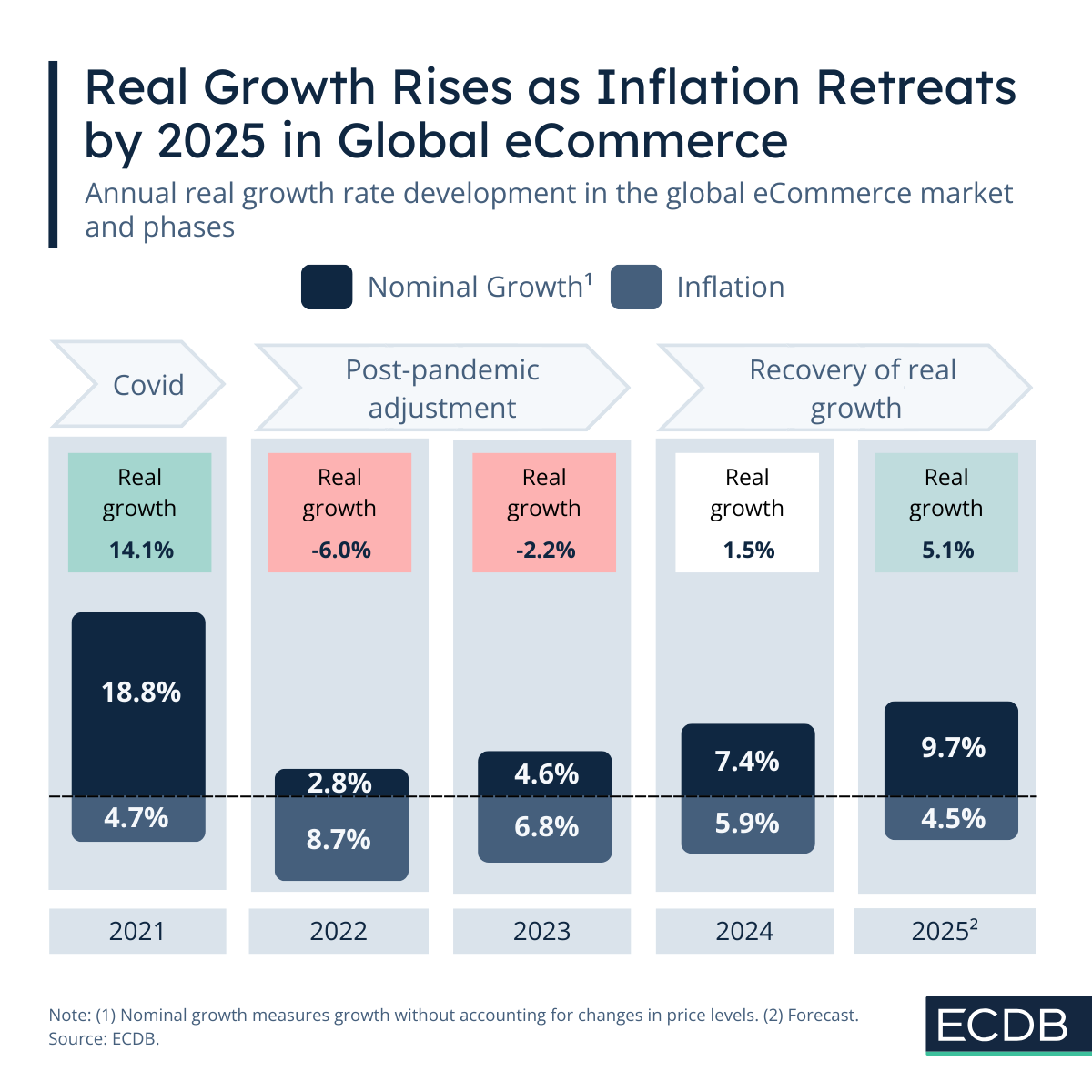

Douyin Is the Hottest Upstart eCommerce Marketplace Right Now

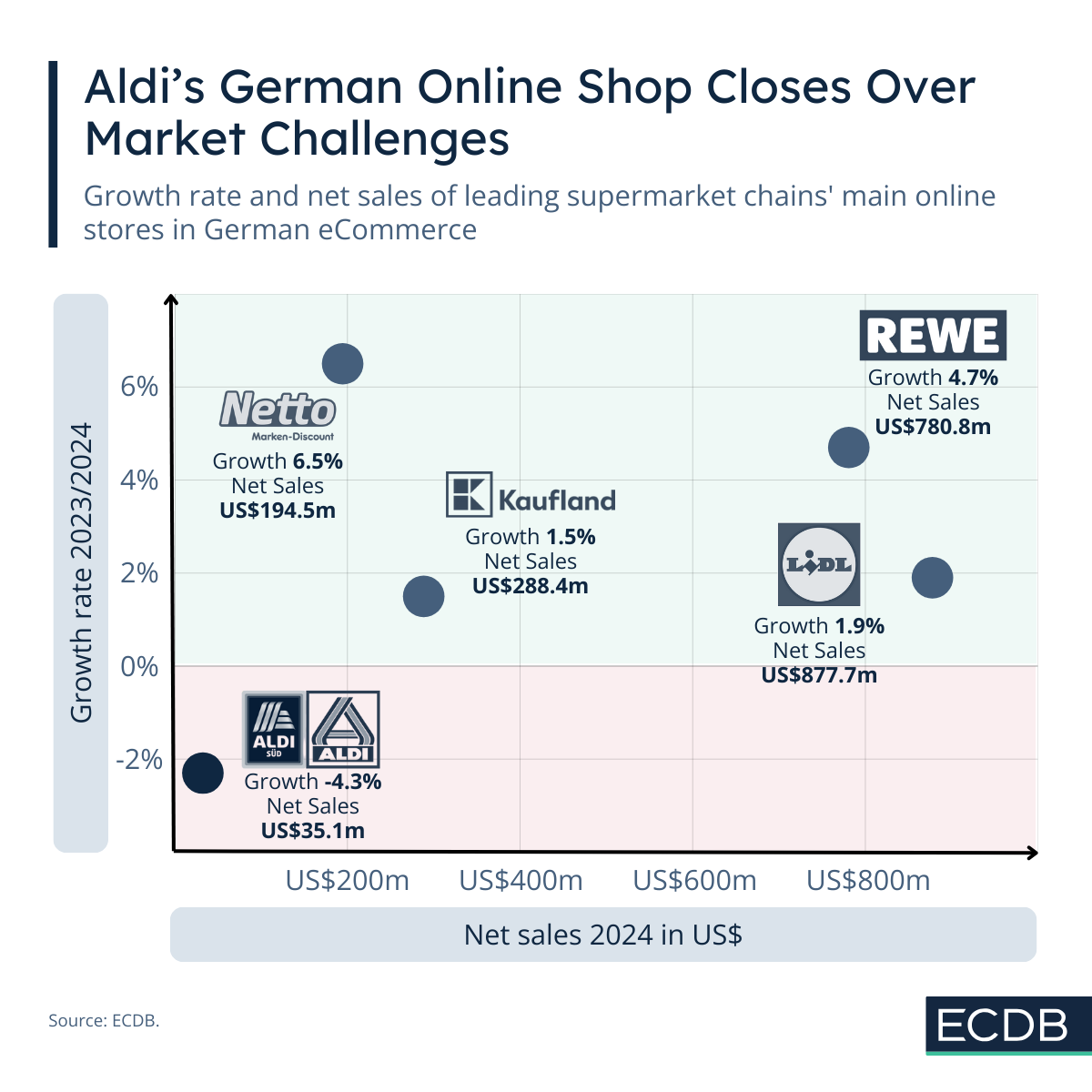

Aldi-Onlineshop.de Shuts Down Due to Low Competitiveness and Profitability

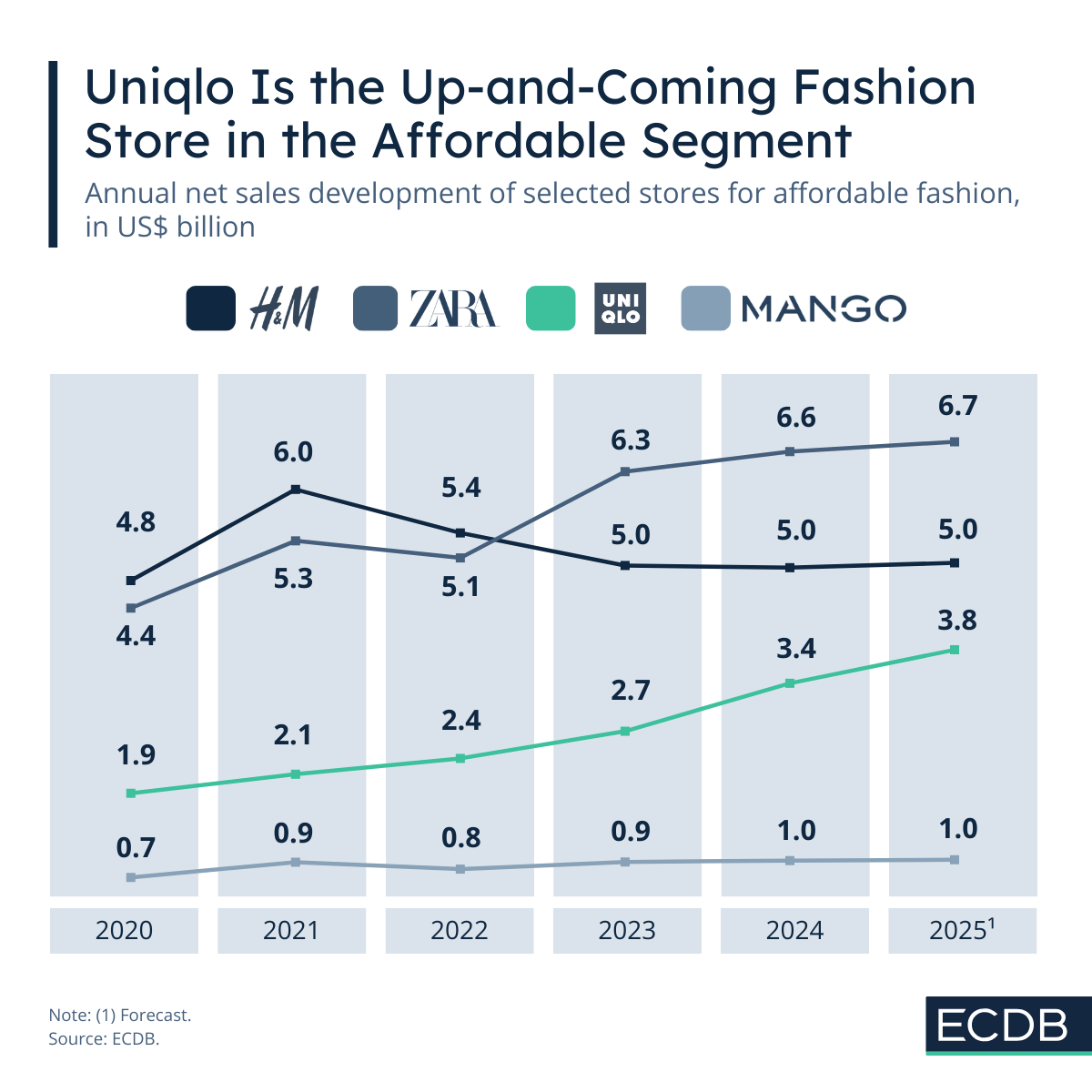

Uniqlo Is Becoming a Rival to Global Fashion Retailers

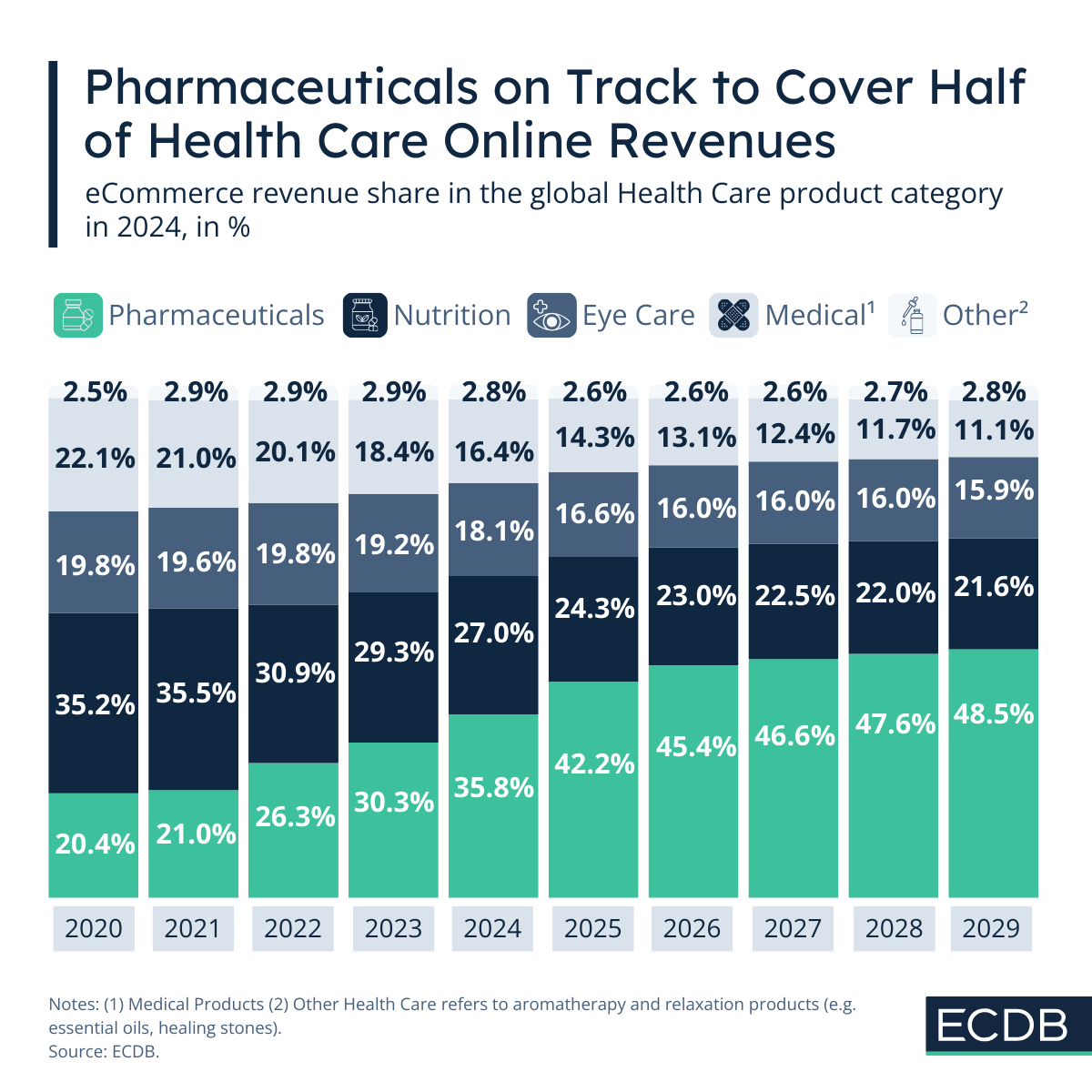

Why the Future Looks Bright for Pharmaceuticals eCommerce

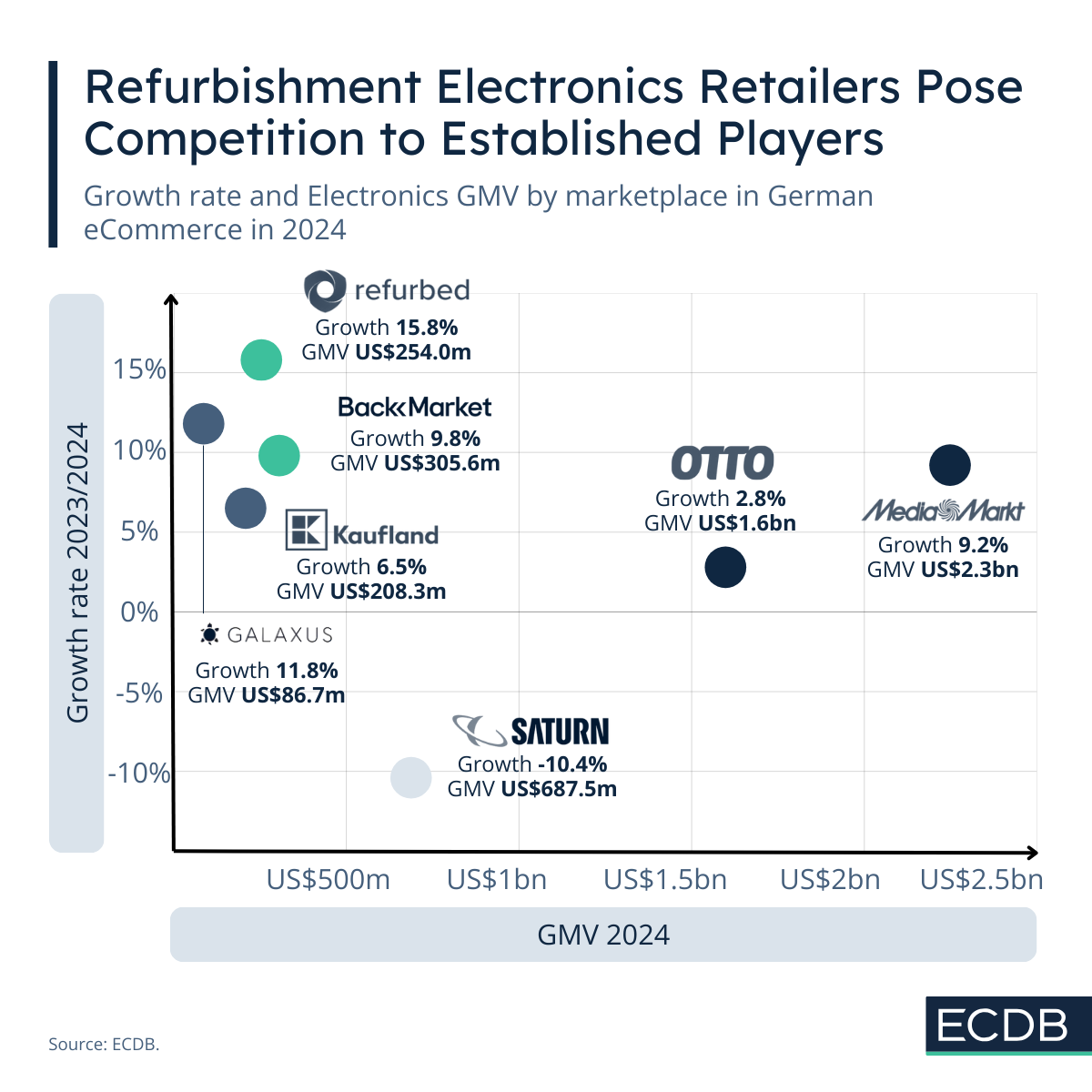

Refurbed and Back Market Rattle German Marketplace Ranking

Ready To Get Started?

Find your perfect solution and let ECDB empower your eCommerce success.