Ranked as the 18th largest eCommerce market, Turkey's eCommerce landscape is fueled by robust consumer spending, bolstered by low interest rate policies and a youthful, spending-conscious population. A surge in Internet and credit card penetration, coupled with the emergence of prominent online platforms and global companies, is further accelerating this momentum.

But what stages has the market gone through to reach its current state? We'll take a quick look before delving into other dynamics that make the Turkish eCommerce market unique in Europe.

Top Online Stores in Turkey: Trendyol on Top

Among the leading online stores in Turkey, based on their 2023 eCommerce net sales:

Trendyol.com holds the top position with sales of almost US$4.08 billion.

Hepsiburada.com follows as a strong contender, recording sales of nearly US$1.31 billion.

Migros.com.tr, with sales of approximately US$663.8 million, and Amazon.com.tr, with US$443.8 million in sales, are also major players.

Going down the list, we see that Apple.com shows notable performance with sales of around US$202.8 million.

Other significant contributors include Mediamarkt.com.tr with US$179.1 million, Ciceksepeti.com with US$163.7 million, and Lcwaikiki.com with US$163.6 million.

A101.com.tr and Flo.com.tr round out the top 10, with sales of US$133.9 million and US$123.8 million, respectively.

Let's take a look at the top 3 players and see what they're all about.

1. Trendyol

Trendyol is the largest online store in Turkey and has established itself as a prominent player in the country's digital marketplace.

Founded in 2010, Trendyol serves as a platform for a wide variety of goods, including clothing, accessories, electronics, and home goods, among others. With its user-friendly interface and a wide array of products, Trendyol has quickly gained popularity among Turkish consumers.

Trendyol has also branched out into private label products, providing services such as instant delivery and mobile top-up. The company's success has been bolstered by significant investment, including from Alibaba Group, one of the world's largest eCommerce companies.

2. Hepsiburada

Established in 2000, Hepsiburada is one of the pioneers of online shopping in Turkey. The platform offers a wide range of products, from electronics and fashion to home appliances and groceries. Known for its reliable service and extensive product offerings, Hepsiburada has built a strong reputation among Turkish consumers.

Hepsiburada has also focused on enhancing the customer experience through innovative services such as HepsiExpress for quick delivery, HepsiPay for secure online payments, and a loyalty program that offers various perks to frequent shoppers. The company's commitment to customer satisfaction and continuous innovation has solidified its position as a leading eCommerce platform in Turkey.

3. Migros

Migros, a well-established supermarket chain in Turkey, has successfully transitioned to the online space, offering a comprehensive range of grocery items, fresh produce, household goods, and more. The online platform mirrors the extensive product range found in Migros' physical stores, providing customers with a convenient and reliable shopping experience.

Migros has invested in logistics and delivery infrastructure to ensure timely and efficient service. Their online store features options for scheduled deliveries, allowing customers to choose convenient times for receiving their orders. Migros' strong brand reputation and commitment to quality have made it a preferred choice for online grocery shopping in Turkey.

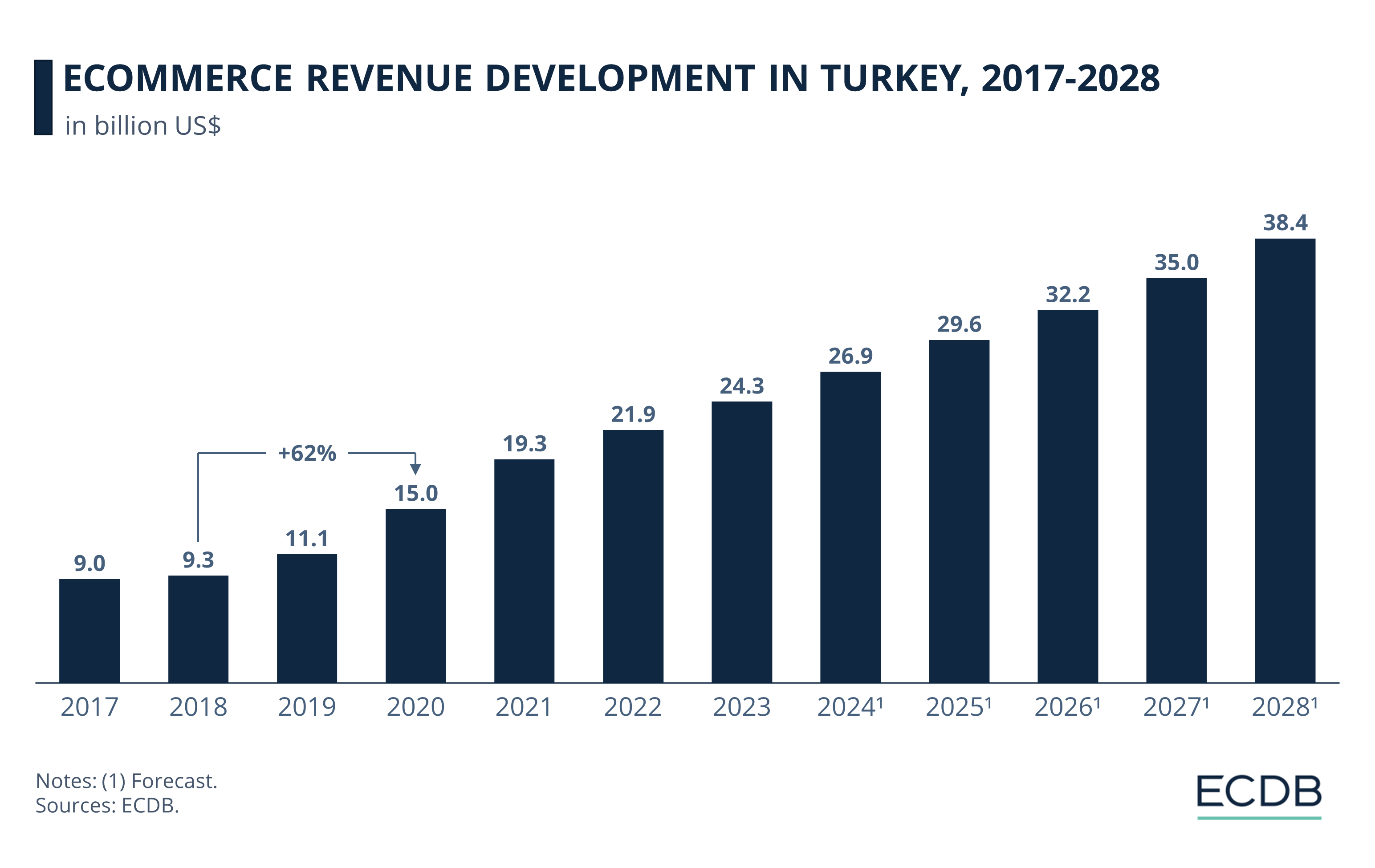

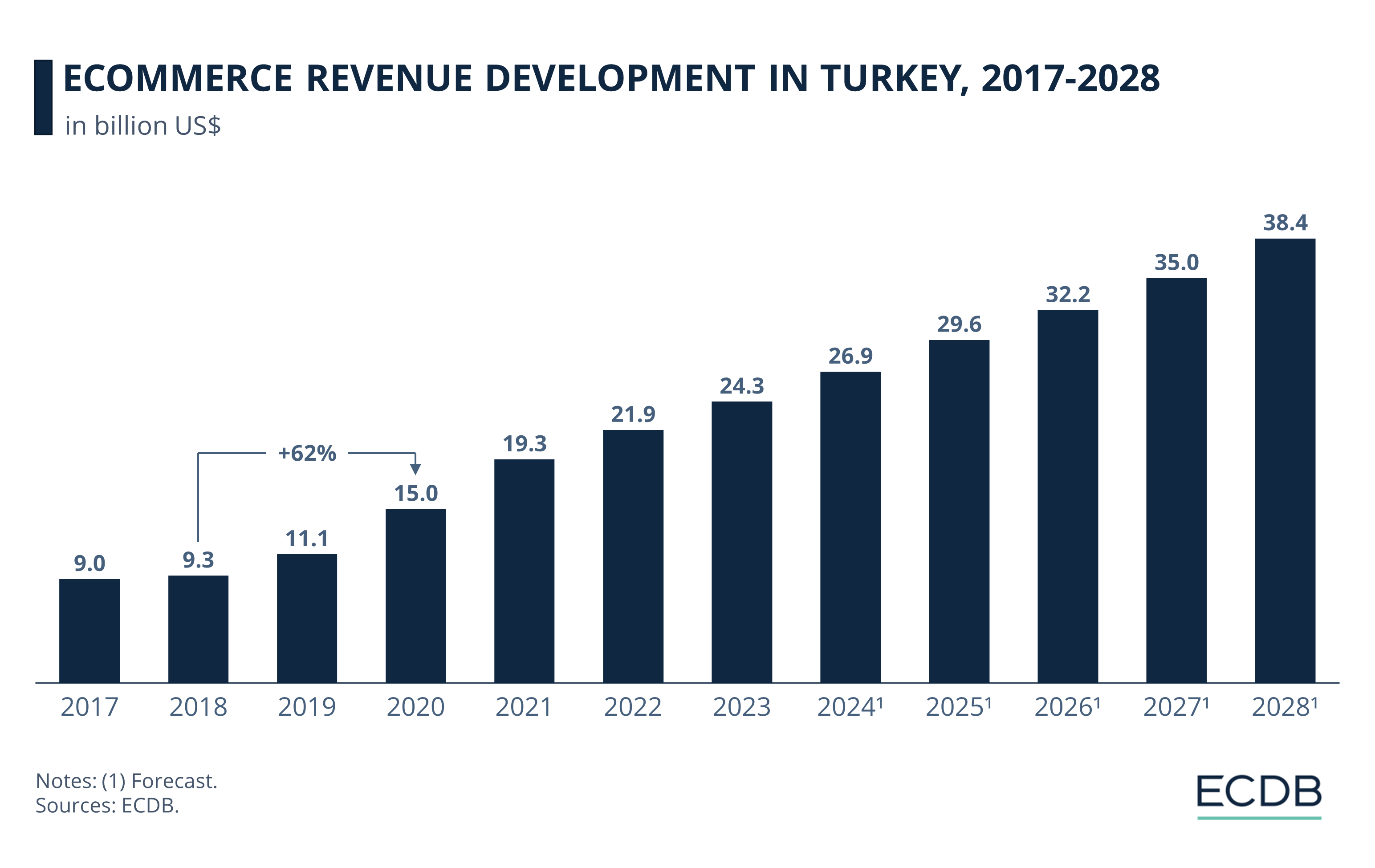

eCommerce Revenue Development in Turkey: 62% Growth in 2018-2020

Based on our data, here is the revenue development and growth in the Turkish eCommerce market from 2017 to 2028:

In 2018, the eCommerce market in Turkey grew by 3.5%, reaching a revenue of US$9.27 billion. In 2019, revenues increased significantly by 20% to US$11.12 billion, indicating strong growth momentum.

The market saw a substantial surge in 2020, with a 35% growth, bringing revenues to US$15.01 billion. This growth continued in 2021, with a 28.6% increase, resulting in US$19.3 billion in revenue. The market expanded by 13.2% in 2022, reaching US$21.86 billion, and grew by 11.2% last year, with revenues hitting US$24.31 billion.

Forecasts for the coming years indicate steady growth. In 2024, the market is expected to grow by 10.6%, reaching US$26.88 billion. By 2028, a growth of 9.8% is anticipated with revenues projected to reach US$38.39 billion.

Importance of eCommerce in

Turkey’s Economy

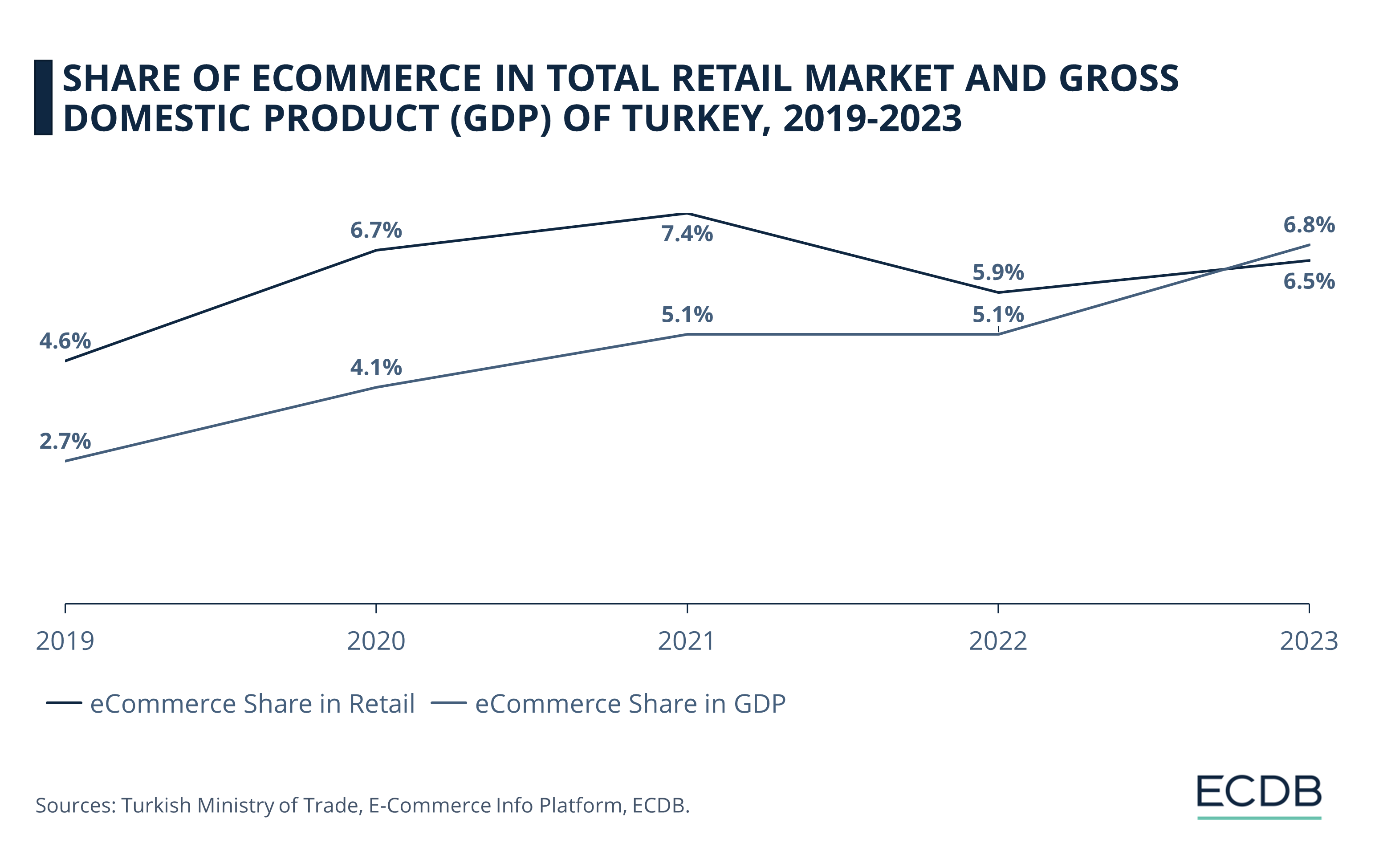

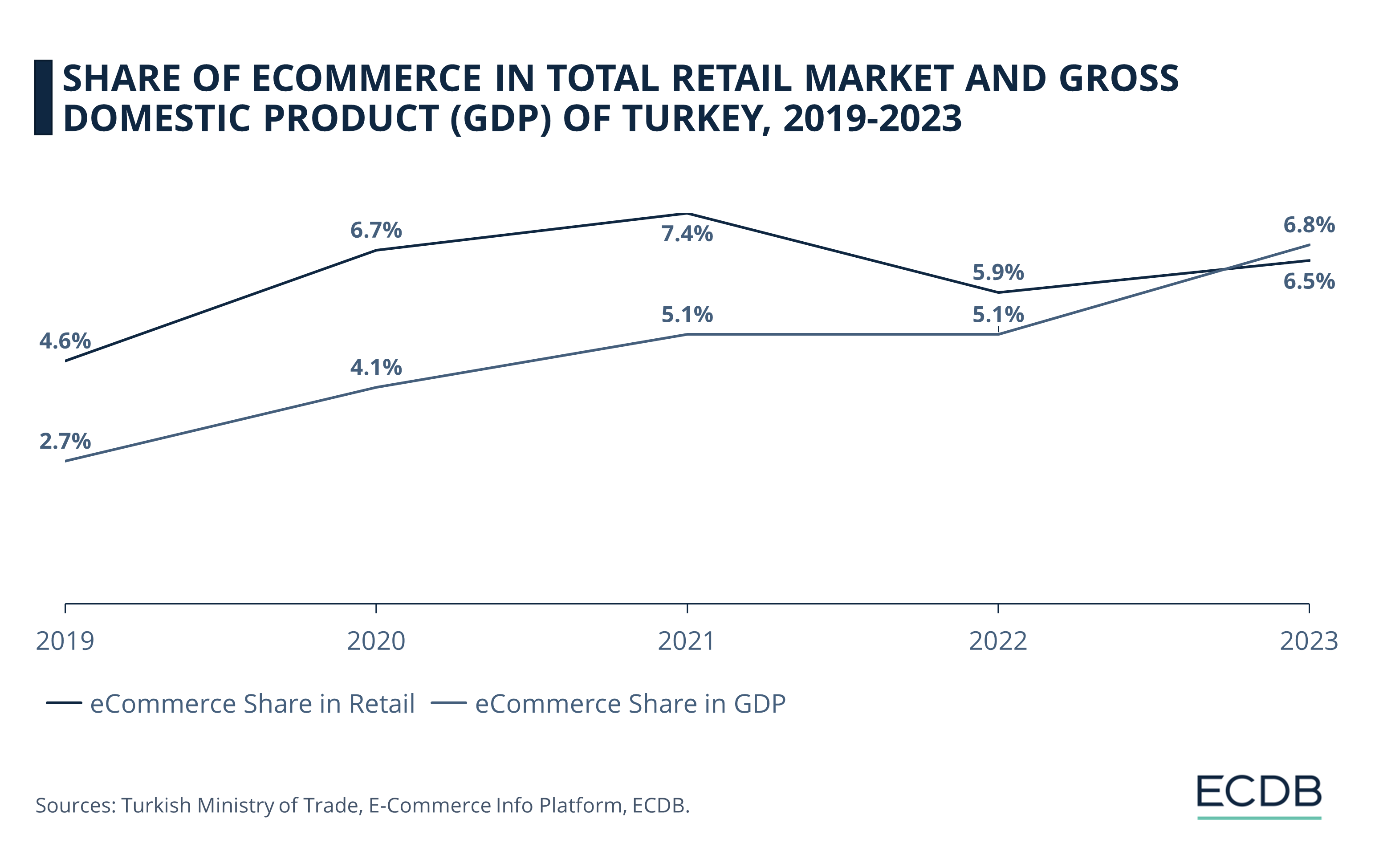

The gravity of the eCommerce market in the Turkish economy has changed in recent years. To get a better picture, let's look at the data: We'll compare our findings on eCommerce's share of the total retail market with eCommerce's contribution to Turkey's gross domestic product (GDP), provided by the Turkish Ministry of Trade:

In 2019, the eCommerce share in retail was 4.6%, while its contribution to GDP was 2.7%.

The year 2020 saw a significant increase, with eCommerce accounting for 6.7% of retail and 4.1% of GDP.

In 2021, the eCommerce share in retail further grew to 7.4%, contributing 5.1% to GDP.

However, 2022 witnessed a decline in the eCommerce share in retail, dropping to 5.9%, while the contribution to GDP remained stable at 5.1%.

In 2023, the eCommerce share in retail rebounded to 6.5%, with a notable increase in its GDP contribution to 6.8%.

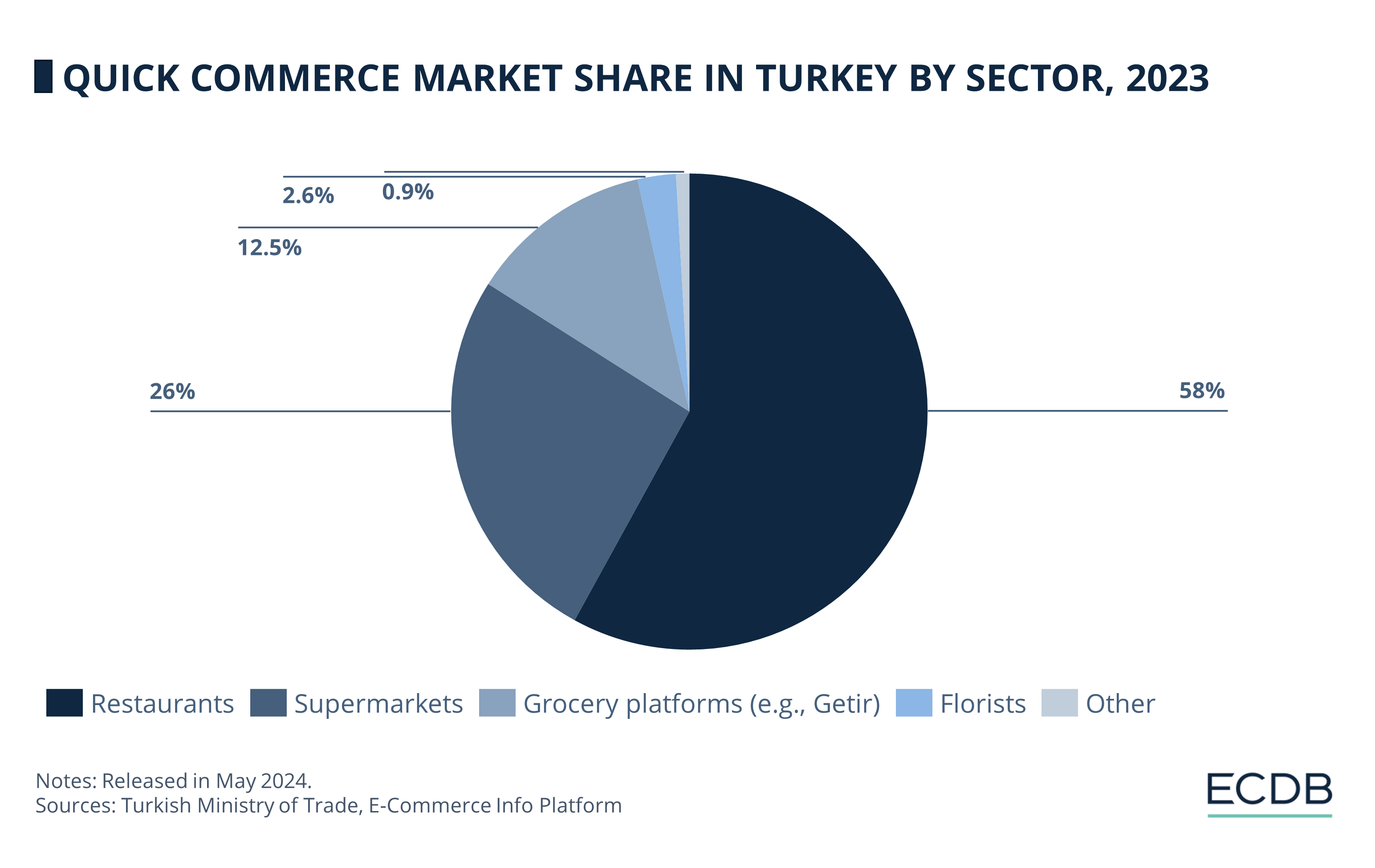

Quick Commerce in Turkey

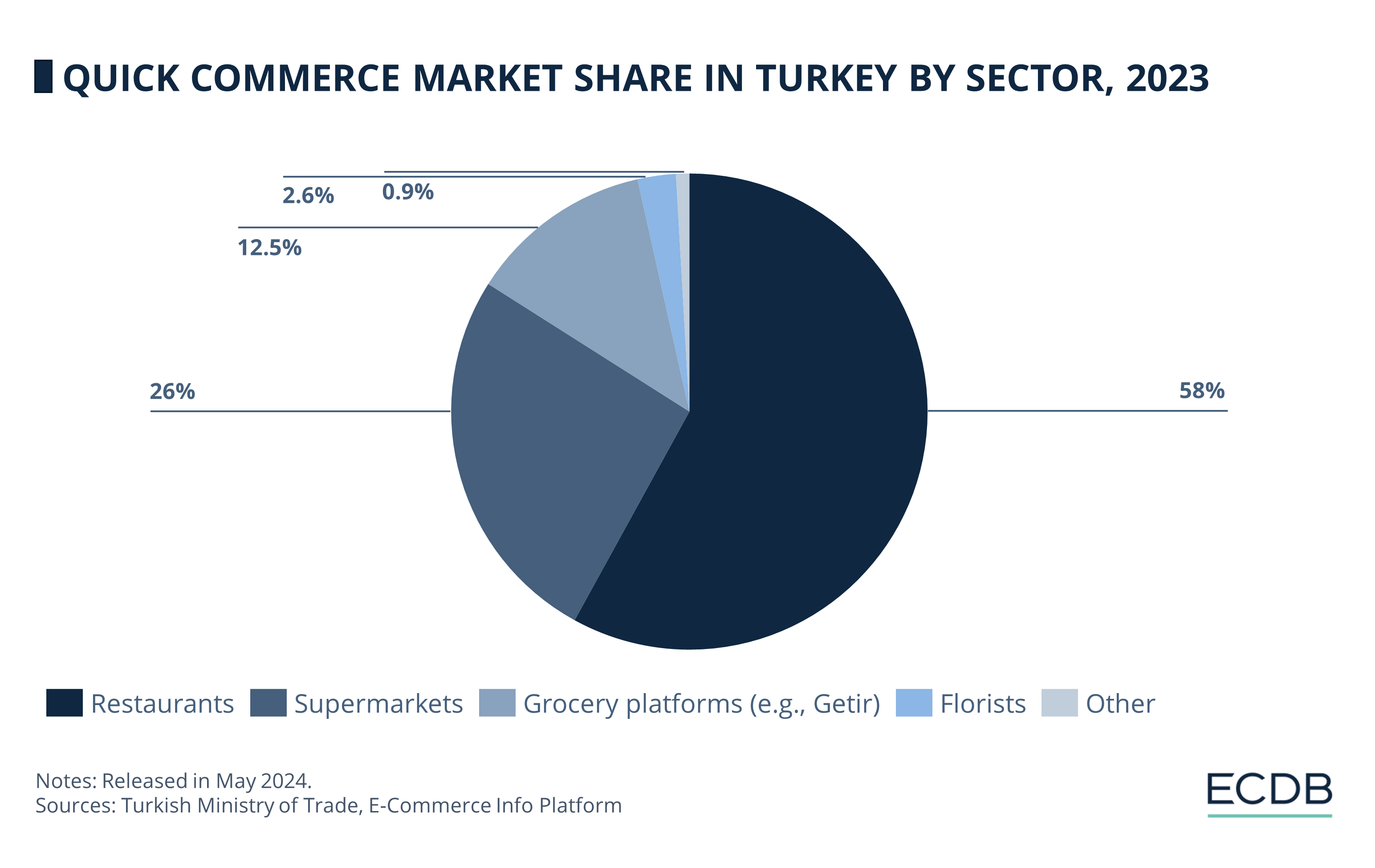

The quick commerce market in Turkey has experienced explosive growth, expanding from – as reported by Turkish Ministry of Trade – ₺2.15 billion (US$66 million) in 2019 to over ₺126 billion (US$3.87 billion) in 2023. This rapid increase highlights the rising demand for ultra-fast delivery services, often within an hour.

The food sector dominates the quick commerce market, accounting for 58% of the total market share. This was followed by groceries and supermarket deliveries, which made up 26%. Grocery platforms like Getir also hold a significant share (12.5%) in this market, while the rest of the market is made up of florists and other smaller sectors.

Getir, an Istanbul-based company that has revolutionized quick commerce with its innovative approach and efficient delivery system, has become a household name over the years. However, the rapid growth of the market has also brought challenges.

True to its business concept, Turkey’s “instant delivery” juggernaut Getir rose quickly. Now, with the quick commerce industry in free fall, it is nosediving just as fast. Recently, the company — once valued close to US$12 billion — announced it would shut down its operations in the U.S., the U.K., and Europe to focus solely on its home market of Turkey.

This decision highlights the instability in the global quick commerce market, where even leading companies face significant challenges. Getir's move to refocus on Turkey underscores the market's importance and the potential for sustained growth domestically, despite setbacks abroad.

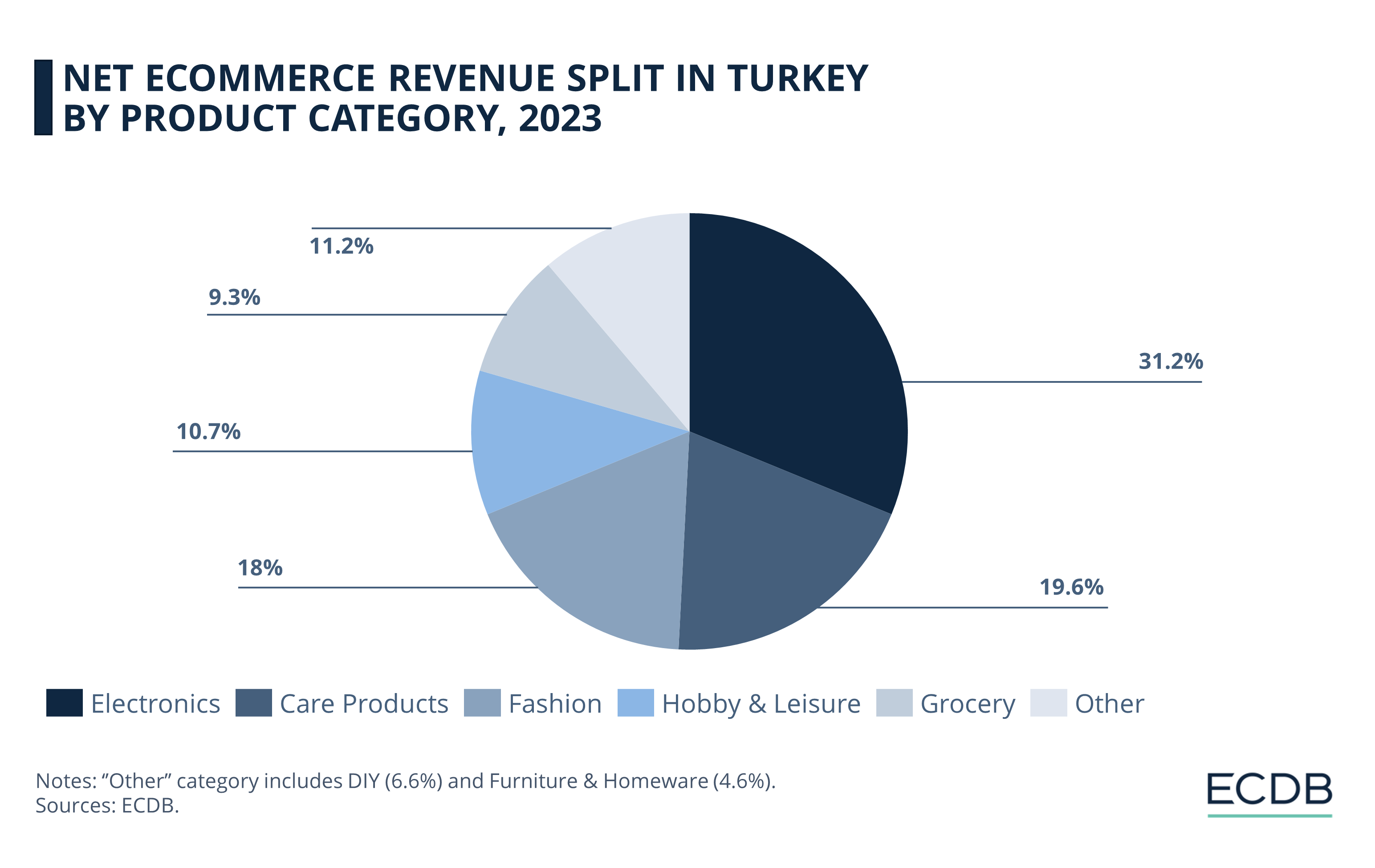

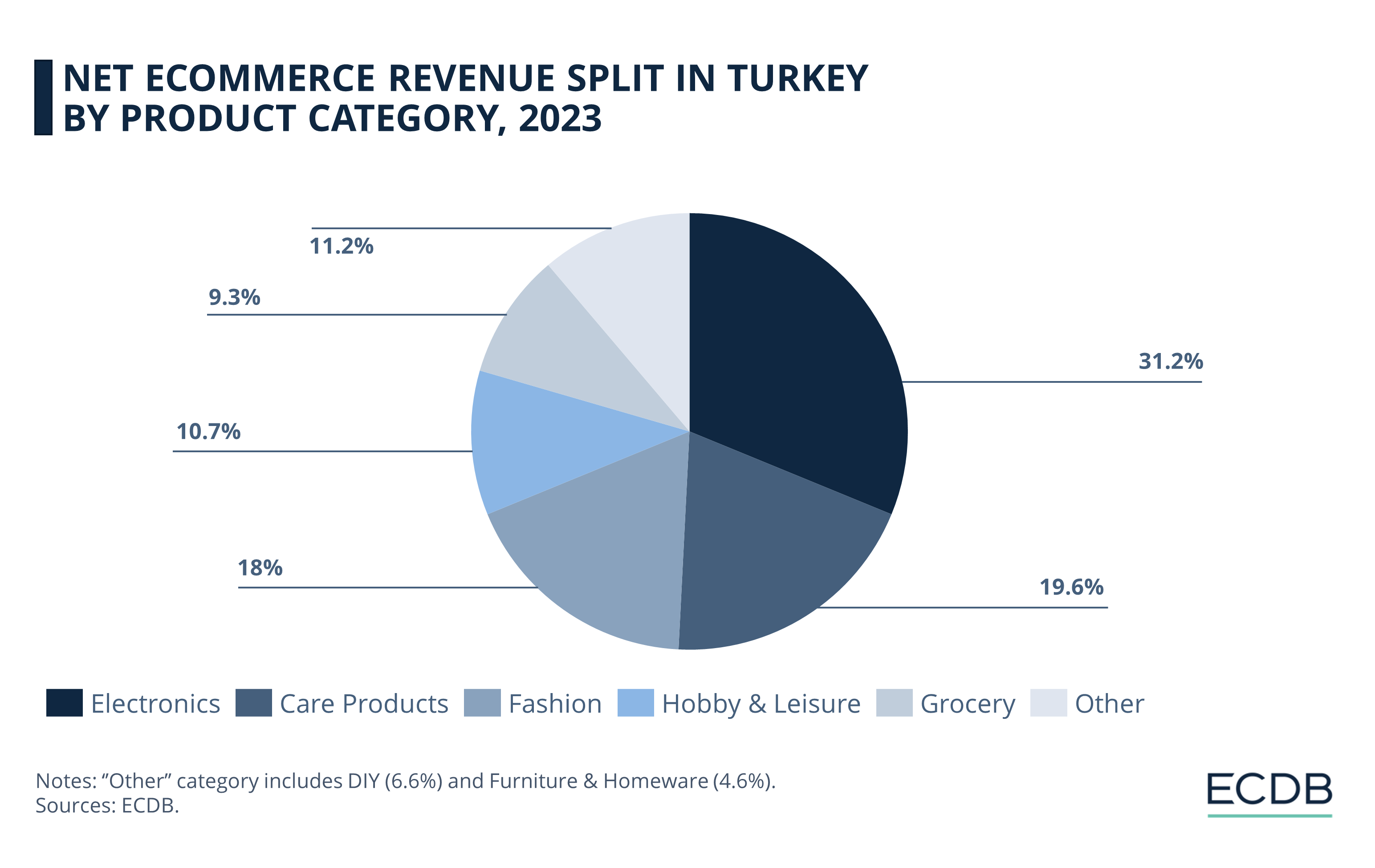

Electronics Make Up a Third of the eCommerce Market in Turkey

Turkey's eCommerce story isn't just about growth rates or market shares, but also about how diverse sectors contribute to the market. Let's take a closer look at these key sectors within the Turkish eCommerce environment:

Our data shows that the Electronics sector emerges as the largest, constituting 31.2% of Turkey's eCommerce earnings.

This is trailed by Care Products, making up 19.6% of the revenue.

Fashion comes in close at 18%, followed by Hobby & Leisure at 10.7%.

The remaining market share is split between Grocery (9.3%), DIY (6.6%) and Furniture & Homeware (4.6%).

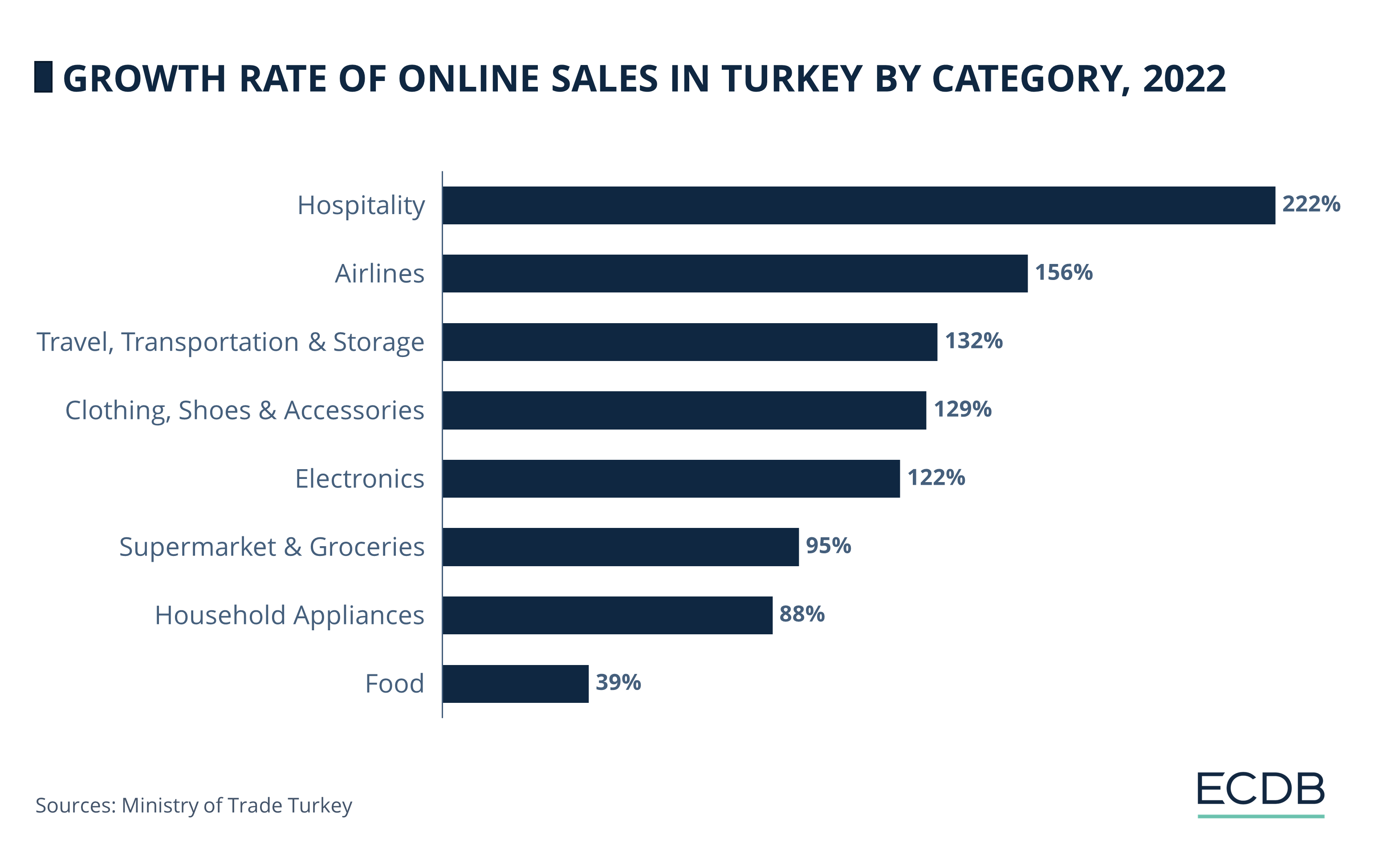

Online Hospitality Sector in Turkey

More Than Tripled in 2022

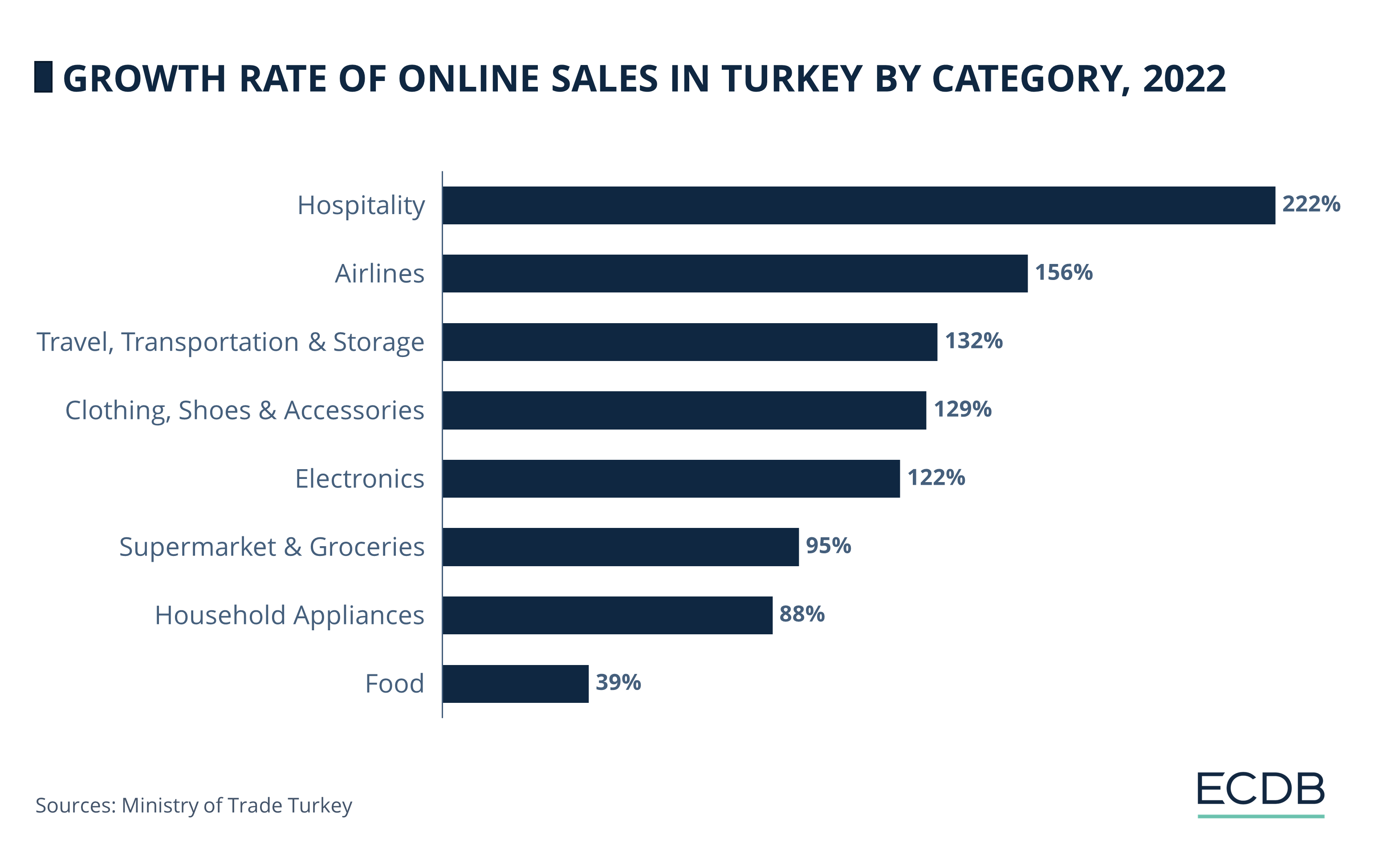

The bounce-back from the pandemic has been instrumental in reshaping eCommerce across sectors in Turkey. The surge in online interactions in some sectors, however, is quite noteworthy.

According to a report published by the Turkish Ministry of Trade, in 2022, the Hospitality sector experienced the most substantial growth in eCommerce volume in Turkey, compared to the previous year. Following the rebound from the pandemic, the Hospitality sector saw a growth of 222%, while the Airlines sector enjoyed an impressive 156% growth in the same year. The Travel, Transportation & Storage sector ranked as the third fastest-growing category, witnessing a growth of 132%.

The growth in these sectors can be attributed to several key factors. Post-pandemic recovery and vaccination progress have renewed global travel demand and restored confidence. Government initiatives, including tourism-promoting campaigns and financial support, have further boosted the sector, while Turkey's appeal as a rich historical and cultural destination has continued to attract global tourists.

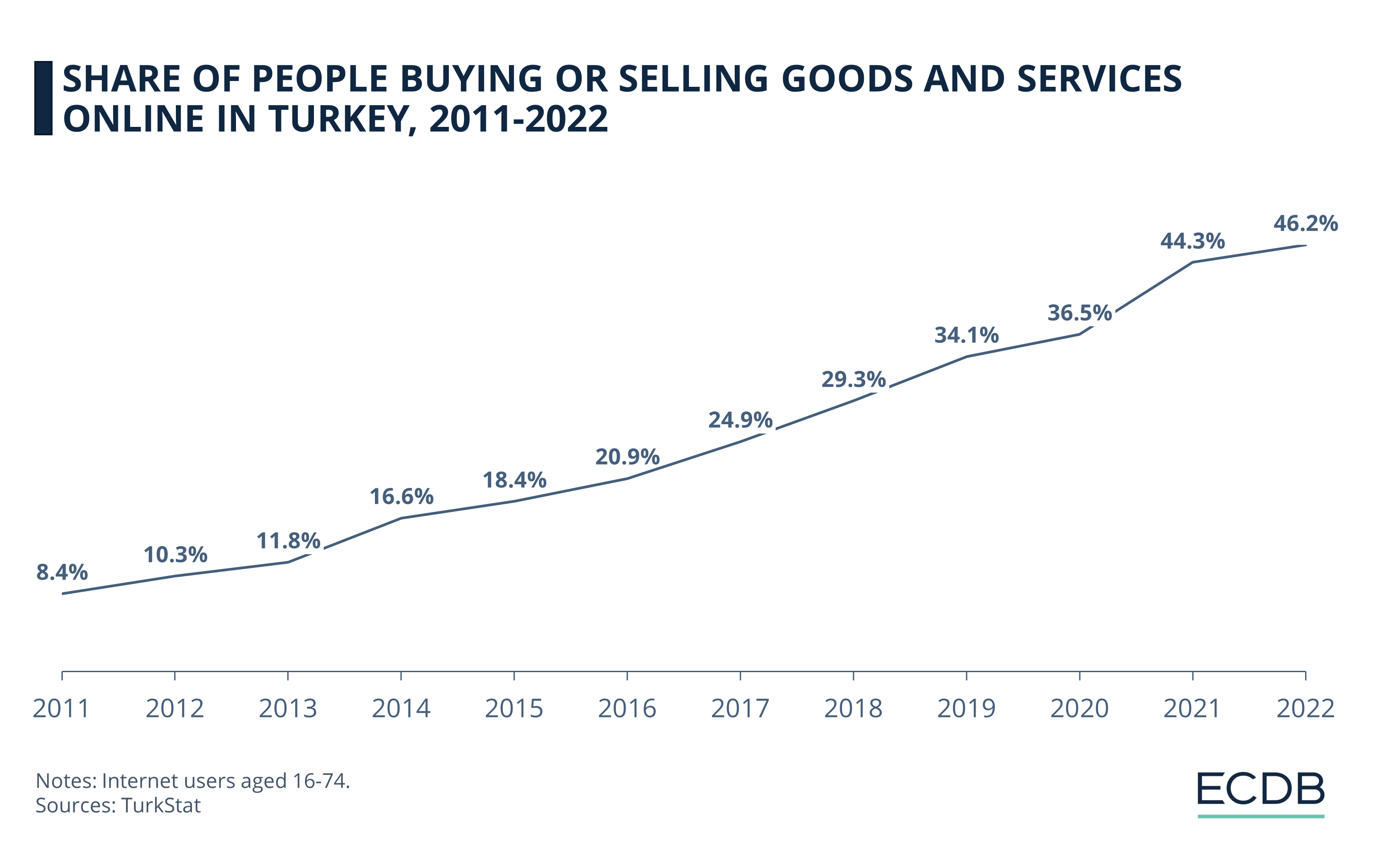

Half of Internet Users in Turkey

Partake in eCommerce

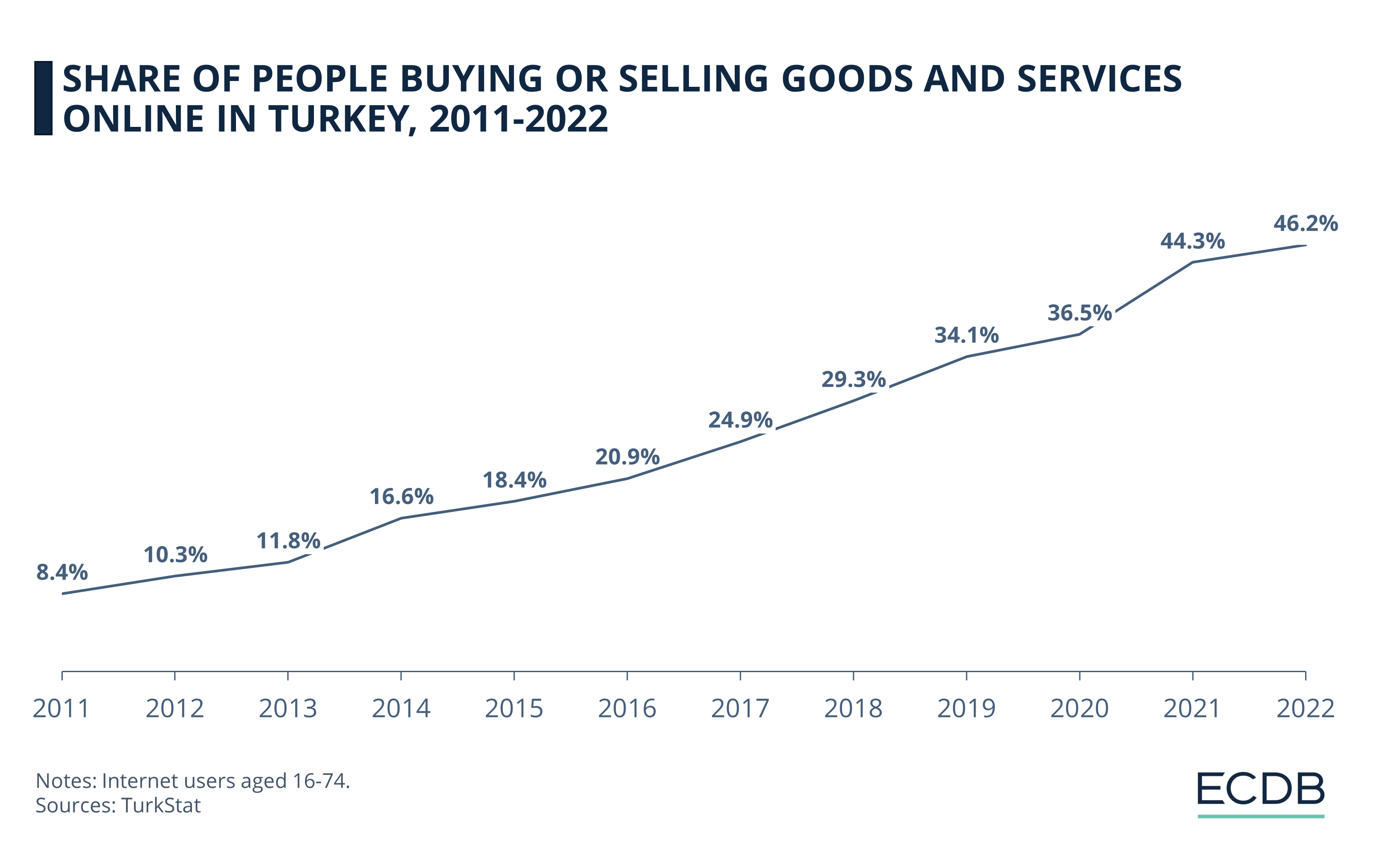

While we have assessed the broad scope of the eCommerce market in Turkey and its various sectors, it's essential to recognize the underlying force driving this growth - the consumers. Let's first explore the increasing involvement of Turkish individuals in the eCommerce space and their contribution to the ever-expanding digital economy.

The findings from the Turkish Statistical Institute (TurkStat) indicate that the proportion of internet users involved in buying or selling goods or services online in Turkey has been on an upward trajectory over the years under review. In 2022, the participation rate in eCommerce activities reached a high of around 46%, marking a 36 percentage point increase in comparison to 10 years prior. A further breakdown of gender reveals that the rate of purchasing or ordering goods or services online was 49.7% for men and 42.7% for women in 2022.

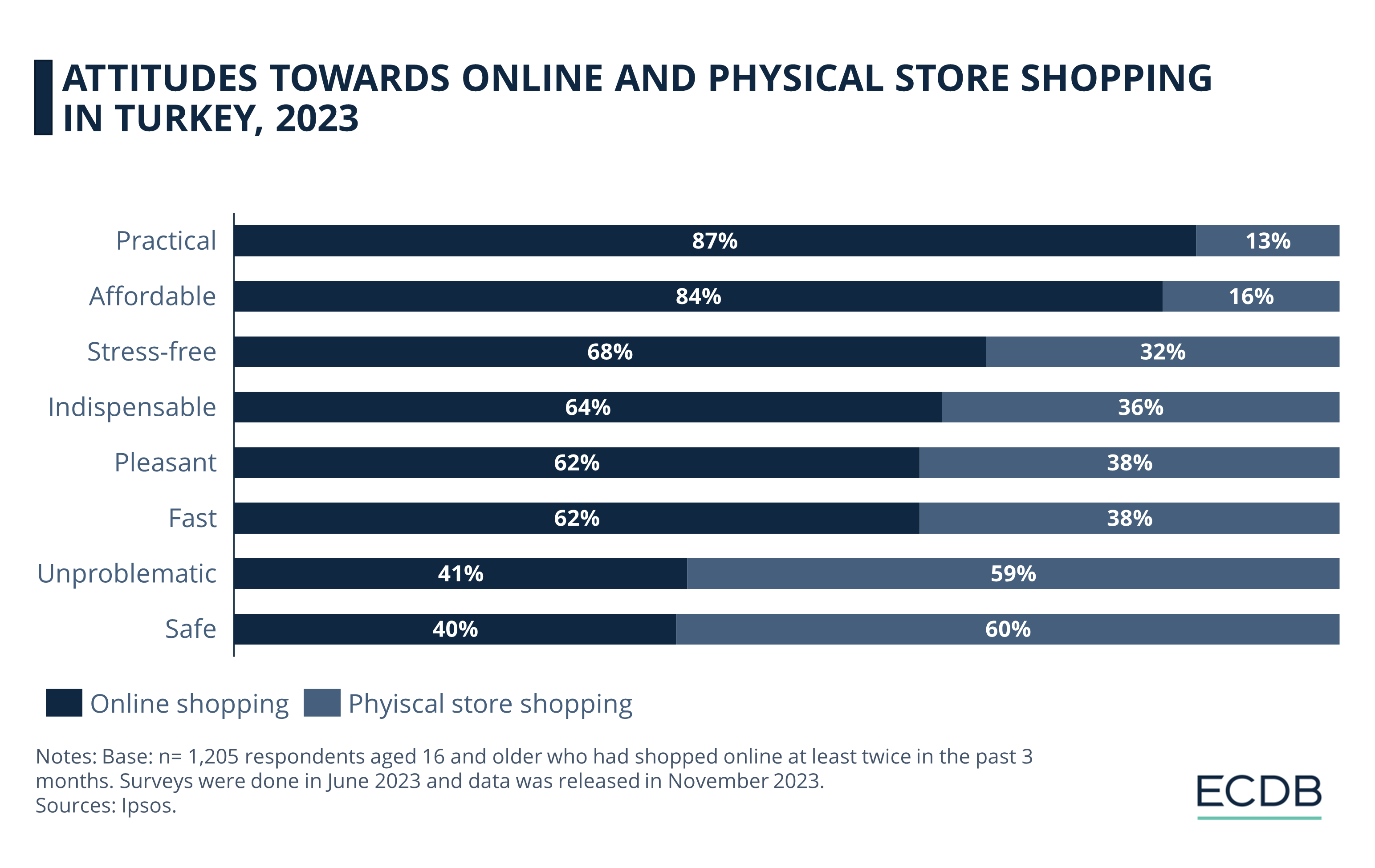

Perception of Online Shopping in Turkey

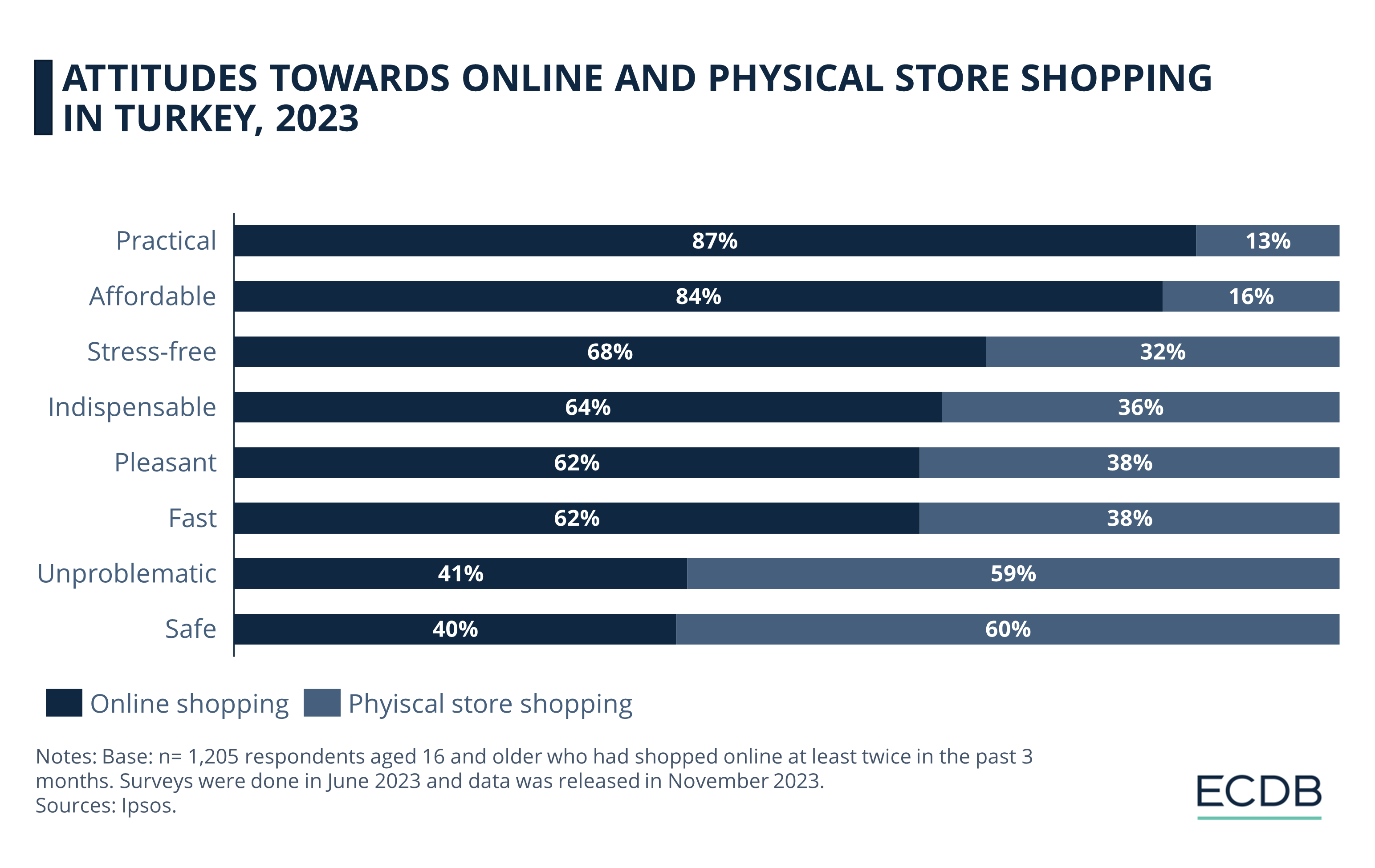

Consumer preferences in Turkey reveal significant insights into the attitudes towards online and physical store shopping.

The data from 2023 reflects a clear preference for online shopping in terms of practicality, affordability, and speed, although physical stores still hold an edge in terms of perceived safety and being unproblematic:

While more than 80% of online shoppers in Turkey see eCommerce as convenient and affordable, about two-thirds associate online shopping with being stress-free, indispensable, convenient and fast.

But eCommerce hasn't yet fully captured the hearts of the Turkish shoppers. According to the survey results, the majority still see shopping in physical stores as safer and less problematic.

Turkish eCommerce: A Lucrative Investment or a Risky Bet?

The rise of eCommerce in Turkey offers intriguing investment opportunities, yet caution is needed due to certain market dynamics.

Growth Potential: The Turkish eCommerce market has demonstrated strong growth over recent years, and forecasts suggest that it will continue to expand. The revenue for the sector is projected to reach US$38.39 billion by 2028, up from an estimated US$26.88 billion in 2024. This represents a promising opportunity for investors looking for growth markets.

Increasing Internet Penetration: The number of internet users in Turkey is on the rise, leading to increased digital literacy and usage of eCommerce platforms. As of 2022, about 46% of internet users in Turkey were participating in eCommerce activities. This number is expected to grow, further boosting the eCommerce market.

Young, Consumer-Oriented Population: Turkey has a relatively young population that is becoming increasingly tech-savvy and consumer-oriented. This demographic trend bodes well for the future growth of the eCommerce sector.

Sectoral Diversity: The Turkish eCommerce market is diverse, with different sectors contributing to its growth. The Electronics sector is currently leading, constituting 31.2% of Turkey's eCommerce earnings, but other sectors such as Fashion and Care Products are also significant contributors. This diversity reduces dependence on a single sector and provides multiple avenues for investment.

Post-Covid Recovery: Certain sectors within the eCommerce market, such as Hospitality and Airlines, have experienced substantial growth post-pandemic, suggesting resilience and adaptability that could be attractive to investors. In 2022, the Hospitality sector saw a growth of 222%, while the Airlines sector enjoyed a 156% increase.

Potential Risks for Investors

Economic Challenges: Turkey is wrestling with high inflation, which could impact consumer spending power and consequently affect eCommerce growth.

Market Saturation: The dip in eCommerce share in retail in 2022 could be indicative of market saturation or a return to physical retail, which could limit growth prospects.

Regulatory Environment: Any changes in regulation that affect online commerce could potentially impact the eCommerce market. It is important to stay updated with the country's digital and commerce policies.

Currency Fluctuations: Investors should also consider potential risks related to currency fluctuations, which could impact investment returns.

Trust and Payment Security: As the survey results indicated, Turkish consumers still perceive physical stores as safer and more reliable. Trust in online marketplaces and payment security are significant factors. Any breaches in these areas could affect consumer confidence and impact market growth.

Political Uncertainty: The unstable political landscape in Turkey may create uncertainties that could impact the stability and growth of the eCommerce sector.