Blog

The ECDB Blog turns data from the Tool into eCommerce insights that illustrate which use you can make of our comprehensive data. It elaborates on relevant eCommerce news to help your brand gain a broader perspective on current retail trends and their effects. Our articles are carefully crafted to present to you the latest market trends, including retail, payment, shipping, transactions, cross-border and more.

Item 1 of 5

All Articles

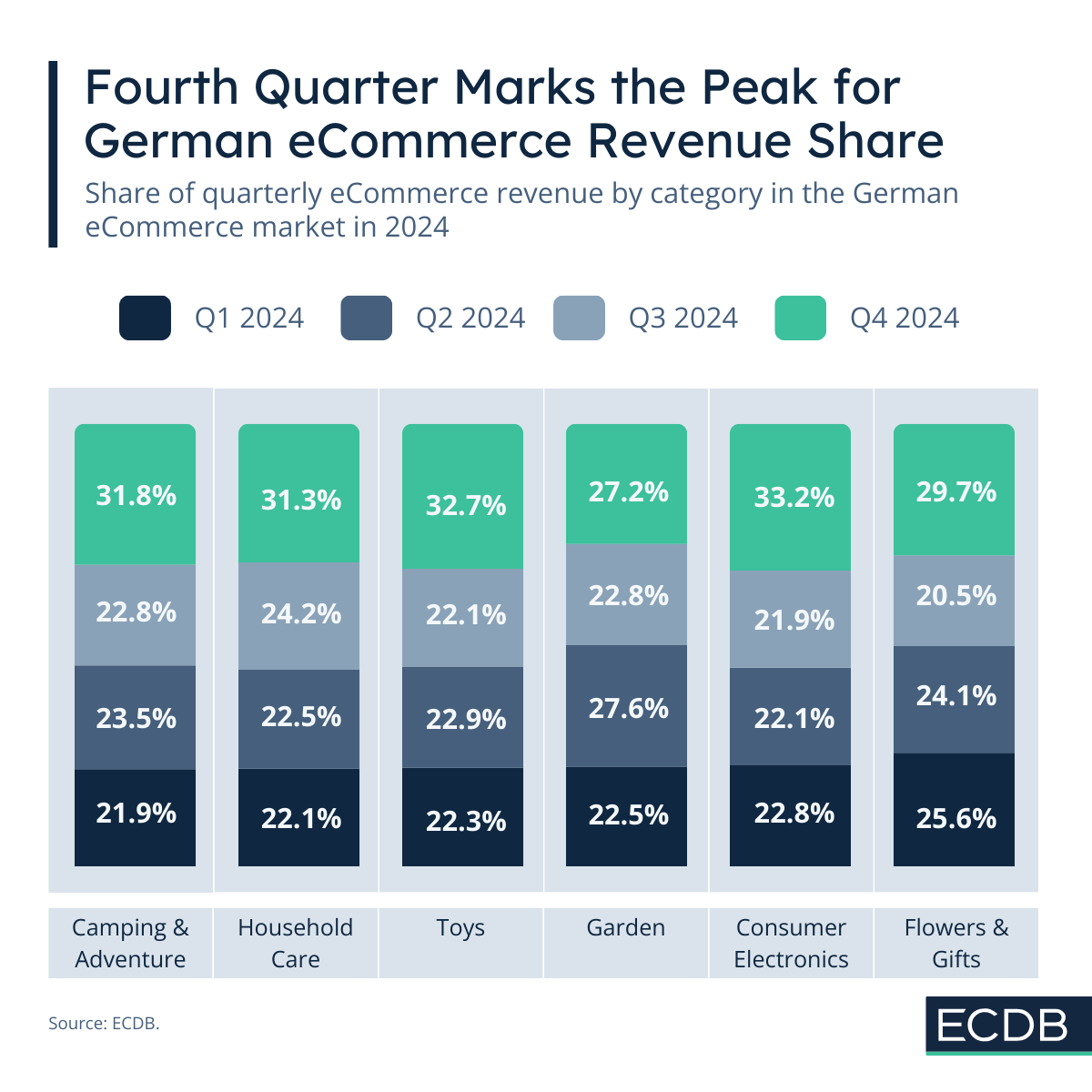

How Typical Consumption Patterns Develop Over the Course of a Year

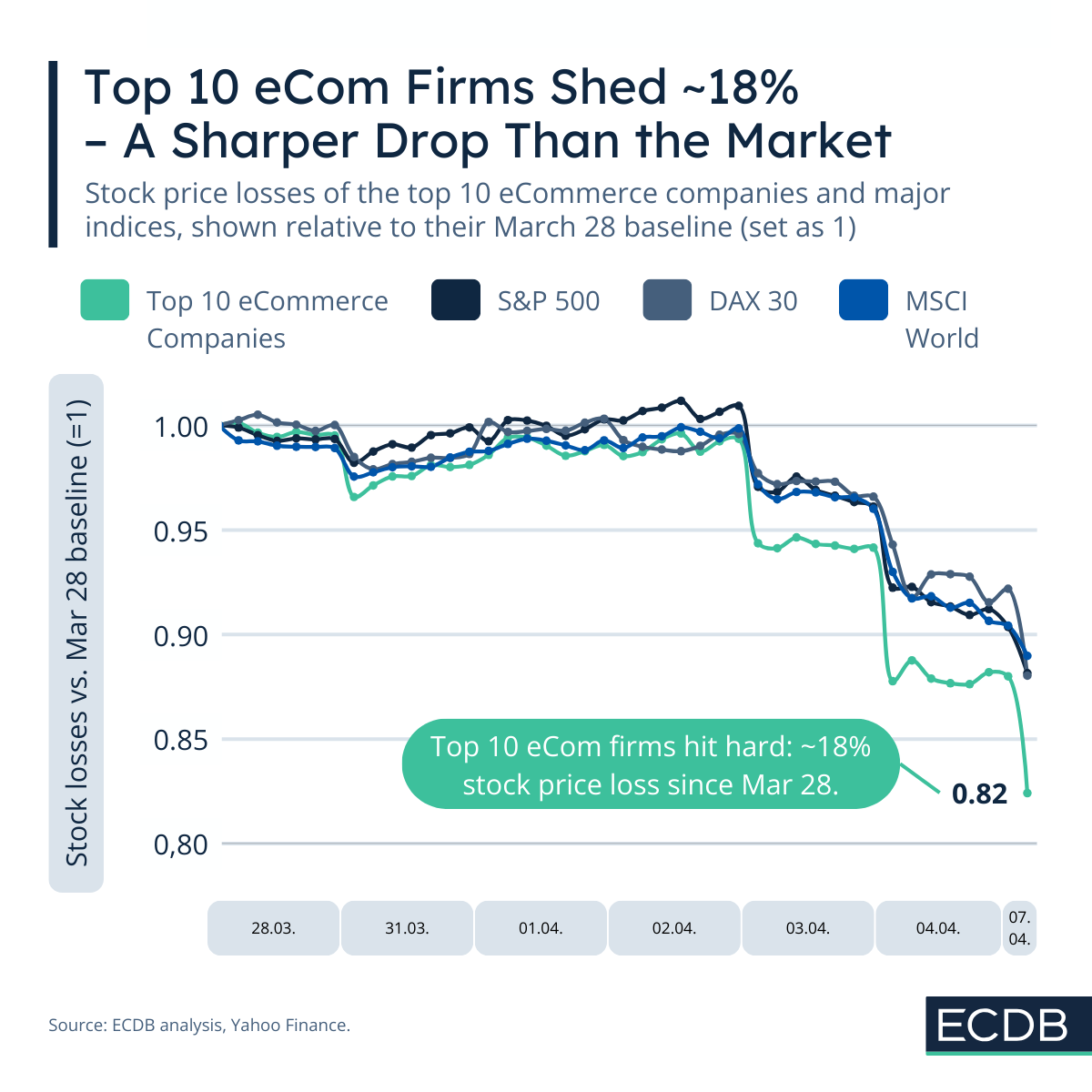

Stock Prices of the Top 10 eCommerce Companies Dropped by 18% Since March

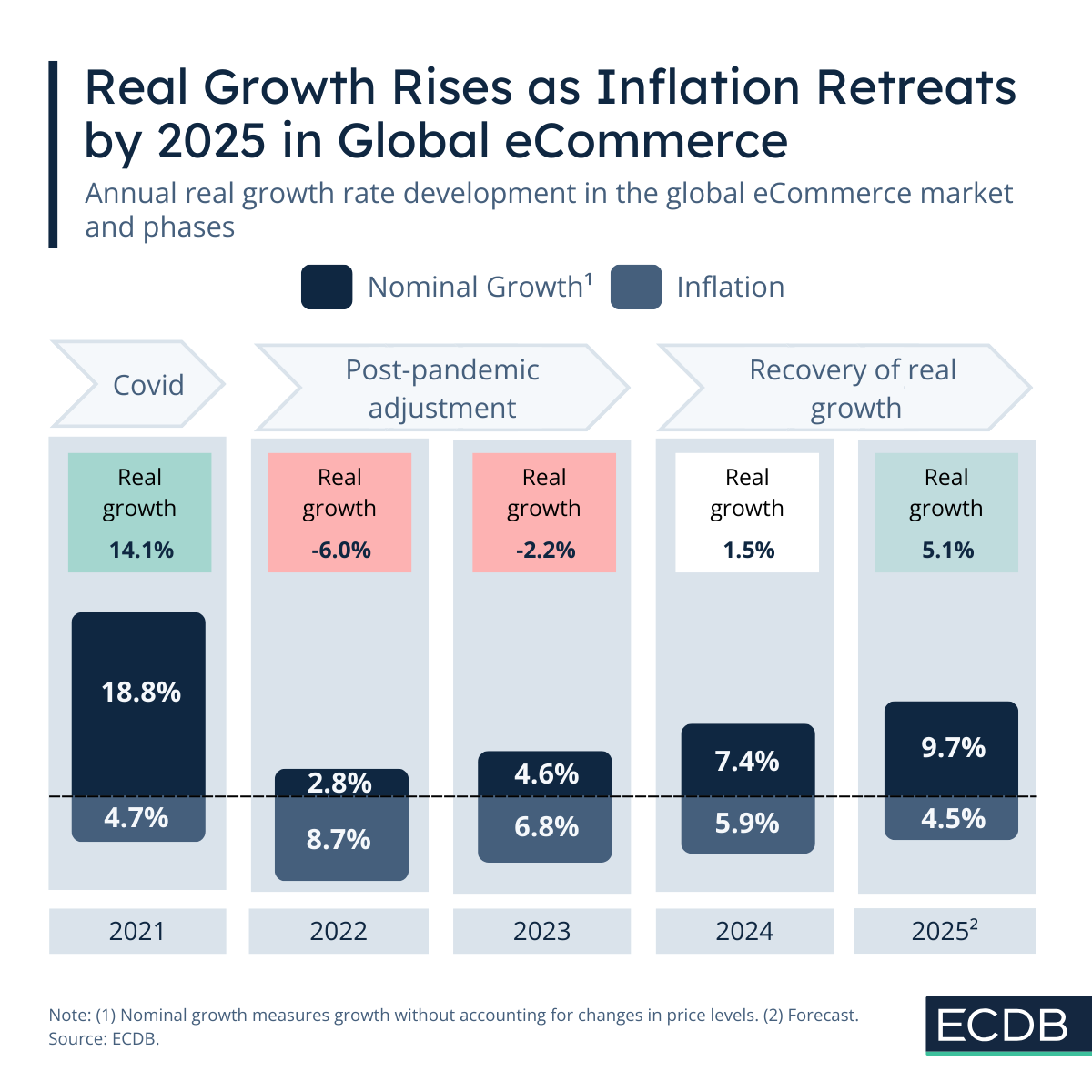

How Nominal Growth, Inflation and Real Growth Connect in World eCommerce

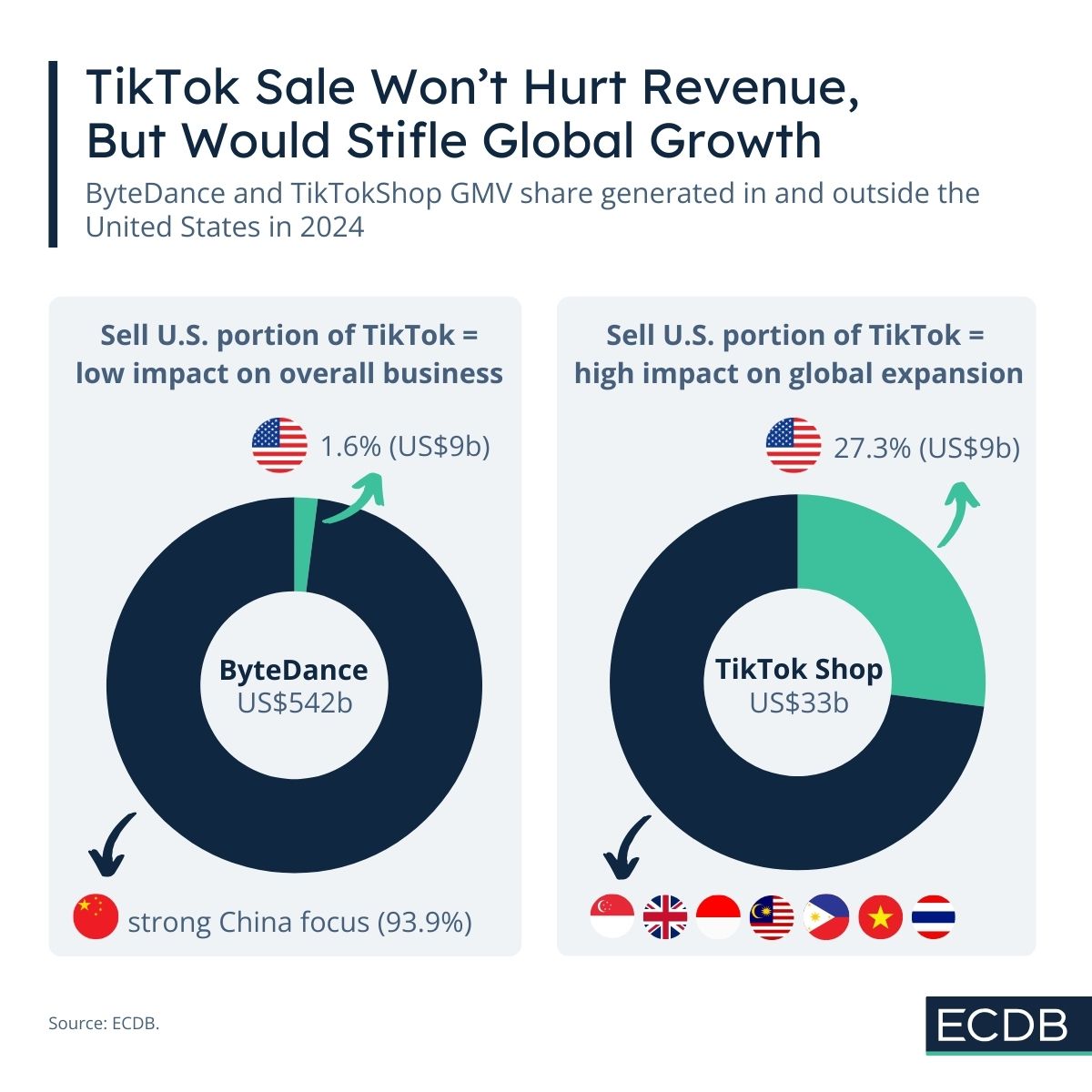

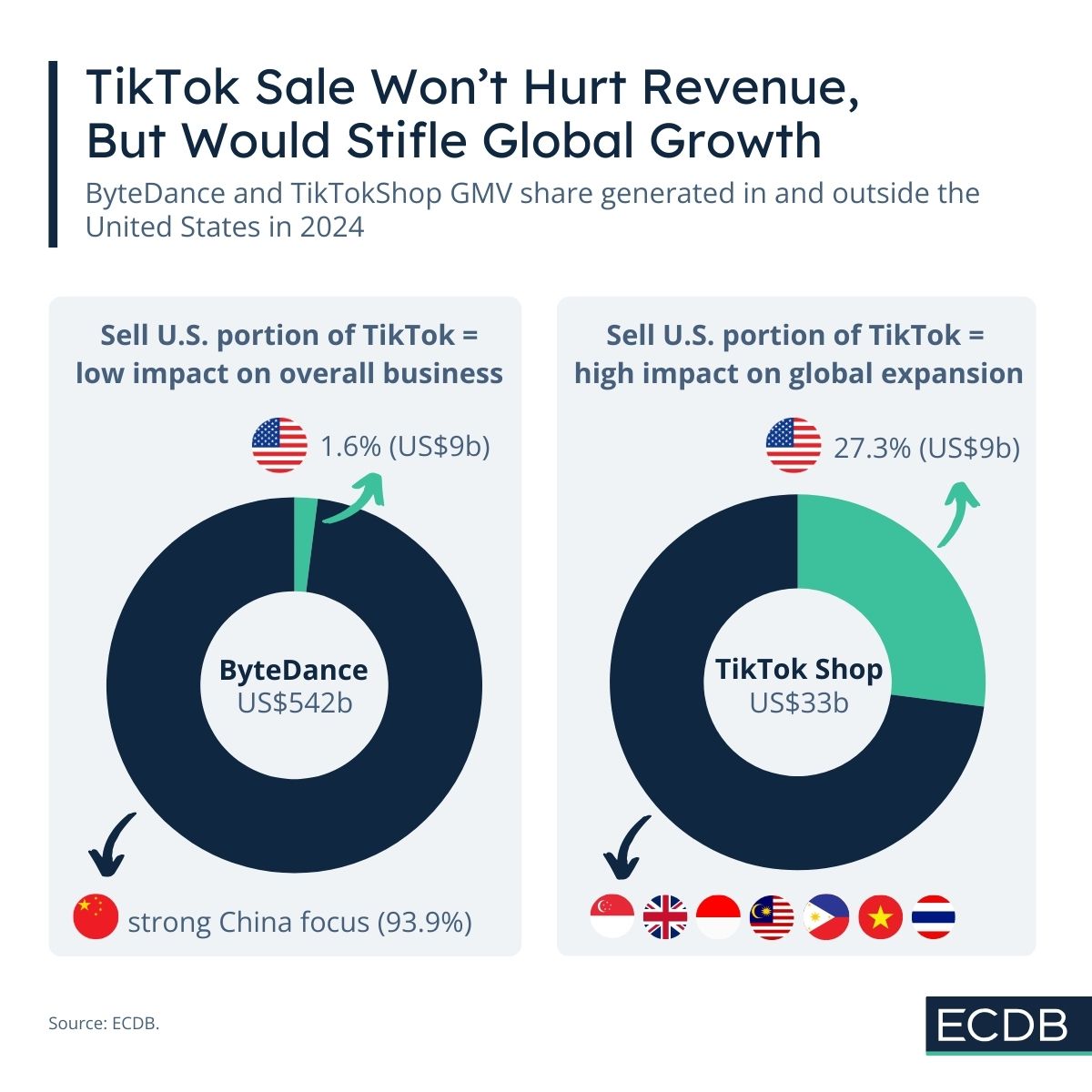

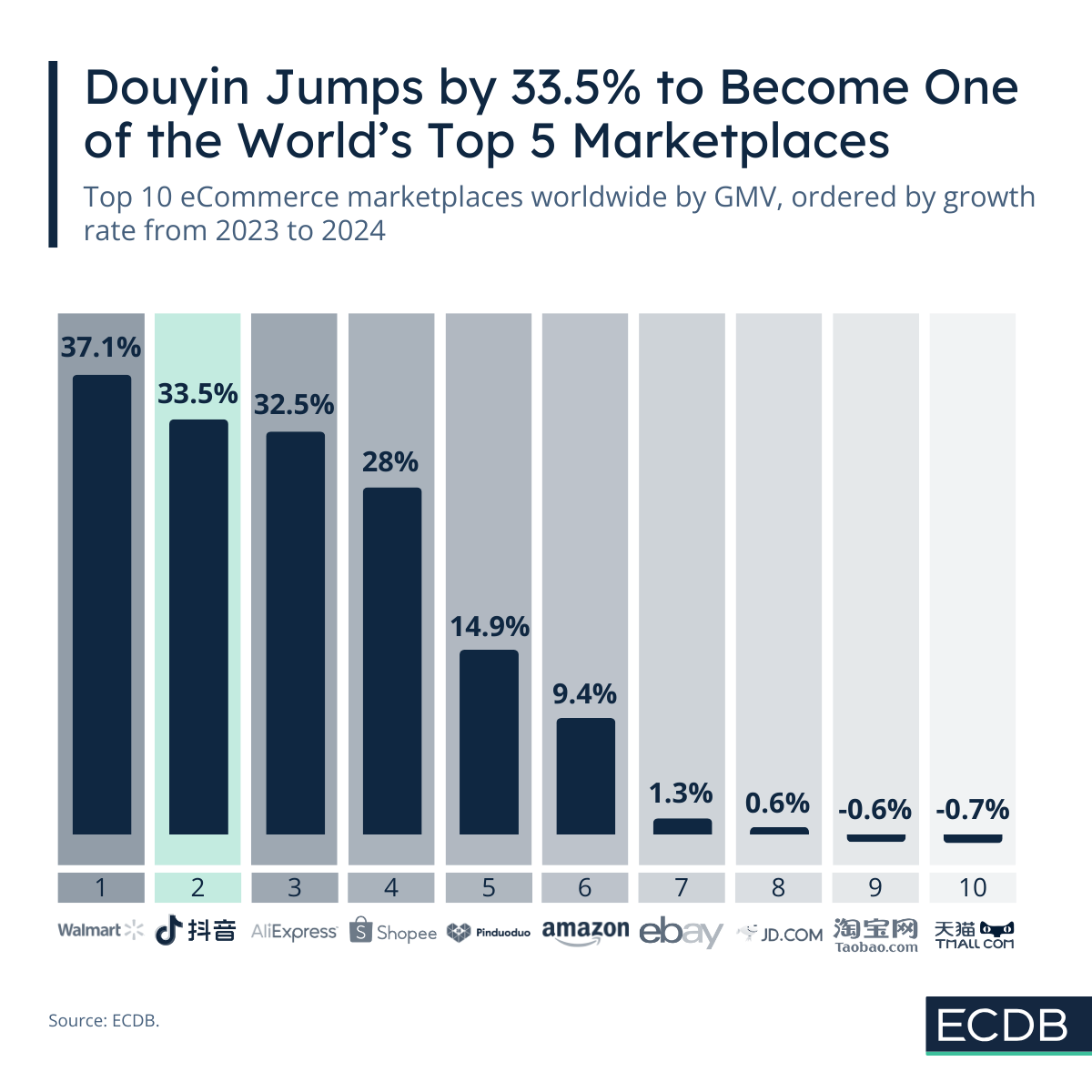

Douyin Is the Hottest Upstart eCommerce Marketplace Right Now

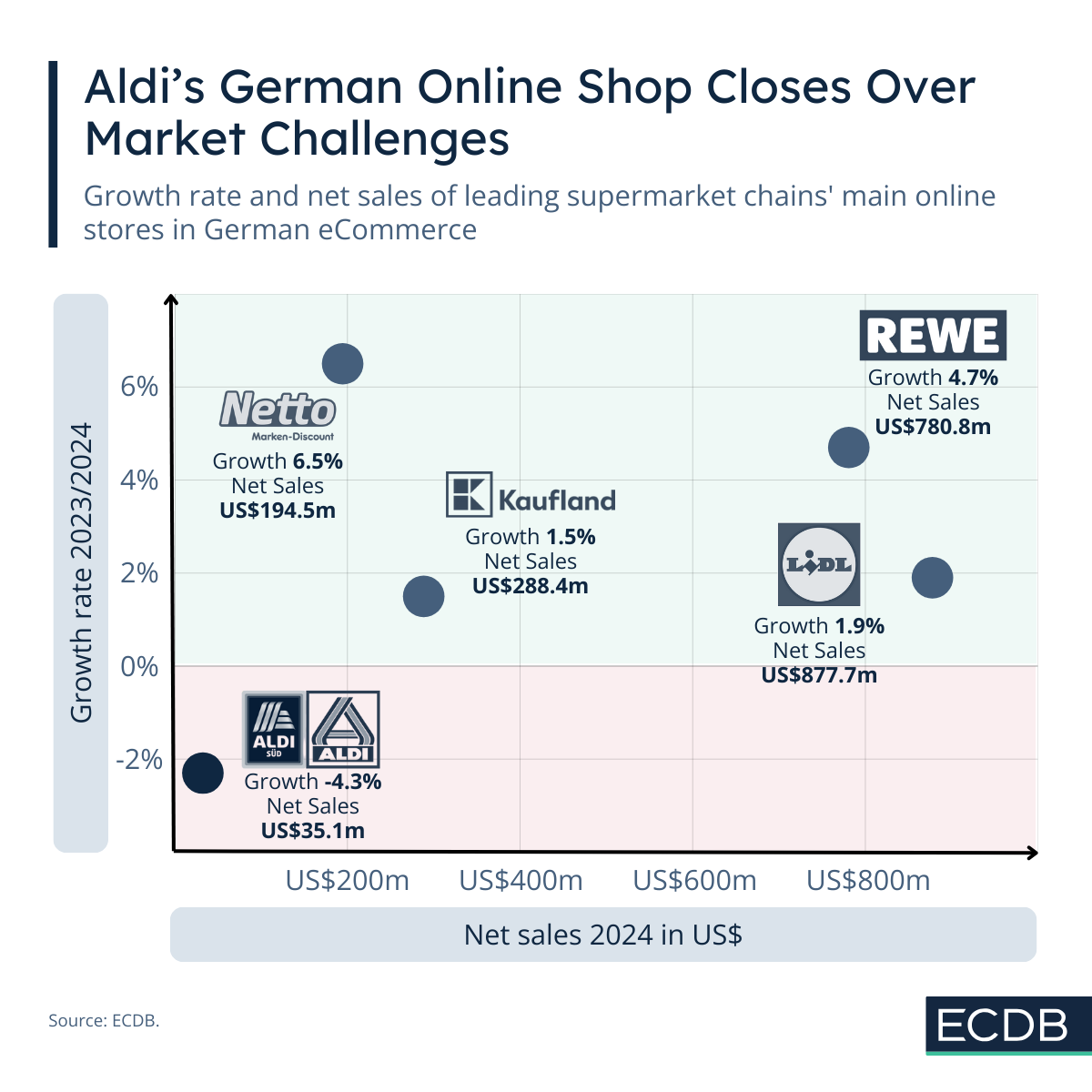

Aldi-Onlineshop.de Shuts Down Due to Low Competitiveness and Profitability

Ready To Get Started?

Find your perfect solution and let ECDB empower your eCommerce success.