Online Marketplaces

eBay Marketplace: GMV, Category Distribution & New AI Tools

eBay is facing tough competition as the online marketplace has lost constantly users and sellers in recent years. What are the reasons and implications of eBay's struggles? What's next for the eCommerce company?

Article by Cihan Uzunoglu | February 20, 2024

eBay Marketplace: Key Insights

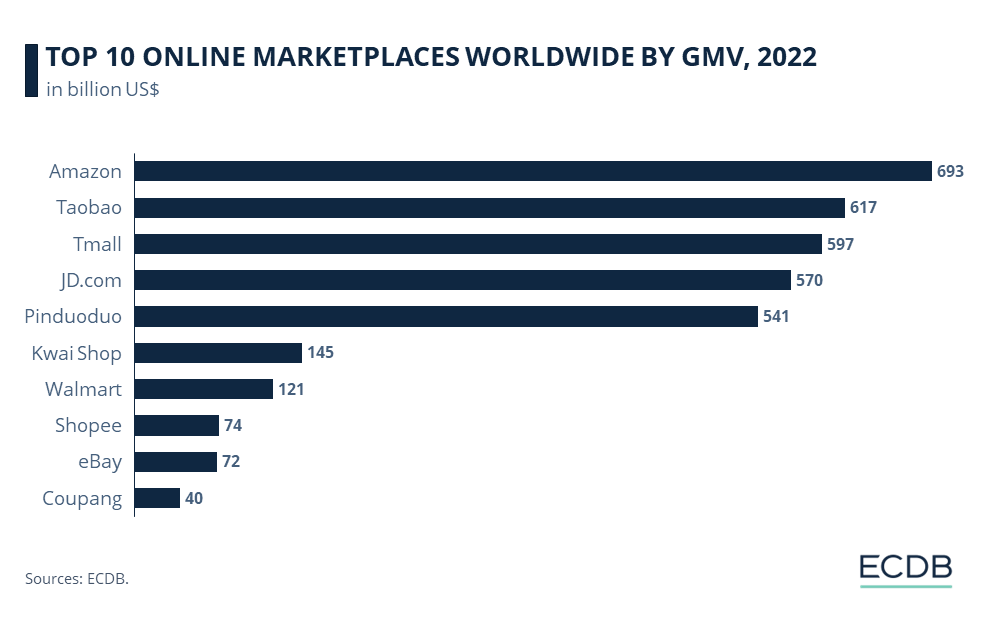

Recent Performance: eBay has seen a slight decline in GMV in recent years, although it remains a significant player in North America and Europe with a projected GMV for 2024 with US$66.1 billion while being the 9th largest online marketplace in the world in 2022.

Implementation of AI: eBay's adoption of AI tools demonstrates its commitment to innovation in the face of challenges such as losing users to emerging competitors.

Post-Pandemic Impact: In early 2024, eBay's decision to cut its workforce by 9%, affecting approximately 1,000 jobs.

eBay marketplace is an old stager in the eCommerce world. An established company, it is now one of the largest marketplaces in the world, ranking as the 9th largest online marketplace in our rankings in 2022. However, the past few years have not gone as smoothly as eBay would have liked, resulting in declining GMV numbers. What happened to eBay?

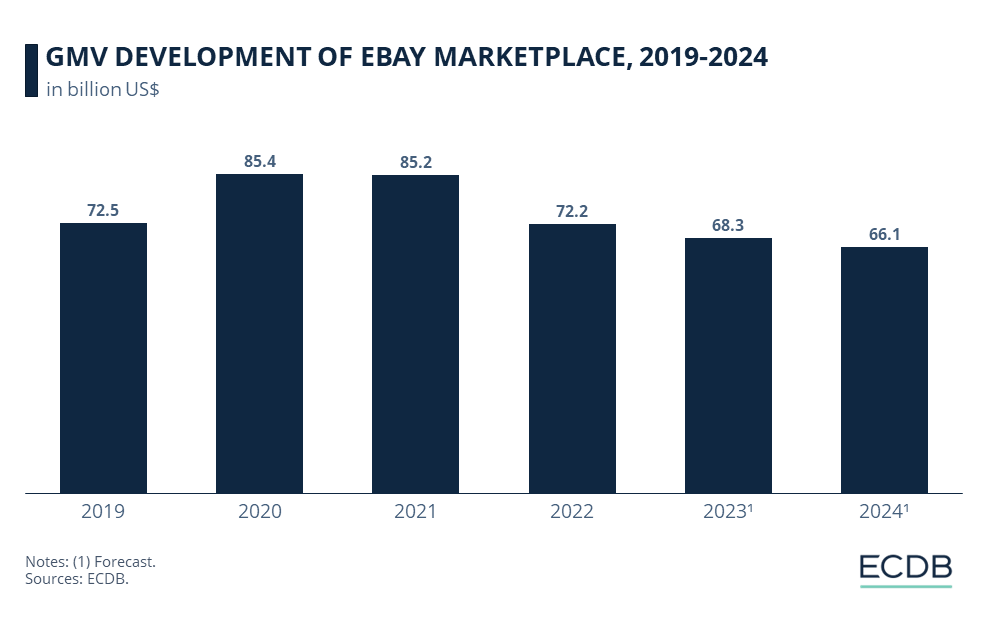

eBay's Up and Down in GMV

In 2018 eBay ended the year with a GMV of US$76.4 billion. As that year marked three years of constantly improving its GMV, 2019 saw a decline to US$72.5 billion before peaking in 2020 with US$85.4 billion. This represents a 17.8% improvement in one year. 2021 follows with almost the same GMV at US$85.2 billion.

After two successful years for eBay, the numbers would've fallen back to pre-pandemic times, as GMV dropped to US$72.2 billion in 2022 – a 15.3% decline.

Our calculations predict a further decline to $66.1 billion in 2024 while other marketplaces are expected to grow massively in the coming years.

This may be due to the aggressively low prices offered by Asian online stores and marketplaces such as Pinduoduo's Temu or Shein, which are among the fastest growing companies in eBay's main market, the US.

These Chinese platforms use a combination of marketing, such as affiliate programs, and gamified online shopping experiences to attract and retain users. While eBay is not doing these things, it is lagging its competitors.

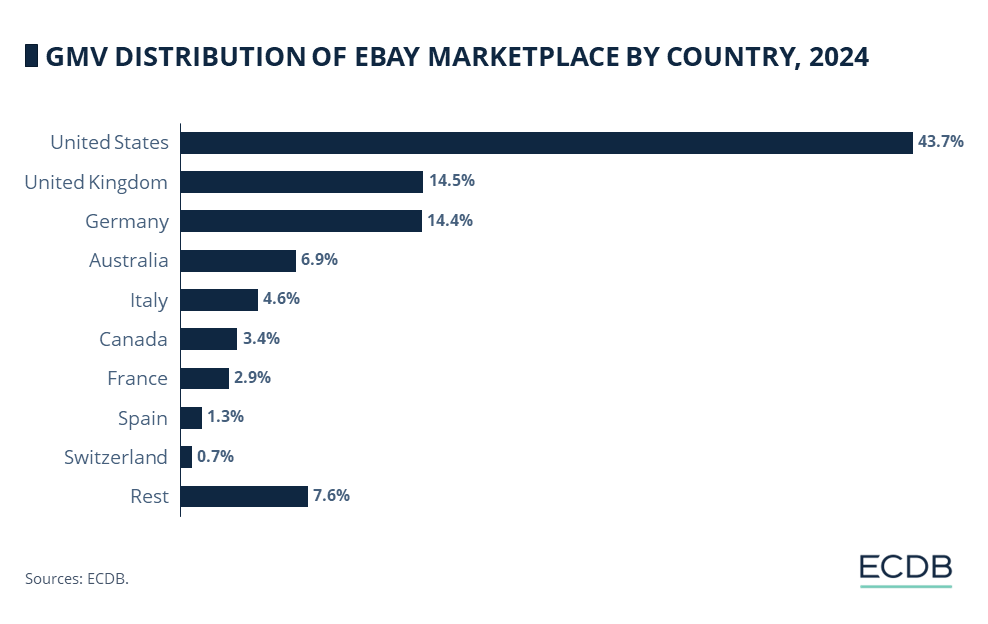

Country Distribution: Top 5 Markets Account for Over 80% of GMV

eBay generates its GMV from all over the world, with the majority coming from North America and Europe. The USA serves as the cornerstone, contributing 43.7% of eBay's GMV. This is followed by the UK and Germany with almost identical shares of 14.5% and 14.4% respectively. Another 6.9% of GMV comes from Australia and another 4.6% from Italy.

This top 5 list accounts for over 80% of GMV, which shows that eBay has its core markets to generate revenue. With smaller shares in many other markets around the world, it shows on the other hand that eBay is well distributed and established in many markets.

Even in the Chinese market, where eBay makes small shares of revenue with 0.5%. With the sole exception being the African market, where eBay registers no revenue whatsoever.

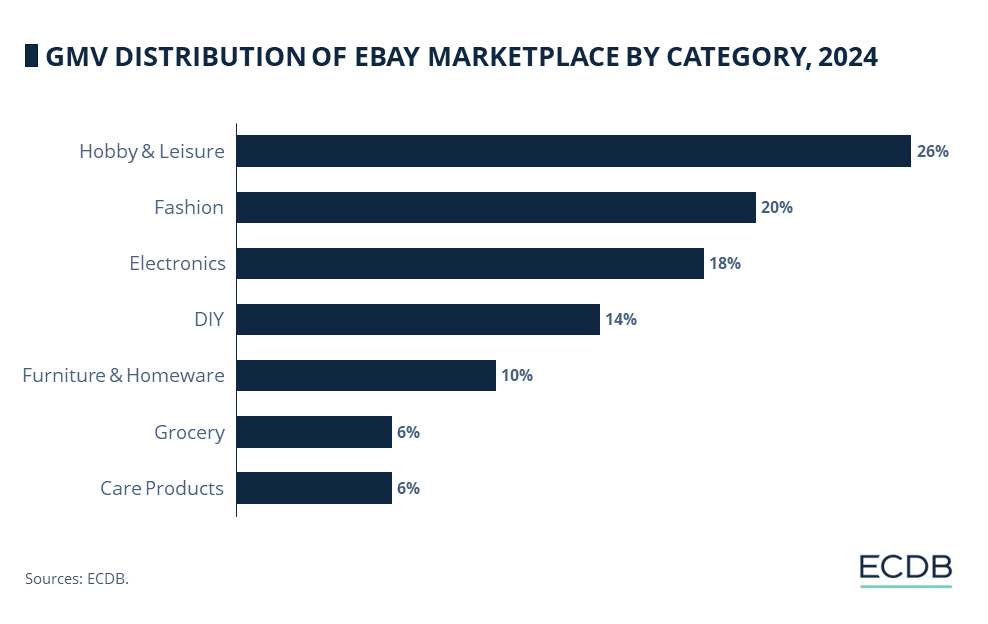

eBay Categories: Hobby & Leisure Tops the Rankings

Looking at eBay's GMV distribution by product category, more than a quarter of GMV is generated by the sale of Hobby & Leisure products at 26%. Fashion comes in second with just over a quarter (20%) of GMV.

Electronics accounts for 18%, indicating a solid demand for gadgets, entertainment products and educational media. Furniture & Homeware contributes 10%. Finally, Grocery & Care Products each account for 6%.

It shows that eBay is not focused on being a marketplace for specific sectors, but on offering a wide variety of products to its customers.

Learn More About Our Marketplace Rankings

What’s Next for eBay?

With eBay's recent negative year-over-year growth numbers, the eCommerce giant is looking to turn the tide. What are eBay's next steps in the face of tough global competition?

eBay Implementing AI

In late 2023, eBay released its latest tool currently available to app users on iOS, allows sellers to list a product by simply uploading an image. The AI generates a title, description, and information such as product release date, category, subcategory, and suggests pricing and shipping costs.

In addition, eBay plans to introduce a plug-in that will allow sellers to automatically generate item descriptions from web content. With this tool, eBay is targeting first-time sellers and guiding them through the process of describing products.

Earlier this year, eBay introduced automated product descriptions created using ChatGPT and based on information provided by the seller. This tool has been very well received by eBay sellers, with an 80% satisfaction rate reported by eBay.

But these are not the only new features. Here are other tools eBay has implemented in its marketplace:

Automated Online Offers: eBay's messaging platform allows sellers to send their customers alerts about reduced prices or product offers on older product listings.

Multichannel Commerce: The ability to create "shoppable posts" on social media accounts, such as Facebook and Instagram, that promote specific products or sellers.

Livestreaming: With the interactive livestreams eBay Live launched in May, eBay claims to be gaining traction with sellers and buyers.

These initiatives not only increase eBay's efficiency, but also keep the company up to date with direct competitors in the fast growing generative AI market.

Implementing AI capabilities is likely just the beginning for eBay. The AI market is growing rapidly, and more and more eCommerce companies are getting involved. Currently, eBay is working on an AI tool that removes the background of a seller's image and replaces it with a white image to highlight the products.

Loss of Buyers and Users

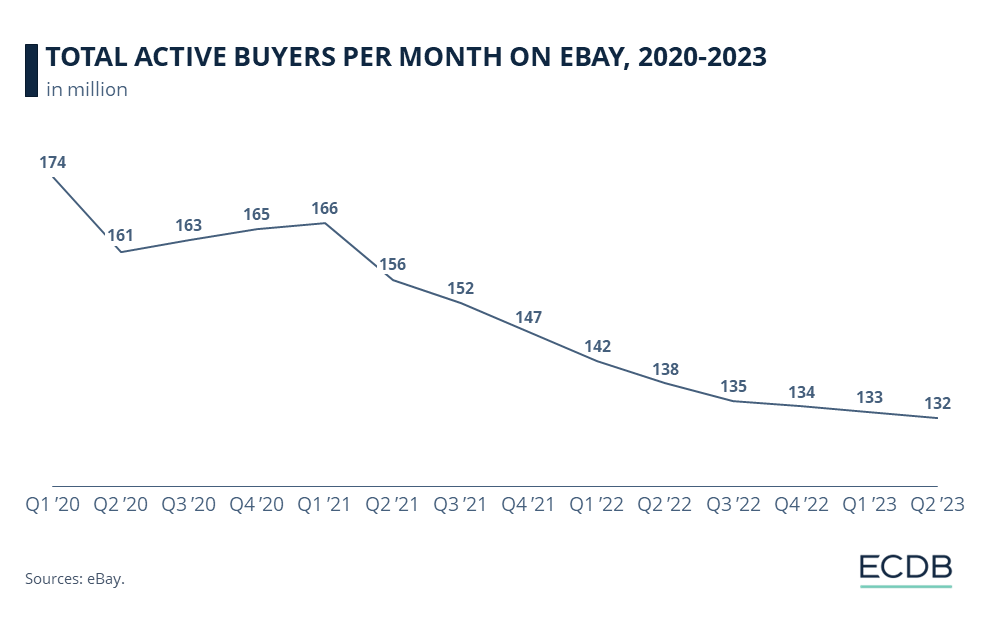

With these new features, eBay is trying to reverse the trend of losing sellers and customers to other marketplaces and online stores. The company's data shows a steady decline in active buyers since the second quarter of 2021, from 166 million monthly users to 132 per month in the second quarter of 2023. In other words, eBay has lost 20.5% of its active buyers per month over this two-year period.

Taking a closer look at eBay's app users, the trend of losing interactions continues. According to data from gwsolutions, from January to July 2023, eBay's daily app users dropped from 6 million to 4.2 million - a loss of 30% daily users in half a year.

At the same time, Shein and Temu have been attracting new users at a high rate. In six months, Shein has doubled its users per day from 1 million to 2 million, while Temu has attracted 3.5 million users per day one month after its launch in the UK.

Cut of Workforce

As a result of years of declining post-pandemic GMV numbers, eBay announced earlier this year that it would cut 9% of its workforce, which would mean the loss of about 1,000 jobs for the eCommerce player. As a result of the announcement, eBay's stock rose 3% the next day.

The statement comes just 12 months after eBay cut 500 jobs from its global workforce. eBay is not the only one to shed jobs after the pandemic, as other tech giants like Google or Amazon have also had to lay off workers after succeeding during the pandemic years but could not retain in the following years.

eBay Marketplace: Closing Remarks

Only time will tell if the new and upcoming AI features can stop the downward trend of losing users, buyers and GMV. eBay cannot rely on these features alone, as the competition will implement AI if they are not already using it.

Tools like automated product listing and description generation will improve the user experience and therefore user engagement. eBay needs to let potential buyers and sellers know about this feature, so creating marketing strategies will be crucial for eBay to get the maximum potential out of its inventions.

For now, we can't say how well eBay's new tools will work in terms of gaining user interactions. But eBay is on the back foot compared to the competition. Replicating what those competitors are doing won't get it back on top. eBay's ideas will have to work better or be more innovative to keep up in the competitive eCommerce market.

Sources: yahoo! finance, digitalcommerce360 1 2 , gws, reuters

Related insights

Article

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Article

Germany's Leading Online Marketplaces

Germany's Leading Online Marketplaces

Article

Most Valuable U.S. eCommerce Companies 2024: Market Cap, Revenue & Growth

Most Valuable U.S. eCommerce Companies 2024: Market Cap, Revenue & Growth

Article

Digital Retail Media Networks in Europe: Amazon Leads Top 10

Digital Retail Media Networks in Europe: Amazon Leads Top 10

Article

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Back to main topics