eCommerce: Top 10 eCommerce Companies

Most Valuable U.S. eCommerce Companies 2024: Market Cap, Revenue & Growth

Dive into the most valuable U.S. eCommerce companies by market cap. We analyze who's leading, why, and how their market value compares to sales figures.

Article by Cihan Uzunoglu | January 31, 2024

Most Valuable U.S. eCommerce Companies 2024:

Key Insights

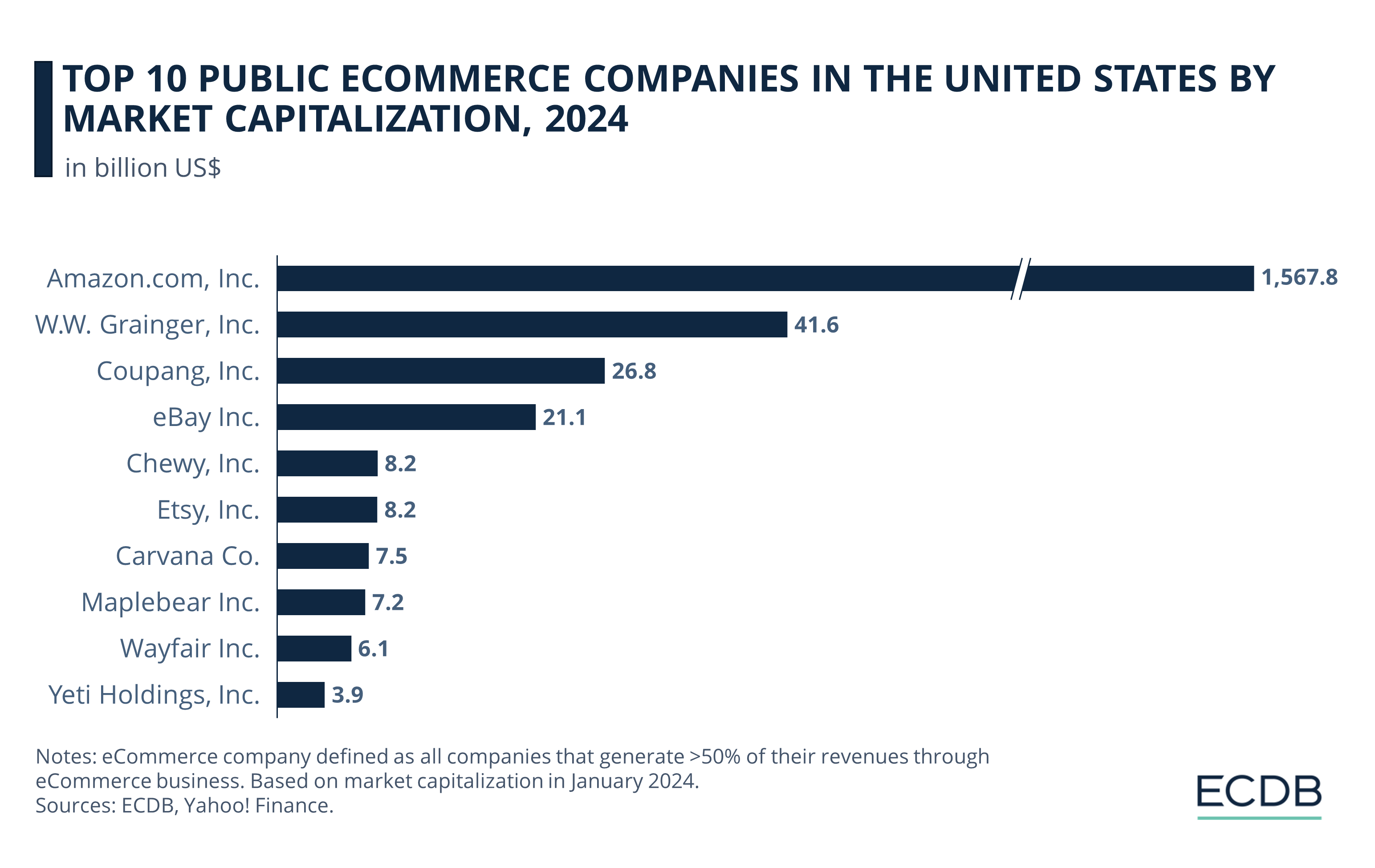

Most Valuable by Market Cap: Amazon.com, Inc., with a market cap of US$1.56 trillion, is the most valuable U.S. eCommerce company, significantly leading in both market size and value.

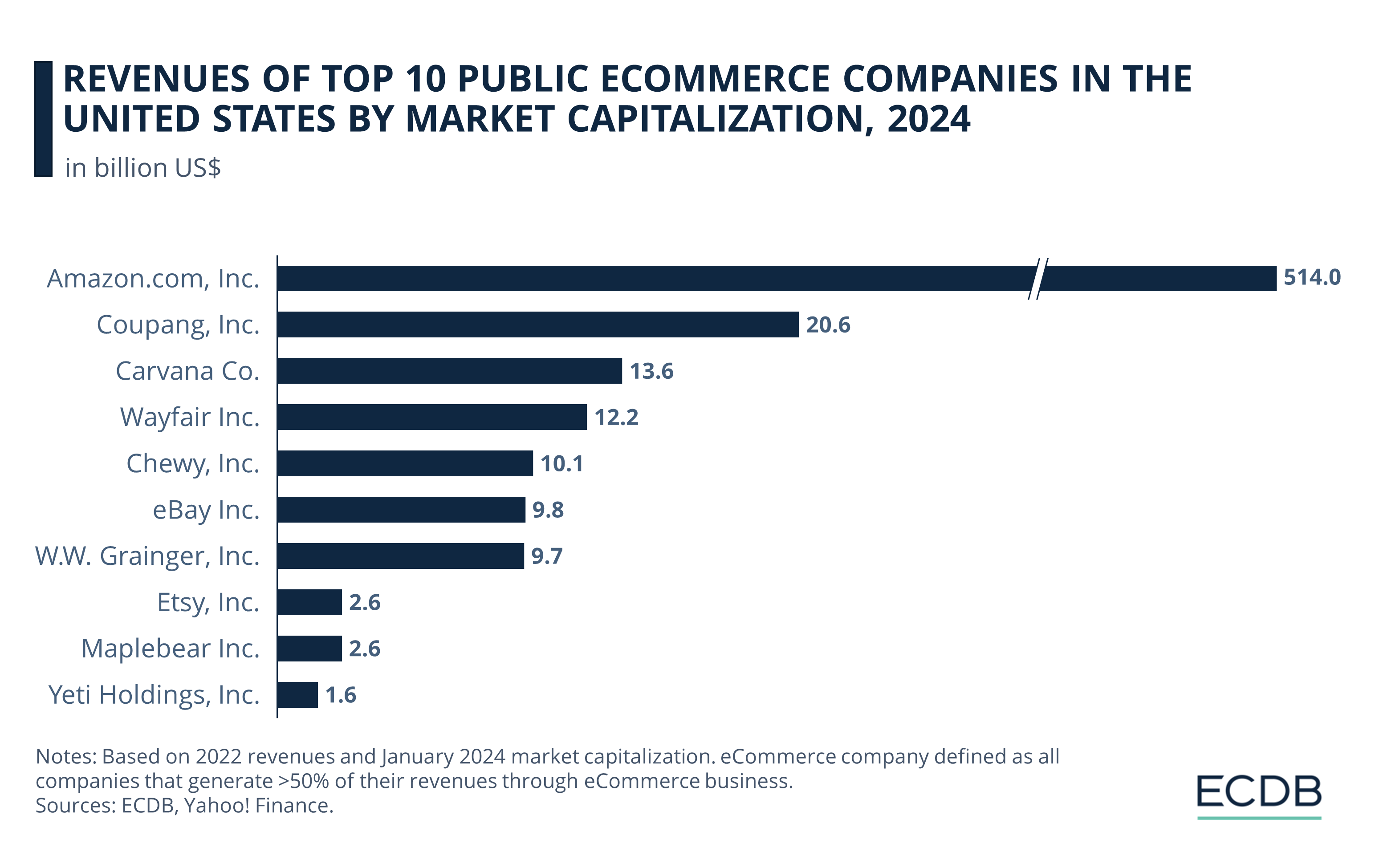

Revenues of the Most Valuable: In terms of revenues, Amazon.com, Inc. stands out again with over US$513 billion in 2022, followed by other major players such as Coupang, Carvana and Wayfair.

Amazon Dominates: Top 3 in terms of market cap is occupied by Amazon.com, Inc., followed by W.W. Grainger, Inc., which specializes in industrial supplies, as well as Coupang, Inc., a significant player in the South Korean eCommerce market.

Other Players: In the lower ranks, eBay Inc. experienced a decrease in revenue in 2022. In contrast, Chewy, Inc., Etsy, Inc., Carvana Co., Maplebear Inc., and Yeti Holdings, Inc. continued to show revenue growth, while Wayfair Inc. saw a decline in the same period.

Have you ever wondered who really leads the pack in the bustling world of U.S. eCommerce? Is it the diversity of products, the cleverness of marketing, or perhaps the sheer scale of operations that puts a company on top?

In this analysis, we delve into the key players in U.S. eCommerce, examining not just their size but also the vital distinctions between their market capitalization and actual sales figures. For a broader perspective, including an analysis of the top global eCommerce companies in 2024, our related article offers in-depth insights.

Top 10 Most Valuable U.S.

eCommerce Companies

In 2024, the largest public U.S. eCommerce company by market cap is Amazon.com, Inc. with a staggering market capitalization of US$1.56 trillion, placing the company far ahead of its competitors. The second spot is occupied by W.W. Grainger, Inc., though with a significantly smaller market capitalization of US$41.64 billion.

Coupang, Inc., an emerging player in eCommerce, holds the third position with a market value of US$26.76 billion. A long-standing name in online auctions and sales, eBay Inc., ranks fourth with a market capitalization of US$21.1 billion.

The rest of the top ten is made up of companies with market values under US$10 billion. Namely, Chewy, Inc., specializing in pet-related products, has a market capitalization of US$8.19 billion, closely followed by Etsy, Inc., known for its focus on handmade and vintage items, at US$8.18 billion.

Carvana Co., an online car sales company, is valued at US$7.49 billion. Maplebear Inc., operating under the Instacart brand in grocery delivery, has a market value of US$7.19 billion. Wayfair Inc., an online store for furniture and home-goods, is valued at US$6.05 billion. Lastly, Yeti Holdings, Inc., known for its outdoor products, rounds out the list with a market capitalization of US$3.88 billion.

But market cap isn't the only important factor. Stakeholders also pay close attention to total revenue, a crucial measure of a company's financial health.

Most Valuable U.S. eCommerce Companies: Amazon Leads in Revenue, Followed by Coupang

Most valuable public U.S. eCommerce companies show a varied range in their revenues.

Taking 2022 revenues into account, Amazon.com, Inc. still leads the list, far outstripping its closest competitor. Under Amazon, Coupang, Inc. stands at a distant second. Carvana Co. at number 3 is followed closely by Wayfair Inc. Chewy, Inc. comes next, closely tailed by eBay Inc. and W.W. Grainger, Inc. The list concludes with smaller players: Etsy, Inc., Maplebear Inc., and Yeti Holdings, Inc.

The difference in market cap and revenue rankings for eCommerce companies (e.g., Wayfair Inc.) is influenced by their business models, profitability, market trends, investor perceptions, and external economic factors. These aspects affect investor confidence and thus the company's market valuation.

Now that we've seen how the most valuable eCommerce companies in the U.S. stack up in terms of revenue, let's take a closer look at these players, providing a brief profile for each and their revenue trajectories over the past few years.

1. Amazon.com, Inc.

Amazon.com, Inc., headquartered in Seattle, Washington, is a formidable presence in the eCommerce sector. Originally founded in 1994 by Jeff Bezos as an online bookstore, it has exponentially expanded its scope over the years. The company has evolved into a massive conglomerate, offering a vast array of products and services, including the widely known Amazon Prime, various electronics like the Kindle and Echo, and Amazon Web Services, which is a significant part of its business.

In 2019, the company reported a revenue of US$280.52 billion. This figure saw a substantial rise in 2020, reaching US$386.06 billion, which represents a growth of about 37.6%. The upward trajectory continued in 2021, with revenues climbing to US$469.82 billion, marking an increase of approximately 21.7% from the previous year. The growth trend persisted into 2022, albeit at a slightly slower pace, with the company's revenue reaching US$513.98 billion, which represents a rise of about 9.4% compared to 2021.

2. W.W. Grainger, Inc.

W.W. Grainger, Inc., established in 1927, is a notable name in the industrial supply sector, primarily focusing on maintenance, repair, and operations (MRO) products. Over the years, it has developed a robust eCommerce platform complementing its physical distribution locations, launched in 1995. Grainger's eCommerce strategy is predominantly B2B, offering a user-friendly online platform with a vast range of small industrial parts, aftermarket materials, and tools, catering to businesses of various sizes.

As of 2021, a significant portion (about 75%) of Grainger's sales was generated electronically. This includes sales through their eCommerce sites like Grainger.com, electronic data interchange, eProcurement, and KeepStock, which involves vendor-managed inventory and on-site internet-connected vending machines.

The company's 2019 revenue was US$6.55 billion. The following year, 2020, saw a noticeable increase, with revenue rising to US$7.67 billion – an approximate 17.1% growth. The momentum continued into 2021, with a more modest increase, bringing the revenue to US$8.14 billion, a 6.1% rise from 2020. The growth trajectory was more pronounced (19.8%) in 2022, with revenue reaching US$9.75 billion.

3. Coupang, Inc.

Coupang, Inc., a major player in South Korea's eCommerce market, was founded in 2010 by Bom Kim. It has evolved from a daily deals business into a full-fledged online retail platform, underpinned by an efficient logistics network known for its fast and reliable delivery services. Notable offerings include Rocket Delivery, which guarantees overnight delivery, and a range of services like Rocket Wow (a subscription service), Rocket Fresh for quick food delivery, Coupang Eats, and Coupang Play, a video streaming service.

Scoring revenues of US$6.27 billion in 2019, the company saw an impressive surge in 2020 revenues, almost doubling (90.7% growth) to US$11.97 billion. The upward trend continued in 2021, with revenues expanding further to US$18.41 billion, reflecting a 53.9% increase from 2020. While the growth rate moderated in 2022, the company still saw an increase in revenue, reaching US$20.58 billion.

4. eBay Inc.

eBay Inc. is a prominent global eCommerce marketplace, established in 1995, known for connecting buyers and sellers around the world. Its wide range of products includes everything from antiques and art to electronics, accessible via its main website and mobile apps. Operating in over 190 markets and headquartered in San Jose, California, eBay boasts about 1.9 billion live listings and 132 million active buyers.

eBay Inc. experienced varied revenue results from 2019 to 2022. In 2019, the company's revenue stood at US$8.64 billion. The next year, 2020, showed a positive movement, with revenue increasing to US$10.27 billion, a growth of approximately 18.9%. In 2021, eBay Inc. continued to see a rise in revenue, albeit at a slower rate, reaching US$10.42 billion. However, in 2022, the trend reversed, with revenue decreasing 6% to US$9.8 billion.

5. Chewy, Inc.

Founded in 2011 and acquired by PetSmart in 2017 for $3.35 billion, Chewy, Inc. has become a major player not only in the online pet products market, but also in the overall U.S. eCommerce market. The company offers a vast range of pet products, including food, health items, toys, and habitats, with a selection of about 110,000 items from over 3,500 brands.

Chewy's success is partly due to its convenient Autoship service, allowing regular deliveries of pet essentials, and its exceptional customer service, which includes thoughtful gestures like sending flowers to bereaved pet owners.

Revenues of US$4.85 billion in 2019 went through a substantial increase in 2020, jumping to US$7.15 billion, which amounts to about 47.4% growth. Continuing this positive trajectory, in 2021, the revenue climbed further to US$8.89 billion, marking a 24.4% increase from the previous year. The growth momentum was maintained in 2022, with Chewy, Inc.'s revenue reaching US$10.1 billion.

6. Etsy, Inc.

Founded in 2005, Etsy, Inc. stands out as a unique eCommerce platform that specializes in handmade, vintage items, and craft supplies. The platform is particularly popular for items in categories like art, home & living, jewelry, and clothing, emphasizing the uniqueness of the products.

Etsy's revenue comes from transaction and listing fees charged to sellers, along with optional paid advertising and promotional services. This model supports the company's growth and profitability. Etsy's user-friendly online interface facilitates interaction between buyers and sellers, fostering a sense of community and long-term relationships.

Etsy, Inc. experienced a notable growth in revenue from 2019 to 2022. A significant leap occurred from 2019 to 2020, with yearly revenues soaring from US$818.4 million to US$1.73 billion, an impressive growth of about 111%. Albeit at a slower pace, the growth trend continued in 2021, with revenues rising to US$2.33 billion. In 2022, too, the company's revenue saw further growth, reaching US$2.57 billion.

7. Carvana Co.

Carvana Co., established in 2012, has transformed the online used car market, offering a wide range of vehicles, transparent pricing, and a stress-free buying process on its innovative platform. Customers can inspect cars through detailed online imaging, with the option of home delivery or picking up from unique car vending machines. Carvana manages the entire process, from vehicle sourcing to sales and delivery, emphasizing technology and data. The company’s growth and innovative approach has led to its inclusion in the Fortune 500.

Looking back at the company’s 2019 and 2020 revenues, we see a notable increase from US$3.93 billion to US$5.58 billion, a growth of about 42%. The most substantial leap in this time period occurred in 2021 though, with revenues skyrocketing to US$12.81 billion at even more impressive 129.6% growth. In 2022, Carvana Co. continued to grow, albeit at a slower pace, with revenue reaching US$13.6 billion.

8. Maplebear Inc.

Maplebear Inc., known for its Instacart brand, is a major player in the North American online grocery sector. Founded in 2012, it offers a wide range of products including food, alcohol, and pet care through its app and website. Key developments include Instacart Pickup and expanding alcohol delivery.

Instacart's growth is marked by strategic partnerships, like with Rite Aid and Walmart, and innovations like contactless delivery during COVID-19. The introduction of the Instacart Platform in 2022 further expanded its services to retailers.

Fueled by the pandemic, the company’s revenue of US$735 million in 2019 went up to US$1.48 billion in 2020 with a growth of 101.4%. The upward trend in revenue continued in 2021, with an increase to US$1.83 billion. In 2022, the company further strengthened its financial performance, with revenue reaching US$2.55 billion, indicating a substantial growth of almost 40%.

9. Wayfair Inc.

Wayfair Inc., established in 2002 by Niraj Shah and Steve Conine, has become a key player in the online furniture, home goods, as well as electronics market. Originating as CSN Stores and later rebranded to Wayfair, the company, headquartered in Boston, offers an extensive range of over 14 million products from more than 11,000 suppliers. Its business model includes selling products, providing installation services, and earning through advertising and fees.

Wayfair Inc.'s revenue trajectory from 2019 to 2022 shows a period of growth followed by a gradual decline. Revenues of US$9.13 billion in 2019 witnessed a significant increase next year, rising to US$14.15 billion. However, in 2021, the revenue trend reversed, dropping to US$13.71 billion at a 3.1% decrease. The downward trend continued into 2022, with revenue further reducing to US$12.22 billion, representing a more noticeable decrease of about 10.8% compared to 2021.

10. Yeti Holdings, Inc.

Yeti Holdings, Inc., based in Austin, Texas, is renowned for its design, marketing, and distribution of innovative outdoor products. The company's product range is diverse, featuring coolers, drinkware, bags, and a variety of other items designed to cater to outdoor activities like fishing, hunting, camping, and snowboarding.

With the pre-pandemic revenues of US$910 million in 2019, the company saw a positive shift with revenue increasing to US$1.09 billion in 2020. This upward movement continued into 2021, with revenues further rising to US$1.41 billion at a significant 29.4% growth. This growth trajectory was sustained into 2022, with Yeti Holdings, Inc.'s revenue reaching US$1.6 billion.

Learn More About ECDB

Most Valuable U.S. eCommerce Companies: Future Trends

Drawing our analysis to a close, it's evident that Amazon reigns supreme in the U.S. eCommerce landscape. Its financial performance soars high above the rest, showcasing consistent growth year after year. Recently, its market capitalization nearly doubled from the end of 2022, reflecting a robust rebound.

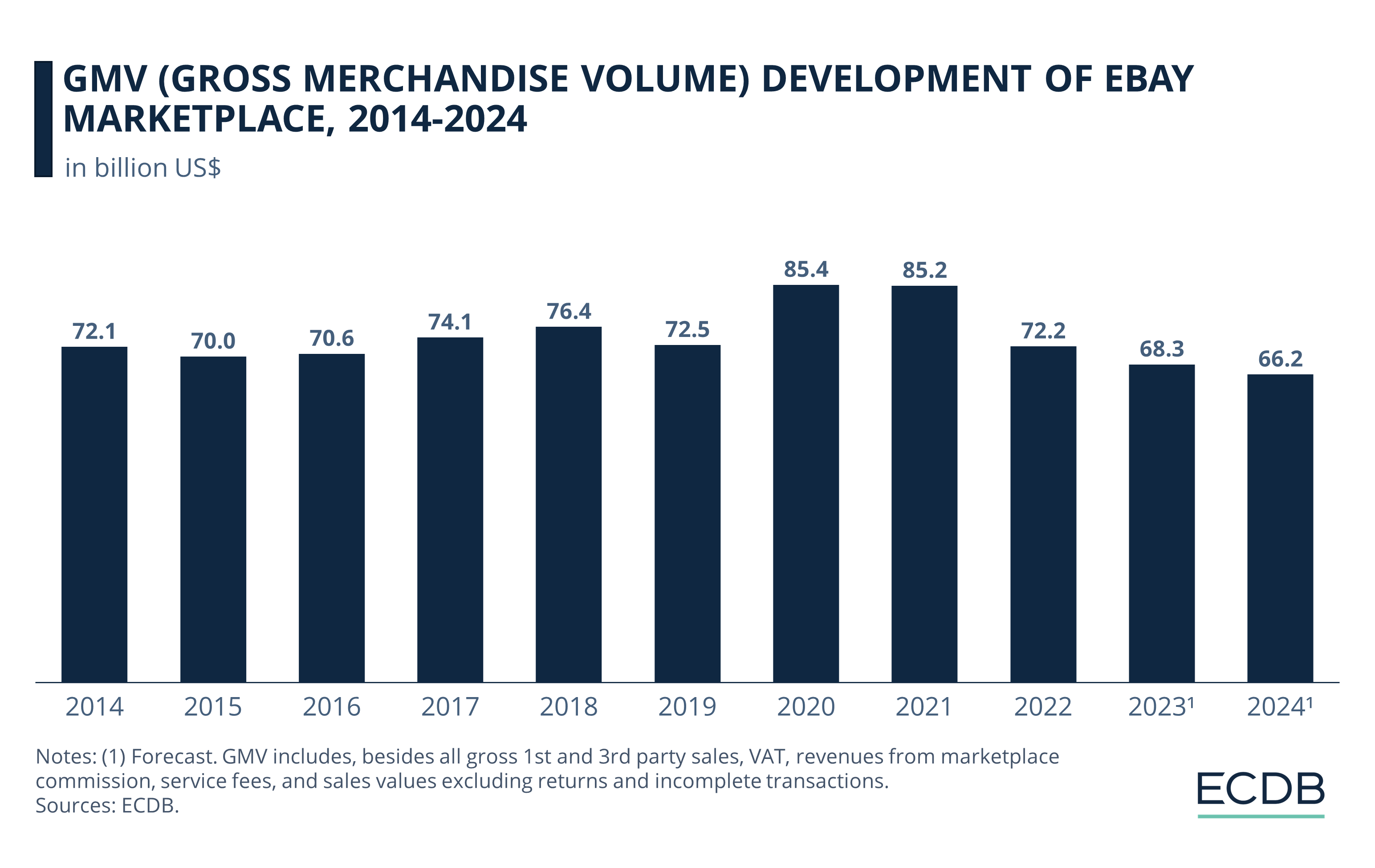

On the flip side, eBay and Coupang have been slipping down the ranks. eBay's recent struggles are marked by underwhelming results and a significant reduction in its workforce, pointing to a challenging road ahead. Analysts foresee a further potential decline in its share price. Coupang, too, has witnessed a steady downturn since its initial public offering, shedding almost US$60 billion in market value.

In contrast, W.W. Grainger stands out as a steady performer in this volatile market. Although it might not be as well-known as some of its counterparts in online retail, Grainger's market capitalization and revenues have consistently trended upwards. This steady growth, coupled with its track record of surpassing earnings expectations, gives no indication of a slowdown in the near future.

What is "Market Cap"?

Market cap, short for market capitalization, is a way to measure a company's value. It's quite simple — you just multiply the current stock price by the total number of shares a company has out there. This number gives us an idea of how big a company is in the eyes of investors.

For example, if a company has 1 million shares and each share is worth US$50, the market cap would be US$50 million. This is a key number in the stock market world. It helps people compare different companies, no matter how many shares each one has. It's not perfect, but it's a quick way to see a company's size and its weight in the market.

Sources: Britannica, Harvard, Digital Commerce 360, Business Review at Berkeley, FourWeekMBA: 1, 2, 3, eBay, GlobalData: 1, 2, 3, databahn, Finpedia, The Strategy Story, Stock Analysis: 1, 2, Etsy, Pitchgrade, YETI, PYMNTS

Related insights

Article

Top 5 Online Jewelry & Watches Stores in the United States: Market Development, Top Online Stores

Top 5 Online Jewelry & Watches Stores in the United States: Market Development, Top Online Stores

Article

Live Commerce in China: Market Size, Top Platforms, Popularity by Generation and Region

Live Commerce in China: Market Size, Top Platforms, Popularity by Generation and Region

Article

German Drugstore CEO Calls for Legislative Action Against Temu

German Drugstore CEO Calls for Legislative Action Against Temu

Article

Amazon GMV: Which Domains Grew the Fastest?

Amazon GMV: Which Domains Grew the Fastest?

Article

Top Marketplaces in Southeast Asia 2024: Can Shopee Dominate the Region?

Top Marketplaces in Southeast Asia 2024: Can Shopee Dominate the Region?

Back to main topics