eCommerce: Black Week and Holiday Season

Peak Season 2023: Consumer Retail Trends & Predictions

As we enter the final month of the year, global eCommerce is building up in the midst of peak season 2023. With all eyes on the upcoming holiday shopping spectacle, forecasts and insights paint a vivid picture of what lies ahead.

Article by Lukas Görlitz | December 08, 2023

Peak Season 2023 Trends & Predictions: Key Insights

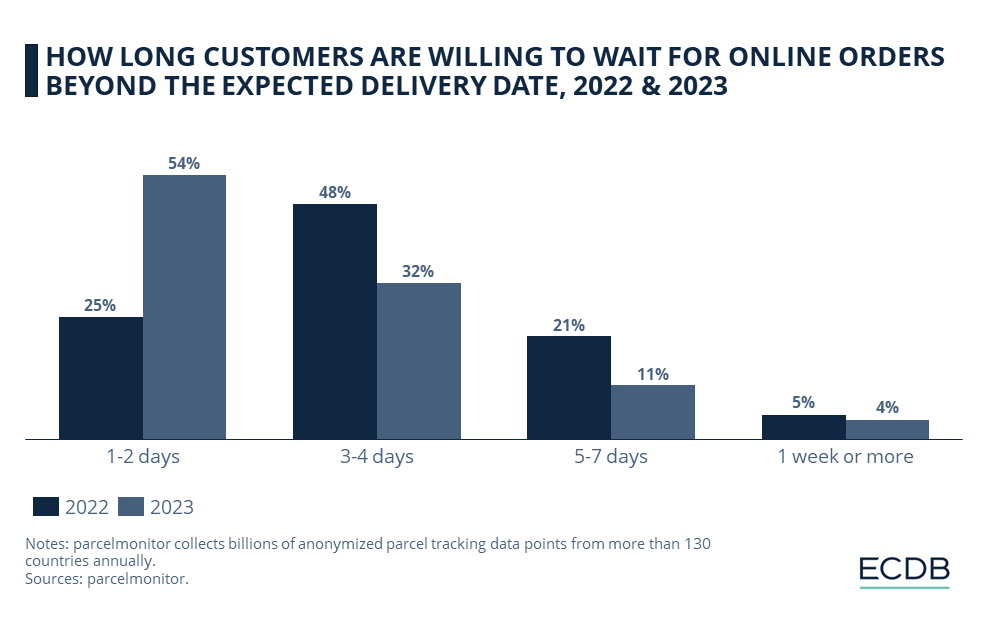

Faster Delivery More Important: Customer expectations for delivery have changed in 2023, with 54% now tolerating 1-2 day delivery delays, a considerable jump from 24.9% in 2022. This reflects a growing demand for faster order fulfillment.

Product Prices and Free Shipping: According to Parcel Monitor's Peak Season 2023 Report, pricing drives 80% of consumer purchase decisions. Free shipping is another influential factor, impacting product choices for 59% of shoppers.

Personalization for Customer Satisfaction: Customers who report a personalized shopping experience are 60-70% more likely to return. Keeping just 5% of customers can lead to a 24% increase in profits over time, according to Parcel Monitor.

In eCommerce, "peak season" refers to the year-end period of increased shopping activity. In the context of the upcoming peak season in 2023, key dates include Singles' Day on November 11, Black Friday on November 24, Cyber Monday on November 27, and the extended holiday shopping period throughout December. These dates represent significant opportunities for businesses to engage customers with promotions, discounts, and strategic marketing efforts. Preparing for these events can help drive peak season sales.

Peak season is arguably the most important time of year for online retailers. Parcel Monitor identifies key trends for the ongoing 2023 peak season: competitive pricing, free shipping, shorter delivery expectations and personalization are consumer preferences that affect which online store they will (re)purchase from.

But first, a brief overview of the significance of key shopping events in November and December.

Cyber Week Is the Key Shopping Holiday in the U.S.

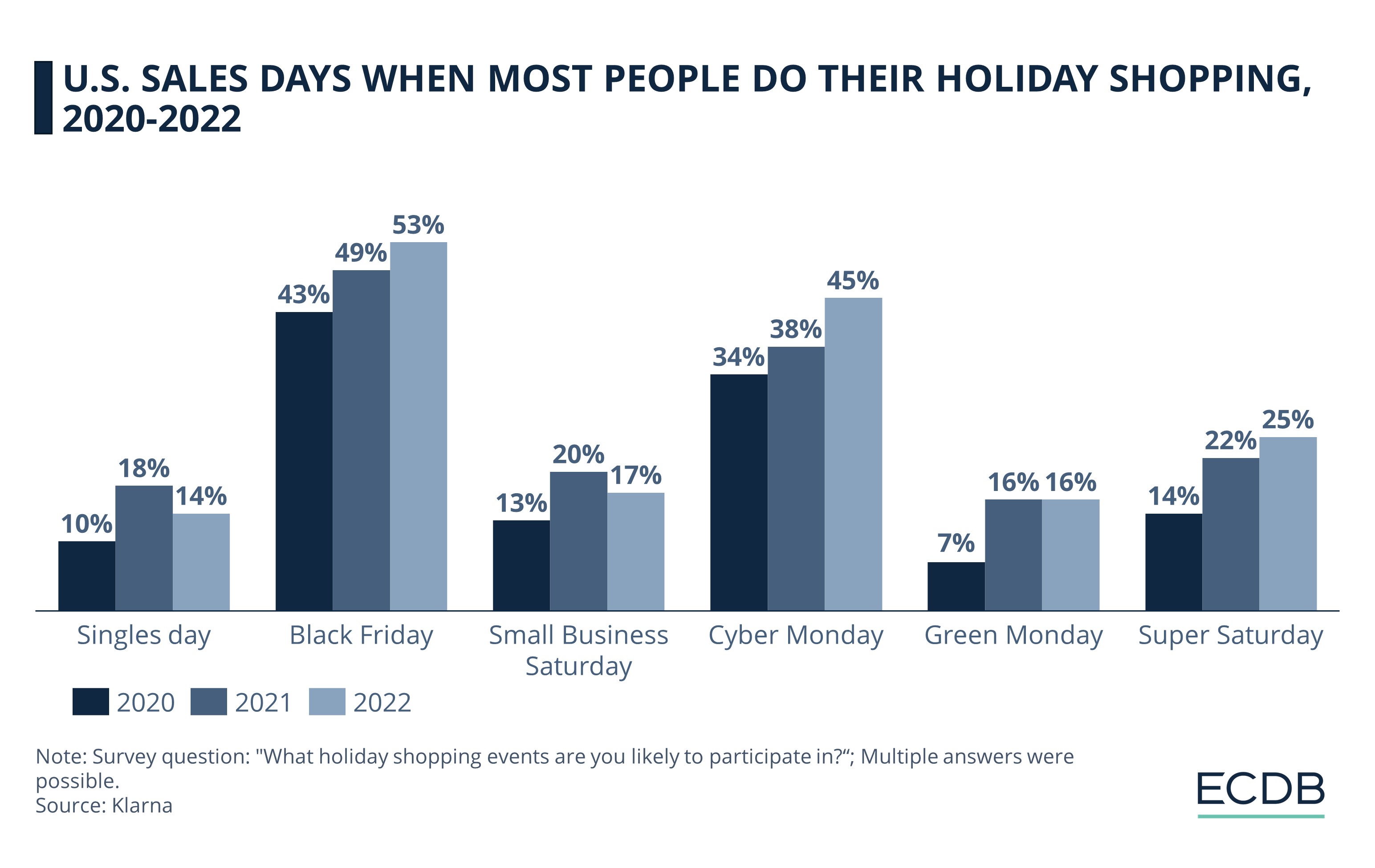

A 2022 survey by Klarna shows that more than half of U.S. consumers (53%) planned to do their holiday shopping on Black Friday. The popularity of this event has steadily increased over the past three years, jumping from 43% in 2020 to 53% in 2022.

Overall, Cyber Week far outpaces other shopping days during this period. Check out this year's results in our recently published insight.

But Cyber Monday and Black Friday are not the only shopping events during the peak season, even though they get the most attention from consumers. There is also Green Monday (this year on December 11) and Super Saturday (on December 23), two additional days that are designed for consumers to splurge on holiday gifts.

There is no doubt that online shoppers have plenty of opportunities for discounts and special product offers during the peak season. But what are the most compelling offers eCommerce stores can make to attract a larger customer base? Parcel Monitor's 2023 Peak Season Report explores this question. The results show: Less patience, more individuality.

eCommerce: Order More, Pay Less

According to Parcel Monitor, 80% of purchase decisions are based on product price. Needless to say, an established eCommerce player has more opportunities to offer products at lower prices than smaller businesses struggling to break even. This competitive advantage is driving conversion rates as consumers use online comparison tools to find the site with the best deal.

Free shipping is another key trend, influencing the purchase decisions of 59% of shoppers. Again, this price-related aspect represents a competitive advantage for retailers that not all may be able to offer. Our recent recap of the Deloitte survey on consumer holiday spending reiterates this point.

Most Consumers Will Wait Up to 2 Days Beyond Expected Delivery Time

Speaking of shipping, how long are customers willing to wait for a purchase beyond the expected delivery date? Parcel Monitor data reveals that 54% of customers now expect their shipments to arrive within 1-2 days of the original estimated delivery date.

This represents a significant increase from the 24.9% recorded in 2022. While a substantial portion, 32% of customers, are still willing to wait for their orders within a 3-4 day window, there is a notable decline in customer patience for 5-7 day deliveries. Only 11% of customers are now willing to accept such longer delays.

The data points to an overall decline in consumer tolerance for delivery delays. As more established retailers move to a next-day delivery model, waiting for a package beyond the announced time is becoming unacceptable to an increasing number of shoppers. This emphasizes the need for a refined logistics network and mutually beneficial partnerships between e-retailers and logistics companies.

Personalized Online Shopping Leads to Repeat Purchases

Personalized shopping can include product recommendations generated on the basis of previous purchases, the use of AR or VR technology to showcase the product, personalized fitting tools, the creation of customized products, gamification such as quizzes for customers to help find the ideal product, and, of course, AI assistants.

Existing customers show a significant 60-70% likelihood to make repeat purchases with personalization tools, compared to a more modest 5-20% for new customers. Parcel Monitor reports that a 5% improvement in customer retention can yield an estimated 24% improvement in profits. Moreover, personalized experiences build trust and emotional attachment to the brand, resulting in higher customer lifetime value.

Are these trends, then, global? Or are there regional variations? Find out in the next section.

Global Contrasts: Peak Season Dynamics in Different Regions

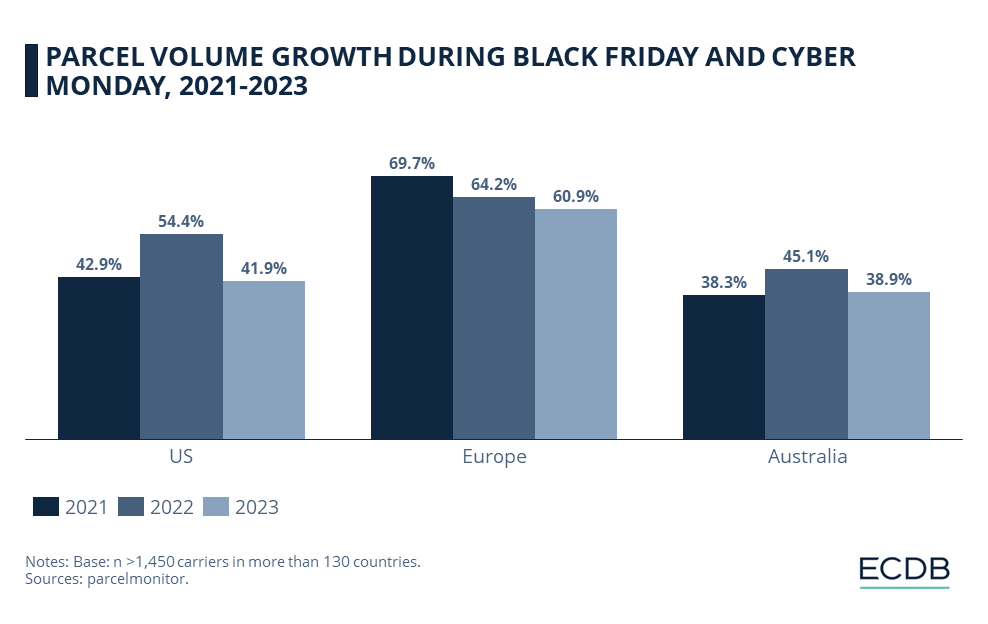

The U.S. saw a notable uptick in eCommerce activity during the peak 2022 season, with package volumes increasing by 54.4% during Black Friday and Cyber Monday (BFCM), up from 42.9% growth in 2021. Despite concerns that post-pandemic store openings would reduce consumer incentives to shop online, these numbers show that eCommerce is here to stay. A hybrid model, where both in-store and online shopping coexist, combines the best of both worlds.

In contrast, Europe experienced a relative slowdown in peak season growth, although it remained at a high level nonetheless. With parcel volumes increasing by 64.2% in BFCM 2022 compared to 69.7% in 2021, online peak season purchases continue to rise.

Australia saw a notable increase in parcel volume during BFCM 2022, with a growth rate of 45.1%, up from 38.3% the previous year. This growth was likely fueled by the increasing popularity of Black Friday in the country, with many Australian shoppers specifically "waiting for Black Friday" rather than buying during early sales.

Delivery Challenges: Who Is at Fault?

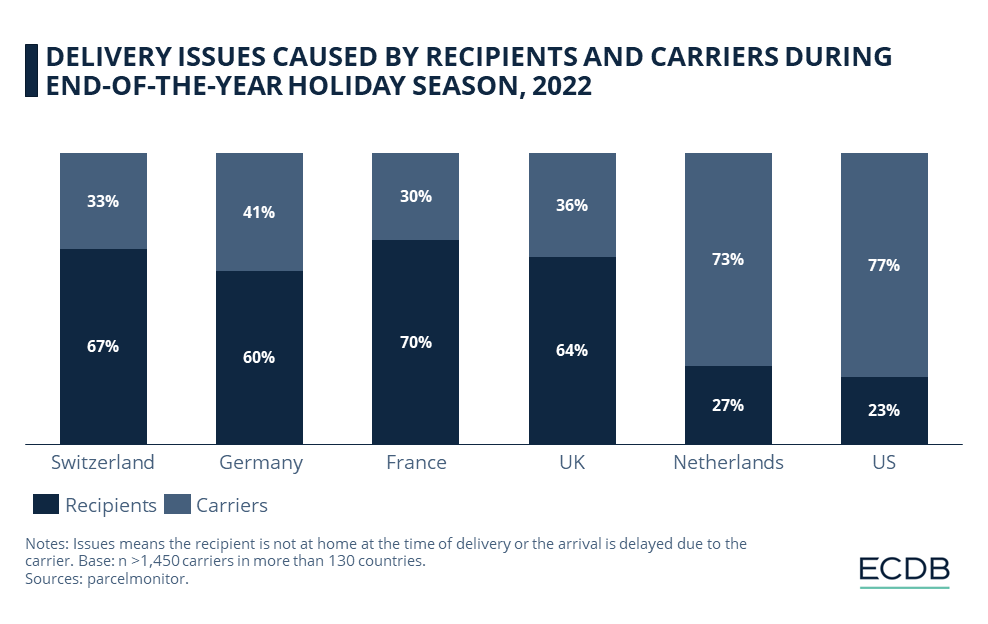

In the midst of the 2022 peak season, the spike in parcel volumes presented a series of complicated delivery challenges that all participants, i.e. carriers, recipients, and retailers had to deal with.

Across Europe, the dynamics of these challenges varied from country to country. In Switzerland, 32.9% of delivery problems were attributed to carriers, with recipients' unavailability at home contributing to 67.1% of problems. Similar patterns emerged in Germany, France, and the UK, highlighting the responsibility of both carriers and recipients for delivery problems.

The scenario was slightly different in the Netherlands, where 73.1% of delivery problems were carrier-related, putting immense pressure on logistics networks. Recipients were responsible for 26.9% of the problems, often due to their absence when parcel delivery was attempted.

The U.S. also experienced significant challenges during the 2022 peak season. A striking 77% of delivery problems were attributed to carriers, primarily due to late deliveries. Approximately 23% of problems were caused by recipients, often due to their absence during delivery attempts.

Predictions for the 2023 Peak Season: Likely Sales Growth

With Cyber Week having reached new heights this year, what about the rest of the holiday season? Predictions are mostly positive:

There is a sense of optimism in the U.S., UK and France. Forecasts indicate that these countries will see the highest sales growth in the 2023 holiday season, with an expected 5-20% year-over-year increase in eCommerce development. Shoppers in these regions can expect a festive season with exciting deals, faster deliveries and an abundance of choice.

While the overall outlook for Europe remains positive, individual countries on the continent face different challenges. Germany, Switzerland and the Netherlands, known for their efficient logistics networks, are expected to experience relatively modest peak season growth, ranging from -5% to 5% compared to 2022. Challenges may stem from the maturation of their eCommerce markets and increased competition, affecting their growth rates relative to neighboring countries.

In Australia and Canada, the forecast suggests a steady course with growth in the range of -5% to 5%. In contrast to the very positive forecasts for the U.S., UK and France, these other regions are expected to maintain a consistent level of eCommerce performance year over year, with less volatility.

Parcel Volume Growth Across Regions

Parcel Monitor conducted an analysis of the number of parcels delivered across regions, spanning the years 2021, 2022, and 2023 (projected). The results show a collective decline in parcel volume growth across the U.S., Europe, and Australia.

In the U.S., parcel volume growth is projected to decline from 54.4% in 2022 to 41.9% in 2023. A similar story unfolds in Europe and Australia, where parcel volume growth is expected to decline from 64.2% to 60.9% and from 45.1% to 38.9%, respectively.

Although still positive, a relative slowdown in growth may occur due to market saturation and shifting consumer behavior. Consumers may plan to increase their in-store purchases, pick up their online orders through omnichannel services, or avoid shopping from many different online retailers.

Peak Season Trends 2023: Closing Remarks

Global eCommerce is developing in line with major online stores, which are driving progress through technological innovation and customer service initiatives. For instance, online shoppers are increasingly accustomed to rapid order fulfillment, personalization through recommendations, AR/VR, or AI, and, of course, expansive discounts during peak seasons.

While all of these trends point to the longevity of online retail, recent data on the projected decline in package volume growth points to another aspect: Offering hybrid shopping experiences, streamlining package volumes through more efficient order fulfillment and an awareness of avoiding unnecessary purchases may appeal to a growing number of consumers. Gift buying during the peak season will certainly continue for years to come, but the way shoppers approach their spending and order volumes may be subject to a shift in mentality.

Related insights

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Article

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

Article

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Article

eCommerce in India: How Young Consumers Like to Shop and Engage Online

eCommerce in India: How Young Consumers Like to Shop and Engage Online

Back to main topics