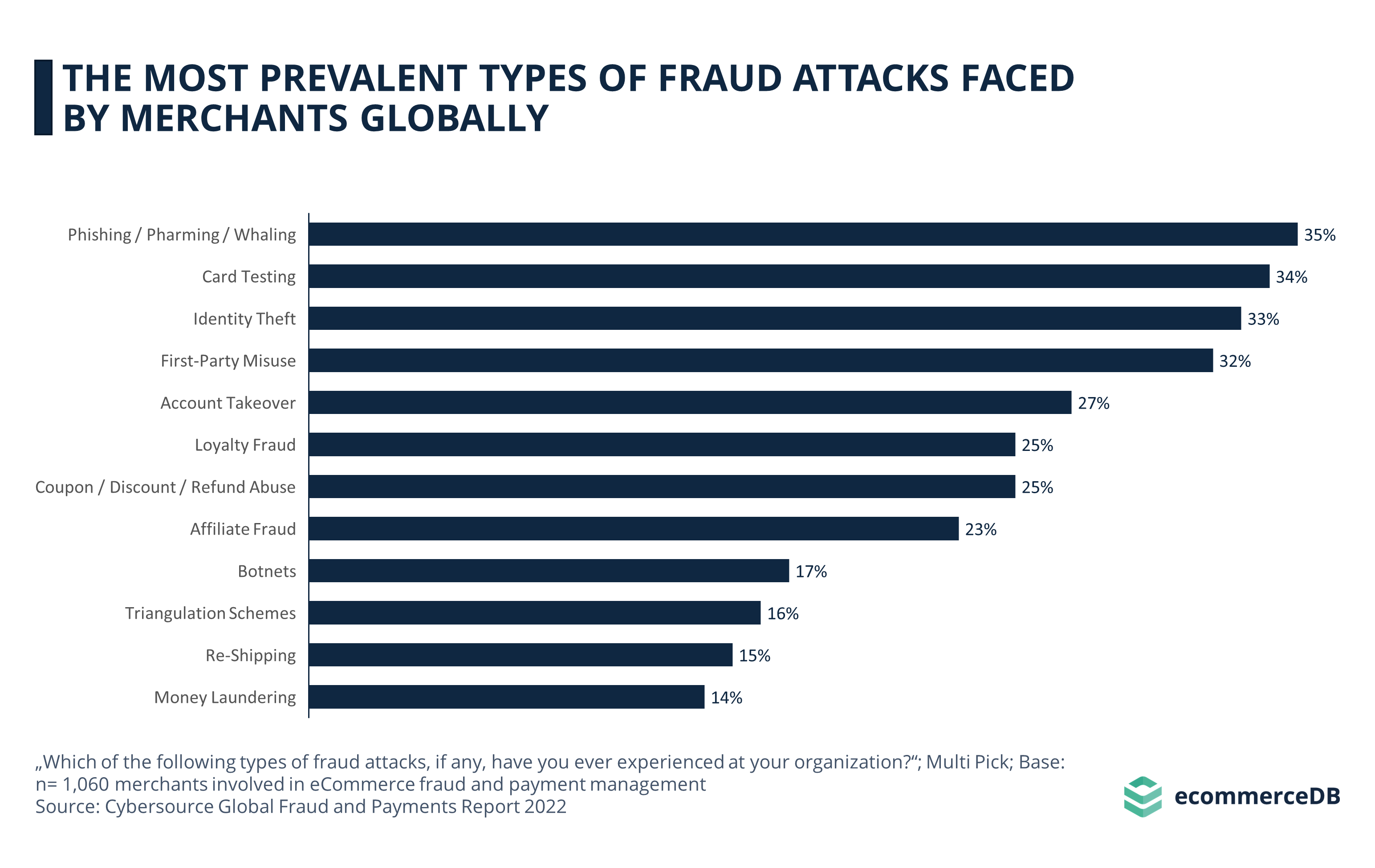

Cybersource’s Global Fraud and Payments survey asked merchants around the world what types of fraud they have experienced at their organization. The top 12 responses are listed below.

Phishing attacks are the most common type of fraud experienced by merchants, with 35% of respondents reporting that they have encountered Phishing, Pharming, or Whaling in their organization. The goal of this type of fraud is to obtain consumer credentials so that criminals can gain access to private banking information or online payment accounts. Pharming involves the creation of a fake website that tricks users into entering their credentials, while Whaling specifically targets high-profile members of organizations.

On second rank, 34% of merchants have come across Card Testing, which manually verifies the validity of stolen credit card information through small transactions. Botnets do the same thing, but automatically and on a larger scale. Less common than Card Testing, 17% of merchants reported encountering Botnets.

Identity Theft is a result of Phishing, but it also involves the physical theft of private information. Criminals use confidential information to impersonate their victims. Reported by 33% of respondents, Identity Theft is the third most common type of fraud attack. Account Takeover (27%) is similar in nature, but involves only one channel, as opposed to Identity Theft, which affects a wider range of hacked accounts or stolen information from one person.

Besides professional fraudsters scheming to obtain funds illegally, private individuals can also defraud businesses in their role as customers. This type of fraud is known as First-Party Misuse or Friendly Fraud, and 32% of merchants surveyed have experienced it. Friendly Fraud commonly occurs when customers charge back the price of items they have already received. Whether malicious or unintentional, this type of fraud is the fourth most common one for merchants.

Both Loyalty Fraud and Coupon / Discount / Refund Abuse were encountered by 25% of respondents. Fraudsters take advantage of company policies such as loyalty programs or discounts to illegally receive larger amounts for a smaller price. They may simply take advantage of existing loopholes or actively use forged documents such as fake coupons to obtain goods at a lower price.

Affiliate marketing is a way for businesses to increase traffic to their website by paying affiliates to direct consumers to their site. Affiliates are paid at a rate based on the amount of traffic they generate. When this number is distorted, for example by generating fake engagement through bots, this is called Affiliate Fraud. 23% of merchants reported experiencing this type of fraud in their organization.

The last three types of fraud are also the most sophisticated scams on this list. Triangulation Schemes (16%) involve fake sellers on legitimate platforms who ship goods purchased from legitimate sellers using stolen credit card information or hacked accounts. Consumers receive the goods, and the fraudsters disappear when account holders request chargebacks.

Re-Shipping (15%) and Money Laundering (14%) aim to cover the traces of criminally obtained goods and payments. While the former fraud describes the shipping of illegally obtained goods to unwitting customers, the latter involves the circulation of money obtained through illegal activity.

Fraud Can Take on Many Forms, and Can Have Serious Consequences for Businesses

Reflecting on the pervasive nature of fraud in today's global eCommerce environment, we see that merchants across the world encounter a variety of fraud schemes, ranging from Phishing and Card Testing to more elaborate scams such as Triangulation Schemes and Money Laundering. Fraud can have serious financial and reputational repercussions for companies. This means that everyone involved, from seller to customer, needs to be aware of the frequency and methods used to commit fraud, for detecting these attacks early on and taking the necessary steps to prevent misuses.

Sources

Related insights

Article

eCommerce Market in Europe 2024: Worth 1 Trillion Dollars Soon

eCommerce Market in Europe 2024: Worth 1 Trillion Dollars Soon

Article

In-Game Purchases Analysis: Walmart Dives Into Roblox

In-Game Purchases Analysis: Walmart Dives Into Roblox

Article

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Article

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Article

Global PayPal Usage: Germany Leads in Online Store Acceptance

Global PayPal Usage: Germany Leads in Online Store Acceptance

Back to main topics