eCommerce in North America – concentrated on Amazon

April 25, 2023

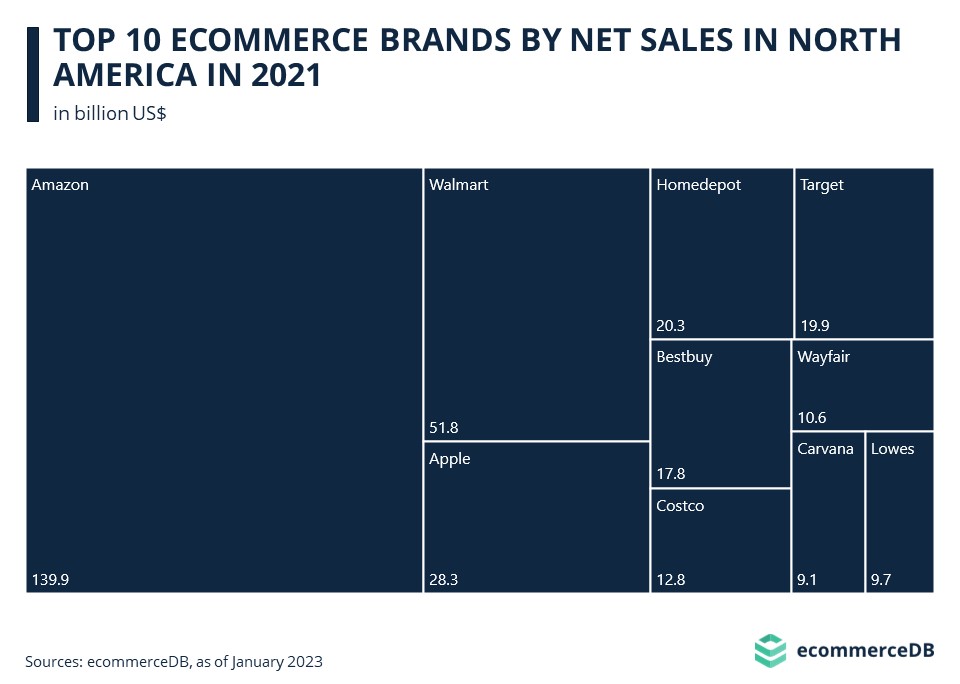

North America has almost broken the US$1 trillion barrier in terms of eCommerce market size in 2022, generating total revenues of US$944 billion from eCommerce. This makes North America the second strongest eCommerce region in the world, beaten only by Asia. This is hardly surprising, as several of the world’s most successful eCommerce brands are founded and headquartered in the United States, from where they spread not only towards the closest neighbors, but across the world. The brand-new ecommerceDB Trend Report “eCommerce in North America” features, among other things, detailed top player analyses in the world’s second largest eCommerce region. These are the top 10:

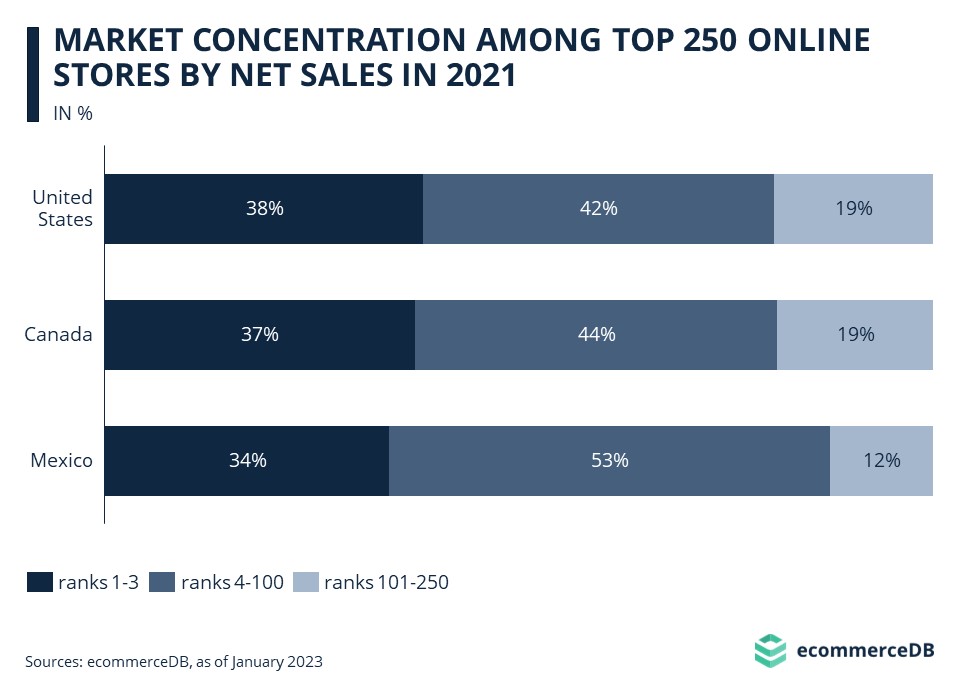

Amazon leads the rankings of top online stores and marketplaces in many countries throughout the world – of course it is also the unbeaten leader in its home market North America. With total net sales of US$140 billion, Amazon is not only far off at the top of the North American eCommerce player ranking, but it also produced higher net sales than ranks 2 to 6 combined and almost 44% of the total top 10 net sales. While ranks 2 and 3, Walmart and Apple, also register substantial leads over their respective followers, ranks 4 to 10 are closer together in terms of total 2021 net sales. The trend of a high market concentration on the top players is also reflected when looking at the top 250:

Market concentration on the top players is strongest in the United States, where 38% of total net sales generated by the top 250 eCommerce players were accounted for by the leading three players Amazon, Walmart, and Apple in 2021. Market concentration in Canada is similar – the leading players Amazon, Walmart, and Costco accounted for 37% of net sales. In Mexico, the situation is more different, with ranks 1 to 3 “only” making 34% of the top 250 net sales and ranks 4 to 100 still contributing a comparably high share of 53%. A look back at the development of the top 250 stores in Mexico however indicates a growing market concentration also in the Latin American country: Between 2019 and 2022, the top 5 players in Mexico grew by 50% and the top 6 to 25 by 60% annually, while the CAGRs for the respective ranks in the U.S. and Canada were below 40%. Get more exciting insights into North America’s eCommerce competitor landscape in the newly released ecommerceDB Trend Report “eCommerce in North America”!

Note: Local URLs such as amazon.com, amazon.ca or amazon.mx have been combined to form the brand Amazon. The other brands follow the same logic.

Related insights

Article

German Drugstore CEO Calls for Legislative Action Against Temu

German Drugstore CEO Calls for Legislative Action Against Temu

Article

Amazon GMV: Which Domains Grew the Fastest?

Amazon GMV: Which Domains Grew the Fastest?

Article

Top Marketplaces in Southeast Asia 2024: Can Shopee Dominate the Region?

Top Marketplaces in Southeast Asia 2024: Can Shopee Dominate the Region?

Article

Zara Statistics: Global Online Sales, Store Count Worldwide & Total Revenue

Zara Statistics: Global Online Sales, Store Count Worldwide & Total Revenue

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Back to main topics