eCommerce: Online Marketplaces

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Online marketplaces provide a direct connection between sellers and their desired customer base, using the platform's infrastructure. Over the past years, Chinese sellers have increasingly entered Western marketplaces, most notably Amazon and eBay.

January 17, 2024Download

Coming soon

Share

Amazon & eBay: China-Based Sellers: Key Insights

More China-Based Sellers on Amazon: According to Marketplace Pulse data, the majority of new Amazon marketplace sellers, 75%, now originate from China, marking a substantial increase from the 47% reported in January 2020.

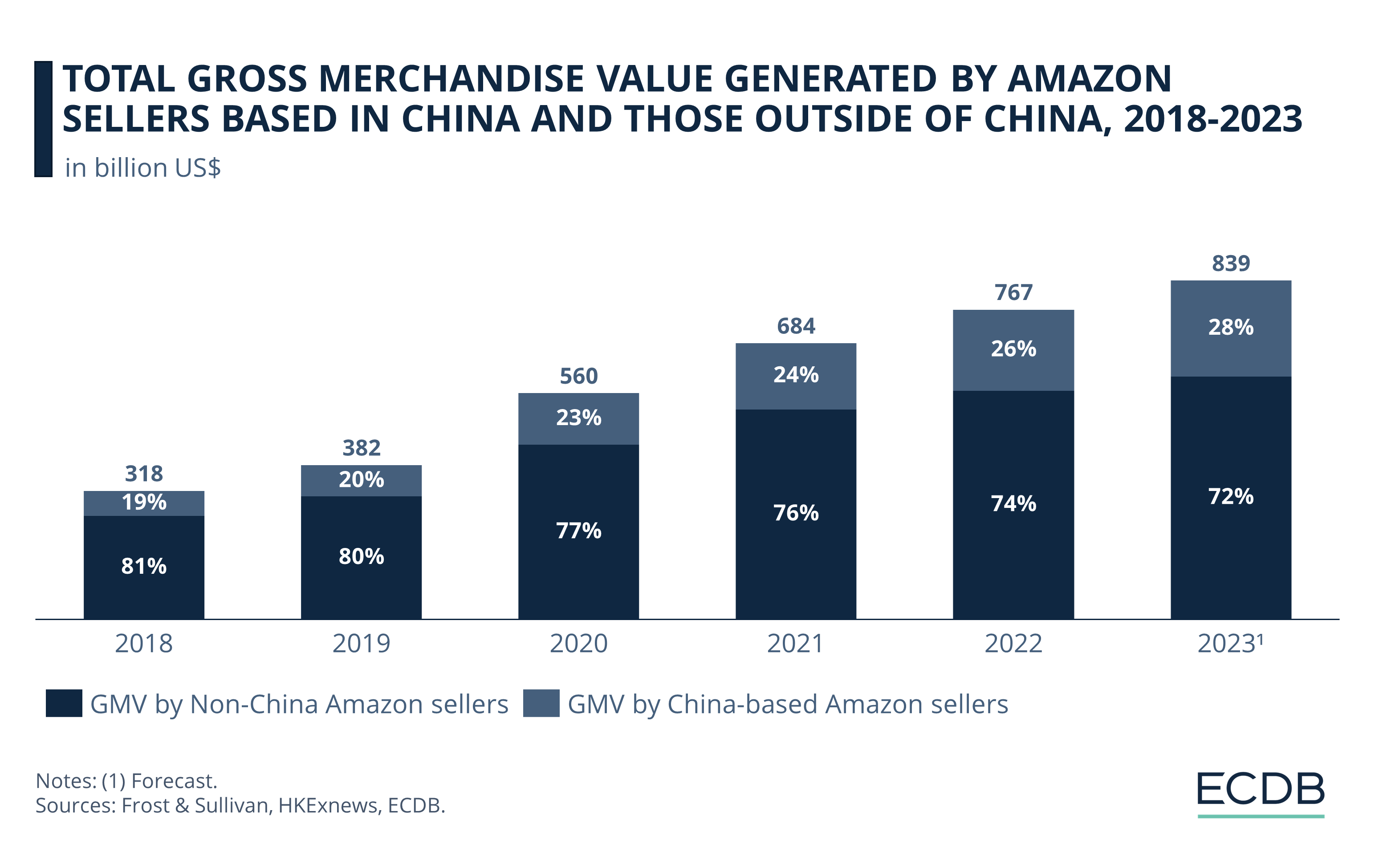

Growing GMV Share: GMV from Chinese sellers has steadily increased pre-pandemic. In 2020, it surged by 64% year-on-year. China-based sellers now constitute over 20% of Amazon's GMV, reaching 28% by 2023.

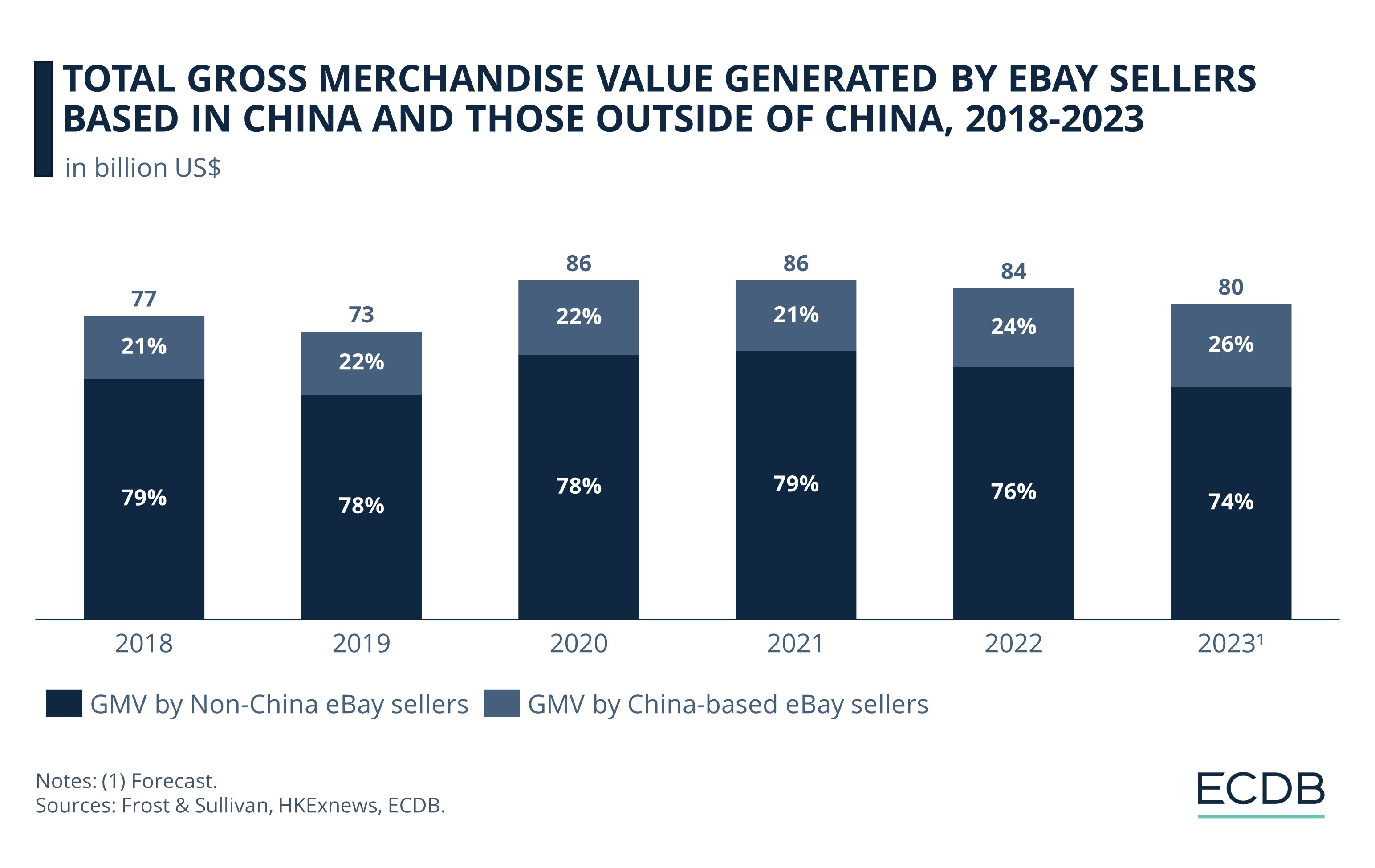

Platform Diversification: In addition to Amazon, Chinese sellers are expanding their presence on platforms like eBay. The GMV share they contribute is similar to Amazon's, indicating a more extensive effort by sellers to diversify their presence across Western platforms.

Sellers in China are increasing their presence on online marketplaces around the world. Third-party platforms are an ideal way for Chinese manufacturers to sell their products directly to consumers in Europe or the U.S. at unbeatable prices.

“[…] Chinese factories who made stuff for Walmart and the likes for the past 20 years now realize they have a shot at building a brand themselves and selling directly to the world, without the intermediary… and we are that vehicle”, wrote former senior vice president of Amazon marketplace Sebastian Gunningham back in 2015.

Since then, the role of China-based sellers on international online marketplaces has become more and more important, with an increasing number of new players from the region entering the business. According to Marketplace Pulse, 75% of new sellers on Amazon's marketplace in January 2021 were located in China, up from 47% in January 2020 and 41% in 2019.

Chinese Producers to Reach 28% of Expected GMV on Amazon by 2023

The data demonstrates that China-based sellers are wielding a growing influence on platform transactions, i.e. GMV (Gross Merchandise Volume). The following chart illustrates their impact in more detail:

The world’s largest marketplace by total GMV, Amazon, has not only seen a steady increase in transactions over the past few years, but the GMV produced by sellers from China in particular has grown. In recent years, China-based sellers are accounting for an increasingly large share of Amazon's total GMV.

In 2018, sellers from China sold a total of US$62 billion worth of products on Amazon, contributing 20% to Amazon’s total GMV that year. Fast forward to 2021, China-based sellers accounted for 24%, representing a GMV of US$164 billion.

The significance of China-based sellers in Amazon's total GMV is projected to persist, with their GMV expected to reach US$238 billion, equivalent to 28.4% of the total, by 2023.

Despite Fluctuating Sales on eBay, the GMV Share of Chinese Sellers Is Set to Grow

But Amazon is not the only international online marketplace on which sellers from China are increasing their presence:

In the case of eBay, the platform's total GMV is volatile and therefore different from Amazon's. However, the impact of sellers based in China is comparable to Amazon's.

eBay’s total GMV has been rising and falling in the years since 2018 and a long-term trend points to stagnation. Still, the share of eBay's GMV accounted for by China-based sellers is growing steadily. Despite declining transaction values across the platform starting in 2021, sellers from China continue to do business on eBay. This is evidenced by their increasing contribution to eBay's total GMV, starting from a 20.9% in 2021 to an expected 26.3% in 2023.

This represents the same share as on Amazon. Of course, when comparing the GMV generated on eBay and Amazon, eBay cannot compete – a possible indication that China-based sellers are positioning themselves broadly across different marketplaces to offset losses on platforms where business is slowing.

Amazon & eBay: China-Based Sellers

Chinese sellers are becoming increasingly influential in global online marketplaces like Amazon and eBay. As these sellers are capturing a growing share of marketplace transactions, they are diversifying their presence across multiple platforms to reach more Western consumers.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics