eCommerce: Transportation

Peak Season of eCommerce & Air Cargo Capacity Crisis

Air freight plays a crucial role in the eCommerce supply chain. Experts predict that this year's peak season will present unparalleled challenges.

Article by Cihan Uzunoglu | October 21, 2024

Air Cargo Capacity Crisis: Key Insights

eCommerce Strains Capacity: eCommerce demand continues to dominate air cargo, with projections showing it could take up to one-third of global air cargo volume by 2027, driving unprecedented capacity constraints.

Rising Freight Costs: Air cargo rates are spiking, especially on Asia-Pacific routes, where prices have increased up to 70%, with no signs of easing due to high demand and geopolitical disruptions.

Long-Term Capacity Issues: Despite strong demand, only a 4.4% increase in new aircraft capacity is expected next year, raising concerns over long-term sustainability and the need for more freighters.

The air cargo industry is bracing for a turbulent end to 2024 as rising demand and capacity constraints intensify competition for freight space, especially in key markets like Asia and Europe.

Air freight operators and general cargo shippers are facing increased pressure from the dominance of eCommerce giants, which have already secured a significant portion of air cargo capacity for the year-end peak season.

eCommerce Growth Intensifies

Air Cargo Capacity Shortage

According to Stefan Krikken, DSV's head of global airfreight, the capacity constraints seen this year are "unprecedented," with eCommerce players driving demand during major shopping events like Black Friday and Singles Day.

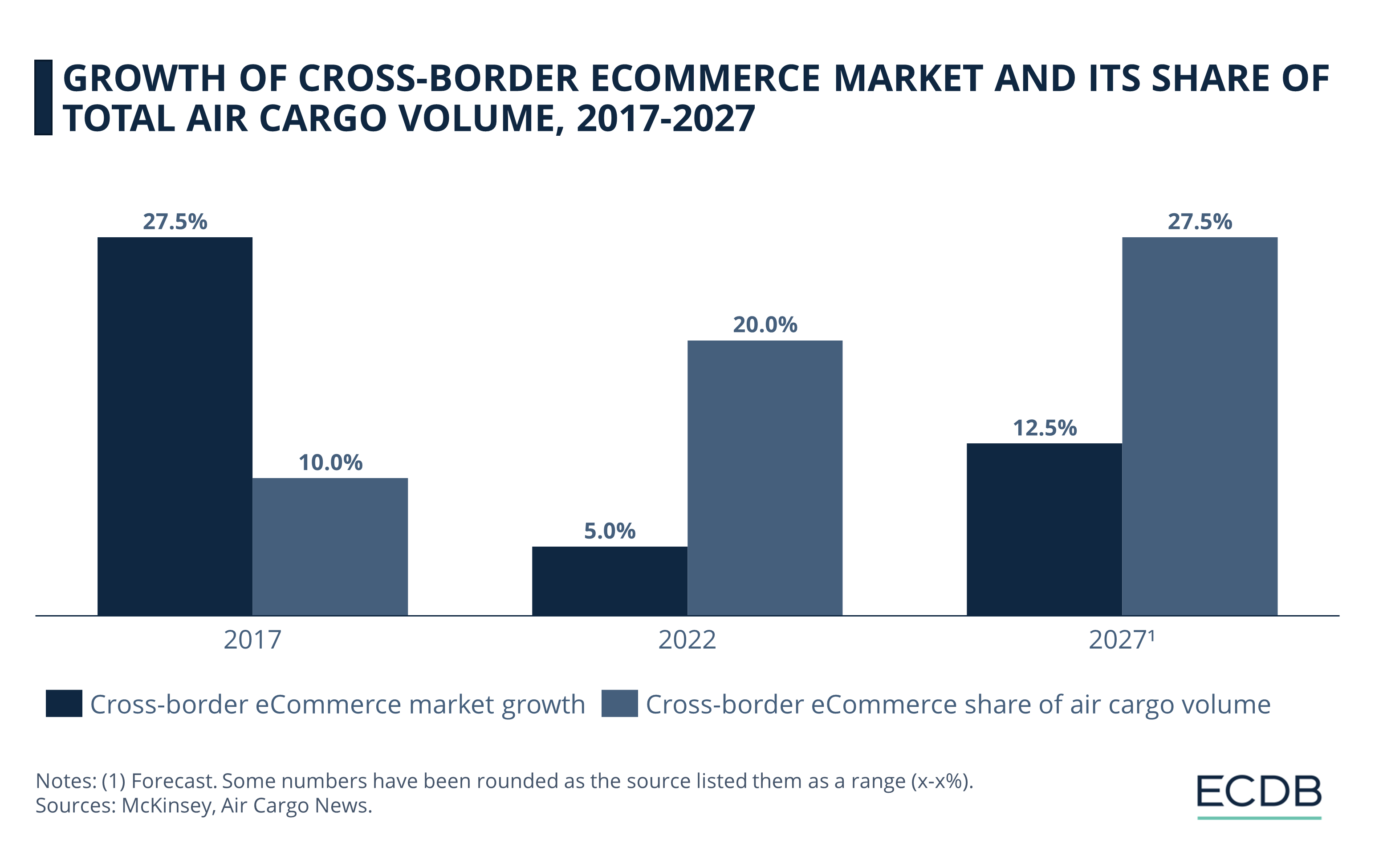

While this is nothing new, the weight of eCommerce in total air cargo volume has been steadily increasing over the past few years and is forecast to continue to do so:

According to McKinsey data, the share of cross-border eCommerce in air cargo volume was 10% in 2017. After the pandemic hit, the share was 20% by 2022.

Projections show that this figure will rise to 25-30% by 2027. This means that eCommerce could account for as much as one-third of global air cargo volume.

The strain on capacity is not just limited to eCommerce-driven demand. The ongoing disruption of sea freight routes, particularly in the Red Sea and ongoing geopolitical issues in Ukraine and the Middle East, is pushing more businesses to rely on air freight, compounding the situation.

Rising Air Freight Rates

With global air cargo demand rising by 13.6% in July year-over-year, carriers are prioritizing routes from Asia, further exacerbating the capacity shortage in other regions. Rates have soared on certain key trade lanes, such as the Asia-Pacific to the U.S., where prices have increased by up to 70% since August.

DHL's market outlook reflects similar concerns, with the company forecasting continued high rates for air cargo through Q4 as demand remains strong despite the overall global economic slowdown. Capacity shortages are expected to persist, especially in Asia, where over 80% of available air cargo capacity has already been contracted by eCommerce companies.

DHL highlights that geopolitical tensions and the threat of additional tariffs in the U.S. and Europe are also pushing businesses to expedite shipments via air, further tightening capacity.

Preparations for the

eCommerce Peak Season

Major freight forwarders like DB Schenker are taking proactive measures to secure capacity ahead of the peak season. This sentiment is echoed by industry leaders like Richard Broekman of Atlas Air, who pointed out that eCommerce companies are better prepared for the peak season, having locked in long-term capacity contracts, while general cargo shippers may struggle to keep up with rising demand.

Despite these challenges, the air cargo industry has shown remarkable resilience. July's figures reflected the 8th consecutive month of double-digit growth in global demand.

Asia Pacific emerged as the dominant region, with a 17% increase in air cargo demand, driven by strong trade along major routes such as Europe-Asia and Middle East-Asia. Meanwhile, Europe recorded a 13% growth, with robust performance on the Middle East-Europe corridor.

Air Cargo Capacity Crisis: Closing Thoughts

The air cargo industry is poised to maintain its rapid growth trajectory, driven predominantly by the expanding eCommerce market. At the recent EU Cross-Border E-commerce Forum, the unprecedented global air cargo growth was emphasized — up 14% year-to-date.

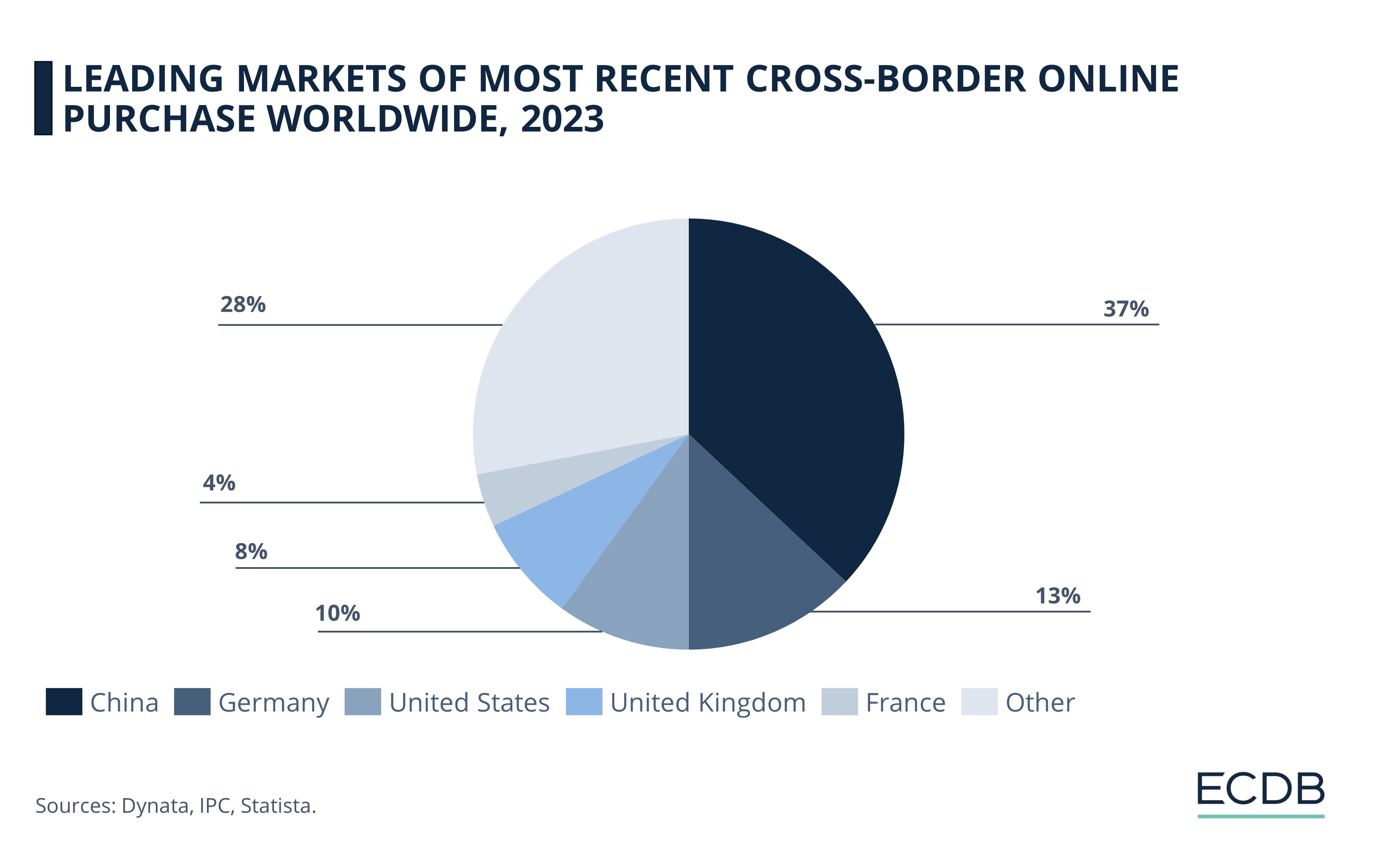

This surge is largely fueled by booming eCommerce exports from China, with annual increases of 22% to the U.S. since 2022, and significant growth in markets such as the EU, Saudi Arabia, South Korea, and Mexico.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Despite these gains, capacity remains a pressing issue, with only a 4.4% increase in new aircraft capacity expected in the coming year. The pressure is intensified by eCommerce events like Singles Day and Black Friday, as well as geopolitical disruptions that could further boost demand. Industry experts caution that the imbalance between outbound and inbound cargo, along with limited fleet growth, could pose long-term sustainability challenges.

At the same time, air cargo companies are adopting longer-term contracts to secure capacity, with deals extending up to six or eight years — a shift from pre-COVID norms. While capacity concerns are front of mind, industry sentiment remains optimistic about continued eCommerce-driven growth, tempered by the need for more freighters and the potential for new customs and tax regulations in key markets like the U.S.

Sources: The Loadstar, Air Cargo News: 1, 2, 3, Freight News, AirInsight, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DoorDash and Uber Eats on the Hunt for the Number One Express Online Delivery Service

DoorDash and Uber Eats on the Hunt for the Number One Express Online Delivery Service

Deep Dive

Regional Carriers Over Larger Shipping Conglomerates in European eCommerce

Regional Carriers Over Larger Shipping Conglomerates in European eCommerce

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

Temu Launched in Vietnam and Brunei, Now Available in 5 Southeast Asian Markets

Temu Launched in Vietnam and Brunei, Now Available in 5 Southeast Asian Markets

Back to main topics