eCommerce: Marketplace Trends in the U.S.

Wayfair and Etsy Struggle in the U.S. Market Because of Temu

Temu has been a huge success in the US market. This is causing even more problems for struggling Wayfair and stagnating Etsy, both of which have seen their GMV's not improve in recent years.

Article by Lukas Görlitz | September 30, 2024Download

Coming soon

Share

Etsy and Wayfair’s Struggle in the U.S.: Key Insights

Etsy and Wayfair Downplay New Threat Despite declining or stagnating sales growth, CEOs from both Etsy and Wayfair appear confident they won't be significantly impacted by Temu.

Temu Potential Expansion for U.S. Sellers: By opening the marketplace to U.S. sellers, Temu can offer a wider variety of products. Low fees and easy listing migration could entice sellers, especially those already on Etsy and Wayfair.

Marketing Success for Temu: While Temu spends heavily on marketing, their organic search traffic is also increasing dramatically from 7.8 million to 20.2 million visits in half a year. Overall Temu is coming close to Etsy’s traffic.

The U.S. market awaits the opening of Temu's marketplace to U.S.-based sellers. A move that would allow furniture and craft sellers to offer their products on the marketplace, which debuted in the U.S. market in September 2022. This competition would put Etsy and Wayfair in a tough spot.

Etsy and Wayfair Struggle to Keep Up

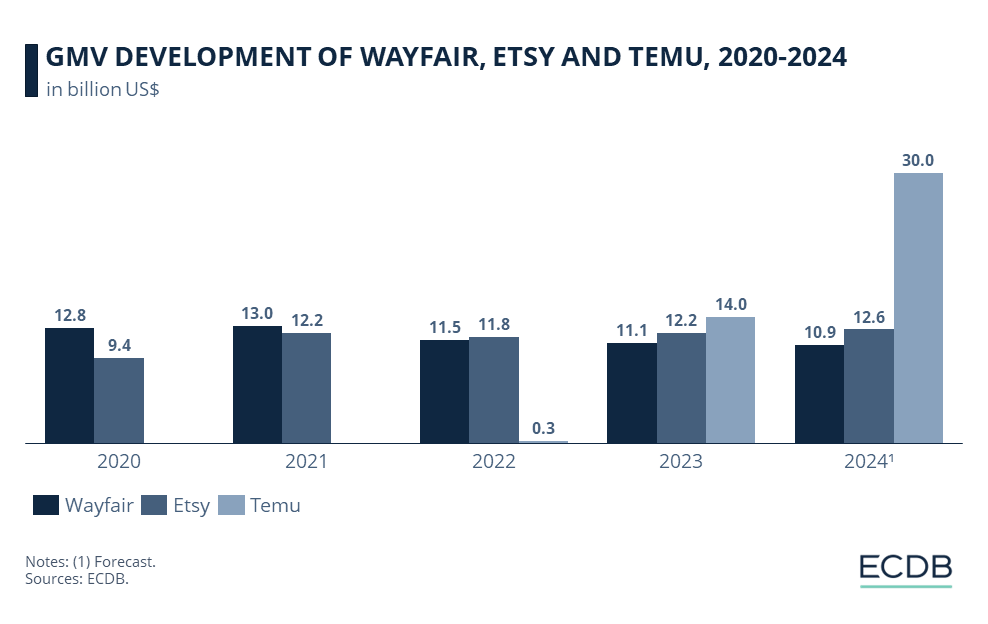

Etsy's GMV has stagnated in recent years. After improving from US$9.4 billion to US$12.2 billion in 2021, its GMV dropped to US$11.8 billion two years later and returned to US$12.2 billion in 2023. Wayfair's GMV declined for the second consecutive year in 2023. After peaking at US$13 billion in 2021, Wayfair faced a decline to US$11.2 billion two years later.

These declining numbers leave both marketplaces vulnerable in their battle with Temu. What are Etsy and Wayfair doing to compete in the U.S. market?

No Concerns About Temu Entering the U.S.

Wayfair CEO Niraj Shah has not seen competition from low-cost sellers like Temu. According to Shah, these marketplaces do not overlap much with Wayfair's product range, as the Chinese online stores compete for low-priced, high-quality products.

While Etsy and Temu's marketplaces compete with their low prices, Etsy, with its DIY focus, is also not afraid of Temu's entry, as CEO Josh Silverman stated at an industry conference in late 2023. According to Silverman, Temu's entry is not seen as "disproportionately impacting Etsy." Silverman may have a different perspective than his own sellers, as top Etsy sellers on a recent panel discussion said they would sell on Temu if the platform allowed them to maintain prices and offered help for sellers to migrate listings in a convenient way.

What is making Temu powerful is that it has been able to offer U.S.-based retailers low merchant fees to gain market share and spend a lot of money on marketing. According to JP Morgan, Temu will spend US$1.7 billion on marketing in 2023 and will increase that spending to US$3 billion this year.

Temu Comes Close to Etsy’s Overall Traffic

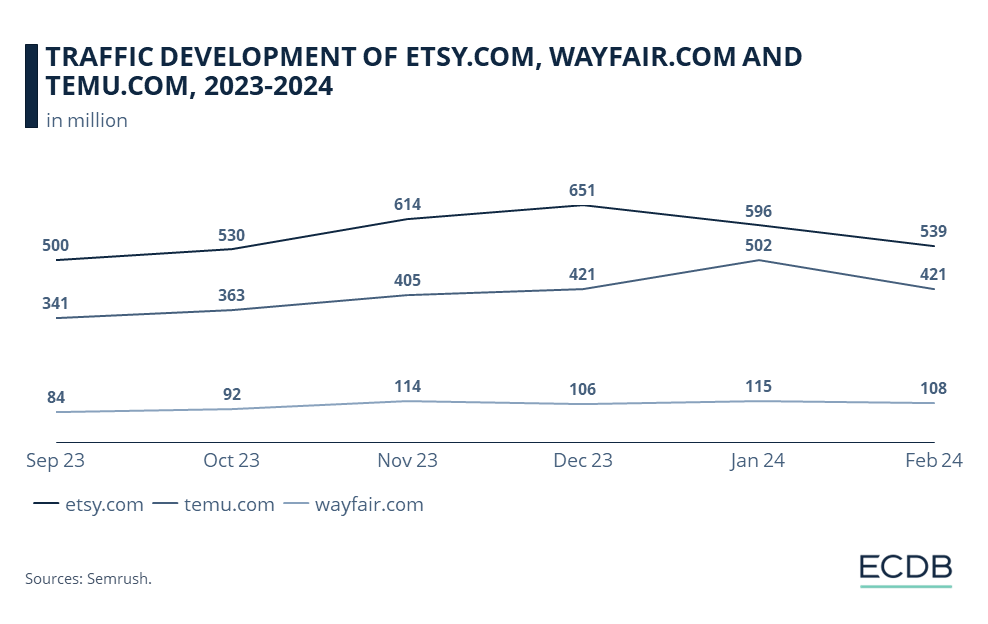

In terms of traffic, temu.com was able to increase its total traffic on all platforms by 80 million visits in half a year. These numbers increased from 341 million in September 2023 to 421 million in February 2024. During this time, temu.com's organic search traffic improved from 7.8 million to 20.2 million – an increase of 159% in six months.

This brings Temu close to the traffic of etsy.com, which had 539 million visits in February 2024 - a smaller increase compared to Temu, which had 500 million visits last September. Meanwhile, organic search traffic dropped from 130 million to 109 million (-16%).

The same is true for wayfair.com, which increased its total views from 84 million to 108 million in the same period, but also decreased its organic search traffic from 19 million to 15 million.

Temu’s Opening for U.S. Sellers

While Temu does a decent job at attracting more traffic on its website, the marketplace its looking to lure sellers from the U.S. too in the future. Low seller fees may be the most crucial factor in attracting those retailers.

Not only the niche marketplace will take a look at Temu's expansion, but also eCommerce giant Amazon, as both marketplaces have overlapping audiences: 92% of users who visited Temu also browsed Amazon in January 2024, according to Similarweb.

Etsy and Wayfair Struggle in the U.S.:

Closing Remarks

Although Temu has been successful in entering the US market, Etsy and Wayfair do not see Pinduoduo's subsidiary as a link to their marketplaces. Meanwhile, Temu is committing and spending billions of dollars on marketing while improving its traffic increasingly.

If Temu decides to open its marketplace to U.S. sellers, the Chinese retailer could gain an edge over its competition with a wider range of products, from handicrafts to furniture, while maintaining low prices. This could force Etsy and Wayfair, which have struggled in recent years, to adjust based on their rival’s success.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics