Suitable payment options are a decisive factor in customer satisfaction and long-term customer retention in the eCommerce field. According to the Statista Global Consumer Survey Content Special on eCommerce, many online shoppers in Germany, for instance, place great importance on payment methods: 41% state that they usually look for a different online store if they cannot use their favorite payment method. Percentages in countries like China, the U.S. or Sweden are similarly high. A great variety of payment options is furthermore among the most important aspects in online stores for U.S. online shoppers. Online stores therefore seem to be well advised to offer a broad range of payment options. Many online retailers are already aware, as a current survey conducted by Paysafe among payment decision makers of small and medium-sized online businesses in eight different countries suggests. Most businesses already offer several different payment methods, with 52% having the impression that COVID-19 even intensified customers’ demand for more payment options. After debit and credit cards, eWallets, direct transfer or cash on delivery – can cryptocurrencies now set foot in the eCommerce world?

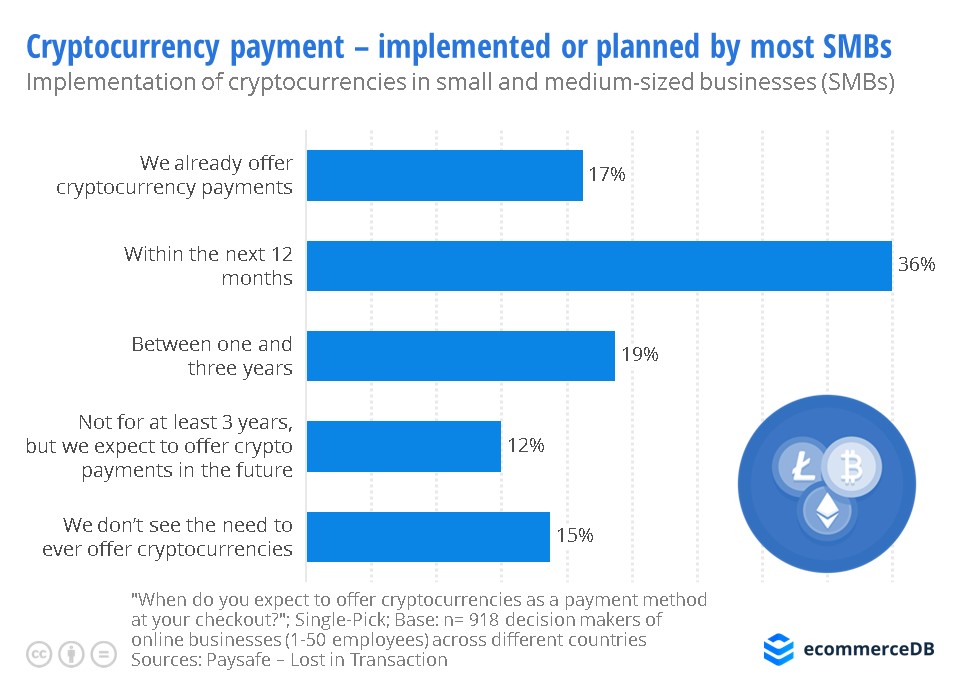

According to the Paysafe survey, it is only a matter of time until cryptocurrencies become a regularly offered payment method in online stores. Out of the decision makers surveyed, only 15% state that they are not planning to offer cryptocurrencies in their online stores in the future at all. 17% already accept cryptocurrencies, but the overwhelming majority of 72% plan to implement cryptocurrency payment at least within the next three years. General attitudes towards cryptocurrency payment are mostly positive:

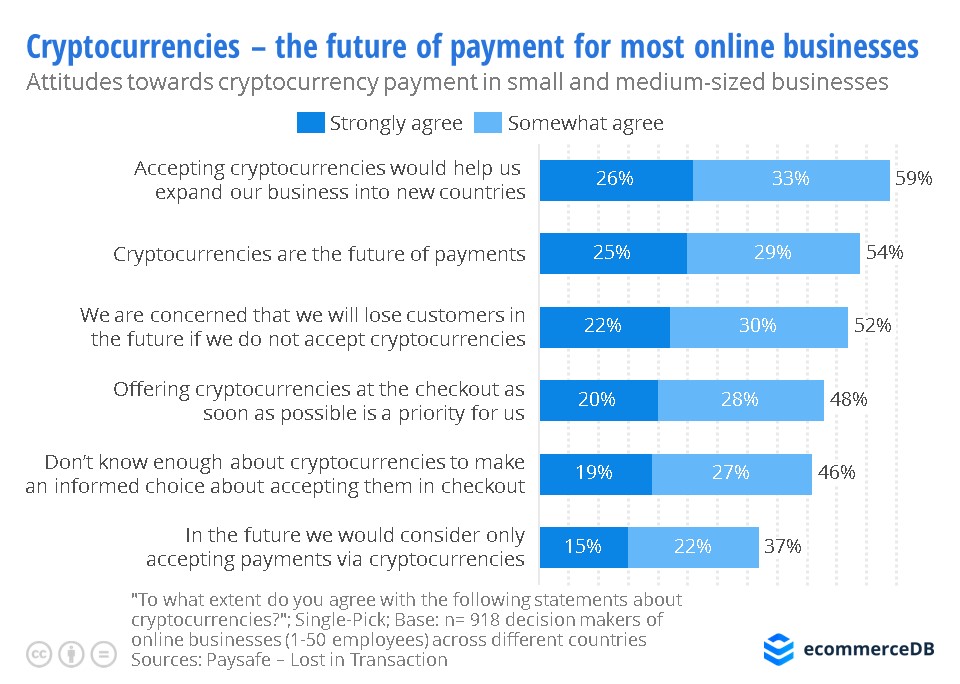

59% of payment decision makers in small and medium-sized online businesses expect the implementation of cryptocurrencies as a payment method to open up new international markets for their businesses. 54% even state that in their view, cryptocurrencies are the future of payments. Another 37% consider exclusively accepting crypto payment in the future. Although these statements show that many online store managers are already very confident with the cryptocurrency topic, some still seem reserved: 46% state that they do not know enough about cryptocurrencies to make an informed decision on whether or not to implement them as a payment method at checkout.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Back to main topics