eCommerce: Payment Methods

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Which online payment methods lead globally, and how can businesses maximize conversions by balancing convenience, security, and cost effectiveness?

October 25, 2024

Top Online Payment Methods: Key Insights

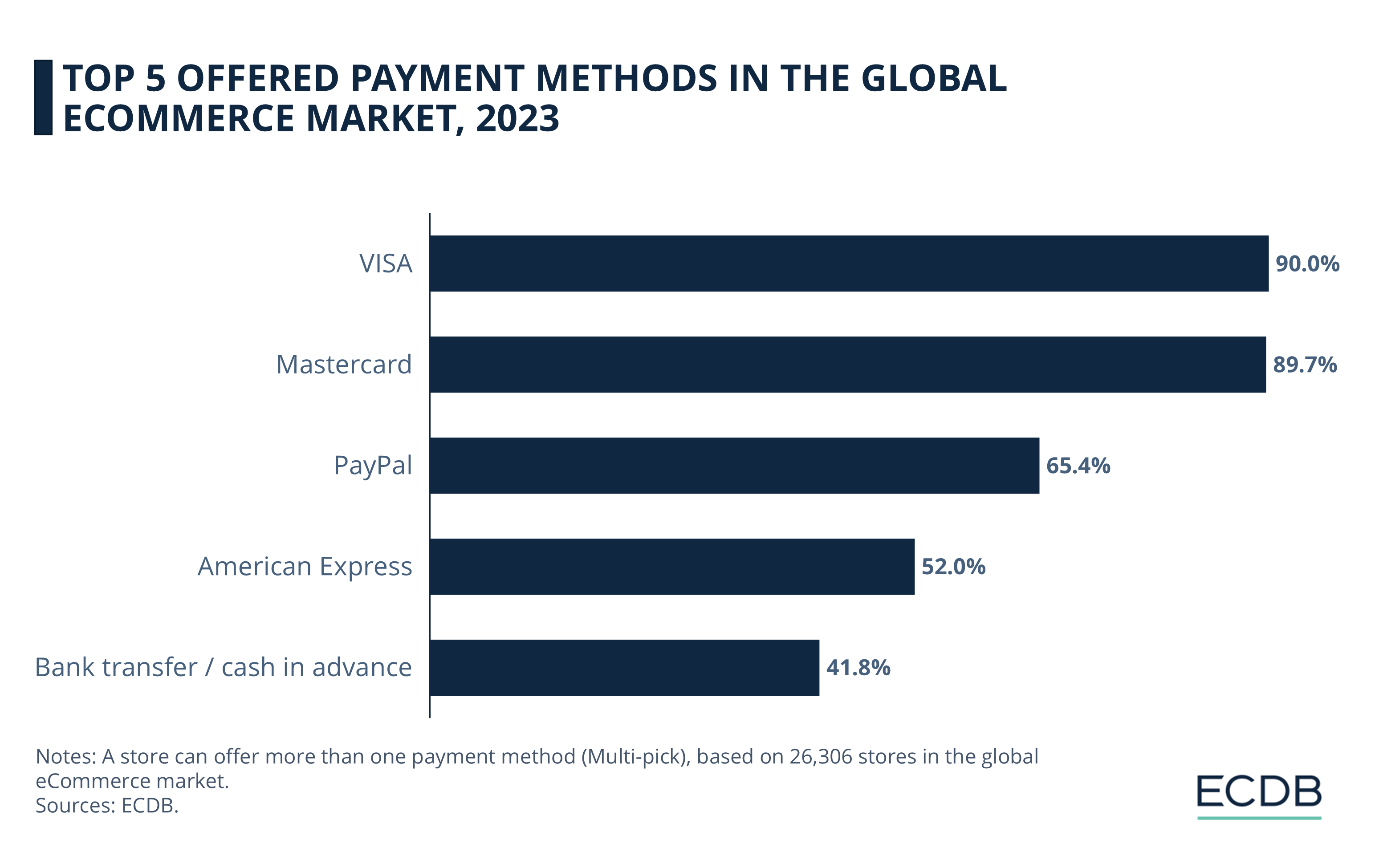

Top Payment Methods: Cards dominate eCommerce payments globally, with Visa leading at 90% usage, followed by Mastercard (89.7%), PayPal (65.4%), American Express (52%), and bank transfer or cash in advance at 41.8%.

Regional Preferences Matter: Offering localized payment options like Bancontact in Belgium or AliPay in China is key to optimizing checkout conversions and meeting regional consumer preferences in global markets.

Optimizing Payments & Future Trends: Businesses must balance convenient options like mobile wallets and BNPL with secure choices like bank transfers. Staying agile is key with emerging trends like blockchain and adapting payment strategies to regional needs and cost considerations.

When shopping online, a variety of payment options are available: cards, eWallets, and even bank transfers.

Visa, for instance, is accepted by 90% of stores—so what makes it so widely used? How do Mastercard and PayPal compare? And how reliable are options like American Express or traditional bank transfers?

For customers, knowing each option's pros and cons helps them choose the most suitable method. For businesses, understanding why certain methods are favored can drive sales. Here’s an in-depth look at why these options are the top picks for online retailers.

Top Online Payment Methods:

Cards Still Lead

Based on ECDB data, cards dominate the top eCommerce payment methods. While eWallets are also popular, more traditional methods like bank transfer and cash in advance are still in use:

Offered by 90% of online stores in our database, the American multinational payment card services company Visa is the leading payment method in the eCommerce market.

Mastercard follows closely at number 2, offered by 89.7%.

The eWallet platform PayPal is used by about two thirds (65.4%) of online stores worldwide.

Another card on our list, American Express, is ranked fourth with 52% usage rate.

Bank transfer / cash in advance rounds out the list, utilized by 41.8% of online stores globally.

Let's take a closer look at each payment method and better understand the market dynamics.

1. Visa

Visa remains a dominant force in the eCommerce payment space, favored by 90% of online stores in our database. The company leverages advanced tokenization technology, which has significantly enhanced transaction security and efficiency. As of 2024, Visa's tokenization has generated over US$40 billion in incremental eCommerce revenue and prevented US$650 million in fraud.

Tokenization: A security process that replaces sensitive payment information, like credit card numbers, with a unique identifier or "token." This token is used during transactions, making the actual payment data virtually inaccessible to hackers. Essentially, even if the token is intercepted, it is useless without the corresponding payment information, which remains securely stored by the payment provider.

Visa's commitment to innovation extends to its infrastructure, promoting a more seamless and secure transaction process. Their tokenization replaces sensitive payment information with cryptographic keys, making digital transactions safer and boosting approval rates globally. Currently, 29% of all Visa transactions use tokenization, reflecting its widespread adoption.

In addition to security, Visa's interoperability efforts have transformed the payment experience by integrating various payment methods and networks. This ensures that Visa remains a top choice for both consumers and merchants, providing convenience and reliability in every transaction.

2. Mastercard

Mastercard also holds a prominent position in the eCommerce payment arena, accepted by 89.7% of online stores globally. This widespread acceptance is due to Mastercard's innovative approach to digital payments, which focuses on security, convenience, and cutting-edge technology.

One of Mastercard's key innovations is its tokenization technology: Mastercard aims to achieve 100% eCommerce tokenization in Europe by 2030, enhancing both security and user experience.

Old Rivalry: The competition between Visa and Mastercard goes back to 1950s: Visa was founded in 1958 by Bank of America as the BankAmericard credit card program, in response to competitor Master Charge (now Mastercard).

Mastercard is also leveraging artificial intelligence (AI) to further revolutionize the payment process. AI is used to enhance security measures, detect fraudulent activities, and personalize user experiences. In 2023, Mastercard's AI-driven systems protected over 125 billion transactions.

Additionally, Mastercard is at the forefront of the open banking movement. Through partnerships with companies like Nexi, Mastercard is facilitating seamless, secure account-based payments across Europe. This technology allows consumers to initiate payments directly from their bank accounts, enhancing speed and security.

Mastercard's dedication to innovation extends to embracing new payment methods such as contactless payments, biometrics, and digital currencies.

3. PayPal

Another key player in eCommerce payment, PayPal is used by 65.4% of online stores globally. Known for its ease of use and strong security, PayPal offers a variety of features that enhance the shopping experience. It supports multiple payment methods, including credit cards, debit cards, and bank transfers, and integrates seamlessly with major eCommerce platforms like Shopify and WooCommerce.

Security is a top priority for PayPal, with encryption and fraud detection tools protecting transactions. PayPal also provides buyer and seller protection policies to cover eligible transactions in disputes or fraud cases. The platform’s Buy Now, Pay Later option has grown significantly, appealing to consumers seeking flexible payment solutions.

With a presence in over 200 countries and support for multiple currencies, PayPal enables businesses to reach a global audience, making it an essential tool for international eCommerce.

4. American Express

American Express, often referred to as Amex, boasts acceptance in over 130 countries worldwide. The higher spending power of Amex cardholders makes it particularly appealing to premium and high-end brands.

To safeguard customer data and prevent fraud, Amex uses advanced security measures including encryption, tokenization, and multifactor authentication. The SafeKey 3D Secure feature further enhances security for online transactions.

With Visa, Mastercard and American Express ranked 15th, 21st and 68th respectively, these top eCommerce payment providers are among the largest companies worldwide by market cap.

American Express provides a range of financing solutions, such as the "Plan It" feature, which allows cardholders to pay off purchases in installments. This option can help boost sales by making high-value purchases more affordable.

Amex also delivers detailed transaction reports and data insights, enabling merchants to better understand customer behavior and tailor their marketing strategies effectively.

5. Bank Transfer / Cash in Advance

Bank transfers and cash in advance are traditional eCommerce payment methods. Bank transfers involve the direct transfer of funds from a shopper’s bank account to a merchant’s account, initiated either online or offline. This method is straightforward and accessible to anyone with a bank account. However, it requires the shopper to initiate the transfer and wait for the funds to be received before the merchant processes the order.

Cash in advance necessitates that buyers pay for goods before they are shipped. This method places the financial risk on the buyer but ensures that the seller receives payment upfront, making it a secure option for merchants. It is commonly used for low-value orders and in markets where credit and debit card usage is limited.

Both methods can offer high security, particularly in reducing the risk of chargebacks, but they are not entirely free from fraud risks. Bank transfers are generally irreversible, which can protect merchants but can also expose buyers to potential fraud if the merchant does not deliver the goods. Similarly, cash in advance transactions can be risky for buyers if the seller is not trustworthy. These methods also reduce the need for intermediaries, potentially lowering transaction costs, although the additional steps and waiting periods can be less convenient for customers.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Top Online Payment Methods in

Top eCommerce Markets

Looking at the use of these top eCommerce payment methods (by number of online stores) in the top eCommerce markets, we see the dominance of the United States.

The study from Statista and BuiltWith shows that the U.S. market has the highest number of online stores using each top payment method. While the UK has the second count for each top payment method, Japan comes in third.

What about the internal eCommerce payment dynamics of each top market?

Local eCommerce Payment Methods Dominate

in China and South Korea

While local players like Ali Pay (used by 72% of online stores), WeChat (61%) and Union Pay (31%) are popular in China (with both Visa and Mastercard at 31%), the eCommerce payment method usage in the United States reflects the global trend closely: Visa with 96%, Mastercard 95%, American Express 90% and PayPal at 77%. The only different payment provider in the top 5 eCommerce payment methods in the U.S. is Discover Card (81%), a credit card by the American chain of department stores Sears.

Like the U.S., the UK market is also in line with the global trend in regards to top eCommerce payment methods: Both Visa and Mastercard are used by 97% of online stores, PayPal and American Express follow with 82% and 61% respectively. Apple Pay sticks out as the top 5th payment method in the country, with 19% of online stores in our data base utilizing the payment method.

South Korea differs from other markets in the top 5, as bank transfer / cash in advance is the top eCommerce payment method by far (85%). While local payment solutions Kakao Pay (39%) and Naver Pay (35%) are also in the top 5, instant bank transfer (37%) and Payco, the U.S. based limited liability company (33%), are other popular payment methods.

eCommerce payment trends in Japan stand close to those of the U.S. and UK: Visa and Mastercard are at the top with 95% and American Express has a usage rate of 88%. Tokyo-based credit card company JCB (Japan Credit Bureau) is at number 3 with 92%, while the American charge card company Diners Club is the top 5th eCommerce payment method.

Regional Payment Preferences

Different regions have distinct payment preferences, which can impact the success of an online store.

In the Asia-Pacific (APAC) region, mobile payments dominate. Platforms like AliPay and WeChat Pay are essential for accessing Chinese consumers, while GrabPay caters to Southeast Asia’s growing digital economy. Afterpay is a key BNPL option in Australia and New Zealand.

In Europe, each country has its own favored payment methods. Bancontact leads in Belgium, Blik is popular in Poland, and Twint dominates Switzerland. These localized methods are crucial to reduce friction at checkout.

In Latin America, cash-based methods like Boleto in Brazil and OXXO in Mexico still hold strong, as large segments of the population remain unbanked. Meanwhile, PIX in Brazil is rapidly gaining ground due to its efficiency in online transfers.

The Middle East is largely card-dominated, with Mastercard and Visa leading, but local networks like BENEFIT in Bahrain and KNET in Kuwait are equally important for reaching customers there.

Convenience vs. Security in Payment Choices

Customers often choose payment methods based on convenience and security. Mobile wallets like Apple Pay and Google Pay provide ease of use, particularly with younger shoppers who value quick transactions. However, traditional payment methods like bank transfers and invoices are still trusted for their security, especially in Germany, where invoice payments are the second most popular method.

Businesses need to strike a balance. Offering convenient options like mobile wallets and BNPL increases impulse purchases, while providing secure alternatives like bank transfers and invoice payments can build trust with cautious buyers.

Practical Payment Strategies for Businesses

For businesses looking to optimize their payment options, a few strategic moves can enhance both customer satisfaction and profitability.

Local Adaptation: Offering the right payment methods based on regional preferences is key. In Germany, this means including PayPal and Klarna for familiarity and trust. In Latin America, options like OXXO and PIX are necessary to reach a broader audience.

Recurring Billing: Businesses that offer subscription services should consider recurring billing via autopay. This reduces churn by automating payments, ensuring consistent revenue and minimal disruption for the customer.

Cost Efficiency: It’s essential to be aware of payment processing fees. Credit card fees can reach up to 3.5%, while mobile wallets and bank transfers often carry lower fees. Streamlining to more cost-effective methods without sacrificing customer choice can help protect margins.

Businesses that understand these elements and tailor their offerings accordingly will be better positioned to increase conversion rates and maintain long-term growth.

Emerging Payment Trends & Future Outlook

eCommerce payment space is rapidly changing. BNPL services like Klarna and Afterpay are expanding, particularly in Europe and APAC, where customers are looking for more flexible ways to pay. Meanwhile, mobile wallets are gaining traction worldwide, especially with younger generations who prefer the ease of contactless payments.

Over time, the adoption rates of payment methods will shift. For example, while Apple Pay and Google Pay are slowly gaining ground in Germany, they are already widely accepted in Switzerland and Austria. Businesses need to stay agile and be ready to incorporate these methods as consumer habits evolve.

Looking ahead, the integration of blockchain technology and cryptocurrencies into mainstream payment systems may further alter the way businesses handle payments, offering new opportunities for security and transparency.

Sources: Visa: 1, 2, Mastercard: 1, 2, 3, 4, PayU Global, Adyen, Amex, Stripe, The Paypers, CompaniesMarketCap, Statista: 1, 2, 3, 4, Adyen, Shopify, Billwerk+, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Back to main topics