eCommerce: Payments in China

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

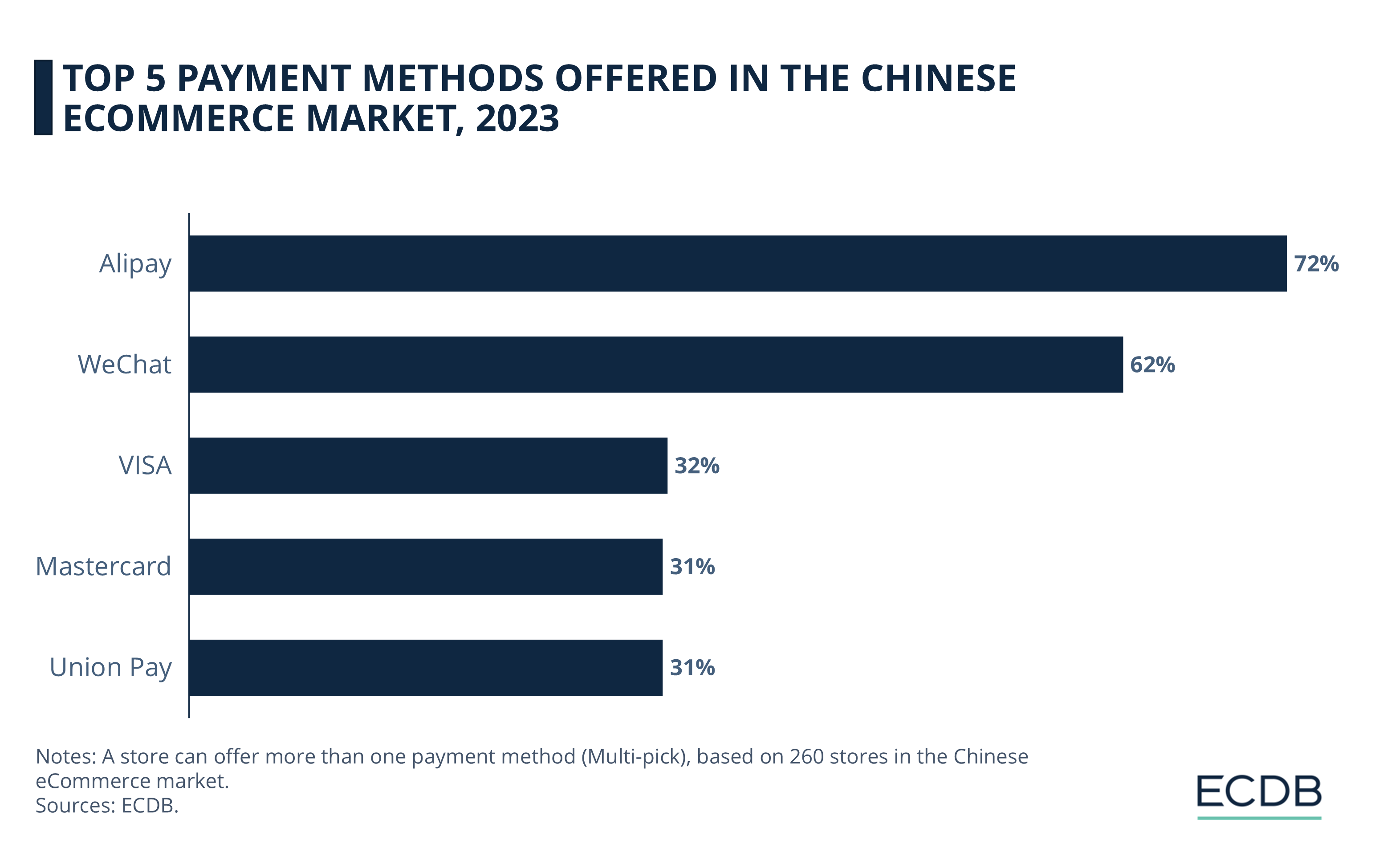

China’s top eCommerce payment methods in 2024 show digital wallets dominating, with Alipay and WeChat Pay leading, followed by Visa, Mastercard, and Union Pay.

Article by Nashra Fatima | October 25, 2024

eCommerce Payments in China: Key Insights

Digital Wallet Preference: China’s eCommerce market shows a clear tilt toward digital wallets, with Alipay and WeChat as top choices, while traditional methods like bank transfers see far less use.

Local Leaders: Alipay and WeChat Pay dominate digital transactions in China with usage rates of 92% and 86%, while Union Pay’s card-based model trails in a market favoring digital solutions.

Foreign Players: Visa and Mastercard have made travel transactions easier by partnering with Alipay and WeChat, reducing fees, and implementing tokenized security to streamline payments for international visitors.

What's in a digital wallet? It's more than just a digital cash substitute: it offers convenience, security and flexibility. As the fastest growing payment method in the world, digital wallets are transforming eCommerce, with China at the forefront.

What are the top five eCommerce payment providers in China? How do local giants like Alipay and WeChat stack up against international options like Visa and Mastercard? We explore the topic with data to show how Chinese consumers' payment preferences have evolved.

Top Payment Methods in China’s eCommerce Market

Our ECDB data shows that China's eCommerce market has largely shifted from cash to electronic payment methods. Digital wallets, particularly local options, lead the way, with traditional methods lagging behind.

Alipay leads with 72% acceptance, WeChat follows at 62%, while Visa, Mastercard, and UnionPay are accepted by 31-32% of stores.

Traditional payment options like bank transfers are uncommon, as cards, though less popular, are often linked to digital wallets for reloads.

Unlike in the U.S. and Europe, where Visa and Mastercard dominate eCommerce, Chinese consumers prefer local wallet-based options, underscoring China’s digital shift.

Here's a closer look at the top eCommerce payment methods in China.

1. Alipay

Launched in 2004 by Alibaba Group, Alipay spearheaded the digital payment revolution in China. Today, it is one of the most popular payment platforms in the world. The app uses cutting-edge technology like QR codes and facial recognition to initiate payments. In February 2024, Alipay drew nearly 660 million Monthly Active Users (MAUs) in China.

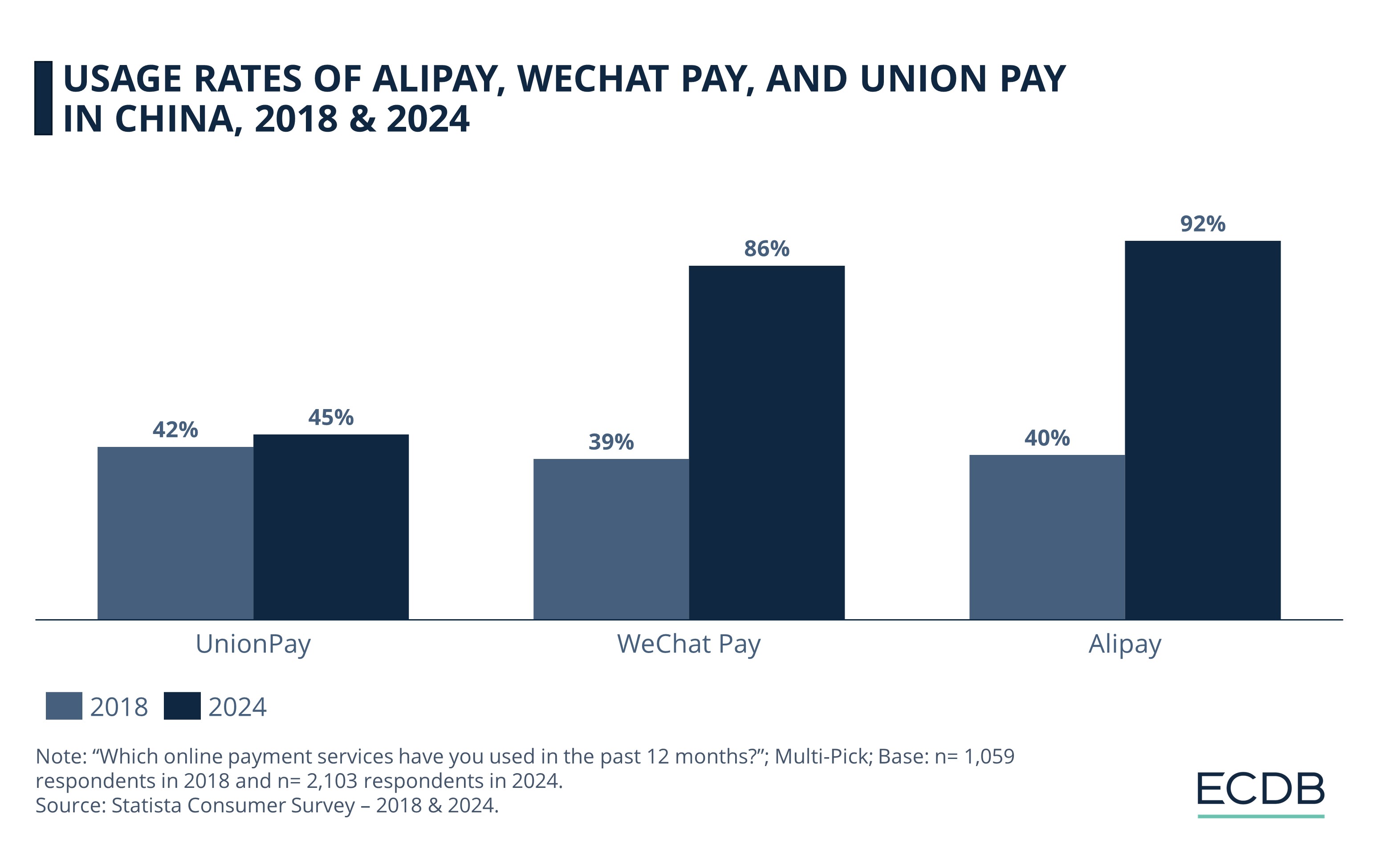

China’s transition to a cashless society is led by third-party payment providers – in particular, Alipay and WeChat. The usage rates of these wallets between 2018 and 2024 show their growth trajectory:

In 2018, Alipay was used by 40% of Chinese consumers who had used any online payment method in the past year. At this time, Alipay was the second most used service in China, behind Union Pay and slightly ahead of WeChat Pay.

Its usage soared in the intervening years, which catapulted this digital wallet to the top of China’s digital payment space.

In 2024, 92% of respondents report using Alipay, underscoring the central role it has come to play in consumer transactions.

2. WeChat

Developed by tech giant Tencent, WeChat Pay is part of the all-rounder messaging and social media app WeChat. The app has become an indispensable part of life in China, where it has a massive user base: 1.4 billion MAUs, as of March 2024. It is also used in other markets including Malaysia, India, and Russia.

WeChat’s widespread adoption facilitates the use of WeChat pay for eCommerce transactions and other purposes like bill payment, transportation, and tourism. WeChat Pay also provides cross-border payment service, meaning Chinese consumers can use it to pay foreign vendors in a variety of currencies for their cross-border purchases.

In the survey mentioned in the previous section, 86% of respondents chose WeChat Pay, making it the second most preferred online payment service among Chinese consumers. The popularity of this mobile wallet has increased significantly since 2018, when it ranked third and was used by only 39% of respondents.

3. VISA

Visa is accepted by 32% of eCommerce stores in China, making it one of the top foreign card options. In an effort to encourage wider use, the Payment & Clearing Association of China recently proposed a transaction fee cut for Visa, Mastercard, and other global cards from 2-3% to 1.5%, aiming to reduce merchant resistance due to high costs.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Visa also enhanced its security in China with tokenization, which replaces card numbers with digital tokens to reduce fraud risk and maintain a smooth user experience. Additionally, Visa partnered with WeChat, allowing foreign visitors to use Visa credit cards linked to the app, enabling easier mobile payments during travel in China. This effort aligns with China's recent push to make payments more accessible to international tourists by expanding support for foreign cards across its retail network.

4. Mastercard

Mastercard ranks among the top foreign payment methods in China’s eCommerce sector, with significant growth driven by its expansion in the local market.

Since gaining regulatory approval, Mastercard has launched over 50 domestic card programs in collaboration with local banks, allowing Chinese consumers to make secure payments worldwide. To ease transactions for international tourists, Mastercard partnered with Alipay and WeChat Pay, enabling users to link foreign-issued Mastercard cards to these digital wallets. In addition, its Tap and Go feature in Beijing’s subway system helps inbound tourists by supporting contactless payments, enhancing accessibility across popular travel hubs.

5. Union Pay

State-owned Union Pay, also called China Union Pay (CUP), ranks fifth, offered by 31% of online stores in China. Going back to the Statista data we discussed earlier, 42% of respondents who were using online payment methods chose Union Pay in 2018, when it ranked first in China. In six years, Union Pay’s usage climbed by only 3 percentage points. Its growth is dwarfed by the meteoric rise of Alipay and WeChat Pay.

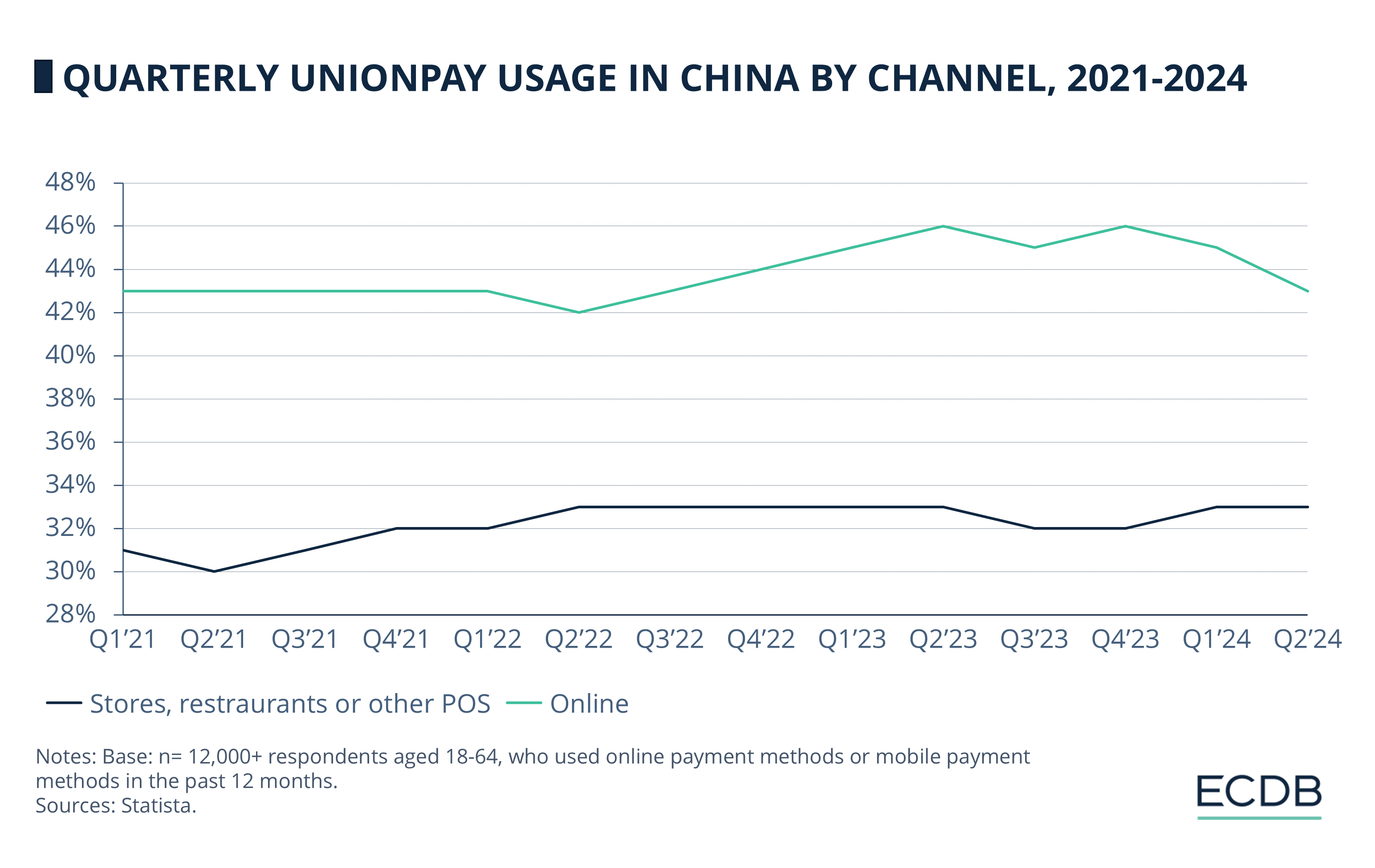

UnionPay usage data from 2021 to 2024 highlights its steady role in both in-person and online transactions:

In-Person Transactions: Usage at physical locations, such as stores and restaurants, has remained stable, ranging between 30% and 33% over the last three years.

Online Transactions: UnionPay’s online usage fluctuated slightly, peaking at 46% in Q4 2023, with recent quarters showing a decline back to 43% in mid-2024.

Union Pay offers online as well as mobile payment solutions, but its focus is on card-based payment. It offers many types of cards including debit, credit, and prepaid cards. Recently, it has partnered with over 60 online merchants to facilitate online payment through Union Pay cards for multiple use cases including eCommerce, ride share, and travel.

China’s Payment Dilemma: To Go Cashless or Not?

From the last decade, China was on the path to becoming a cashless society, leading the world in digital payment adoption. This transition, occurring against the backdrop of rising internet and smartphone penetration, is a boost for eCommerce.

The Chinese government played an instrumental role in promoting cash-free transactions. The regulatory environment for digital payment is supportive. A digital currency – the digital yuan or e-CNY – was also launched in 2019 to replace physical bank notes. Overall, this support was so successful that most businesses, from retail giants to street vendors, began to refuse cash payments.

But this move exposed problems accompanying the digital shift. The elderly demographic in China, with less technological literacy, still preferred paying in cash. Moreover, tourists and international traders who do not have Alipay or WeChat accounts struggled with making transactions, as they could not open accounts without extensive documentation.

To address the issue, the Chinese government recently fined several businesses that refused to accept cash. Alipay and WeChat also allowed overseas users to link their international cards to their digital wallets in 2023, in a bid to lower the barriers foreigners faced in China.

Such measures do not indicate that China is reverting to a cash-dominant economy, but they signal a slowdown in China’s complete shift to digital payments. The state’s renewed emphasis on cash acceptance shows that China is aiming for a comprehensive payment ecosystem. Digital wallets are projected to reign, but cash is unlikely to go out of the picture any time soon.

Sources: PYMNTS, WorldPay, Finance Magnates, CNBC, SCMP, Yicai Global, China Daily: 1, 2, Mastercard, CNN, PaymentsJournal, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Back to main topics