eCommerce: Video Games, Social, Venture Capital

Tencent Holdings: Business Model, Strategy & Latest Revenue

Tencent announced in its quarterly earnings report for Q2 2024 that the last three months signaled a recovery from the slowdown of previous years. Here is what there is to know about the Chinese tech conglomerate.

Article by Nadine Koutsou-Wehling | September 25, 2024

Tencent Holdings Business Model: Key Insights

Ecosystem Applications: Tencent's most prominent applications are QQ and WeChat. They both have become expansive ecosystems where users spend most of their time.

Gaming Investments Part of Diverse Portfolio: The conglomerate invests heavily in domestic and international businesses, taking a special part in the video games industry. But it doesn't stop there: Tencent's investment portfolio is highly diversified.

Revenue Recovery in 2023 and 2024: After a slowdown in 2022 due to macroeconomic developments and the regulatory landscape, Tencent managed to regain revenue growth in 2023 by cutting costs and improving its platform functionalities. This dynamic continues into 2024.

Tencent Holdings published its second quarter 2024 results, which showed renewed growth after slower years, especially in Chinese domestic gaming paired with an ambitious online retail strategy. 2023 saw an increase in revenue on the one hand, but a decrease in profit on the other. The China-based conglomerate recovered from 2022's revenue losses, after being significantly impacted by regulations imposed by the Chinese government on the tech and gaming industries to limit their negative impact on consumers.

In Q2 2024, revenues were up 8% to US$22.6 billion. All profit metrics were up more than 20%. This is believed to be due to "substantial increases" in the video shopping experience due to enhanced recommendation algorithms and better local content, which is more engaging to users.

Tencent is best known for its ecosystem around the multifunctional WeChat application. Before reviewing Tencent's revenue performance over the past few years, it is important to consider its business structure.

What Is Tencent’s Core Business?

Tencent Holdings is the world’s largest video game provider and belongs to the top-notch social media and venture capital businesses.

Tencent QQ

The corporation was founded in 1998 using technology based on an early web communication application called ICQ, which was developed into Tencent’s own version, QQ. It allowed users to chat online with a free account and was easy to use, which accounted for its rapid success. Since then, QQ has evolved into a multi-layered online platform for gaming, social networking, microblogging and online shopping.

WeChat (Weixin)

The other popular application is WeChat, which was launched years later in 2011. It is similar in nature to WhatsApp, but at the same time, WeChat encompasses significantly more functionalities, including beyond messaging and social media, its own payment application, marketplace, live commerce, gaming features, and more.

Due to its variety of functions, WeChat is commonly referred to as an ecosystem rather than an application, since it invites users to conduct virtually all of their daily business on the platform. Not without reason, WeChat boasts over 1.3 billion active users, resulting in a penetration rate of about 95% of the Chinese population.

WeChat’s features include

Moments: A social media interface that displays a timeline where users can post updates, share media, and write blog posts.

WeChat Pay: Digital wallet application with mobile payment and money transfer capabilities. Cashless transactions have become the norm with the high usage rate of WeChat Pay, as users pay for everyday commodities like groceries and utility bills through the app.

Official Accounts: Companies can set up storefronts and a dedicated marketing channel on WeChat, where they can interact with consumers and sell products. After becoming indispensable during the pandemic, many merchants kept the feature even after the restrictions ended because of its high profitability.

Other services include ride-hailing, translators, photo-editing tools, games, video streaming and more.

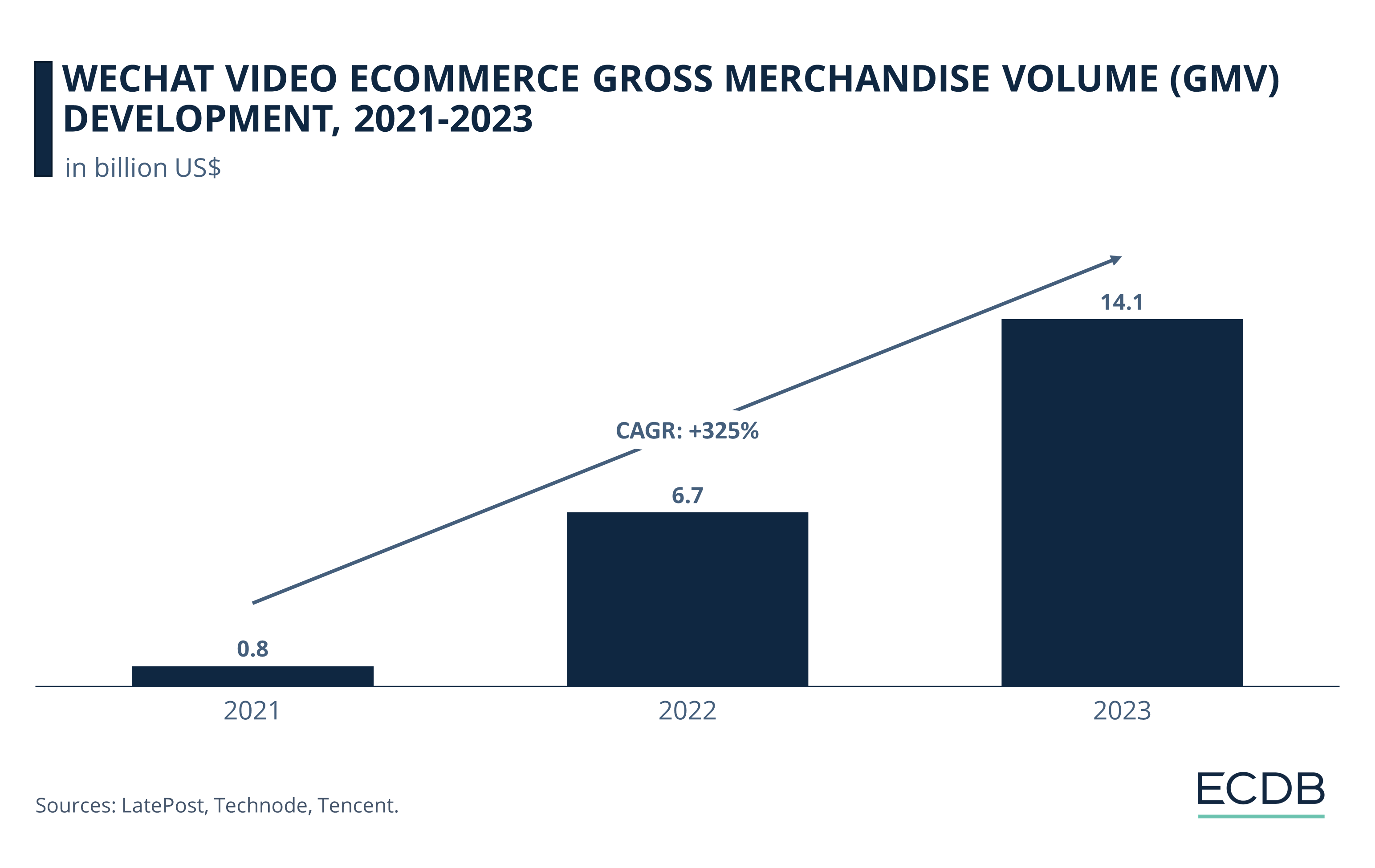

In particular video eCommerce, or livestreaming commerce, is a lucrative feature on the app. The explosive growth of GMV (gross merchandise volume) on WeChat’s video feature in recent years can be seen in the chart below:

With application transactions of US$800 million in 2021, activity more than tripled each year on average, reaching US$6.7 billion in 2022 and then jumping to US$14.1 billion in 2023.

Additional Businesses

In addition, Tencent operates various platforms for television and video on demand, music streaming, video streaming, virtual reality, its own search engine and web browser, as well as ventures in healthcare and insurance. Through its platforms, Tencent makes money from online advertising and financial and business services, including payments, wealth management, cloud services, logistics, and loans.

Indeed, all facets of life are covered by Tencent’s far-reaching ecosystem.

But it is not restricted to these segments. Rather, the conglomerate is also known for its extensive investment portfolio.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

Tencent Investments: Video Games, Social Media, Innovators

Tencent is known to be an avid investor in various economic sectors, including both international and domestic markets. Widely recognized as an extensive investor in gaming companies, its portfolio also includes social media companies and technology innovators.

Some of the most prominent include

Video game companies Funcom, Riot Games, Digital Extremes, Sumo Digital, where Tencent owns 100% of the company.

Other video game companies in the portfolio with smaller stakes are Activision Blizzard, Epic Games, Frontier Development, Grinding Gear Games, and Ubisoft.

eCommerce companies JD.com and Pinduoduo, of which Tencent owns respective shares of 18% and 16.5%.

Social media companies Snapchat (12%), Reddit (11%) and Discord (unknown).

Automaker Tesla (5%).

Music streaming platform Spotify (7.5%).

Tencent’s investments are a testament to its strategic approach, which emphasizes security through diversification and expansion into different markets. By owning stakes in innovative companies, Tencent always has access to the latest technological advances and benefits from financial returns.

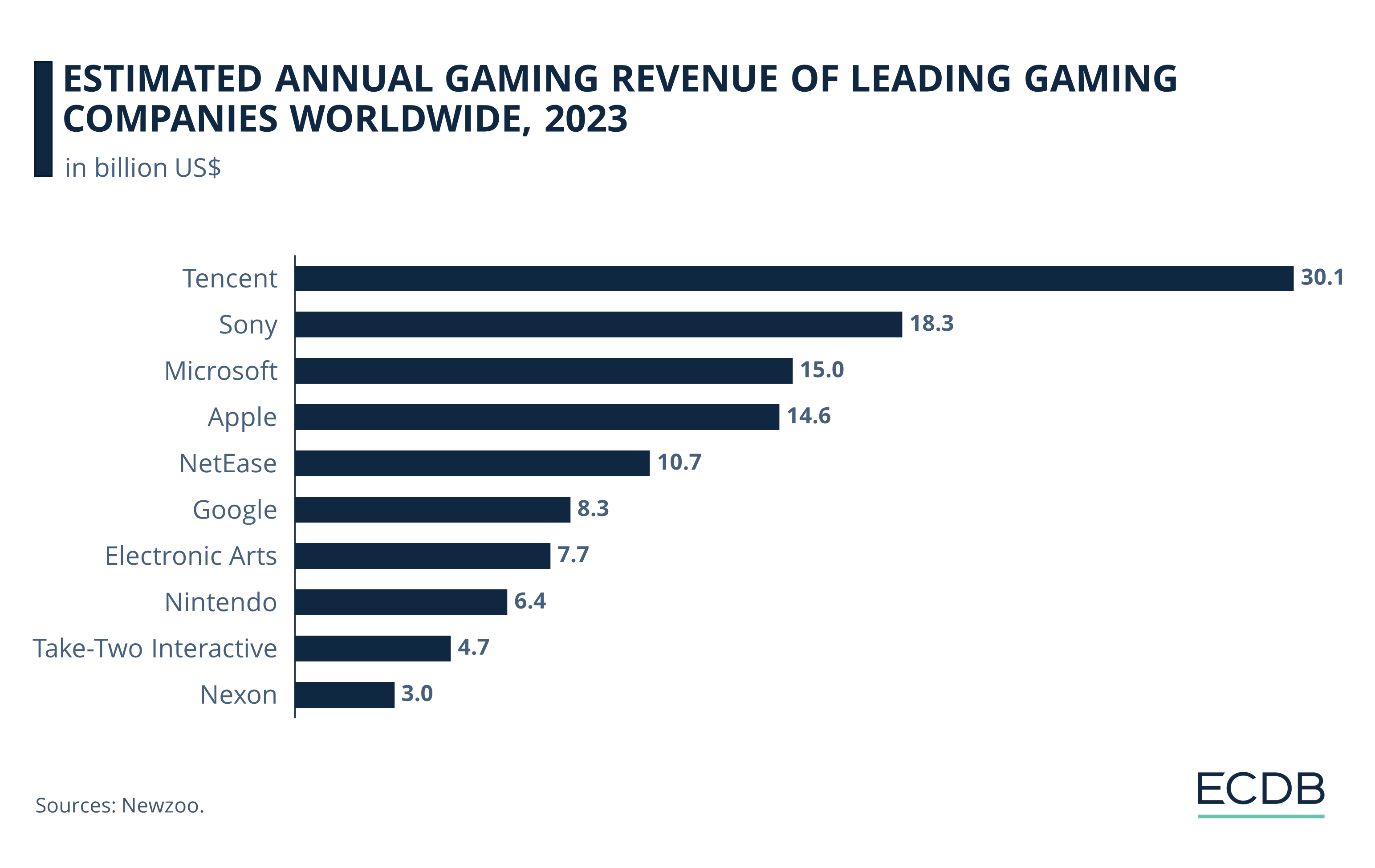

See how despite degrowth in 2022, the company is still considered the largest player in the video games market:

However, its ties to external businesses can also prove detrimental when economic conditions fluctuate.

2023 Revenue Recovers After Temporary Dip

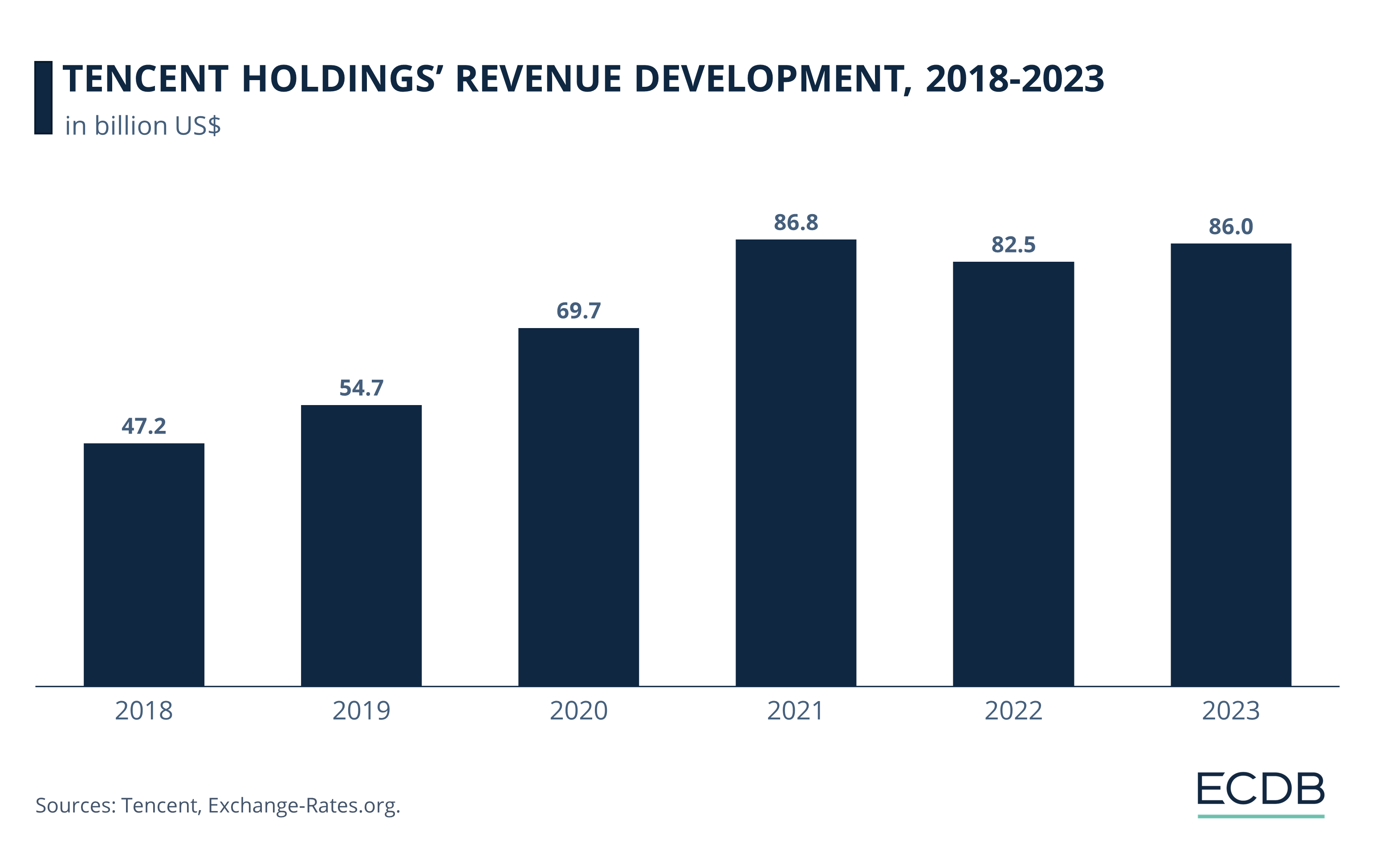

An examination of Tencent’s overall revenue performance over the past few years shows that the pandemic acted as an accelerator of earnings growth, as revenues increased from US$54.7 billion in 2019 to reach a temporary peak of US$86.8 billion at the height of the pandemic in 2021.

In 2022, revenues declined for the first time in more than a decade. This was due to macroeconomic factors that hampered the growth of the tech and gaming industries: The Chinese government stopped approving new games from July 2021 to April 2022 and imposed stricter regulations on youth gaming due to concerns about gaming addiction.

As a result, Tencent’s revenue fell to US$82.5 billion in 2022, but quickly recovered the subsequent year. This is believed to be due in part to cost-cutting strategies (closing non-essential segments like online education, rationalizing low-performing segments, reducing marketing spending and layoffs) and an increased focus on international ventures while divesting from domestic platforms JD.com and Meituan, a food delivery app.

A detailed breakdown of Tencent’s revenue by business segment provides additional clarity.

Revenue Growth in 2023 Driven by FinTech and Advertising

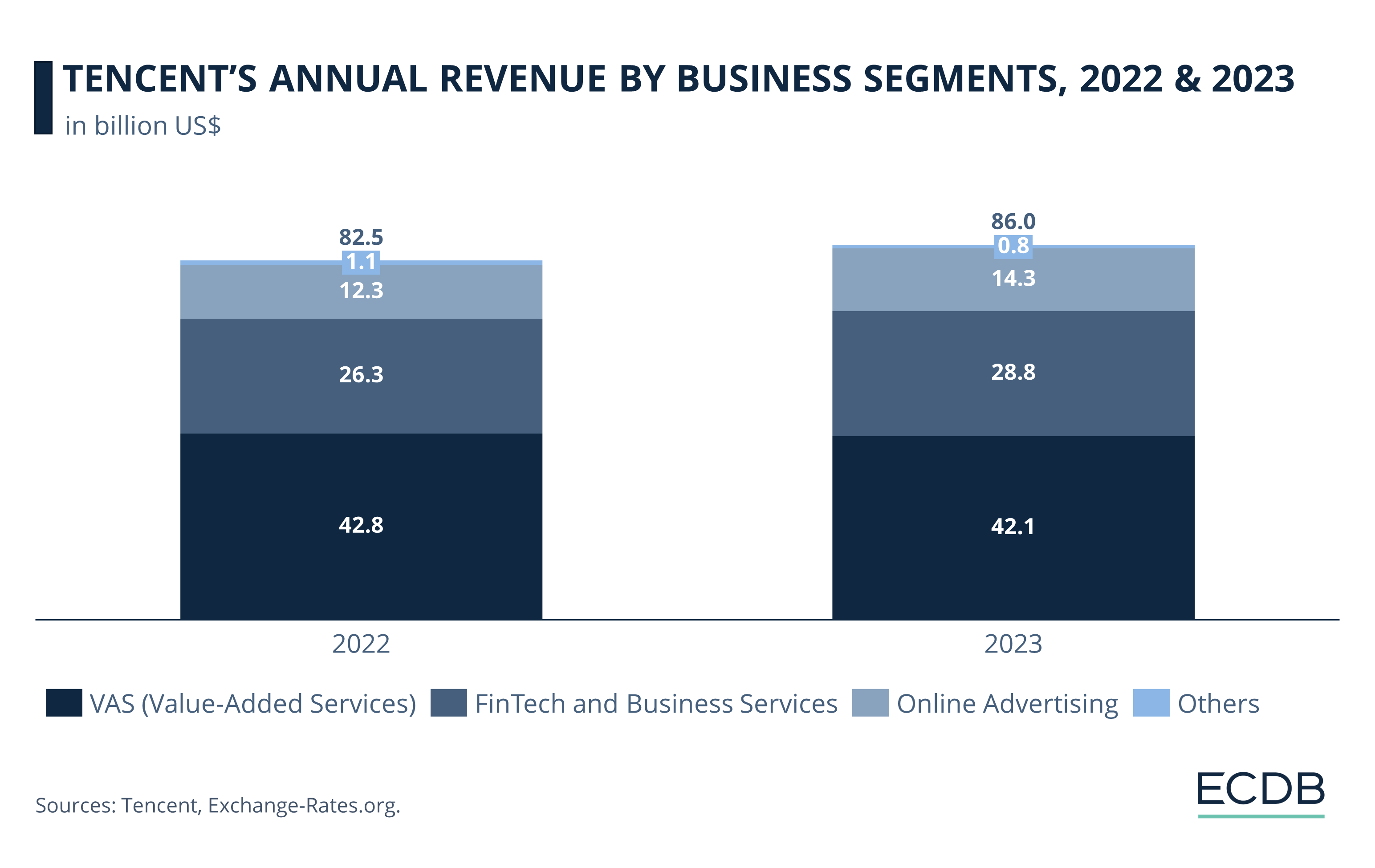

A comparison of revenue by business segment in 2022 and 2023 shows that FinTech and business services grew year-over-year, as did online advertising.

The VAS (Value-Added Services), which includes social networks and domestic and international gaming, remains the best-performing segment, but has lost US$700 million in revenue since 2022.

The "Other" division, which contributed a small portion of revenue to begin with, has lost US$300 million in that time.

In Tencent's earnings release, the company credited the AI integration of its advertising platform and video accounts for the revenue growth in these segments. Increased targeting accuracy for advertising and improved recommendation for video drove revenue, according to the statement. This continued into 2024.

The good financial metrics in Q2 2024 are believed to have been primarily driven by further growth in VAS: Tencent saw double-digit percentage growth of GMV from commerce mini programs; users spent 20% more time on the small applications within larger apps like WeChat. On top of that, the domestic games market recovered, allowing for the launch of highly anticipated titles like Peacekeeper Elite and Honour of Kings as well as the successful launch of Dungeon&Fighter Mobile. The international games segment thrived as well, mostly due to better sales from titles such as Valorant and brawl Stars.

Tencent’s Business Model: Wrap-Up

Tencent’s business model is considered the blueprint for app success, as its all-encompassing features keep users engaged and address a plethora of necessities in one location. Its reach extends far all over the globe, which ensures Tencent’s business does not hinge on one market or industry alone.

Its influence is only expected to grow, with new technologies such as AI, VR and AR providing the baseline for platform expansion.

Sources: Cascade – Investopedia – Morethandigital – Tencent

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Klarna, Afterpay, or PayPal: Which Is the Most Widely Used Payment Installment?

Klarna, Afterpay, or PayPal: Which Is the Most Widely Used Payment Installment?

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Back to main topics