Payment Options in eCommerce

Klarna, Afterpay, or PayPal: Which Is the Most Widely Used Payment Installment?

As online shoppers become more inclined to buy before they pay, installment payments continue to grow. Klarna is here clearly winning the race.

Article by Antonia Tönnies | March 11, 2025

When it comes to online shopping, fine details can make the difference between a purchase and an abandoned shopping cart – including the choice of payment options. Three of the most commonly used providers for installment payments are Klarna, PayPal and Afterpay. Here is what ECDB data can show about their global penetration.

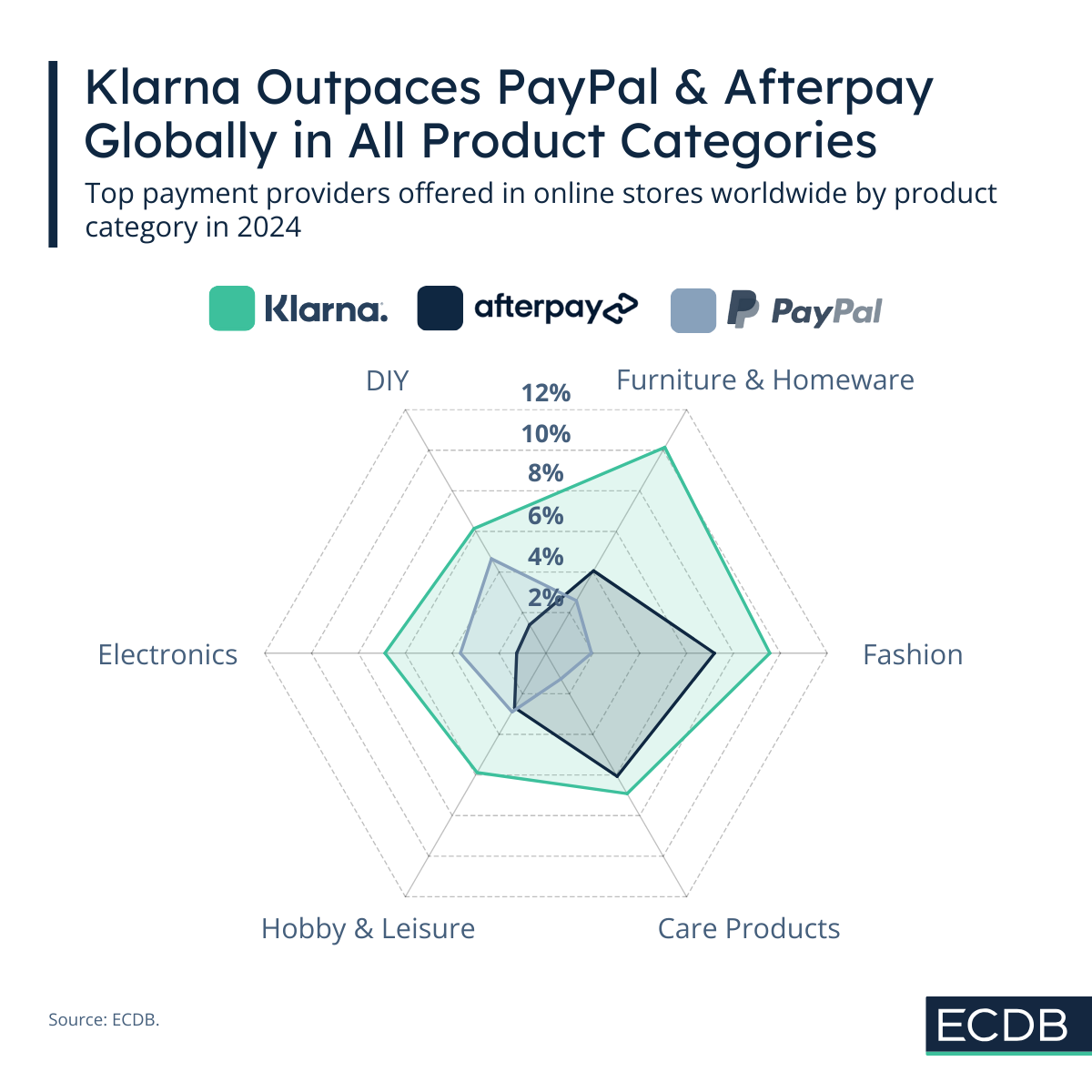

Klarna as the Most Offered Payment Installment Across All Product Categories

Klarna, the Swedish fintech company, is the most widely offered payment installment. In all product categories, it beats its nearest rivals, PayPal and Afterpay. Two product categories are remarkably strong, with Klarna having the highest coverage of 10.1% in Furniture & Homeware and 9.6% in Fashion.

Furniture & Homeware products are compared to items such as clothing or care products in a higher price range. Installments allow users to pay for items, such as a new sofa or bed, over time rather than making a large investment all at once.

Another reason for this trend is the opportunity to try an item before buying it. As we tend to shop more and more online, this gives the consumer the opportunity to try an item in real life before deciding whether to buy it or not – a behavior that is more common with Fashion products.

PayPal and Afterpay Focus on different Categories

A similar trend can be seen with Australian payment provider Afterpay, where installment payments are mainly used for Fashion (7.2%) and Care Products (6.1%). Meanwhile, the U.S. player PayPal has its main presence in the DIY (4.7%) and Electronics (3.7%) categories – both categories in which Afterpay is less present.

As the oldest payment method, PayPal enjoys great trust, especially in the United States. This fact may contribute to customers' tendency to use PayPal for more expensive purchases such as electronics, while they feel equally comfortable using Afterpay for smaller purchases such as personal care products.

In addition to the contents of the shopping cart, other factors play a role, such as the consumer's location, personal liquidity or the availability of payment providers. For example, Klarna is more present in Europe, PayPal in the U.S. and Afterpay in Australia. The sum of all these factors constitutes the coverage of the installments.

The BNPL Trend: Curse or Blessing?

Klarna, Afterpay and PayPal share one more feature in addition to being the most widely used installment payment providers: All three offer a Buy Now Pay Later payment option, or BNPL for short. This payment option has seen a sharp increase in popularity during the pandemic, and is more like a reinterpretation of credit in the modern shopping world that started back in the 2010s.

It gives customers more flexibility in their purchases by only paying for what they really want to buy, and often has a lower interest rate than credit cards. The downside is the consumer debt trap. Younger consumers in particular are likely to get into debt quickly, as seen in an older TikTok trend called #klarnaschulden (#klarnadebts) in Germany.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Back to main topics