eCommerce: Video Gaming

Video Games Market in 2024: Market Revenue, Companies & Distribution

Learn about global gaming ecommerce companies, revenues, and distribution.

Article by Nadine Koutsou-Wehling | August 13, 2024Download

Coming soon

Share

Video Gaming eCommerce: Key Insights

Market Growth: Valve's 2003 launch of Steam revolutionized online gaming. Gaming increased in previous years because of growing access and its popularity as a home pastime.

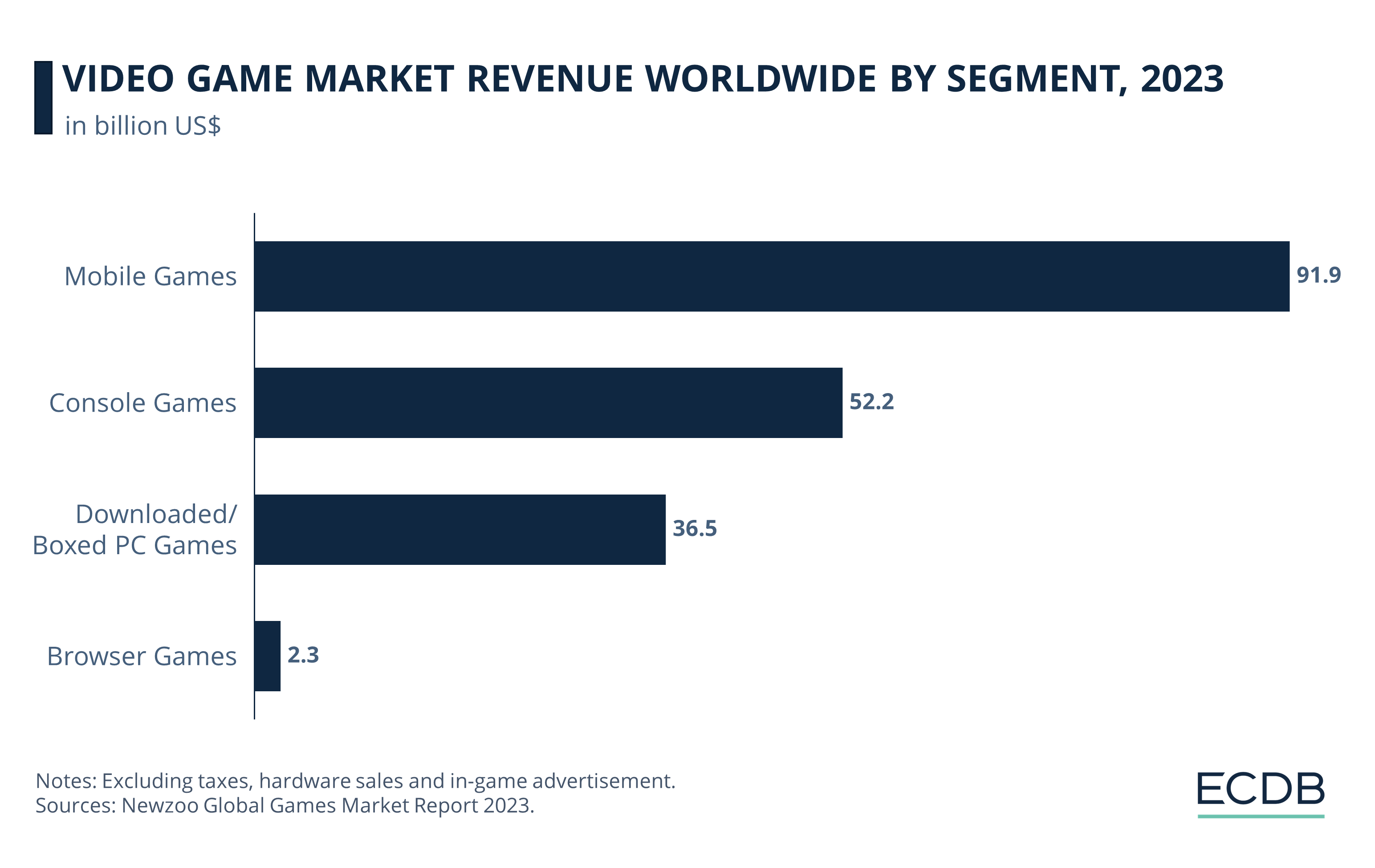

Leading Industry Segments: Mobile games generate highest revenues, with over US$90 billion in 2023. Console games follow with US$52 billion.

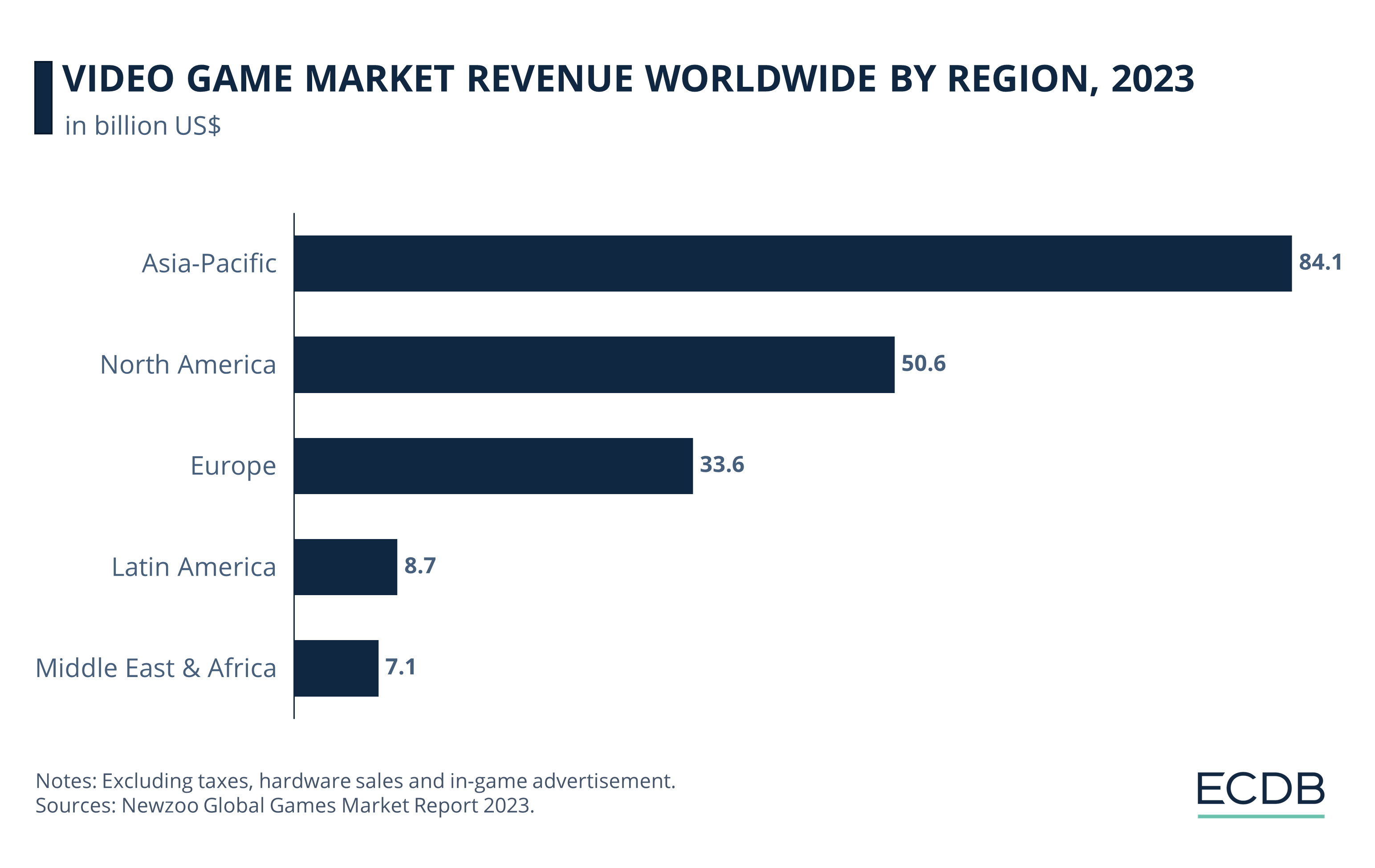

Regional Differences: Asia-Pacific is leading in online gaming with 2023 revenues of US$84 billion. North America earned US$50.6 billion, and Europe US$33.6 billion.

Top Companies: Tencent generated highest revenues with US$24.2 billion in 2022. Sony, Microsoft, Apple, and Google are also top competitors.

Online gaming stays a favorite pastime for consumers, and market revenues are growing way past pandemic highs. The reason for this is simple: Video games are a favorite distraction for many.

Here is what there is to know on video gaming eCommerce.

Defining the Video Games Market?

Video games are typically not included in ECDB’s definition of online markets. ECDB’s market data includes the sale of physical goods over the internet. But games are nowadays mostly consumed through downloads or cloud gaming on mobile devices.

This analysis considers video games that are distributed online, as well as downloads to game consoles or PCs. In-scope are mobile games, pay-to-play games, and browser games that require in-game purchases. Network or cloud gaming is included, but hardware games, taxes and in-game advertising are excluded.

Top Gaming Companies by Revenue

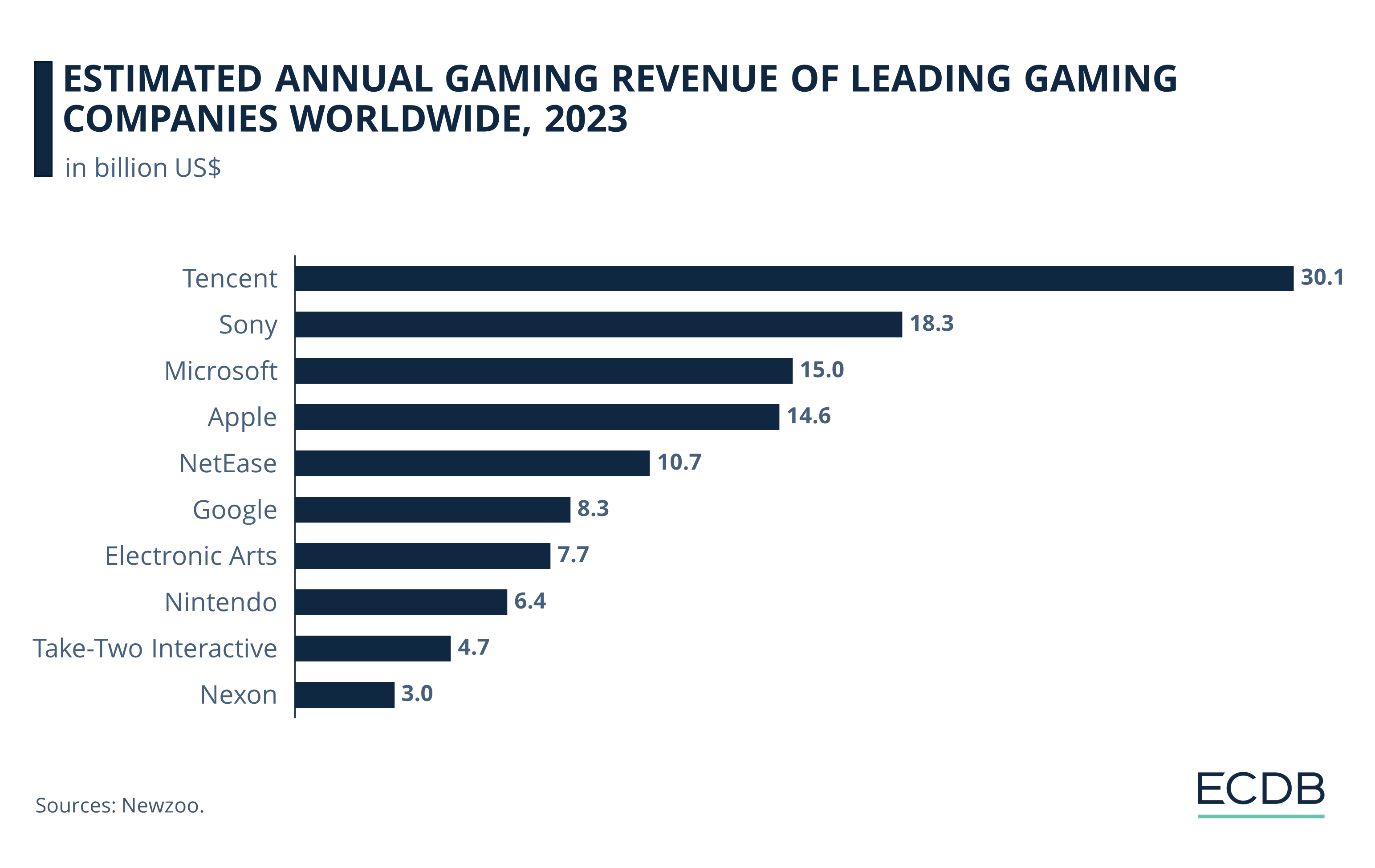

Newzoo compiled a list of leading gaming companies by revenue:

1. Tencent

Tencent generated gaming revenues of US$30.1 billion in 2023.

The Chinese multinational conglomerate company owns the League of Legends franchise, which is one of the most popular games in the world. It is free to play, but players can purchase cosmetic items called skins to customize the appearance of their characters.

2. Sony

Second with revenues of US$18.3 billion in 2023.

Sony drove sales over the past few years with the release of its latest console, the PlayStation 5 in November 2020. It also owns the game selling platform, PlayStation Store, and manages subscriptions like PlayStation Plus.

3. Microsoft

Microsoft climbed to third position in 2023.

This is in no small part due to its acquisition of Activision Blizzard, which ranked 7th in 2022.

4. Apple

Apple made gaming revenues of US$14.6 billion.

The company has recently placed increasing weight on the playability of its products, advertising, and continuously new product versions.

5. NetEase

NetEase ranks fifth with revenues of US$10.7 billion.

Microsoft renewed NetEase's agreement with Blizzard to bring popular titles like World of Warcraft and Hearthstone back to China. This renewed partnership will see numerous Blizzard games returning to the Chinese market.

Gaming Companies: Further Rankings

In sixth place is Google with 2023 gaming revenues of US$8.3 billion, followed by EA with US$7.7 billion. Further behind are Take-Two Interactive (US$4.7 billion) and Nexon (US$3 billion).

Note that all 10 companies on this list have annual revenues in the billions of dollars, indicating the immense profitability of the gaming industry. Considering that this is just one branch of the whole industry, we move on to the next category: video game distribution platforms.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Video Games Market Continues Growing

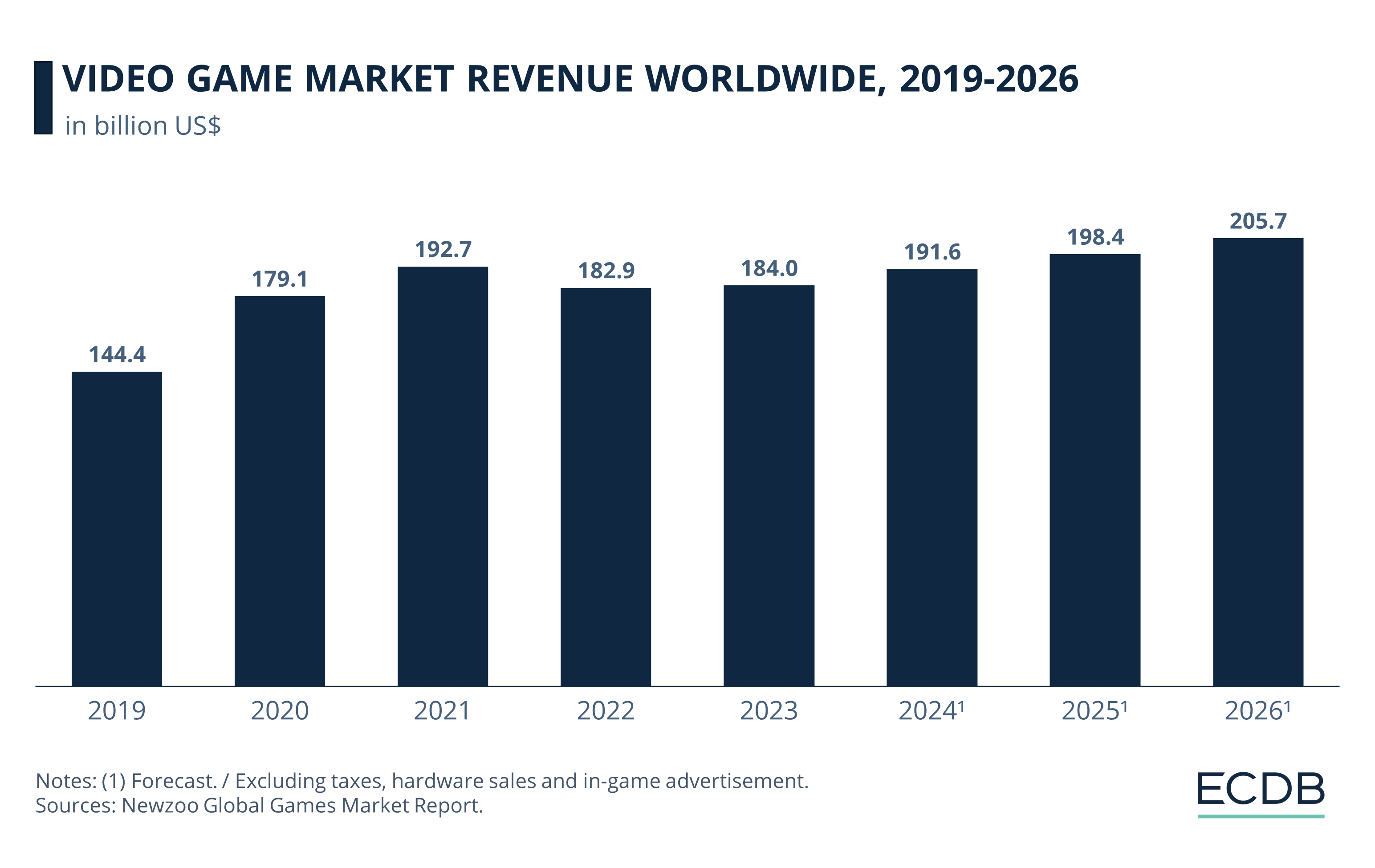

According Newzoo’s Global Games Market Report, video game revenues are expected to surpass US$200 billion by 2026. US$200 billion is roughly what a small-scale European economy generates in a year.

Market value was at US$144.4 billion in revenue by 2019.

Revenues continued to grow throughout the pandemic to US$192.7 billion in 2021.

Despite post-pandemic losses, the gaming market recovered quick to generate US$184 billion in 2023.

It is expected that the market will continue to grow over the next three years, although it may not be as pronounced as it was during the global health crisis.

Ultimately, the video games market is forecast to reach US$205.7 billion by 2026.

Gaming was perfect for pandemic consumers. But there were revenue losses after governments lifted bans and consumers went outside again. Despite slowdowns, however, gaming stays a popular hobby.

Let’s get into further details.

Mobile Games Most Lucrative in 2023

There are different types of distribution platforms for online games that determine where and how players interact with the product. Each distribution type generates revenue differently, and while some methods are more common, others are niche.

Here is how each segment is performing.

Mobile has the highest share of the video gaming market. In 2023, mobile games generated US$91.1 billion, which is nearly 50% of total market revenues.

The easy access of mobile games is a likely reason for their popularity, as they can be bought by anyone with a smartphone or tablet. They also provide a fun distraction on public transport or during waiting times and short breaks.

Other categories like console games and downloaded/boxed PC games, are experiencing losses. Sources cite the decline is caused by disrupted gaming development schedules during the pandemic, so people shifted to mobile games that were available and cheap.

Asia-Pacific Revenues Highest

Gaming is a universal hobby. Revenues are highest in Asia-Pacific, but market growth has stalled in recent years. The Chinese government imposed playtime limitations for underaged consumers in 2021, which likely had a lasting impact on consumption rates.

Asia Pacific gaming generated revenues of US$84 billion in 2023, compared to US$50.6 billion in North America.

Europe saw US$33.6 billion. Latin America and Middle East & Africa have lowest revenues.

Developers and Distributors in the Video Game Business

First, it pays to know the distinction between video game development companies and game distribution services. While game businesses can fall into both categories, they describe different aspects of the industry.

Game developing companies are involved in the design, development, and sometimes the publishing of games. They are responsible for creating the game's content, graphics, sound, and gameplay. Game distribution services, on the other hand, are platforms that host and distribute games developed by these companies or by independent developers. Big companies like Sony or Microsoft do both things. With big success!

Most game sales today are made through digital distribution services. Even physical retailers tend to offer mostly game cards and codes that can be used on these platforms, some of which are:

Steam is considered the largest game distribution service. The platform hosts thousands of games and new releases, excluding games from competitors that are limited to their own distribution services like Sony, Microsoft or CDPROJEKTRED. There are some Valve games that can only be accessed through Steam, such as Dota 2, the Left 4 Dead series, and Counter Strike.

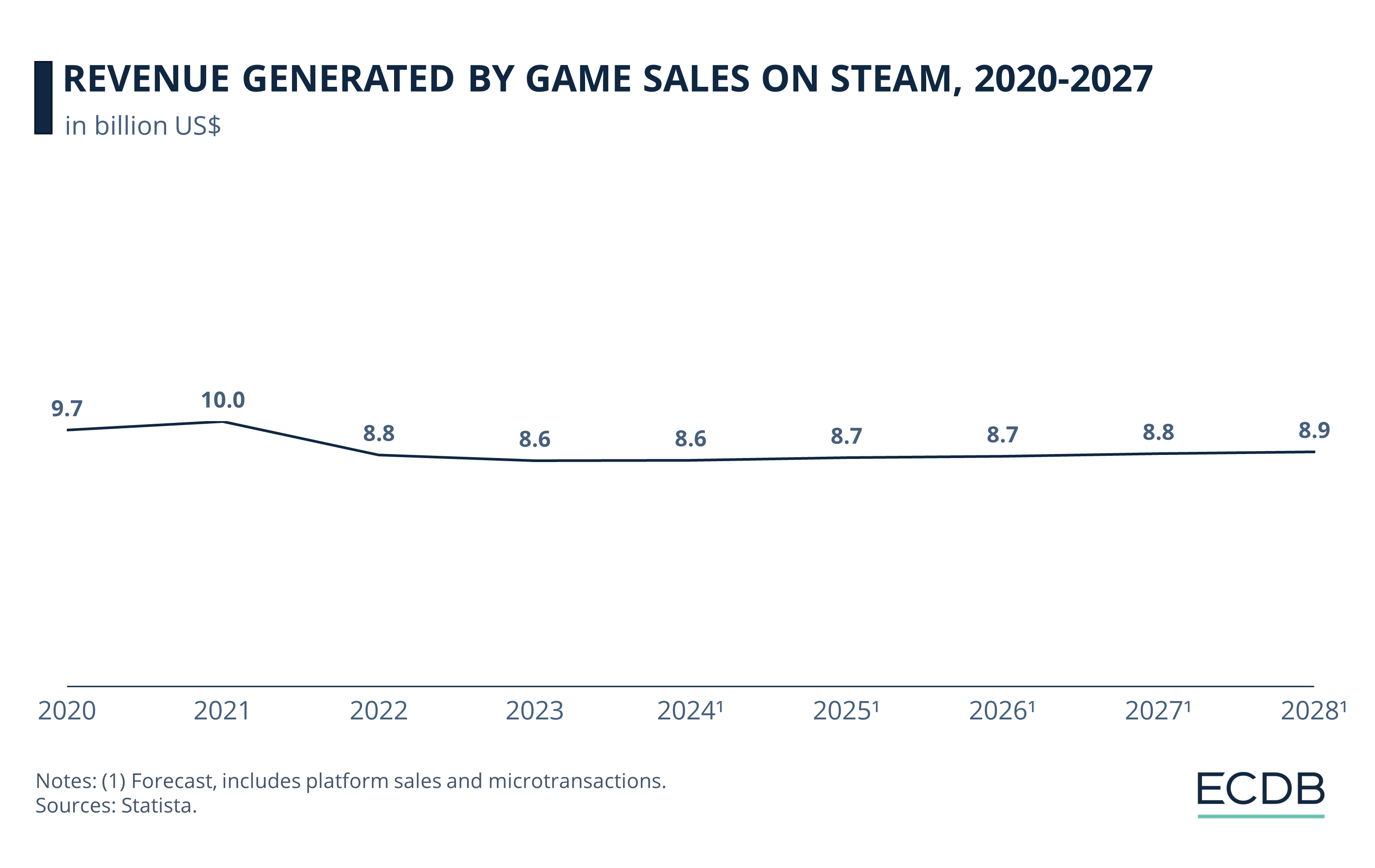

Below is a chart depicting past and projected game sales revenue on Steam from 2020 to 2028.

Other popular digital distribution platforms include:

Green Man Gaming: This smaller platform gained popularity through a competitive pricing strategy and rewards programs, including rewards for purchases, trade-ins, referrals, and game reviews.

GamersGate, a Swedish digital distributor, is similar in size and strategy to Green Man Gaming, and also offers incentives, discounts, and rewards programs.

GOG.com, formerly Good Old Games, is a Polish distribution service. Having started out as a digital download platform for classic PC games, it now also provides new releases. GOG.com offers a money-back guarantee, additional downloadable content, and a loyal following of classic game enthusiasts.

Origin is Electronic Arts' distribution platform, launched in 2011 as a competitor to Steam. It contains some third-party games, a large catalog of older EA titles, and exclusive popular EA game titles.

Amazon offers new releases, online digital codes that can be used in Steam, and discounts. However, it lacks older titles and re-released classics.

Epic Games is a U.S. company, founded in 1991. The company is best known for one of the world's largest games, Fortnite, as well as Unreal Engine.

Video Games Market: Closing Thoughts

The online video games market has gained substantial ground in recent years. Despite positive expectations for growth, external factors can impact the industry, which in recent years were rising prices through inflation and microchip shortages, and new legislation like the one implemented by the government in China to reduce user times.

In the meanwhile, the number of online gamers is climbing by the year. Statista estimates that the number of global users in the Games segment is 2.6 billion in 2024. The figure is expected to increase until 2029. Thus, projections for the video gaming market are optimistic, also because of increasing innovation for consumers.

Sources: All Top Everything, Lifewire, Statista, Statista Digital Market Outlook, Game Developer

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Back to main topics