ECOMMERCE TRENDS

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Download

Coming soon

Share

Next Gen eCommerce: Key Insights

Next Generation eCommerce: The new era of eCommerce is characterized by technology investment and customer-centric features. Personalization, efficiency, and the integration of physical and digital experiences are notable aspects.

Technology integration: Generative AI, headless eCommerce, and warehouse automation are innovative technologies that companies must invest in, if they aim to raise productivity and upgrade their customer experience.

Customer-centric models: A customer-first approach will be key in the new age of eCommerce. Retailers like Amazon and Walmart are already using a combination of strategies – such as omnichannel retail, mobile commerce, and shopping days – to please modern online shoppers.

Gone are the days when eCommerce only meant ordering products online and receiving them on one’s doorstep. In 2024 and beyond, eCommerce stands for intuitive, personalized, and immersive shopping experiences.

Consumers expect hyper-personalization and convenience while retailers aim for higher productivity and profitability. Thus, the next generation of eCommerce growth will be shaped by innovations in technology and changing customer expectations.

Learn what the next generation of eCommerce entails and the top trends driving the industry’s growth.

What is Next Gen eCommerce?

Next gen eCommerce refers to the latest advancements taking place in online retail.

The focus areas are greater customer engagement, efficiency, and the integration of physical and digital experiences. Therefore, next generation eCommerce uses emerging technologies like Artificial Intelligence (AI) and Internet of Things (IoT) to deliver more seamless and personalized shopping experiences.

Here are the defining trends of next generation eCommerce.

1. Generative AI

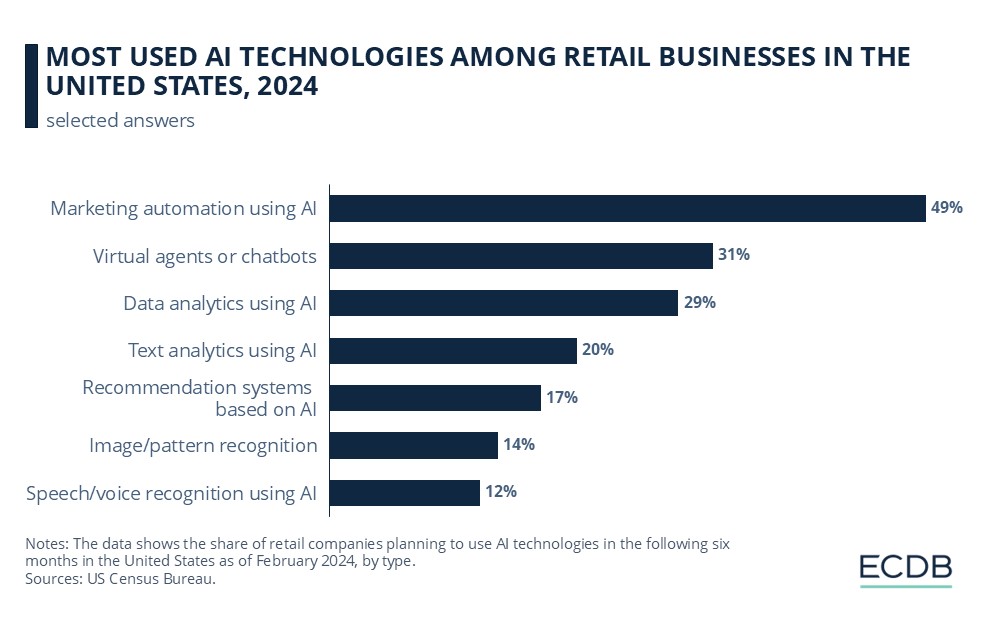

A type of Artificial Intelligence, Generative AI understands natural language and uses it to generate content and answer questions. In 2024, retail industry professionals in the United States plan to use GenAI for a broad range of purposes:

Nearly one in two U.S. retail professionals expect to use marketing automation, making it the top choice.

31% of retailers anticipate the use of virtual agents or chatbots.

29% and 20% of retailers, respectively, expect to use data and text analytics. These functions enable companies to sift through data and gain insight into customer behavior.

17% of retailers plan to use AI-based recommendations. It is also favored by a growing share of online shoppers across the world.

14% of retailers intend to use image and pattern recognition.

12% of online businesses plan to integrate speech and voice recognition.

Several eCommerce retailers are using Gen AI today. Walmart employs AI smart pricing, and eBay offers Find It On eBay, a built-in image search function.

2. Customer Shopping Journey

Customers are at the heart of next gen eCommerce. However, there exists a gap in the eCommerce conversion funnel which prevents visitors from becoming buyers.

As retailers strategize to upgrade customer experience, online consumers today are well-aware of their preferences, as a recent survey in the U.S. and the UK shows:

Streamlined results are high on the shoppers’ priority list. 45% of survey respondents identify it as the top feature they want eCommerce retailers to offer.

Better filtering is important to 33% of shoppers. Examples include category-specific, thematic, or multiple filters, or suggesting filters per what’s trending.

Personalization is next, with 30% of respondents citing this feature.

Autocomplete functionality was chosen by 27% of shoppers.

Improved integration of online and offline experience is expected by 34% of respondents.

The answers above further indicate AI’s central role in addressing customers’ pain points. Its adoption can enable brands to track consumer preferences, offer real-time personalization, and optimize the user experience.

3. Mobile-First Shopping

Mobile commerce activity is on the rise, with an increasing portion of eCommerce now occurring via mobile devices. Retailers have adopted mobile-first technologies such as dedicated shopping apps, mobile-based marketplaces, online payment options, and targeted smartphone marketing.

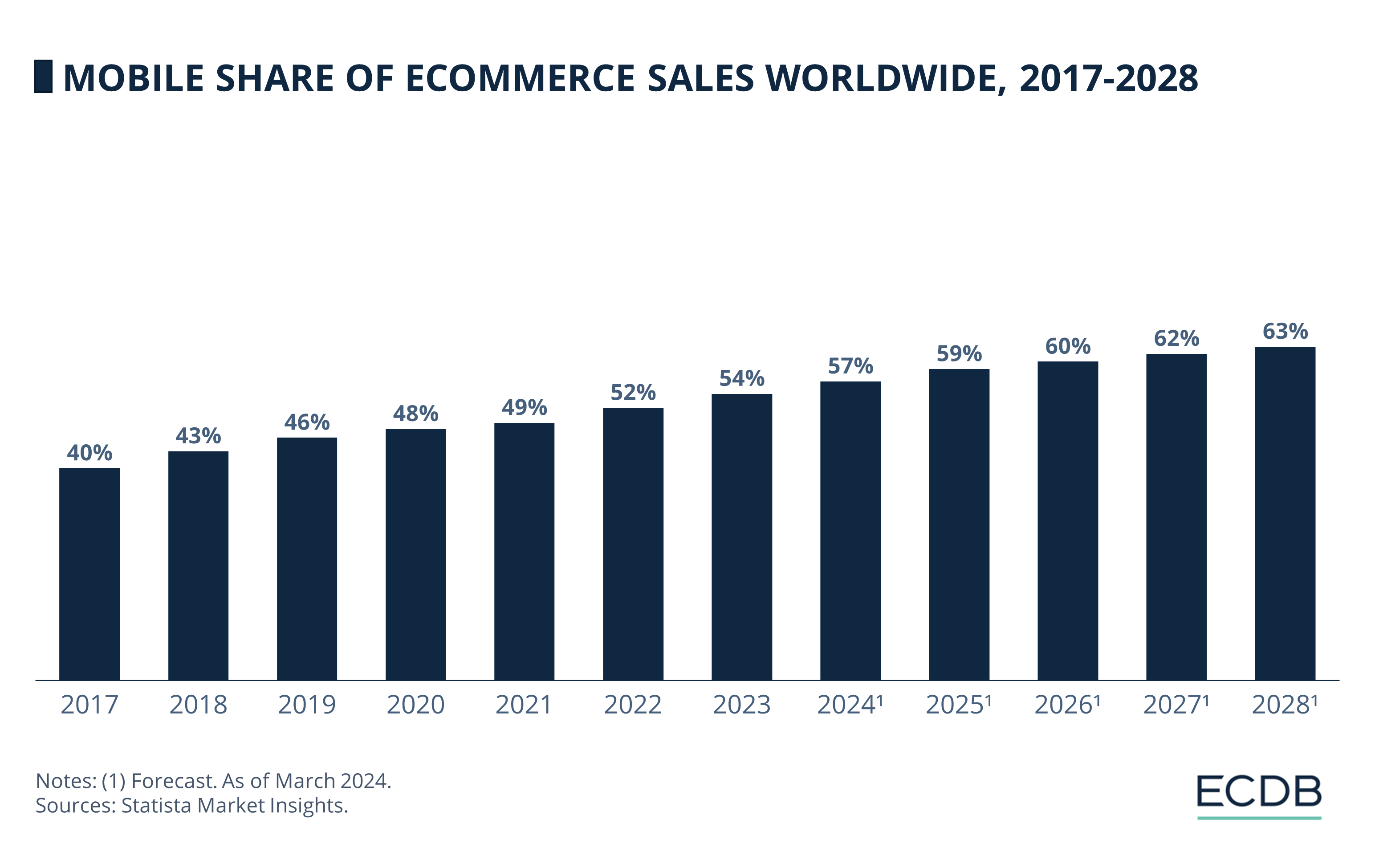

The share of mobile eCommerce or mCommerce has grown considerably in the past few years:

2017: 40% of eCommerce sales worldwide were conducted through mobile devices this year.

2022 onwards: Mobile shopping accounts for over half of all eCommerce sales globally.

2028: Over 60% of all eCommerce sales across the world are projected to occur on mobile devices by this year.

Mobile technology advances rapidly, and eCommerce retailers must ensure timely adoption of the latest functions. Good examples are Walmart and Ikea, which offer AR-powered solutions like virtual tryouts which customers shopping via mobile phones can easily use.

4. Headless Commerce

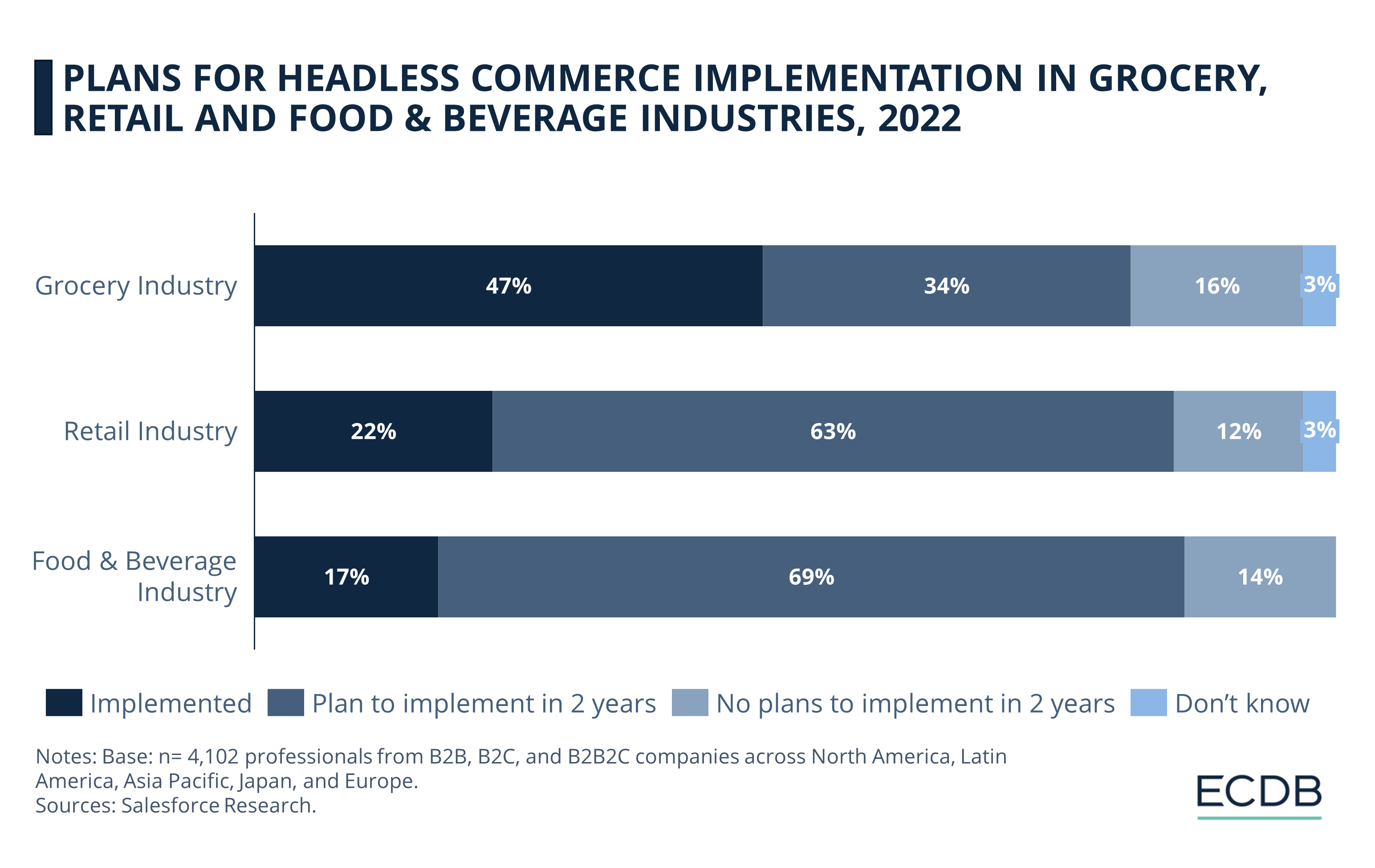

With headless commerce, retailers can have more flexible and scalable eCommerce applications than traditional all-in-one eCommerce systems offer. Headless commerce separates the front end of an eCommerce system from its back end. The front-end is the customer interface or app, while the backend is the commerce engine which manages products, orders and customer information. Several industries, including retail, are adopting this technology:

Retail: 22% of respondents from the retail industry already used headless commerce, as of 2022. 63% planned to implement it in the next two years from the survey period. At 12%, the share with no intention of doing so is comparatively low.

Grocery and Food and Beverage: 47% of respondents working in the Grocery industry used headless architecture in 2022, while the share was 17% for professionals in Food and Beverage.

With headless eCommerce, online retailers can have more control over changing or upgrading their digital storefronts. For example, they can add more sales channels, social media accounts, and new features without disrupting the backend operations.

5. Omnichannel Retail

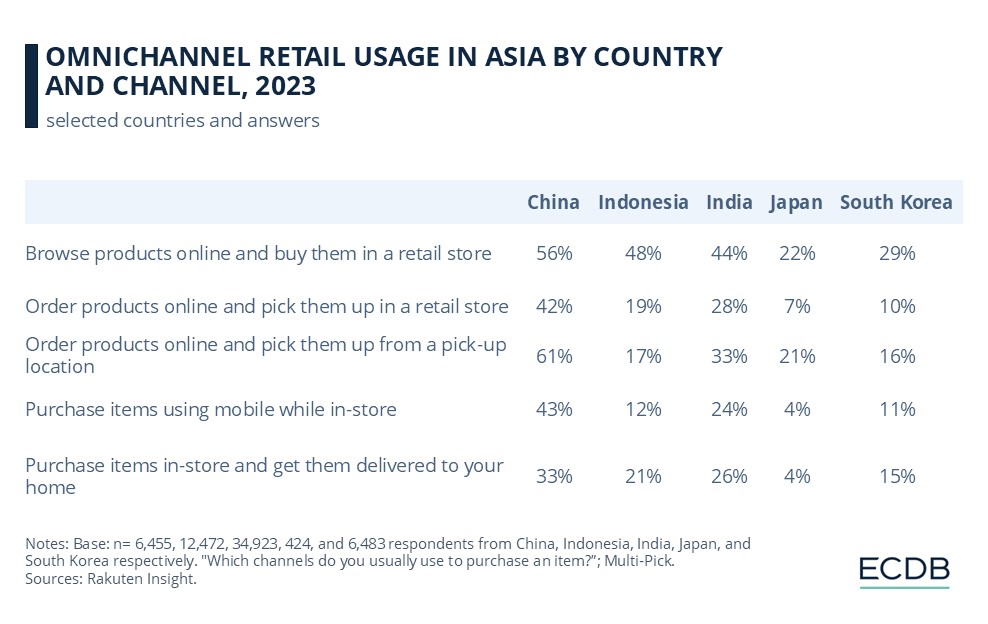

A well-executed omnichannel retail strategy will be crucial for online retailers aiming to reach more customers and ensure personalization across multiple channels. According to a survey by Rakuten Insight, Asian consumers are combining in-store and online options in creative ways:

Browsing products online and buying them in a retail store was the leading omnichannel choice in 2023, with the highest share of respondents from China (56%) using it.

Order products online and pickup in retail store is most used in China (43%), and least used in Japan (7%)

Order product online and pickup from a pick-up location is also most used by Chinese shoppers (61%), followed by Indian consumers (33%).

Mobile purchase while in-store is used more in China (43%) and India (24%) than other countries on our list.

In-store purchase followed by home delivery is popular in China (33%), India (36%) and Indonesia (21%).

An omnichannel retail strategy allows brands to connect with consumers both online and offline. An example is Target, which unifies customer experience on multiple channels. Shoppers using the Target loyalty program get valid discounts applied automatically at checkouts online, in-app, or in-store.

6. Warehouse Management Systems

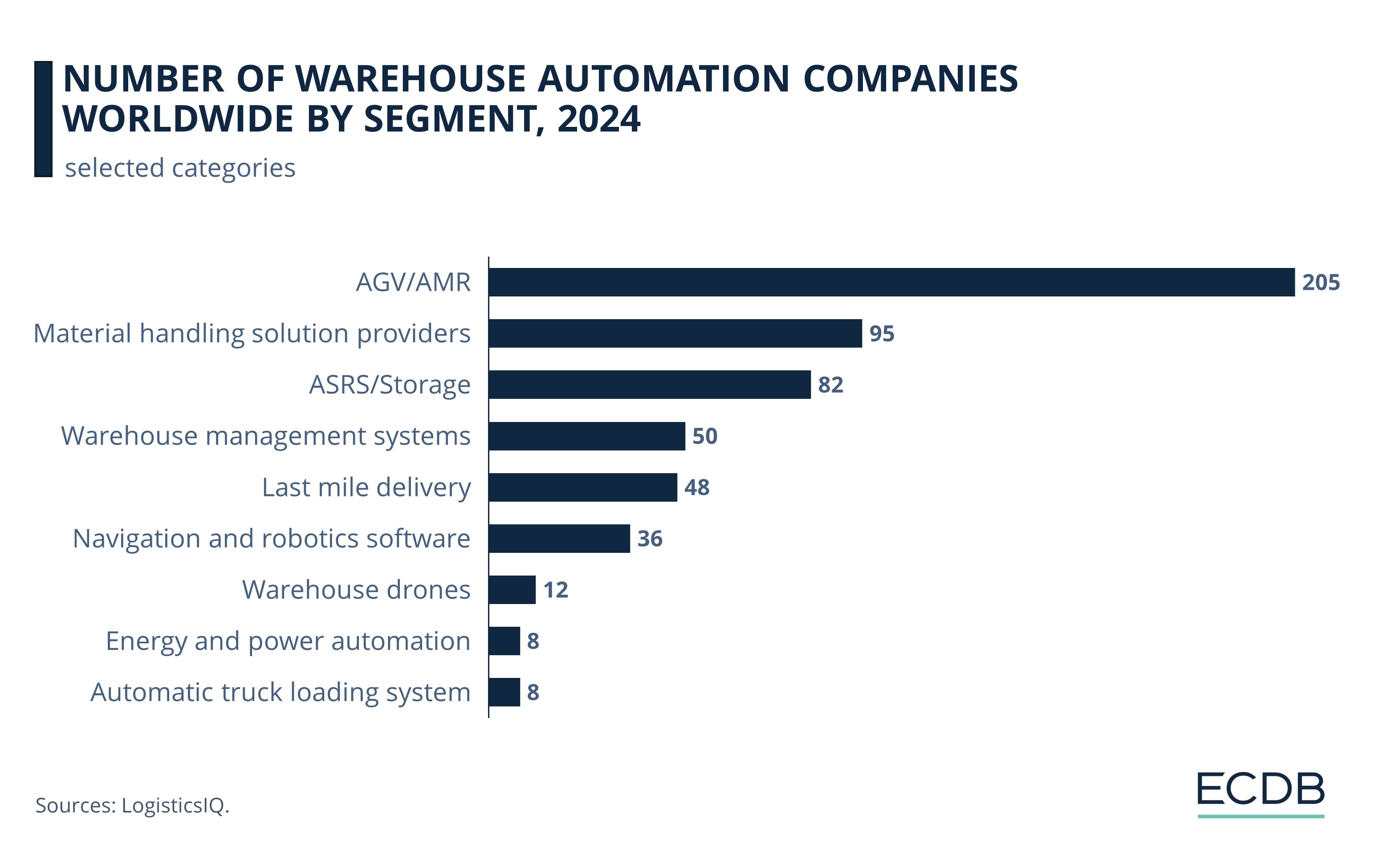

Advanced warehouse management systems are central to modern eCommerce. Interest in this area is increasing, as the number of companies working in this area confirms:

AGV (Automated Guided Vehicles) and AMR (Automated Mobile Robots): 205 companies are working in this field.

Material handling solution providers and ASRS (Automated Storage and Retrieval System): 95 companies are active in this field.

Warehouse management systems (WMS): 50 companies are focused on WMS.

Centralized warehouse management systems integrate various aspects of warehouse operations, from inventory tracking to order fulfillment. They provide real-time visibility into stock levels and help optimize storage and retrieval processes, also minimizing human errors and speeding up workflows.

7. Shopping Days

Events like Black Friday and Singles' Day are highlights on the eCommerce calendar. Retailers must plan in advance, build up inventory, launch marketing campaigns, and offer exclusive deals to attract shoppers.

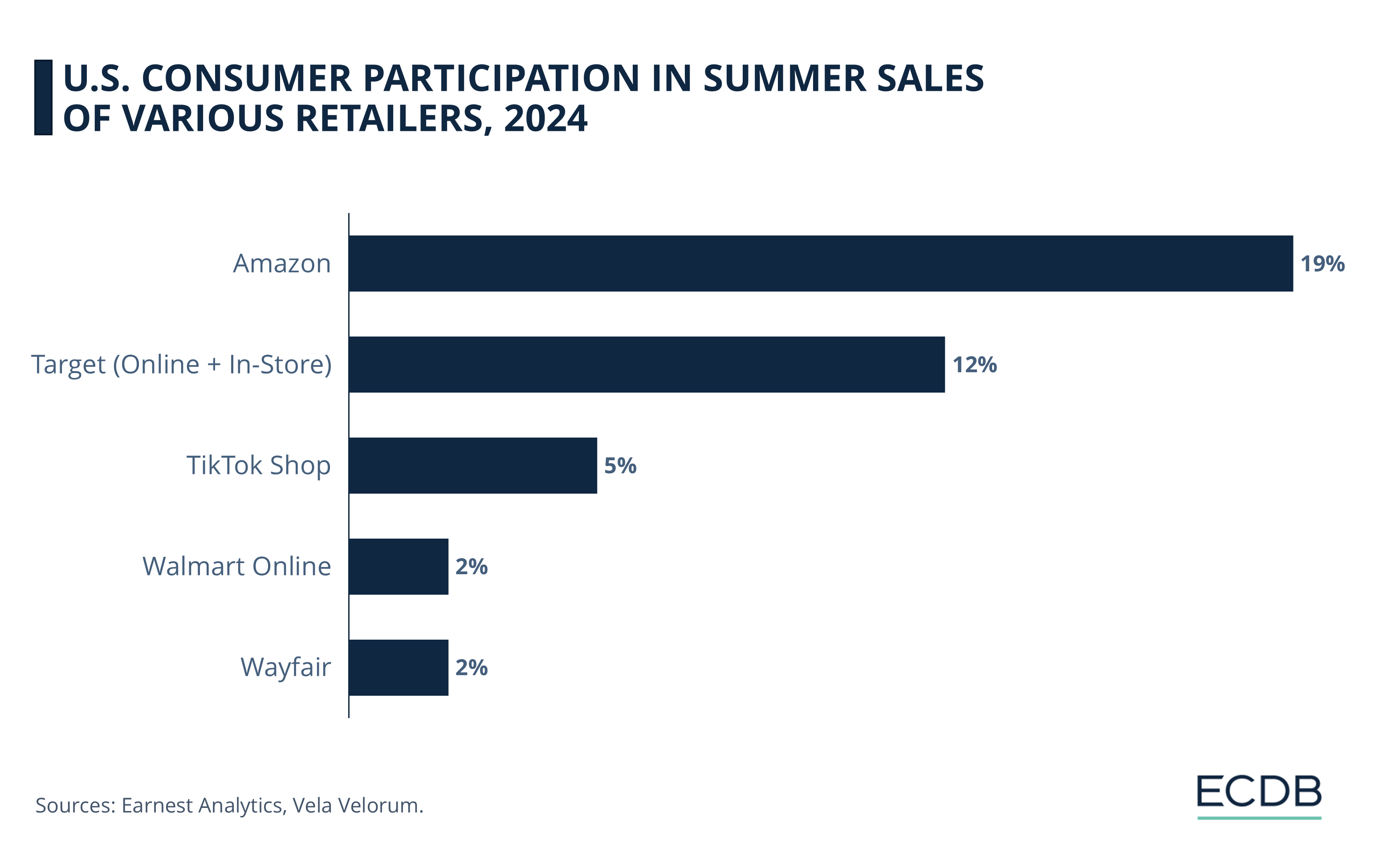

Data on the U.S. market emphasizes Amazon’s success when it comes to shopping events:

Amazon has a clear edge over other retailers: 19% of U.S. consumers who shopped at Amazon in the past year also bought from its Prime Day sales.

Target is next, with 12% of recent shoppers making purchases through its sales event, both online and in-store.

TikTok Shop and Walmart Online have much smaller shares, at 5% and 2% respectively.

As the data shows, shopping days are no longer limited to holidays like Christmas or Thanksgiving. Retailers have created their own sales promotions, which are widely popular amongst consumers. Amazon Prime Day has expanded into a multi-day event, generating an estimated US$14 billion in 2024 in the United States alone.

Next Gen eCommerce: Closing Thoughts

The key trends in next generation eCommerce involve tech integration and personalized shopping. As customer expectations around convenience and immediacy increase, brands can leverage the latest technologies to meet their demands.

Omnichannel retail is another cornerstone aspect, which will likely lead to further transformation of eCommerce sales models. Online marketplaces remain central to eCommerce operations presently, but retailers are now also shifting to direct-to-consumer strategies, where they can exert greater control over product quality and customer engagement.

The globalization of eCommerce will open up new market opportunities for online retailers. While AI adoption and innovative business models can bolster their position, it will be important to address issues like security concerns and eCommerce fraud, which are some side-effects of tech use.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

Deep Dive

How to Avoid Online Shopping Scams Ahead of the Holiday Season

How to Avoid Online Shopping Scams Ahead of the Holiday Season

Deep Dive

Artificial Intelligence in Italy eCommerce: Consumer Behavior & Preferences

Artificial Intelligence in Italy eCommerce: Consumer Behavior & Preferences

Deep Dive

Amazon’s New AI Assistant Project Amelia Will Support Third-Party Sellers

Amazon’s New AI Assistant Project Amelia Will Support Third-Party Sellers

Back to main topics