eCommerce: Business Models

Business Models in eCommerce: B2B-D2C Shift Brought by the Pandemic

The pandemic changed many aspects of our lives, and one of them was the shift in business models for some online companies. But how permanent was this change?

Article by Cihan Uzunoglu | July 09, 2024Download

Coming soon

Share

Business Models in eCommerce: Key Insights

Pandemic-driven Shift: The COVID-19 pandemic accelerated the move from B2B to D2C models, enabling companies to reach consumers directly and adapt to new market conditions, fostering innovation and long-term strategic changes.

Post-pandemic Reversion: Post-pandemic, the eCommerce sector saw a significant transformation from D2C back to B2B models, driven by economic factors and the need for more stable revenue streams across various industries.

Technology and Marketplaces: Businesses are switching back to B2B due to advancements in eCommerce technology and the rise of B2B marketplaces, which have simplified hybrid operations and expanded opportunities for reaching new business audiences.

Luxury Market Adaptation: The luxury goods market has navigated major B2B-D2C movements, with brands like Chanel, Louis Vuitton, Cartier, Chow Tai Fook, and Prada adapting to market changes by balancing traditional and modern eCommerce strategies to maximize reach and maintain exclusivity.

Why did companies change from selling to businesses to selling directly to consumers during the pandemic? How did food suppliers, furniture retailers, and telemedicine startups adapt so quickly? And why are some now switching back to business-focused strategies?

These changes weren’t just reactions; they were strategic moves to meet new market demands. Examining how brands like Rastelli's and Maven Clinic made their pivots, and why others like Calm and Farmbox are now exploring B2B opportunities again is key in understanding this shift.

First, it's important to clear up the definitions before diving into the main topic.

Understanding B2B, B2C, and D2C

in eCommerce

Although there are more business models, we will focus on the main ones for the purposes of this article.

Business-to-Business (B2B)

This is when companies sell products or services to other companies, just like a factory selling raw materials to a manufacturer or a business hiring another company for advertising. B2B deals usually involve larger quantities and long-term contracts, aiming for cost savings and steady business relationships.

Business-to-Consumer (B2C)

In this model, businesses sell products or services to individual consumers, typically through third-party retailers or online marketplaces. For example, a department store selling clothing made by an outside manufacturer is a B2C transaction. B2C focuses on appealing to a wide audience through marketing and branding efforts, with retailers acting as intermediaries between the brand and the consumer.

Direct-to-Consumer (D2C)

D2C eliminates intermediaries, allowing brands to sell directly to customers through their own online stores. This approach gives companies full control over pricing, product quality, and customer service. For instance, a skincare company selling its products directly on its own website is a D2C transaction. D2C fosters direct relationships with customers, providing a more personalized shopping experience.

The 2020 Shift: B2B to D2C

During the Pandemic

During the pandemic, many companies had to rethink their strategies. Businesses traditionally focused on B2B and B2C models found themselves exploring D2C to reach customers directly. This transition led to some remarkable developments in how companies operate and connect with their audiences.

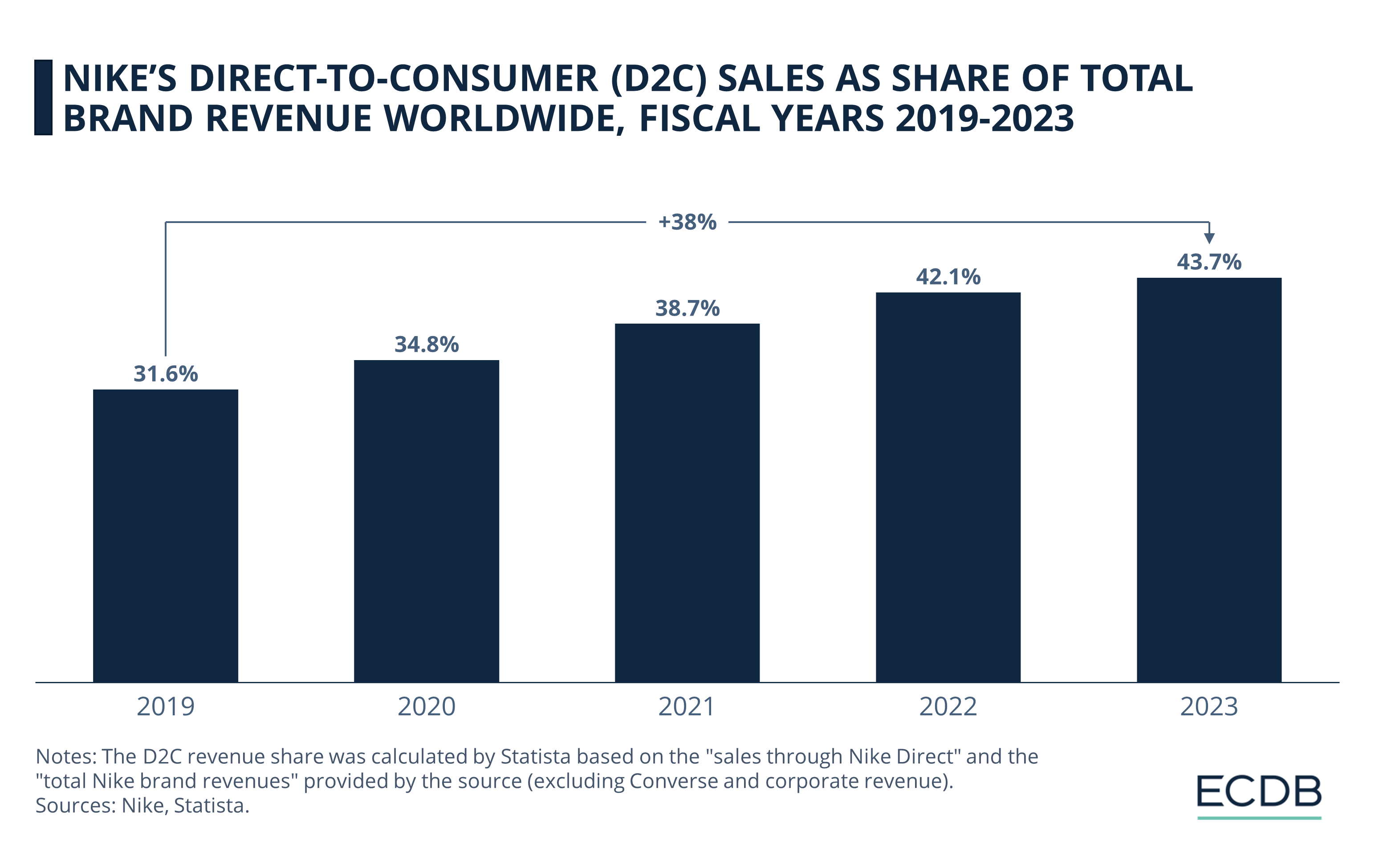

Nike’s D2C sales as share of total brand revenue worldwide grew by 38% between fiscal years 2019 and 2023. By the end of last year, this share constituted close to half of total brand revenue worldwide.

Major online platforms like Amazon, Google, and Facebook facilitated these transitions by providing the necessary infrastructure and reach. It is more insightful to look at some specific cases in highlighting why and how this transition took place:

Rastelli's: The food supplier capitalized on the sudden surge in online food purchases. As consumers became more comfortable buying fresh food online, Rastelli's saw a momentous boost in their D2C business without heavily investing in brand advertising.

Maven Clinic: The telemedicine startup switched its focus from B2B to D2C, benefiting from the increased willingness of people to try telemedicine during the pandemic.

AB InBev Mexico: By leaning on eCommerce after their traditional channels – like bars and restaurants – were shut down, the company developed new delivery methods and adjusted production to cater to bulk buying, which was more suited for online sales.

Industry West: The furniture retailer experienced a similar transformation. With their commercial customers pausing operations, they quickly prioritized their D2C strategy, focusing on home-friendly products and improving their online presence. This move resulted in a considerable increase in their D2C revenue share.

Fleuron: The slow fashion brand embraced the D2C model to maintain control over their brand image and customer relationships. By eliminating intermediaries, they could offer high-quality products at fair prices and produce sustainably, which resonated well with their customer base.

These moves were more than just a reaction to immediate challenges. They were rather strategic moves that allowed businesses to meet consumers where they were: online and ready to try new purchasing methods. This period set the stage for continued innovation and adaptation in the years that followed.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

The Post-Pandemic Shift: D2C Back to B2B

As we moved past the pandemic, the eCommerce sector saw another significant transformation: a noticeable conversion from direct-to-consumer (D2C) back to business-to-business (B2B). This trend has been driven by various factors that have made B2B models more appealing and sustainable in the current economic climate.

Digital Health Sector

In the digital health sector, major players like Calm, Cost Plus Drugs, and GoodRx began to pivot towards B2B strategies in 2023. Economic downturns reduced consumer spending power, making the B2C space less attractive.

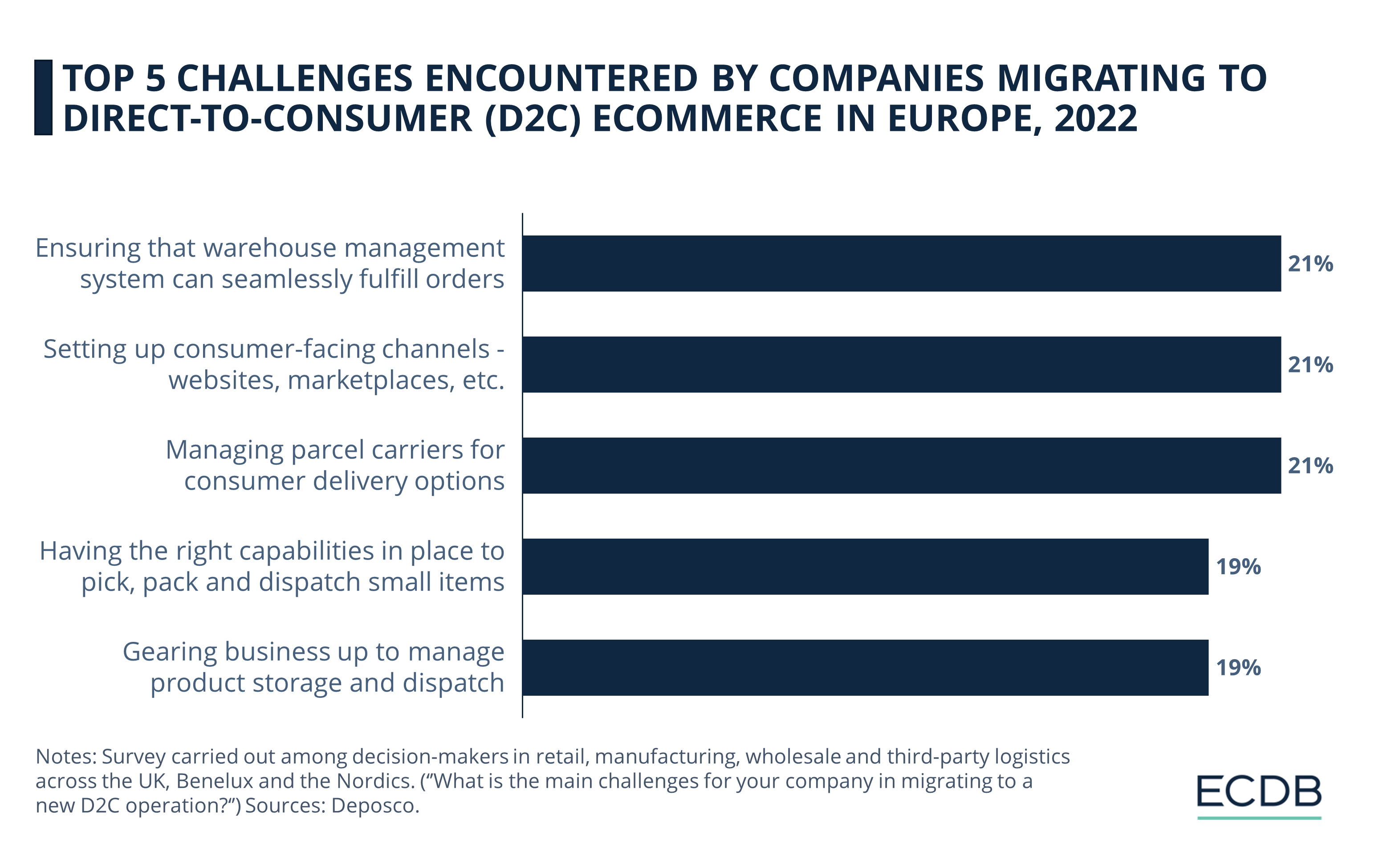

Ensuring that warehouse management systems could seamlessly fulfill orders was the top challenge encountered by companies in Europe which were migrating to D2C eCommerce.

As Richard Anderson of DarioHealth highlighted, the market reality dictated a focus on B2B, where companies could offer clear value propositions to other businesses, promising healthier employees and reduced healthcare costs.

This strategic shift allowed companies to stabilize and potentially increase their profitability by catering to businesses rather than individual consumers.

Other Sectors

This trend was not limited to digital health. Across various sectors, the increased cost of customer acquisition for D2C brands pushed companies to explore B2B and wholesale opportunities.

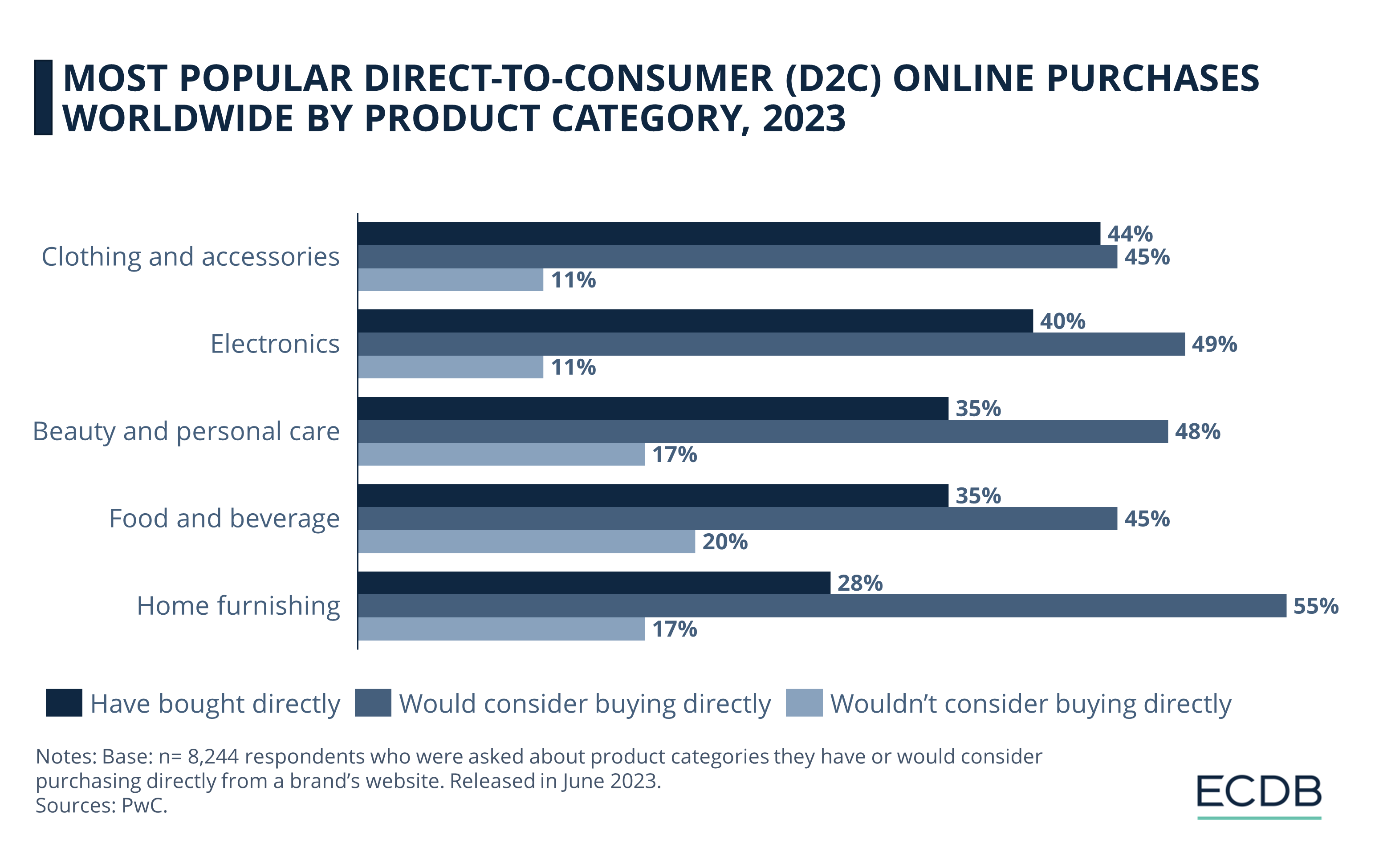

A PwC survey from last year shows that clothing and accessories (44%) was the top product category online shoppers bought directly. Although only 28% of shoppers bought home furnishings directly, more than half (55%) would consider buying them directly.

Solo Brands and Farmbox, for instance, transitioned to B2B partnerships to enhance brand awareness and secure bulk orders, which provided more consistent revenue streams compared to the volatile D2C market. Farmbox even shut down its D2C operations entirely to focus on its successful B2B ventures.

Why Are Online Businesses Switching to B2B?

As mentioned, the pandemic was a major factor for this strategy shift for many online businesses around the world. But why exactly are businesses switching back to B2B again?

Improved eCommerce Technology

Technical advancements in handling online businesses have also played a crucial role in this transition. Platforms like Shopify, Bigcommerce, and Faire have made it easier for D2C brands to manage hybrid B2B/D2C operations. This technological support reduces overhead costs and simplifies the process of scaling up B2B operations without major upfront investments.

Furniture and beauty brands, for instance, have successfully leveraged these platforms to reach new B2B audiences, such as interior designers and small business owners, blending consumer-like features with traditional B2B functionalities.

Rise of B2B Marketplaces

Another factor that accelerated this shift is the fact that B2B marketplaces have become more commonplace. Platforms like Faire have created new opportunities for brands to connect with a wide array of retailers and independent shops, providing a robust infrastructure for B2B growth.

Companies like Latico Leathers and Graza have seen substantial benefits from partnering with such platforms, experiencing increased search visibility, improved wholesale email open rates, and significant lead generation.

The B2B-D2C Shift in the

Online Luxury Goods Market

The online luxury goods market has seen remarkable shifts between B2B and D2C models, especially during and after the pandemic. Let’s see how brands like Chanel, Louis Vuitton, Cartier, Chow Tai Fook, and Prada have navigated these changes:

Chanel, traditionally known for its high exclusivity and classic branding, experienced substantial growth in D2C sales during the pandemic. However, most of its revenue continues to come from offline sales, maintaining a strong B2B presence.

Louis Vuitton has led the luxury market with a strong online presence, generating a hefty revenue through D2C channels. The brand has successfully balanced its classic luxury appeal with modern eCommerce strategies, making a substantial portion of its sales directly to consumers.

Cartier, another heavyweight, increased its focus on online sales during the pandemic but maintained a balanced approach between B2B and D2C. The brand's strategy has been to leverage both models to maximize reach and maintain its exclusive image.

Chow Tai Fook, a major player in the jewelry market, has embraced both B2B and D2C models effectively. Despite an extensive network of physical stores, the brand has boosted its online presence, adapting to the changing market dynamics.

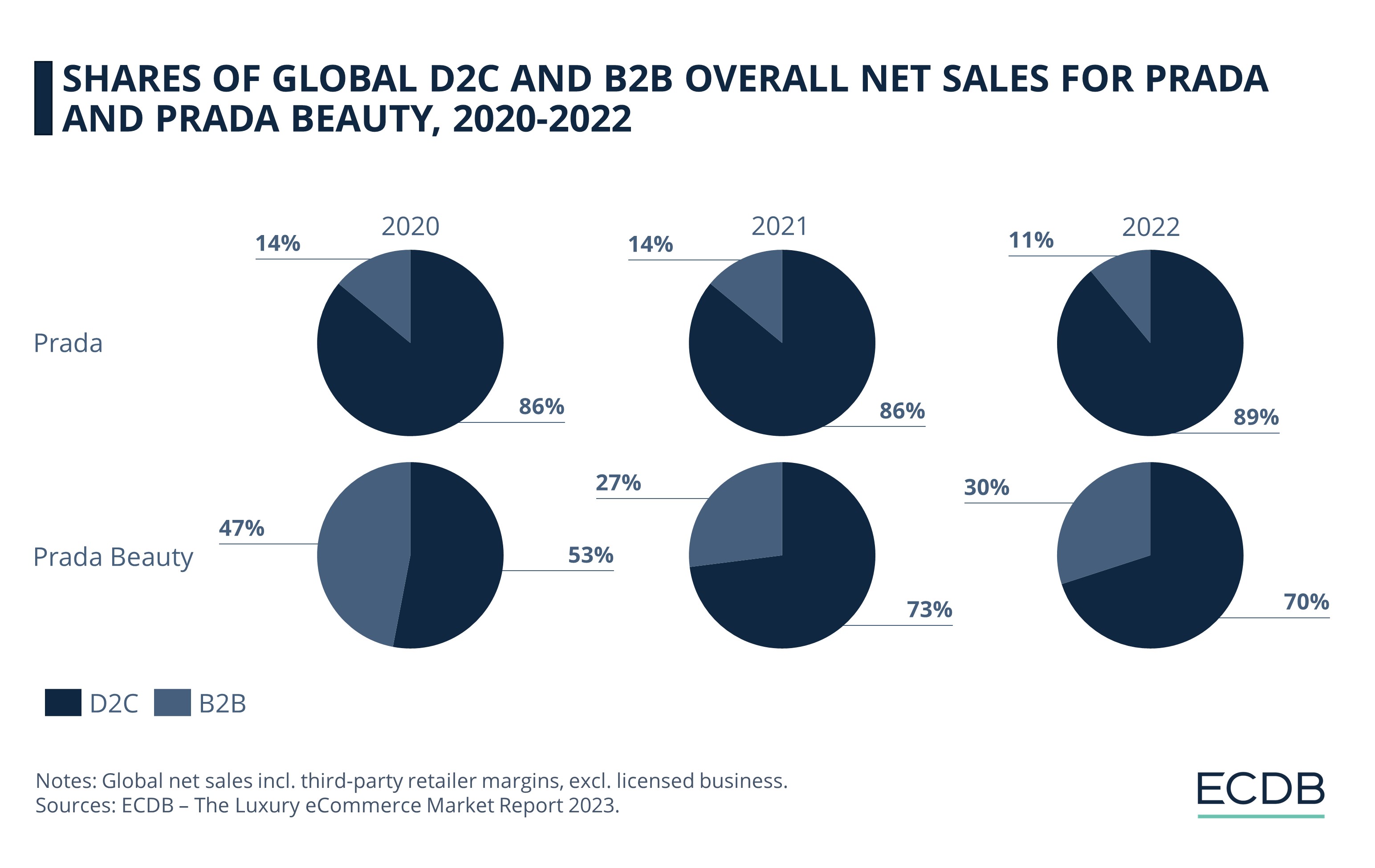

Prada and Prada Beauty have taken different paths. While Prada has gradually increased its D2C sales, focusing more on direct consumer engagement, Prada Beauty has seen a noticable move towards online sales, reflecting a strategic pivot to capture the growing eCommerce market.

Business Models in eCommerce:

Final Thoughts

While some D2C brands continue to thrive, the economic pressures and evolving market dynamics have made B2B an increasingly attractive and viable option for many.

This switch reflects a strategic adaptation to current realities, ensuring that businesses can sustain growth by diversifying their revenue streams and leveraging technological advancements to operate efficiently in both B2B and D2C spaces.

Sources: AdExchanger, Adobe Blog, Fleuron, Medtech Pulse, Entropy, Forbes, Business Express, Shopify, Nike, Deposco, PwC, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Back to main topics