Luxury eCommerce: Chow Tai Fook

Chow Tai Fook: Strong Online Sales Growth

With a mix of online and offline retail along with a combination of D2C and B2B sales, jewelry company Chow Tai Fook dominates the luxury market. Find out more about the Hong Kong-based company in ECDB's Luxury eCommerce Report.

Article by Cihan Uzunoglu | May 02, 2024Download

Coming soon

Share

Chow Tai Fook: Key Insights

Chow Tai Fook's Legacy: Founded in 1929, Chow Tai Fook Jewellery has a rich history and a significant presence with over 6,800 retail outlets, employing digital strategies to maintain market leadership.

Market Positioning: Categorized as a "Classic" luxury brand, Chow Tai Fook boasts high exclusivity, ranking among the top 40% of global luxury brands, attracting discerning consumers worldwide.

Online Sales Performance: While ranked 23rd in online sales, Chow Tai Fook jumps to 5th in total sales, highlighting its robust business strategy and market position among luxury giants.

Revenue Growth: Chow Tai Fook witnesses’ substantial growth in net sales from 2020 to 2022, both online and offline, maintaining a consistent ratio of online to offline sales.

Sales Distribution Strategy: With a slight shift towards B2B sales, Chow Tai Fook maintains a predominantly D2C focus, aligning with evolving industry trends towards direct consumer engagement.

Since its founding in 1929 in Guangzhou, China, the luxury brand Chow Tai Fook Jewelry has made a significant impact on the jewelry market. In particular, its eCommerce strategies have been a crucial shift in maintaining its market leadership.

The combination of the company's extensive network of 7,655 points of sale worldwide in 2023 – including more than 6,800 retail stores in mainland China – and its strong online presence is key to its success. This dual approach of physical and online retail has been key to Chow Tai Fook's sustained dominance in the jewelry market.

Chow Tai Fook: A Classic Luxury Brand with High Exclusivity

Now available for purchase, the ECDB Report on Global Luxury eCommerce offers detailed insights into the top luxury brands, including the likes of Louis Vuitton and Prada, also covering Chow Tai Fook with a focus on new, tax-exclusive personal luxury goods net sales, excluding both returns and the pre-owned market. The report also considers the overall market value of each brand's products, considering mark-ups from sales through third parties.

Our report categorizes Chow Tai Fook as a "Classic" level brand, recognized for its lasting legacy that defines its identity. In terms of product accessibility, Chow Tai Fook is classified in the high exclusivity tier, on par with brands like Gucci and Prada, based on a thorough evaluation of various luxury exclusivity indices that ranks Chow Tai Fook among the top 40% of global luxury brands.

Chow Tai Fook Ranks 23rd in Online Sales, But 5th in Total Sales

When we look at the top luxury brands, it's important to remember that rankings can change based on what we're measuring. Our Luxury Brands report focuses on global online net sales. While we've chosen online net sales as our main metric, we could also rank these brands by total net sales or other measures, like B2B and D2C revenue.

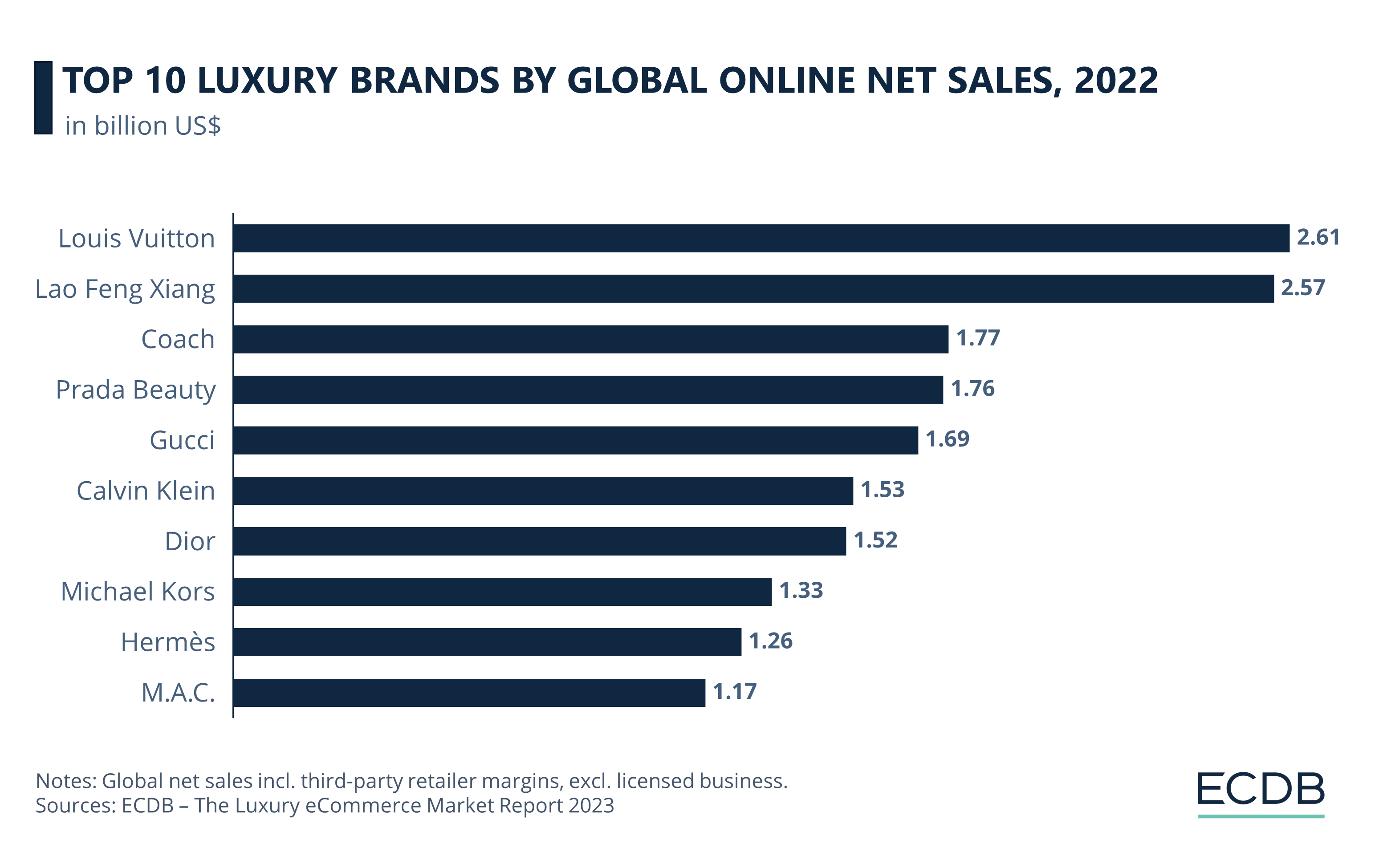

At the top of our list for online net sales, we have Louis Vuitton with US$2.61 billion, followed closely by Lao Feng Xiang at US$2.57 billion, and Coach in third place with US$1.77 billion. The rest of our top 10 list includes well-known names like Prada Beauty, Gucci, Calvin Klein and Dior. The likes of Michael Kors, Hermès and M.A.C. round out the top 10.

Focusing on Chow Tai Fook, an important insight here is that while it ranks 23rd based on online sales, it leaps to 5th place when ranked by overall net sales, placing the brand just behind giants like Louis Vuitton, Chanel, Dior, and Hermès. This shift in ranking points to Chow Tai Fook's business strategy, which has a significant impact on its market position.

Substantial Net Sales Growth, Online/Offline Share Stays the Same

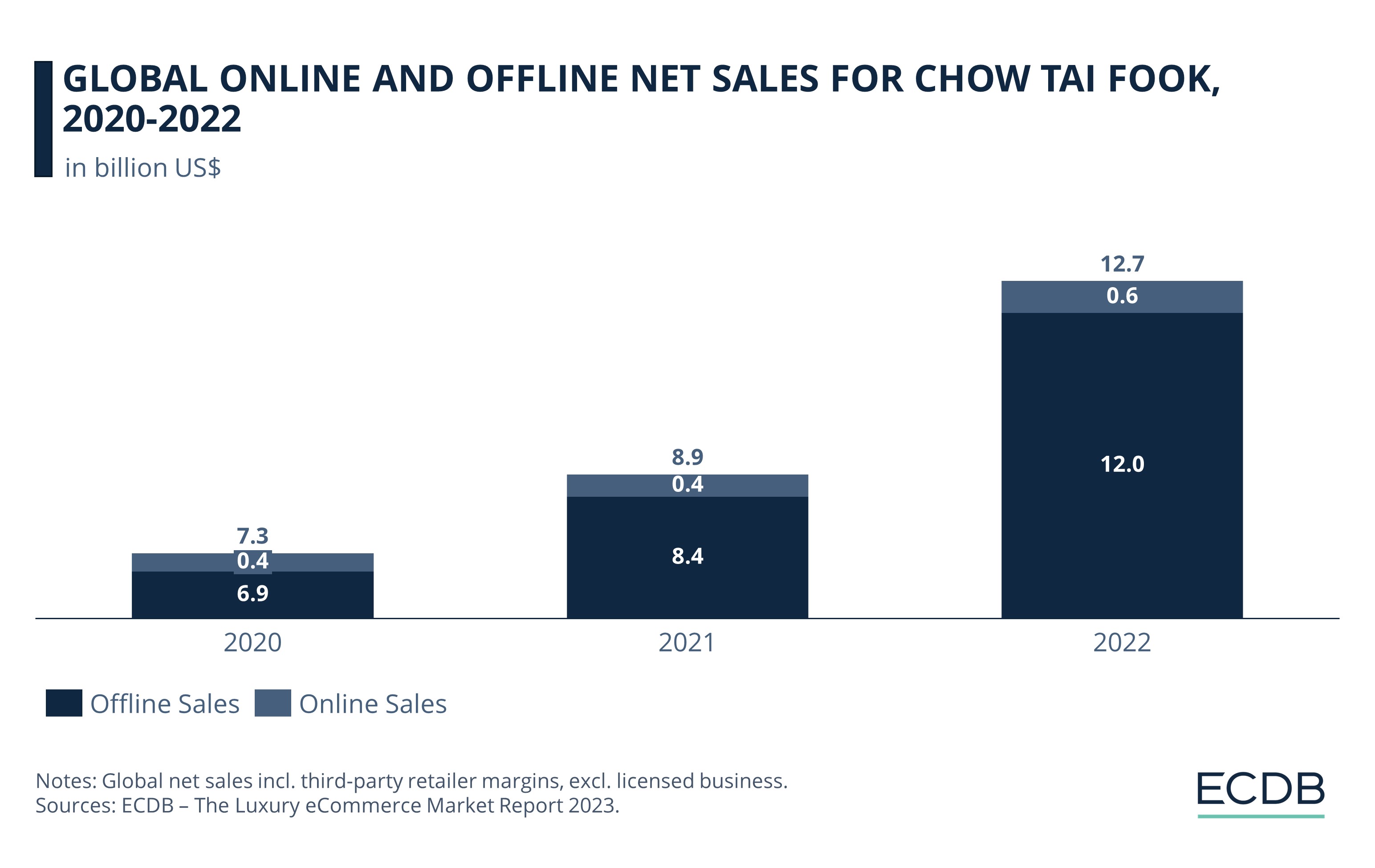

Chow Tai Fook has shown a performance that is worth revisiting in terms of revenue from 2020 to 2022. The chart below provides a detailed overview of the brand's net sales, highlighting both online and offline sales during this period.

In 2020, Chow Tai Fook's online sales stood at US$364 million, which increased to US$442 million in 2021, and further rose to US$634 million in 2022. The brand's offline sales also saw a significant rise. Starting from US$6.92 billion in 2020, these sales jumped to US$8.4 billion in 2021, and reached an impressive US$12.04 billion in 2022. It is worth noting that, in this time period, the online/offline split of net sales has stayed at the 5/95% mark for the brand.

The ECDB Luxury Report provides further insights, focusing on how leading luxury brands like Chow Tai Fook manage their online revenues while maintaining exclusivity, positioning in the market, and considering the types of products they offer. It's observed that brands with higher exclusivity tend to have lower online sales. Chow Tai Fook, known for its exclusivity, exemplifies this trend, as it generates only a small portion of its revenue through online channels.

Chow Tai Fook Slightly Increases B2B Focus in 2020-2022

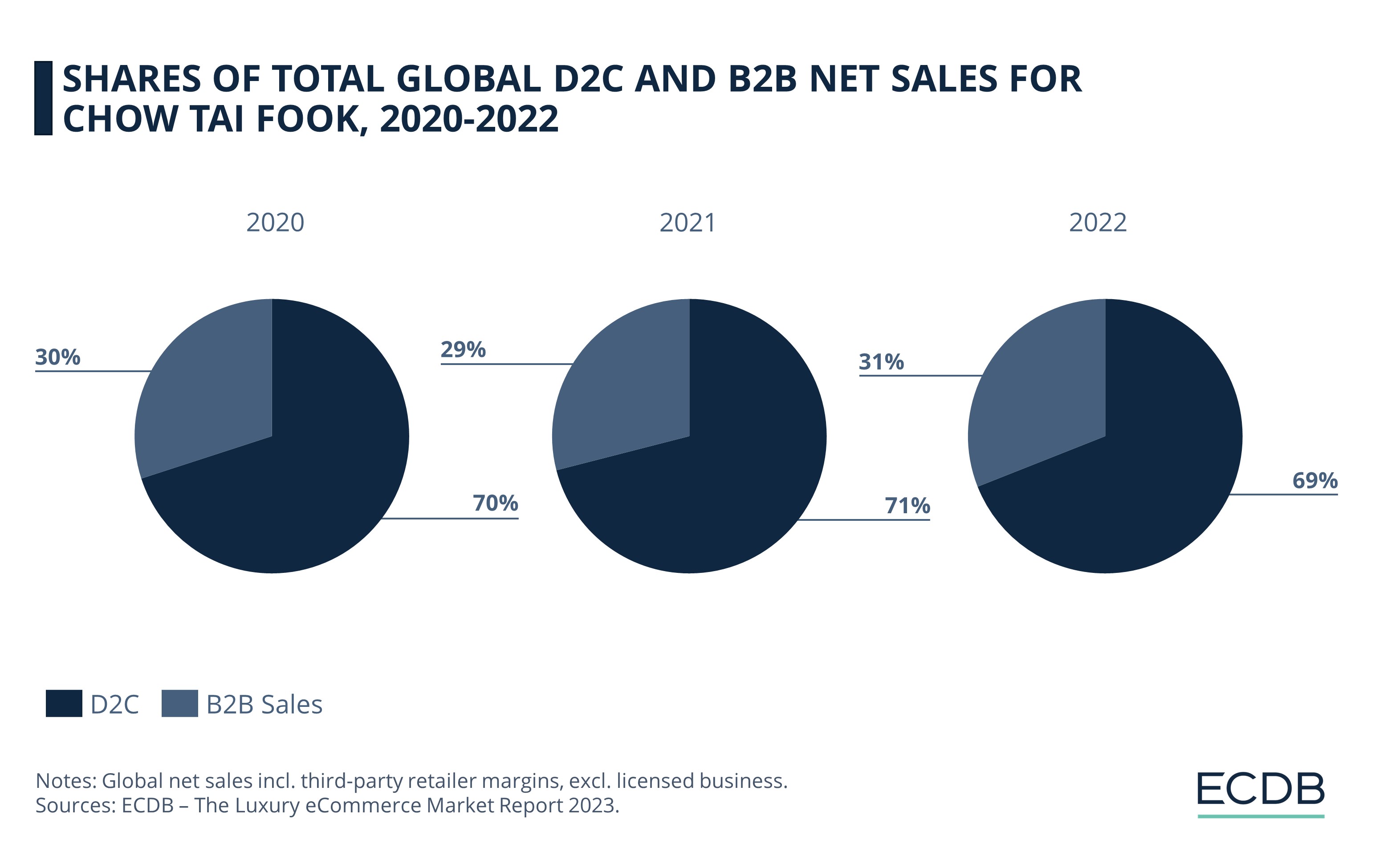

The strategic decision between D2C and B2B models plays a crucial role in defining a luxury brand's operational direction and its partnerships for product distribution. Traditionally, luxury brands have preferred the B2B model, working with intermediary retailers to sell their products through online or physical stores. However, there's a growing shift towards D2C models, allowing these brands more control over the customer experience and product marketing.

Reflecting this industry trend, Chow Tai Fook's sales data from 2020 to 2022 illustrates their approach to the B2B and D2C sales distribution.

In 2020, the brand's sales were divided into 30% for B2B and 70% for D2C. In 2021, the split was slightly altered, with B2B sales comprising 29% and D2C sales 71%. By 2022, there was a slight shift, with B2B sales rising to 31% and D2C sales decreasing to 69%. This change suggests a growing importance of business client sales in Chow Tai Fook's strategy, although direct sales to consumers still remained predominant.

The Luxury eCommerce Market – Available Now!

The 2023 Luxury eCommerce Market Report by ECDB provides the comprehensive data set for 250 leading luxury companies in an additional Excel spreadsheet, which includes sales channels, product categories, brand exclusivity and positioning over the three-year-period from 2020 to 2022.

Order the report here for the full data set, including complete market analysis from our experts.

Chow Tai Fook: FAQ

What Does CTF Stand for in Jewelry?

"CTF" in jewelry refers to Chow Tai Fook Jewellery, an esteemed jewelry brand established in 1929 in Guangzhou, China. This brand has played a major role in shaping the jewelry market. With its impressive network of more than 6,800 retail outlets across mainland China and beyond, Chow Tai Fook has also emphasized digital and eCommerce strategies to remain a leader in the industry.

Who is the CEO of CTFE?

Patrick Tsang is the Chief Executive Officer of Chow Tai Fook Enterprises (CTFE). He plays a pivotal role in guiding the company's growth and strategic direction. Under his leadership, CTFE continues to expand and strengthen its presence in various sectors, including the jewelry market through its notable subsidiary, Chow Tai Fook Jewellery.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics