eCommerce: Markets

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Indonesia ranks as the eighth-largest eCommerce market globally, with online spending steadily increasing. The growth of its online revenues is driven by rising eCommerce penetration and the growing influence of social commerce, both contributing to the rapid expansion of this dynamic market.

Article by Cihan Uzunoglu | September 27, 2024Download

Coming soon

Share

eCommerce in Indonesia: Key Insights

Revenue Growth Forecast: The country's eCommerce revenue is expected to see substantial growth, potentially reaching US$120 billion by next year.

Online Spending Dominance: Indonesia's online spending makes up 64% of its total consumer spending, highlighting a major shift towards digital retail, spurred by broader internet access and increased digital literacy.

Weekly Shopping Habit: More than a third of Indonesians engage in online shopping on a weekly basis, embedding eCommerce deeply into daily life and pointing to opportunities for market expansion, especially given the minimal number of consumers who do not shop online at all.

Livestream Commerce Surge: In Indonesia, 69% of consumers participated in livestream commerce in 2022, mainly through eCommerce platforms.

TikTok Shop and Regulatory Challenges: The Indonesian government has banned direct transactions on social media platforms like TikTok Shop, which could dampen social commerce. However, TikTok's strategic acquisition attempts with Tokopedia suggest a possible countermeasure to these new regulations.

The Indonesian eCommerce market generated revenues worth US$73 billion in 2023, with a promising yearly growth of 22%.

Moreover, the country has a population of nearly 290 million, most of whom are young and online. These factors position Indonesia as a formidable online market—one to watch for in the coming years.

Learn how accelerating online spend and presence of social commerce platforms like TikTok Shop are driving Indonesia’s eCommerce market.

Indonesian eCommerce Market: US$120 Billion by Next Year?

As internet access expands and digital skills improve, more people are shopping online, boosting the potential for eCommerce revenue in Indonesia.

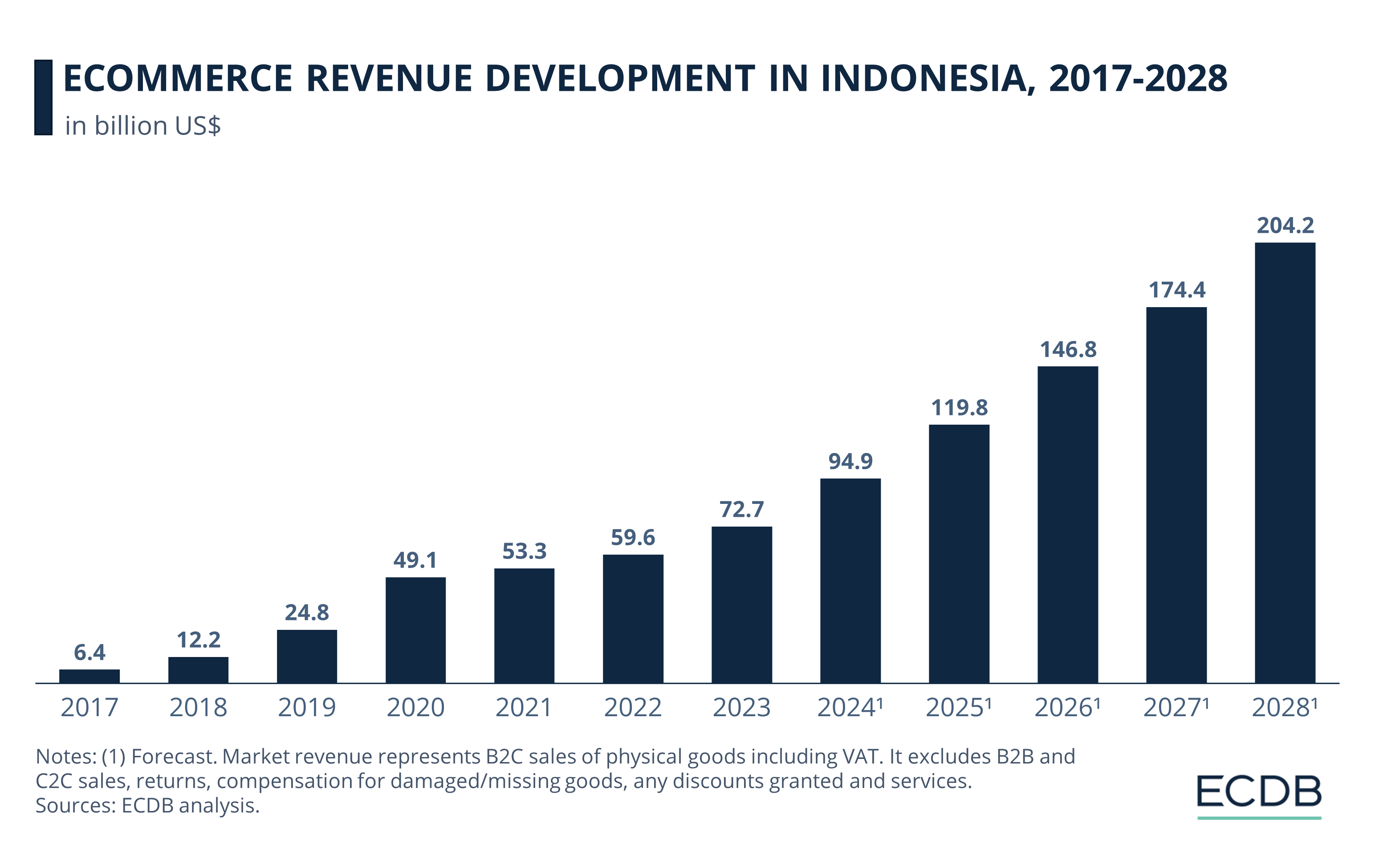

Looking at recent data, we see a significant jump in revenue from 2019 (nearly US$25 billion) to 2020 (US$49 billion), largely driven by the COVID-19 pandemic's boost to online shopping.

After this surge, growth has continued at a steadier pace. For instance, revenue moved up from US$53 billion in 2021 to US$59 billion in 2022, following with almost US$73 billion last year.

Forecasts for upcoming years are even more optimistic. Revenue is expected to hit US$95 billion this year and continue its upward trajectory, reaching US$120 billion in 2025, US$147 billion in 2026, and further climbing to US$174 billion by 2027.

By 2028, eCommerce revenue in Indonesia is projected to exceed US$204 billion, showcasing a substantial growth from the figures recorded in recent years.

Indonesia’s eCommerce Penetration Rate Grows

In general, there is a high probability of a positive correlation between Internet penetration and eCommerce penetration rate. As more people gain internet access and develop digital literacy, the customer base for eCommerce grows, potentially increasing the country's penetration rate.

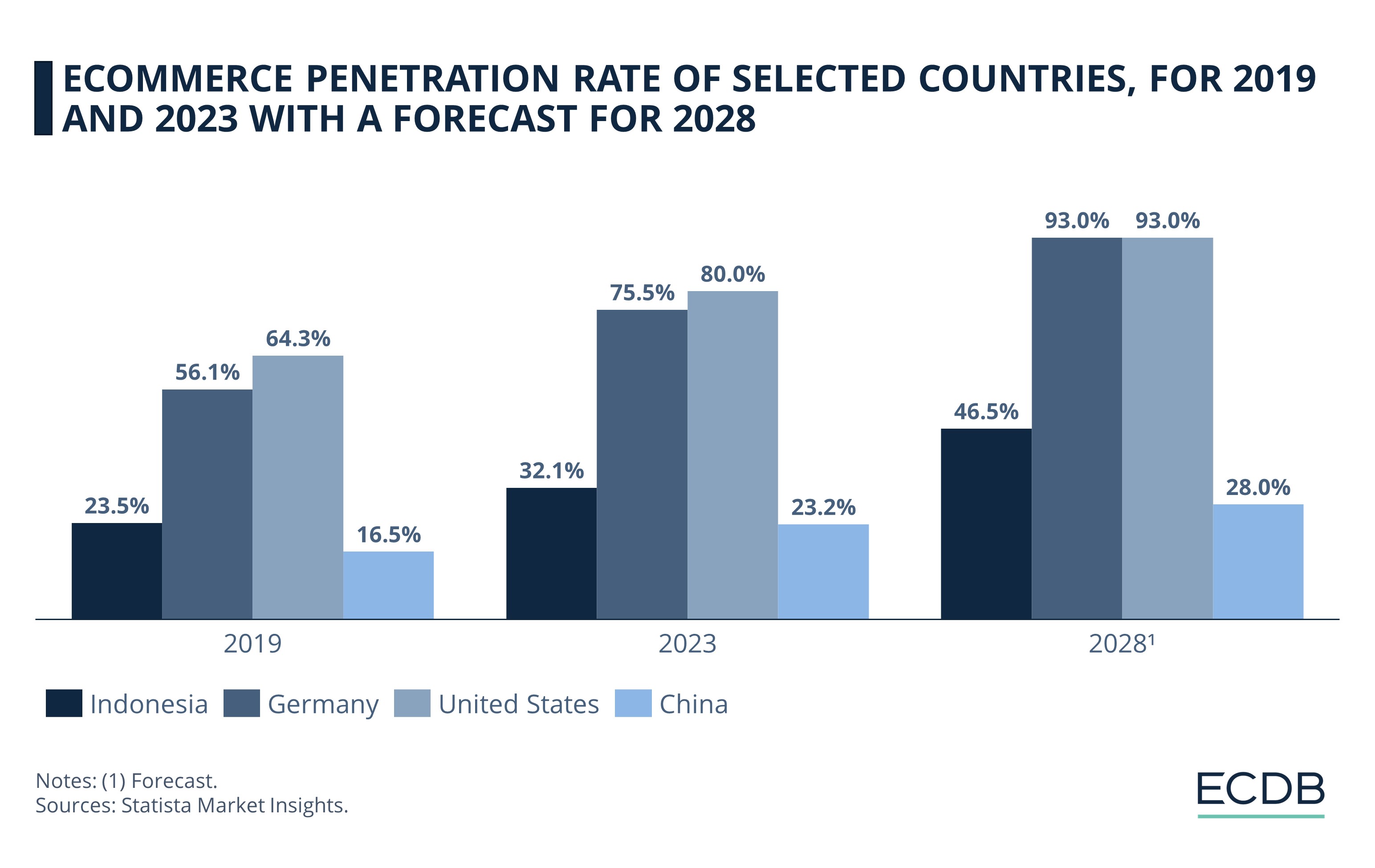

Back in 2019, Indonesia's eCommerce penetration rate was only 23%, and by 2023 it grew to 32%. As projections indicate, this increase is set to continue, pushing the rate to an estimated 46% by 2028.

This expansion reflects the nation's burgeoning digital literacy, even though countries like Germany and the United States are way ahead with values twice as high as the Indonesian eCommerce penetration rate, each forecast at 93% by the year 2028. Meanwhile, China remains behind and is expected to reach a 28% rate by 2028.

eCommerce in Indonesia: Spending Takes Place Online

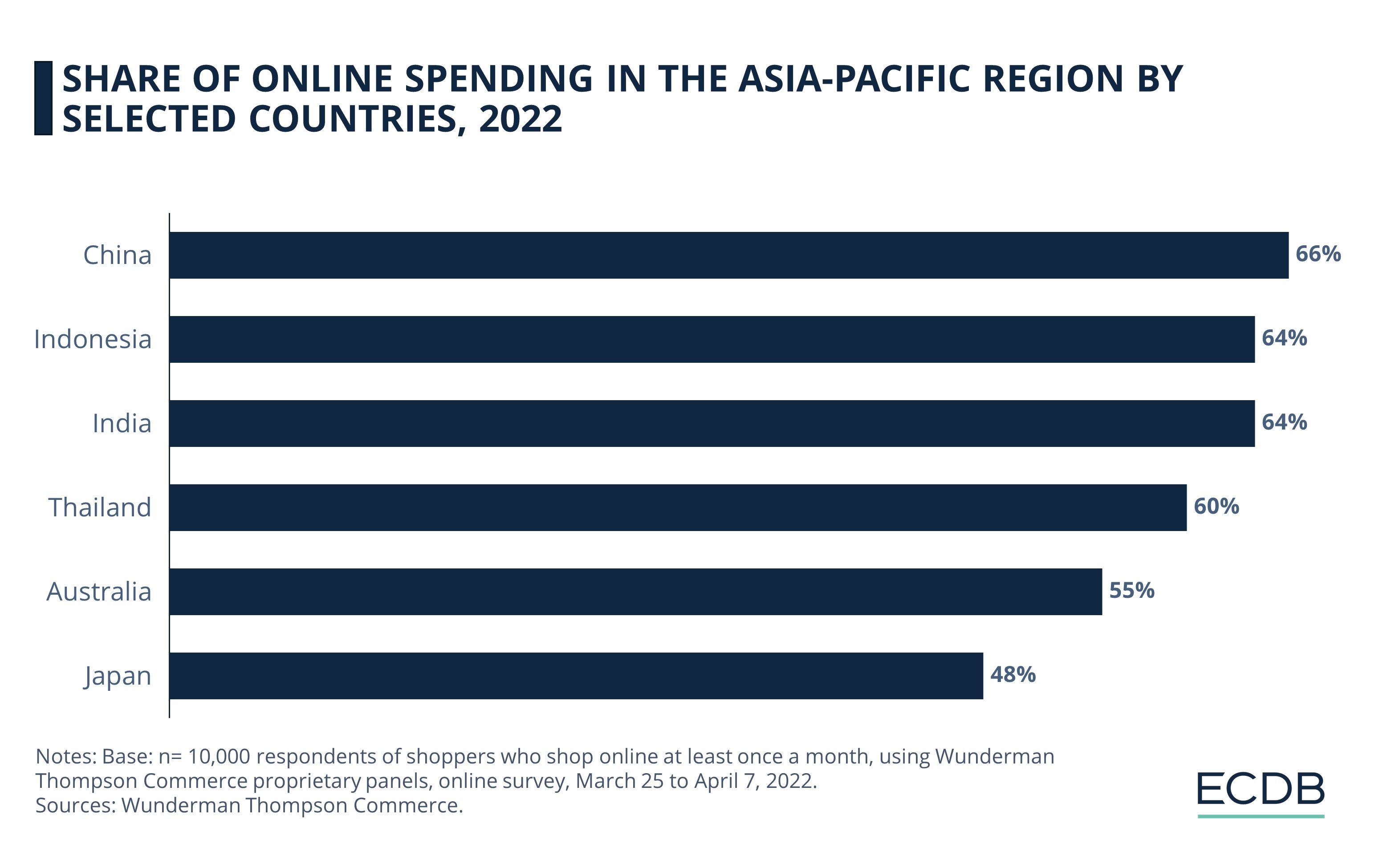

Indonesia is a significant player in the APAC region. According to a 2022 report by Wunderman Thompson Commerce, Indonesia's online spending accounted for a significant 64% of the country's total consumer spending, aligning it with India and just trailing China, which led the pack at 66%.

Moreover, Indonesia's performance surpasses other countries like Thailand, Australia, and Japan, which reported online spending rates of 60%, 55%, and 48%, respectively.

Indonesia's high online spending percentage stems from multiple factors. The country's rapid digital transformation, fueled by widespread internet access via mobile phones, has driven a shift towards online shopping. With the fourth-largest global population, Indonesia's growing internet penetration naturally increases online transactions.

More Than a Third of Indonesians Shop Online Weekly

The Indonesian eCommerce market is characterized by consumer engagement that isn't simply episodic, but rather habitual.

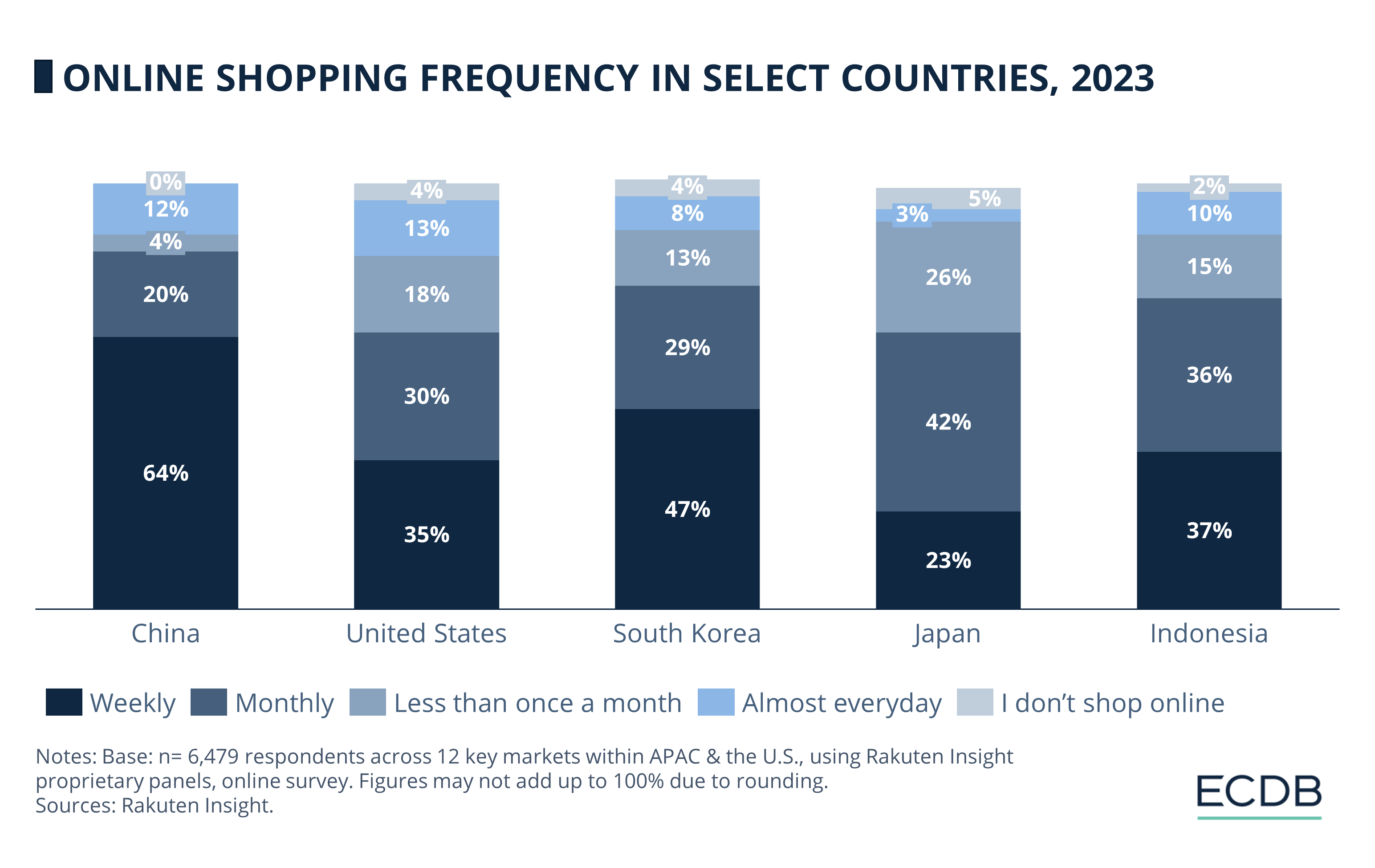

The 2023 data from Rakuten Insight showcases the online shopping frequency among consumers in Indonesia. The majority (37%) shops weekly, followed closely behind by 36% who shop several times a week, and 15% shopping less than once a week. Less frequently, 10% shop almost every day, and a mere 2% never shop online.

Comparative data provides context. Notably, Indonesia has a relatively low percentage of consumers who never shop online. While this share is around 0% in China, it is 4% in both the U.S. and South Korea, and 5% in Japan. With 10%, Indonesia is just behind the world leaders China (12%) and the U.S. (13%) in terms of (almost) daily online shoppers.

This trend in Indonesia reflects a persistent demand that businesses can seize for their benefit. Additionally, the small fraction of consumers who never partake in online shopping suggests there is still substantial room for market growth.

Livestream Commerce in Indonesia

One of the latest developments in the eCommerce landscape is the emergence of livestream commerce which originated in China. Livestream commerce, or live shopping, is essentially a hybrid of entertainment and eCommerce.

It involves the use of livestream video content to showcase and sell products directly to consumers in real-time, with the ability to interact with sellers and make purchases immediately, combining the thrill of live video and social media engagement with the convenience of online shopping.

In the case of Indonesia, where this digital trend has gained popularity in the online shopping sphere, the data shows that the country is a strong adopter of livestream commerce within the APAC region.

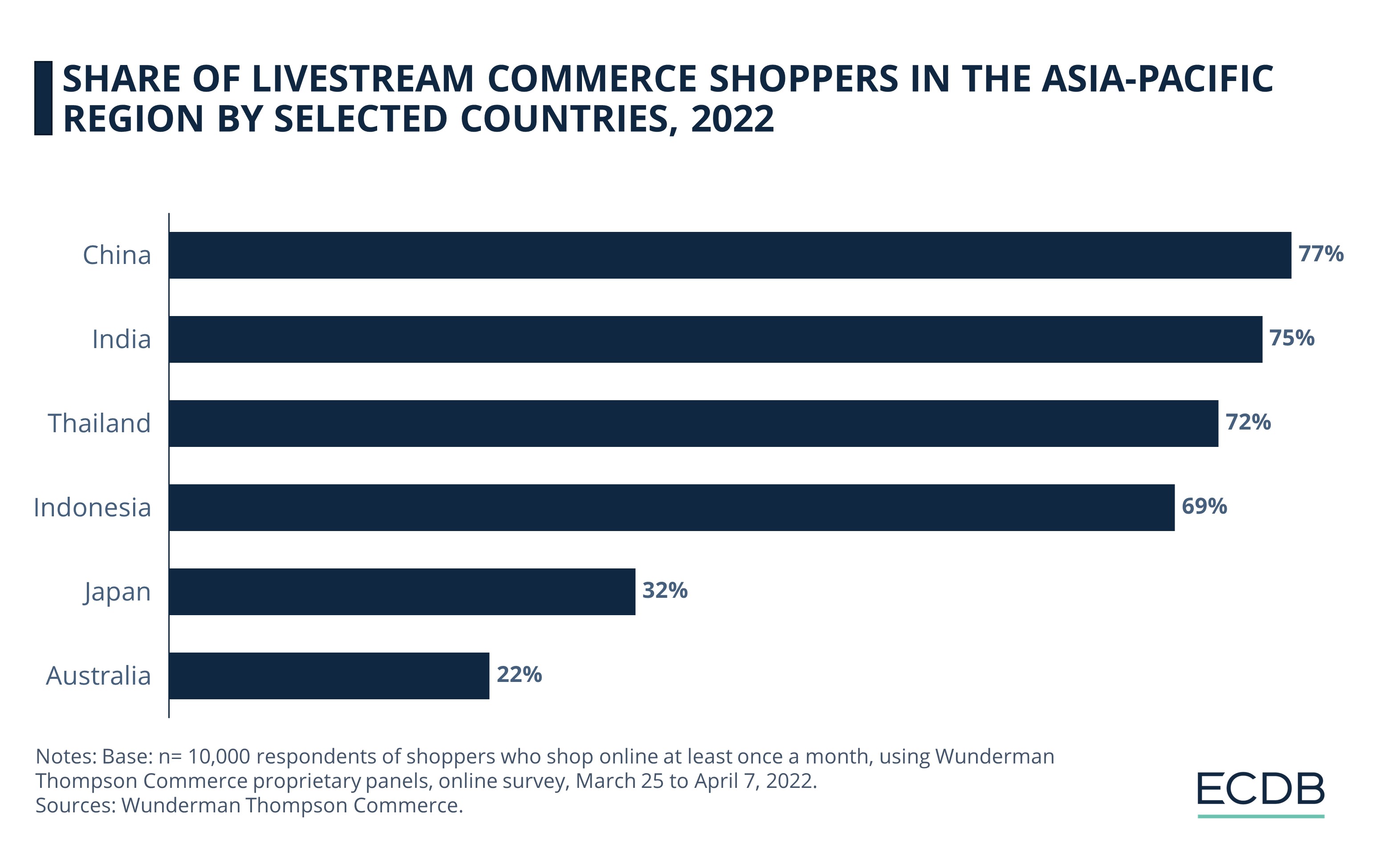

As per the forementioned report by Wunderman Thompson Commerce, 69% of Indonesian shoppers engage with livestream commerce in 2022, marking a significant adoption rate.

This, however, still places Indonesia slightly behind China, India, and Thailand, which report rates of 77%, 75%, and 72% respectively. Meanwhile, Japan and Australia trail behind with respective livestream commerce adoption rates of 32% and 22%.

Indonesia Prefers eCommerce Platforms for Live Shopping

Indonesia's recognition of the growing livestream commerce trend has been evident in the proactive steps taken by its eCommerce platforms, like Shopee.

The Singapore based eCommerce platform has integrated livestream commerce into their marketing strategies by creating Shopee Live, effectively employing this potent tool to stimulate sales growth and enhance customer engagement. The adoption, however, extends beyond businesses — it's being wholeheartedly embraced by consumers as well.

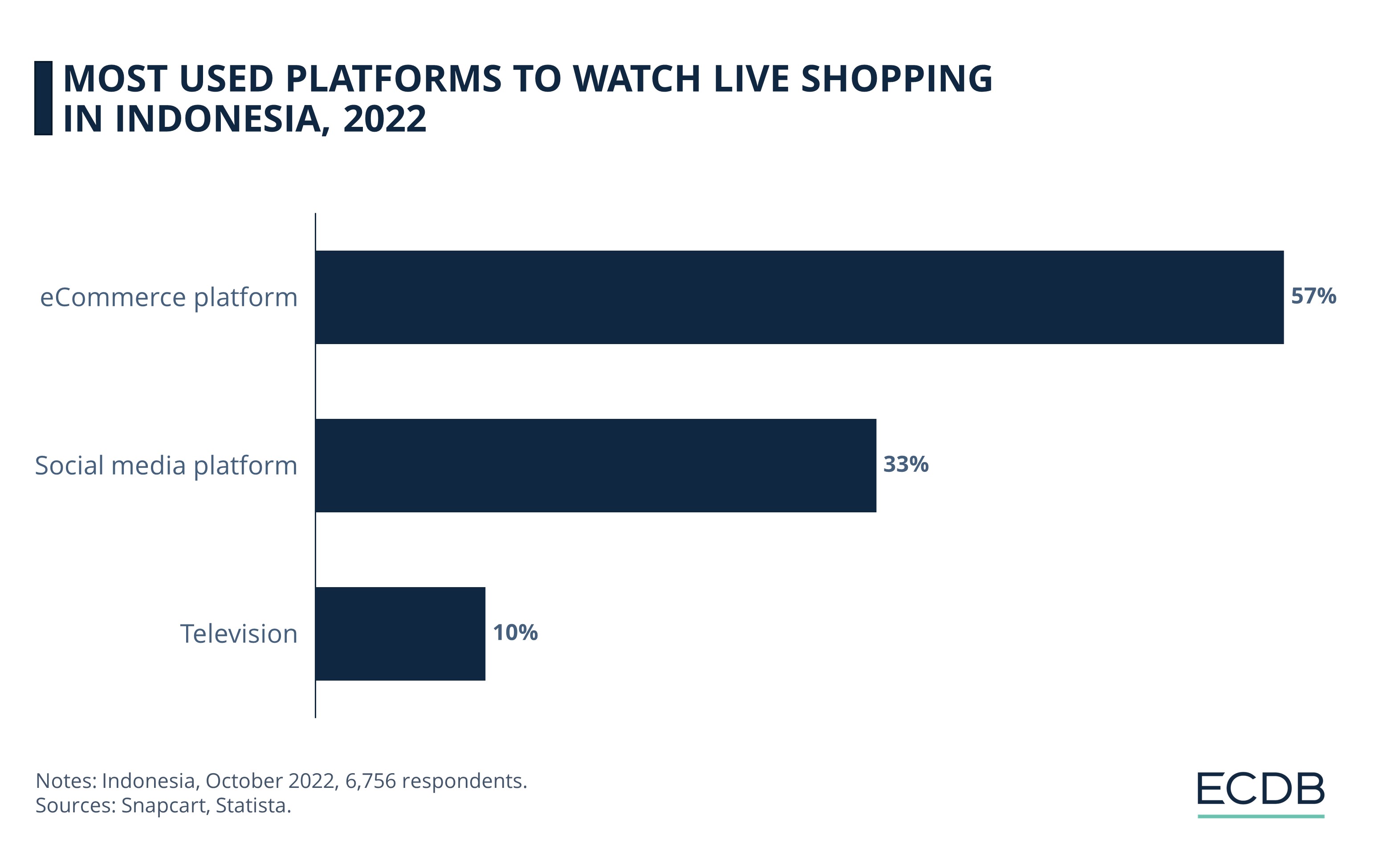

A 2022 survey conducted by Snapcart revealed that a significant 57% of Indonesian participants engage in live shopping, primarily through eCommerce platforms. Although social media platforms captured a substantial share with one-third of the responses, the traditional medium TV stood at a mere 10%.

Indonesian Government Targets TikTok Shop

TikTok’s takeover of social media is paralleled by its meteoric rise in eCommerce through its sales platform TikTok Shop, particularly in the Asia Pacific region.

Indonesia was also a leading market for TikTok Shop, where it generated 12% of its total GMV in 2023.

However, the Indonesian government banned direct transactions on social media in September 2023. The sanction specifically targeted TikTok Shop, as it had grown rapidly and created a monopoly in the Southeast Asian region. The step gave rise to speculations of a slowdown in social commerce in the country.

The new regulation obligated TikTok Shop to close in Indonesia. At the year end, however, TikTok began its preparations to buy 75% stakes in GoTo’s Tokopedia, the biggest Indonesian eCommerce platform. Through this US$840 million investment, TikTok was able to restart its eCommerce business in Indonesia.

The U.S. president Joe Biden recently signed a bill requiring TikTok's parent company, ByteDance, to sell its stake within a year or face a U.S. ban.

Sales can now take place on the TikTok platform again - however, the transactions are managed by Tokopedia's system. While this measure permits TikTok to carry out its eCommerce activities in the country, it remains under government scrutiny for possible violations.

Since its return, while sales in categories like beauty products and FMCG (fast-moving consumer goods) have been promising, categories like dietary supplements have seen their sales volume dip well below their pre-ban level.

Moreover, in the aftermath of this merger and acquisition, ByteDance recently announced that it would reduce the workforce in its Indonesian TikTok Shop arm by 9%, which amounts to 450 jobs. Such developments highlight the adjustment phase that TikTok Shop must go through before it regains its footing in the Indonesian eCommerce market.

Sources: Wunderman Thompson Commerce, Rakuten Insight, Snapcart, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

Back to main topics