eCommerce: Best Online Stores in the U.S.

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

The American eCommerce market has experienced remarkable growth over the past decade, with online retail sales hitting new records annually. While industry giants such as Amazon and Walmart lead the market, many smaller retailers are also making their presence felt.

September 27, 2024Download

Coming soon

Share

Top Online Stores in the United States: Key Insights

Top Online Stores in the United States: Key Insights

The U.S. eCommerce market is dominated by Amazon, Walmart, and Apple, which together generate over US$225 billion in net sales, highlighting the significant influence of a few major players in shaping the industry.

Diverse Focuses:

Homedepot.com, Target.com, Shein.com, BestBuy.com, Chewy.com, Costco.com, and Samsclub.com hold significant positions in the U.S. eCommerce market, with diverse focuses ranging from home improvement to fashion and pet supplies.

Most Popular Shops:

Amazon, Walmart, and Target lead in customer preferences, with significant purchase rates of 74%, 47%, and 25% respectively, showcasing their strong consumer appeal and dominance in the U.S. eCommerce market.

Rising eCommerce Penetration:

The U.S. eCommerce penetration rate has steadily increased from 55% in 2017 to 81% last year. Forecasts suggest it will reach 84.5% this year and 97% by 2029, indicating that nearly all U.S. consumers will shop online.

Continued Growth:

The U.S. eCommerce market is set to surpass US$1 trillion by 2024, reflecting its crucial and expanding role in the economy, with continued growth projected to reach US$1.4 trillion by 2028.

The global eCommerce landscape is significantly influenced by the United States, holding the position of the world’s second-largest market with an anticipated total revenue of over US$1 trillion by the end of this year. Want to know more? Here are the top online stores and detailed information on revenue analytics, competitor analysis and market development.

eCommerce in the United States: Top Online Stores By Net Sales

Based on ECDB data, the American online retail sphere is essentially a story of giants and their followers. The top three online stores (Amazon.com, Walmart.com, and Apple.com) distinctly dominate the field, collectively amassing over US$225 billion in net sales.

1. Amazon.com

Amazon.com is the undisputed leader among ecommerce companies in the U.S. online retail sector, boasting impressive sales of US$135.2 billion in 2023, far surpassing its competitors. Dominating the market for years, Amazon’s influence in American eCommerce remains unchallenged. Notably, 97.3% of Amazon’s global revenue comes from its U.S. operations, highlighting its strong domestic focus.

Despite its leading position, Jeff Bezos has expressed concerns about Amazon falling behind in the AI race. To stay competitive, Amazon is heavily investing in AI tools and startups, including a US$4 billion investment in Anthropic. The company is also developing its own AI solutions, such as the Amazon Bedrock platform for businesses and the recently launched AI assistant Q. Bezos is actively involved in these efforts, aiming to keep pace with industry giants like OpenAI, Microsoft, and Google.

2. Walmart.com

Walmart.com is next, but at a substantial distance, reporting US$64.9 billion in sales. The online store rose from third to second place in 2019 and has successfully maintained this rank through 2023. This ascendancy, although noteworthy, hasn’t been enough to topple Amazon.com from the top spot.

Recently, Walmart has expanded its drone delivery service to more customers. This service, powered by Wing and Zipline, offers super fast delivery of essentials, with over 20,000 orders already completed. Walmart aims to build on this momentum, providing convenient drone deliveries to more communities and solidifying its position in the competitive eCommerce sector.

3. Apple.com

Apple.com rounds out the top three with US$25.9 billion in eCommerce net sales. The website has had a turbulent ride, holding second place in 2018 but dropping to sixth in 2020. It regained its footing by climbing back to third place in 2021 and maintained it until last year. The U.S. is the dominant contributor to Apple.com’s global revenue, accounting for 54.8%.

Last year, Apple updated its online store with a feature called “Shop with a Specialist over Video.” This allows U.S. customers to connect with an Apple Specialist via one-way video when purchasing products like the iPhone. Recently, this feature was added to the Apple Store app on iOS. Customers can now get live support during their purchase process, making shopping more interactive and convenient.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companiesstores, and marketplaces. Stay a step ahead in the market with ECDB.

4. Homedepot.com

Homedepot.com closely follows Target.com with US$19.38 billion in sales. In the first quarter of this year, Home Depot experienced a 2.3% decline in overall sales, down to US$36.4 billion, and a 2.8% drop in comparable sales.

Despite these challenges, online sales grew by 3.3%. The company emphasized improving the online shopping experience, enhancing search functionality, and simplifying returns. Home Depot’s investment in its ecommerce platform has been crucial as the company navigates economic challenges and shifts in consumer behavior.

5. Target.com

Target.com sits in fifth place, pulling in US$19.36 billion. Recently, Target announced changes to its Pride Month merchandise strategy, limiting availability to online and select stores after backlash over last year’s designs. The collection, which includes adult apparel, home products, and food and beverages, is curated based on consumer research and historical sales.

This development, although having minimal direct impact, might draw more customers to shop online, where Target can sell the full range of Pride products without confronting in-store controversies.

Top Online Stores in the U.S: Lower Ranks

Further down the list are Shein.com, BestBuy.com, Chewy.com, Costco.com, and Samsclub.com. These stores report eCommerce net sales figures ranging from US$10 billion to US$18 billion for 2023. Although they operate at a significant level, their scale pales in comparison to the leading trio.

Shein.com has seen a remarkable rise, moving from the 51st position in 2018 to break into the top 10 by 2022. The Chinese-Singaporean company’s main online store climbed to sixth position in 2023. This rapid ascent highlights its growing influence in the U.S. market, particularly in the Fashion sector.

BestBuy.com, known for its strong presence in the Electronics category, grabbed attention by capturing the third spot in 2020. However, it slipped back to sixth place in subsequent years and eventually dropped to seventh place last year. Despite this, it remains a key player in the electronics retail space.

Chewy.com specializes in pet products and has carved out a significant niche in the online retail market. Its focus on pet supplies and excellent customer service has helped it secure a spot among the top online stores in the U.S.

Costco.com, another major player, continues to perform strongly, leveraging its well-known warehouse club model to attract online shoppers. It consistently ranks in the top 10, driven by its diverse product range and competitive pricing.

Finally, Samsclub.com, another warehouse club giant, rounds out the top 10. Like Costco, it benefits from its membership model and bulk purchasing options, which appeal to a broad customer base looking for value and convenience.

A look at the main product categories of these top 10 online stores reveals that Electronics is the dominant retail sector, represented by four stores. Hobby & Leisure and Fashion follow with three and two stores respectively, while only one top 10 shop has DIY as its main category. These stores also offer a range of services, from tutorials and customer support to membership benefits and bulk purchasing options, enhancing their appeal to a wide audience.

Most Popular Online Shops in

the United States

Based on a survey from Statista Consumer Insights, here are the most popular online shops accessed through mobile devices:

Amazon leads with 74% of respondents having made purchases, matching its top position in net sales. Walmart follows with 47%, reflecting its strong presence in both popularity and revenue.

Target, at 25%, shows strong consumer engagement despite ranking fifth in net sales. eBay appears with 19%, highlighting its significant user base not reflected in top net sales.

Apple (16%) and Bestbuy.com (16%) both maintain high popularity, consistent with their net sales standings. Chewy.com (15%), Costco (14%), and Home Depot (14%) also show strong customer bases, aligning with their net sales figures.

AliExpress, with 11%, highlights its presence in the market, though it doesn’t appear in the top net sales rankings, indicating a different market segment or smaller transaction sizes. This comparison underscores the diverse shopping preferences among U.S. consumers.

U.S. eCommerce Penetration Rate Might Reach 87% By 2029

The eCommerce penetration rate in the U.S. has been on a steady incline, a trend clearly visible when examining key years. In 2017, the rate stood at a then-modest 54.9%. By 2023, this figure had risen significantly to 81.3%. Looking ahead to the near future, the forecast for 2024 suggests this upward momentum will persist, albeit at a slightly moderated pace. The rate is expected to hit 84.5%, marking a modest yet positive increase from the 2023 level. Peering even further into the horizon, the projected penetration rate for 2029 is 97.1%, at which point, virtually almost all U.S. consumers will be shopping online.

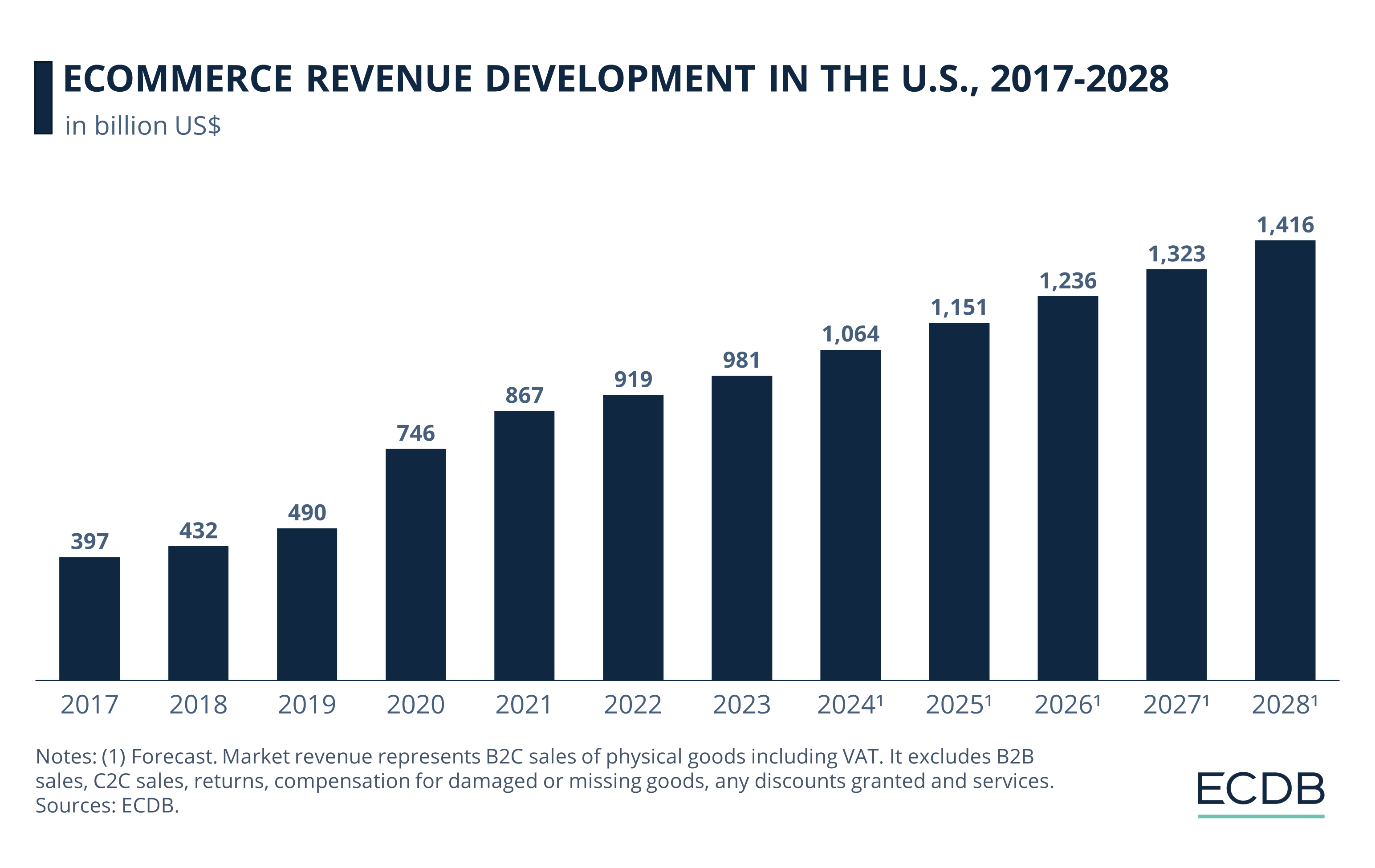

Market Growth in the U.S.: Revenue Hits US$1 Trillion This Year

The U.S. eCommerce market has been on a steady climb, growing from US$397 billion in 2017 to a projected US$1.06 trillion by 2024. Notably, the sector experienced a significant jump in 2020, fueled by the pandemic, reaching US$746 billion.

It's important to underline that by 2024, the market is expected to hit the US$1 trillion mark, confirming eCommerce's growing role in the U.S. economy. Beyond 2024, the market is projected to sustain its growth, reaching US$1.41 trillion by 2028.

Sources: Business Insider, Daily Mail, 9to5Mac, Digital Commerce 360, The Hill, Statista, ECDB

FAQ: Top Online Stores in the United States

What is the most popular online store in America?

The most popular online store in America is Amazon.com. It leads the U.S. online retail sector with impressive sales figures and a significant share of the market. In 2023, Amazon.com reported sales of US$135 billion, showcasing its dominance in the eCommerce space.

What is the #1 online store?

Amazon.com is the #1 online store, not only in the United States but globally. Its extensive product range, efficient delivery system, and customer-centric approach have made it the top choice for online shoppers. Amazon continues to innovate and invest in technology to maintain its leading position.

What are the top 10 shopping sites?

The top 10 shopping sites in the United States, based on eCommerce net sales, are:

1. Amazon.com

2. Walmart.com

3. Apple.com

4. Homedepot.com

5. Target.com

6. Shein.com

7. Bestbuy.com

8. Chewy.com

9. Costco.com

10. Samsclub.com

Who is the #1 online retailer?

Amazon.com is the #1 online retailer, dominating the market with substantial sales and a broad customer base. Its focus on providing a seamless shopping experience, fast delivery, and a wide variety of products has cemented its top spot in the eCommerce industry.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

Back to main topics