eCommerce in China

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

A battle of prices between Chinese tech giants such as JD.com, vip.com, and chaoshi.tmall.com, driven by revenue, challenges the eCommerce market in China. Learn about the top online stores, as well as market sales, size, growth, and recent developments.

Article by Cihan Uzunoglu | September 25, 2024Download

Coming soon

Share

eCommerce Market in China: Key Insights

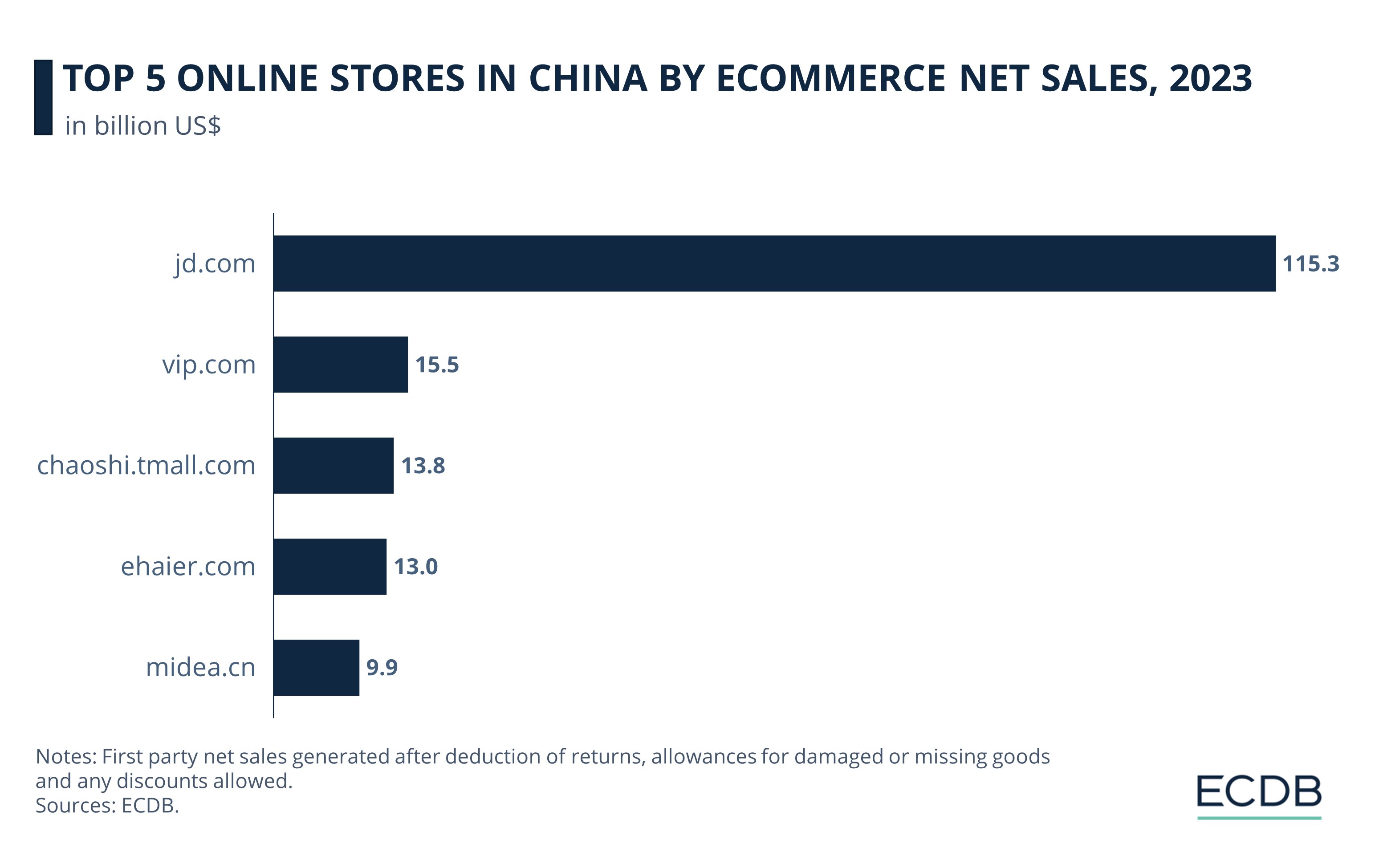

Top eCommerce Players: JD.com leads China's eCommerce market with US$115 billion in net sales for 2023, with vip.com, chaoshi.tmall.com, ehaier.com, and midea.cn completing the top five.

Market Growth and Stability: China's eCommerce sector has seen remarkable expansion over the past decade, surpassing US$2 trillion in 2024. However, as the market matures, growth is leveling off, with monthly revenue fluctuations indicating ongoing volatility.

Price Wars: Intense price wars among top players are straining profit margins in China’s maturing eCommerce sector. These battles threaten both small vendors and major platforms, potentially leading to a deflationary spiral that could dent consumer confidence and slow economic growth.

Shifting Consumer Preferences: Electronics, Hobby & Leisure, and Fashion dominate China’s eCommerce categories. However, the fastest growth was seen in Household Care, followed by Food, Apparel, Beverages, and Electrical Appliances.

Technological Integration: The Chinese market is rapidly adopting Metaverse, AR, and VR technologies. With robust government backing, these innovations are extending beyond retail into sectors like manufacturing, despite ongoing challenges.

As the largest eCommerce market in the world, the Chinese market operates in a distinctly different environment, characterized by live commerce innovation, intense price wars, and the unique dynamics of social commerce. In China, eCommerce giants like JD.com aren't just leading the pack — they're navigating the complexities of cross-border eCommerce, community group buying, and even the emerging Metaverse.

But what happens when these platforms face challenges, from the aggressive strategies of China-based sellers on Western marketplaces to Amazon's struggles in China? As we observe these dynamics, some key questions emerge: How are top retailers adapting, and what trends are truly shaping the future of eCommerce in China? Let’s find out through data.

China eCommerce Market: Top Online Stores in China

Looking at the net sales of the top online stores in China, we see a significant disparity between the leading online retailers. JD.com dominates the market by a large margin:

Ranked second behind amazon.com globally, JD.com leads the Chinese market with eCommerce net sales figure of US$115.25 billion in 2023, setting itself far ahead of its closest competitors.

Vip.com follows as a distant second, generating US$15.45 billion in net sales. Chaoshi.tmall.com, with US$13.82 billion, ranks third, closely followed by ehaier.com at US$13 billion.

Midea.cn rounds out the top five, with US$9.87 billion in net sales.

What makes these online stores the best in the market, and what are some of the latest developments surrounding these retailers?

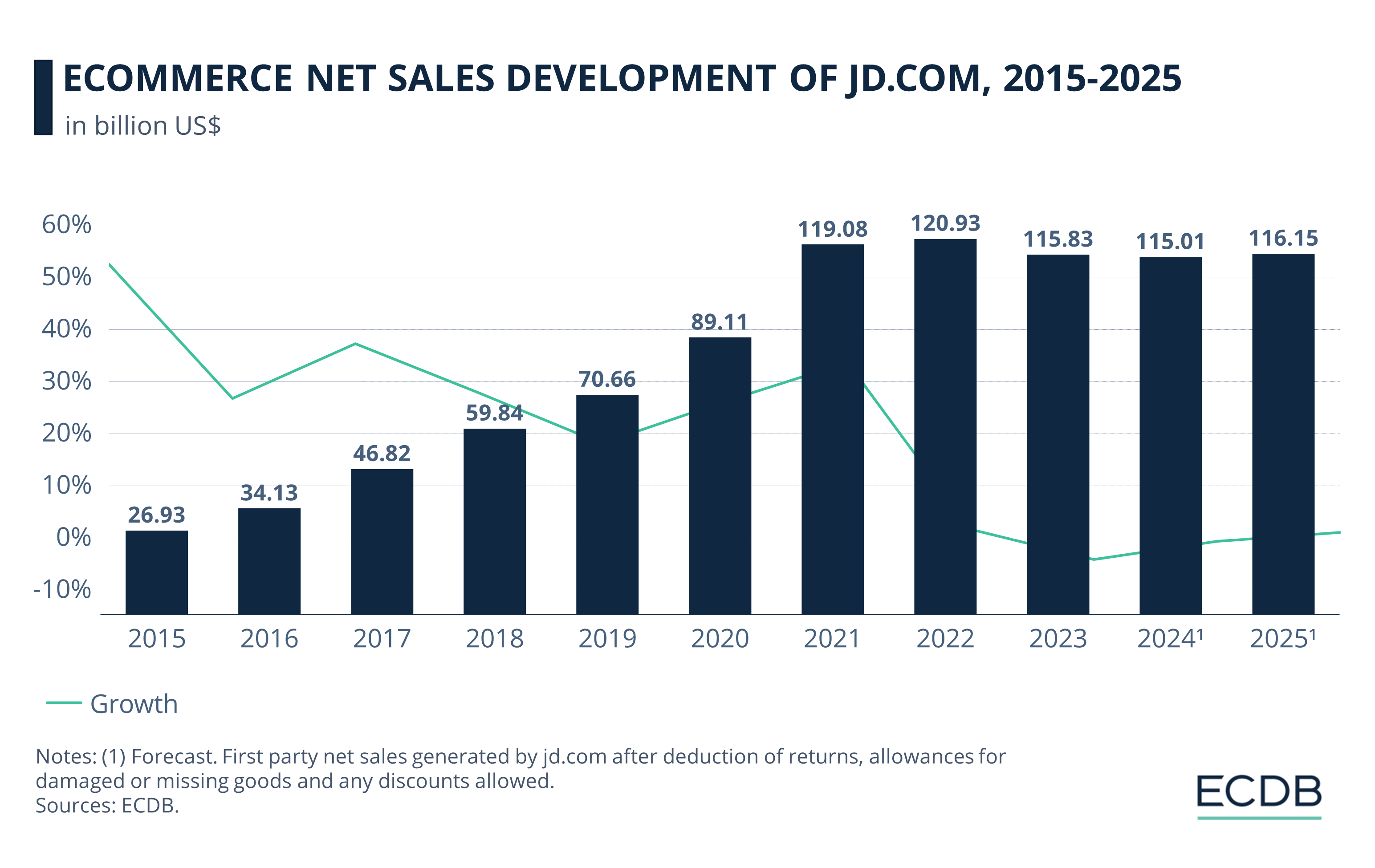

1. JD.com

JD.com is a powerhouse in China’s eCommerce sector, boasting an impressive US$115.25 billion in net sales in 2023. However, recent strategic shifts by major stakeholders like Walmart have cast a spotlight on the challenges and changing dynamics within the market.

Founded in 1998, JD.com rapidly grew into one of China's largest online retailers, known for its vast product selection, reliable logistics network, and commitment to quality. The platform's dominance has been solidified by its ability to deliver goods quickly across the country, often within 24 hours, thanks to its extensive warehousing and delivery infrastructure.

Recently, Walmart's decision to sell its entire US$3.6 billion stake in JD.com marked a significant turning point. This move, driven by Walmart's strategic refocus and the rising prominence of its Sam's Club brand in China, led to a notable impact on JD.com's stock performance, including an 8% drop in its Hong Kong-listed shares.

JD.com's future in the market appears questionable, and the company will need to navigate the complexities of a shifting geopolitical environment and increasing competition to maintain its leading position.

2. Vip.com

Vip.com, known for its strong focus on discounted products, secured US$15.45 billion in net sales in 2023, making it a significant player in China’s eCommerce market.

Launched in 2008, Vip.com carved out a niche by offering flash sales and deep discounts on branded products, which resonated with cost-conscious Chinese consumers. The platform's model of limited-time offers on high-quality goods at reduced prices has been central to its appeal and success over the years.

Despite this, Vip.com faced a 3.6% year-over-year decline in revenue during the second quarter of 2024, bringing in 26.88 billion yuan (US$3.7 billion). The number of orders also fell from 213.8 million to 197.8 million, signaling a slowdown in consumer activity. The company attributed these results to the agility of its team and the resilience of its business model, though the decrease in sales momentum remains a concern.

Looking ahead, Vip.com’s third-quarter revenue projections further underscore these challenges, with expectations of a year-over-year decline of 5% to 10%.

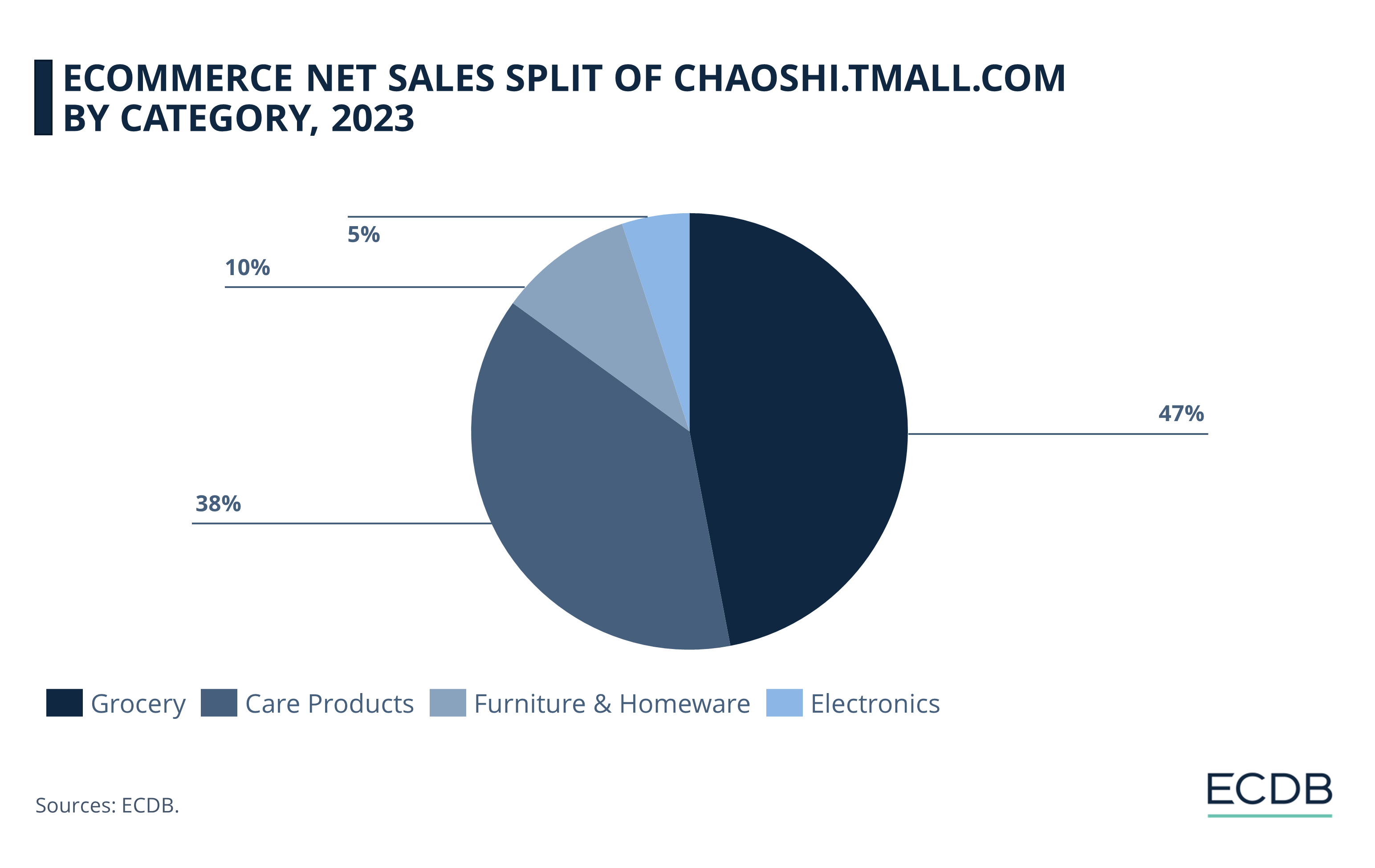

3. Chaoshi.tmall.com

Chaoshi.tmall.com, operated by Alibaba Group Holding, Ltd., is a key online store in China's grocery sector, contributing US$13.82 billion in net sales in 2023. Despite a slight dip in overall revenue across Alibaba's Taobao and Tmall businesses, Chaoshi.tmall.com remains essential for Chinese consumers seeking convenient access to groceries and daily essentials.

In the second quarter of 2024, Alibaba reported a 2% decline in Taobao and Tmall revenue, mainly due to a reduction in direct sales, particularly in consumer electronics and appliances. However, the grocery sector, anchored by Chaoshi.tmall.com, showed resilience and growth.

Alibaba's strategic initiatives, including investments in competitive pricing, customer service, and AI-powered marketing tools, have improved user retention, purchase frequency, and consumer satisfaction on Chaoshi.tmall.com.

4. Ehaier.com

Ehaier.com, eCommerce platform of the Chinese home appliances and consumer electronics company Haier, generated US$13 billion in net sales in 2023. Haier, known for its wide range of domestic and commercial products, continues to expand its global footprint, with significant recent developments in Europe.

In June 2024, Haier HVAC Europe signed a distribution agreement in Greece and established a partnership with Dutch supplier Rexel Netherlands. These moves are part of Haier’s strategy to broaden its reach in the European market. A Haier training center will also be established in Greece, showing the company's commitment to expanding its product offerings and market presence in Europe.

5. Midea.cn

Midea.cn, the eCommerce platform of Midea Group, achieved US$9.87 billion in net sales in 2023, reflecting the company's strong position in the global home appliance market. Despite a challenging market environment, Midea Group reported a record net profit for the first half of 2024.

Midea's revenue climbed 10% year-over-year to 218.1 billion yuan (US$30.5 billion) in the first six months of 2024, driven by an 11% increase in its business-to-consumer segment. The company’s overseas income rose 13%, underscoring the growing significance of international markets.

Over the years, Midea has effectively leveraged online sales channels and digital marketing to boost its international presence. This has been further supported by strategic investments, acquisitions, and localization efforts.

eCommerce Market Development in China

China's eCommerce market has seen remarkable expansion over the past decade, with total revenues rising from US$1.06 trillion in 2018 to US$1.83 trillion in 2023. While the market has experienced rapid growth, particularly during the early 2020s, the pace has started to moderate as the sector matures:

In 2024, China's eCommerce revenue is projected to surpass the US$2 trillion mark, reaching approximately US$2.02 trillion. This marks a significant milestone, but it also reflects a shift toward more stabilized growth.

Moving forward, revenues are expected to continue their upward trajectory, albeit at a more measured pace, with projections of US$2.22 trillion by 2025 and US$2.76 trillion by 2028.

As the market grows, this slower rate of expansion suggests that China's eCommerce sector is entering a more mature phase. This transition will likely bring new challenges and opportunities as businesses adjust to a sector where explosive growth is giving way to more sustained, incremental gains.

Monthly eCommerce Revenue of the Chinese Market

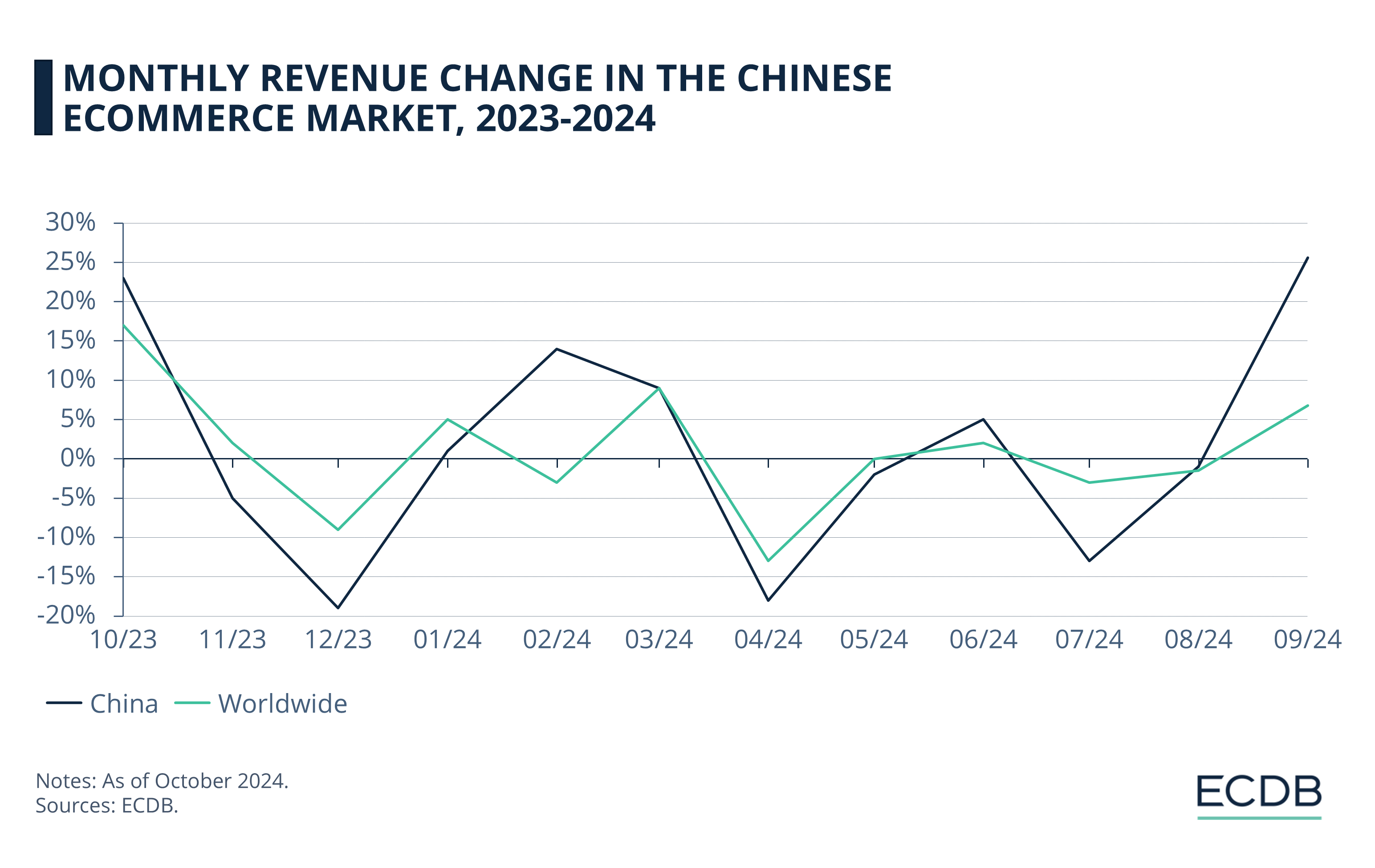

Monthly eCommerce revenue shifts in the market also highlight the ongoing volatility in China's eCommerce sector, with periods of recovery often offset by subsequent declines:

After a significant downturn in July 2023, the market saw a strong rebound during September and October. However, this recovery was short-lived as revenue dipped again in November and December.

Entering 2024, the market displayed a mix of slight growth and renewed challenges. Early in the year, there was a modest uptick, but this was followed by a sharp decline in April. May and June showed signs of recovery, with June even achieving a positive growth rate of 5%.

After declines in July (13%) and August (1%), the Chinese market grew 26% in September, its best monthly performance in the last 12 months.

Price Wars in Chinese eCommerce:

A Double-Edged Sword

As China's eCommerce market matures, price wars among major platforms like Alibaba, JD.com, and Pinduoduo have become unsustainable, squeezing profit margins and threatening financial stability. Small vendors are particularly affected, struggling to survive as extreme discounting and high return rates force them to sell below cost.

Large platforms are also feeling the strain, prompting shifts toward more sustainable strategies and value-driven offerings. However, the broader impact of continuous price cuts raises concerns about a potential deflationary spiral, which could further erode consumer confidence and hinder economic growth.

China-Based Sellers on Western Marketplaces

vs. Amazon in China

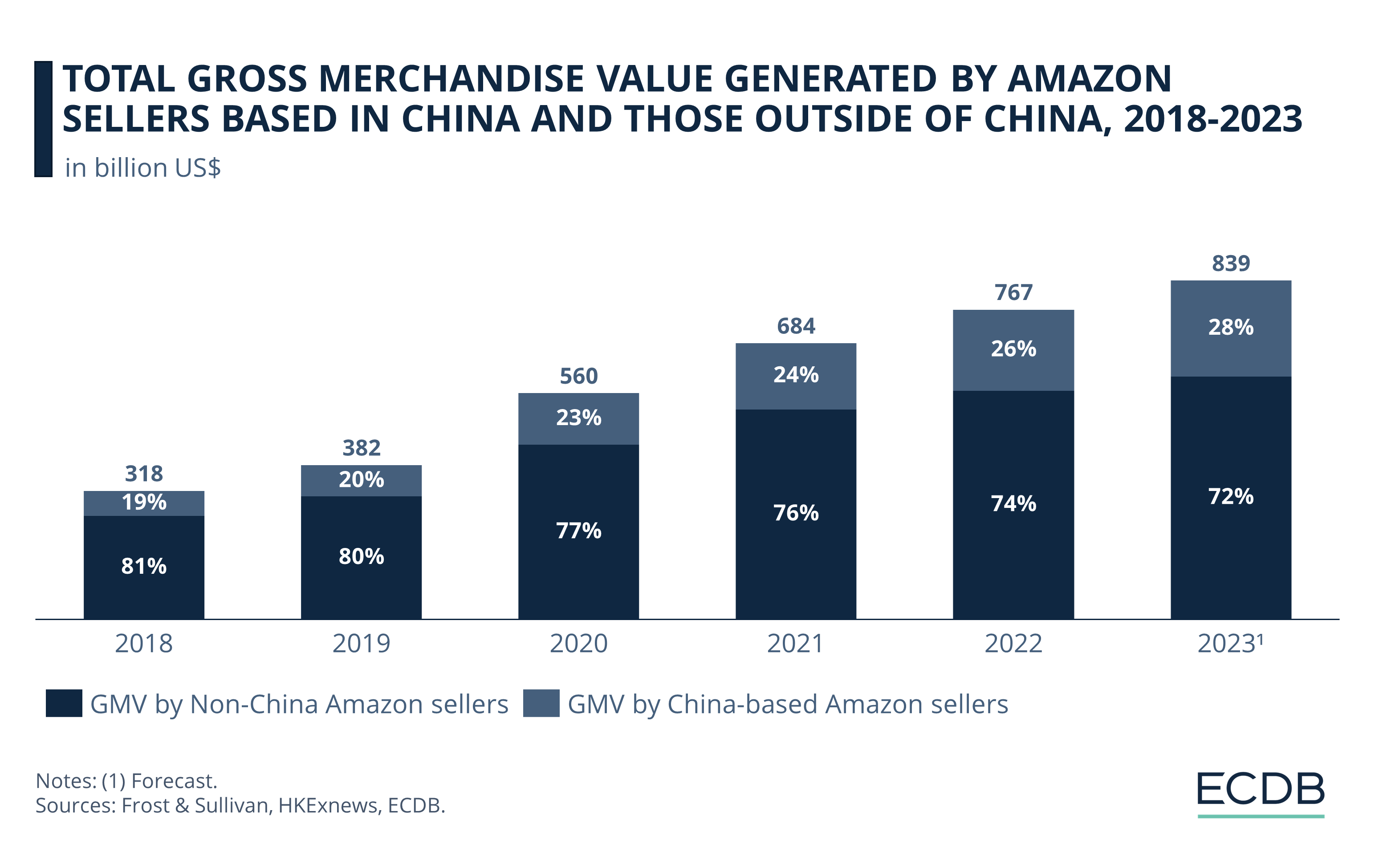

Looking beyond China, the country's eCommerce influence is not confined to its domestic market. China-based sellers are increasingly dominating Western online marketplaces like Amazon and eBay, with their share of Amazon’s GMV (gross merchandise volume) growing from 20% in 2018 to an estimated 28.4% by 2023.

Conversely, Western marketplaces have struggled in China. Amazon's attempt to penetrate the Chinese market, despite acquiring Joyo.com and rebranding as "Amazon China," failed against local giants Alibaba and JD.com. Amazon’s inventory-centric model, successful in the U.S., did not resonate in China, leading to its retreat in 2019.

But given China's global influence, we need to talk about cross-border eCommerce in China and its important role as a cross-border player. Let’s see what the findings show.

Cross-Border eCommerce in China

China's cross-border eCommerce market is a significant force in global trade. In 2023, cross-border export GMV reached US$523 billion, with projections to hit US$847 billion by 2027. Japan is the top market for Chinese exports, contributing 10.4% of total cross-border revenues, followed by South Korea and the United States.

Shein leads as the most valuable Chinese cross-border eCommerce company, with a market valuation of US$66 billion, far surpassing others like Airwallex at US$6 billion. China's dominance in cross-border eCommerce is supported by its competitive pricing, strong production capabilities, and strategic investments in global logistics, positioning it to maintain its growth trajectory despite challenges like supply chain costs and international regulations.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Top eCommerce Categories in China

Beyond how the online shopping market has evolved, what sells the most in China?

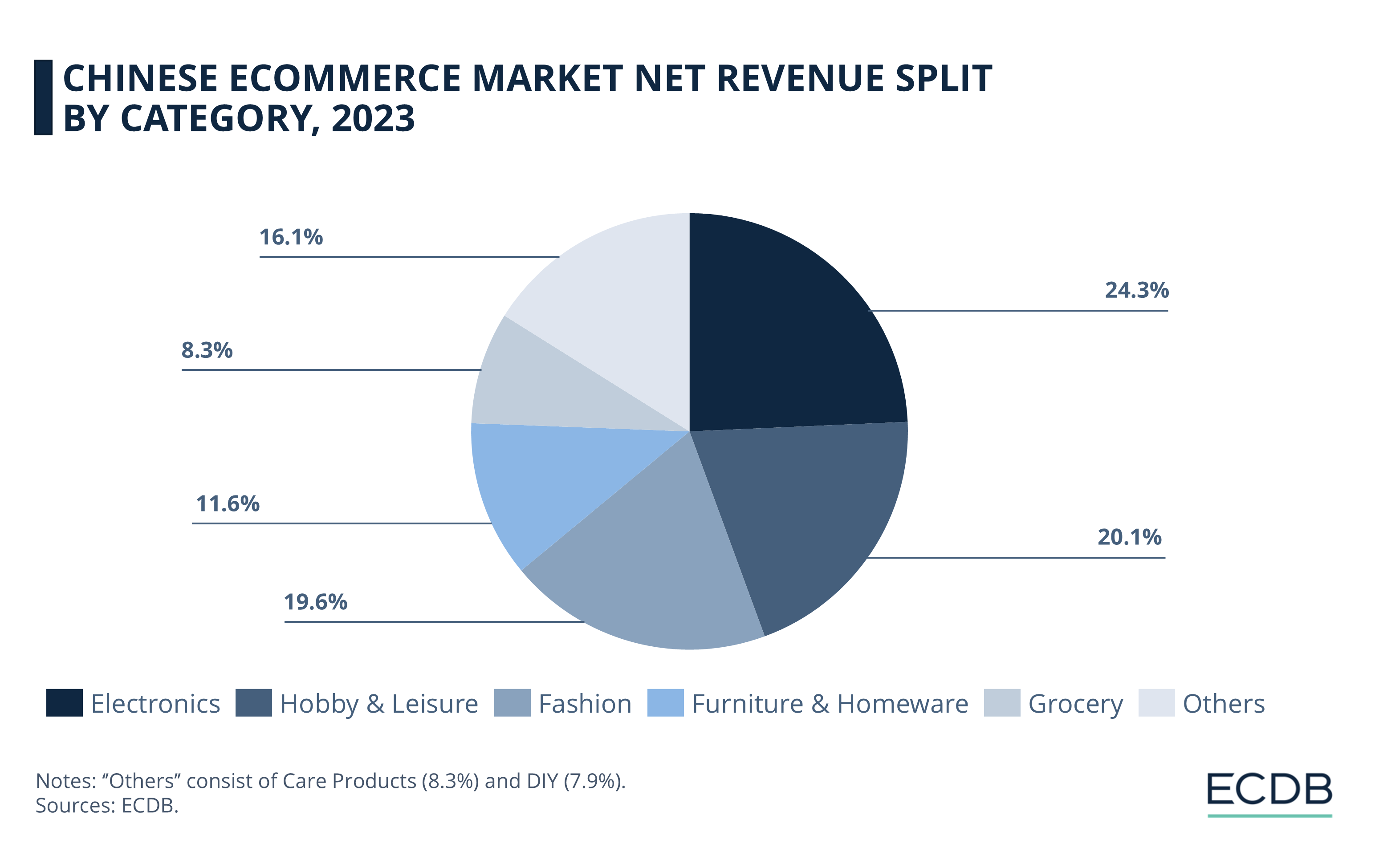

The Chinese eCommerce market in 2023 was dominated by a few key categories, each of which contributed significantly to the overall revenue:

Electronics emerged as the largest category, making up 24.3% of the market, while Hobby & Leisure followed closely with a 20.1% share.

Fashion was also a major contributor, accounting for 19.6% of the market. The largest 4th category Furniture & Homeware held an 11.6% share.

Grocery represented 8.3% of the market, followed by Care Products (8.3%) and DIY (7.9%).

Looking only at revenue gives us a limited view. The fastest growing sub-categories in the country’s eCommerce market also reveal valuable insights.

Fastest Growing Categories in Chinese eCommerce

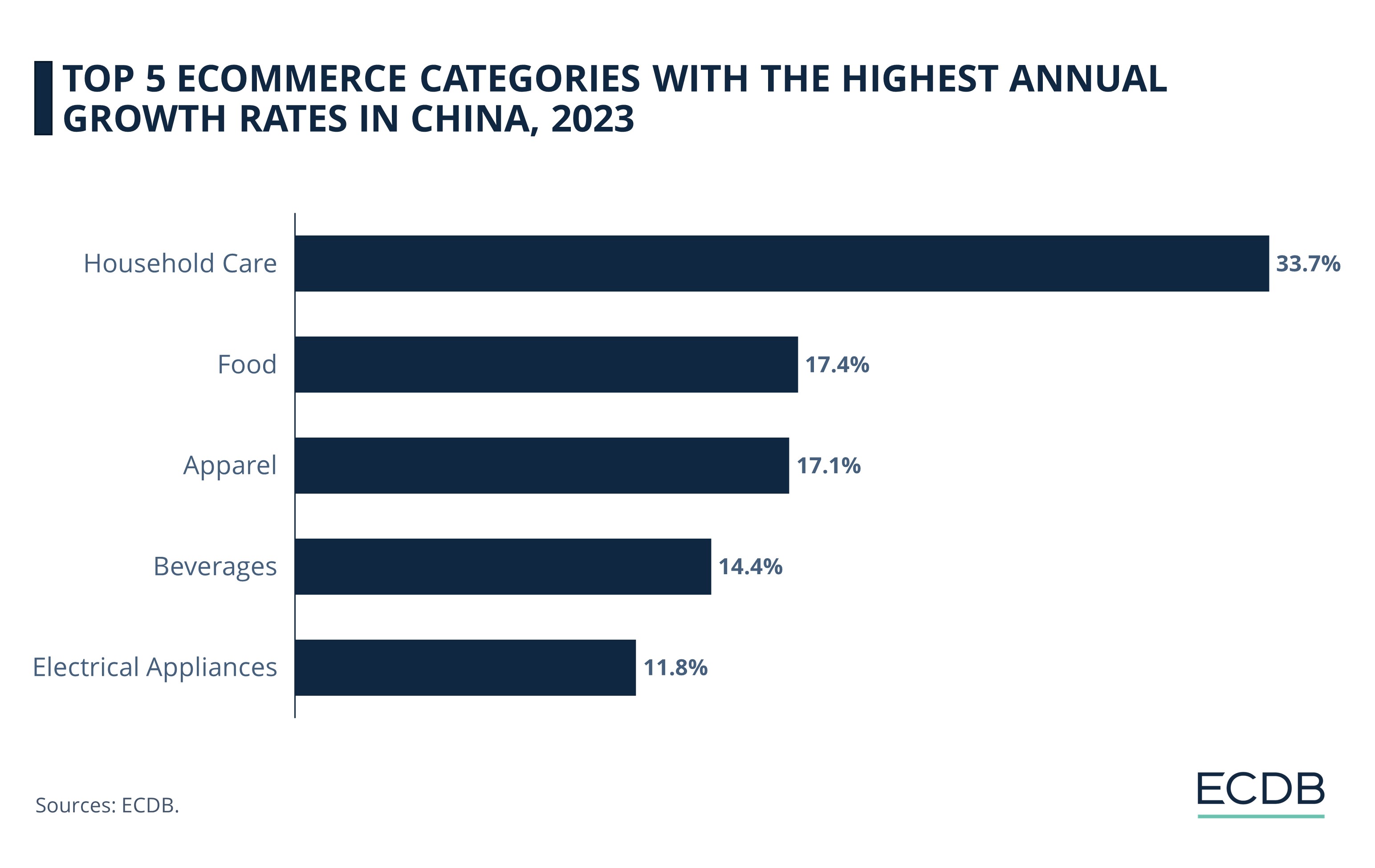

Based on growth rate rather than total revenue, the following categories saw the most significant yearly increases in the Chinese eCommerce market in 2023:

Household Care led the pack with an exceptional 33.7% growth, far outpacing other categories. Food followed with a 17.4% increase, though still significantly behind Household Care.

Apparel, while leading in revenue, recorded a 17.1% year-on-year growth, placing it third in terms of growth rate. Beverages grew by 14.4%, securing the fourth spot.

Electrical Appliances, which ranks second in total revenue, saw an 11.8% increase, rounding out the top five.

In addition to hard facts, trends are another good indicator of a market. What is the first trend that comes to mind when we talk about online shopping in China? It is, of course, live commerce, which was born in the country.

Live Commerce in China

Live commerce in China has rapidly matured since its large-scale emergence in 2016, with market GMV growing exponentially each year. By 2023, live commerce transactions reached US$694.5 billion, with projections suggesting the market will exceed US$1 trillion by 2026. This growth has attracted international brands like Zara, which use live streaming to expand their reach in China.

Key platforms like Taobao and Douyin dominate the scene, with the latter seeing explosive GMV growth from US$5.8 billion in 2019 to US$222.6 billion in 2022. The market's evolution reflects a shift towards quieter, more sophisticated selling techniques, weekly fashion shows, and innovative hosting trends, including virtual and employee hosts, highlighting the sector's ongoing innovation and expansion.

Live commerce wouldn't have been possible without the emergence of social media. Let's zoom out a bit and look at how social commerce has evolved in China.

Social Commerce in China

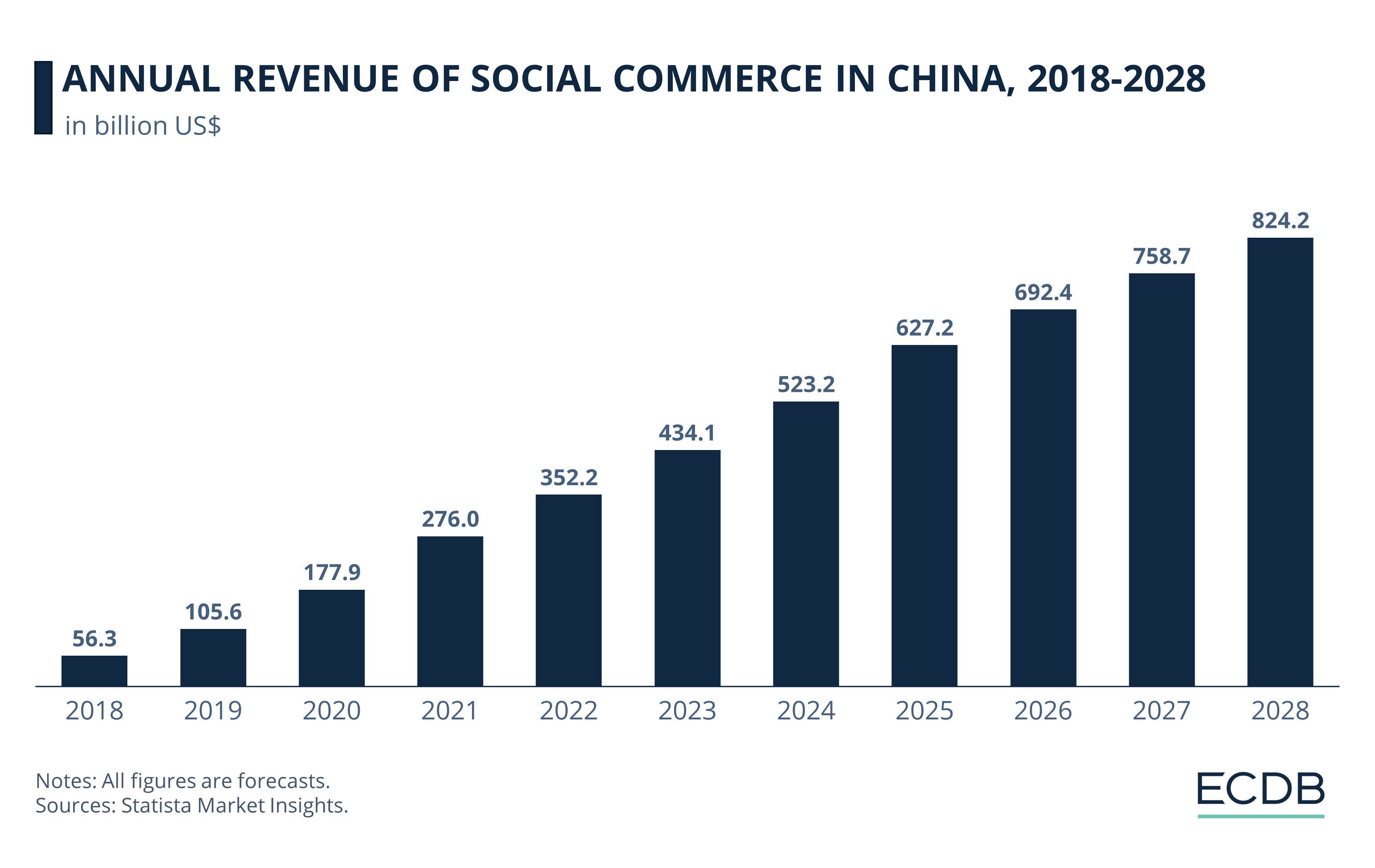

In 2023, China dominated global social commerce, generating 75% of worldwide revenue, largely driven by the purchasing power of women. Women in China not only lead in personal consumption but also significantly influence family buying decisions, with over 70% involved in household purchases.

Social commerce has seen immense growth in China, with platforms like Douyin capitalizing on events like International Women’s Day, rebranded as Goddess Day. In 2023, Douyin’s GMV surged by 276% year-over-year during this event, driven by categories like beauty, skincare, and household appliances.

Interestingly, the majority of female social commerce users in China are over 50 years old, reflecting the country’s aging population and higher life expectancy.

Community Group Buying in China

Community group buying in China, a significant aspect of social commerce, merges eCommerce with offline communities, enabling groups to purchase items together at discounted prices.

This model, popular among China's rising middle class, saw explosive growth during the pandemic, reaching US$45.6 billion in 2023. Major players like Meituan Select and Duo Duo Grocery dominate, targeting price-sensitive residents in smaller cities and rural areas.

Community leaders, often local shop owners or housewives, play a key role in organizing orders and delivery. However, the model faces challenges such as intense competition, government regulation, and shifting strategies as the market matures.

Future of eCommerce in China:

Metaverse, AR & VR

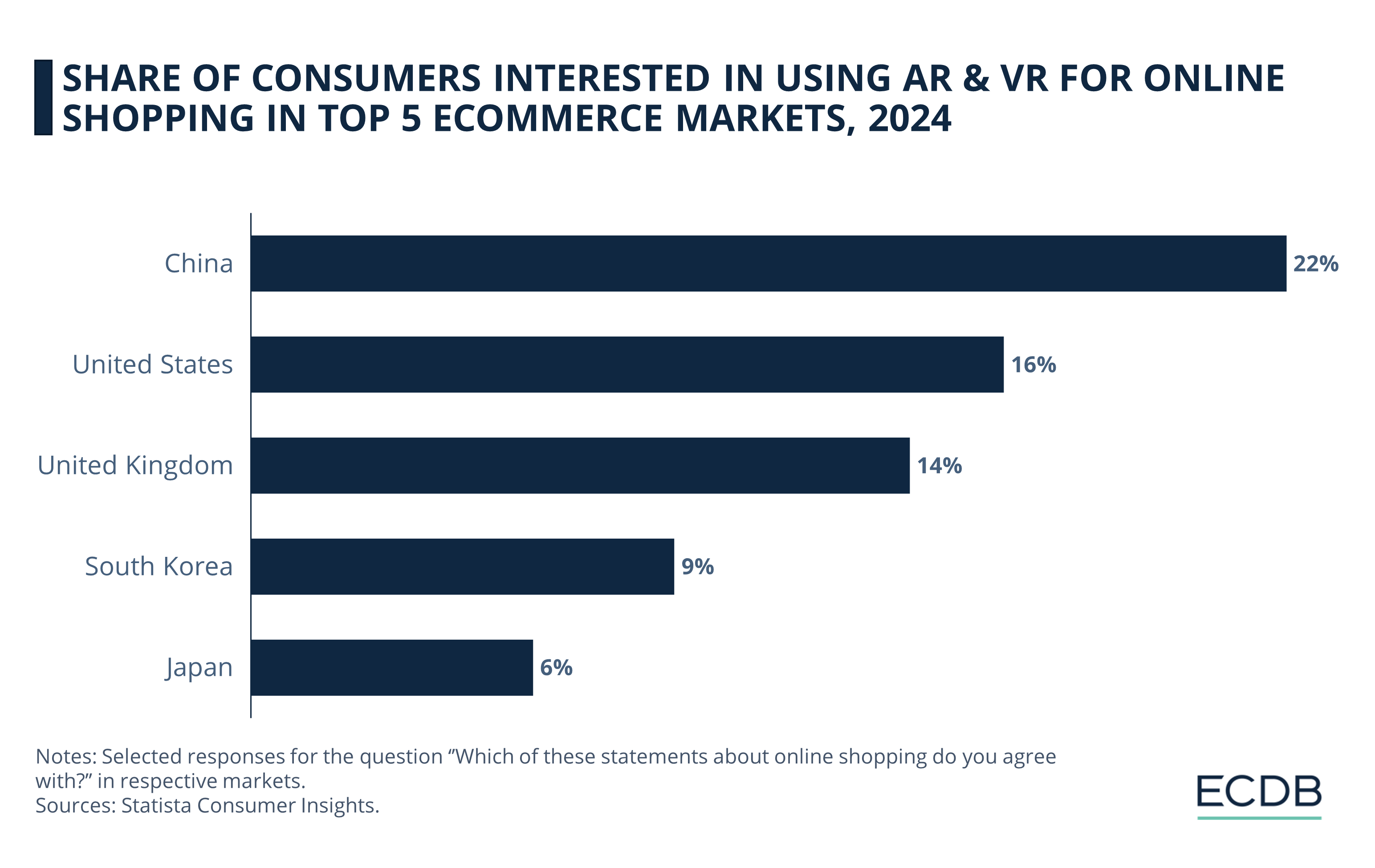

Despite the challenges, the world's largest eCommerce market is also embracing technology and the novelties that innovation brings. China's eCommerce is rapidly evolving with the integration of the Metaverse, Augmented Reality (AR) and Virtual Reality (VR).

A recent IPSOS survey reveals that 78% of Chinese consumers view extended reality (XR) positively, far above the global average. While only 5% have direct Metaverse experience, 26% are very familiar with it, showing growing engagement.

Initially popularized by gaming, the Metaverse is now redefining shopping in China. Virtual environments increase consumer engagement and boost conversion rates by 70%. Retailers report significant ROI, with some seeing a 450% surge.

AR bridges the gap between virtual and physical shopping, with 22% of Chinese consumers interested in using AR/VR for online shopping—the highest among major markets. However, challenges persist, particularly in replicating the "true fit" of products.

The Chinese government supports Metaverse development, focusing on industrial innovation. The Three-Year Action Plan (2023-2025) aims to integrate these technologies into sectors like manufacturing and aerospace, aligning with broader economic goals.

eCommerce Market in China:

Closing Thoughts

China’s eCommerce market, once driven by rapid, unchecked growth, is now maturing into a more complex and competitive arena. The pandemic accelerated digital adoption, but the market has since evolved, revealing both strengths and vulnerabilities.

The aggressive price wars that once fueled expansion are now forcing a shift towards sustainability. Meanwhile, the embrace of technologies like the Metaverse, AR, and VR signals a forward-looking approach that could define the next decade.

As China continues to shape global eCommerce trends, the balance between innovation and stability will determine its long-term success. We expect this market to remain a global leader, but with more calculated strategies.

Sources: MSN, Alibaba Group, Cooling Post, Yicai, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

Back to main topics