CROSS-BORDER ECOMMERCE

China’s Cross-Border eCommerce: GMV Development, Top Markets & Companies

China is not only the world’s biggest eCommerce market—it is also the top choice for foreign consumers. What is the state of China’s cross-border GMV? What are the leading destination markets and which Chinese companies lead in cross-border exports? Find out.

Article by Nashra Fatima | August 12, 2024Download

Coming soon

Share

Cross-Border eCommerce in China: Key Insights

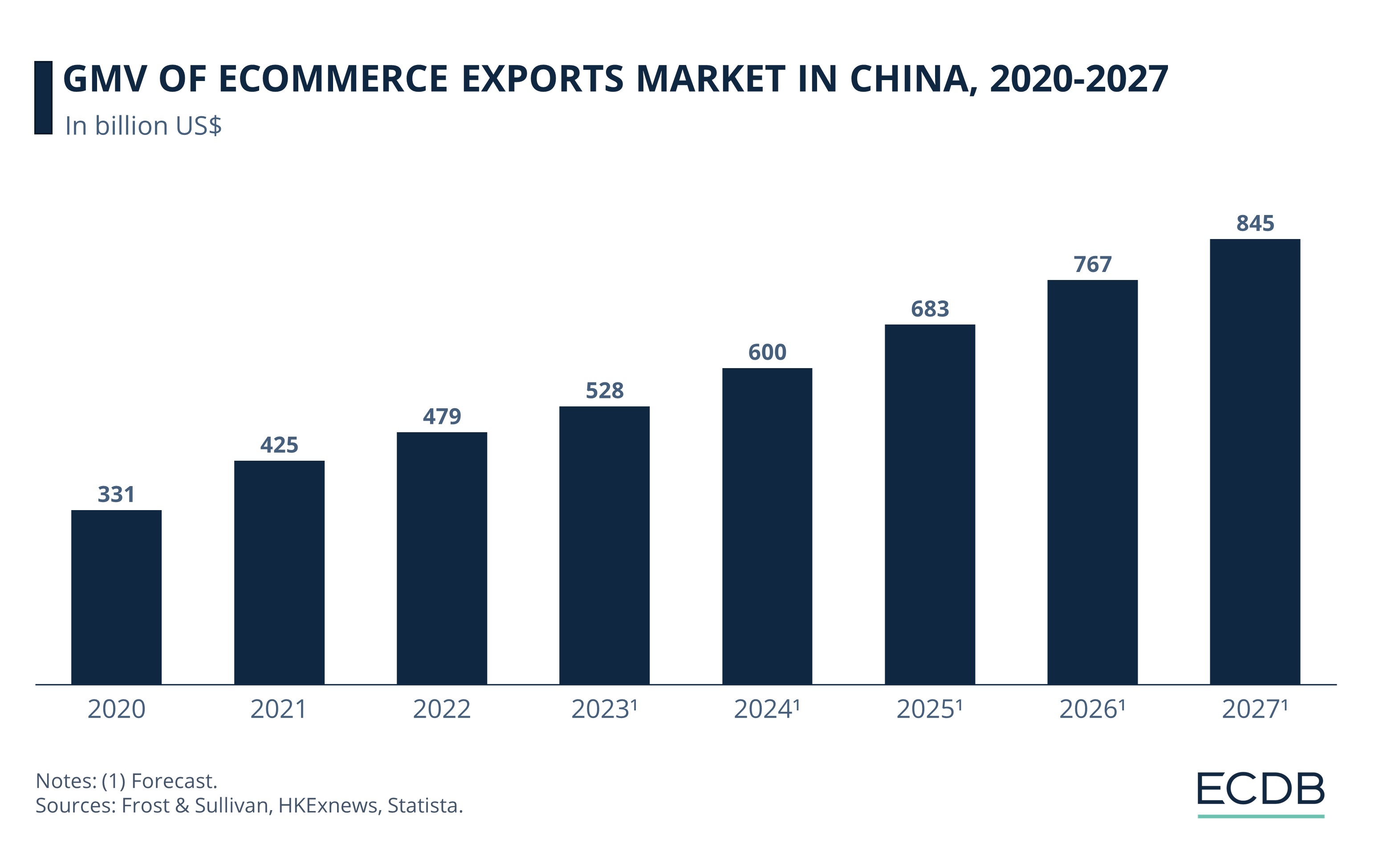

Cross-Border Export GMV: In 2023, the gross merchandise value (GMV) of China’s cross-border exports is estimated to be US$523.5 billion, with projections that it will hit US$847 billion by 2027.

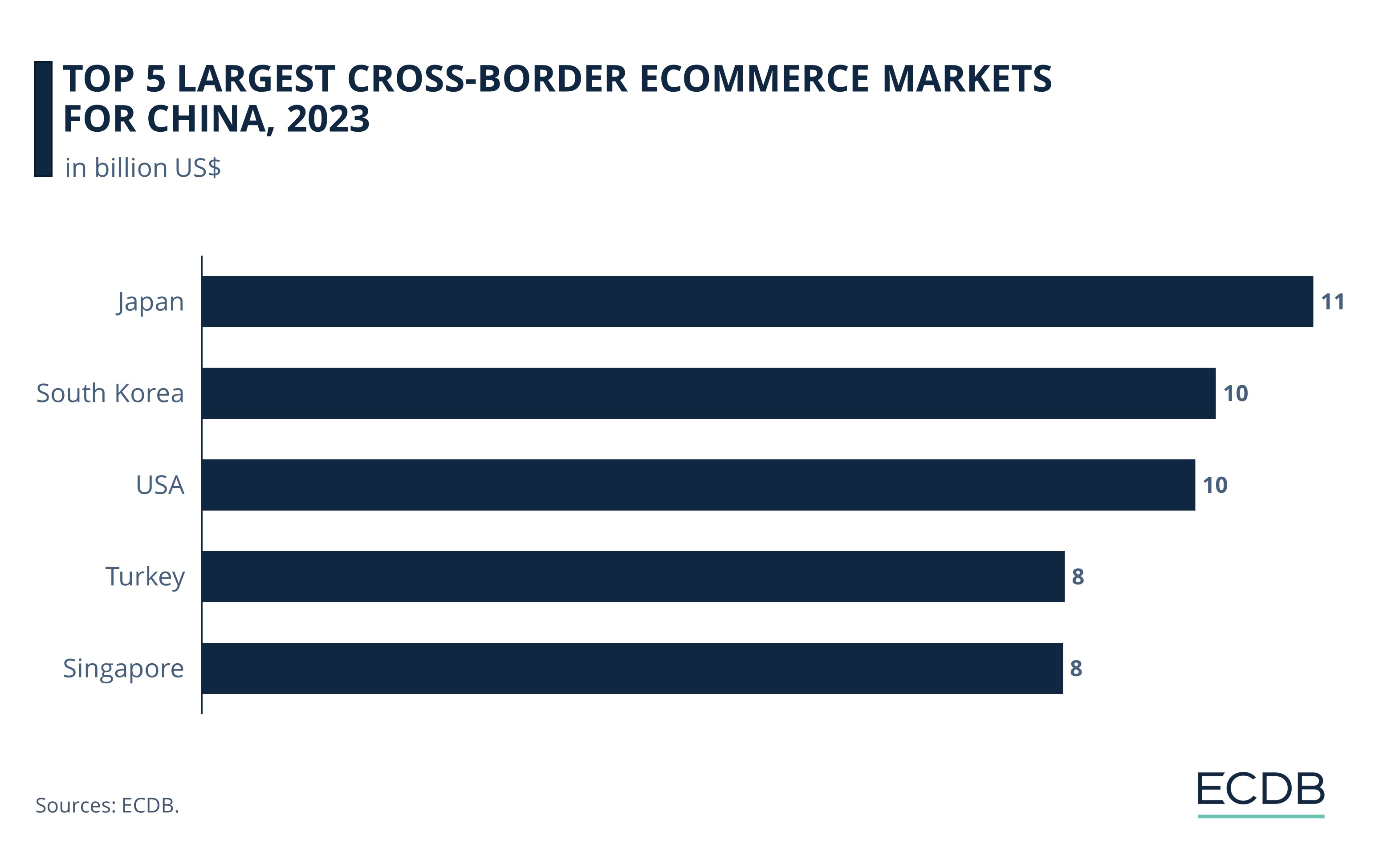

Top Cross-Border Markets for China: Japan is the top destination market for Chinese cross-border exports. It makes for 10.4% of the total cross-border revenues – or US$11 billion. Next up are South Korea and the United States.

Leading Chinese Cross-Border eCommerce Companies: In terms of market valuation, Shein tops the list of China’s most valuable cross-border eCommerce companies. Its market valuation is US$66 billion. Far behind at second position is Airwallex, valued at US$6 billion.

The use of Temu and Shein spread like wildfire amongst online shoppers in diverse world markets.

What does the popularity of these Chinese-origin platforms reveal? For one thing, it underlines China’s towering stature in eCommerce. It also bolsters consumer awareness of China in their quest to shop across borders.

In fact, China’s popularity amongst cross-border shoppers trumps that of markets like the United States and Germany: in 2023, 37% of survey respondents shopped from China, compared to a meagre 13% and 10% who bought from Germany and the U.S. respectively.

Predictably then, the GMV of China’s cross-border eCommerce market is increasing. We analyze its growth, alongside the top destination markets for Chinese goods and the most valuable cross-border Chinese companies.

GMV Growth of China’s Cross-Border eCommerce Exports, 2020-2027

Cross-border export GMV refers to the total value of merchandise sold by retailers and marketplaces outside the country of origin.

A look at the data shows that Chinese cross-border eCommerce exports have grown consistently in value since 2017.

The largest growth jump in GMV occurred in 2020. Aided by the turn towards online shopping during the pandemic, the value of Chinese eCommerce exports climbed by 43% in this year, crossing the US$300 billion mark.

Following the peak pandemic period, despite global economic headwinds and slowdown in eCommerce activity, cross-border eCommerce exports in China continued to increase in value, reaching over US$451 billion by 2021.

Projections put the GMV of eCommerce exports in China at US$523.5 billion in 2023. This is an increase of 16% from the past year, when GMV stood at US$452 billion.

In terms of market size as well, Chinese cross-border eCommerce has expanded, with no decline recorded in the past several years. Per Statista, the market size for China’s export cross-border eCommerce grew from US$1.75 trillion in 2020 to an estimated US$2.3 trillion in 2023.

The developments indicate the resilience of Chinese eCommerce market, which is able to withstand disturbances in global trade. By 2027, the cross-border eCommerce export GMV is projected to reach US$847 billion.

Japan and South Korea are China’s Top Cross-Border eCommerce Markets in 2023

China’s online retail market has found consumers in several parts of the world. But from a regional perspective, East Asia is the biggest market for Chinese eCommerce.

ECDB data shows the top destination for China’s cross-border eCommerce activity in 2023:

Japan was the leading market for Chinese eCommerce exports. It accounted for 10.4% of all eCommerce revenue generated outside of China, amounting to US$11 billion.

South Korea is the second largest market, making up 9.5% of all the revenue – or US$10 billion.

United States was the third largest market for China. Despite threats of losing tariff exemption, China’s cross-border activity remained robust in the U.S., where China generated 9.3% of all its cross-border eCommerce revenues, worth US$9.8 billion.

Turkey and Singapore contributed US$8.5 billion each to the total cross-border exports for China.

In comparison, European countries like France, Germany, and the UK are not the biggest markets for Chinese eCommerce – although China is the leading market for cross-border online shopping for consumers in these countries. Their share in China’s cross-border revenue stands between 2%-2.75%.

Top Chinese Cross-Border Companies by Market Value: Shein Leads with US$66 Billion

Market value refers to the worth of a company on the financial market. It indicates investor confidence in a company, as well as the strength of its brand name and access to capital.

In China, one cross-border eCommerce company by market value towers over others, with other players having a comparatively modest market valuation:

Shein was the top cross-border company by market value in China in 2023. Its market cap was a sizeable US$66 billion.

At second place is Airwallex, a global eCommerce payment service. Its market value was US$6 billion.

The third to fifth ranked eCommerce companies on the list are Xingyun Group, KK Group, and Patpat.com – each with a market value between US$3 to 4 billion.

Notably, the top valued Chinese cross-border company Shein has made ripples globally. It is one of only 1,200 “unicorn” companies in the venture market – those with market cap of over US$1 billion. Shein ranks fourth on the list, just behind OpenAI, hinting at strong investor confidence.

There is a good reason for it: Shein has recorded staggering growth in the past years and is slated to maintain its growth momentum. Its revenues are predicted to hit US$44 billion by 2024.

China's Cross-Border eCommerce: Closing Remarks

Cross-border eCommerce activity has surged in China in recent years. The GMV of cross-border exports has increased at a consistent pace, and its market size has also expanded.

Several reasons fortify China’s cross-border eCommerce – including strong production values, price competitive goods, and supportive government policies for eCommerce exports. New marketplaces like Temu have garnered enormous success upon entering the international market, underlining the dominance of Chinese players in global eCommerce.

Cross-border eCommerce comes with many challenges. Factors like supply chain and delivery costs, customs regulations, as well as tax and tariffs thwart many companies’ ambitions of international expansion. But Chinese companies are investing heavily in key areas like global warehousing and logistics infrastructure. Such steps are likely to bolster China’s cross-border eCommerce market going forward.

Sources: Statista: 1, 2, Reuters, CB Insights, China Daily: 1, 2, CSA

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Shein Workers Share Videos About Labor Conditions in Factories

Shein Workers Share Videos About Labor Conditions in Factories

Deep Dive

Temu Competitors: Three Types of eCommerce Players and How They Are Affected

Temu Competitors: Three Types of eCommerce Players and How They Are Affected

Deep Dive

Online Fashion in Poland: Zalando dominates the Market with Its Online Stores

Online Fashion in Poland: Zalando dominates the Market with Its Online Stores

Deep Dive

Temu is Attracting Less Customers This Year

Temu is Attracting Less Customers This Year

Back to main topics