eCommerce: Global Marketplaces

Temu Competitors: Three Types of eCommerce Players and How They Are Affected

Temu's launch has made established eCommerce retailers aware of their shortcomings. Others are themselves outperforming Temu at its own game. Here are Temu's top competitors.

Article by Nadine Koutsou-Wehling | September 25, 2024Download

Coming soon

Share

Temu Competitors: Key Insights

Temu's Strategy: Using the C2M model, Temu keeps prices below industry standards. Temu also engages consumers with gamification and rewards.

Three Types of Competitors: Even market leader Amazon has responded to Temu's success, demonstrating how effectively the low-cost approach attracts widespread consumer interest. But there are others who have neither the financial backing nor the differentiation to match it.

TikTok Shop Is Expected to Outpace Temu: Of all the retailers discussed, TikTok Shop is the platform that beats Temu at its own game.

Temu is the marketplace that is stirring up global eCommerce with its approach of offering low-cost products across a wide range of products. Together with Shein, Temu has brought the C2M (consumer-to-manufacturer) model to Europe and the Americas on a large scale, even overwhelming the local logistics infrastructure in the process.

Apart from Shein, who are Temu’s main competitors? The answer is that it mostly depends on the region, but one emerging marketplace is the biggest rival for both of them: TikTok Shop.

Temu’s Strategy: C2M, Gamification, Social Referrals

Temu originated in China and is a subsidiary of the large Chinese eCommerce conglomerate PDD Holdings, which also operates Pinduoduo. Temu’s and Pinduoduo’s strategies are therefore related and consist of offering a wide range of products at very low prices.

This is made possible by two factors: First, the C2M model. This is a production mode pioneered by Chinese eCommerce players, which establishes a direct link between consumer demand and production facilities in order to avoid overstocking and eliminate intermediary steps such as warehousing, which consume additional resources and time.

The second factor is the merchant strategy: Temu first offers merchants the opportunity to sell their products without additional fees, and then gradually increases the fees, which are still lower than industry standards. Because of the sheer volume of merchants and products, even small increases result in high revenue growth.

In fact, Shein is following the same strategy, which is also why Shein and Temu are in such embittered competition. Typical of Chinese-origin eCommerce platforms, both Temu and Shein lure consumers with flashy discounts. Temu is similar to its sister company Pinduoduo in the sense that it uses gamification and social referrals to engage users. This increases the average time consumers spend on the app.

So, who is affected by Temu’s entry into global eCommerce? Here are a few retailers that are indicative of a larger pattern.

1. Amazon

Everyone knows Amazon, so why should it be a competitor to a newcomer like Temu? The answer lies in Temu’s subsidiary relationship to Pinduoduo, which comes alarmingly close to Amazon’s marketplace activity in all areas:

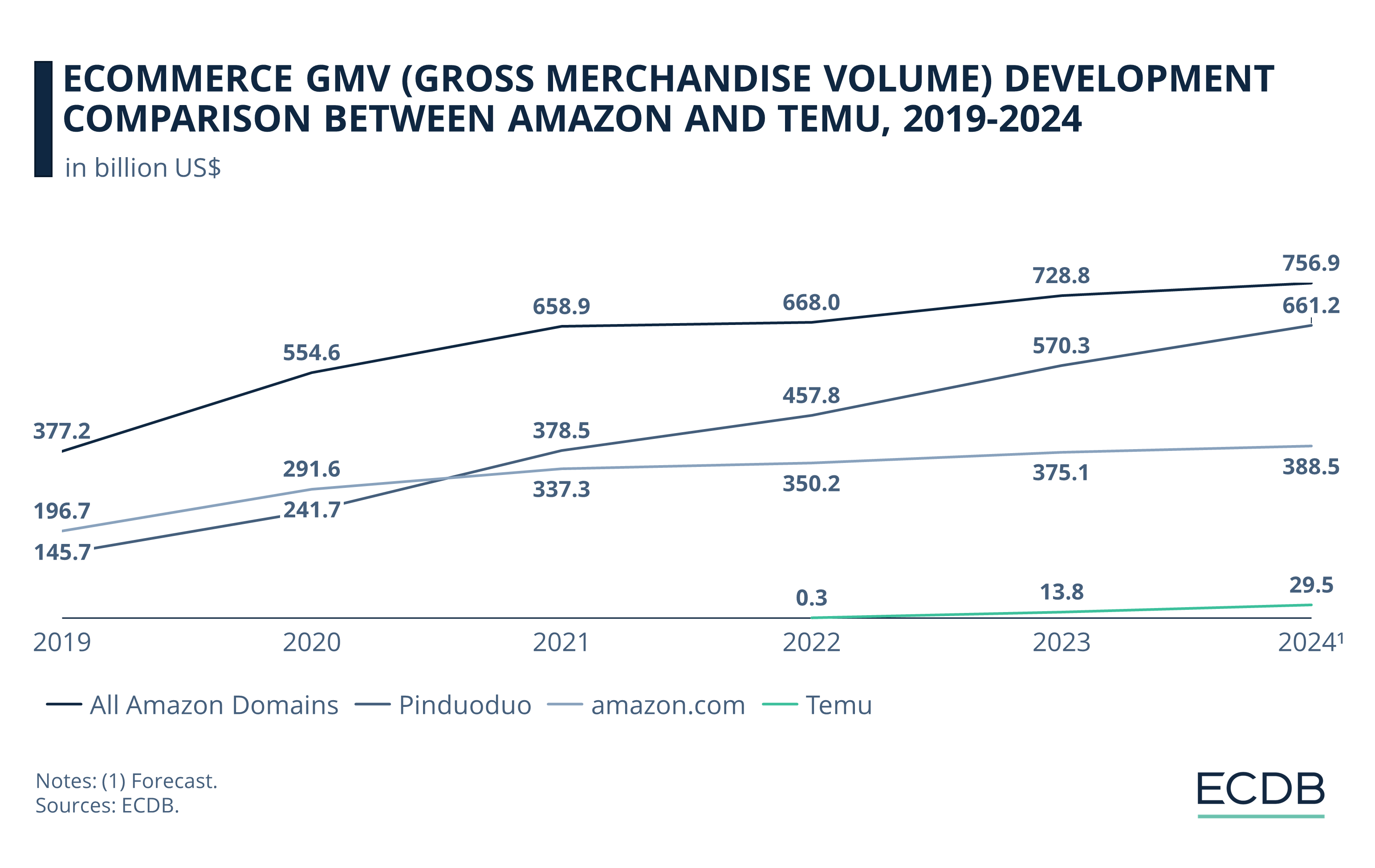

Amazon Is Still Ahead: With a projected GMV (gross merchandise volume) of US$756.9 billion, Amazon is in first place across all of its domains. But Pinduoduo, one of the top 5 marketplaces in Asia, is very close to Amazon’s GMV, with US$661.2 billion.

Temu Is Just Getting Started: Temu's GMV is still very low compared to the others, but given the progress of its sister company Pinduoduo, Temu's relevance could be just as high in a few years.

For this reason, Amazon has taken precautions to prevent another platform from outperforming it on its own turf. These include the introduction of a discount segment with its own version of the C2M model and the launch of a low-cost grocery brand.

The fact is that Temu’s low prices attract hype and consumer interest, for which it accepts temporary losses. Because it has the capital backing of PDD Holding, Temu doesn’t go bankrupt with that strategy.

Obviously, Amazon's dominance does not really put it at a serious disadvantage. But what about others?

2. Wayfair

Wayfair is a furniture and homeware retailer with eCommerce origins, but it recently began selling offline. Wayfair is facing problems with the emergence of Temu that are very similar to the issues of other retailers. As such, this issue applies to a number of players, not just Wayfair, which is used here as an illustrative example.

The nature of Temu's approach is to undercut existing offerings in order to stand out from the flood of products offered to consumers every day.

It is commonplace for retailers to take a profit margin on the products they sell. However, it is becoming increasingly apparent that a significant portion of products are from the same manufacturer, while being offered at different prices on different platforms. Discerning consumers are using tools like Google Image Search to find the exact same product at a different price on multiple platforms.

Temu is one of these sites, offering the same or eerily similar products at such a low price that consumers do not really care which version they are buying. Controversial reputation or not.

This is visible in the fact that Temu has outperformed similar sites in just a few years:

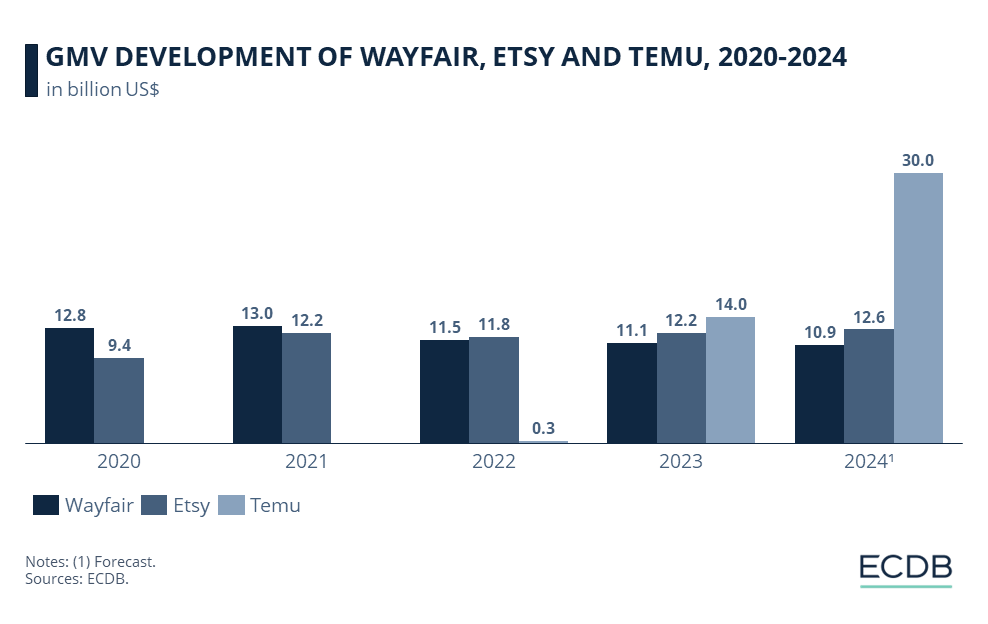

Wayfair and Etsy Remain Steady: From 2020 to 2024, Wayfair and Etsy generate a GMV that stays around US$12 billion.

Temu Surpassed Both in 2023: Already one year into its business, Temu surpassed Wayfair and Etsy. Another year later, the two can’t hope to keep up.

While the different price points may seem arbitrary, the profit margin is used to cover costs and ensure that a business remains profitable. Since few have the capital backing of a large conglomerate like PDD Holdings, the consequences are obvious.

Domestic retailers in each market where Temu operates suffer from price competition, especially if they have no other differentiating factors and are essentially offering the same products under different brand names, but at slightly higher price points than Temu.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

3. TikTok Shop

The other side of the coin for Temu's competitors are those that Temu has reason to be wary of. TikTok Shop has several advantages over Temu, including the following:

TikTok Shop has a large global audience that is automatically exposed to products by using the social media platform. With the integration of seamless payment methods and related social phenomena such as doom spending, TikTok is already at the fingertips of consumers.

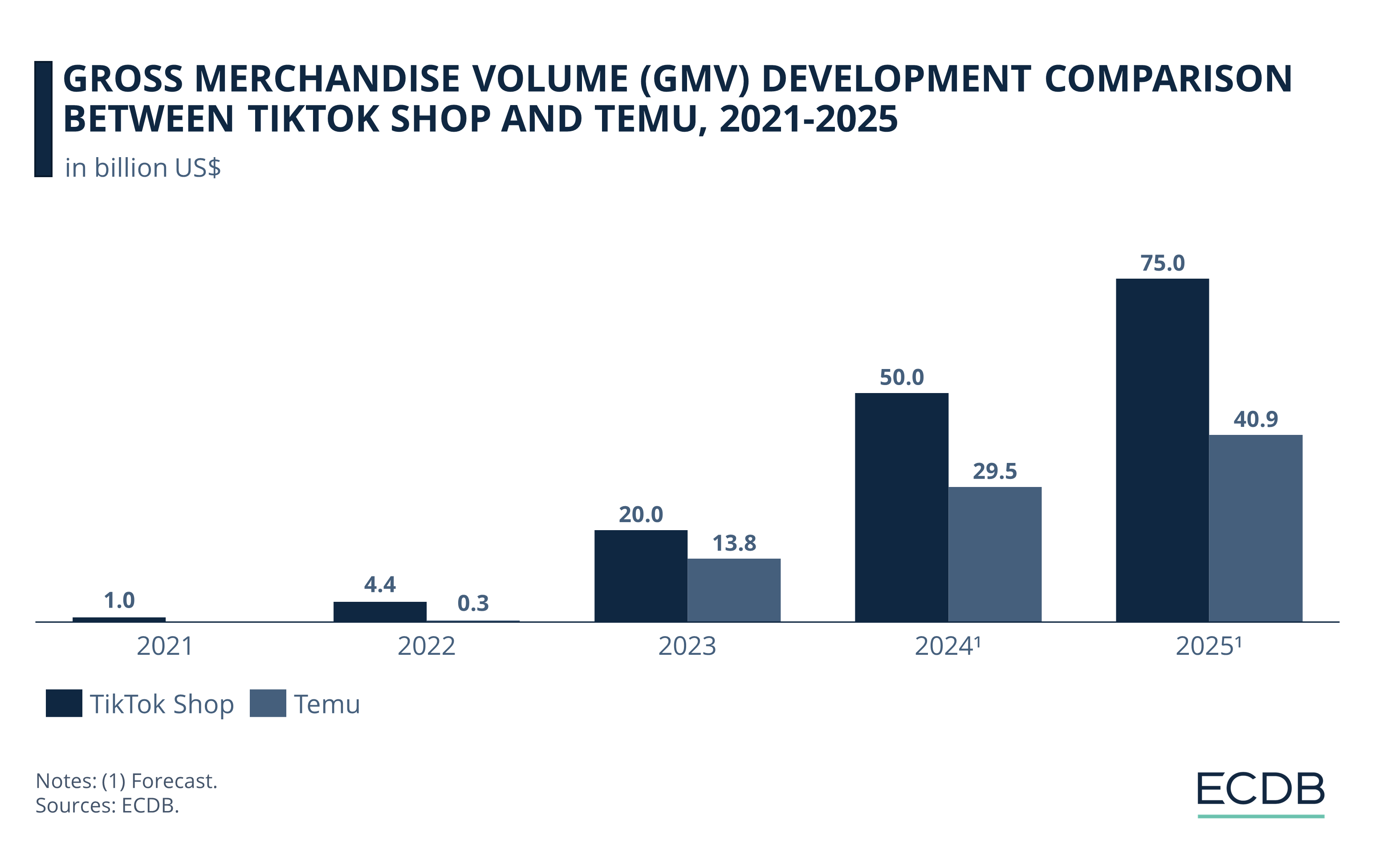

TikTok Shop Launched a Year Earlier Than Temu: But it’s not just about timing, TikTok is also growing faster than Temu. By 2025, TikTok Shop is expected to be about US$35 billion ahead of Temu.

TikTok Shop is similar to Temu and Shein in that it is bringing a popular trend from Asia to the world. In this case, it's social commerce being introduced to an audience that hasn't yet embraced the format on a larger scale. The same can be said for live commerce, for which TikTok Shop also provides a platform. Recent news of the first TikTok Shop livestream reaching US$1 million in sales confirms the platform's disruptive nature for previously untapped audiences.

Temu Competitors: Closing Thoughts

Temu is putting pressure on retailers across the board, which is indicative of a wider shift toward more efficient production and a trimming down of logistics handling. While the strategy is not practical without a financial backing and has not been tried and tested for a longer period of time, it has shown established players where their weaknesses are.

What’s clear, however, is that those brands and players with a high recognition and distinguishing factor have no reason to fear Temu.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics