eCommerce: Amazon Saver

Amazon Goes Budget-Friendly: Expanded Grocery Offerings with Amazon Saver

With companies like Temu and Shein leading the way, discount offers are becoming increasingly popular. Amazon is jumping on the bandwagon with Amazon Saver.

Article by Cihan Uzunoglu | September 13, 2024Download

Coming soon

Share

Amazon Saver Strategy: Key Insights

Amazon Saver Heats Up the Beef: By introducing its low-cost Amazon Saver brand, Amazon is stepping up its game in the grocery sector, following the lead of Walmart and Target in appealing to budget-focused shoppers through private-label offerings.

Appealing to Price-Conscious Consumers: Amazon’s strategy to expand its grocery market presence includes launching Amazon Saver and offering deeper Prime member discounts, targeting consumers who are increasingly looking for affordable alternatives to name-brand items.

Shifting Focus to Budget Competition: The company’s recent push into discount initiatives signals a shift in strategy, positioning the company to compete more aggressively in the budget segment. This is likely to drive more intense eCommerce competition over the next years.

Amazon has introduced Amazon Saver, a new low-cost private-label brand aimed at budget-conscious shoppers, a move in line with recent launches by competitors like Walmart and Target.

Most Amazon Saver products are priced under US$5 and include essentials like pantry staples, deli items, and canned goods. Prime members can also enjoy an additional 10% off, as the company seeks to make grocery shopping more affordable amid persistent inflation.

Private-Label Brands Intensify Competition

The launch mirrors Walmart's "bettergoods" and Target's "dealworthy" brands, both rolled out earlier this year, highlighting the intensified competition in the grocery sector. According to experts, private-label brands offer greater margins and loyalty-building potential.

Private-label brands refer to products made by a third-party manufacturer but sold under a retailer's brand name, typically at lower prices than national brands, offering retailers higher margins and fostering customer loyalty.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Walmart has already reported significant growth in its private-label segment, with grocery penetration rising by 30 basis points during its first fiscal quarter, driven by its new food brand.

Amazon Targets Value-Conscious Shoppers

Amazon Saver is part of a broader strategy that includes expanding discounts for Prime members. More than 3,000 grocery items are currently available at reduced prices, with weekly rotating deals offering up to 50% off select products.

The launch is a clear attempt by Amazon to capture a larger share of the grocery market, particularly as inflation-weary consumers increasingly seek out value-priced alternatives to name brands.

While Amazon trails behind Walmart and Target in grocery market share, it continues to refine its offerings. Claire Peters, worldwide vice president of Amazon Fresh, emphasized that the company aims to make grocery shopping “easier, faster, and more affordable” for customers, whether they shop online or in-store.

The introduction of Amazon Saver is expected to boost its position in the highly competitive grocery sector, which remains dominated by private-label sales.

Amazon Saver Strategy: Closing Thoughts

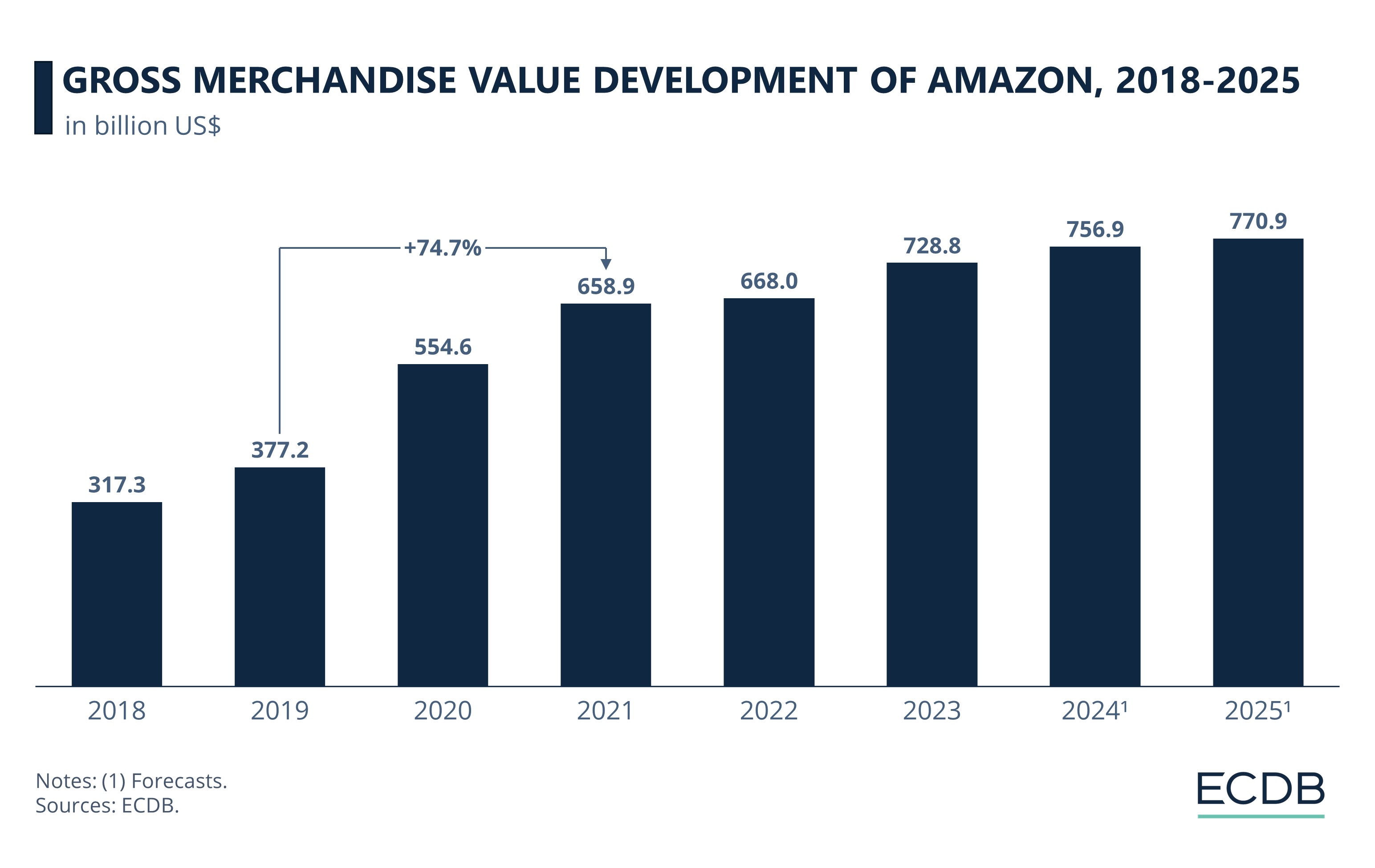

Amazon’s focus on low-price strategies has been on our radar for a while, as competition from rivals like Temu and Shein intensifies.

While these platforms thrive by offering cheaper goods with slower shipping, Amazon has traditionally banked on speed and convenience. However, its new discount initiatives signal a shift in priorities, balancing lower prices with longer delivery times.

Over the next 5 to 10 years, we may see a deeper integration of this model, with Amazon adapting its supply chain to compete directly in the budget segment. This would further intensify competition in the eCommerce space as more and more retailers flock to the trend and follow in the footsteps of the giants.

Sources: FOX Business, CNN, ABC News, Food Business News, PYMNTS, Wall Street Journal, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics