eCommerce: Top Grocery Companies

Digital Grocery 2024: What’s New at Amazon, Getir, Walmart & Target

The eCommerce market for grocery has shifted notably in the recent past. Learn what's new with Amazon, Walmart, Getir, Uber Eats, and other providers in the digital grocery game.

Article by Nadine Koutsou-Wehling | May 28, 2024Download

Coming soon

Share

Digital Grocery 2024: Key Insights

Online Grocery in the U.S.: Amazon, Walmart, and other major e-grocers in the market launched a subscription service offering perks for frequent online grocery shoppers.

Getir Leaves International Markets: Getir returns exclusively to its home market of Turkey after failing to reach profitability in other European markets.

ECDB Predictions for Quick Commerce Success: Regional necessities call for varying approaches to ensure business success. In Europe, sellers with local market insights are well-positioned to thrive, while U.S. consumers tend to buy from big-name players.

Digital grocery stole the spotlight in 2021 and 2022. But by 2023, problems began to pile up. Now, in 2024, new developments confirm what ECDB predicted a few months ago: A growing number of startups with promising prospects are pulling back, leaving only a few larger companies to pick up the scraps.

The most dynamic markets for quick commerce are in Europe, where Getir is making a splash with its exit, while Amazon and competitors are rolling out new features in the States.

Let’s get into the State of Digital Grocery in 2024.

What Is Grocery eCommerce?

Grocery eCommerce, or digital grocery, includes all online platforms that sell or distribute FMCG (fast-moving consumer goods) such as food, perishables, beverages, and products for everyday use that include cleaning utensils and hygiene products.

Grocery eCommerce can be subsumed under the umbrella of quick commerce, when online grocery orders are processed within an hour, but it can also include more long-term orders, when orders are pre-planned for the week or repeated on a habitual basis.

Together with the top providers in this field, find out about the different forms of digital grocery in this market.

Top eCommerce Grocery Companies

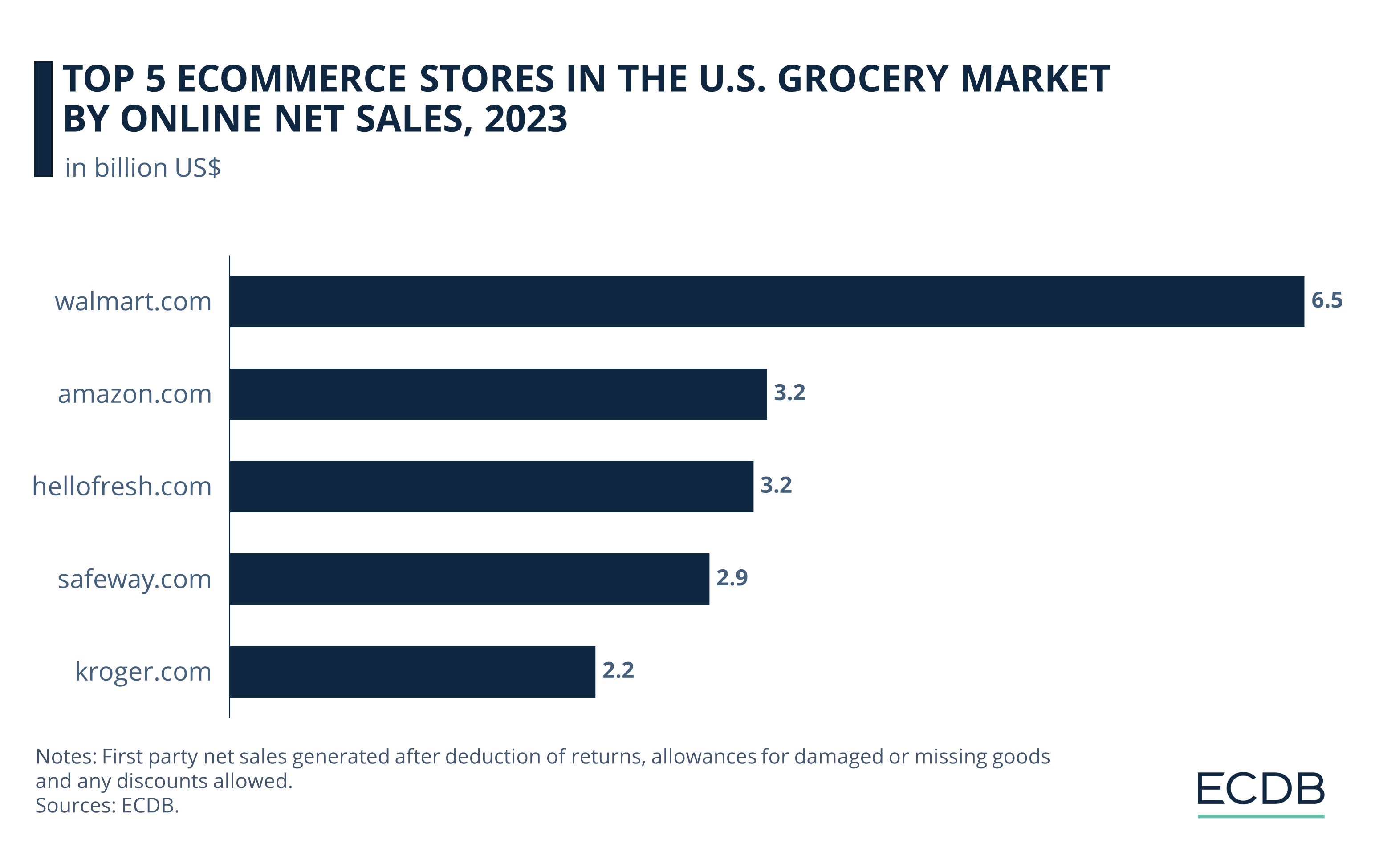

The most successful companies for digital grocery diverge between the United States and Europe. For the United States, the following providers are on top:

1. Walmart

Walmart has the advantage of its recognition among consumers and the expansive network of physical stores with which it operates. This improves the services Walmart can offer to its customers. Accordingly, in 2023 walmart.com generated US$6.5 billion in grocery online net sales.

As with the next rank Amazon, Walmart constantly enhances its offerings to provide more convience to consumers. To this belongs the latest addition: Grocery online subscriptions.

2. Amazon

Amazon’s grocery branch is the second largest in the U.S., but its US$3.2 billion online net sales place it far behind the first rank Walmart. Recently, Amazon introduced its grocery subscription service for US$9.99 per month.

For orders over US$35, customers get free one-hour delivery, can schedule a half-hour pickup, or get special access to recurring reservations for a weekly delivery service. The offer is available at all Amazon-affiliated stores, including Amazon Fresh, Amazon Go, Whole Foods Market, and other local grocery and specialty retailers.

Membership programs with free delivery perks are also being launched by grocery retailers Kroger and Target.

But the third spot by eCommerce revenues in the market belongs to another company.

3. Hello Fresh

Hello Fresh generated around US$3.2 billion online net sales in the U.S. by 2023, in close proximity behind Amazon. Its meal kits with matching recipes are popular among the working crowd and for consumers who are willing to try out new tastes without much hassle.

With an extensive social media marketing campaign and influencer affiliations, Hello Fresh consistently works to expand its customer base. But maintaining the pandemic spike in revenue has been hard to sustain.

Other Providers to Watch

The online platforms of Safeway and Kroger rank fourth and fifth in terms of 2023 online net sales in the U.S. with respective figures of US$2.9 billion and US$2.2 billion.

But there are other providers in U.S. digital grocery, particularly popular among online shoppers:

Apart from the previously mentioned leaders in U.S. digital grocery, Walmart and Amazon, online shoppers prefer to order groceries at Costco (26%), Aldi (21%), Instacart (21%), Blue Apron (15%), and Burpy, Deliv, and EveryPlate, each with 11%.

In Europe, the digital grocery market is more volatile, owed to the fragmented nature of quick commerce providers that forged partnerships with established retailers. Here are the latest developments in this region.

Getir Exits European Markets

Turkish quick commerce company Getir is shutting down operations in international markets outside of its home base, as recent developments suggest the company is unable to achieve profitability. ECDB reported in August 2023 that Getir was exiting underperforming markets to focus its strengths on serving customers in the remaining countries of Germany, the Netherlands, the UK, and the U.S.

But latest reports indicate that Getir is now focusing exclusively on its home market of Turkey, while exiting all international business. An investigation by Wirtschaftswoche revealed that Getir’s monthly fixed costs reached into US$50 million, a large sum considering that revenues outside of Turkey were only a minor part of the total.

While investors initially discussed the option of buying rival quick commerce service Flink, Getir is instead withdrawing altogether to focus on the Turkish market, a decision that was reportedly backed by capital investment.

Our insight on Quick Commerce, Food Delivery, and Uber Eats cited the difficulty for emerging companies in the sector to balance expenses for warehousing, staffing, and marketing in a highly competitive market with fluctuating demand.

Equipped for Success: Which QCommerce Providers Will Prevail?

A few remaining competitors in the U.S. and Europe are still doing business as usual, slowly emptying the ranks of those who initially lined up to flood the quick commerce market.

The most obvious candidates have already been mentioned: established retail giants with an additional quick commerce branch, such as Amazon and Walmart, but also Uber Eats. The fact that these players are amongst the last ones standing in global quick commerce is related to the issue of fixed costs discussed earlier.

Building consumer awareness and a viable infrastructure while maintaining quality is cost-intensive, which is why the companies with a more diversified offering have an obvious advantage over emerging startups.

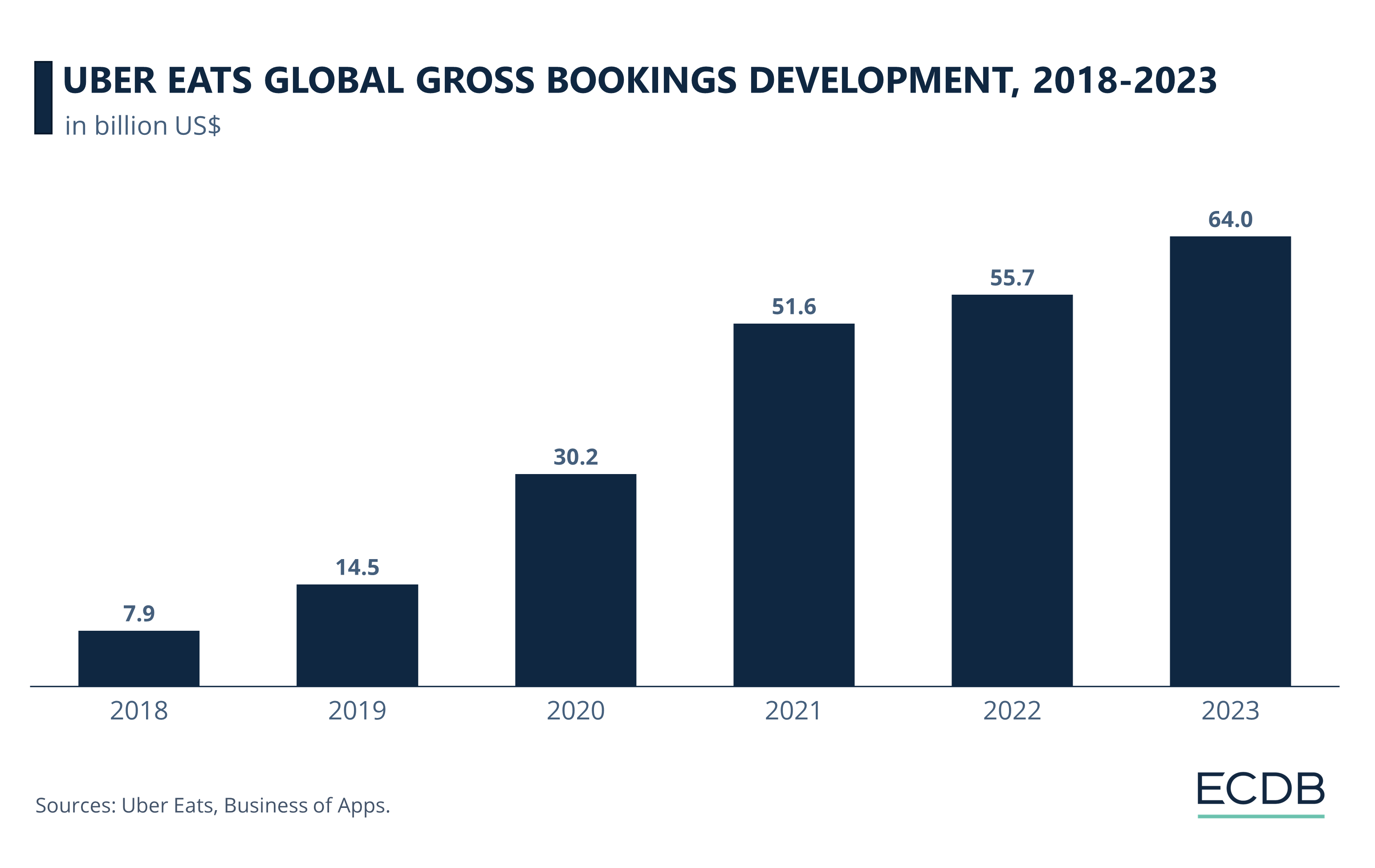

Check out Uber Eats’ case: Global gross bookings have grown steadily through 2023.

As would be expected, Uber Eats saw a jump in net sales at the height of the pandemic, jumping 71% from US$30.2 billion in 2020 to US$51.6 billion in 2021. The typical, industry-wide revenue decline in 2022 did not reach Uber Eats, which saw slight growth. In 2023, the company reported that gross bookings reached US$64 billion.

By comparison, the Financial Times noted that Flink made €400 million (about US$420 million) in 2022.

Europe: Regional Differences Fragment QCommerce Market

Flink is one of the quick commerce providers expected to succeed in Europe, along with up-and-coming Dutch provider Picnic. Flink’s strategic advantage is its partnership with supermarket chain REWE, which eliminates the need for costly dark stores while increasing the assortments available to customers. Picnic has forged similar partnerships in its operating markets, which emphasizes the importance of efficient networks to make quick commerce viable.

Other providers are local companies in their respective markets, such as Norway’s Oda, which failed to gain a foothold in Germany and Finland, but announced a merger with Swedish quick commerce company Mathem in 2024.

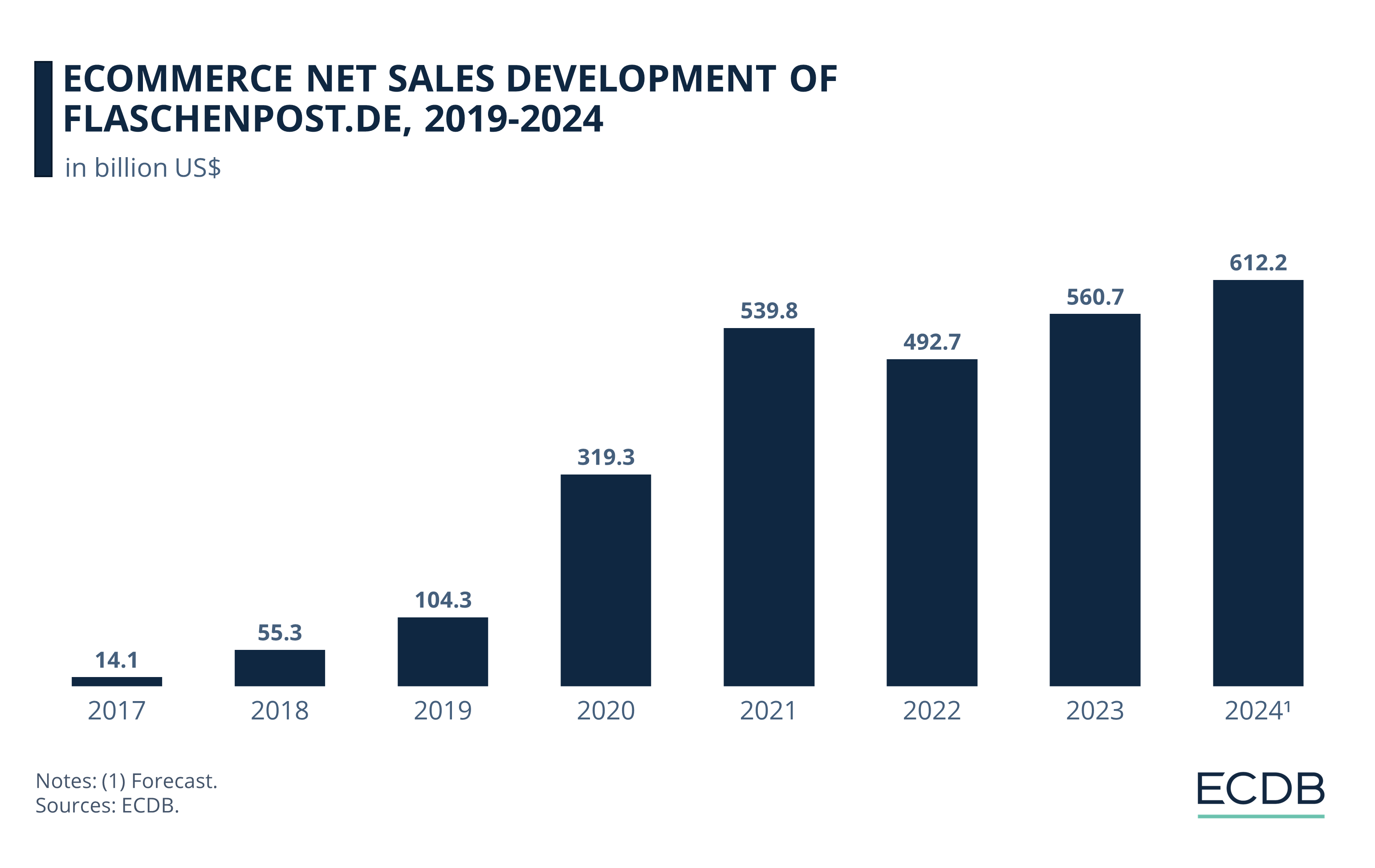

Flaschenpost, which merged with Oetker-owned delivery company Durstexpress in 2020, is a former German beverage delivery service that expanded to include groceries as well. ECDB analysts expect Flaschenpost’s net sales to grow above US$600 million the following year.

If Flaschenpost can maintain positive rates in the following years, it likely will consolidate its position in the DACH region.

State of Digital Grocery in 2024: Wrap-Up

Grocery eCommerce is an interesting case to watch, as we can observe in real time how a new industry matures into an established market. Nonetheless, the global emergence of this market should not distract from the fact that there are regional differences and consumer preferences that determine long-term success for providers.

Sources: About Amazon – CNBC – Excitingcommerce – Iamsterdam – Sifted – Tech Crunch – Uber – Wirtschaftswoche: 1 2