eCommerce: Market Insight

Amazon Switzerland & Top Online Stores in the DACH Region

The DACH region – comprising Germany, Austria, and Switzerland – is a key eCommerce market in Europe. In its strong online retail landscape, some interesting trends become visible: namely, Amazon’s use. Is Amazon equally popular across the DACH region? Find out in this article.

Article by Cihan Uzunoglu | April 08, 2024Download

Coming soon

Share

Top Online Stores in the DACH Region: Key Insights

Amazon’s dominance in DACH: Amazon.de is the overall dominant player in the DACH region. In Germany, its revenue was US$17.1 billion in 2023, making it the biggest online store. It is similarly popular in Austria, although not in Switzerland.

Amazon in Switzerland: Amazon does not feature in the top five eCommerce stores in Switzerland. Various factors impact Amazon's operations in the country – most importantly, state regulations.

Top stores in Germany and Austria: Apart from Amazon, the other leading online stores in Germany and Austria include Otto.de, Zalando.de, and Ikea.com.

In the DACH region, Germany drives the economy owing to its size and cultural influence. However, Austria and Switzerland share many similarities with their neighbor. This closeness is visible in the prevalence of cross-border eCommerce as well as in the leading online stores in each country.

Yet, each of these eCommerce markets also possess distinctive features. ECDB data highlights these market differences, particularly Amazon’s performance, in the three countries.

Amazon Dominates the German and Austrian Online Market

In terms of online stores, amazon.de is the biggest player in the German eCommerce market with a net revenue of US$17.1 billion in 2023. The second and third-ranked stores are otto.de and zalando.de, with much smaller revenues of US$5.6 billion and US$2.7 billion respectively.

In the Austrian eCommerce market, amazon.de again leads, generating US$981 million in 2023. It is followed by zalando.at and ikea.com, each earning US$363 million and US$261 million respectively.

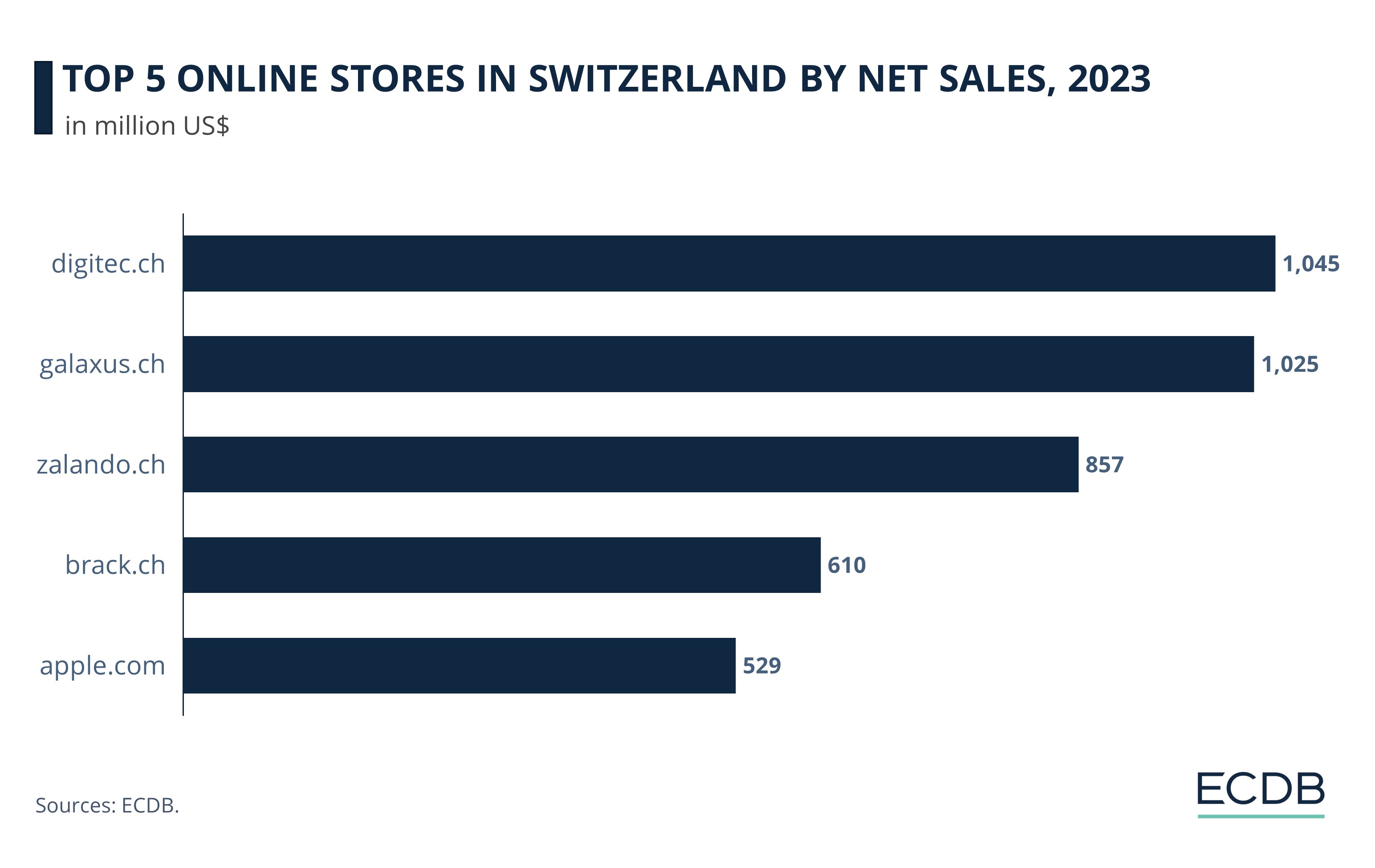

In Switzerland, however, the landscape is markedly different. The largest player in the Swiss eCommerce market is digitec.ch, with a revenue of US$1.04 billion in 2023. Galaxus.ch is a close second at US$1.02 billion, followed by zalando.ch at US$857 million.

Amazon’s Presence in Switzerland

The data confirms: in Switzerland, no trace of Amazon exists in the top 5. Instead, amazon.de is found at the eighth spot with net sales of US$345 million generated in the country in 2023.

While Amazon dominates conversations about top online stores of most markets in Europe, why does its name not pop up in Switzerland’s case?

From a technical standpoint, it is because consumers in Switzerland are directed to websites such as amazon.de, amazon.fr and amazon.it when they try to access amazon.ch, although the domain name was already registered in 1997.

Taking a closer look at the share of first party net sales of amazon.de by country, we see Switzerland in the third spot with 1.8%. The shares are comparable for amazon.fr (1.8%), but lower for amazon.it (1.1%).

Contrary to its near unanimous popularity across eCommerce markets, it emerges that Amazon is not quite as powerful in Switzerland. Several factors contribute to its lackluster performance in the country, the most important of which is state regulations.

Amazon and the Swiss Customs Tariff Act

The Swiss Customs Tariff Act takes weight into account instead of value of goods, which is typically not the case in the European Union. This alone puts off giants like Amazon from entering the Swiss market due to the high taxes.

The fact that Switzerland has four official languages also does not help when it comes to marketing and reaching out to shoppers in general.

Despite rumors and Swiss Post having signed a deal with Amazon to streamline customs clearance fees and the transfer of goods across the border, Amazon just didn’t quite take off in Switzerland as some projected.

The final nail in the coffin came in December 2018, when Amazon announced that “customers shopping on amazon.com and other non-EU Amazon websites will not be able to ship non-digital orders to any shipping address in the Swiss Customs Union”. This was due to the changes in the Swiss VAT (Value Added Tax) system that were to be implemented in 2019.

These adjustments concern the collection of VAT, where wholesalers with sales of more than CHF100,000 (US$110,135) could not benefit from the tax exemption on shipments with a value of up to CHF65.00 (US$71.5) anymore.

The main reasoning behind this regulatory change was giving local online retailers equal opportunities in the face of giants such as Amazon. This, to a degree, worked as intended, since the Swiss market ended up being far too costly and complex for players like Amazon to expand in.

Closing Remarks

Overall, Amazon remains a dominant force in the DACH eCommerce landscape, but its presence and challenges vary from country to country within the region. The future of eCommerce in Switzerland and other markets in the region is uncertain, and further developments will be closely monitored.

Note: Currency conversions are as of April 2024.

Sources: Le Temps, Fedlex, Swissinfo: 1, 2, Blick, Neue Zürcher Zeitung

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics