Cross-Border eCommerce of Austria: A Closer Look

Article by Cihan Uzunoglu | July 14, 2023

Download

Coming soon

Share

Have you ever stopped to think about how effortless it is for someone sitting on their couch in Vienna to order a one-of-a-kind, handcrafted vase from a small artisan in China? In today’s world of cross-border eCommerce, geographical distances are reduced to mere seconds of shipping information and transaction confirmations. Our shopping carts have never been more diverse or more global.

Europe is a region of great interest when it comes to cross-border eCommerce. With its multitude of distinct markets under a largely unified legislative structure, the European Union, it presents a unique dynamic in the global landscape. Cross-Border Commerce Europe reports that the share of cross-border online sales within Europe rose from 25.5% in 2020 to 26.8% in 2021, while this figure was merely 23.6% back in 2019. The magnitude of this rise is more evident in the actual numbers: Cross-border sales in Europe stood at €108.75 billion in 2019, but by 2021, the value had reached €171.2 billion, marking a nearly 60% surge within a two-year period.

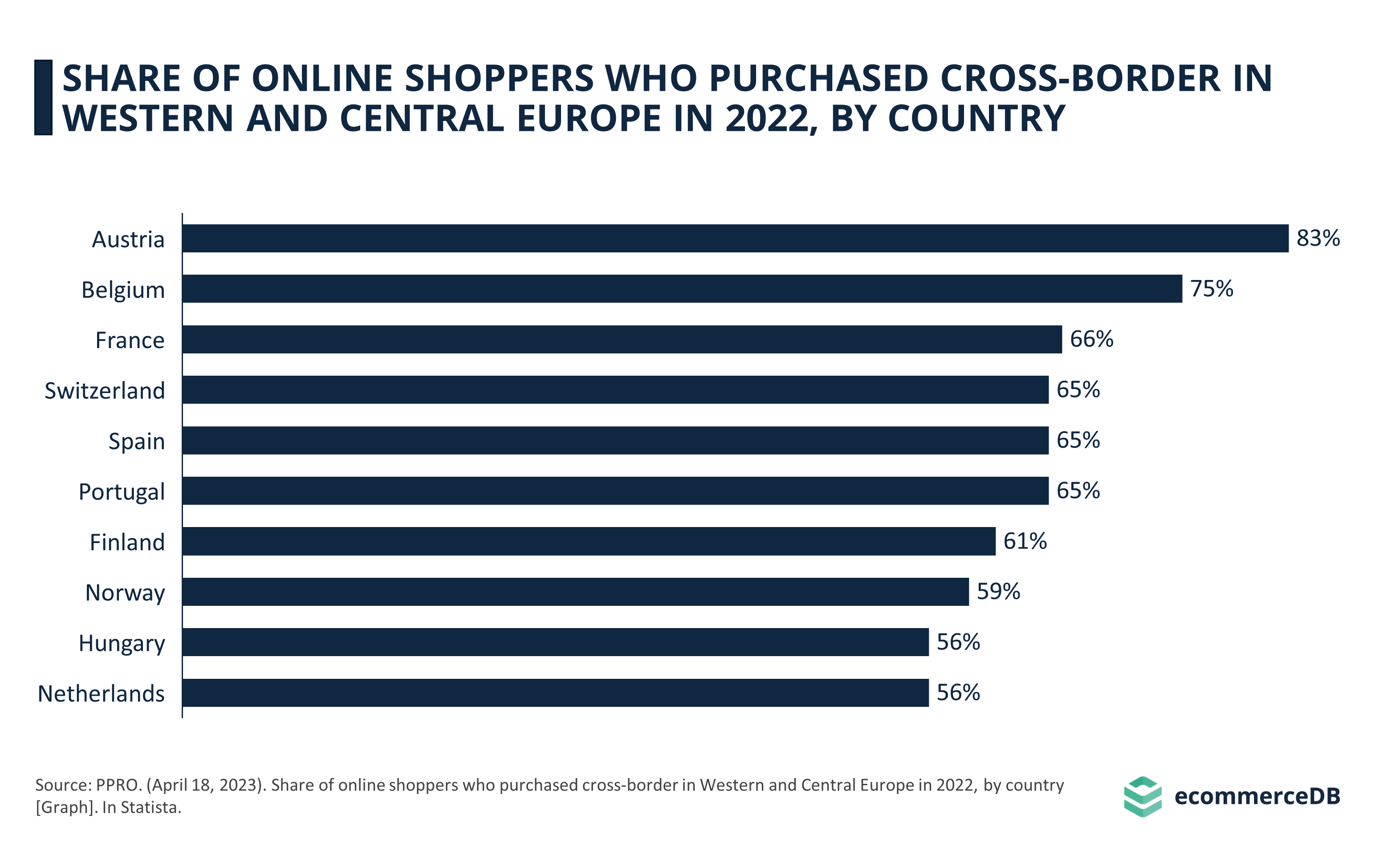

Looking closely, the share of online shoppers who purchase cross-border in each European country, of course, differs from one another. In particular, countries with smaller populations that have a robust economy nearby, with which they also happen to share a language, tend to have a significant share of cross-border eCommerce. In 2022, over 80% of online buyers in Austria engaged in cross-border shopping, as the data published by PPRO showcases. The same study had Belgium and France next in line, with 75% and 66% of their online shoppers respectively making purchases from international sites.

The Austrian example is particularly interesting, yet, what countries do Austrian consumers order products from? What kinds of items are filling their virtual shopping carts? Last but not least, what payment methods are preferred by Austrians when they are shopping from foreign websites? With a focus on these questions, let's take a look into the world of Austrian cross-border eCommerce to understand the “where”, “what” and “how” of Austria's online shopping behavior in this context.

Two Thirds of Austria’s Cross-Border Online Purchases Are Made From Germany

Austria may not be the biggest market for eCommerce (26th largest, with a predicted revenue of US$11.7 billion by 2023) nor for cross-border eCommerce, but the share of online shoppers in the country who purchase cross-border is, for sure, remarkable. Having already established that, it is also interesting to look at which countries Austrian online shoppers prefer for their cross-border orders.

As the world’s biggest exporter, China comes to mind first when talking about cross-border eCommerce. Data published by IPC (International Post Corporation) regarding the cross-border eCommerce purchase behavior of consumers in Europe unveils that shoppers from Central and Eastern European nations are the ones who predominantly engaged in online purchases from Chinese retailers in 2021. The survey, which collected data from consumers all over Europe about the most recent country from which they made an online purchase, also reveals that – along with consumers from Ireland and Belgium – Austrian consumers reported "China" as their latest shopping destination considerably less frequently.

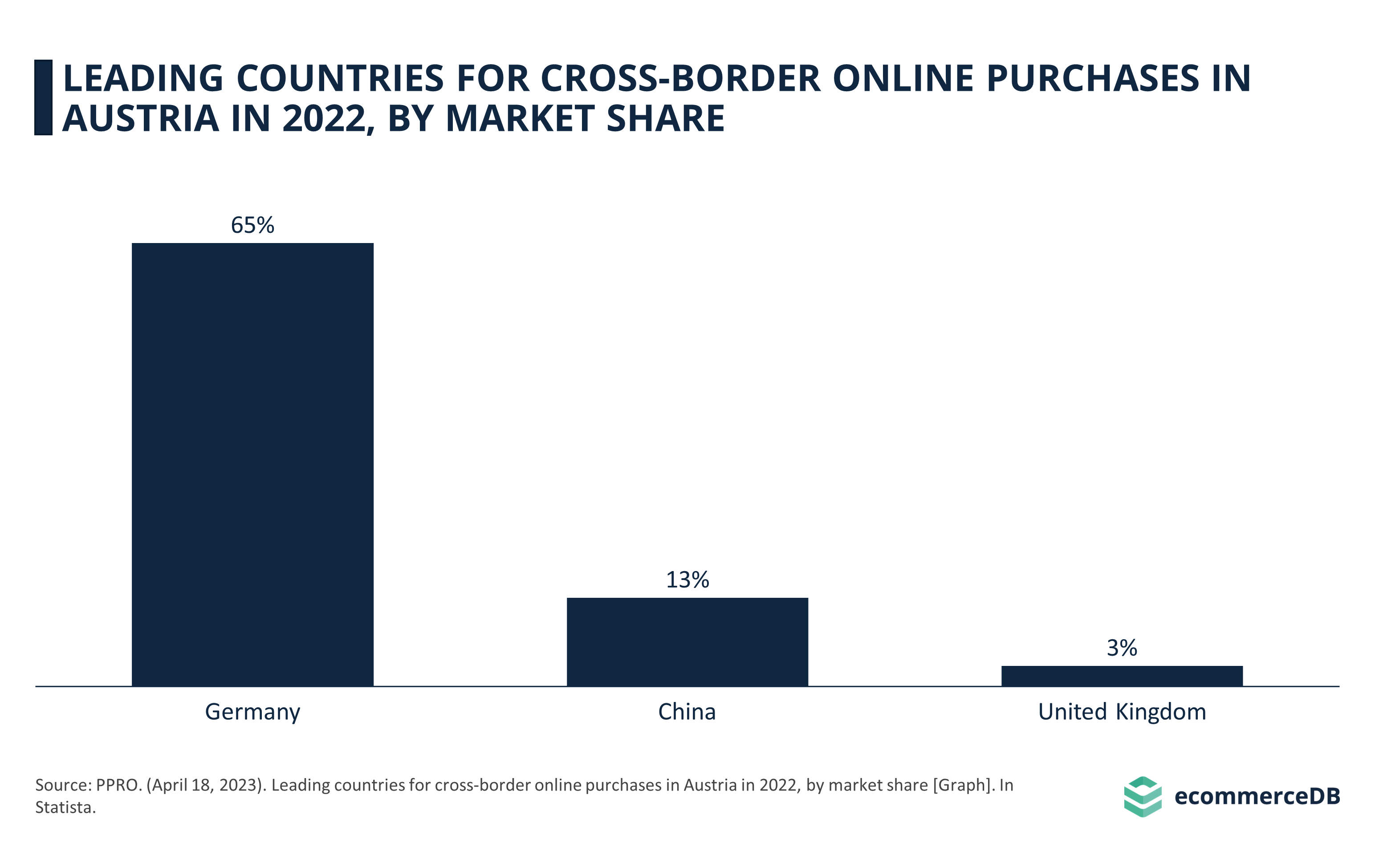

Tying back to the point made earlier about small countries near a same-language-speaking big economy having high cross-border purchase volume, this is indeed the case for Austria: As the findings of a study published by PPRO shows, most Austrians prefer to shop online from Germany, with the neighboring country accounting for 65% of Austrian cross-border eCommerce purchases in 2022. China comes next, contributing 13% to Austria's cross-border eCommerce shopping, while the UK has a smaller share, representing only 3% of Austria's cross-border online market.

Clothing & Footwear Accounts for More Than Half of Cross-Border Purchases in Austria

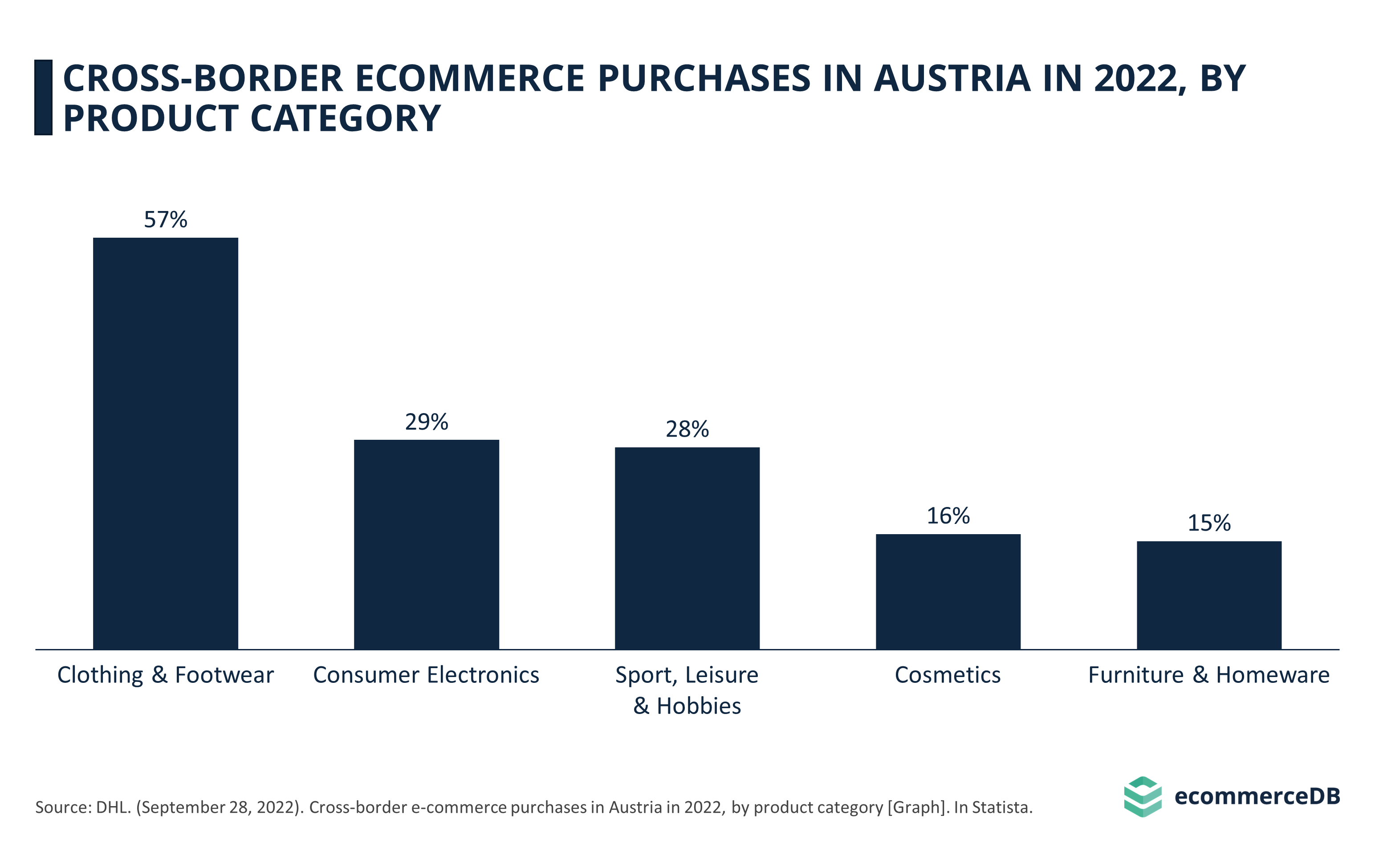

In addition to where Austrian cross-border online shoppers get their orders from, understanding what they get is equally significant. A 2022 report published by DHL indicates that 57% of Austria's cross-border purchases are from the Clothing & Footwear category, making this the most favored cross-border eCommerce category in the nation. Consumers Electronics and Sport, Leisure & Hobbies come in second and third, with respective shares of 29% and 28%, followed by Cosmetics and Furniture & Homeware at 16% and 15%, respectively.

According to our data, these results are in line with the overall Austrian eCommerce market shares: Fashion dominates with a 31.6% share of revenue, while Electronics & Media trails behind in second place, accounting for 20.0% of the revenue.

Mastercard Is the Top Payment Method for Cross-Border Purchases in Austria

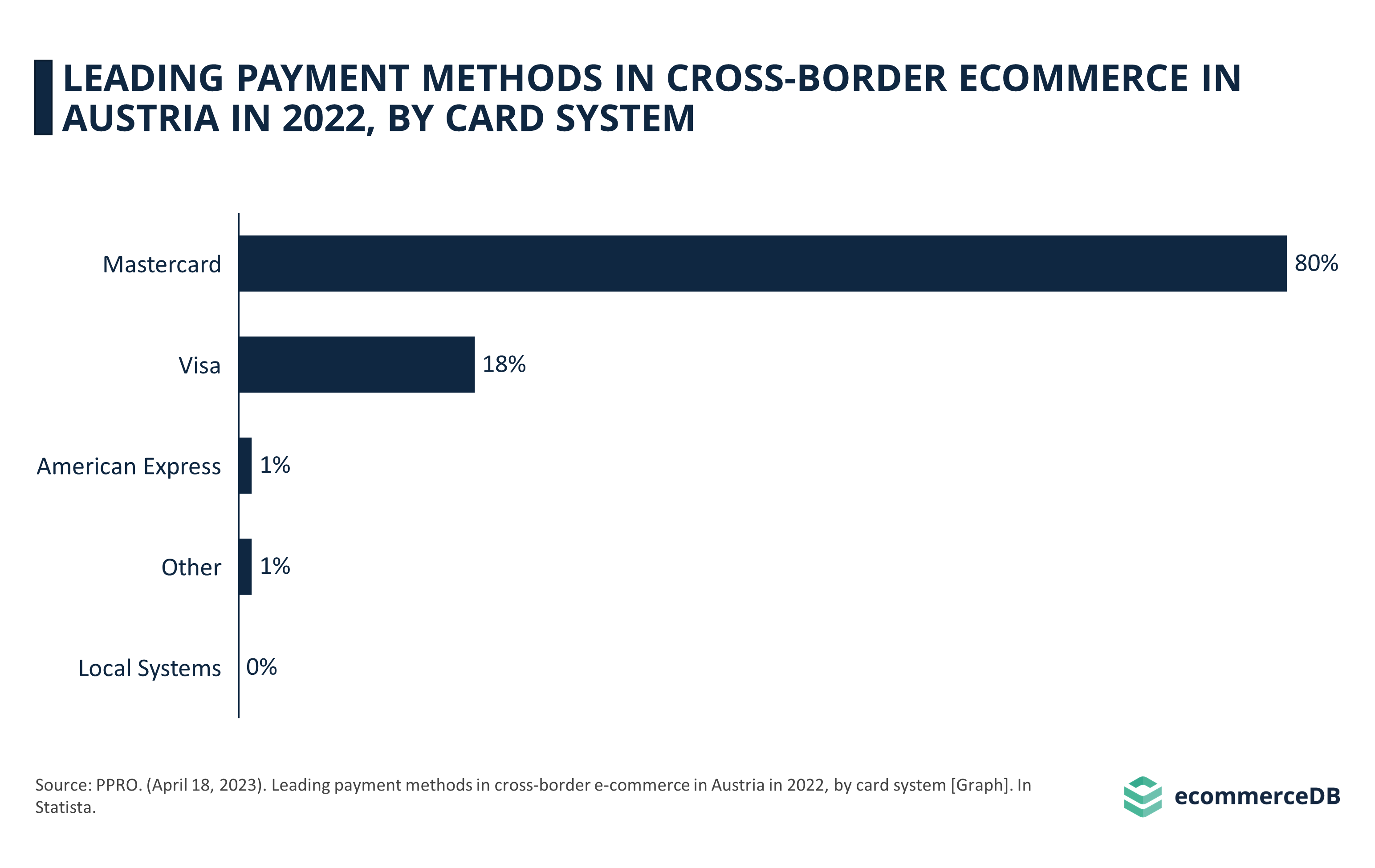

Finally, we’ll look into how Austrian cross-border online shoppers pay for their purchases. According to a study published by PPRO, in 2022, approximately 80% of cross-border eCommerce transactions in Austria were facilitated through Mastercard as the payment method. The second most popular card utilized was Visa. While American Express and other payment methods stood at 1%, local systems had none to very little preference.

As a side note, it bears mentioning that the significant uptick in cross-border volumes worldwide primarily impacted operating revenues of Mastercard in 2022. Due to this, Mastercard managed to enhance this volume by an impressive 45% in 2022 when measured in local currency terms.

Key Takeaways: High Engagement, Germany, Clothing & Footwear, Mastercard

As we unpack the dynamics of cross-border eCommerce in Austria, several key observations come to the fore. From the favored countries for these purchases to the most popular product categories and preferred payment methods, these facets collectively give us a good idea about the topic:

The growth of cross-border eCommerce in Europe has resulted in diverse shopping behaviors throughout the continent, with Austria, in particular, showing a high rate of engagement in cross-border online purchases.

Despite Austria's relatively small market size for eCommerce, the prevalence of cross-border online shopping is significant, with Germany being the preferred choice due to its geographical proximity and shared language.

Austrians primarily order products from the Clothing & Footwear category in their cross-border online shopping, followed by Consumer Electronics and Sport, Leisure & Hobbies, closely reflecting the overall Austrian eCommerce market trends.

Mastercard is the most preferred payment method for Austrians engaging in cross-border eCommerce.

Sources: Cross-Border Commerce Europe, PPRO, IPC, DHL, ecommerceDB, Statista

Related insights

Article

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Article

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Article

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

Back to main topics