ReCommerce Market

Second-Hand Fashion Online Market in the UK - Just a Trend or a Consumer Behavior Here to Stay?

Secondhand fashion in UK eCommerce is growing. Here are which categories perform best in reCommerce, prevalent consumer trends, and popular platforms.

Article by Nadine Koutsou-Wehling | October 25, 2024ReCommerce – or reverse commerce – is the online buying and selling of used products. This growing eCommerce sector is largely driven by eco-conscious consumers looking to buy pre-owned goods at affordable prices and less damage to the environment. The reCommerce hype in the UK is evident across a range of product categories, particularly in fashion.

Here is which sub-categories of secondhand fashion are most popular, how different generations engage, and which platforms are driving the secondhand trend in the UK.

Top Secondhand Fashion Category Is Clothing

In Statista’s 2024 Consumer Insights, UK online shoppers were asked if they had bought secondhand products over the last year. Although the numbers are not limited to online purchases, we can use these responses to assess consumer willingness to buy pre-owned products.

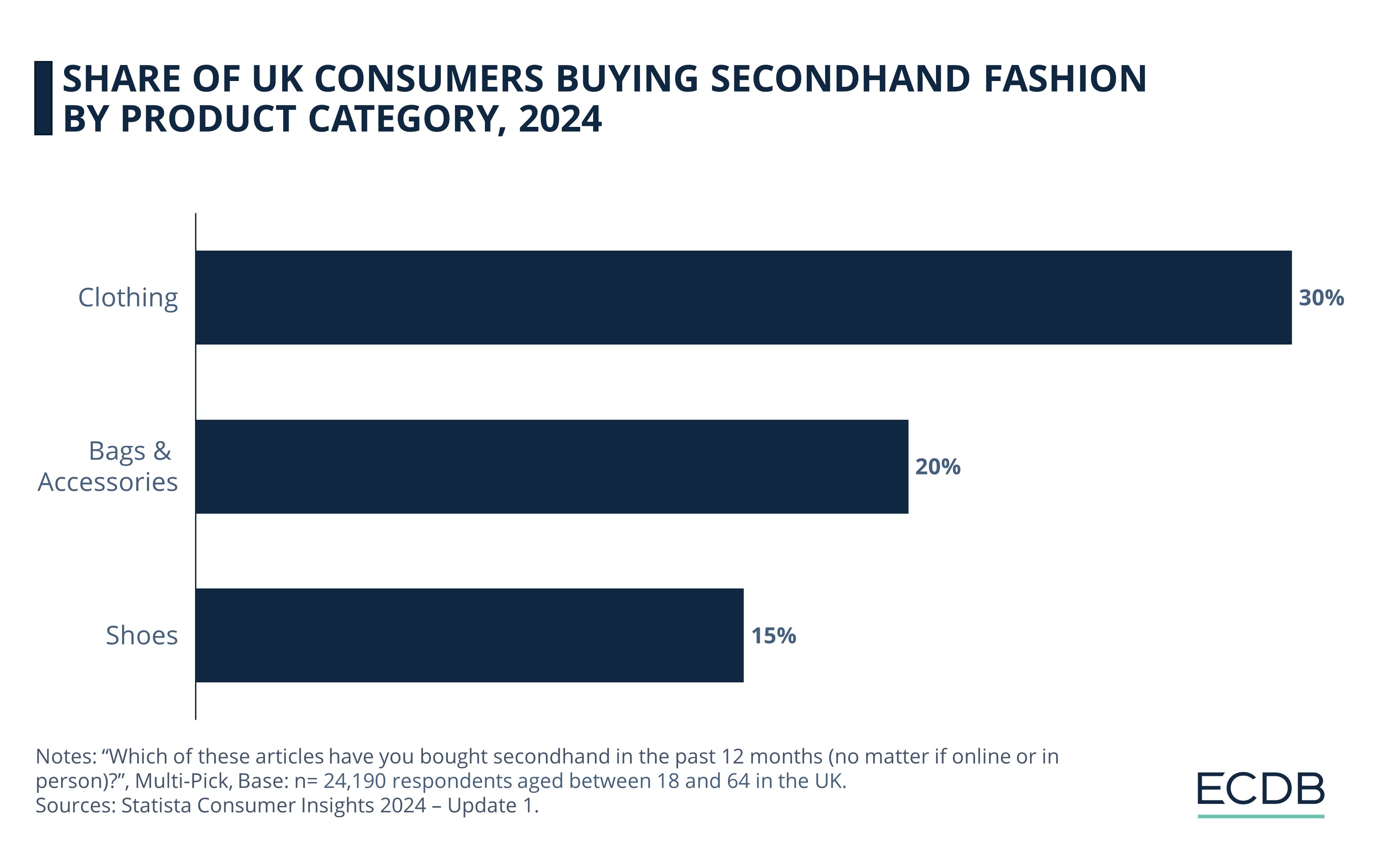

Secondhand purchases are not uncommon in the UK. Clothing is popular among UK secondhand shoppers, with 30% of consumers stating that they bought a used piece of clothing in the last 12 months.

The second most-bought fashion category for secondhand purchases is Bags & Accessories, at 20%. The least popular is Shoes, with 15%.

Looking at secondhand purchases in general, regardless of product category, an even higher percentage of UK users say they have recently purchased a secondhand item: 63% of UK online shoppers say they've bought secondhand in the past year, compared to 37% who haven't.

What impact does age have on consumers' willingness to buy pre-owned products? Here is a generational breakdown.

Young Users Drive the Trend

Age is negatively correlated with buying secondhand, which means that younger shoppers are more likely to have bought a pre-owned item recently. This is consistent with previous reports by other publications.

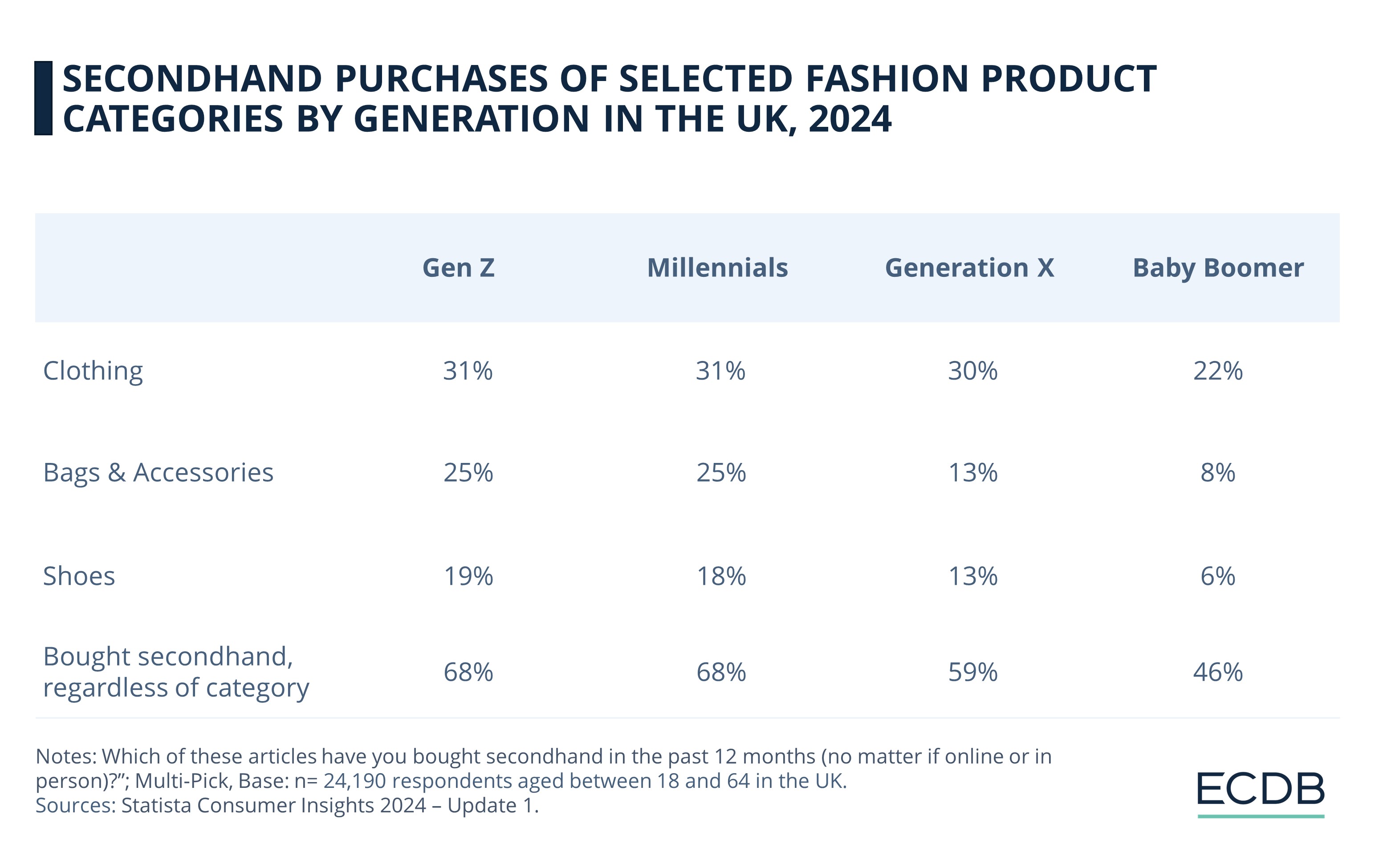

Youngest generations drive the trend: In general, 68% of Gen Z as well as Millennial respondents said they have bought secondhand in the last year.

More Generation X (59%) bought secondhand in the past year than Baby Boomers who, at 46%, are the least inclined amongst all generational cohorts to buy secondhand. But even at this rate, nearly half of Baby Boomers purchased secondhand products.

The survey question did not specify which channels were used to purchase secondhand products. Whether online or analog, the preferences indicate that there is a high willingness to buy secondhand fashion products in the UK. Age plays a role, but the willingness to buy secondhand products exists across generations.

Secondhand Clothes Most Attractive to All Generations

Looking at specific fashion product categories, clothing is not only the top choice to buy pre-owned, but is also the secondhand category with the least variation across generations.

31% of Gen Z and Millennial online shoppers said they have bought secondhand clothing in the past year, followed by 30% of Gen X and 22% of Baby Boomers.

Bags & Accessories are most popular among Gen Z shoppers (25%), while secondhand shoes were bought by Gen Z at a lower rate of 19%. For Millennials, the category preference is comparable to Gen Z.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Older Users Are Less Interested in Secondhand Accessories or Shoes

Categories other than clothing are of much less interest to Gen X and Baby Boomer secondhand shoppers.

13% of Gen X shoppers have bought either used bags & accessories or shoes, while these rates are even lower for Baby Boomers, at 8% and 6% respectively.

The reasons for this disparity between the younger and older cohorts are thought to lie in changing attitudes towards fashion and the textile industry. While fast fashion has contributed to increasing amounts of waste in landfills around the world, affordability is also a major concern.

On the one hand, young users are the most likely to buy from the likes of Shein and Boohoo, but there is a reverse trend where young users are buying secondhand to combine sustainability with lower costs.

Top Online Secondhand Platforms

Online fashion retailers are taking note of this trend and offering customers a selection of used clothing, as well as repair services for damaged clothing that is still fit to wear or resell. In addition, marketplaces are either integrating new secondhand features or launching new reCommerce online stores that focus exclusively on used apparel.

Number One: eBay tops the list by a sizeable margin: 62% of respondents said they prefer this platform for secondhand buying.

Number Two and Three: Vinted and Etsy are the second- and third-most liked by UK consumers, with respective rates of 48% and 41%.

Number Four: Depop is next, taking the fourth position with 32%.

Number Five Through Ten: In fifth place is ASOS Marketplace (26%), followed by FARFETCH (25%). Ranks 7 to 10 include Cow (21%), Poshmark (21%), ROKit (18%), and Re-Fashion (18%).

While high-end products are certainly a focus for many of the aforementioned stores, it is not a must for a viable business strategy. More important is a good balance between quality and price at a tasteful product presentation.

UK Fashion ReCommerce: Wrap-Up

The reCommerce Fashion market in the UK is growing, with younger UK buyers at the forefront and driving this trend. Older generations, however, are less inclined to buy secondhand fashion products

With growing criticism of fast fashion and greenwashing mounting, UK retailers are more willing to embrace circularity concepts. The benefits are evident, but there are still issues to be addressed, which include maintaining profitability, consumer protection obstacles, and the potential for fraud.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Deep Dive

Why eCommerce and Luxury Sales Are Tough to Unite

Why eCommerce and Luxury Sales Are Tough to Unite

Deep Dive

What Countries Are Driving Revenues in the Global Online Smartphones Market?

What Countries Are Driving Revenues in the Global Online Smartphones Market?

Back to main topics